Ashford Bundle

How Does Ashford Company Shape the Hospitality Investment Landscape?

Ashford Inc. is a key player in the hospitality sector, offering crucial asset and investment management services. Its influence is felt through its advisory role to major real estate investment trusts (REITs) and other investment vehicles. Understanding Ashford Inc.'s operational strategies is vital for investors and industry professionals alike.

Ashford Inc. advises on a portfolio of high-end hotels across the United States, impacting the performance of significant hospitality investment vehicles. Recent initiatives, such as the 'GRO AHT' plan, highlight Ashford Company's commitment to boosting profitability. For a deeper dive into the company's strategic positioning and competitive advantages, consider exploring the Ashford SWOT Analysis.

What Are the Key Operations Driving Ashford’s Success?

Ashford Inc. focuses on delivering value through asset management, investment management, and advisory services, primarily within the hospitality sector. They work with companies like Ashford Hospitality Trust and Braemar Hotels & Resorts, aiming to boost performance and profitability. As of March 31, 2025, Ashford Hospitality Trust's portfolio, managed by Ashford Inc., included 72 hotels with 17,329 rooms.

The company's operations involve strategic asset management, collaborating with property managers such as Remington Hospitality. They implement initiatives to maximize revenue and efficiency. This includes efforts like the 'GRO AHT' initiative, launched in December 2024, which targets improved room revenue market share and explores new revenue streams.

Operational efficiency is a key focus, involving renegotiating vendor contracts, implementing energy-saving measures, and optimizing labor costs. Ashford Inc. leverages its advisory expertise to drive tangible improvements at the property level, setting them apart from competitors. The strategic repositioning of hotels, like converting La Concha Hotel to Marriott's Autograph Collection, demonstrates their ability to enhance customer benefits and market differentiation.

This involves working closely with property managers to implement initiatives focused on revenue maximization and operational efficiency. The 'GRO AHT' initiative, launched in December 2024, is a key example. It focuses on boosting room revenue market share and exploring new revenue streams.

Efforts include renegotiating vendor contracts, implementing energy-saving measures, and optimizing labor costs. These measures aim to improve profitability and streamline operations across the hotel portfolio. The goal is to enhance the overall financial performance of the managed assets.

Ashford Inc.'s supply chain and distribution networks are primarily channeled through its advised REITs and their property management companies. This integrated approach allows for efficient management and direct oversight of hotel operations.

The strategic repositioning of hotels, such as the conversion of La Concha Hotel to Marriott's Autograph Collection, showcases how its core capabilities translate into enhanced customer benefits and market differentiation. These conversions are expected to drive 20-30% premiums to pre-conversion RevPAR.

Ashford Inc. creates value through strategic asset management, operational efficiency, and market differentiation. These strategies aim to improve the financial performance of the hotels they manage. For more details on their target market, you can read about the Target Market of Ashford.

- Strategic Asset Management: Enhancing revenue and efficiency.

- Operational Efficiency: Reducing costs and streamlining processes.

- Market Differentiation: Repositioning hotels to increase profitability.

- Integrated Approach: Leveraging advisory expertise for tangible improvements.

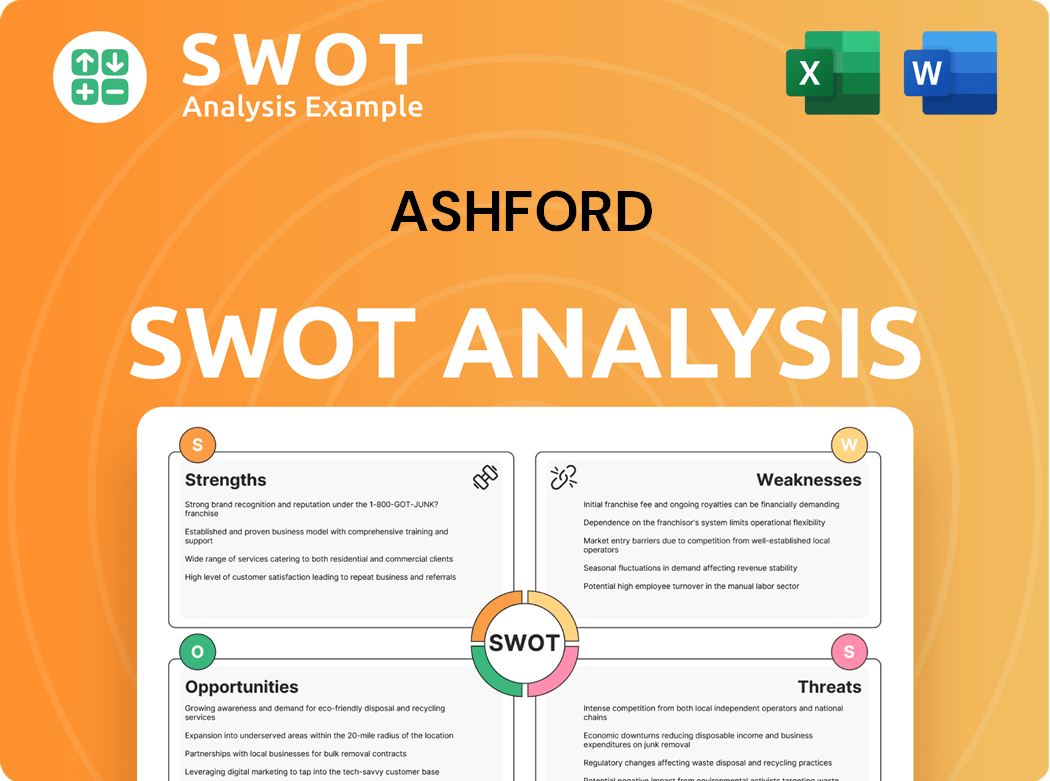

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ashford Make Money?

The primary revenue streams and monetization strategies of Ashford Inc. are multifaceted, encompassing advisory fees, operational business revenue, and strategic capital raising. The company leverages its expertise in the real estate and hospitality sectors to generate income from various sources. This approach allows Ashford Inc. to maintain financial stability and pursue growth opportunities.

A significant portion of Ashford Inc.'s revenue comes from advisory fees derived from REITs such as Ashford Hospitality Trust and Braemar Hotels & Resorts. Additionally, the company's diverse portfolio of operating businesses contributes substantially to its overall financial performance. Strategic capital raising, including non-traded preferred stock offerings, further supports the company's financial strategy.

For the first quarter of 2024, Ashford Inc.'s total revenue, excluding cost reimbursement revenue, was $94.8 million. This figure highlights the company's ability to generate substantial income. The strategic approach to revenue generation is crucial for its sustained success in the competitive market.

Ashford Inc. employs several key strategies to generate revenue and maintain a strong financial position. These strategies are essential for the company's sustained growth and operational success. Understanding these revenue streams is crucial for evaluating the company's financial health and future prospects.

- Advisory Fees: Base advisory fees totaled $11.5 million in the first quarter of 2024, with $8.2 million from Ashford Trust and $3.3 million from Braemar.

- Operating Businesses: INSPIRE, an event technology company, generated $148.6 million in audio-visual revenue in 2023, with $39.2 million from international markets. RED Hospitality generated $11.2 million in revenue during the first quarter of 2024.

- Strategic Capital Raising: Approximately $195 million was raised through non-traded preferred stock offerings as of February 2025, providing capital for deleveraging and growth.

- Asset Sales and Refinancing: Proceeds from asset sales and refinancing efforts by advised REITs are used for debt repayment and strategic initiatives.

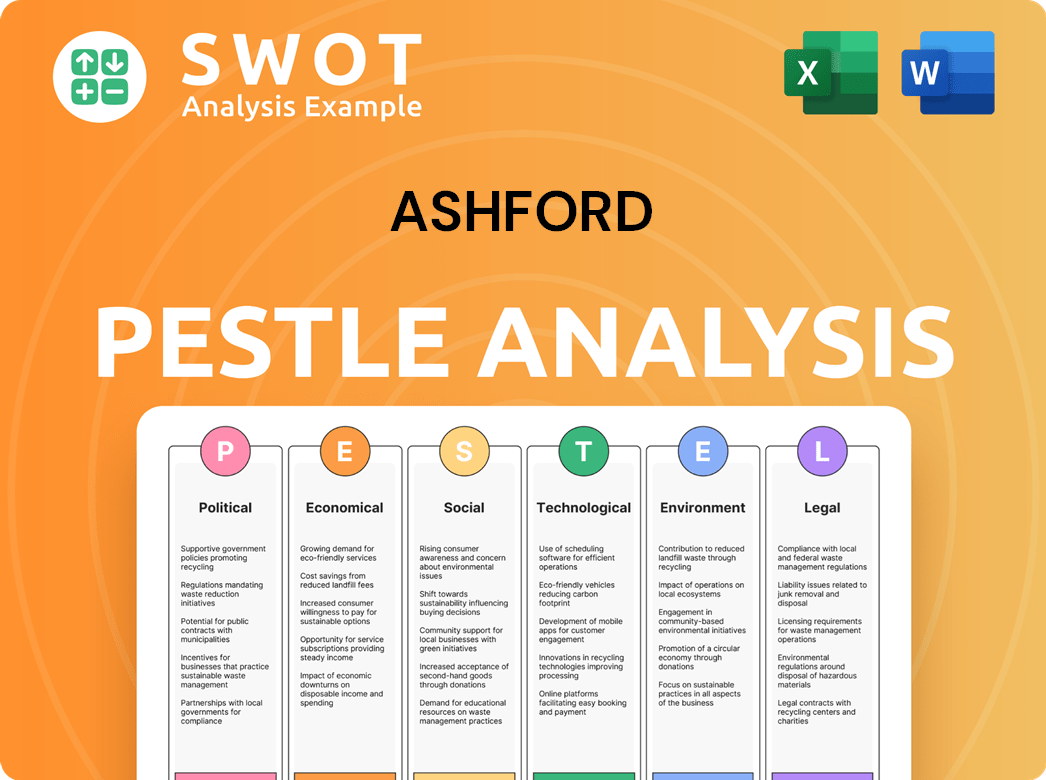

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ashford’s Business Model?

Ashford Inc. and its advised REITs have navigated significant strategic shifts and achieved key milestones, shaping their operational and financial trajectories. A central initiative is the 'GRO AHT' plan, launched in December 2024 by Ashford Hospitality Trust, with advisory support from Ashford Inc. This strategy aims to boost EBITDA and enhance shareholder value, targeting an additional $50 million of EBITDA improvement to run-rate corporate EBITDA, representing an increase of over 20%.

The plan includes substantial cuts to management and board compensation, renegotiating advisory fees with Ashford Inc., and reducing professional and administrative costs. These measures reflect a proactive approach to streamline operations and improve financial performance. Furthermore, the company has addressed operational and market challenges, such as the impact of the COVID-19 pandemic and high leverage, through aggressive deleveraging efforts.

Since the beginning of 2024, Ashford Hospitality Trust has sold over $430 million in hotel assets, refinanced several properties for excess proceeds, and raised approximately $195 million through non-traded preferred stock offerings. The sale of the Courtyard Boston Downtown for $123.0 million in January 2025 further highlights these efforts.

The 'GRO AHT' plan, initiated in December 2024, is a major strategic move. The sale of hotel assets and refinancing efforts have been crucial for deleveraging. Raising capital through non-traded preferred stock offerings has also been a significant step.

Aggressive deleveraging efforts, including asset sales and refinancing, are key. The 'GRO AHT' plan focuses on cost reduction and EBITDA growth. Strategic hotel brand conversions are also part of the strategy.

Specialized focus on the hospitality industry provides a competitive advantage. Integrated asset management and advisory services enhance property performance. Revenue maximization strategies, such as boosting room revenue market share, are also key.

Ashford Hospitality Trust sold over $430 million in hotel assets since early 2024. The company raised approximately $195 million through non-traded preferred stock offerings. The 'GRO AHT' plan targets an incremental $50 million of EBITDA improvement.

Ashford Inc.'s competitive advantages stem from its specialized focus on the hospitality industry and integrated services. The company's proactive approach to market differentiation includes boosting room revenue market share by more than 200 basis points in 2025 and increasing ancillary revenues.

- Specialized focus on the hospitality industry.

- Integrated asset management and advisory services.

- Revenue maximization strategies, including boosting room revenue market share.

- Strategic hotel brand conversions, such as La Concha Hotel and Le Pavillon Hotel to Marriott brands.

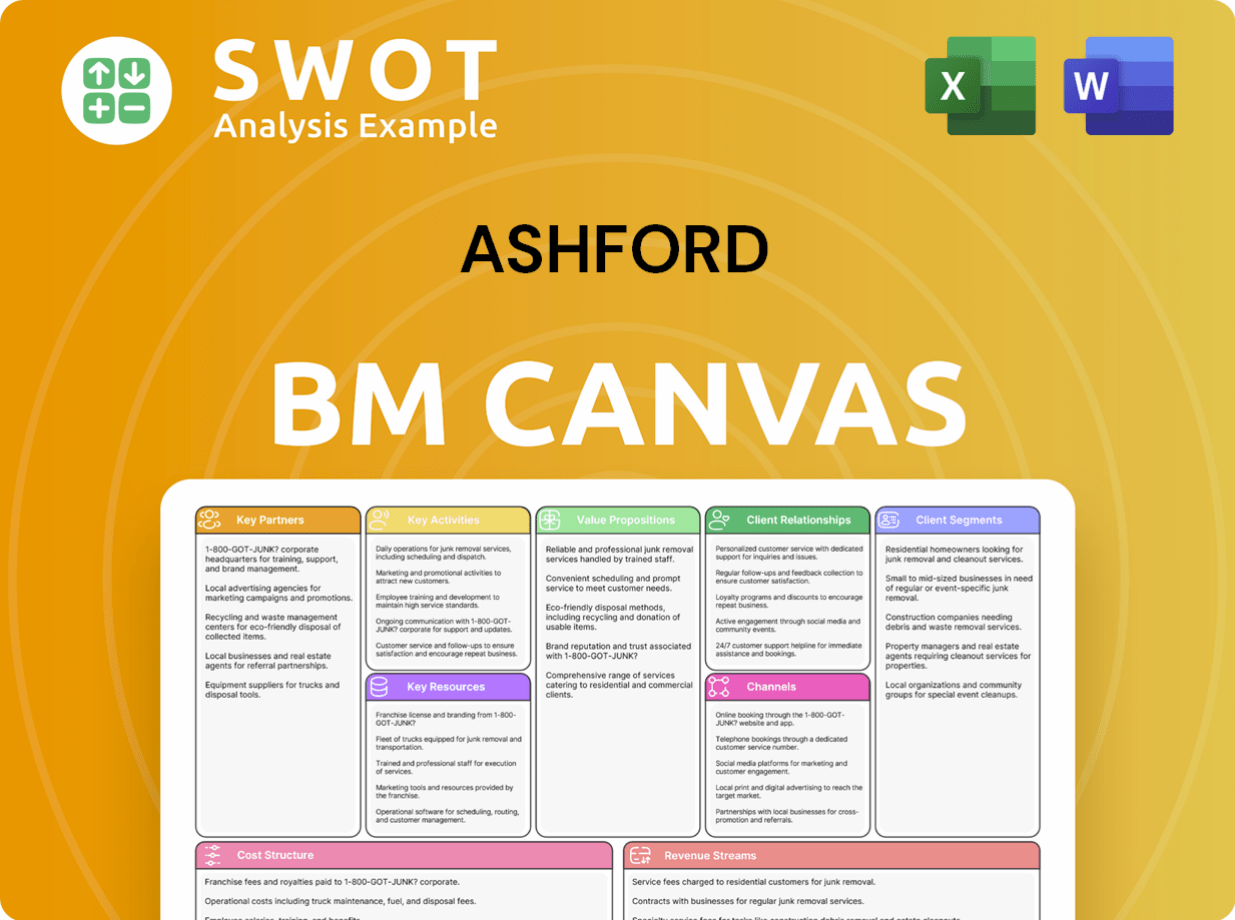

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ashford Positioning Itself for Continued Success?

The Ashford Company operates within the hospitality asset management sector, primarily through advisory relationships with real estate investment trusts (REITs). This structure allows the company to manage and oversee hotel portfolios, focusing on maximizing performance and shareholder value. As of March 31, 2025, Ashford Hospitality Trust's portfolio included 72 hotels with 17,329 rooms, highlighting Ashford's significant presence in the upscale and upper-upscale hotel segments.

The company's geographically diverse portfolio is a key competitive advantage, helping it navigate market fluctuations. However, it faces risks such as high interest rates and potential market volatility, which could impact its financial performance and strategic initiatives. Despite these challenges, Ashford is focused on strategic growth and operational improvements to drive future success.

Ashford Company's primary role is advising REITs in the hospitality sector. It specializes in managing upscale and upper-upscale hotels. Its diverse portfolio is a key advantage, enabling it to adapt to different market conditions effectively. The company's focus is on creating shareholder value through strategic management and operational improvements.

Ashford faces risks including high interest rates on loans, with Ashford Hospitality Trust having $2.6 billion in loans at a blended average interest rate of 8.1% as of March 31, 2025. Market volatility could impact asset sales and capital structure improvements. Limited international travel exposure could also restrict growth opportunities.

Ashford is focused on its 'GRO AHT' strategy, aiming for a $50 million increase in run-rate corporate EBITDA. Strategic initiatives for 2025 include $95 million to $115 million in capital expenditures and potential asset sales of $50 million to $75 million. The company anticipates continued strong group demand in 2025, supporting RevPAR growth.

Ashford is implementing the 'GRO AHT' strategy to enhance revenue generation. Planned capital expenditures range from $95 million to $115 million. The company is also considering asset sales valued between $50 million and $75 million. These initiatives aim to improve capital structure and increase shareholder value.

Ashford is focused on maximizing hotel performance and strategic portfolio turnover. Deleveraging is a key priority to enhance shareholder value. The company anticipates continued strong group demand in 2025, which is expected to support RevPAR growth, demonstrating its focus on operational excellence and financial stability. For more detailed insights, see the Growth Strategy of Ashford.

- 'GRO AHT' strategy to increase corporate EBITDA.

- Planned capital expenditures for property improvements.

- Potential asset sales to improve capital structure.

- Focus on maximizing hotel performance and deleveraging.

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.