AVIC Capital Bundle

What's Next for AVIC Capital?

AVIC Capital, a prominent AVIC Capital SWOT Analysis, is a key player in China's financial sector, boasting a $4.21 billion market capitalization as of April 2, 2025. This investment company, integral to the Aviation Industry Corporation of China (AVIC), offers a wide array of financial services, including trust, securities, and leasing. Understanding its growth strategy and future prospects is crucial for anyone seeking to navigate the complexities of the financial market.

This analysis delves into AVIC Capital's strategic initiatives, exploring its plans for expansion and innovation within the dynamic financial landscape. We will examine its financial performance, conduct a thorough market analysis, and assess potential risks, offering valuable insights into AVIC Capital's long-term growth strategy and investment opportunities. The goal is to provide a comprehensive overview of AVIC Capital's future financial outlook, helping investors and strategists make informed decisions.

How Is AVIC Capital Expanding Its Reach?

AVIC Capital's Growth Strategy centers on expanding its service offerings and entering new investment areas. The company provides a wide array of financial services, including fund management and advisory services. AVIC Capital also focuses on leasing services, particularly for aircraft and other equipment, which supports the aviation industry.

The company is actively pursuing strategic investments in various industries beyond traditional finance. As a private equity firm, AVIC Capital focuses on venture opportunities in sectors like consumer discretionary, energy, and information technology. This diversification aims to boost revenue streams and capitalize on emerging industry trends. This approach is a key element of their long-term growth strategy.

AVIC International Capital, a subsidiary, invests in aviation parts manufacturing and related areas. This investment strategy reflects AVIC Capital's commitment to expanding its portfolio and exploring new investment opportunities. The company's financial performance is closely tied to these strategic initiatives.

AVIC Capital's expansion includes broadening its financial service offerings. This involves providing services like centralized fund management, settlement, and foreign exchange services. The company's leasing services, covering aircraft, ships, and equipment, are a significant part of its growth strategy.

The company is actively pursuing strategic investments in diverse industries. AVIC Capital focuses on venture opportunities in sectors like consumer discretionary, energy, and information technology. AVIC International Capital invests in aviation-related businesses, including parts manufacturing and equipment.

AVIC Capital supports the aviation industry through leasing services. The company also invests in aviation-related businesses, such as parts manufacturing and airport equipment. Recent investments, like the one in Greendisplay on March 16, 2023, highlight the company's focus on new ventures and emerging technologies.

AVIC Capital is exploring investments in 'three new' fields to diversify its portfolio. These initiatives include collaborations with companies like Chengfei Integration and AVIC Heavy Machinery. These moves aim to capitalize on industry trends and improve the company's future financial outlook.

AVIC Capital's expansion strategy involves both broadening its service portfolio and entering new investment areas. The company's leasing services, particularly for aircraft, are a significant part of its growth. Strategic investments in diverse industries beyond traditional finance are also a key focus.

- Diversification of financial services, including fund management and advisory services.

- Strategic investments in sectors like consumer discretionary, energy, and information technology.

- Focus on aviation-related businesses through leasing and direct investments.

- Exploration of 'three new' fields to diversify the investment portfolio.

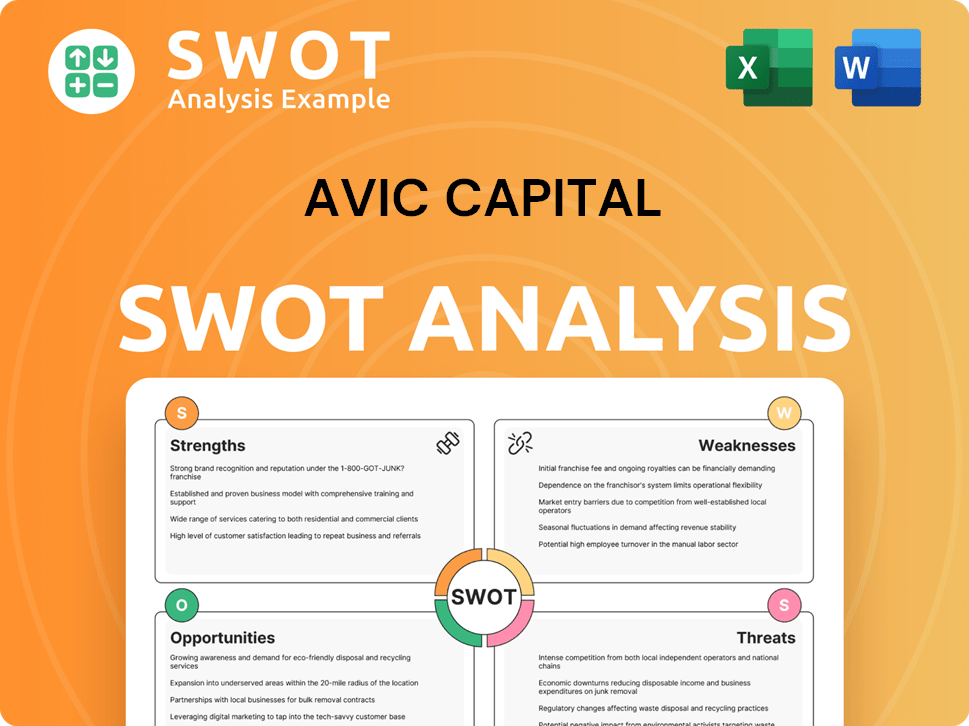

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AVIC Capital Invest in Innovation?

The innovation and technology strategy of AVIC Capital is integral to its growth strategy, focusing on technological advancements to enhance financial services and support industrial development. This approach extends beyond traditional financial offerings, aligning with broader innovation within the AVIC conglomerate. AVIC Capital's commitment to technology is demonstrated through strategic investments in cutting-edge areas, which are crucial for its future prospects.

One key area of focus is the research and development of lithium-ion power batteries and power management systems. This investment highlights the company's dedication to technological advancement and its role in supporting the development of advanced manufacturing processes. The company's strategic investments in technology-driven companies and projects within the AVIC ecosystem underscore its indirect, yet significant, role in fostering innovation to achieve growth objectives.

Another important technological focus is laser rapid forming and installation application for large-scale integral titanium alloy main load-bearing structural parts of aircraft. This showcases AVIC Capital's contribution to the aerospace industry's advanced manufacturing processes. While specific details on R&D investments or patents directly under AVIC Capital were not extensively detailed, its strategic investments in technology-driven companies and projects within the AVIC ecosystem underscore its indirect, yet significant, role in fostering innovation to achieve growth objectives.

AVIC Capital invests in technologies that support both financial services and industrial development. This includes areas like lithium-ion power batteries and power management systems, demonstrating a commitment to innovation beyond traditional financial products.

The company supports advanced manufacturing processes, such as laser rapid forming for aircraft components. This involvement highlights AVIC Capital's strategic alignment with the aerospace industry's technological advancements.

AVIC Capital plays an indirect but significant role in fostering innovation through its investments. These investments support the growth of the AVIC ecosystem and contribute to its overall strategic objectives.

Key technological areas include lithium-ion batteries and aerospace manufacturing. These areas are crucial for supporting industrial innovation and enhancing the company's Revenue Streams & Business Model of AVIC Capital.

While specific R&D details may not be extensively available, AVIC Capital's strategic investments highlight its support for technological advancements within the AVIC group. This approach contributes to the company's long-term growth strategy.

Innovation and technology are key components of AVIC Capital's growth strategy. These investments are designed to improve financial performance and expand market share. The company's focus on sustainable growth is evident through its technological initiatives.

AVIC Capital's technology strategy is designed to enhance its financial services and support industrial development. This approach includes investments in cutting-edge areas like lithium-ion power batteries and advanced manufacturing processes for the aerospace industry. These investments are crucial for the company's long-term growth and competitive advantage.

- Lithium-Ion Power Batteries: Investment in R&D for power batteries and management systems.

- Aerospace Manufacturing: Focus on laser rapid forming for aircraft components.

- Strategic Alignment: Supporting technological advancements within the AVIC ecosystem.

- Indirect Role: Fostering innovation through strategic investments.

- Growth Strategy: Enhancing financial performance and expanding market share through technology.

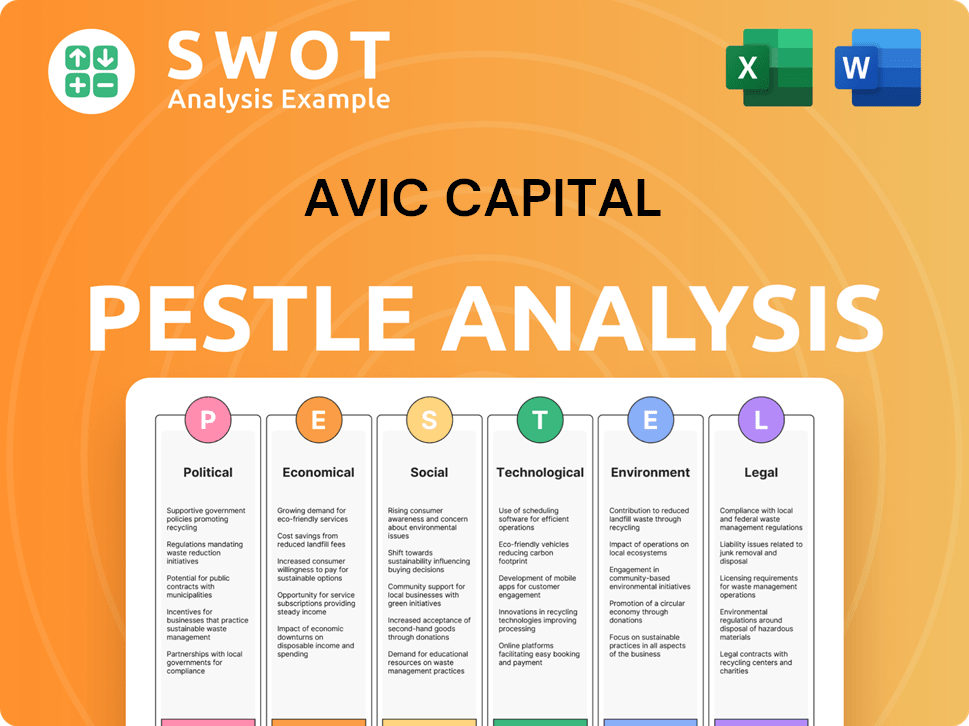

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AVIC Capital’s Growth Forecast?

The financial outlook for AVIC Capital, an investment company, appears stable, supported by its parent group's financial health and strategic initiatives. The company's financial performance reflects its position within the financial services sector, with a focus on maintaining access to low-cost funding. This approach is designed to support future prospects and growth investments, crucial for its long-term strategy.

As of September 30, 2024, AVIC Capital reported a trailing 12-month revenue of $2.21 billion, with total assets of $63.09 billion and total debt at $26.88 billion. For the full year 2023, the company's revenue was $2.39 billion, and it recorded a net income of $41.02 million. These figures provide a baseline for understanding the company's current financial standing and potential for future expansion.

The company's financial strategy includes maintaining access to low-cost funding, which is expected to enhance its financial flexibility and support growth investments. For instance, AVIC International Holdings Ltd., a subsidiary, issued two ten-year domestic corporate bonds in 2024 with 2.74% and 2.9% coupon rates, demonstrating strong access to the domestic capital market. This is anticipated to help increase the EBITDA interest coverage to 4.2x-4.3x over 2024-2025, up from 3.7x in 2023. While specific revenue targets or detailed profit margin forecasts for AVIC Capital were not explicitly available, the broader AVIC International group anticipates its EBITDA to grow to RMB16 billion-RMB17 billion in 2024-2025, from RMB14 billion-RMB14.5 billion in 2022-2023, with an overall EBITDA margin improving to 8.5%-9.0% in 2024 and staying at this level in 2025-2026. This suggests a positive financial narrative underpinning the strategic plans for AVIC Capital as a key financial arm of the group.

AVIC Capital's financial performance in 2023 showed a revenue of $2.39 billion. The company's net income for the same year was $41.02 million, indicating its profitability. This performance sets the stage for future growth, supported by strategic financial planning.

The company focuses on securing low-cost funding to boost its financial flexibility. AVIC International Holdings Ltd.'s bond issuances in 2024, with low coupon rates, highlight this strategy. These initiatives are designed to support investment and expansion plans.

The broader AVIC International group anticipates EBITDA growth to RMB16 billion-RMB17 billion in 2024-2025. The group's EBITDA margin is expected to improve to 8.5%-9.0% in 2024, maintaining this level through 2025-2026. This suggests a positive outlook for the group.

As of September 30, 2024, AVIC Capital's total assets were $63.09 billion, with total debt at $26.88 billion. The company's access to capital markets is strong, as demonstrated by recent bond issuances. This supports its financial stability.

The future prospects for AVIC Capital are closely tied to the overall performance of the AVIC International group. The group's projected EBITDA growth and margin improvements provide a positive backdrop for the company. This supports the company's strategic initiatives and long-term growth plans.

- The company is expected to leverage its access to low-cost funding.

- EBITDA interest coverage is projected to increase to 4.2x-4.3x over 2024-2025.

- The broader group's EBITDA is expected to grow significantly.

- The company is set to benefit from the group's overall financial health.

For a deeper understanding of the company's origins and evolution, consider exploring the Brief History of AVIC Capital. This provides valuable context for understanding the company's current position and future trajectory.

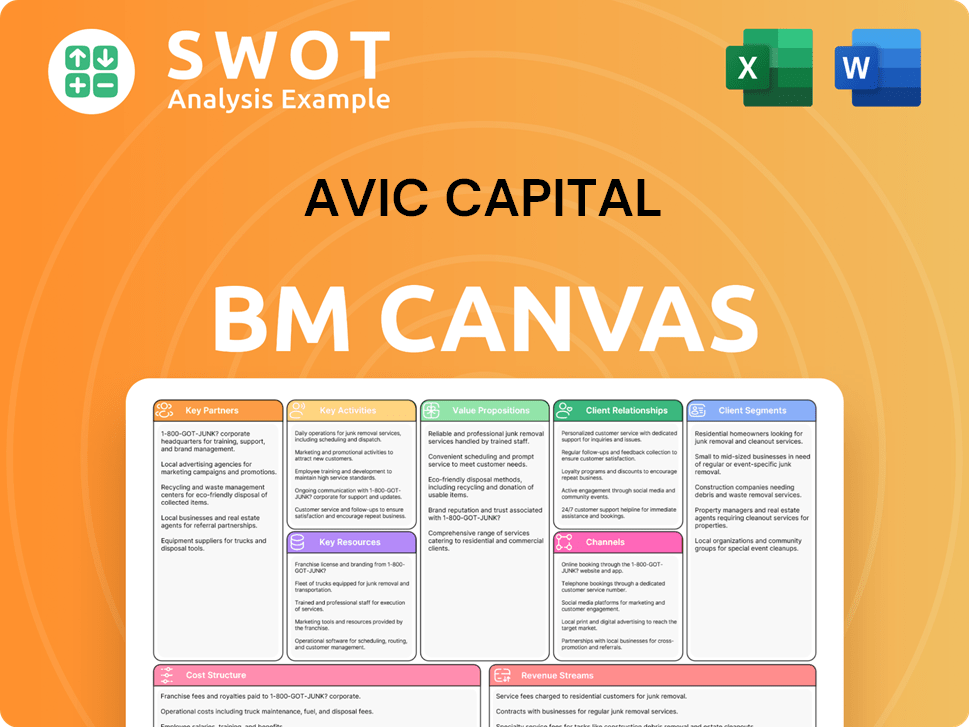

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AVIC Capital’s Growth?

The AVIC Capital faces several potential risks and obstacles that could affect its Growth Strategy and Future Prospects. These challenges include intense competition within China's financial services sector and the potential for regulatory changes that could impact its operations. Furthermore, its close ties to the aviation industry introduce indirect risks related to supply chain issues and technological disruptions.

Given its role as an Investment Company, AVIC Capital's Financial Performance is subject to market fluctuations and the overall economic climate. The company's success is closely tied to its ability to navigate these complexities and adapt to evolving market conditions. Understanding these risks is crucial for a comprehensive Market Analysis and for assessing the company's long-term viability.

To better understand the company, you can read about the Marketing Strategy of AVIC Capital.

The financial sector in China is highly competitive, with numerous firms offering similar services. This includes trust companies, securities firms, leasing companies, and futures brokers. This intense competition could potentially affect AVIC Capital's Market Share Analysis and profitability.

Changes in regulations within China's financial industry pose a significant risk. New policies or stricter oversight could impact AVIC Capital's operations and its ability to generate revenue. The regulatory environment is dynamic, requiring continuous adaptation.

As a financial entity linked to the aviation sector, AVIC Capital is indirectly exposed to risks. This includes supply chain vulnerabilities, technological disruptions, and delivery delays. For example, in 2024, the aviation industry faced challenges with engine maintenance and production.

An economic downturn in China or globally could negatively affect AVIC Capital's investment portfolio. Reduced investment activity and lower asset valuations can impact the company's financial results. Economic cycles are a constant factor.

Geopolitical events and trade tensions can create uncertainty in financial markets. These factors can lead to volatility in investments and impact AVIC Capital's strategic initiatives. This is a key area of risk.

Operational risks, such as cybersecurity threats and internal control failures, can affect AVIC Capital. These risks can lead to financial losses and damage the company's reputation. Robust risk management is essential.

Diversifying the investment portfolio across various industries is a key strategy. However, this diversification can be challenging. It requires expertise in multiple sectors, and the company's success depends on its ability to identify and manage risks across different industries. This includes sectors like consumer discretionary, energy, healthcare, and information technology.

Despite diversification efforts, the company's close ties to the aviation industry remain. A significant portion of its investments and financial activities may still be linked to this sector. This creates a dependency that could impact the company's Financial Reports if the aviation industry faces difficulties. The aviation industry is projected to grow by approximately 6% in 2025, but this growth could be uneven.

AVIC Capital's involvement in mergers and acquisitions within the AVIC group introduces integration risks. Successfully integrating financial assets and managing post-merger operations can be complex. This requires careful planning and execution to realize the intended benefits. The success of such activities is crucial for the company's Long-Term Growth Strategy.

The volatility of capital markets can significantly impact AVIC Capital's investment performance. Market fluctuations can affect the value of its portfolio and the returns generated. Effective risk management and a long-term investment horizon are important for navigating market volatility. In 2024, the volatility index (VIX) has shown periods of high and low volatility, reflecting market uncertainty.

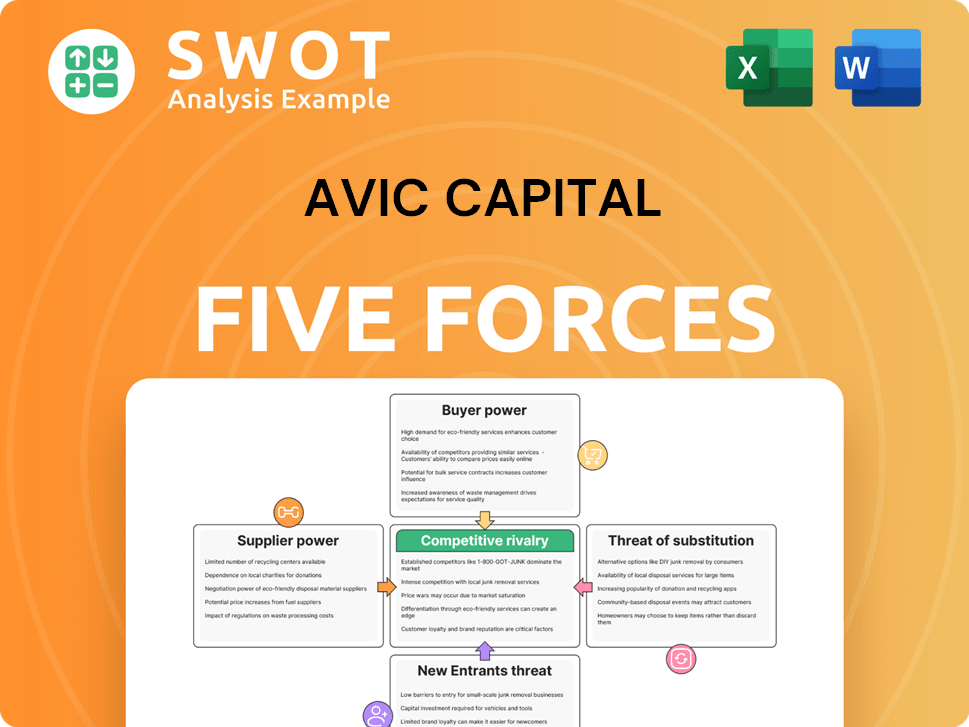

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Competitive Landscape of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.