AVIC Capital Bundle

Who Really Owns AVIC Capital?

Unraveling the ownership structure of AVIC Capital is key to understanding its strategic positioning and influence within the dynamic Chinese financial landscape. From its 1992 founding to its pivotal reverse merger, AVIC Capital's journey has been marked by significant shifts. This exploration is crucial for investors and strategists alike.

Understanding the AVIC Capital SWOT Analysis is crucial. As a publicly traded entity on the Shanghai Stock Exchange (600705), knowing who owns AVIC Capital provides vital insights for investment decisions. This deep dive into AVIC ownership will examine its history, major shareholders, and its relationship with the China aviation industry and the broader AVIC Group, offering a comprehensive view of this important player in the Chinese financial market and its role as a Chinese state-owned enterprise.

Who Founded AVIC Capital?

The origins of AVIC Capital Co., Ltd. trace back to its establishment in 1992. While specific details about the individual founders are not readily available, the company's inception is closely linked with the Aviation Industry Corporation of China (AVIC).

AVIC Capital is a subsidiary of AVIC, a major Chinese state-owned aerospace and defense conglomerate. This structure indicates that AVIC, as a state-owned entity, likely held a significant ownership stake from the beginning. This reflects the strategic importance of developing a financial arm to support the aviation industry.

The initial vision for AVIC Capital was aligned with AVIC's objectives. The goal was to provide comprehensive financial services to the aviation industry and related sectors within China. This strategic alignment was crucial for supporting the growth and development of the aviation sector.

AVIC, the parent company, is a key player in the China aviation industry. Its influence shaped AVIC Capital's early direction.

As a subsidiary, AVIC's ownership of AVIC Capital was likely substantial from the start. This reflects the state's strategic interest in the aviation sector.

The primary aim was to offer financial services to the aviation industry. This included supporting projects and investments crucial for sector expansion.

Understanding the founders and early ownership of AVIC Capital provides insight into its strategic role within the Chinese aviation industry.

- AVIC, as the parent company, played a crucial role in AVIC Capital's formation.

- The initial ownership structure was likely dominated by AVIC, a state-owned enterprise.

- The primary goal was to provide financial support to the aviation industry.

- The company's structure reflects the strategic importance of the aviation sector in China.

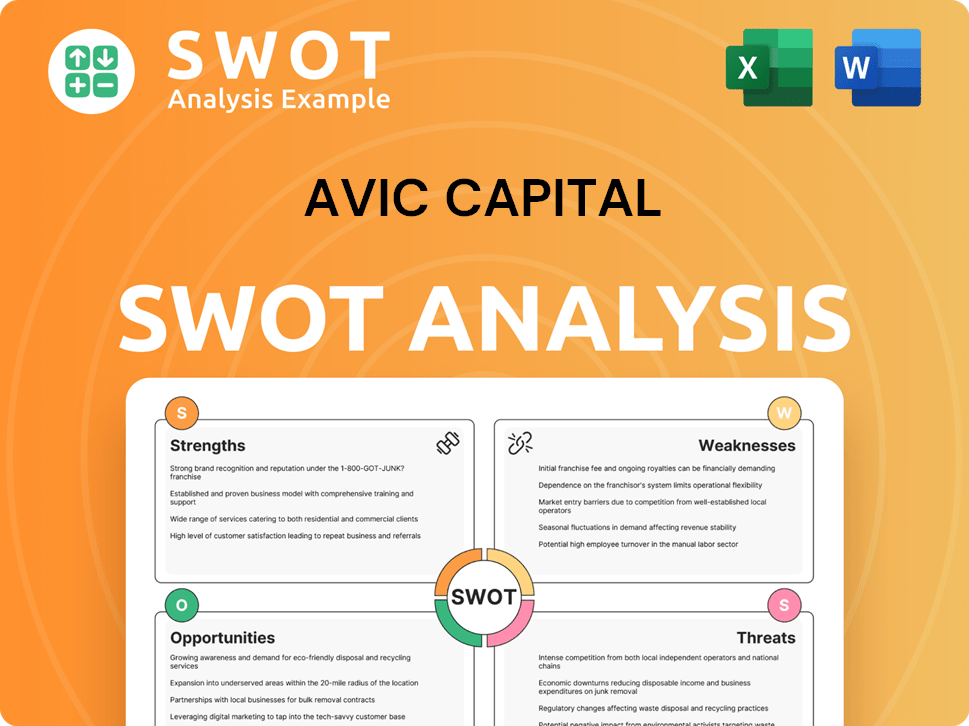

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AVIC Capital’s Ownership Changed Over Time?

The ownership structure of AVIC Capital has evolved significantly, particularly with its public listing. The company, trading on the Shanghai Stock Exchange under the symbol 600705, underwent a crucial reverse merger in 2012. This involved AVIC Capital Co., Ltd. acquiring Beiya Industrial (Group) Co., Ltd., a transaction approved by the State-owned Assets Supervision and Administration Commission (SASAC). This strategic move, which included transferring a 100% stake in AVIC Capital from Aviation Industry Corporation of China, transformed AVIC Capital into a publicly listed entity.

The reverse merger was a pivotal moment, solidifying AVIC Capital's position as a publicly traded financial platform. This allowed the company to access capital markets, supporting its growth and expansion within the aviation industry and beyond. The deal involved the exchange of AVIC Capital's stake for shares in Beiya Industrial (Group) Co., which was a key step in restructuring the ownership and enabling AVIC Capital to broaden its financial service offerings.

| Key Event | Details | Impact |

|---|---|---|

| Reverse Merger (2012) | AVIC Capital acquired Beiya Industrial (Group) Co., Ltd. | Public listing, access to capital markets |

| Parent Company Restructuring | Aviation Industry Corporation of China (AVIC) transferred its stake. | Consolidated AVIC's financial platform. |

| Public Trading | Listed on the Shanghai Stock Exchange (600705). | Enhanced financial flexibility and growth opportunities. |

Currently, Aviation Industry Corporation of China (AVIC) remains the primary stakeholder in AVIC Capital Co., Ltd., now known as AVIC Industry-Finance Holdings Co., Ltd. since June 28, 2021. AVIC, a Chinese state-owned aerospace and defense conglomerate, uses AVIC Capital as a key financial investment platform. As of April 2, 2025, AVIC Capital's market capitalization is $4.21 billion with 8.82 billion shares outstanding. AVIC's role as the parent company signifies a controlling interest, crucial for understanding AVIC ownership. AVIC Capital’s financial services include aviation finance, leasing, and investment banking. For more details, explore the Revenue Streams & Business Model of AVIC Capital.

AVIC Capital is primarily owned by Aviation Industry Corporation of China (AVIC), a major player in the China aviation industry.

- AVIC Capital's total assets as of September 30, 2024, were $63.09 billion.

- Trailing 12-month revenue reached $2.21 billion.

- The company's strategic goal is to provide comprehensive financial services.

- The public listing has enabled access to capital for expansion.

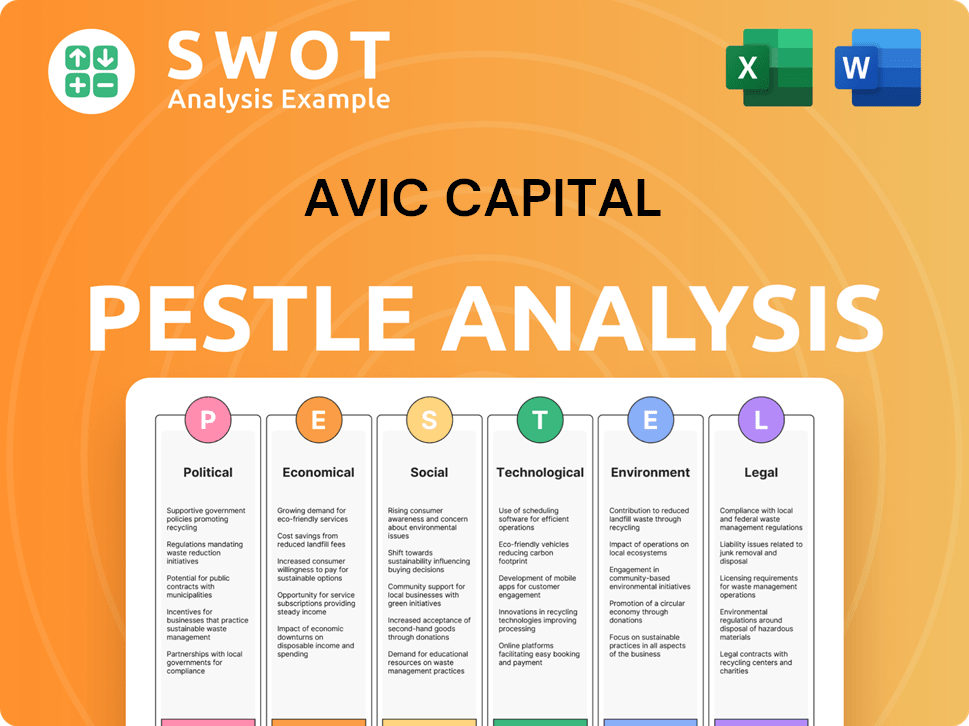

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AVIC Capital’s Board?

The specifics of the current Board of Directors for AVIC Capital Co., Ltd. (now AVIC Industry-Finance Holdings Co., Ltd.) are not explicitly detailed in the available information for 2024-2025. However, given its status as a subsidiary of the Aviation Industry Corporation of China (AVIC) and its public listing, the board likely includes representatives from AVIC, independent directors, and members of the executive management team. Tan Ruisong serves as a key figure in the company's leadership, holding the positions of Chairman and CEO.

The composition of the board reflects a blend of state control and public shareholder representation, typical of Chinese state-owned enterprises (SOEs). The structure is designed to balance the strategic direction from the parent company, AVIC, with the oversight and interests of public investors. The board's role encompasses overseeing the company's strategic direction, financial performance, and adherence to regulatory requirements.

| Board Member | Role | Affiliation |

|---|---|---|

| Tan Ruisong | Chairman & CEO | AVIC |

| [Information not available for 2024-2025] | [Information not available for 2024-2025] | [Information not available for 2024-2025] |

| [Information not available for 2024-2025] | [Information not available for 2024-2025] | [Information not available for 2024-2025] |

The ultimate voting power and control of AVIC Capital reside with its parent company, AVIC. As a state-owned enterprise, AVIC maintains significant influence over strategic decisions and key appointments. The parent company's ownership structure ensures its dominant role in shaping the company's direction. For more insights into the company's growth, consider reading about the Growth Strategy of AVIC Capital.

AVIC Capital's board structure is a mix of state and public interests.

- AVIC, the parent company, holds significant voting power.

- The board includes representatives from AVIC, independent directors, and executive management.

- Tan Ruisong is a key leader, serving as Chairman and CEO.

- Oversight mechanisms are in place, as demonstrated by past regulatory actions.

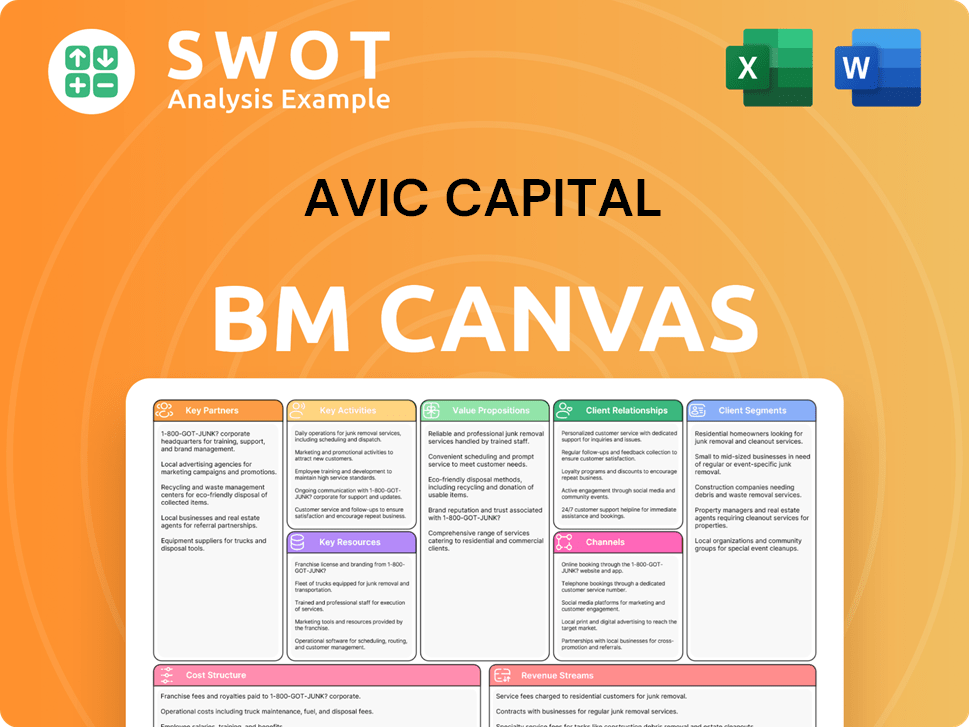

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AVIC Capital’s Ownership Landscape?

In the past few years, AVIC Capital Co., Ltd., now known as AVIC Industry-Finance Holdings Co., Ltd., has remained a significant player in China's financial landscape. As of April 2, 2025, its stock price was at $0.48, with a market capitalization of $4.21 billion. The company's trailing 12-month revenue, as of September 30, 2024, was $2.21 billion. This data reflects the company's ongoing operations and its position within the broader Chinese financial sector.

Recent developments show a continued emphasis on core financial services and strategic investments. For example, in August 2024, AVIC Capital made a later-stage venture capital deal with AVIC SAC Commercial Aircraft. The company's shift towards industry-finance integration is evident, with leasing accounting for over 50% of its business by the end of 2020, leading to the name change to better reflect its strategic direction. These activities highlight how AVIC Capital is adapting to market dynamics and focusing on its core strengths.

| Key Financial Metrics | Value | Date |

|---|---|---|

| Stock Price | $0.48 | April 2, 2025 |

| Market Capitalization | $4.21 billion | April 2, 2025 |

| Trailing 12-Month Revenue | $2.21 billion | September 30, 2024 |

| Net Loss | CNY 352.71 million | Q1 2024 |

In terms of ownership, AVIC Capital remains a subsidiary of the Aviation Industry Corporation of China (AVIC), a state-owned conglomerate. This structure indicates a consistent pattern of state control and strategic alignment within the larger AVIC group. Internal restructuring continues, as demonstrated by Aviation Industry Corporation of China, Ltd.'s agreement in May 2025 to acquire a 5.76% stake in AVIC Xi'an Aircraft Industry Group Company Ltd. from AVIC Investment Holdings Co., Ltd. AVIC Industry-Finance Holdings also reported a net loss of CNY 352.71 million for the first quarter ended March 31, 2024, signaling financial fluctuations despite strategic investments. For more insights into the competitive environment, you can explore the Competitors Landscape of AVIC Capital.

AVIC Capital is primarily owned by the Aviation Industry Corporation of China (AVIC), a state-owned enterprise.

AVIC Capital operates as a subsidiary within the broader AVIC Group, reflecting a centralized management approach.

Ownership trends show continued state control and internal restructuring, with AVIC optimizing its asset portfolio.

The company has shown recent fluctuations in financial performance, including a net loss reported in Q1 2024.

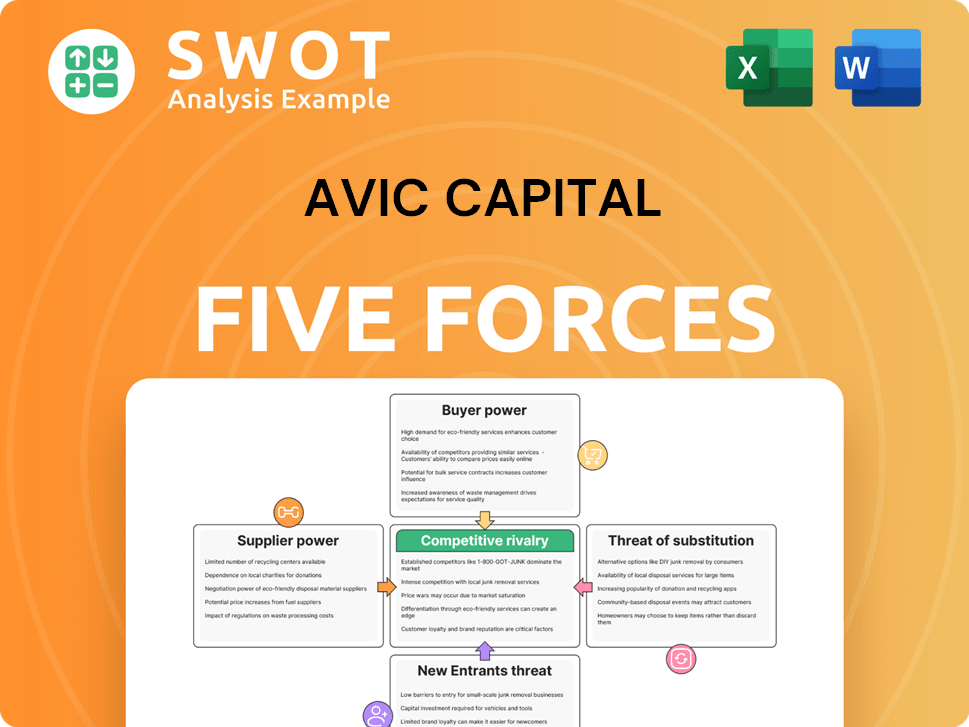

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Competitive Landscape of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.