Booking Holdings Bundle

How Did Booking Holdings Conquer the Travel World?

Embark on a journey through the fascinating Booking Holdings SWOT Analysis, a story of innovation and strategic dominance in the online travel agency sector. From its inception as a revolutionary online reservation service, the company has redefined how we experience global travel. Discover how this pioneering spirit propelled Booking Holdings to become a global leader, transforming the very landscape of the travel industry.

The Booking Holdings company profile reveals a remarkable transformation, from a startup to a global powerhouse. Understanding the Booking.com history and early history of Priceline Group is crucial to understanding the company’s current market position. This exploration will uncover the key acquisitions, strategic decisions, and innovative approaches that have shaped Booking Holdings' impressive trajectory within the competitive travel industry.

What is the Booking Holdings Founding Story?

The story of Booking Holdings, formerly priceline.com, began on July 17, 1997. Jay S. Walker, the founder, saw an opportunity to revolutionize the travel industry by selling unsold inventory. His vision was to create a marketplace where consumers could name their price for travel products.

This innovative approach, known as 'name your own price,' allowed consumers to bid on flights, hotel rooms, and rental cars. Initially, the company focused on airline tickets before expanding to include hotel accommodations. This model offered consumers unprecedented price transparency and control, marking a significant shift in how travel was booked.

The early days of Booking Holdings' ownership and history were characterized by the challenge of educating both consumers and suppliers about this new pricing dynamic. The company's success was also fueled by the rapid growth of the internet and increasing consumer confidence in online transactions during the late 1990s.

Priceline.com's initial funding came from venture capital and strategic investors.

- The 'name your own price' model was a key differentiator.

- The company's name, priceline.com, directly reflected its core value proposition.

- Early challenges included convincing consumers and suppliers to adopt the new model.

- The late 1990s internet boom provided a fertile ground for growth.

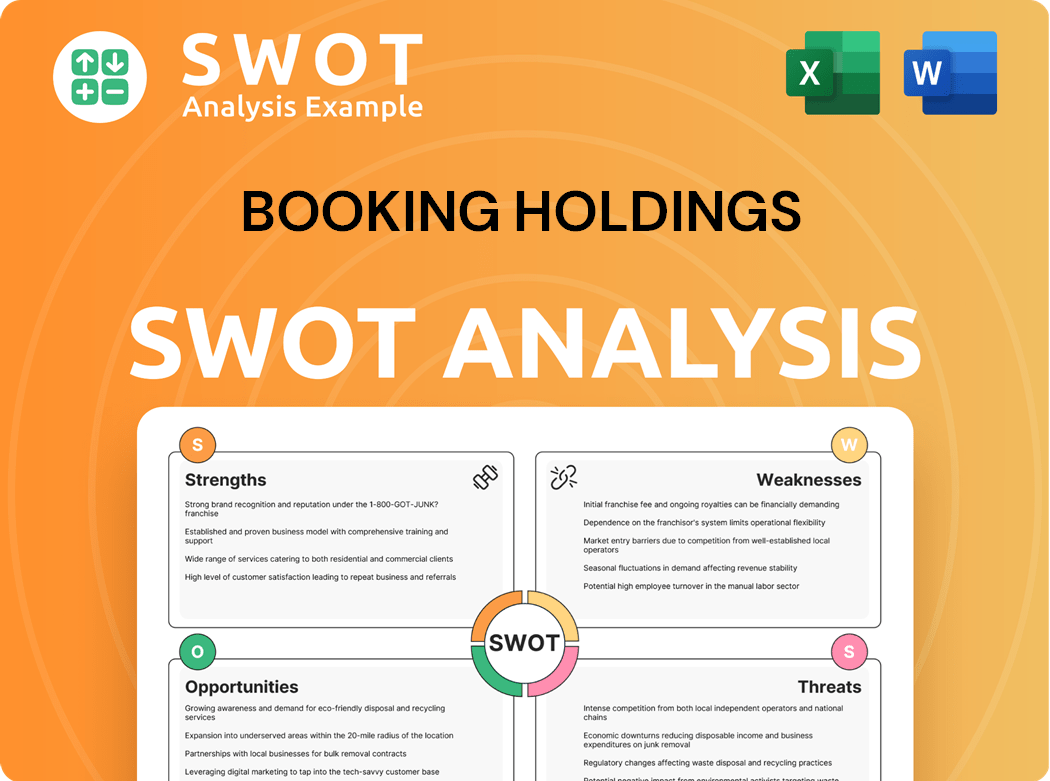

Booking Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Booking Holdings?

The early growth of the company, now known as Booking Holdings, was marked by innovation and strategic acquisitions. Its initial success stemmed from the 'name your own price' model, attracting cost-conscious travelers. This early phase set the stage for rapid expansion and a transformation into a major player in the online travel agency sector. The company's journey reflects a dynamic evolution in the travel industry, adapting to market changes and consumer preferences.

Founded in 1997, Priceline.com quickly gained traction with its 'name your own price' model, offering significant discounts and attracting a large customer base. The company's initial public offering in March 1999 saw a surge in stock price, reflecting strong investor confidence. Early product offerings expanded beyond airline tickets to include hotel rooms and rental cars, broadening its appeal within the travel industry.

A pivotal move was the acquisition of Booking.com in 2005 for approximately $133 million, introducing a traditional agency model. Booking.com, established in 1996, was already a strong player in Europe. This acquisition proved crucial as Booking.com became the primary revenue driver. Subsequent acquisitions, including Agoda.com (2007), Rentalcars.com (2013), KAYAK (2013 for approximately $1.8 billion), and OpenTable (2014 for approximately $2.6 billion), expanded its global footprint.

The company rebranded as Booking Holdings in 2018, reflecting its diversified portfolio of brands. This shift from a single 'name your own price' model to a multi-brand approach was key to sustained growth. By 2024, Booking Holdings reported gross travel bookings of $150.6 billion, demonstrating its significant market share and financial performance within the online travel agency sector.

The acquisitions of Booking.com, Agoda.com, Rentalcars.com, KAYAK, and OpenTable expanded the company's reach. These subsidiaries allowed Booking Holdings to enter new geographical markets and product categories. The company's strategic acquisitions and diversified business model have been crucial for its growth. The company's acquisitions have been instrumental in shaping its position as a leader in the travel industry.

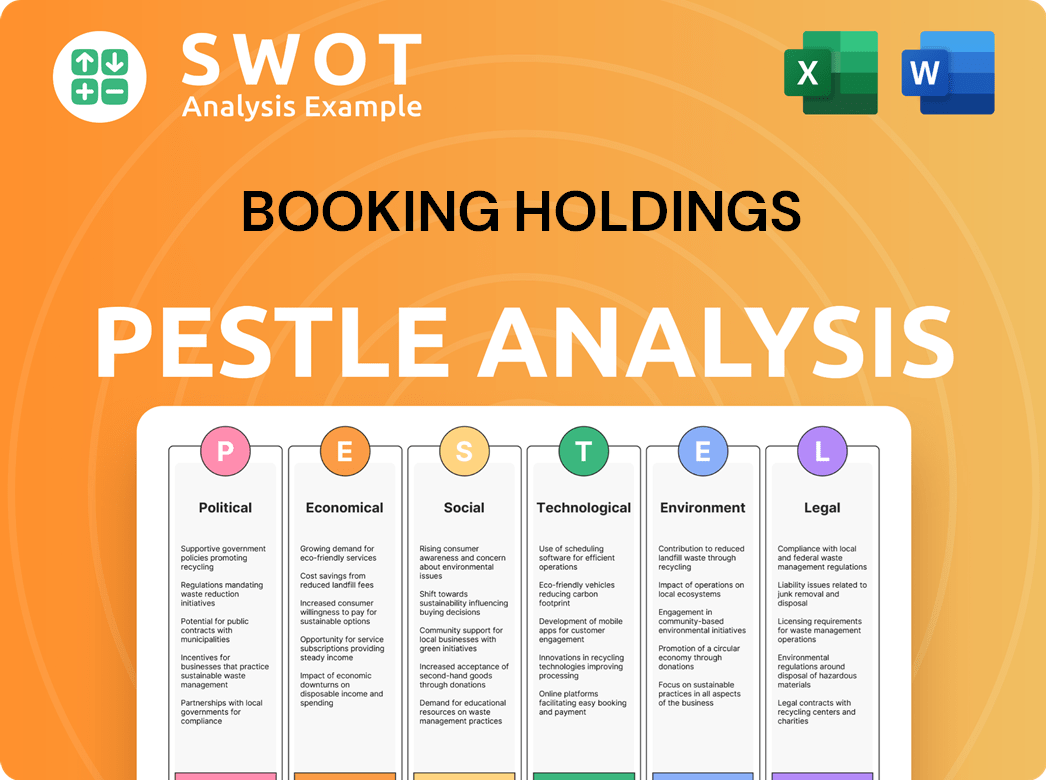

Booking Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Booking Holdings history?

The story of Booking Holdings, formerly known as the Priceline Group, is a compelling narrative of strategic pivots and acquisitions that have reshaped the online travel agency landscape. From its early days to its current status as a global leader, the company's journey is marked by significant milestones that highlight its adaptability and vision within the dynamic travel industry.

| Year | Milestone |

|---|---|

| 1997 | Priceline.com is founded, introducing the 'name your own price' model, revolutionizing how consumers book travel. |

| 2005 | Priceline.com acquires Booking.com, a move that significantly expands its global footprint and accommodation offerings. |

| 2013 | The Priceline Group officially changes its name to Booking Holdings, reflecting the importance of Booking.com to its business. |

| 2016 | Booking Holdings acquires KAYAK, integrating meta-search capabilities to enhance its price comparison services. |

| 2023 | Booking.com reports a record 1.1 billion room nights booked, demonstrating strong recovery and continued demand. |

Booking Holdings has consistently innovated to stay ahead in the competitive market. A groundbreaking innovation was the 'name your own price' model, which disrupted traditional pricing strategies. The acquisition of Booking.com proved to be a pivotal move, establishing a commission-based model that became a global standard.

Priceline.com's pioneering 'name your own price' model empowered consumers by allowing them to suggest prices for travel services, a disruptive approach in the late 1990s.

The acquisition of Booking.com brought a vast inventory of accommodations and a user-friendly interface, which became a global standard for online bookings.

The integration of KAYAK introduced meta-search capabilities, allowing users to compare prices across various platforms, enhancing the consumer experience.

Booking Holdings has consistently invested in mobile technology, ensuring a seamless booking experience for users on smartphones and tablets, a crucial aspect of modern travel.

The company expanded its services beyond hotels to include flights, rental cars, and other travel-related products, creating a one-stop shop for travelers.

Booking Holdings leverages data analytics to personalize recommendations and offers, enhancing user engagement and driving sales.

Despite its successes, Booking Holdings has faced several challenges. The dot-com bubble burst in the early 2000s significantly impacted priceline.com's stock value. Intense competition from other online travel agency (OTAs) and direct bookings from suppliers has been a constant pressure. The COVID-19 pandemic presented an unprecedented crisis, severely impacting the travel industry. For more insights, you can explore the Competitors Landscape of Booking Holdings.

The early 2000s saw a significant downturn in the stock market, affecting priceline.com's valuation and requiring strategic adjustments.

The travel industry is highly competitive, with numerous online travel agency (OTAs) vying for market share, creating constant pressure on pricing and innovation.

Direct bookings from hotels and airlines pose a challenge, as they can offer competitive pricing and potentially bypass Booking Holdings' services.

The COVID-19 pandemic severely impacted the travel industry, leading to a sharp decline in bookings and requiring significant adaptation.

Integrating diverse corporate cultures and technologies from various acquisitions has presented logistical and operational challenges.

Economic downturns and fluctuations in currency exchange rates can impact travel demand and Booking Holdings' financial performance.

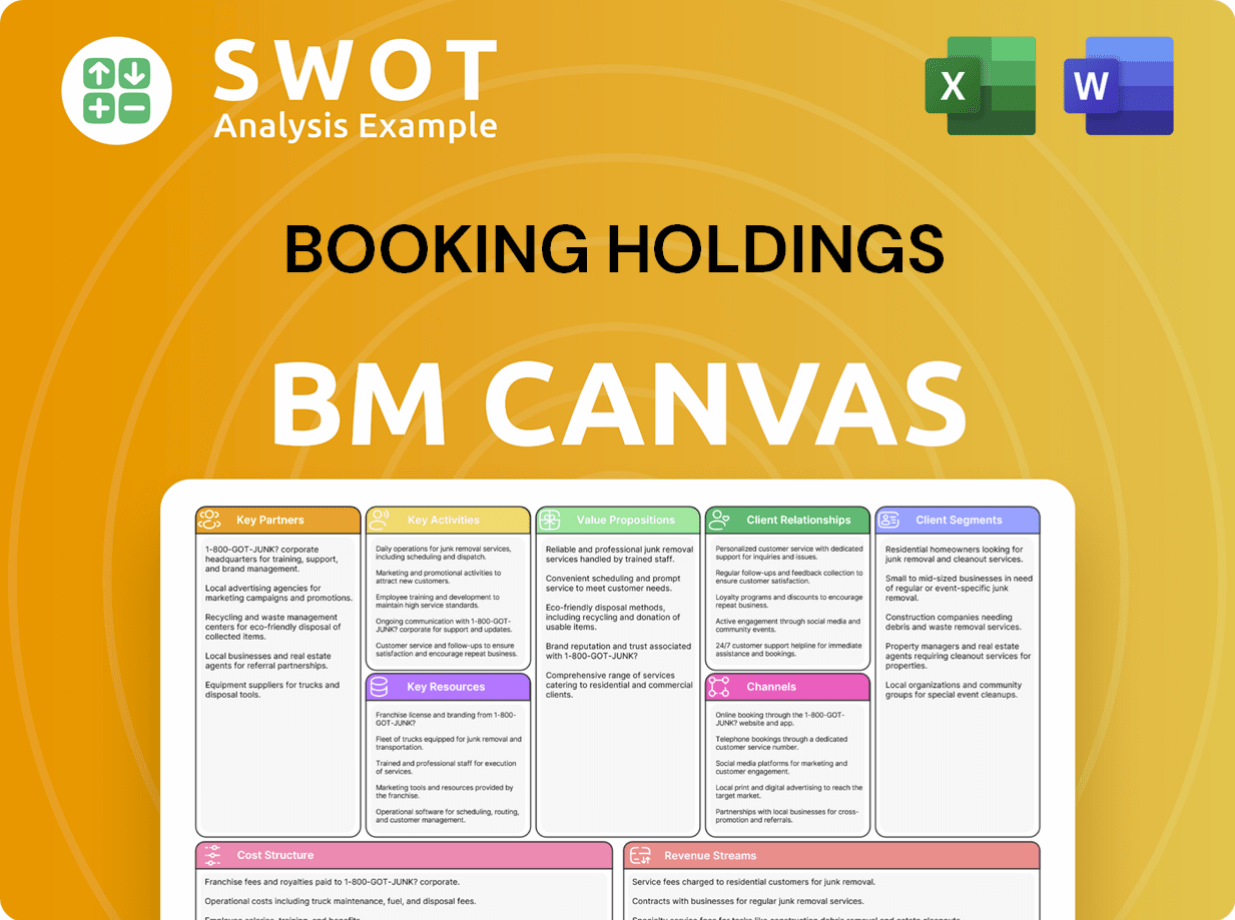

Booking Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Booking Holdings?

The story of Booking Holdings, a major player in the online travel agency landscape, is marked by strategic acquisitions and a focus on technological innovation. From its beginnings as Priceline.com in 1997, the company has evolved into a global travel powerhouse. Key acquisitions, including Booking.com, Agoda.com, KAYAK, and OpenTable, expanded its reach and diversified its offerings. The company's evolution culminated in a rebranding to Booking Holdings Inc. in 2018, reflecting its broad portfolio and the significance of Booking.com. The company navigated the challenges of the COVID-19 pandemic, and in 2023, reported strong financial results, with gross travel bookings reaching $150.6 billion, showcasing a robust recovery in travel demand. This timeline highlights the Booking.com history and its strategic moves in the travel industry.

| Year | Key Event |

|---|---|

| 1997 | Priceline.com is founded by Jay S. Walker, marking the start of its journey in the online travel agency sector. |

| 1999 | Priceline.com goes public, entering the financial markets and gaining capital for future growth. |

| 2005 | Priceline.com acquires Booking.com, a crucial step in building its global presence. |

| 2007 | The acquisition of Agoda.com expands its footprint in the Asian market. |

| 2013 | KAYAK is acquired, adding meta-search capabilities to its portfolio. |

| 2014 | OpenTable is acquired, diversifying into restaurant reservations. |

| 2018 | Priceline Group rebrands as Booking Holdings Inc., reflecting its expanded scope. |

| 2020-2021 | The company navigates the COVID-19 pandemic, focusing on recovery and supporting its partners. |

| 2023 | Booking Holdings reports strong financial results, with gross travel bookings reaching $150.6 billion. |

| 2024 | The company continues strategic initiatives, including investments in artificial intelligence and connected trip experiences. |

Booking Holdings is investing heavily in artificial intelligence (AI) and machine learning to personalize travel experiences. This technology is used to optimize pricing and enhance customer service. These advancements are key to staying competitive in the travel industry.

The 'connected trip' concept aims to integrate all aspects of a traveler's journey. This includes booking, on-trip experiences, and more. The goal is to create seamless and personalized travel experiences. This strategy is central to Booking Holdings' long-term vision.

Booking Holdings plans to expand its presence, particularly in emerging markets. This involves building relationships with local partners. The company aims to tap into new growth opportunities in these regions.

Booking Holdings is adapting to industry trends, such as the rising demand for sustainable travel. The integration of generative AI in travel planning is also a focus. These trends are shaping the company's future strategies.

Booking Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Booking Holdings Company?

- What is Growth Strategy and Future Prospects of Booking Holdings Company?

- How Does Booking Holdings Company Work?

- What is Sales and Marketing Strategy of Booking Holdings Company?

- What is Brief History of Booking Holdings Company?

- Who Owns Booking Holdings Company?

- What is Customer Demographics and Target Market of Booking Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.