AVIC Capital Bundle

How Does AVIC Capital Navigate China's Financial Landscape?

Uncover the secrets behind AVIC Capital's impressive growth and market dominance in China's dynamic financial sector. As a subsidiary of the Aviation Industry Corporation of China (AVIC), AVIC Capital has strategically integrated industrial finance with its aviation parentage, offering a unique suite of financial services. This innovative approach sets it apart, transforming it from a conventional institution into a strategic partner within the industrial ecosystem.

Established in 1992, AVIC Capital has evolved from an internal financial arm to a major player, providing trust, securities, leasing, and futures services. This AVIC Capital SWOT Analysis offers a deep dive into its sales and marketing strategies, exploring how it reaches customers, builds brand awareness, and strategically positions itself. Understanding AVIC Capital's AVIC Capital sales strategy and AVIC Capital marketing strategy is crucial for anyone interested in AVIC Capital investment or the broader AVIC Capital financial services market. This analysis will also explore the company's AVIC Capital business plan for sustainable growth, including its approach to AVIC Capital market analysis and addressing AVIC Capital sales and marketing challenges.

How Does AVIC Capital Reach Its Customers?

The sales channels of AVIC Capital are designed to reach a diverse clientele through a mix of direct and indirect methods. The company's AVIC Capital sales strategy leverages its position within the Aviation Industry Corporation of China (AVIC) to serve its corporate and institutional clients, especially within the aviation and industrial sectors. This approach is crucial for its AVIC Capital business plan, enabling it to offer financial services like fund management and leasing directly to entities within the AVIC group.

AVIC Capital's sales strategy also incorporates specialized financial service subsidiaries such as AVIC Securities, AVIC REITs, and AVIC Futures. These entities provide brokerage, investment banking, and asset management services, utilizing online platforms and physical offices. Furthermore, the company engages in financial leasing of large equipment, which involves direct sales and established industry networks. This multifaceted approach supports its AVIC Capital marketing strategy and overall market presence.

In 2024, AVIC International Holdings Ltd. issued ten-year domestic corporate bonds with coupon rates of 2.74% and 2.9%, indicating effective channel management and strategic financial flexibility. This access to low-cost funding underscores the success of its sales and marketing efforts. The focus on direct client relationships and personalized solutions further enhances its sales strategy.

AVIC Capital utilizes direct sales teams to target corporate and institutional clients, particularly within the aviation and industrial sectors. These teams focus on building relationships and providing tailored financial solutions. This direct approach is crucial for managing large-scale transactions and complex financial arrangements.

Subsidiaries like AVIC Securities, AVIC REITs, and AVIC Futures operate as distinct channels offering a range of financial services. These subsidiaries use a combination of online platforms and physical offices. This strategy allows AVIC Capital to reach a broader audience and provide diverse financial products.

The company engages in financial leasing and operating leasing of large equipment, such as aircraft and ships. This involves direct sales forces and established industry networks. This channel is essential for serving specific client needs within the aviation and maritime industries.

As a subsidiary of AVIC, AVIC Capital benefits from a captive market within the AVIC group. This internal structure, with its 'single line of production, financing, and marketing,' provides a competitive advantage. This built-in customer base ensures a steady flow of business and facilitates integrated service offerings.

AVIC Capital employs a variety of sales channels, including direct sales teams, specialized subsidiaries, and financial leasing operations. These channels are designed to cater to different client segments and product offerings. The company's focus on customer satisfaction and personalized solutions further strengthens its direct client relationships.

- Direct Sales: Targeting corporate and institutional clients.

- Subsidiary Operations: Utilizing online platforms and physical offices.

- Financial Leasing: Serving the aviation and maritime industries.

- Captive Market: Leveraging the AVIC group's internal structure.

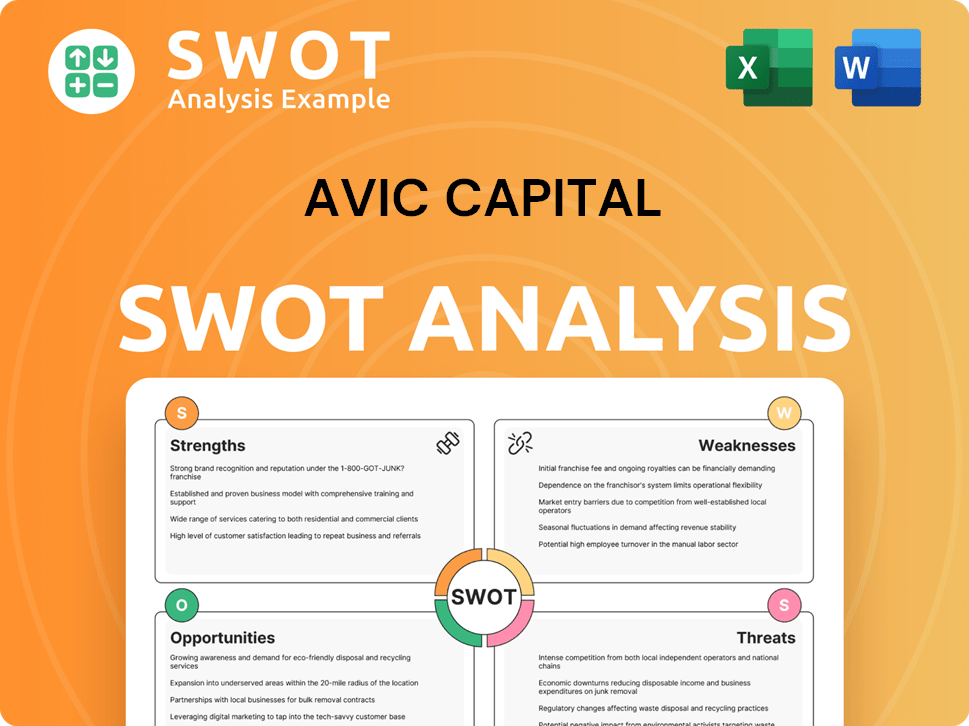

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does AVIC Capital Use?

The marketing tactics employed by AVIC Capital are designed to enhance brand awareness, generate leads, and boost sales within the specialized financial services sector. The company likely uses a combination of digital and traditional marketing strategies to reach its target audience, which includes individual investors, financial professionals, business strategists, and academic stakeholders. These strategies are crucial for implementing the Growth Strategy of AVIC Capital.

Given the focus on data-driven marketing, AVIC Capital probably segments its customer base to tailor messaging and offers, utilizing analytics tools to track engagement and conversion rates. Email marketing is likely used for direct communication, distributing market updates, product information, and invitations to exclusive events. The financial services industry in China is experiencing significant growth, with a 6.5% expansion in 2024, indicating a strong emphasis on digital adoption and innovation in marketing strategies.

Content marketing is a key component, with reports, analyses, and whitepapers published on the company's website to establish thought leadership. Social media platforms are used for brand awareness and industry news dissemination. Traditional media, such as financial publications and industry events, are also important for networking and reaching high-net-worth or institutional clients. The company's commitment to personalized and innovative financial solutions implies a sophisticated approach to understanding client needs and tailoring marketing efforts accordingly.

AVIC Capital likely uses digital marketing extensively to reach its target audience. This includes content marketing, social media, and email marketing to build brand awareness and generate leads. The digital marketing strategy is essential for the AVIC Capital sales strategy.

Content marketing is used to establish thought leadership. This involves publishing reports, analyses, and whitepapers on the company's website. The content marketing strategy supports the AVIC Capital business plan.

Customer segmentation is used to tailor messaging and offers. Analytics tools track engagement and conversion rates. Customer Relationship Management (CRM) systems are used to manage and nurture leads.

Email marketing is used for direct communication with clients and prospects. This includes market updates, product information, and invitations to exclusive events. Email marketing is a key component of AVIC Capital's marketing strategy.

Social media platforms are used for brand awareness and industry news dissemination. Brand building strategies are essential for establishing trust and credibility in the financial services sector. Effective brand building supports AVIC Capital's investment goals.

Traditional media, such as financial publications, and industry events are important for networking and reaching a high-net-worth clientele. These channels complement the digital marketing efforts. Participation in industry events supports AVIC Capital's market analysis.

AVIC Capital's marketing strategy incorporates a variety of tactics to reach its target audience and achieve its business objectives. These tactics are designed to support the company's sales and marketing efforts.

- Digital Marketing: Content marketing, social media, email marketing, and search engine optimization (SEO) are used to enhance online visibility and generate leads.

- Content Marketing: High-quality content, including reports, whitepapers, and blog posts, is created to establish thought leadership and provide valuable insights.

- Customer Relationship Management (CRM): CRM systems are used to manage customer interactions and personalize marketing efforts.

- Traditional Media: Financial publications and industry events are utilized to reach high-net-worth individuals and institutional clients.

- Market Analysis: Continuous market analysis is conducted to understand customer needs and adapt marketing strategies accordingly.

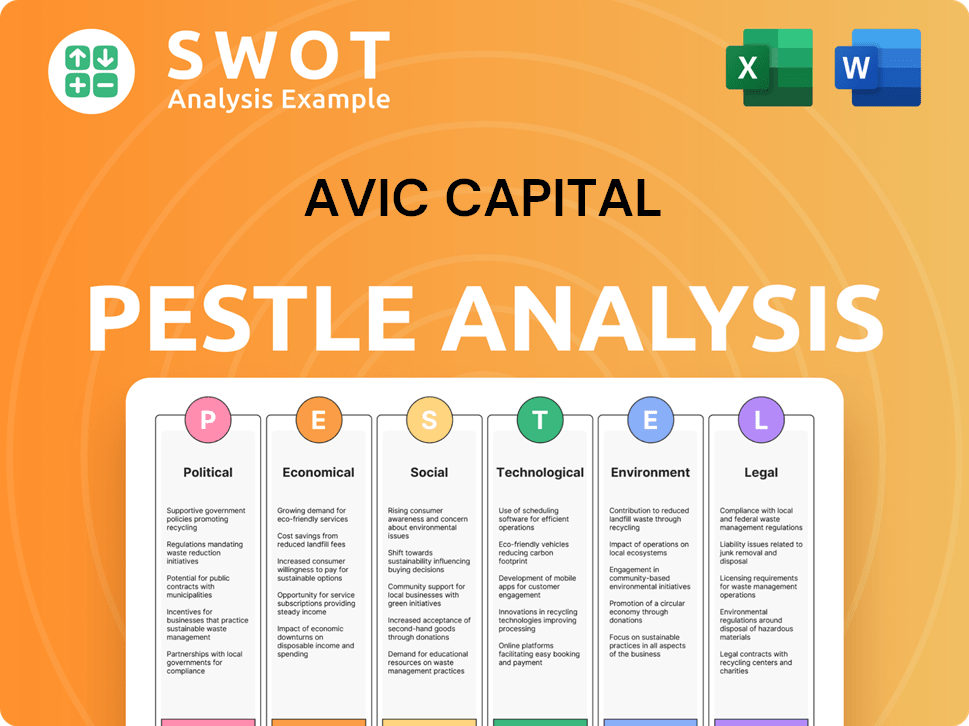

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is AVIC Capital Positioned in the Market?

The brand positioning of AVIC Capital centers on its identity as a leading financial investment and management firm. It distinguishes itself through its strong ties with the aviation industry, leveraging its affiliation with Aviation Industry Corporation of China (AVIC). This unique association provides a competitive advantage, setting it apart from competitors in the financial services sector.

The core message of AVIC Capital revolves around offering comprehensive and specialized financial services. These include trust, securities, leasing, futures, and industrial finance solutions. The company tailors its offerings to meet the diverse needs of its clientele, focusing on delivering value through personalized and innovative financial strategies.

The visual identity and tone of voice for AVIC Capital likely convey professionalism, stability, and expertise, reflecting its role within a critical national industry. Its Owners & Shareholders of AVIC Capital benefit from this strong brand image. AVIC Capital aims to build long-term client relationships through customized offerings and a client-centric approach, emphasizing a commitment to excellence and sustainable growth in the financial market.

AVIC Capital's value proposition focuses on providing specialized financial services tailored to the aviation industry. This includes trust services, securities, leasing, and futures, aiming to meet diverse client needs. The company emphasizes its commitment to delivering value through personalized and innovative financial strategies.

The target audience includes high-net-worth individuals, institutional investors, and companies involved in the aviation and related industries. AVIC Capital targets clients seeking comprehensive financial solutions and a partner with deep industry knowledge. The focus is on building long-term relationships through customized offerings.

Brand messaging emphasizes professionalism, stability, and expertise, reflecting its role in a critical national industry. Communication strategies likely include a strong online presence, direct client interactions, and targeted marketing campaigns. Consistency across all touchpoints, from its website to client communications, is crucial.

Key competitive advantages include its strong affiliation with AVIC, providing deep industry expertise and backing. The focus on specialized financial services and a client-centric approach also sets AVIC Capital apart. Its ability to offer customized solutions and build long-term relationships is a significant differentiator.

AVIC Capital's brand is built on several key elements that define its market position and customer value. These elements work together to create a strong brand identity and support its sales and marketing efforts.

- Industry Affiliation: Leveraging its association with AVIC to highlight industry expertise and financial strength.

- Service Specialization: Focusing on providing comprehensive financial services tailored to the aviation sector.

- Client-Centric Approach: Building long-term relationships through customized offerings and personalized service.

- Brand Consistency: Maintaining a consistent brand image across all communication channels.

- Innovation and Adaptability: Responding to market changes and client needs by offering innovative solutions.

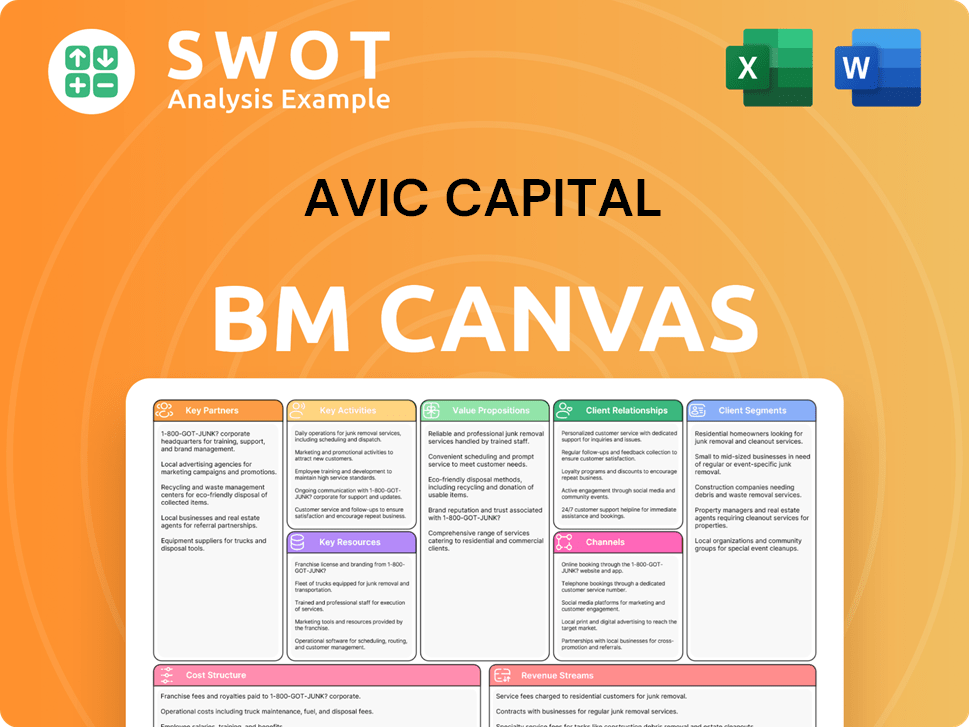

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are AVIC Capital’s Most Notable Campaigns?

The sales and marketing strategies of AVIC Capital, a financial investment and management company, are not typically defined by traditional advertising campaigns. Instead, the company's approach centers on investor relations, strategic partnerships, and demonstrating financial strength and expertise. This strategy is crucial for maintaining trust and attracting investment within the financial services sector.

A key aspect of the AVIC Capital sales strategy involves leveraging its parent company's resources and market position. This includes facilitating the broader AVIC group's financial operations and expansion. The company's focus is on providing financial solutions across diverse industries, and its recent investment activities reflect its strategic growth initiatives.

The primary focus of the AVIC Capital marketing strategy revolves around building credibility and trust within the financial and industrial sectors. This is achieved through successful financial performance, strategic investments, and strong relationships with stakeholders. The company's activities, such as bond issuances and investments, serve as powerful indicators of its financial health and attract further investment.

Successful bond issuances and robust financial performance are key components of AVIC Capital's strategy. These actions enhance the company's reputation and attract investments. The company's trailing 12-month revenue as of September 30, 2024, was $2.21 billion, which demonstrates financial stability and attracts further investments.

Strategic investments and partnerships are integral to AVIC Capital's growth. The company's investments, such as the one in JSAB Technologies as part of their Series C on April 8, 2024, showcase its commitment to expanding its financial solutions across various industries. These actions boost brand visibility and credibility.

AVIC Capital's business plan includes leveraging capital markets for growth. This involves strategically injecting the main businesses of AVIC into its listed companies. This approach is part of a continuous effort to expand and strengthen its market position.

In 2024, AVIC International Holdings Ltd., a subsidiary of AVIC Capital's parent AVIC, issued two ten-year domestic corporate bonds. These bonds had coupon rates of 2.74% and 2.9%, showcasing the company's access to the domestic capital market. This low-cost funding supports future investments and strengthens its financial position.

AVIC Capital focuses on offering financial solutions across various industries. This includes investments in technology and other sectors, reflecting a strategic approach to diversify its portfolio. This strategy helps to attract further investment and partnerships.

The company's actions, such as successful bond issuances and strong financial performance, directly contribute to its brand visibility and credibility within the financial and industrial sectors. These activities are crucial for building a strong reputation and attracting investors. For more insights, you can read an article about AVIC Capital's sales strategy for new products.

Investor relations play a critical role in AVIC Capital's strategies. The company communicates its financial performance and strategic initiatives to build trust and attract investment. This helps in maintaining strong relationships with stakeholders.

AVIC Capital supports the broader AVIC group's market expansion. This includes facilitating financial operations and leveraging its parent company's resources. This helps the company to grow and strengthen its position in the market.

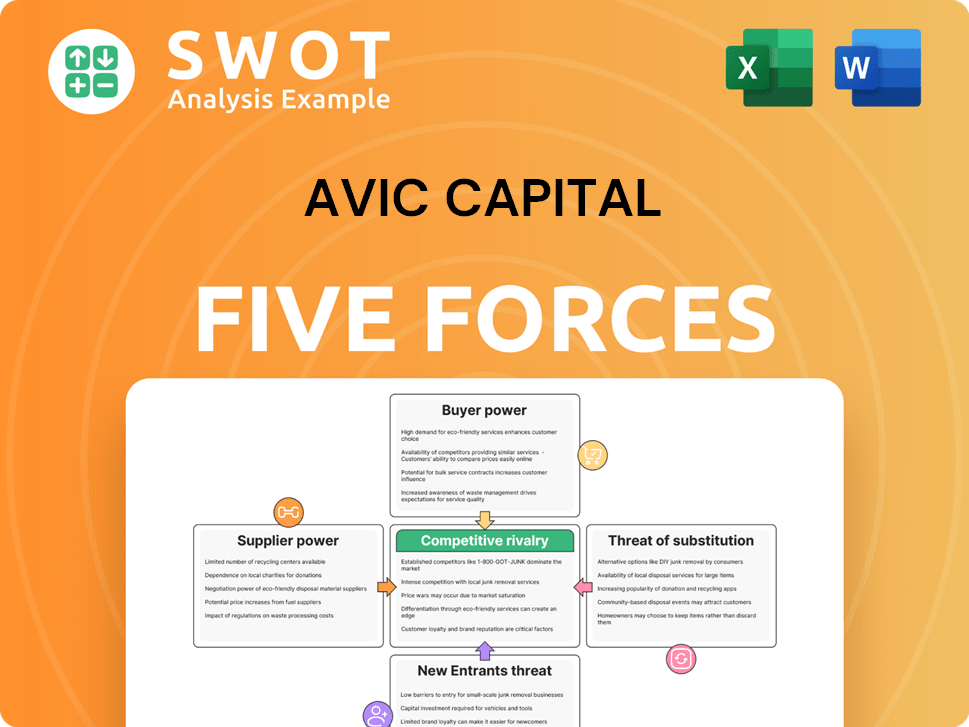

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Competitive Landscape of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.