AVIC Capital Bundle

How Does AVIC Capital Thrive in China's Financial Landscape?

Founded in 1992, AVIC Capital Co., Ltd. is a pivotal player in China's financial sector, deeply intertwined with the nation's strategic industries. As a key subsidiary of the state-owned Aviation Industry Corporation of China (AVIC Group), this AVIC Capital SWOT Analysis reveals the company's strategic positioning. AVIC investment is crucial for understanding the dynamics of the Chinese investment landscape.

This analysis will explore how AVIC Capital, a prominent AVIC company, operates within the complex financial ecosystem. Its diverse financial services, from trust to leasing, support not only the China aviation industry but also other sectors, making it a compelling case study for investors. Understanding AVIC Capital's financial performance and investment strategy offers valuable insights into its role in national industrial goals.

What Are the Key Operations Driving AVIC Capital’s Success?

AVIC Capital's core operations are centered around providing a broad range of financial services. These services are designed to create value primarily for its parent company, AVIC Group, and its related ecosystem, while also serving wider market segments. The company's offerings include trust services, securities brokerage, financial leasing, futures brokerage, and industrial finance.

These services support various activities, from centralized fund management and credit provision to investment banking and asset management. AVIC Capital's financial leasing services cover large equipment like aircraft, ships, and electromechanical equipment, directly supporting the operational needs of the aviation industry and beyond. Its investment activities include industrial and equity investments, such as strategic stakes in companies like AVIC Heavy Machinery and AVIC Lithium Battery, demonstrating its role in fostering new industrial development directions.

What makes AVIC Capital's operations unique is the strong support from AVIC Group. This provides consistent demand for its financial offerings and access to multiple financing channels. This internal synergy allows the company to facilitate complex financial transactions crucial for the smooth operation of the aviation sector. The company's structure supports its role in the Growth Strategy of AVIC Capital.

AVIC Capital's operations are multifaceted, encompassing various financial services that support both the AVIC Group and the wider market. The company's value proposition lies in its ability to provide comprehensive financial solutions, leveraging its strong parent company support and access to diverse financing channels.

- Financial Leasing: Provides leasing services for aircraft and other equipment, crucial for the aviation industry.

- Investment Banking: Engages in investment activities, including industrial and equity investments.

- Trust Services: Offers trust services to manage assets and provide financial solutions.

- Securities Brokerage: Operates in securities brokerage to facilitate trading and investment activities.

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AVIC Capital Make Money?

AVIC Capital, a key player in the financial sector, generates revenue through a diverse range of financial services and investment activities. Its primary revenue streams are driven by interest and fees from leasing and financing arrangements, alongside returns from strategic investments. Understanding how AVIC Capital operates is crucial for anyone interested in Chinese investment and the China aviation industry.

The company's financial performance is influenced by various segments, including securities, internal financial services for the AVIC Group, leasing, futures brokerage, and trust businesses. While specific percentages for each revenue stream in 2024-2025 are not fully detailed, the company's trailing 12-month revenue, as of September 30, 2024, was reported at $2.21 billion. The company's financial health is a critical aspect of its capital management.

In the first quarter of 2024, AVIC Industry-Finance Holdings Co., Ltd. reported revenue of CNY 3.59 billion. However, the company faced a net loss of CNY 352.71 million in Q1 2024, a shift from the net income of CNY 167.38 million in the prior year. This indicates a change in the revenue mix or profitability. To learn more about their strategies, you can read about the Marketing Strategy of AVIC Capital.

AVIC Capital's monetization strategies involve offering tailored financial solutions, particularly for the aerospace industry, leveraging its deep industry insight. It also maintains a balanced asset portfolio to generate consistent returns.

- Tailored financial solutions for the aerospace industry.

- Strategic investments in 'three new' fields.

- Participation in the AVIC Group's mergers, acquisitions, and restructurings.

- Managing a balanced portfolio of assets.

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AVIC Capital’s Business Model?

The journey of AVIC Capital has been marked by significant milestones and strategic maneuvers. Established in 1992, it became the first financial holding company in the PRC listed on the Shanghai Stock Exchange. This positioned AVIC Capital as the financial arm of the AVIC Group, playing a crucial role in the Chinese investment landscape.

AVIC Capital has actively pursued strategic investments and acquisitions throughout its history. A key example is the 2011 reverse merger acquisition of Beiya Industrial (Group) Co., Ltd., which broadened its operational scope. More recently, in August 2024, AVIC Capital made a Later Stage VC investment with AVIC SAC Commercial Aircraft, demonstrating its ongoing commitment to strategic growth within the aviation industry.

The company has also navigated operational and market challenges. In 2024, AVIC Capital reported a decline in revenue and commission income, partly due to business structure adjustments and macroeconomic pressures. In response to these challenges, AVIC Industry-Finance Holdings announced its intention to voluntarily delist its A-share stocks from the Shanghai Stock Exchange in March 2025. This strategic move, with the controlling shareholder, AVIC, offering a cash opt-out to shareholders, aims to resolve risks and seek operational development.

Established in 1992, becoming the first financial holding company in the PRC listed on the Shanghai Stock Exchange. AVIC Capital serves as the financial arm of the AVIC Group. The company has actively engaged in strategic investments and acquisitions, such as its 2011 reverse merger acquisition of Beiya Industrial (Group) Co., Ltd.

In August 2024, AVIC Capital made a Later Stage VC investment with AVIC SAC Commercial Aircraft. AVIC Industry-Finance Holdings announced its intention to voluntarily delist its A-share stocks from the Shanghai Stock Exchange in March 2025. The controlling shareholder, AVIC, offered a cash opt-out to shareholders as part of the delisting process.

Strong shareholder support from the AVIC Group provides a significant advantage. AVIC Capital holds a leading position in the PRC finance industry with a diverse customer base. The company benefits from a diversified business portfolio and access to multiple financing channels.

In 2024, the company experienced a decline in revenue and commission income. The decrease in asset book value was attributed to macroeconomic pressures. The delisting in 2025 aims to resolve risks and seek operational development. For more insights, consider reading about the Growth Strategy of AVIC Capital.

AVIC Capital's competitive advantages stem from its strong backing and diverse operations. The company's strategic moves, such as the 2024 investment and the 2025 delisting, reflect its adaptability to market conditions. These factors contribute to its position in the Chinese investment landscape.

- Strong shareholder support from AVIC Group.

- Leading position in the PRC finance industry.

- Diversified business portfolio.

- Access to multiple financing channels.

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AVIC Capital Positioning Itself for Continued Success?

The industry position of AVIC Capital is significantly shaped by its strong ties to the Aviation Industry Corporation of China (AVIC Group). This close relationship provides a steady demand for its financial products and services, giving it a distinct advantage in the Chinese investment market. On April 2, 2025, AVIC Capital's market capitalization was approximately $4.21 billion.

However, AVIC Capital faces considerable risks and headwinds. The company's 2024 financial performance was affected by business restructuring and macroeconomic conditions, leading to a decrease in revenue and commission income. The company reported a net loss of around -48 million yuan attributable to the parent company for the fiscal year 2024 and an estimated -0.189 billion yuan after excluding non-recurring gains and losses. A dispute with China Life Insurance also presents a challenge.

AVIC Capital benefits from its strategic alignment with AVIC Group, ensuring a consistent demand for its services within the China aviation industry. This symbiotic relationship supports its position in the capital management sector. The company's market capitalization stood at $4.21 billion as of April 2, 2025.

The company is navigating challenges including business structure transformation and macroeconomic impacts, which led to a decline in financial performance in 2024. AVIC Capital reported a net loss, with additional financial strain from disputes with China Life Insurance. Additionally, the company is undergoing a voluntary delisting process.

The future of AVIC Capital hinges on its ability to overcome current challenges and streamline operations. The company could potentially leverage its core strengths in specialized financial services for the aviation sector. The delisting and restructuring efforts are aimed at resolving risks and supporting future operational development.

AVIC Industry-Finance Holdings has initiated a voluntary delisting from the Shanghai Stock Exchange, with a cash opt-out for shareholders. This strategic move is intended to address and mitigate ongoing risks. While there are no immediate plans for asset injections or relisting, the company's future depends on its ability to adapt.

The company's future success will depend on its ability to navigate financial and operational challenges. AVIC Capital must leverage its core competencies and adapt to market dynamics, especially within the Chinese investment landscape. Further insights into the company's history can be found in the Brief History of AVIC Capital.

- The impact of the delisting and restructuring on shareholder value.

- The potential for new investment strategies and portfolio adjustments.

- The evolving relationship with AVIC Group and its influence on future projects.

- The company's ability to manage and mitigate financial risks effectively.

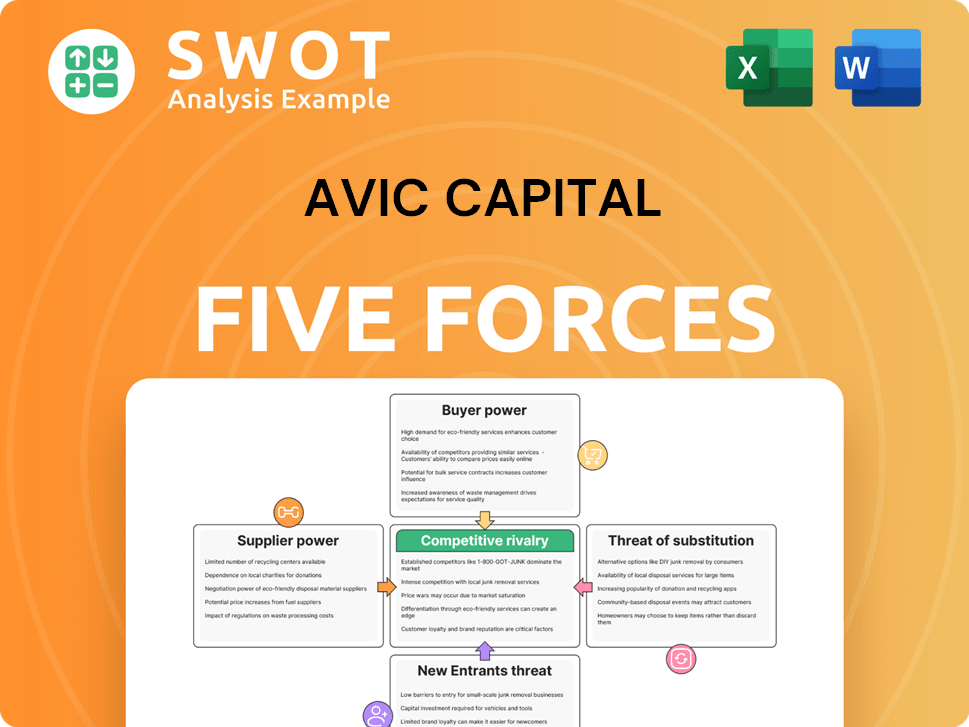

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Competitive Landscape of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.