AVIC Capital Bundle

Who Does AVIC Capital Serve?

In the ever-evolving financial landscape, understanding customer demographics is crucial for any financial institution's success. AVIC Capital Company, a key player in China's financial sector, has broadened its services since its inception in 1992. This expansion raises critical questions about its target market and how it adapts to meet the needs of its diverse clientele.

To thrive, AVIC Capital must deeply understand its AVIC Capital SWOT Analysis, including its customer base. This involves a detailed demographic analysis to identify its target audience, including their age range, geographic location, and income levels. Analyzing its customer profile and market segmentation allows AVIC Capital to refine its investment strategy and customer acquisition strategy, ensuring it remains competitive and relevant. Understanding the AVIC Capital target market characteristics is essential for long-term growth.

Who Are AVIC Capital’s Main Customers?

Understanding the customer demographics and target market of AVIC Capital Company is crucial for grasping its operational scope. AVIC Capital, primarily operating in the business-to-business (B2B) sector, offers a range of financial services. These include trust, securities, leasing, futures, and industrial finance. Its core clientele is largely composed of businesses and institutions within China.

Given its historical ties to the aviation industry through its parent company, Aviation Industry Corporation of China (AVIC), a significant portion of AVIC Capital's customers likely includes large state-owned enterprises. It also includes private corporations and other financial institutions involved in various industrial sectors. These sectors encompass consumer discretionary, energy, financial services, healthcare, industrials, and information technology.

The company's focus on clients needing substantial financial solutions is evident from its services. Its involvement in private equity, venture capital, and corporate finance further indicates that it serves businesses seeking investment, growth capital, or financial advisory services. To learn more about the company's financial structure, consider reading Revenue Streams & Business Model of AVIC Capital.

AVIC Capital's target audience includes large state-owned enterprises, private corporations, and financial institutions. These clients are involved in diverse industrial sectors. The company's services are tailored to meet the complex financial needs of these entities.

AVIC Capital provides services such as trust, securities, leasing, and futures. These offerings are designed to support the financial requirements of its target market. The company's diversified portfolio indicates a broadening of its target segments.

AVIC Capital has expanded its investment portfolio over time. This suggests a strategic move to include emerging industries and technologies. This expansion is likely driven by market research and economic trends.

The company aims to broaden its influence within the financial landscape. This objective is supported by market research and strategic planning. AVIC Capital's customer acquisition strategy is focused on long-term growth.

The AVIC Capital target market is characterized by businesses requiring significant financial solutions. This includes entities seeking investment, growth capital, or financial advisory services. The company's focus extends beyond its initial aviation-centric focus.

- Large State-Owned Enterprises: Significant part of the client base.

- Private Corporations: Businesses seeking financial services.

- Financial Institutions: Partners in various investment activities.

- Emerging Industries: Expanding into new sectors.

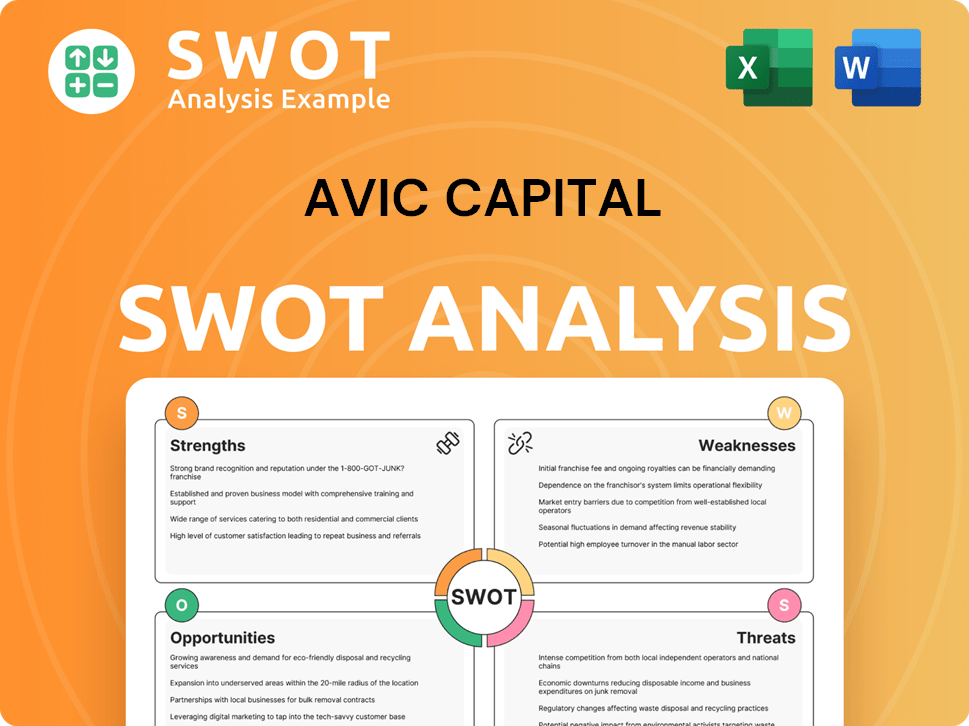

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do AVIC Capital’s Customers Want?

Understanding the customer needs and preferences is crucial for AVIC Capital Company to tailor its financial products and services effectively. The company's target market, primarily composed of businesses and institutions, seeks financial solutions that drive growth, manage risk, and streamline operations. This focus on customer needs allows AVIC Capital to build strong relationships and maintain a competitive edge in the financial sector.

The purchasing behaviors of AVIC Capital's clients are influenced by factors like the reliability of financial partners, competitive pricing, and the ability to offer customized financial products. Businesses often require tailored financing structures and a deep understanding of their specific industries. AVIC Capital’s ability to address these needs is essential for attracting and retaining clients.

The psychological drivers for choosing AVIC Capital include the assurance of working with a stable, well-backed entity. Practical drivers encompass the need for comprehensive financial solutions. Unmet needs that AVIC Capital addresses could include specialized financing for specific industrial projects and access to a broad network of financial expertise. This approach helps AVIC Capital meet the diverse needs of its customer base.

AVIC Capital's customers prioritize capital access, risk management, and investment growth. They also value efficient financial operations and comprehensive solutions. These needs drive their purchasing decisions and influence their choice of financial partners.

Clients consider the reliability of financial partners, competitive pricing, and tailored product offerings. The ability to navigate complex regulatory environments is also a key factor. These elements significantly impact their decision-making processes.

Customers are drawn to the stability and backing associated with AVIC Capital. The perception of security and the strength of the parent company are significant factors. This influences their trust and confidence in the services provided.

Clients seek comprehensive financial solutions that integrate across various business functions. This includes fund management, credit, investment banking, and asset management. These integrated solutions streamline operations and enhance efficiency.

AVIC Capital addresses unmet needs through specialized financing and access to financial expertise. This includes solutions for complex cross-border transactions. This approach allows them to cater to specific client requirements effectively.

The company's investment in technology and new materials reflects its responsiveness to market trends. AVIC Capital adapts to evolving client demands by offering innovative financial solutions. This focus ensures they remain relevant and competitive.

AVIC Capital's approach to understanding its target market involves a deep dive into the specific needs of various industries. For example, in 2024, the global aircraft leasing market was valued at approximately $280 billion, indicating a significant opportunity for AVIC Capital to provide specialized financing. The company's ability to offer flexible financing structures and deep industry understanding is crucial. Furthermore, the growth in sectors like renewable energy, with investments reaching over $300 billion in 2024, presents another area where AVIC Capital can provide tailored financial solutions, thus meeting the evolving demands of its customer base. AVIC Capital's focus on customer satisfaction and personalized attention suggests an adaptive approach to client needs.

Customers prefer reliable financial partners with competitive pricing and tailored products.

- Reliability and Stability: Customers seek partners with a strong financial backing and reputation.

- Competitive Pricing: Clients are looking for favorable terms and cost-effective solutions.

- Tailored Financial Products: Customized solutions that meet specific industry needs are highly valued.

- Industry Understanding: Partners with deep knowledge of the client's industry are preferred.

- Flexible Financing Structures: Clients require adaptable financing options.

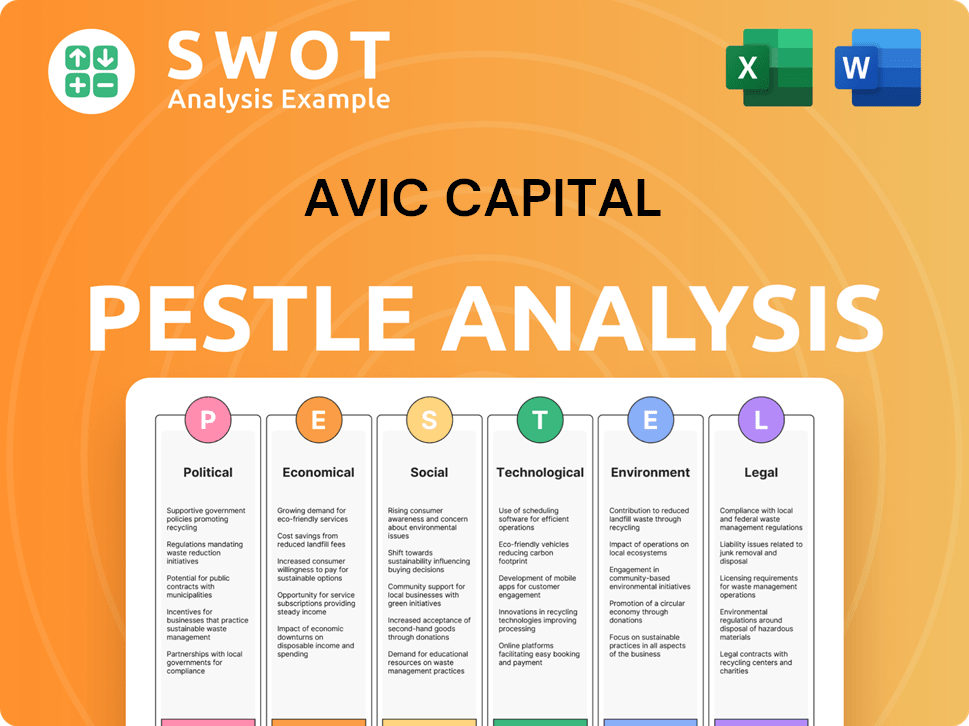

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does AVIC Capital operate?

The primary geographic focus for AVIC Capital Company is China, where it is headquartered in Beijing. This strategic positioning allows the company to leverage its deep understanding of the Chinese market and cater to the specific needs of its clientele within the country. The company's operations are heavily concentrated in China, reflecting its commitment to the robust and evolving domestic financial landscape.

As a subsidiary of the Aviation Industry Corporation of China (AVIC), AVIC Capital benefits from a strong domestic presence. This affiliation provides a significant advantage in navigating the complexities of the Chinese market. AVIC Capital offers a range of financial services, including trust, securities, leasing, and industrial finance, primarily within China.

While the core operations are centered in China, its parent company, AVIC, has a broader international reach. AVIC Group operates in over 180 overseas countries or regions. This global presence suggests that AVIC Capital may indirectly support international financial activities related to AVIC Group's global operations, although its direct market share outside China is not extensively detailed. For more insights into the company's structure, you can explore Owners & Shareholders of AVIC Capital.

Market segmentation for AVIC Capital likely involves dividing the Chinese market into distinct groups based on various factors. These factors may include industry, size of the business, and specific financial needs. This approach allows AVIC Capital to tailor its services and strategies to meet the unique requirements of different customer segments.

The geographic location of AVIC Capital's clients is primarily within China. The company's focus on the domestic market suggests a concentration of clients in major economic centers and regions with high financial activity. Understanding the geographic distribution of clients is crucial for targeted marketing and service delivery.

AVIC Capital's target market characteristics are centered on businesses and individuals within China seeking financial services. These characteristics include a need for trust services, securities trading, leasing, and industrial finance solutions. The company aims to serve clients with diverse financial needs, focusing on the domestic market.

Customer demographics for AVIC Capital likely include a mix of corporate clients and high-net-worth individuals within China. The age range, income levels, and industry focus of these clients are key factors in defining the customer profile. AVIC Capital's investment strategy and customer acquisition strategy are likely tailored to these demographics.

A customer profile analysis helps AVIC Capital understand its ideal customers. This analysis involves identifying the characteristics of the most profitable and loyal clients. The analysis considers factors such as the industry, financial needs, and geographic location of the clients.

Market research and analysis are essential for AVIC Capital to understand the evolving needs of its target market. This includes analyzing market trends, competitor activities, and customer preferences. This research informs the company's strategic decisions and helps it maintain a competitive edge in the Chinese financial market.

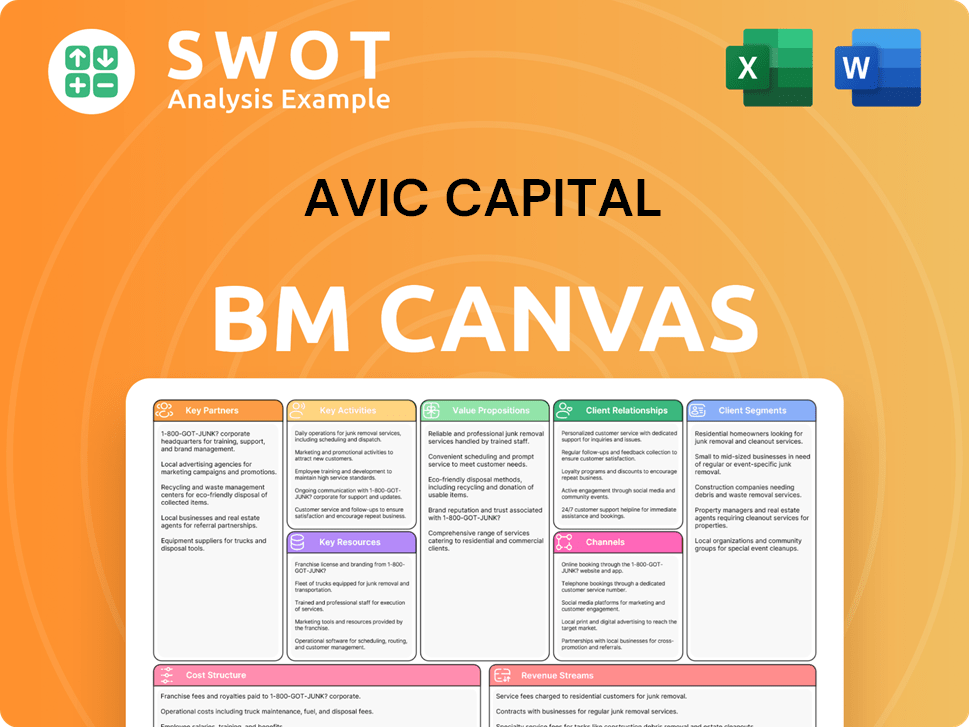

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does AVIC Capital Win & Keep Customers?

The customer acquisition and retention strategies of AVIC Capital are likely tailored to its business-to-business (B2B) focus and the diverse financial services it offers. Understanding the customer demographics and AVIC Capital target market is crucial for effective strategies. Given its parent company's extensive network, AVIC Capital probably leverages traditional marketing channels, industry events, and direct sales to attract clients.

Customer acquisition might involve a consultative sales approach, where financial experts work closely with potential clients to understand their needs and offer customized solutions. The company's website serves as a digital touchpoint, showcasing services and vision. This approach is essential to capture the AVIC Capital customer profile analysis and define who are AVIC Capital's ideal customers.

Customer retention is likely driven by high-quality service, competitive offerings, and building long-term relationships based on trust and performance. The reliability and stability of services are critical for client loyalty, especially in areas like fund management and investment banking. Consistent service delivery and customized solutions would be key retention drivers. The company's continued investment in diverse industries suggests an effort to evolve its offerings to meet changing client demands, thereby retaining existing customers and attracting new ones.

AVIC Capital likely participates in industry-specific conferences and events to network and generate leads. These events provide opportunities to connect directly with potential clients and showcase their financial solutions. Attending such events is a common practice in the financial services sector, with some firms spending significant portions of their marketing budgets on them.

Given the B2B focus, direct sales efforts and relationship-building are probably key. This involves a dedicated sales team reaching out to potential clients, understanding their needs, and offering tailored financial solutions. Building strong relationships is crucial in the financial industry, and AVIC Capital likely prioritizes this approach to retain clients. This aligns with the AVIC Capital's preferred customer profile.

AVIC Capital's website acts as a crucial digital touchpoint, showcasing its services and vision. A well-designed website is essential for attracting and retaining clients in today's market. The website provides information about the company's offerings and serves as a platform for lead generation. This is part of the AVIC Capital market research and analysis.

A consultative sales approach, where financial experts work directly with potential clients, is likely utilized. This involves understanding clients' specific needs and offering customized financial solutions. This approach helps build trust and tailor services to meet the unique requirements of each client, which is vital for AVIC Capital's target market characteristics.

The company's approach to customer acquisition and retention aligns with the broader trends in the financial services industry. For example, according to a 2024 report by Deloitte, customer experience and personalization are increasingly important for retaining clients in the financial sector. Furthermore, a 2024 study by McKinsey highlighted the significance of digital channels and data analytics in acquiring and retaining B2B clients. To delve deeper into how AVIC Capital approaches its strategic growth, you can explore the Growth Strategy of AVIC Capital.

Providing high-quality service is a cornerstone of client retention in the financial services industry. This includes reliable and stable services, especially in areas like fund management and investment banking. Excellent service builds trust and fosters long-term relationships, crucial for demographic analysis of clients.

Offering competitive and innovative financial products is essential. This ensures that AVIC Capital remains attractive to clients and meets their evolving needs. Staying ahead of market trends and providing cutting-edge solutions is key to retaining clients and attracting new ones, aligning with AVIC Capital's investment strategy and target market.

Building and maintaining long-term relationships based on trust and performance is a priority. This involves consistent communication, personalized service, and a deep understanding of each client's needs. This approach is vital for identifying AVIC Capital's core customer base.

Offering customized financial solutions tailored to each client's specific needs is a key retention strategy. This demonstrates a commitment to understanding and meeting the unique requirements of each client. This is part of how does AVIC Capital define its target market.

Continuously evolving its offerings to meet changing client demands is critical. This involves staying informed about market trends and adapting to the evolving needs of clients. This approach shows AVIC Capital's customer acquisition strategy.

AVIC Capital's engagement in various financial products and diverse industries suggests an effort to retain existing customers and attract new ones. This diversification helps to mitigate risks and allows the company to cater to a broader range of client needs. This is part of the market segmentation.

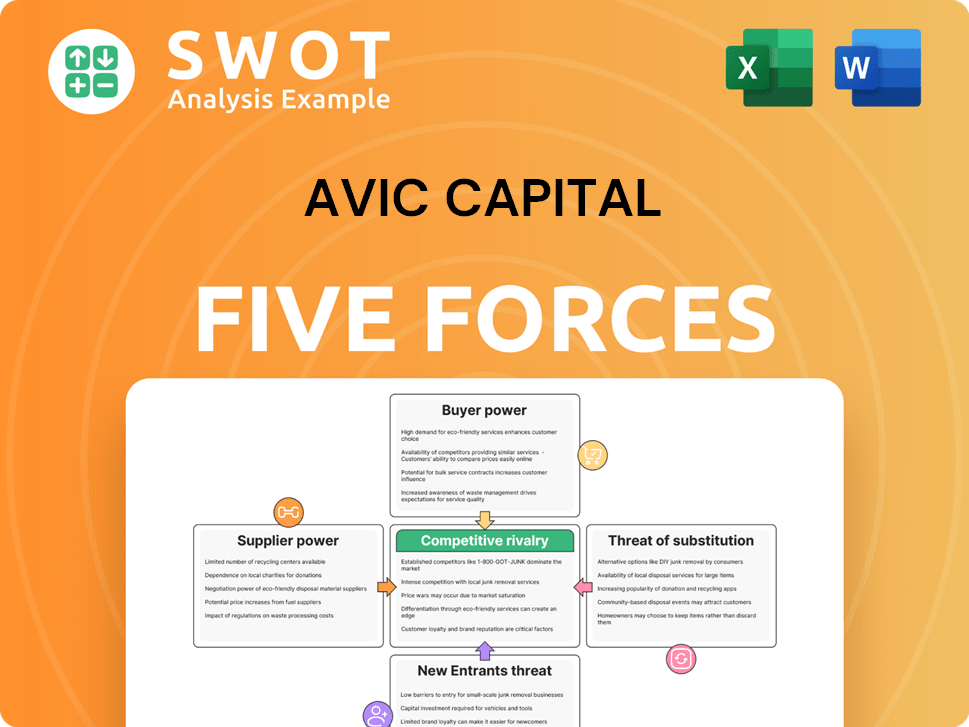

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Competitive Landscape of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.