AVIC Capital Bundle

How Does AVIC Capital Navigate China's Financial Waters?

In the bustling financial services sector of China, AVIC Capital Co., Ltd. isn't just another player; it's a strategic entity backed by the Aviation Industry Corporation of China (AVIC). Leveraging its parent company's extensive network, AVIC Capital has carved out a unique niche. This positions it distinctively within the market, especially as it expands beyond its initial focus on aviation-related financial needs.

To truly understand AVIC Capital's standing, we must dissect its AVIC Capital SWOT Analysis and the forces shaping its market position. This exploration will uncover the company's competitive advantages, pinpoint its main rivals, and examine its financial performance review. Understanding AVIC Capital's competitive landscape is crucial for anyone seeking insights into China's financial industry and the company's future prospects, including its investment strategies and business model.

Where Does AVIC Capital’ Stand in the Current Market?

AVIC Capital Co., Ltd. carves out a significant market position within China's financial services sector. This is largely due to its unique link to its parent company, Aviation Industry Corporation of China (AVIC). The company's operations span trust, securities, leasing, futures, and industrial finance, often catering to AVIC's extensive ecosystem and state-owned enterprises. This affiliation provides a solid foundation for deal flow, particularly in industrial finance and leasing.

The company's primary offerings encompass a wide array of financial services. AVIC Capital's geographic footprint is primarily within China, capitalizing on AVIC's nationwide industrial presence. Customer segments range from major state-owned enterprises and private corporations to individual investors, depending on the specific financial product. A deeper dive into the Marketing Strategy of AVIC Capital reveals how it maintains its competitive edge.

Over time, AVIC Capital has strategically diversified its offerings, evolving beyond a purely industrial finance focus to encompass a broader spectrum of financial products. This shift mirrors a broader trend in China's financial sector towards comprehensive financial groups. While precise recent financial data for AVIC Capital as a standalone entity compared to industry averages can be challenging to isolate from its parent company's consolidated reports, its consistent operational performance and strategic investments suggest a healthy financial standing within its niche. The company likely holds a particularly strong position in sectors related to aviation and high-tech manufacturing financing, given its parent company's expertise and influence in these areas.

AVIC Capital's core operations encompass trust, securities, leasing, futures, and industrial finance. It provides a comprehensive suite of financial services tailored to both corporate and individual clients. The company leverages its affiliation with AVIC to secure a strong position in aviation-related financing and leasing.

The value proposition of AVIC Capital lies in its ability to provide specialized financial solutions. It leverages its industry expertise and strong parent company backing to offer competitive services. This includes tailored financial products for aviation and high-tech manufacturing, along with a broad range of financial offerings.

AVIC Capital's market focus is primarily within China, aligning with AVIC's nationwide industrial reach. The company serves a diverse customer base, including state-owned enterprises, private corporations, and individual investors. Its strategic emphasis is on sectors related to aviation and high-tech manufacturing.

Key competitive advantages include strong backing from AVIC, industry expertise, and a diversified product portfolio. AVIC Capital benefits from a captive client base within the AVIC ecosystem. Its ability to offer specialized financial solutions and its strategic focus on high-growth sectors contribute to its market position.

AVIC Capital's strengths include its parent company's backing, industry expertise, and diversified financial offerings. However, challenges include dependence on the parent company and the competitive landscape within China's financial sector. The company must navigate regulatory changes and maintain its competitive edge.

- Strengths: Strong parent company support, industry-specific expertise, diversified financial products.

- Challenges: Dependence on AVIC, intense competition in the financial sector, regulatory changes.

- Opportunities: Expanding into new financial services, leveraging technology for enhanced offerings.

- Threats: Economic downturns, increased competition from both domestic and international players.

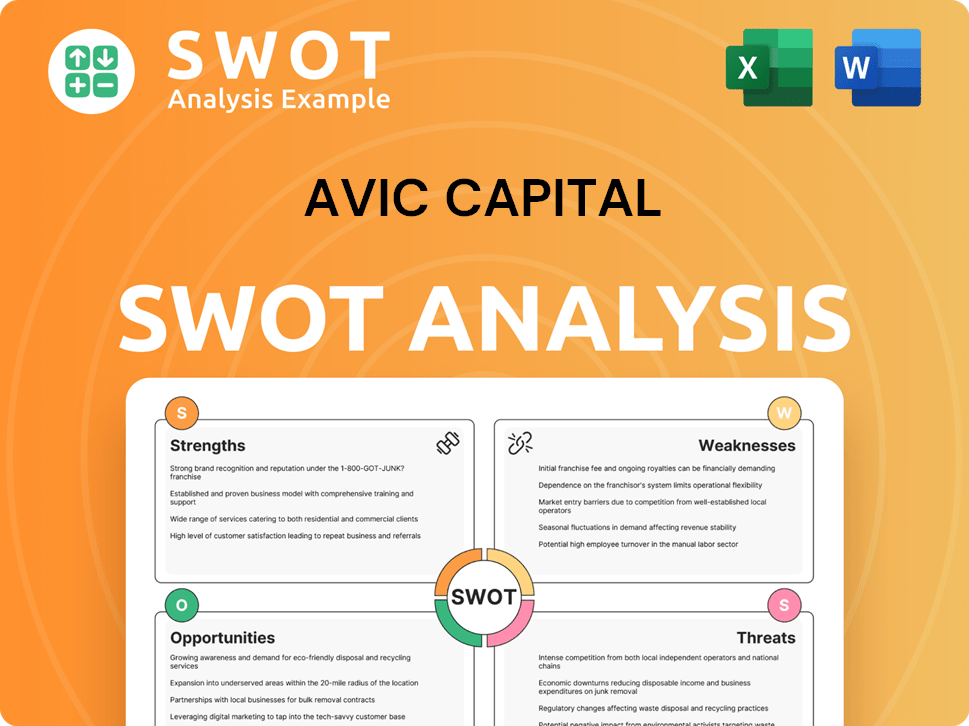

AVIC Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AVIC Capital?

The AVIC Capital faces a complex competitive landscape across its diverse financial service segments. This landscape includes a mix of large, state-owned entities and specialized private companies. Understanding the competitive dynamics is crucial for assessing its market position and future prospects.

In various sectors such as trust, securities, financial leasing, and futures, AVIC Capital analysis reveals competition from established players. These competitors often have significant market share and extensive client networks. The emergence of fintech companies further complicates the competitive environment, especially in areas like supply chain finance.

This article explores the key competitors of AVIC Capital, providing an industry overview and insights into how it compares to its peers. It also touches upon AVIC Capital's strengths and weaknesses, and its current market challenges.

In the trust sector, AVIC Capital competes with major players. These competitors have extensive client networks and long-standing reputations. Key competitors include CITIC Trust Co., Ltd. and China Foreign Economy and Trade Trust Co., Ltd.

In securities, AVIC Capital faces competition from established full-service brokerages. These firms have significant market share in brokerage, investment banking, and asset management. Key rivals include CITIC Securities Co., Ltd. and CSC Financial Co., Ltd.

Within the financial leasing domain, AVIC Capital competes with the leasing arms of major banks. These entities often have greater capital bases and offer competitive financing terms. Key competitors include ICBC Financial Leasing Co., Ltd. and China Everbright Financial Leasing Co., Ltd.

In the futures market, competition comes from leading futures companies. These companies offer a range of futures trading and risk management services. Key competitors include CITIC Futures Co., Ltd. and Everbright Futures Co., Ltd.

For industrial finance, AVIC Capital benefits from its parent company's ecosystem. However, it still competes with commercial banks and other non-banking financial institutions. These institutions offer corporate lending and supply chain finance solutions.

Emerging fintech companies and internet finance platforms pose an indirect challenge. They offer more agile and digitally-driven solutions, particularly in supply chain finance and SME lending. This creates additional pressure on traditional financial institutions.

AVIC Capital's competitive advantages include its parent company's ecosystem and its ability to offer a diverse range of financial services. However, it faces challenges from competitors with larger capital bases, broader product offerings, and stronger brand recognition. The company's financial performance review is crucial for understanding its position.

- Market Share: Competitors like CITIC Securities Co., Ltd. and ICBC Financial Leasing Co., Ltd. often hold significant market share in their respective sectors.

- Product Offerings: Some competitors offer a wider array of financial products and services, providing a more comprehensive solution to clients.

- Capital Strength: Larger financial institutions often have greater capital resources, allowing them to offer more competitive financing terms.

- Technological Advancement: Fintech companies are rapidly innovating, offering more agile and digitally-driven solutions that challenge traditional financial institutions.

- Regulatory Environment: The regulatory environment influences AVIC Capital's regulatory environment and its ability to compete effectively.

For further insights, consider reading about the Target Market of AVIC Capital.

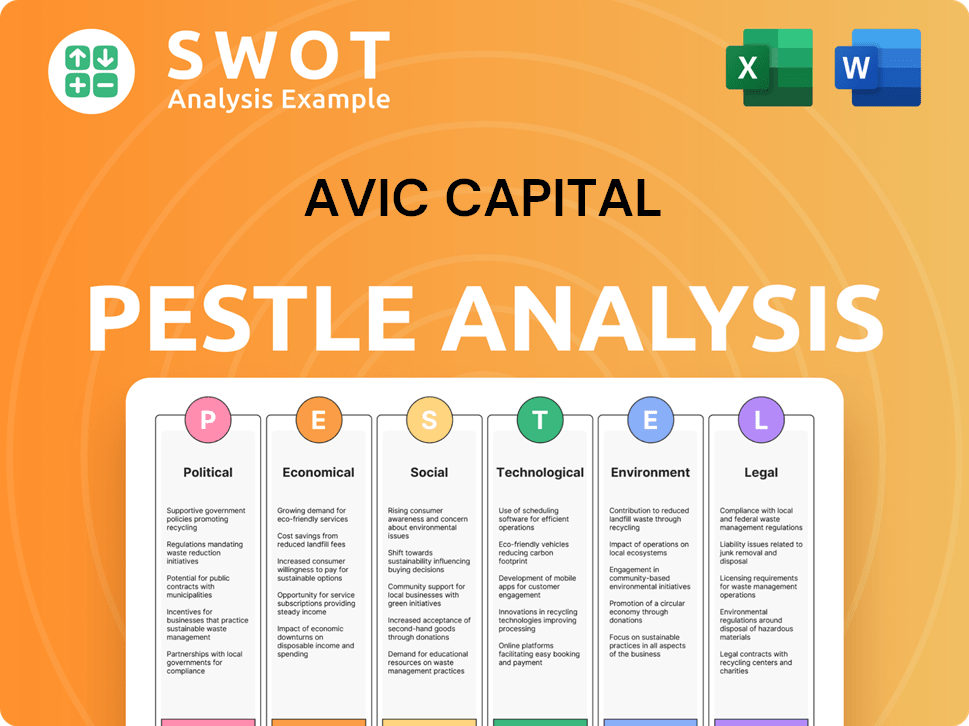

AVIC Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AVIC Capital a Competitive Edge Over Its Rivals?

The competitive landscape for AVIC Capital Co., Ltd. is significantly shaped by its unique position within China's financial services sector. AVIC Capital's strategic affiliation with the Aviation Industry Corporation of China (AVIC) is a cornerstone of its competitive advantage. This relationship provides unparalleled access to the aviation and defense industrial ecosystem, enabling the company to offer specialized financial solutions tailored to this high-value sector. Understanding the Brief History of AVIC Capital helps to understand its evolution.

AVIC Capital's competitive edge is further bolstered by the backing of a large state-owned enterprise, which enhances its creditworthiness and access to funding, potentially leading to more favorable borrowing costs. Its diversified portfolio of financial services, including trust, securities, leasing, and futures, allows for cross-selling opportunities and a more comprehensive client engagement model. This integrated approach fosters greater customer loyalty and positions AVIC Capital favorably within the competitive landscape.

The company's operational efficiencies, derived from serving a complex industrial group, likely contribute to its cost structure and service delivery. While specific patents or unique technologies are not highlighted as primary competitive advantages, the evolution from a financial arm to a more integrated financial services provider, leveraging its industrial heritage, has allowed AVIC Capital to carve out specialized niches. These niches are relatively sustainable due to the strategic importance of the aviation industry to China and AVIC Capital's embedded position within it.

AVIC Capital's close ties with AVIC provide it with unique insights into the aviation industry. This allows for the development of specialized financial products. The company can offer tailored solutions for project financing and supply chain finance within this sector.

As a state-owned enterprise, AVIC Capital benefits from enhanced creditworthiness. This can lead to more favorable terms in the financial market. This backing also facilitates strategic partnerships and client relationships within the state-owned enterprise network.

AVIC Capital offers a wide range of financial services, including trust, securities, and leasing. This diversified portfolio allows for cross-selling and a comprehensive client engagement model. This approach fosters customer loyalty and enhances market position.

Serving a complex industrial group has led to operational efficiencies for AVIC Capital. This likely contributes to a competitive cost structure and improved service delivery. The company has evolved from a financial arm to an integrated financial services provider.

AVIC Capital's competitive advantages are centered on its strategic affiliation, state-backed support, and diversified service offerings. These factors contribute to its market position. The company's focus on the aviation industry provides a specialized advantage.

- Strategic affiliation with AVIC provides industry-specific expertise.

- State-owned enterprise backing enhances financial stability and access to capital.

- Diversified financial services foster customer loyalty and cross-selling opportunities.

- Operational efficiencies contribute to a competitive cost structure.

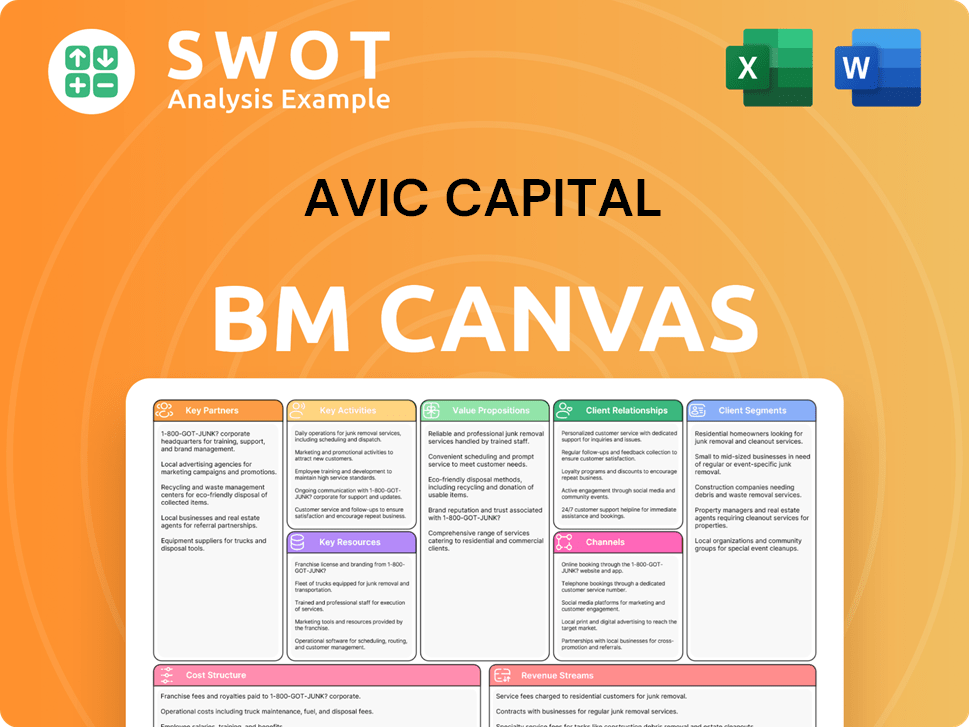

AVIC Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AVIC Capital’s Competitive Landscape?

Understanding the competitive landscape for AVIC Capital involves examining its industry position, the risks it faces, and its future outlook. The company operates within China's financial services sector, with a specific focus on aviation and industrial finance. Its market position is influenced by broader economic trends, technological advancements, regulatory changes, and evolving consumer preferences. This Growth Strategy of AVIC Capital provides insights into its strategic direction.

The financial services industry in China is dynamic, with ongoing shifts. AVIC Capital's success depends on its ability to adapt to these changes, manage risks effectively, and capitalize on emerging opportunities. Key factors include the rise of fintech, regulatory pressures, and the demand for specialized financial products.

Technological advancements are driving digital transformation in financial services, increasing efficiency and improving customer experience. Regulatory changes, aimed at de-risking the financial system, influence business models. Shifting consumer preferences are leading to a greater demand for digital and personalized financial products.

Intensifying competition from fintech companies and tech giants poses a significant challenge. Increased regulatory scrutiny requires continuous adaptation and investment in compliance. Economic downturns in the aviation or industrial sectors could impact AVIC Capital's client base.

Ongoing industrial upgrading and strategic emerging industries initiatives in China present substantial demand for industrial finance. The 'Belt and Road' initiative offers opportunities for cross-border financial services. Product innovations leveraging big data and AI can enhance risk assessment and product development.

AVIC Capital is likely deploying strategies focused on deepening its specialization in aviation and industrial finance. Enhancing digital capabilities and actively managing regulatory compliance is crucial. Exploring new growth avenues in line with national economic priorities is also important.

To navigate the evolving financial landscape, AVIC Capital needs to focus on several key areas. This includes leveraging its expertise in aviation and industrial finance, enhancing its digital capabilities, and ensuring strong regulatory compliance.

- Specialization: Deepen expertise in aviation and industrial finance to capitalize on industry-specific opportunities.

- Digital Transformation: Invest in technology and data analytics to improve efficiency and customer service.

- Strategic Partnerships: Collaborate with technology firms to accelerate digital transformation and expand reach.

- Risk Management: Implement robust risk management practices to mitigate potential financial and operational risks.

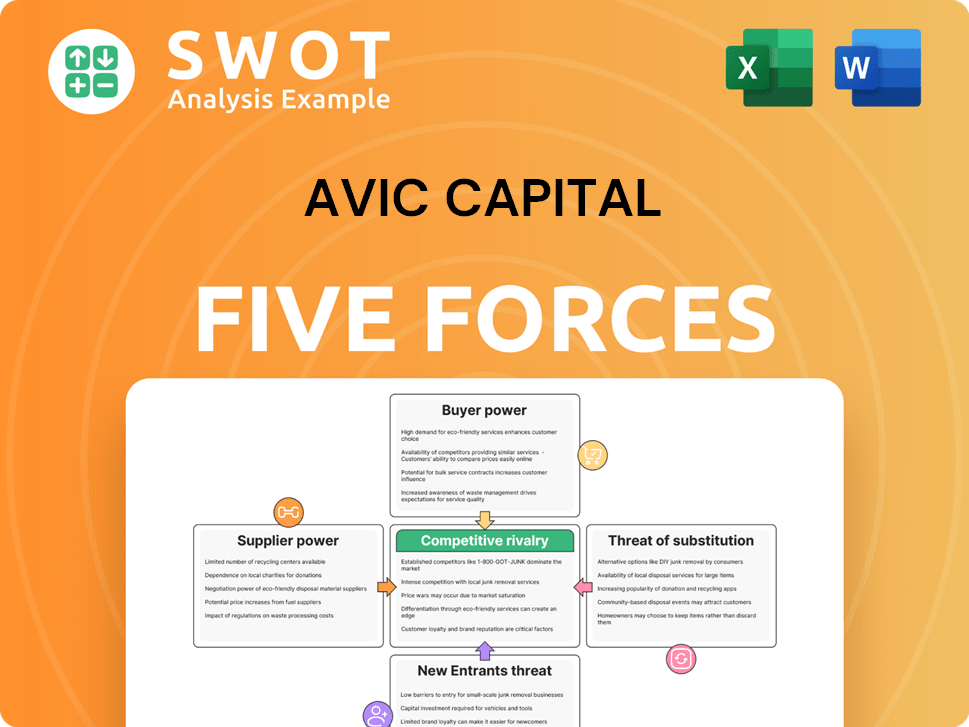

AVIC Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVIC Capital Company?

- What is Growth Strategy and Future Prospects of AVIC Capital Company?

- How Does AVIC Capital Company Work?

- What is Sales and Marketing Strategy of AVIC Capital Company?

- What is Brief History of AVIC Capital Company?

- Who Owns AVIC Capital Company?

- What is Customer Demographics and Target Market of AVIC Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.