Ashford Bundle

Can Ashford Inc. Thrive in the Evolving Hospitality Landscape?

Ashford Inc., a key player in the hospitality sector, has built a significant presence through its strategic advisory roles and asset management. From its roots in 1968 to its current management of billions in assets, the company's journey reflects a dynamic approach to real estate investment. This analysis will dissect Ashford Inc.'s Ashford SWOT Analysis, growth strategy, and future prospects.

This exploration of Ashford Company's growth strategy will examine its strategic planning process, expansion plans, and operational efficiency measures. Understanding Ashford Company's market position and its ability to navigate challenges and opportunities is crucial. We'll delve into the company's investment potential and long-term goals, providing insights for informed decision-making in the ever-changing hospitality industry. The analysis will also touch upon Ashford Company's financial performance review and competitive landscape.

How Is Ashford Expanding Its Reach?

The Brief History of Ashford reveals a company actively pursuing growth within the hospitality sector. The Ashford Company's growth strategy is multifaceted, focusing on operational efficiency, revenue maximization, and strategic acquisitions. These expansion initiatives are designed to enhance market position and drive long-term value.

Ashford's approach involves both organic and inorganic growth strategies. Organic growth is pursued through initiatives like the 'GRO AHT' program, while inorganic growth includes strategic brand conversions and acquisitions. The company's focus on revenue growth and operational improvements indicates a commitment to sustainable financial performance.

Ashford's future prospects are closely tied to the successful execution of these expansion initiatives. By focusing on key areas like revenue maximization and strategic acquisitions, the company aims to strengthen its market position and deliver value to its stakeholders. The financial results from these initiatives will be critical in evaluating the effectiveness of the Ashford Company's growth strategy.

Launched in December 2024, the 'GRO AHT' initiative is a key component of Ashford's growth strategy. This initiative aims to achieve an incremental $50 million in run-rate EBITDA improvement. The focus areas are General & Administrative (G&A) Reduction, Revenue Maximization, and Operational Efficiency.

Ashford Hospitality Trust is implementing aggressive sales efforts to grow room revenue market share in 2025 by over 2% (as measured by RevPAR index). The company is also increasing ancillary revenues through pricing audits for food and beverage, gift shops, parking, and other revenue streams. Specific initiatives are expected to deliver more than $3 million in incremental hotel EBITDA annually.

Hotel brand conversions, such as those into Marriott brands, are a significant element of Ashford's expansion strategy. These conversions are expected to yield significant RevPAR premiums and enhance market positioning. Strategic hotel brand conversions contributed to notable revenue growth for Ashford Hospitality Trust in Q1 2025.

Ashford continues to pursue bolt-on acquisitions to strategically grow its business. This includes the expansion of Remington Hospitality into the Caribbean and Latin American markets. RED Hospitality's acquisition of Alii Nui and Maui Dive Shop, and Premier's diversification into new verticals, all contributed to market share gains in 2023.

Ashford Securities has been crucial in raising capital for deleveraging and future growth. Since its launch in 2021, approximately $580 million of gross capital has been raised. This includes $212 million raised through a non-traded preferred stock offering that closed on March 31, 2025.

- The 'GRO AHT' initiative, launched in December 2024, is expected to improve EBITDA by $50 million.

- Aggressive sales efforts aim to increase room revenue market share by over 2% in 2025.

- Ancillary revenue initiatives are projected to deliver over $3 million in incremental hotel EBITDA annually.

- Ashford Securities raised approximately $580 million in gross capital since 2021.

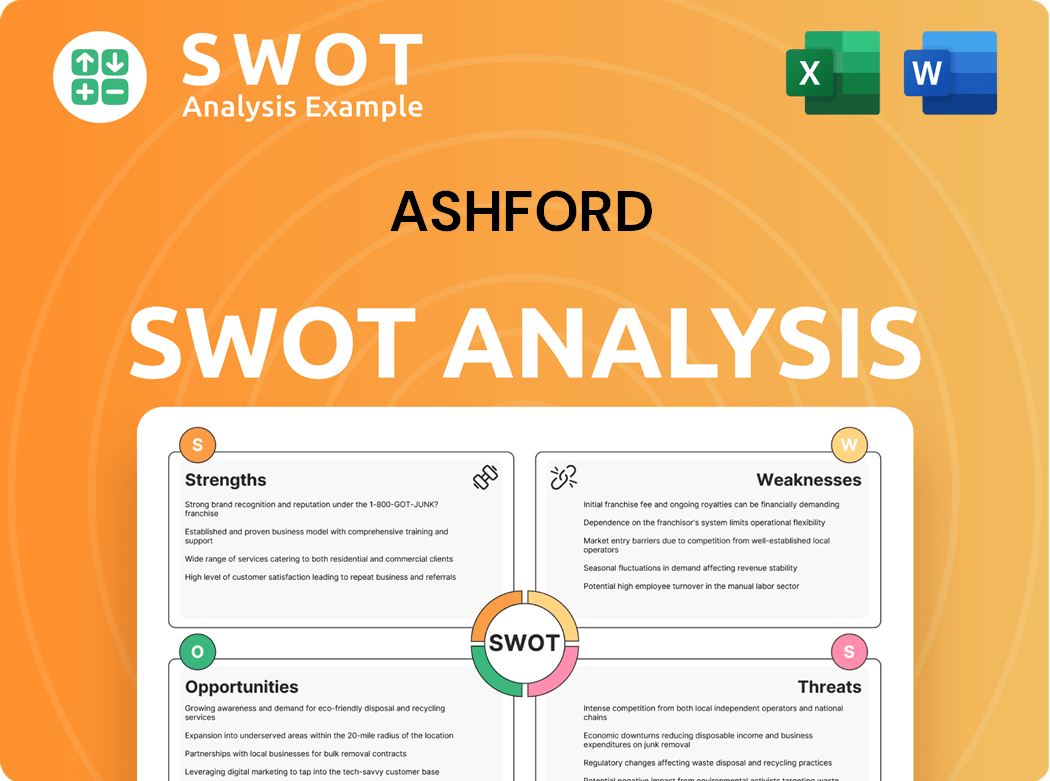

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ashford Invest in Innovation?

The innovation and technology strategy of the company centers on operational efficiency and revenue maximization within its hospitality portfolio. This approach is primarily executed through its strategic operating businesses and by optimizing asset performance within its advised REITs. The focus is on driving growth through strategic initiatives and leveraging technological advancements to enhance service offerings and efficiency.

The company's approach involves data-driven decisions and the implementation of new technologies to improve operational performance. This includes initiatives aimed at enhancing revenue streams and optimizing various business functions. The company's focus on maximizing asset performance across its portfolio is also a key part of its strategy.

The 'GRO AHT' initiative, a key strategic plan for Ashford Hospitality Trust, demonstrates a commitment to operational improvements that often involve technological advancements and data-driven decisions. This initiative aims for a $50 million run-rate EBITDA improvement. This includes efforts in revenue maximization and operational efficiency.

The company focuses on improving operational efficiency through strategic initiatives. This involves leveraging technology and data analytics to streamline processes and reduce costs. This focus is crucial for enhancing the company's overall Revenue Streams & Business Model of Ashford.

Aggressive sales efforts and pricing audits are conducted across various revenue streams. This includes food and beverage, gift shops, and parking. Data analytics and integrated technology platforms are used to identify and capitalize on opportunities.

The company implements ancillary revenue initiatives to optimize business functions. This includes comprehensive menu engineering analysis and streamlined parking operations. These initiatives are supported by relevant technologies.

The company acts as an accelerator for operating companies that service the hospitality industry. This involves supporting the adoption of new technologies within these companies. The goal is to enhance their service offerings and efficiency.

Robust asset management systems are used to drive investment returns. Predictive analytics may also be employed to maximize asset performance. The company manages a portfolio of 83 hotels with over 20,000 rooms.

The company demonstrates an adaptive and forward-thinking approach to leveraging innovations within the hospitality sector. This is evident through its consistent focus on improving operational performance. The company explores new revenue streams for its advised platforms.

The company's innovation strategy focuses on enhancing operational efficiency and maximizing revenue. This approach involves leveraging technology and data analytics to improve performance across its hospitality portfolio. The 'GRO AHT' initiative is a key example of this strategy.

- Data Analytics: Utilizing data to identify opportunities for revenue maximization and operational improvements.

- Technology Platforms: Implementing integrated technology platforms to streamline processes.

- Asset Management Systems: Employing robust systems to optimize asset performance and drive investment returns.

- Strategic Investments: Supporting the adoption of new technologies within operating companies to improve service offerings.

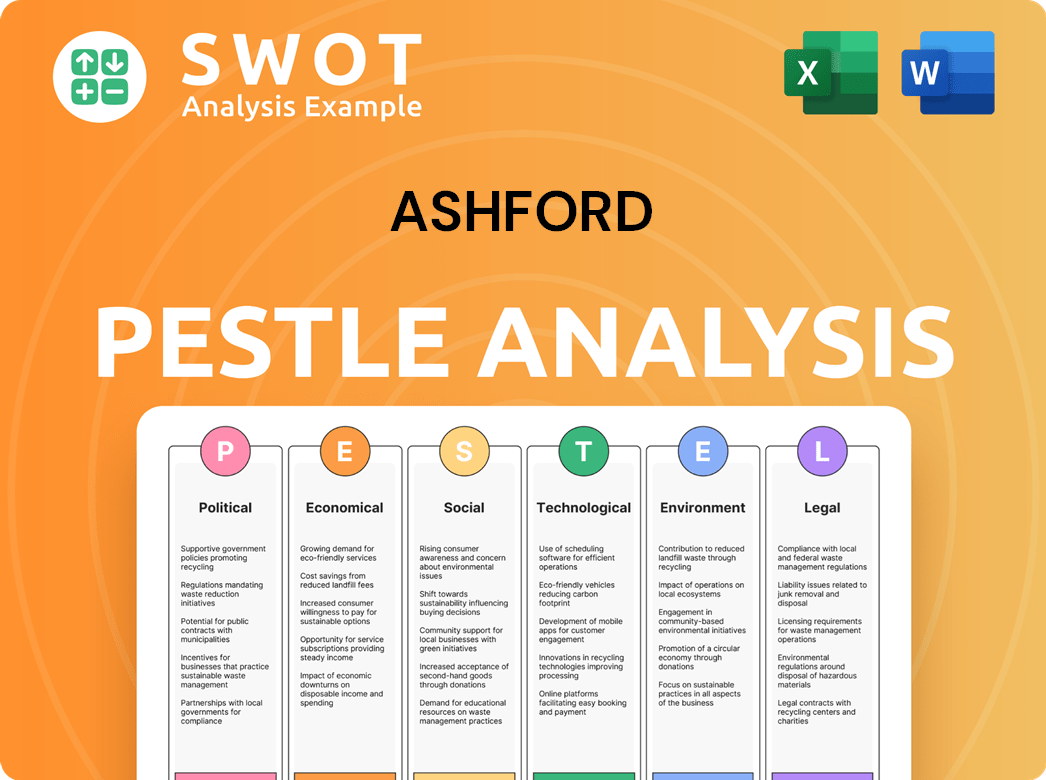

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ashford’s Growth Forecast?

The financial outlook for the company, particularly concerning its advised REITs, such as Ashford Hospitality Trust and Braemar Hotels & Resorts, is focused on strategic initiatives. These efforts include improving capital structure, reducing expenses, and driving revenue growth. This approach is crucial for navigating the current market conditions and achieving sustainable growth. The company’s strategic planning process is designed to address challenges and capitalize on opportunities within the hospitality sector.

For Q1 2025, Ashford Hospitality Trust reported a net loss, but also demonstrated operational improvements. The company is actively working on its business strategy to enhance its market position. Initiatives like the 'GRO AHT' program are central to the company's plans for future growth opportunities. These strategic moves are designed to improve the company's financial performance review.

Ashford Inc.'s financial performance review includes a focus on cost reduction and operational efficiency. The company is also involved in capital raising efforts through Ashford Securities. These efforts are designed to support the company's financial strategy and expansion plans and strategies. The company's long-term goals and objectives are aligned with the current industry outlook.

Ashford Hospitality Trust reported a net loss of $27.8 million, or $4.91 per diluted share, for Q1 2025. Adjusted FFO per diluted share was -$0.98. Total revenue for Q1 2025 was $277.36 million.

The company plans capital expenditures between $95 million and $115 million for the rest of 2025. Potential asset sales are valued between $50 million and $75 million.

Ashford Hospitality Trust fully repaid its strategic financing in early 2025. The refinancing extended the maturities of approximately 60% of the company's outstanding debt to 2027 and beyond, with a blended average interest rate of 8.1% on its $2.6 billion total loans.

Launched in December 2024, the 'GRO AHT' initiative aims for an incremental $50 million of EBITDA improvement. Over $11 million in incremental EBITDA is expected from reductions in board and management compensation, and over $3 million from ancillary revenue initiatives implemented in early 2025.

Ashford Inc. reported a net loss attributable to common stockholders of $40.8 million for the full year 2023. Adjusted EBITDA was $60.4 million, and total revenue (excluding cost reimbursement) was $97.4 million for Q4 2023, reflecting a 27.1% growth rate over the prior year quarter.

Analyst forecasts project an annual EBIT of $34 million for 2024 and annual revenue of $910 million for 2026 for Ashford Inc. Ashford Securities has placed approximately $212 million of capital from a preferred stock offering for Ashford Hospitality Trust.

The financial strategy includes cost reduction, operational efficiency, and capital raising efforts. The company's focus is on sustainable growth strategies within the hospitality sector. For a deeper dive into the company's performance, read this detailed analysis on Ashford Company's growth strategy examples.

- Focus on portfolio optimization and deleveraging.

- Full repayment of strategic financing.

- Implementation of the 'GRO AHT' initiative to improve EBITDA.

- Capital raising through Ashford Securities.

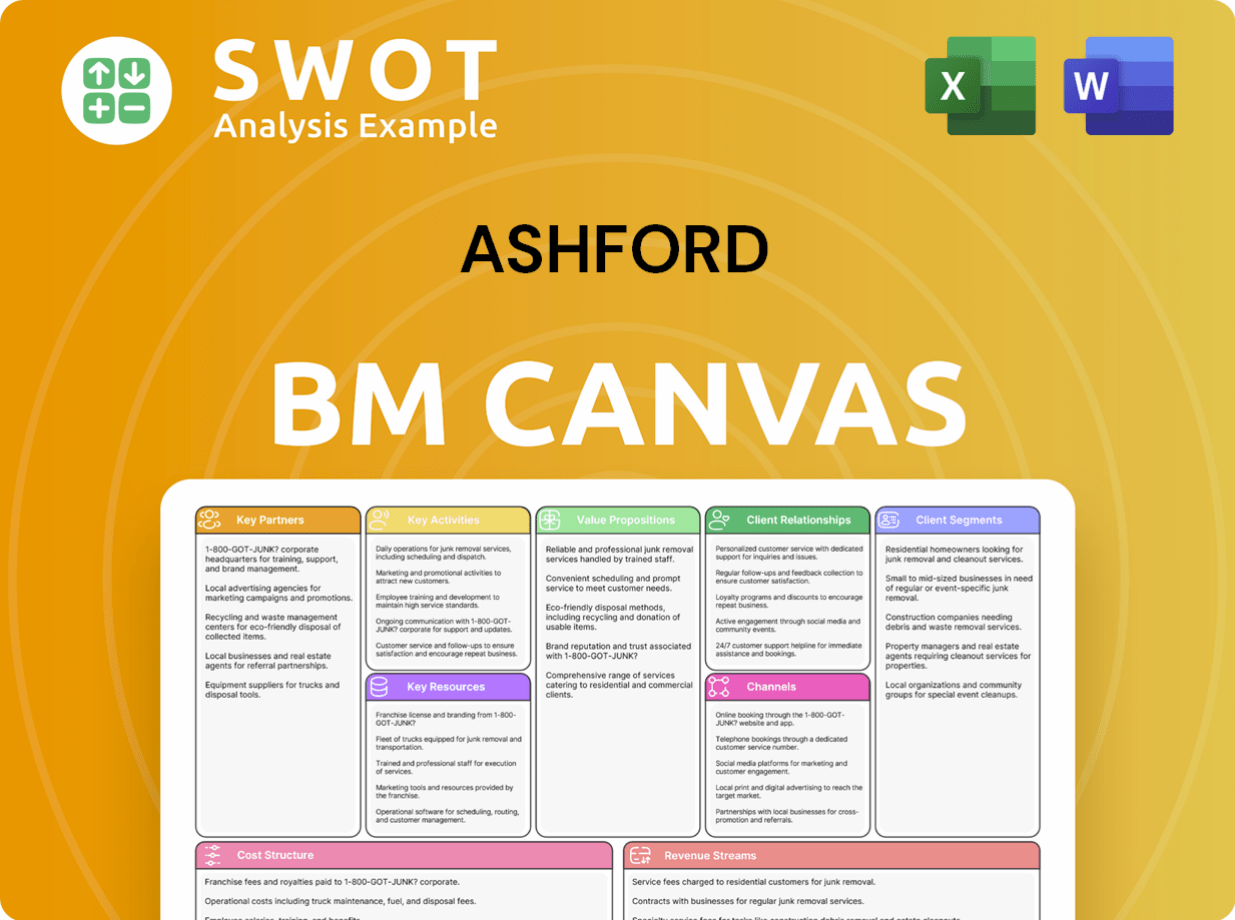

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ashford’s Growth?

The Ashford Company Analysis reveals several potential risks and obstacles impacting its growth strategy. These challenges stem from the volatility inherent in the financial markets and the specific dynamics of the hospitality sector, where Ashford Inc. is deeply involved. Understanding these risks is crucial for assessing the company's future prospects and its ability to execute its business strategy.

One of the primary concerns revolves around the fluctuations in the market price of its common and preferred stock, directly affecting the company's financial health. Additionally, high interest rates and competition within the hospitality market pose significant threats. These factors can influence Ashford Company's market position and overall performance.

Furthermore, Ashford's venture into the insurance sector through Warwick introduces new risks due to lack of prior experience. The company's strategic planning process must address these diverse challenges to ensure sustainable growth.

The stock price of Ashford Hospitality Trust has seen significant volatility, trading between $5.20 and $13.85 over the past 52 weeks. This fluctuation can impact investor confidence and the company's ability to raise capital. This volatility is a key factor in understanding Ashford Company's challenges and opportunities.

A substantial portion of Ashford Hospitality Trust's debt is floating-rate, exposing it to interest rate hikes. As of Q1 2025, the trust had $2.6 billion in total loans at an 8.1% blended average interest rate. Rising rates could increase interest expenses, affecting profitability.

The hospitality sector is highly competitive and subject to economic uncertainties and evolving market trends. These factors can introduce challenges to forecasts and impact Ashford Company's market share and trends. Staying ahead requires constant adaptation and strategic planning.

Changes in regulations and accounting rules can significantly affect Ashford Company's operations and financial performance. The company must stay compliant with these changes. These changes require constant monitoring and adaptation to ensure financial stability.

Ashford's foray into the insurance sector through Warwick presents challenges due to a lack of prior experience. This includes adhering to stringent regulations and maintaining adequate capital. The competitive landscape further complicates successful integration.

To mitigate these risks, Ashford Inc. employs various strategies, including cost reduction through the 'GRO AHT' initiative, debt management via refinancing and asset sales, and diversification through its dual REIT structure. These efforts are crucial for Ashford Company's long-term goals and objectives.

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.