Booking Holdings Bundle

How Does Booking Holdings Dominate the Travel Industry?

Booking Holdings, a powerhouse in the Booking Holdings SWOT Analysis, is revolutionizing how we explore the globe. With a staggering $150.6 billion in gross travel bookings in 2023, the company's influence is undeniable. Its diverse portfolio of brands, including Booking.com, Priceline, and Agoda, caters to a vast audience seeking seamless travel experiences. Understanding the inner workings of this online travel agency is key to navigating the evolving travel landscape.

This exploration will uncover the strategies behind Booking Holdings' success, from its robust Booking Holdings SWOT Analysis to its innovative approach to the travel industry. We'll dissect how Booking.com, a cornerstone of its operations, drives significant revenue and customer engagement. By examining its operational model, we aim to provide actionable insights for investors, travelers, and industry professionals alike, answering questions like: How does Booking Holdings make money and what are the future prospects for this online travel agency?

What Are the Key Operations Driving Booking Holdings’s Success?

Booking Holdings, a major player in the travel industry, operates primarily through its network of online travel agency (OTA) brands. These platforms connect travelers with a wide range of travel services, including accommodations, flights, car rentals, and restaurant reservations. The company's business model is built on facilitating transactions between travelers and service providers, offering a convenient and efficient way to plan and book travel.

The core value proposition of Booking Holdings lies in its ability to offer consumers a vast selection of travel options at competitive prices. Through its various brands, including Booking.com, Priceline, and Agoda, the company provides access to a global inventory of hotels, flights, and other travel services. This extensive selection, combined with user-friendly booking platforms and customer support, makes Booking Holdings a go-to resource for travelers worldwide.

The company's operational processes are heavily reliant on sophisticated technology platforms. These platforms manage everything from search and booking functionalities to secure payment processing and customer service. The strength of Booking Holdings lies in its ability to aggregate travel options, providing consumers with unparalleled choice and often better pricing due to its scale and direct relationships with suppliers.

Booking.com: Focuses on accommodation bookings globally, offering a wide selection of hotels, apartments, and other lodging options.

Priceline: Known for its "Name Your Own Price" and Express Deals features, providing deals on flights, hotels, and rental cars.

Agoda: Specializes in the Asia-Pacific region, offering a wide range of accommodations and travel services in that market.

Rentalcars.com: Focuses on car rental services, providing a global platform for booking rental cars.

Booking Holdings' operational success is driven by its extensive network of suppliers and its robust technology infrastructure. The company's platforms facilitate millions of transactions daily, connecting travelers with a vast array of travel services.

- Booking.com alone offers over 28 million total reported listings, including over 6.6 million listings of homes, apartments, and other unique places to stay.

- The company has a significant presence in the Asia-Pacific region through Agoda, which is a key factor in its global reach.

- The company's marketing strategies, as discussed in Marketing Strategy of Booking Holdings, are crucial for maintaining its competitive edge.

- Booking Holdings reported a gross travel booking of over $121 billion in 2023.

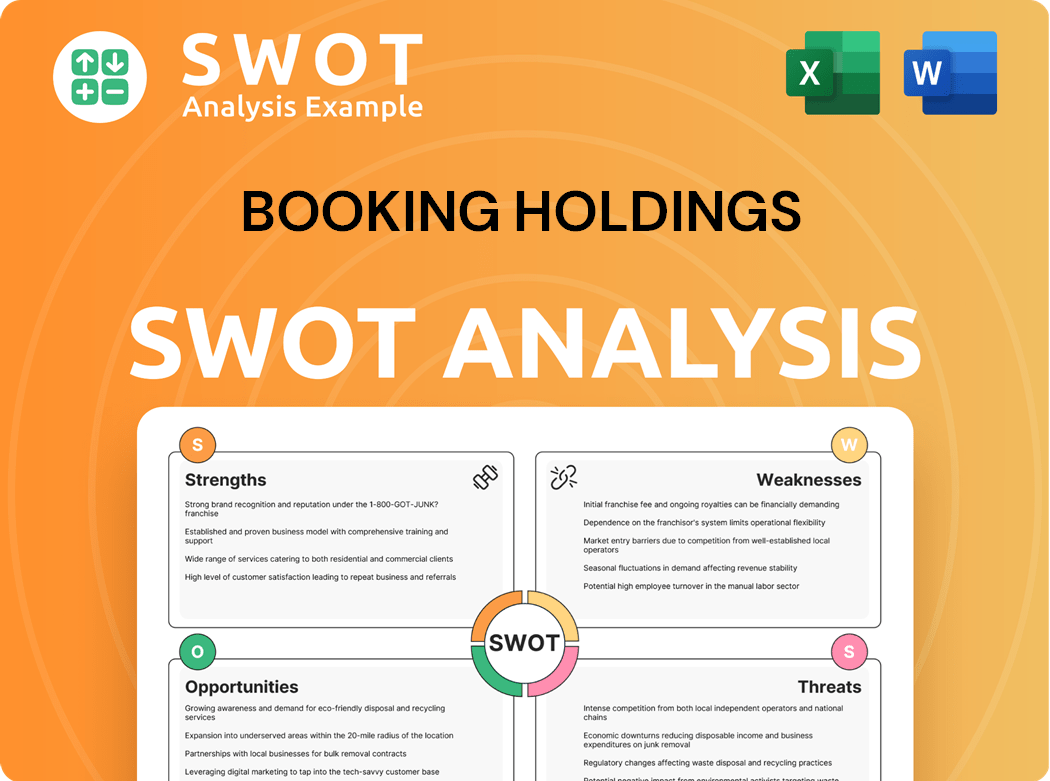

Booking Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Booking Holdings Make Money?

Understanding the revenue streams and monetization strategies of Booking Holdings is crucial for investors and anyone interested in the online travel agency (OTA) sector. The company, which operates several prominent brands, including Booking.com, has a diversified approach to generating income. This strategy allows it to capture value across various aspects of the travel industry.

Booking Holdings employs a multi-faceted approach to generate revenue, primarily through agency commissions, merchant revenues, and advertising. Each revenue stream contributes significantly to the company's financial performance. This structure supports its growth and market position within the competitive landscape.

The main revenue source for Booking Holdings is agency commissions. Booking.com operates on an agency model, collecting commissions from accommodation providers for bookings made through its platform. In 2023, agency revenues reached $15.0 billion, a notable increase from $12.3 billion in 2022, demonstrating the platform's continued dominance in the market.

Merchant revenues, particularly for brands like Priceline and Agoda, represent a significant portion of Booking Holdings' income. The company acts as the merchant of record, purchasing inventory from suppliers and reselling it to consumers. This includes packaged deals, airline tickets, and car rentals. Merchant revenues in 2023 were $6.7 billion, up from $5.3 billion in 2022, reflecting the expansion of services offered.

- Priceline and Agoda contribute significantly to merchant revenues.

- The company purchases inventory and resells it to consumers.

- This includes packaged deals, airline tickets, and car rentals.

- Merchant revenues showed strong growth in 2023.

Advertising and other revenues also contribute to Booking Holdings' top line. This segment includes revenue from KAYAK's metasearch model and OpenTable's subscription services. KAYAK generates revenue from user clicks on travel links and advertising on its platforms. OpenTable generates revenue through reservation and subscription fees. Advertising and other revenues reached $0.9 billion in 2023, increasing from $0.8 billion in 2022.

Booking Holdings uses several monetization strategies to maximize revenue. These include tiered pricing for partners based on commission rates, bundled services that offer discounts, and cross-selling opportunities across its brands. For example, a user booking a hotel on Booking.com might be prompted to rent a car through Rentalcars.com or make a dinner reservation via OpenTable. Understanding the Growth Strategy of Booking Holdings gives a better view of the company's expansion plans.

- Tiered pricing based on commission rates.

- Bundled services offering discounts.

- Cross-selling opportunities across various brands.

- Focus on accommodation bookings through Booking.com.

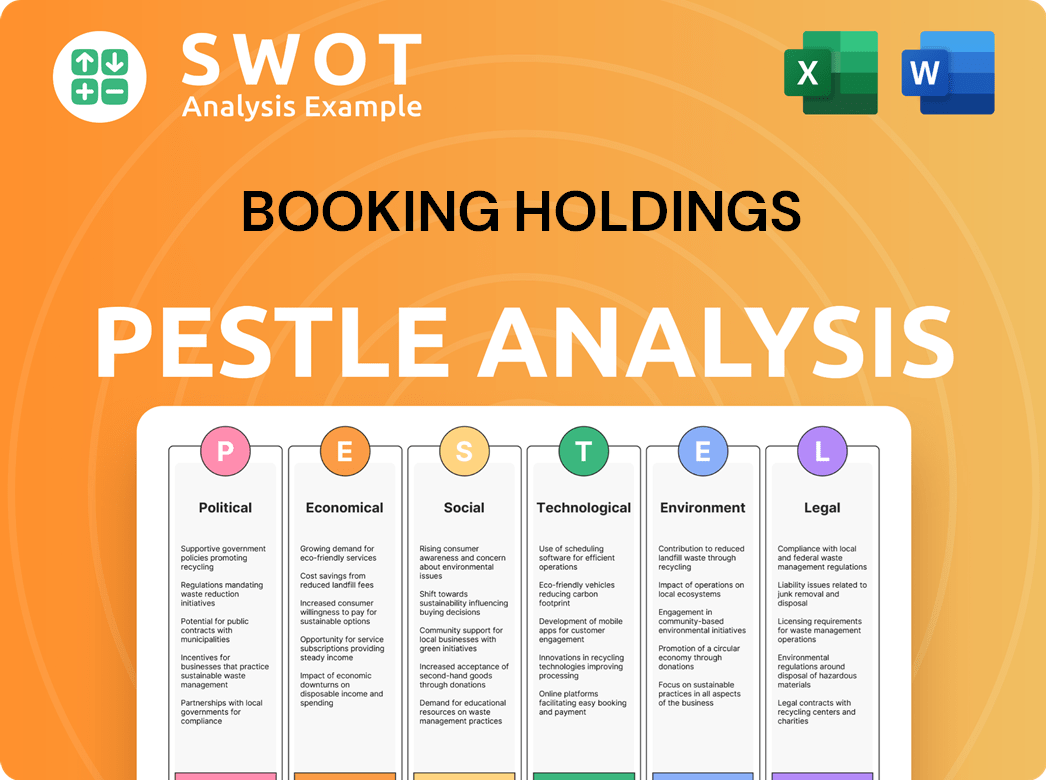

Booking Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Booking Holdings’s Business Model?

The journey of Booking Holdings has been marked by strategic acquisitions that have significantly shaped its operational and financial landscape. A critical milestone was the acquisition of Booking.com in 2005, which became the company's largest and most profitable brand, driving its global expansion in accommodation bookings. Other key acquisitions, such as Agoda (2007), Rentalcars.com (2004), KAYAK (2013), and OpenTable (2014), broadened its service offerings and market reach, allowing the company to diversify its portfolio beyond Priceline's original 'Name Your Own Price' model.

Booking Holdings has navigated various challenges, including economic downturns, geopolitical events, and intense competition. The COVID-19 pandemic presented an unprecedented challenge, severely impacting global travel. The company responded by strengthening its financial position, optimizing its cost structure, and focusing on domestic and regional travel recovery. Booking Holdings continues to adapt to evolving consumer preferences, such as the increasing demand for sustainable travel options and flexible booking policies. Understanding the Target Market of Booking Holdings is crucial for its continued success.

The company's competitive advantages are multifaceted, including strong brand recognition, technology leadership, economies of scale, and a powerful network effect. These factors enable Booking Holdings to maintain a strong position in the dynamic travel industry. The integration of generative AI for travel planning and customer service is a key area of focus to maintain its competitive edge.

The acquisition of Booking.com in 2005 was a pivotal moment, transforming the company's trajectory. Agoda, Rentalcars.com, KAYAK, and OpenTable were also key acquisitions. These moves expanded service offerings and market reach.

The company has consistently adapted to market changes, including economic downturns and the COVID-19 pandemic. Booking Holdings responded by strengthening its financial position. It also focuses on domestic and regional travel recovery, and adapting to consumer preferences.

Booking Holdings benefits from strong brand strength, particularly with Booking.com. Its technology leadership, including AI-driven personalization, enhances user experience. Economies of scale and a powerful network effect further solidify its market position.

In 2023, Booking Holdings reported a gross travel booking value of approximately $121 billion. The company's revenue for 2023 was around $21.4 billion, reflecting a significant recovery from the pandemic. The adjusted EBITDA for 2023 was about $6.9 billion, demonstrating strong profitability.

Booking Holdings maintains a strong position in the online travel agency market through several key advantages. These advantages enable the company to navigate challenges and capitalize on opportunities within the travel industry.

- Brand Strength: Booking.com's strong brand recognition and customer loyalty drive direct traffic and repeat bookings.

- Technology Leadership: Advanced AI-driven personalization and search algorithms enhance user experience and conversion rates.

- Economies of Scale: Massive inventory and global reach enable favorable terms with suppliers and significant investments in marketing and technology.

- Network Effect: More users attract more suppliers, and vice versa, solidifying market position and driving growth.

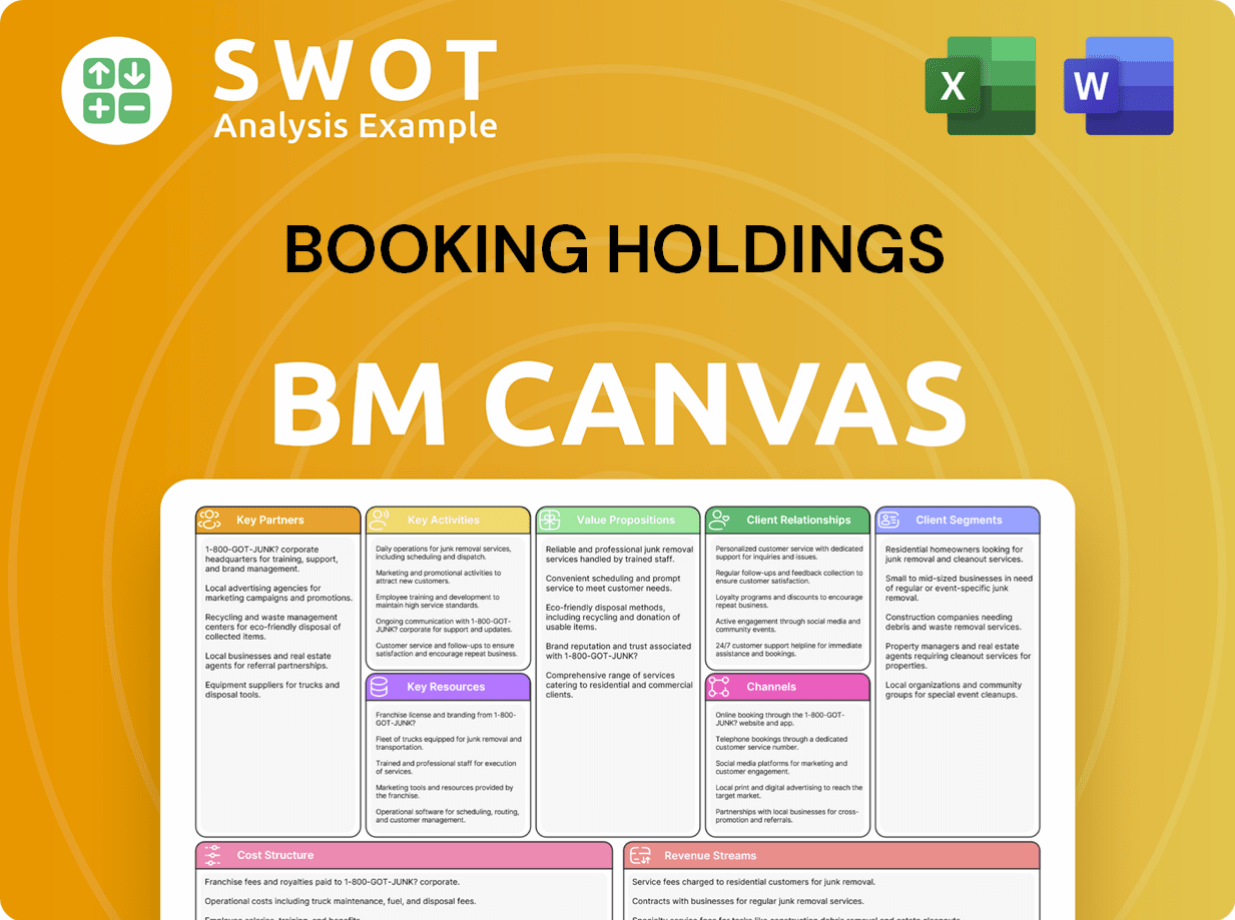

Booking Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Booking Holdings Positioning Itself for Continued Success?

Booking Holdings, a prominent player in the online travel agency (OTA) sector, holds a leading position in the global travel market. Its flagship brand, Booking.com, is particularly dominant in the accommodation segment. The company's diverse portfolio of brands provides extensive global reach and fosters strong customer loyalty across various travel verticals, making it a key player in the travel industry.

The company consistently ranks among the top online travel agencies worldwide, competing with major players like Expedia Group and various regional OTAs. Booking Holdings' strong brand recognition and extensive inventory contribute significantly to its ability to attract and retain a large customer base, solidifying its position in the competitive online travel market.

Booking Holdings maintains a strong market share, especially in accommodations through Booking.com. Its global reach is extensive, supported by a diverse portfolio of brands. The company competes with major OTAs like Expedia Group and regional players, leveraging strong brand recognition.

Regulatory changes, particularly concerning data privacy and antitrust, pose risks. New competitors, including direct booking initiatives from hotels and airlines, challenge market share. Technological advancements and changing consumer preferences require continuous innovation and adaptation.

Booking Holdings is focused on technology and product innovation, especially in AI for personalization. The company is exploring new growth avenues, such as connected trip experiences. It aims to leverage its financial position to capitalize on the travel market's growth.

In 2023, Booking Holdings reported a total revenue of approximately $21.4 billion, a significant increase compared to the prior year. Gross bookings for the same period reached around $121.0 billion. The company's strong financial performance reflects its robust recovery from the pandemic and its effective strategies in the online travel agency market.

Booking Holdings faces challenges from regulatory changes and new competitors. However, it has opportunities in technological advancements and changing consumer preferences. The company's strategic focus on innovation and expansion of services positions it to capitalize on the travel market's growth.

- Regulatory Compliance: Navigating data privacy regulations like GDPR and CCPA.

- Competitive Landscape: Addressing competition from direct booking and tech startups.

- Technological Adaptation: Investing in AI and virtual reality to enhance user experience.

- Consumer Trends: Adapting to experiential travel and sustainable tourism demands.

Booking Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Booking Holdings Company?

- What is Competitive Landscape of Booking Holdings Company?

- What is Growth Strategy and Future Prospects of Booking Holdings Company?

- What is Sales and Marketing Strategy of Booking Holdings Company?

- What is Brief History of Booking Holdings Company?

- Who Owns Booking Holdings Company?

- What is Customer Demographics and Target Market of Booking Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.