Ashford Bundle

Who Really Controls Ashford Company?

Unraveling the ownership structure of a company is like deciphering its DNA, revealing the forces that shape its destiny. The Ashford SWOT Analysis is critical to understanding the company. This deep dive into Ashford Company ownership explores the key players, from founders to major investors, and how they influence its strategic direction.

Understanding who owns Ashford is essential for anyone looking to assess its long-term viability and investment potential. This analysis will explore the Ashford Group's history, including the Ashford Inc. spin-off, and examine the evolution of its ownership profile. We'll investigate Ashford Company shareholders, key personnel, and the impact of ownership changes over time, providing valuable insights for investors and business strategists alike.

Who Founded Ashford?

The story of the Ashford Company, now known as Ashford Inc., began in 1968, with its roots firmly planted in the hospitality sector. The company's foundation was laid by the family of Monty J. Bennett, who would later become a key figure in its development. While the exact initial ownership structure isn't fully detailed in public records, the influence of the Bennett family is undeniable.

Monty J. Bennett is recognized as the founder, Chairman, and CEO of Ashford Inc. His early involvement in the hotel industry, including co-founding Remington Hotels in 1989, provided the experience needed to build the broader Ashford enterprise. This background in hotel management was crucial in shaping the company's strategic direction and operational expertise.

Ashford Inc. went public in November 2014, marking a significant shift in its ownership structure. This transition occurred through a spin-off from Ashford Hospitality Trust, distributing shares to its common stockholders. This move opened up the company to public investment and set the stage for its future growth and development.

The 2014 spin-off from Ashford Hospitality Trust was a pivotal moment for Ashford Inc., transforming its ownership landscape. Following the spin-off, approximately 70% of Ashford Inc.'s outstanding common stock was publicly held. This included shares owned by officers and directors of both Ashford Trust and Ashford Inc., while the remaining 30% was retained by Ashford Trust. At the time of the spin-off, there were roughly 2.0 million shares of Ashford Inc. common stock available.

- The public offering allowed a broader range of investors to participate in Ashford Inc.'s growth.

- The initial ownership structure reflected the company's origins in the hospitality sector.

- The spin-off provided Ashford Inc. with greater financial flexibility and access to capital.

- The leadership team's focus on hospitality real estate was evident in the establishment of an asset management firm.

For a deeper dive into the company's strategic direction, consider exploring the Growth Strategy of Ashford. This article offers insights into the company's approach to expansion and market positioning.

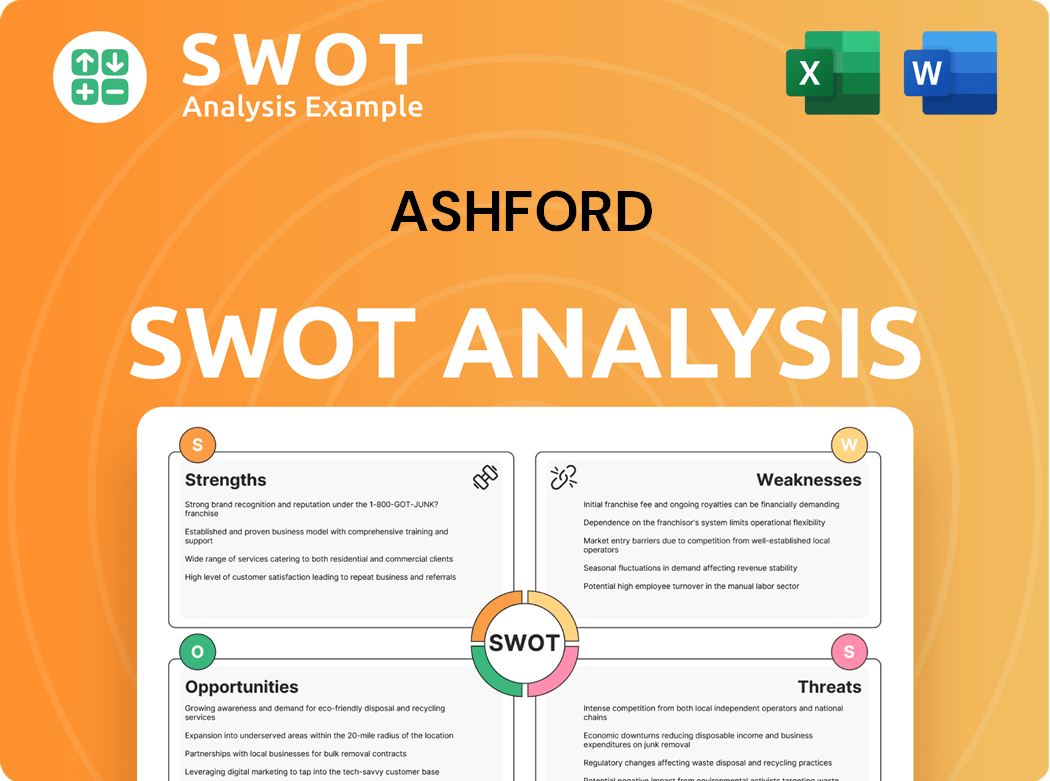

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ashford’s Ownership Changed Over Time?

The ownership journey of Ashford Inc., a company that has seen notable shifts, began with its emergence as a publicly traded entity in November 2014. A key aspect of understanding Ashford Company ownership is recognizing the influence of its major stakeholders. The ownership structure has evolved, particularly with the Bennett family's significant stake.

As of December 31, 2023, the Bennett family, specifically Monty J. Bennett (Chairman and CEO) and Archie Bennett, Jr., held a controlling interest. They controlled approximately 610,261 shares of common stock, representing about 19.0% ownership. Additionally, they held 18,758,600 shares of Series D Convertible Preferred Stock. If converted, this would have increased their ownership to 65.0%. This includes 360,000 shares held by trusts, highlighting the family's long-term commitment and influence on the Ashford business.

| Ownership Component | As of December 31, 2023 | Ownership Percentage |

|---|---|---|

| Common Stock (Bennett Family) | 610,261 shares | ~19.0% |

| Series D Convertible Preferred Stock (Bennett Family) | 18,758,600 shares | N/A (convertible) |

| Total Potential Ownership (upon conversion) | N/A | ~65.0% |

Institutional investors also play a crucial role, especially in Ashford Hospitality Trust, an advised REIT of Ashford Inc. As of May 2025, institutional investors held 21.34% of Ashford Hospitality Trust. Mutual funds held 10.01%, a decrease from 10.84% in December 2024. Key institutional shareholders include CastleKnight Management LP, Vanguard Group Inc, Varde Management, L.P., and BlackRock, Inc. Insider holdings in Ashford Hospitality Trust remained stable at 0.56% in May 2025. These details, often found in SEC filings, help paint a picture of Ashford Company shareholders and the dynamics influencing the company's strategic direction. For insights into the company's marketing approach, consider reading this Marketing Strategy of Ashford.

The Bennett family maintains a controlling interest in Ashford Inc., significantly influencing its strategic decisions.

- Institutional investors hold substantial stakes in Ashford Hospitality Trust.

- Ownership details are regularly updated in SEC filings.

- Understanding Ashford Company ownership is crucial for assessing its governance and strategic direction.

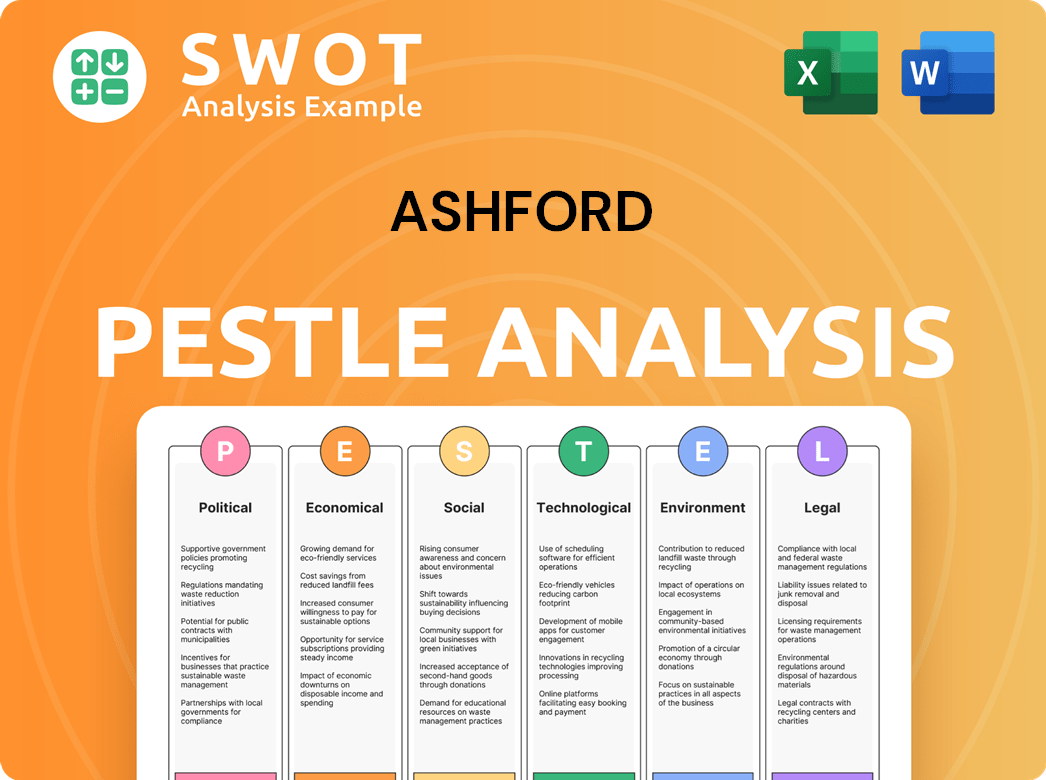

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ashford’s Board?

The Board of Directors of Ashford Inc. is pivotal in the company's governance, with representation from major shareholders and independent members. Monty J. Bennett is the Chairman and Chief Executive Officer of Ashford Inc. He also holds the positions of Founder and Chairman at Ashford Hospitality Trust and Braemar Hotels & Resorts. His substantial ownership stake, particularly through convertible preferred stock, gives him and his father, Archie Bennett, Jr., significant control over Ashford Inc. This controlling interest could reach as high as 65.0% if all convertible preferred stock were exercised as of December 31, 2023, offering them considerable influence.

While specific details on dual-class shares or special voting arrangements are not explicitly detailed in recent public filings, the convertible preferred stock held by the Bennetts functions as a mechanism for concentrated voting power. In May 2024, Ashford Hospitality Trust, an advised REIT of Ashford Inc., faced a proxy battle initiated by activist investor Blackwells Capital. Blackwells Capital aimed to remove Monty Bennett and other board members, citing underperformance and alleged 'self-dealing external advisory agreements.' Although preliminary results indicated that Monty Bennett and another director did not receive a majority of votes for re-election, their resignations were not accepted by the board, and they continued to serve. This event underscores the complexities of governance and shareholder influence within the Ashford ecosystem, even amid activist campaigns.

| Key Personnel | Title | Relationship |

|---|---|---|

| Monty J. Bennett | Chairman and CEO | Founder and Chairman of Ashford Hospitality Trust and Braemar Hotels & Resorts |

| Archie Bennett, Jr. | Shareholder | Father of Monty J. Bennett, significant ownership |

| Blackwells Capital | Activist Investor | Initiated proxy battle in May 2024 |

The ownership structure of Ashford Inc. is primarily influenced by the Bennett family's holdings. Understanding the dynamics of Ashford Company ownership is crucial for investors. The concentration of voting power through convertible preferred stock highlights the importance of monitoring the board's actions and the influence of major shareholders. For more details on the Ashford Group's operations and structure, you can refer to external resources.

The Board of Directors of Ashford Inc. is crucial for governance, with major shareholders and independent members represented. Monty J. Bennett, as Chairman and CEO, holds significant influence. The Bennett family's convertible preferred stock grants them substantial control, potentially reaching 65.0%.

- Monty J. Bennett serves as Chairman and CEO.

- Archie Bennett, Jr. holds significant ownership.

- Blackwells Capital initiated a proxy battle in May 2024.

- Convertible preferred stock concentrates voting power.

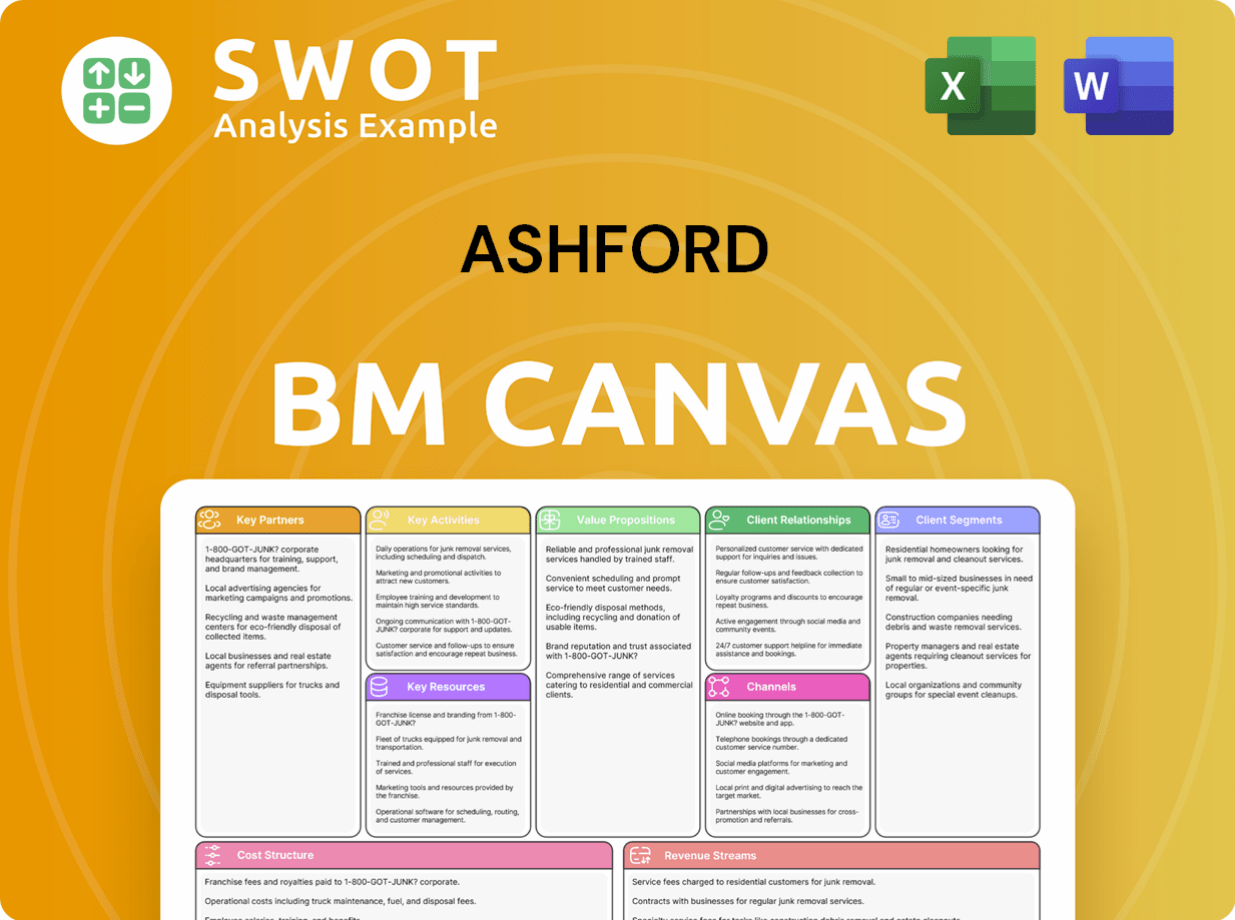

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ashford’s Ownership Landscape?

In the past few years, there have been notable shifts in the Ashford Company ownership landscape. A significant move is the plan to terminate the registration of its common stock under the Exchange Act. This action, initiated with a Form 15 filing on August 8, 2024, is expected to be effective around November 6, 2024. The goal is to reduce the number of record holders below 300, which would cease public reporting and delist from the NYSE American. This strategy aims to focus resources on enhancing long-term stockholder value and avoid the costs associated with being a public reporting company. This move suggests a strategic shift towards a more private structure, influencing how Ashford Company operates and is perceived in the market.

Industry trends also highlight the ongoing involvement of activist investors within the broader Ashford Group. In May 2024, Blackwells Capital engaged in a proxy battle against Ashford Hospitality Trust and Braemar Hotels & Resorts. This involved accusations against Monty Bennett, emphasizing the scrutiny and pressure from activist investors within the hospitality REIT sector. Furthermore, Ashford Inc has been involved in strategic acquisitions, such as Remington Hotels' purchase of Chesapeake Hospitality in April 2022. The company continues to focus on expanding its third-party business and assets under management. Since its launch in 2021, Ashford Securities, its fundraising platform, has raised approximately $580 million in capital.

| Aspect | Details | Impact |

|---|---|---|

| Delisting Plan | Filing Form 15 on August 8, 2024, effective around November 6, 2024. | Transition to a more private operational structure, less public reporting. |

| Activist Investor Engagement | Blackwells Capital's proxy battle in May 2024. | Increased scrutiny and pressure on management within the hospitality REIT sector. |

| Strategic Acquisitions | Remington Hotels acquired Chesapeake Hospitality in April 2022. | Expansion of the hotel management business and assets under management. |

| Fundraising | Ashford Securities raised approximately $580 million since 2021. | Supports growth and expansion of the Ashford business. |

These developments reflect a dynamic period for Ashford Company, with changes in ownership structure and investor relations. For a deeper understanding, you might find Brief History of Ashford insightful.

The Ashford Company ownership structure is evolving, with a move towards privatization. This shift impacts the company's reporting obligations and public presence.

Activist investors are actively influencing the Ashford Group, putting pressure on management. This dynamic affects strategic decisions and operations.

Acquisitions and fundraising are key strategies. These moves support the growth of the hotel management business and enhance assets under management.

Ashford Company has raised significant capital through its fundraising platform. This financial backing fuels its expansion and strategic initiatives.

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.