Booking Holdings Bundle

Can Booking Holdings Maintain Its Dominance in the Cutthroat Travel Industry?

The online travel industry is a constantly shifting battleground, fueled by technological advancements and changing consumer demands. Booking Holdings, a titan in this arena, has built its empire through strategic acquisitions and innovative platform development. But how does this travel giant navigate the intense competition, and what strategies does it employ to stay ahead?

This exploration delves into the Booking Holdings SWOT Analysis, dissecting its competitive landscape and identifying its key strengths and weaknesses. We'll examine its primary rivals within the online travel agencies (OTAs) market and conduct a thorough Booking Holdings market analysis to understand its competitive advantage. Ultimately, we'll uncover how Booking Holdings differentiates itself and what its future outlook might be in the ever-evolving travel industry, considering its competitive threats and growth strategies.

Where Does Booking Holdings’ Stand in the Current Market?

Booking Holdings maintains a leading position within the global online travel industry. Its core operations revolve around facilitating travel bookings through its various platforms, with a primary focus on accommodations. The company offers a wide array of travel-related services, including flights, car rentals, and restaurant reservations, catering to a diverse customer base.

The value proposition of Booking Holdings lies in its extensive selection of properties, user-friendly platforms, and competitive pricing. By connecting travelers with a vast network of accommodations and other travel services, it simplifies the booking process and provides convenience. This approach allows the company to capture a significant share of the online travel market.

Booking Holdings is a dominant player in the online travel agencies (OTA) market. Booking.com, its flagship brand, is generally considered the largest online accommodation booking platform globally based on room nights booked. This strong market position is supported by a broad geographic presence and a comprehensive range of travel services.

The company's primary offerings include accommodation bookings (hotels, vacation rentals), airline tickets, car rentals, and restaurant reservations. Booking Holdings serves a wide spectrum of travelers, from budget-conscious individuals to luxury seekers. The diverse range of services contributes to its competitive advantage within the travel industry.

Booking Holdings operates in over 220 countries and territories, with a strong presence in Europe through Booking.com. This extensive global footprint allows the company to cater to a diverse international customer base. Its widespread reach is a key factor in its market dominance.

Booking Holdings reported total revenues of $17.1 billion in 2023, a 25% increase year-over-year. Gross travel bookings for 2023 were $150.6 billion, a 29% increase from the previous year. This strong financial performance enables significant investments in technology, marketing, and strategic initiatives, further solidifying its market position.

Booking Holdings has strategically emphasized Booking.com's agency model, providing a wider inventory of properties. This has allowed it to capture a significant share of the alternative accommodations market, directly competing with platforms like Airbnb. The company's focus on technology and innovation enhances its competitive advantage.

- Strong brand recognition and customer loyalty.

- Extensive global network of accommodations and travel services.

- Robust financial performance, enabling strategic investments.

- Advanced technology and user-friendly platforms.

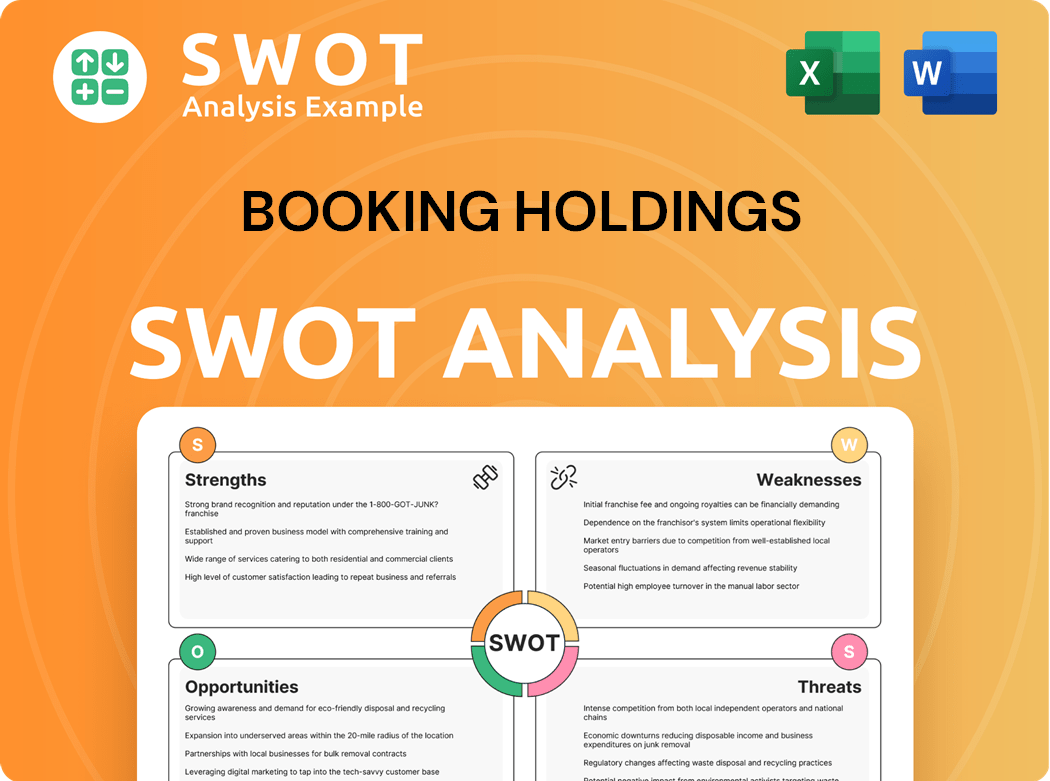

Booking Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Booking Holdings?

The Booking Holdings competitive landscape is characterized by intense competition across various segments of the travel industry. The company faces a diverse array of rivals, from established online travel agencies (OTAs) to emerging players and direct booking channels. Understanding these Booking Holdings competitors and their strategies is crucial for assessing the company's market position and future prospects. This Booking Holdings market analysis reveals a dynamic environment where innovation and strategic partnerships play pivotal roles.

Booking Holdings operates in a highly competitive environment, with rivals constantly vying for market share. The company's competitive strategy involves a combination of aggressive marketing, technological innovation, and strategic acquisitions. The ability to adapt to changing consumer preferences and industry trends is critical for maintaining a competitive advantage.

The company's success is also influenced by its ability to navigate regulatory hurdles and economic fluctuations. For example, the travel industry is subject to various economic and geopolitical factors that can significantly impact demand and profitability. The company must continuously monitor these factors and adjust its strategies accordingly.

Booking Holdings' most significant direct competitor is Expedia Group, which operates brands such as Expedia, Hotels.com, and Vrbo. These companies compete head-to-head in accommodations, flights, and car rentals. Expedia Group reported gross bookings of $105.7 billion in 2023.

Airbnb presents a significant challenge, particularly in the alternative accommodations sector. Airbnb's peer-to-peer lodging model and focus on unique stays present a distinct competitive threat to Booking.com's broader inventory. Airbnb's revenue in 2023 was approximately $9.9 billion.

In the flight meta-search arena, KAYAK competes with Google Flights and Skyscanner. These platforms aggregate flight information from various sources, offering users a way to compare prices and options. These services are integrated into the larger travel ecosystem, providing users with comprehensive travel planning tools.

Rentalcars.com faces competition from traditional car rental companies like Enterprise and Hertz, as well as other online aggregators. These companies compete on price, location, and vehicle availability. The car rental market is highly competitive, with numerous players vying for market share.

OpenTable, Booking Holdings' restaurant reservation platform, competes with services like Resy (owned by American Express) and Yelp Reservations. These platforms offer reservation services and compete for market share in the restaurant industry. The restaurant reservation market is also competitive, with various players vying for market share.

Direct bookings from hotel chains like Marriott, Hilton, and IHG pose a significant indirect competitive threat. These chains encourage direct bookings, offering incentives such as loyalty points and exclusive rates. Direct booking channels are becoming increasingly important as hotels seek to reduce their reliance on OTAs.

The travel industry is constantly evolving, with new players and technologies emerging regularly. Booking Holdings must continually adapt to maintain its competitive advantage. For more insights into the company's strategies, consider reading the Marketing Strategy of Booking Holdings.

- Market Share: Booking Holdings and Expedia Group dominate the OTA market, but Airbnb is rapidly gaining ground, especially in alternative accommodations.

- Technological Innovation: Companies are investing in AI and machine learning to personalize travel planning and improve user experiences.

- Strategic Partnerships: Alliances with airlines and other travel providers offer bundled travel solutions, impacting competitive dynamics.

- Direct Bookings: Hotel chains are increasingly focusing on direct bookings, offering incentives to attract customers.

- Emerging Players: Niche travel platforms and those leveraging new technologies pose a constant threat to the established players.

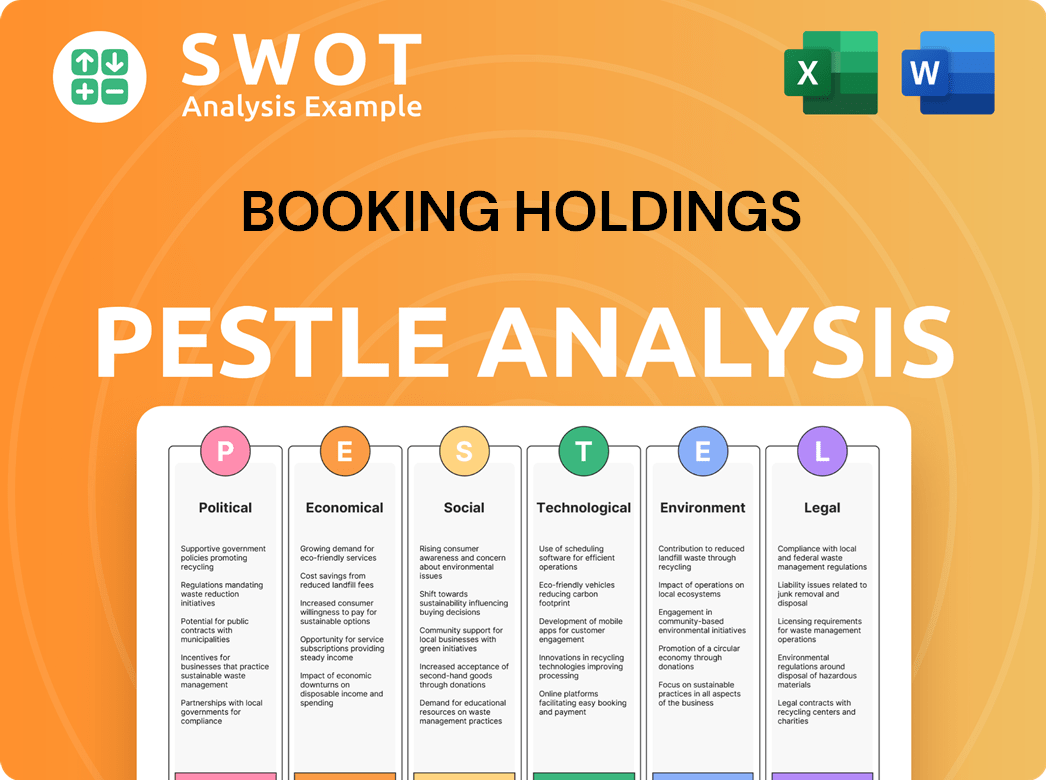

Booking Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Booking Holdings a Competitive Edge Over Its Rivals?

Understanding the Booking Holdings competitive landscape involves recognizing its significant advantages in the online travel agency (OTA) market. The company has cultivated a strong position through strategic acquisitions and organic growth, resulting in a diverse portfolio of brands. This diversification and its robust technology infrastructure are key elements in its competitive strategy.

Booking Holdings' competitors are numerous and varied, including both established players and emerging challengers. The company's ability to adapt to market dynamics and leverage data analytics further strengthens its position. A deep dive into its market share and growth strategies is crucial for a comprehensive Booking Holdings market analysis.

The company's success is built on a foundation of technological innovation, extensive global reach, and a customer-centric approach. These factors contribute to its ability to maintain a competitive edge in a dynamic and evolving travel industry.

Booking Holdings benefits from a vast global presence, with operations and users spanning numerous countries. Booking.com, its flagship brand, is recognized worldwide, fostering strong customer loyalty. This widespread recognition allows for effective marketing and a broad customer base.

The company's proprietary technology platform is a cornerstone of its competitive advantage. This platform supports seamless booking experiences and integrates a vast network of travel providers. The scale of Booking.com creates strong network effects, attracting both accommodation providers and a large user base.

Booking Holdings operates a diverse portfolio of brands, including Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK, and OpenTable. This diversification allows the company to cater to a broad spectrum of traveler needs and preferences. The diversified approach provides resilience against market fluctuations in specific segments.

The company leverages its vast data analytics capabilities to personalize recommendations, optimize pricing, and enhance the user experience. This data-driven approach solidifies customer engagement and drives repeat business. Data analytics are crucial for maintaining a competitive edge.

Booking Holdings' competitive advantages are rooted in its global reach, brand recognition, technology, and data analytics. The company's ability to adapt to market changes and leverage its diverse brand portfolio are also key strengths. These factors help differentiate it within the travel industry.

- Extensive global presence and strong brand recognition, particularly through Booking.com.

- Proprietary technology platform that supports seamless booking experiences.

- A diversified portfolio of brands catering to a wide range of traveler needs.

- Advanced data analytics capabilities for personalized recommendations and optimized pricing.

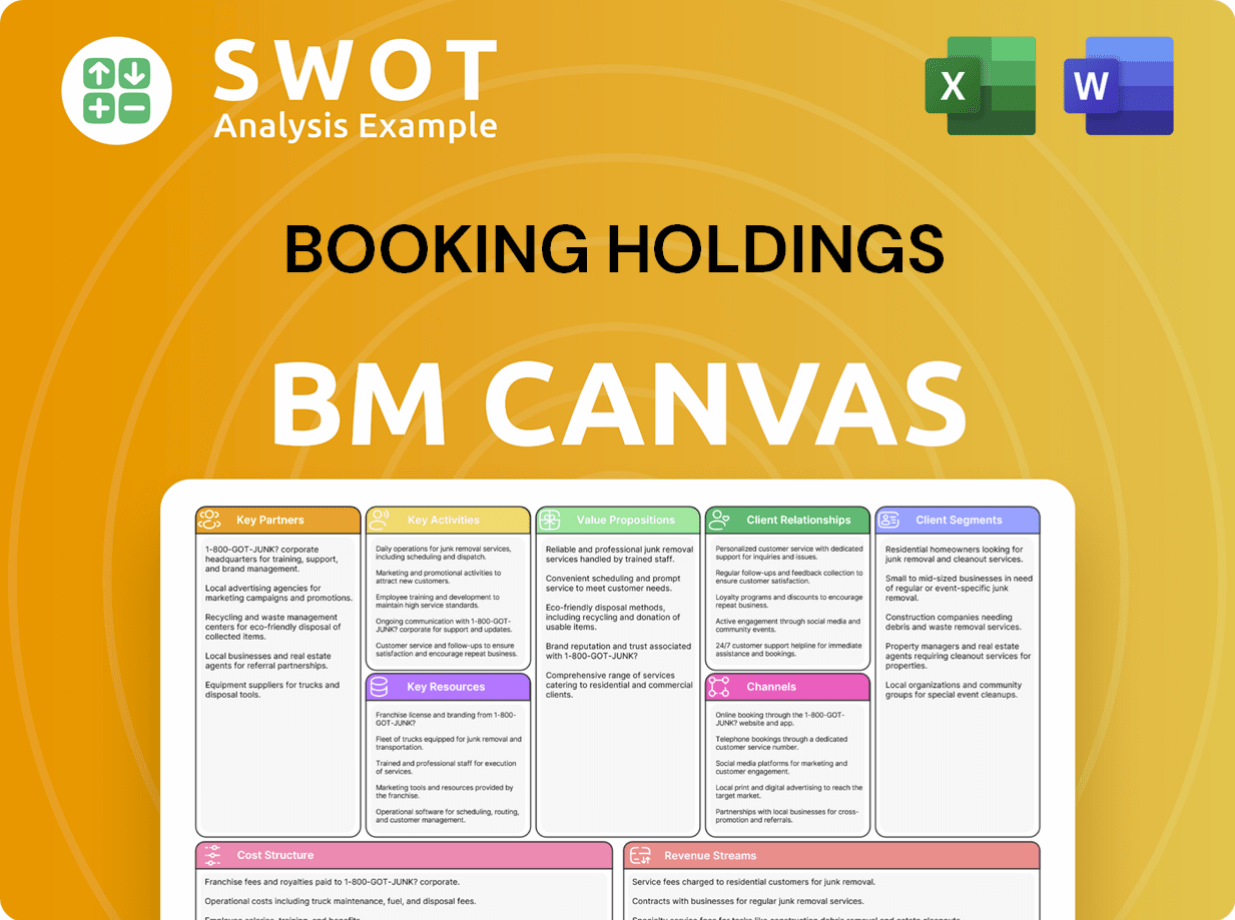

Booking Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Booking Holdings’s Competitive Landscape?

The online travel industry is a dynamic sector, and the competitive landscape for companies like Booking Holdings is constantly evolving. Understanding the industry trends, potential challenges, and emerging opportunities is crucial for assessing its future prospects. This involves analyzing the company's position relative to its competitors, recognizing potential risks, and evaluating its strategic outlook.

The Owners & Shareholders of Booking Holdings should be aware of the shifting dynamics within the travel industry. This includes technological advancements, changing consumer preferences, and the impact of global events. These factors significantly influence the company's ability to maintain its competitive edge and achieve sustainable growth.

Technological innovations, such as AI and machine learning, are driving personalized travel experiences and intelligent search functionalities. The increasing demand for sustainable travel options is another significant trend. These advancements present opportunities for Booking Holdings to enhance its services and align with evolving consumer values.

Regulatory changes regarding data privacy and consumer protection could increase operational costs. Economic downturns and geopolitical instability may reduce travel demand, directly impacting revenue. The rise of direct booking initiatives by hotels and airlines presents a persistent challenge to online travel agencies (OTAs).

Significant growth opportunities exist in emerging markets, particularly in Asia and Latin America. Further product innovations, such as expanding into experiences or local activities, can unlock new revenue streams. Strategic partnerships with other travel providers or technology companies can strengthen Booking Holdings' competitive position.

The competitive landscape is shaped by major players and emerging competitors. Key rivals include Expedia Group and other OTAs. Understanding their market strategies and financial performance is crucial for Booking Holdings' market analysis and competitive advantage. The company's ability to differentiate itself through technology, brand portfolio, and customer service is essential.

Booking Holdings' competitive strategy must address both current and future challenges. It should focus on leveraging technology, expanding into new markets, and forming strategic partnerships. The company's recent acquisitions and brand portfolio play a crucial role in its growth strategies and overall financial performance compared to competitors.

- Market Share Analysis: Booking Holdings and Expedia Group are the two largest players in the OTA market, with significant market share.

- Technological Advancements: AI and machine learning are critical for personalizing travel experiences and optimizing operations.

- Geographic Expansion: Emerging markets, such as Asia and Latin America, offer significant growth potential for Booking Holdings.

- Sustainability: Increasing consumer demand for eco-friendly options can be a key differentiator.

Booking Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Booking Holdings Company?

- What is Growth Strategy and Future Prospects of Booking Holdings Company?

- How Does Booking Holdings Company Work?

- What is Sales and Marketing Strategy of Booking Holdings Company?

- What is Brief History of Booking Holdings Company?

- Who Owns Booking Holdings Company?

- What is Customer Demographics and Target Market of Booking Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.