AVIC Capital Bundle

What's the Story Behind AVIC Capital's Rise?

Delve into the fascinating AVIC Capital SWOT Analysis and uncover the journey of AVIC Capital Co., Ltd., a powerhouse in China's financial sector. From its inception in 1992, this state-owned enterprise has evolved into a multifaceted financial institution. Its strategic location in Beijing has been pivotal in its growth, shaping its role within the Chinese investment landscape.

This brief history reveals AVIC Capital's pivotal role in supporting the China aviation industry, initially serving as the financial backbone for its parent company, the Aviation Industry Corporation of China (AVIC). Understanding the AVIC company's evolution provides crucial insights into its current market position and its impact on the broader economy. Explore how AVIC Capital's strategic investments and diverse financial services have contributed to its significant market capitalization and financial performance.

What is the AVIC Capital Founding Story?

The story of AVIC Capital Co., Ltd. begins in 1992. The company emerged as a strategic financial arm of the Aviation Industry Corporation of China (AVIC), a state-owned enterprise. This marked the official founding of AVIC Capital, designed to support the growing needs of China's aviation industry and related sectors.

The establishment of AVIC Capital was a direct response to the evolving economic landscape of China. It was created to provide specialized financial services, which included aviation finance, leasing, and investment banking. This initiative was crucial for supporting the development and expansion of key strategic industries within China.

The company's formation was influenced by broader economic factors, aiming to facilitate investment and growth. AVIC Capital's early focus was on providing financial solutions to support the aviation industry. AVIC Capital's role in China's aviation was significant from the start.

AVIC Capital was officially founded in 1992 as a subsidiary of AVIC.

- The primary goal was to provide financial services to the aviation industry and related sectors.

- It was created to support the growth and investment within key strategic industries.

- The company's establishment was influenced by the evolving economic conditions in China.

- AVIC Capital's early business model centered on aviation finance, leasing, and investment banking.

The company's initial focus on aviation finance and leasing played a crucial role in supporting the development of China's aerospace industry. AVIC Capital's early activities were closely aligned with the strategic goals of its parent company, AVIC. For an overview of its competitors, you can check out the Competitors Landscape of AVIC Capital.

Over time, AVIC Capital expanded its scope to include various other investment activities. The company's early years were marked by its efforts to establish itself within the financial sector and support the growth of the aviation industry. AVIC Capital's impact on the economy continues to evolve.

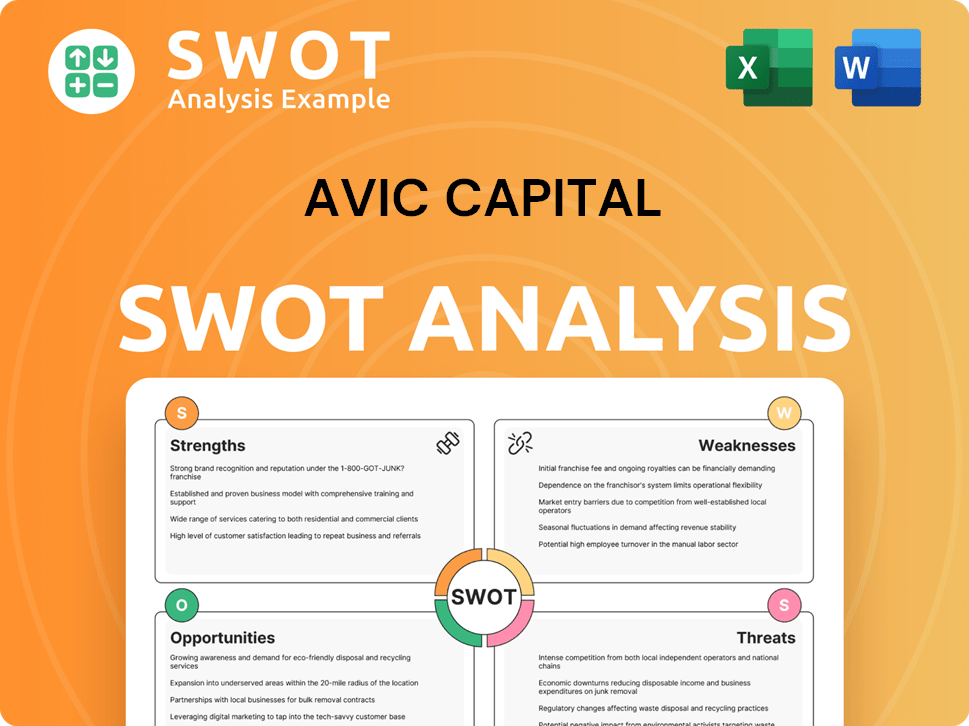

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AVIC Capital?

During its early growth, AVIC Capital focused on establishing itself as a key financial services provider within China. The company expanded beyond aviation finance to include various financial products like trust, securities, leasing, and industrial finance. This expansion indicates a strategic move to broaden its service offerings and client base. The continuous operation and growth of AVIC Capital suggest a steady acquisition of clients and expansion of its service portfolio.

The workforce of AVIC Capital has grown to 3,233 employees as of April 2025, reflecting the company's expansion over the years. This growth in personnel highlights the increasing scope of operations and the company's expanding influence within the financial sector. The headquarters in Beijing serves as the central hub for all operations.

AVIC Capital has been actively involved in various investment activities, with 21 investments recorded, including a Later Stage VC deal with AVIC SAC Commercial Aircraft on August 2, 2024. These investments demonstrate the company's strategy to diversify and strengthen its market presence. The company's strategic moves indicate an effort to diversify and strengthen its market presence.

AVIC Capital has also made acquisitions, with Supercell being its latest acquisition on June 16, 2016. As of September 30, 2024, AVIC Capital reported total assets of $63.09 billion, showcasing significant growth in its financial footprint. For a deeper dive into how AVIC Capital generates revenue, see Revenue Streams & Business Model of AVIC Capital.

Despite a reported net income of $27.68 million as of September 30, 2024, and a projected net income attributable to shareholders of -0.048 billion yuan for 2024, the company maintains a significant presence in the diversified financials sector. This financial performance reflects the ongoing dynamics within the AVIC company and the broader financial landscape.

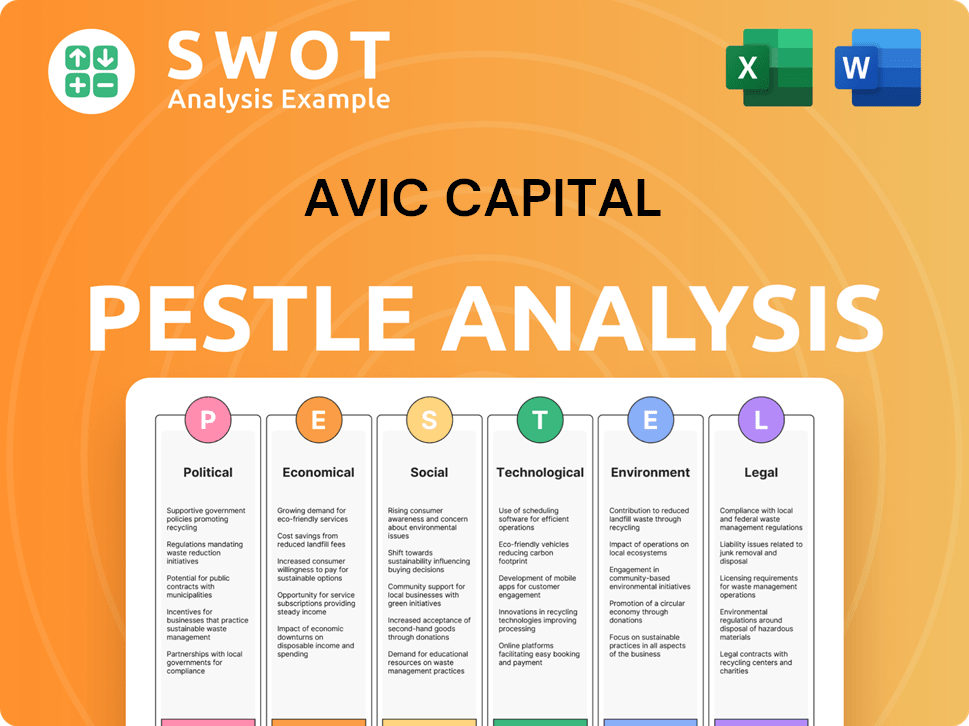

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AVIC Capital history?

The AVIC Capital has achieved significant milestones, expanding its financial services to include trust, securities, leasing, futures, and industrial finance, showcasing its growth within the China aviation industry. The AVIC company has strategically invested in various sectors, solidifying its position in the market.

| Year | Milestone |

|---|---|

| Ongoing | Expansion of financial services, encompassing trust, securities, leasing, futures, and industrial finance. |

| Ongoing | Strategic investments in diverse sectors, including consumer discretionary, energy, healthcare, and information technology. |

| Ongoing | Focus on supporting the aviation industry and other key sectors within the Chinese economy. |

AVIC Capital has demonstrated an innovative approach through its involvement in research and development. This includes work on lithium-ion power batteries, power management systems, and laser rapid forming for aircraft structural parts, reflecting its commitment to technological advancement.

Research and development in lithium-ion power batteries to support various industrial applications.

Development of advanced power management systems to enhance efficiency and performance.

Involvement in laser rapid forming for aircraft structural parts to improve manufacturing processes.

Strategic investments in various sectors, including consumer discretionary, energy, healthcare, and information technology, in addition to its core focus on industrials.

Expansion of financial services to encompass trust, securities, leasing, futures, and industrial finance.

Supporting various industries, including consumer discretionary, energy, healthcare, and information technology, in addition to its core focus on industrials.

Despite its achievements, AVIC Capital has faced challenges, including a decline in revenue and asset values due to external factors. The company's financial performance has been affected, leading to impairment provisions and a share buyback dispute.

The company experienced a decline in revenue, service fees, and commission income due to unexpected factors.

External macroeconomic conditions put pressure on market asset prices, resulting in a decrease in the book value of assets held by the company.

In 2024, AVIC Capital provided impairment provisions totaling over 2.2 billion yuan, reflecting financial strain.

The company was involved in a share buyback dispute with China Life Insurance, with an involved amount of 2.71 billion yuan, stemming from a capital increase agreement.

The deteriorating performance has led to a proposed voluntary delisting, with net income attributable to shareholders for 2024 estimated at -0.048 billion yuan.

AVIC Capital's financial performance has been affected by unexpected factors, leading to a decline in revenue, service fees, and commission income.

For a deeper dive into the strategic direction of the company, consider reading about the Growth Strategy of AVIC Capital, which provides further context on its market positioning and future prospects within the Chinese investment landscape.

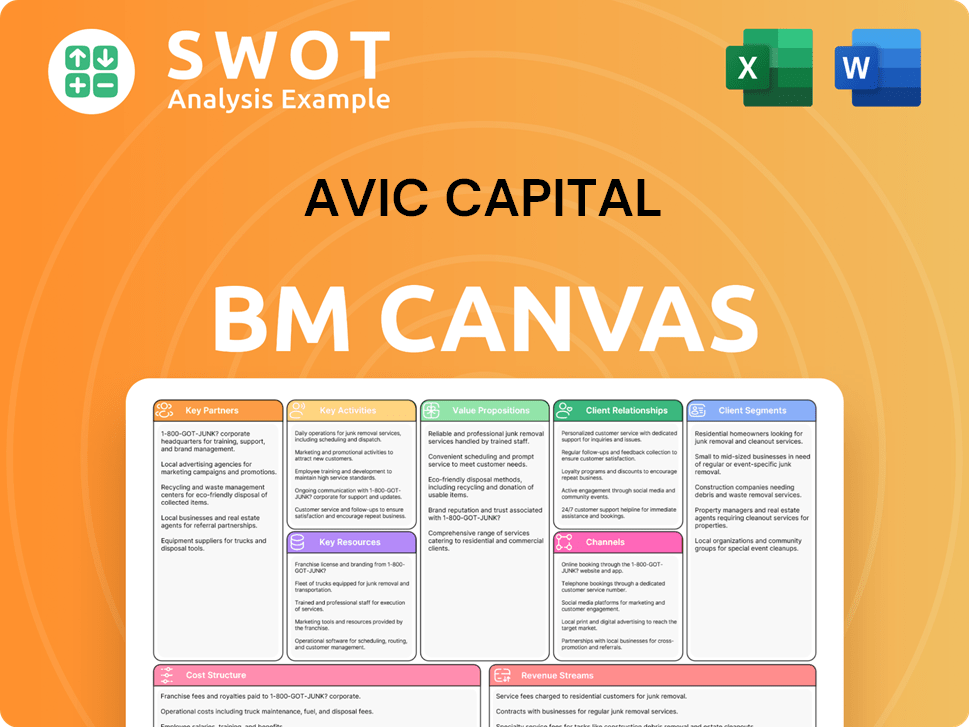

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AVIC Capital?

The AVIC Capital story is marked by strategic shifts and financial maneuvers. Founded in 1992, the company has evolved from its initial structure. A key turning point was its establishment as a private equity firm in December 2012, broadening its investment scope across diverse industries. The company has been involved in venture opportunities. Recent financial data shows that as of September 30, 2024, AVIC Capital reported a trailing 12-month revenue of $2.21 billion. The company's stock price was $0.48 as of April 2, 2025.

| Year | Key Event |

|---|---|

| 1992 | AVIC Capital was founded. |

| 2012 | Established as a private equity firm. |

| 2016 | Acquired Supercell. |

| April 8, 2024 | Made a recent investment in JSAB Technologies as part of their Series C. |

| May 2025 | Moody's Investors Service downgraded AVIC Industry-Finance Holdings' credit rating to 'Baa2'. |

In 2024, AVIC Capital faced operational challenges, with a projected net income attributable to shareholders of -0.048 billion yuan. Additionally, impairment provisions totaled over 2.2 billion yuan. These financial results highlight the need for strategic adjustments and a focus on improving profitability. The company's performance is also being influenced by broader economic conditions.

The announced plan for voluntary delisting will significantly shape AVIC Capital's immediate future. This decision is driven by recent performance declines and a dispute with China Life Insurance. The company's ability to navigate these challenges and adapt its strategies will be crucial. AVIC Capital's strategic direction will likely involve significant restructuring.

AVIC Capital continues to operate as a financial investment and management company, offering services such as trust, securities, leasing, futures, and industrial finance. The long-term outlook may involve a restructuring of its business model to enhance resilience and profitability. The company's future will likely be tied to supporting China's industrial and aviation sectors through specialized financial services.

AVIC Capital's historical role has been supporting China's aviation industry. The company's investments and financial services have contributed to the growth and development of this sector. The company's future success may depend on its ability to adapt to the evolving needs of the China aviation industry. This includes supporting technological advancements and strategic partnerships.

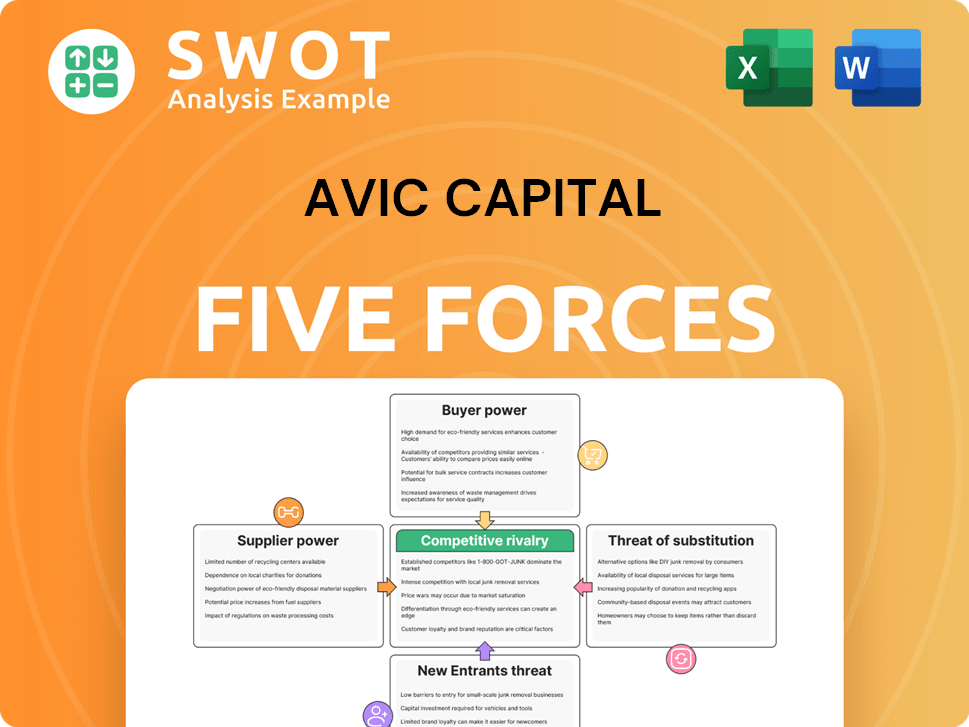

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.