Ashford Bundle

How Does Ashford Company Navigate the Hospitality Investment Arena?

Ashford Inc., a key player in the hospitality sector since 2014, manages a substantial portfolio of hotels, but how does it stack up against its rivals? With the industry showing resilience and significant growth in recent years, understanding the Ashford SWOT Analysis and its competitive positioning is crucial. This deep dive into the Ashford Company's strategy is essential for any investor or strategist.

This market analysis will dissect the competitive landscape to reveal the strengths and weaknesses of Ashford Company, providing an in-depth industry overview. We'll explore the company's business strategy, its company performance, and how it leverages its assets to compete effectively. By examining key market players and industry trends, we aim to provide actionable insights into Ashford's future outlook and growth strategies.

Where Does Ashford’ Stand in the Current Market?

Ashford Inc. carves out a distinct market position within the hospitality sector by concentrating on upscale, upper upscale, and luxury hotel assets. Its operational model revolves around external management, overseeing affiliated entities like Ashford Hospitality Trust (AHT) and Braemar Hotels & Resorts (BHR). This specialized focus allows the company to offer tailored services and expertise, catering to the unique needs of high-end hotel properties in key gateway and resort locations.

The company's value proposition centers on its asset management capabilities, providing strategic oversight and operational enhancements to drive performance. This approach is particularly evident in its management of Ashford Hospitality Trust, which focuses on full-service hotels with a specific RevPAR target. This strategic alignment enables Ashford Inc. to optimize the financial and operational outcomes for its affiliated entities, enhancing shareholder value and market competitiveness.

As of December 31, 2024, Ashford Inc. managed approximately $7.5 billion in gross assets. This substantial asset base underscores its significant presence in the hospitality industry and its ability to attract and manage a diverse portfolio of high-value hotel properties. The company's strategic focus and operational expertise contribute to its competitive advantage within the market.

Ashford Inc. strategically positions itself in the hospitality industry by focusing on upscale and luxury hotel assets. The company operates as an external manager, overseeing affiliated entities with distinct investment strategies. This approach allows for specialized management and tailored services, optimizing performance for high-end hotel properties. This is a key aspect of the Owners & Shareholders of Ashford.

Ashford Hospitality Trust reported a comparable RevPAR increase of 3.2% to $133 as of March 31, 2025. Total revenue for the trailing twelve months ending March 31, 2025, was $1.15 billion. The company's focus on operational improvements, such as the 'GRO AHT' initiative, also contributed to its financial performance. Adjusted EBITDAre for Q1 2025 was $61.7 million, a year-over-year increase of $2.2 million.

Ashford Inc. prioritizes strategic locations and high-value assets within the hospitality sector. The company's focus on upper upscale, luxury, and resort properties allows it to target specific market segments. This targeted approach supports its business strategy, providing a competitive edge. This focus is reflected in the performance of its affiliated entities.

Ashford Hospitality Trust's 'GRO AHT' initiative highlights the company's commitment to operational enhancements. The initiative led to a $30 million run-rate EBITDA enhancement. These improvements demonstrate the company's ability to optimize its operations. These operational improvements directly impact the company's financial performance and market position.

Ashford Inc.'s competitive advantages stem from its specialized focus, asset management expertise, and operational efficiencies. These strengths position the company favorably within the competitive landscape. The company's ability to manage high-value assets and improve operational performance is crucial.

- Specialized Focus: Concentrating on upscale and luxury hotels.

- Asset Management: Expertise in managing a diverse portfolio of hotels.

- Operational Efficiency: Implementing initiatives to enhance financial performance.

- Strategic Locations: Targeting key gateway and resort locations.

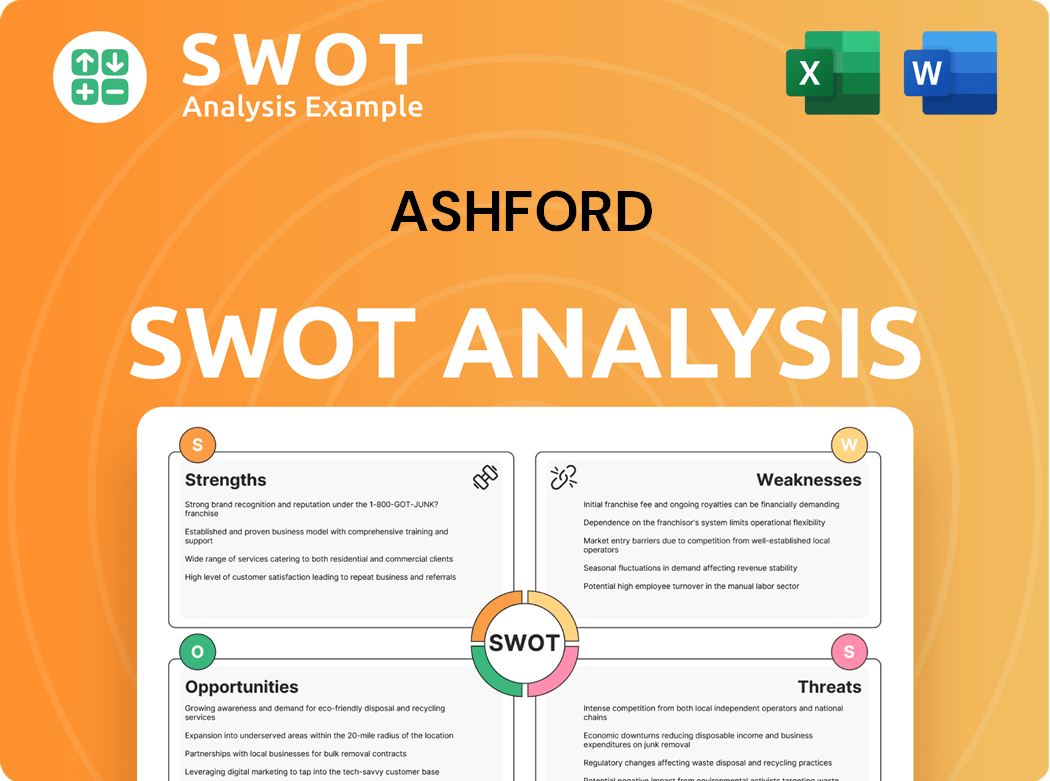

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ashford?

The Ashford Company operates within a competitive landscape, particularly in the hospitality asset management and real estate investment trust (REIT) sectors. This necessitates a thorough market analysis to understand its position relative to its rivals. Understanding the competitive dynamics is crucial for formulating effective business strategy and assessing company performance.

The competitive landscape for Ashford Inc. involves both direct and indirect competitors. Direct competitors are other asset management firms specializing in hospitality, while indirect competitors include REITs and real estate companies that offer similar investment opportunities. Analyzing these competitors helps in evaluating Ashford Company's competitive advantages and potential areas for improvement.

While specific market share data for Ashford Inc. against its direct competitors are not readily available, its focus on upscale and luxury hotel assets distinguishes it from broader real estate asset managers. The industry overview reveals a dynamic environment with constant shifts in competitive positioning.

Key competitors and alternatives to Ashford Hospitality Trust, one of Ashford Inc.'s advised REITs, include various companies within the 'specialized REITs' industry. These companies challenge Ashford Inc. through their investment strategies and operational efficiencies.

Examples of specialized REITs include American Tower (AMT), Welltower (WELL), Public Storage (PSA), Extra Space Storage (EXR), Ventas (VTR), Weyerhaeuser (WY), Omega Healthcare Investors (OHI), CubeSmart (CUBE), Ryman Hospitality Properties (RHP), and Healthcare Realty Trust (HR). These REITs operate in diverse sectors, competing for investor capital.

More direct competitors in the hospitality investment and management space include Impact Properties, RLJ Lodging Trust, Chatham Lodging Trust, Maximum Hospitality, Noble Investment Group, Aimbridge Hospitality, and Vesta Hospitality. These companies compete directly with Ashford Inc. for hotel assets and management contracts.

Noble Investment Group, a multi-billion-dollar investment manager, focuses on upscale select-service hotels and extended-stay properties. Their strategy and portfolio composition provide insights into the competitive dynamics of the hospitality sector.

Competitors challenge Ashford Inc. through investment strategies, property portfolios, operational efficiencies, and client relationships. These factors influence company performance and require continuous adaptation to maintain a competitive edge.

The industry has seen new and emerging players, and mergers or alliances can significantly impact competitive dynamics. Staying informed about industry trends and strategic moves is crucial for understanding the competitive landscape.

A thorough competitive landscape analysis involves evaluating the strengths and weaknesses of each competitor. This includes assessing their financial performance, product portfolio, and geographic presence. Understanding these aspects helps in identifying Ashford Company's competitive positioning and potential growth strategies.

- Market Share Analysis: Assessing the market share of key players.

- SWOT Analysis: Evaluating strengths, weaknesses, opportunities, and threats.

- Financial Performance Review: Comparing financial metrics such as revenue, profitability, and return on investment.

- Product Portfolio Analysis: Examining the types of hotels and services offered.

- Geographic Presence: Analyzing the regions where competitors operate.

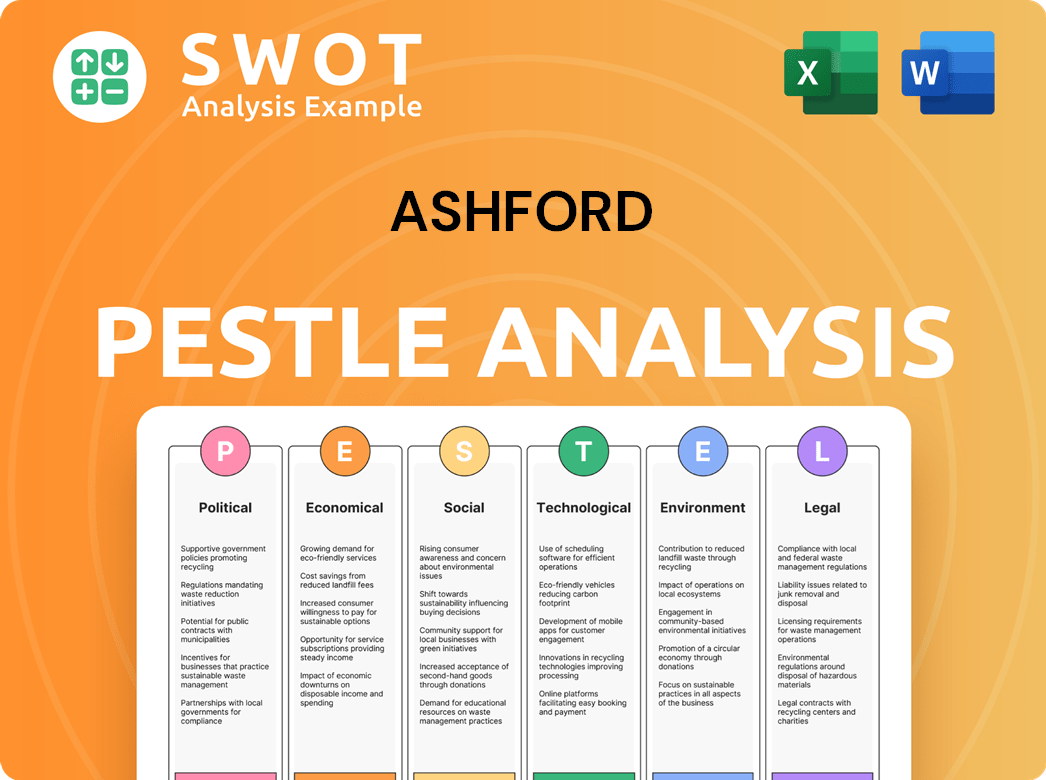

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ashford a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of the Ashford Company requires a deep dive into its strategic advantages within the hospitality sector. The company, with its specialized focus, has carved a niche in the market, offering tailored management services for upscale and luxury properties. This focus allows for a more refined approach compared to broader real estate asset managers, providing a competitive edge in a dynamic industry. For a deeper understanding, consider exploring the Target Market of Ashford.

A key aspect of Ashford's competitive strategy is its vertically integrated platform, encompassing asset management, investment management, and advisory services. This integrated approach allows for comprehensive management of asset performance, driving investment returns through specialized groups. This is a significant differentiator, especially when compared to traditional asset management models. The company's long-standing presence in the lodging real estate market, dating back to 1968, has cultivated deep industry relationships and experience.

Ashford's role as the external manager for publicly traded REITs, such as Ashford Hospitality Trust and Braemar Hotels & Resorts, is another strategic advantage. This structure allows for diversified investment strategies and risk mitigation. For instance, initiatives like Ashford Hospitality Trust's 'GRO AHT' program, aiming for a $50 million increase in run-rate corporate EBITDA, highlight the company's proactive approach to enhancing asset performance. This aggressive approach, combined with a focus on revenue optimization, underscores Ashford's commitment to sustainable differentiation in the competitive hospitality market.

Ashford Company's deep understanding of the hotel investment landscape allows for tailored management services. This focused approach sets it apart from broader real estate asset managers. This niche expertise enhances its competitive positioning in the market analysis.

The vertically integrated platform, including asset and investment management, enables comprehensive performance management. This integrated approach drives investment returns, optimizing revenue streams. The company leverages specialized groups for revenue optimization.

Serving as external manager for publicly traded REITs diversifies investment strategies and mitigates risks. This strategic advantage allows for flexible investment approaches. This enhances the company's overall financial performance review.

Proactive initiatives, such as 'GRO AHT', demonstrate a commitment to enhancing asset performance. Aggressive sales efforts and revenue optimization strategies drive financial results. This operational excellence contributes to sustainable differentiation.

Ashford Company's competitive advantages are rooted in its specialization, integrated platform, and strategic partnerships. The company's ability to drive operational efficiencies and maximize revenue streams is a key differentiator in the competitive landscape. These strengths are continuously refined through market research and performance monitoring.

- Specialized Focus: Expertise in upscale and luxury properties.

- Integrated Platform: Asset, investment, and advisory services.

- Strategic Partnerships: Management of publicly traded REITs.

- Operational Excellence: Proactive initiatives to enhance performance.

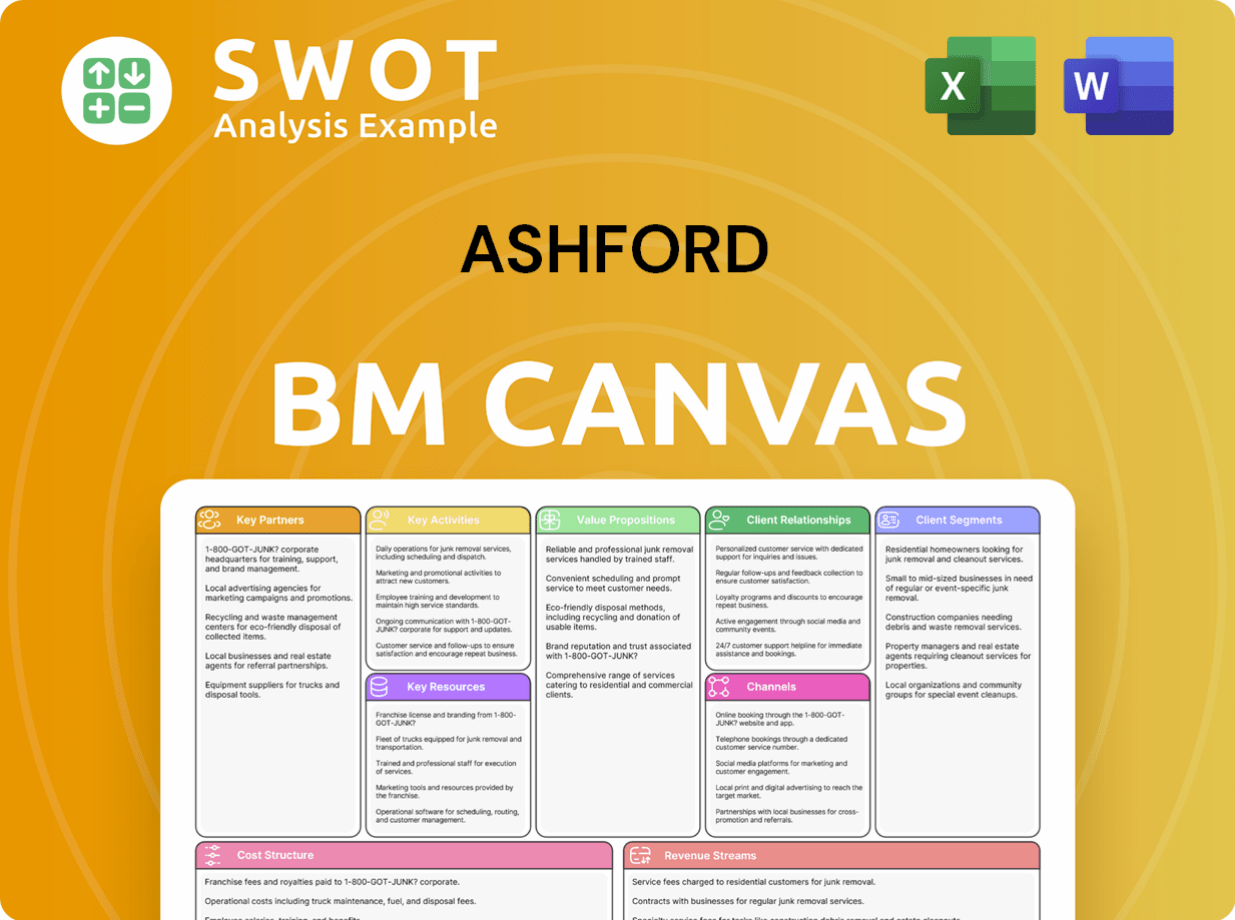

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ashford’s Competitive Landscape?

Understanding the Ashford Company's competitive landscape requires a close look at industry trends, future challenges, and opportunities. The hospitality sector is dynamic, influenced by technological advancements, changing consumer preferences, and global economic conditions. A thorough market analysis reveals how Ashford Company navigates these complexities to maintain its competitive positioning.

The industry overview highlights the importance of adapting to new technologies and sustainability practices. Financial performance is also key, with factors like interest rates and market volatility impacting the sector. Ashford Company's ability to adapt to these factors is crucial for its future outlook and success in the competitive landscape.

The hospitality industry is increasingly data-driven, using analytics for performance assessment. Tech-enabled asset management, including AI, can boost operational efficiency by up to 23%. Sustainability and ESG principles are becoming essential, with green certifications often leading to premium rates.

High interest rates and market volatility pose financial challenges. Shifts in F&B dynamics, with competition from external restaurants, can impact profitability. Navigating these challenges requires strategic financial planning and operational flexibility.

Global hotel investment is projected to grow by 15-25% in 2025. Limited supply growth, with a 1.1% CAGR from 2023-2028, enhances investment prospects. Strategic initiatives like 'GRO AHT' can improve EBITDA through operational efficiencies.

Ashford Company focuses on initiatives to boost profitability and operational excellence. Capital structure improvements, including refinancing and asset sales, are crucial. These strategies position the company to capitalize on industry opportunities.

Ashford Company's success hinges on its ability to adapt to changing market dynamics. Effective business strategy and financial management are crucial for navigating challenges and seizing opportunities. The company's company performance will depend on its strategic responses.

- Leveraging data analytics for informed decision-making.

- Prioritizing sustainability and ESG practices.

- Optimizing capital structure and financial planning.

- Focusing on operational efficiency and revenue maximization.

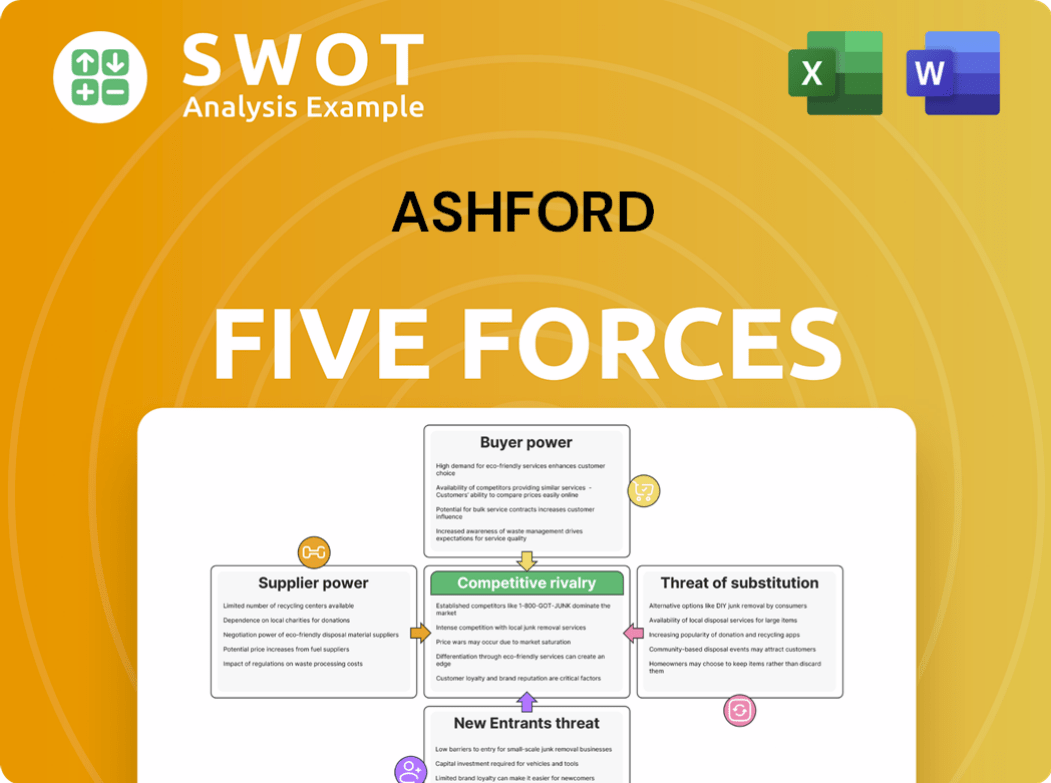

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.