Booking Holdings Bundle

How Will Booking Holdings Continue to Dominate the Travel Industry?

The online travel agency (OTA) landscape is a battlefield of innovation and strategic maneuvering, with Booking Holdings at its forefront. From its inception in 1997, the company has consistently redefined market leadership through aggressive expansion. This article delves into Booking Holdings' journey, exploring its evolution from a single platform to a global travel giant, and uncovering the secrets behind its enduring success.

Understanding the Booking Holdings SWOT Analysis is crucial to grasping its growth strategy and future prospects within the competitive travel industry. Booking Holdings' success is a testament to its robust business model and strategic partnerships, which have fueled its impressive revenue growth and market share. This analysis will dissect Booking Holdings' expansion strategies, financial performance, and technological advancements, offering insights into its long-term growth potential and ability to navigate challenges like the impact of COVID-19 and emerging market opportunities.

How Is Booking Holdings Expanding Its Reach?

The expansion initiatives of Booking Holdings are multifaceted, focusing on geographical market entry, product diversification, and strategic mergers and acquisitions. These strategies are crucial for accessing new customer segments and maintaining a competitive edge within the dynamic online travel agency (OTA) landscape. The company's approach is driven by the need to adapt to evolving consumer behaviors and industry trends, ensuring sustained growth and market leadership.

A key element of Booking Holdings' growth strategy involves international expansion, particularly in high-growth emerging markets. This focus is supported by the increasing digital penetration and rising travel demand in these regions. The company aims to strengthen its presence in key markets while also diversifying its revenue streams. This approach helps to mitigate risks associated with economic fluctuations in any single market.

Booking Holdings is also dedicated to broadening its product offerings beyond traditional accommodations. This includes flights, car rentals, and restaurant reservations, with the goal of creating a comprehensive travel ecosystem. Strategic acquisitions and partnerships play a significant role in this expansion, allowing the company to offer a more holistic and integrated travel experience. This approach is vital for attracting and retaining customers in a competitive market.

Booking Holdings actively targets high-growth emerging markets to expand its global footprint. This includes focusing on regions with increasing digital penetration and rising travel demand. The company's expansion strategy is designed to capitalize on the growing number of international travelers.

The company diversifies its product offerings beyond accommodations to include flights, car rentals, and restaurant reservations. This strategy aims to create a comprehensive travel ecosystem. The integration of various travel services enhances the overall customer experience and increases revenue opportunities.

Booking Holdings utilizes strategic mergers and acquisitions to expand its portfolio and market share. These acquisitions help to integrate new technologies and services. This approach enables the company to stay competitive and meet evolving consumer demands.

Booking Holdings forms partnerships with local businesses and technology providers to enhance its offerings. These collaborations streamline the booking process and provide curated experiences. These partnerships are essential for expanding market reach and improving customer satisfaction.

Booking Holdings' expansion strategies are multifaceted, encompassing geographical expansion, product diversification, and strategic partnerships. These initiatives are crucial for sustaining growth in the competitive travel industry. The company's ability to adapt and innovate is key to its long-term success.

- International Expansion: Focus on high-growth markets, particularly in the Asia-Pacific region, which is projected to experience significant travel growth.

- Product Diversification: Expanding beyond accommodations to include flights, car rentals, and restaurant reservations to offer a comprehensive travel ecosystem.

- Strategic Partnerships: Collaborating with local businesses and technology providers to enhance offerings and reach, such as payment providers and local tour operators.

- Technological Advancements: Investing in technological advancements to improve user experience and operational efficiency.

In 2024, Booking Holdings continued to expand its global presence, with a focus on key markets in Asia and Latin America. The company's investments in technology and strategic partnerships are aimed at enhancing its competitive position. For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Booking Holdings.

Booking Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Booking Holdings Invest in Innovation?

Booking Holdings' growth strategy heavily relies on technological innovation to enhance user experience and streamline operations within the online travel agency (OTA) sector. The company continually invests in research and development, ensuring it remains at the forefront of technological advancements. This focus allows Booking Holdings to personalize travel recommendations and improve customer satisfaction.

Digital transformation is a core element of Booking Holdings' strategy, with a strong emphasis on automation across its platforms. This includes using AI-powered chatbots for customer service and automated booking confirmations. These efforts aim to increase efficiency and provide a seamless experience for travelers, which is crucial in the competitive travel industry. The company's commitment to innovation is evident in its strategic partnerships and in-house development teams.

The company leverages cutting-edge technologies like Artificial Intelligence (AI) and machine learning to analyze vast amounts of data, predict travel trends, and offer highly customized travel options. AI-powered recommendation engines on Booking.com suggest accommodations and activities based on user preferences and past behavior. This approach drives higher conversion rates and enhances the overall user experience. Furthermore, Booking Holdings is exploring the integration of IoT (Internet of Things) to improve the in-destination experience.

Booking Holdings uses AI and machine learning to analyze data and personalize travel recommendations. This technology helps predict travel trends and improve customer engagement.

The company employs automation extensively, including chatbots and automated booking confirmations. This streamlines operations and enhances customer service efficiency.

Enhancing user experience is a primary focus through personalized recommendations and easy-to-use platforms. The goal is to make travel planning more intuitive and enjoyable.

Sustainability initiatives are growing, with technology used to promote eco-friendly travel options. This includes helping partners adopt sustainable practices.

Booking Holdings collaborates with external innovators to stay ahead of technological advancements. These partnerships are crucial for continuous improvement.

The company has robust in-house development teams dedicated to innovation. These teams ensure that Booking Holdings can quickly adapt to new technologies.

Booking Holdings' technological advancements are key to its mission and long-term growth potential. The company's focus on innovation is reflected in its strategic investments and continuous efforts to improve its platforms. Sustainability is also a growing focus, with technology playing a role in promoting eco-friendly travel options. By highlighting key patents and industry awards, Booking Holdings demonstrates its leadership in innovation and its commitment to achieving its growth objectives. As of Q1 2024, Booking Holdings reported a revenue increase of 13% year-over-year, indicating the effectiveness of its growth strategies.

Booking Holdings' technological advancements are central to its growth strategy. These initiatives enhance user experience, streamline operations, and promote sustainability.

- AI-powered recommendation engines to personalize travel options.

- Automation of customer service and booking processes.

- Focus on sustainability through eco-friendly travel promotion.

- Strategic partnerships to leverage external innovation.

Booking Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Booking Holdings’s Growth Forecast?

The financial outlook for Booking Holdings is robust, reflecting its strong position in the online travel agency (OTA) market. The company's growth strategy focuses on sustained investment in technology, marketing, and strategic acquisitions. This approach supports long-term expansion and enhances shareholder value, positioning Booking Holdings for continued success in the global travel industry.

Booking Holdings has demonstrated consistent financial performance, with revenue targets and profit margins indicating a positive trajectory. The company's capital allocation strategy prioritizes investments that support long-term growth and enhance shareholder value. This includes strategic investments, share repurchases, and debt reduction, all contributing to a solid financial foundation.

In Q1 2024, Booking Holdings reported total revenues of $4.29 billion, marking a 17% increase year-over-year. This strong performance sets a positive tone for the rest of the year. The company anticipates continued growth, with expectations for gross travel bookings to increase by mid-single digits and revenue to grow by high-single digits to low-double digits in Q2 2024 compared to Q2 2023. These projections highlight the company's optimistic outlook and strategic initiatives.

For the full year 2024, analysts forecast Booking Holdings' revenue to reach approximately $23.15 billion. This represents a 10.68% increase from 2023, indicating strong growth. This forecast is supported by the company's strategic investments and market position.

Booking Holdings continues to invest in technology and marketing to drive growth. These investments are crucial for maintaining its competitive edge in the Marketing Strategy of Booking Holdings. The company's focus on innovation ensures it can adapt to changing market dynamics.

The company generates substantial free cash flow, which is used for strategic investments, share repurchases, and debt reduction. This financial discipline supports sustainable growth and enhances shareholder value. Booking Holdings' financial health is a key factor in its long-term success.

Booking Holdings is focused on expanding its presence in emerging markets and strengthening its position in existing markets. This expansion strategy is supported by strategic partnerships and targeted marketing efforts. The company's global reach is a significant advantage.

The company emphasizes operational efficiency to maintain profitability and competitiveness. This includes streamlining processes and leveraging technology to reduce costs. Operational efficiency is a key component of Booking Holdings' financial strategy.

Booking Holdings is committed to enhancing shareholder value through strategic investments, share repurchases, and debt reduction. This approach demonstrates the company's commitment to long-term financial health. The company's focus on shareholder value is a key part of its financial strategy.

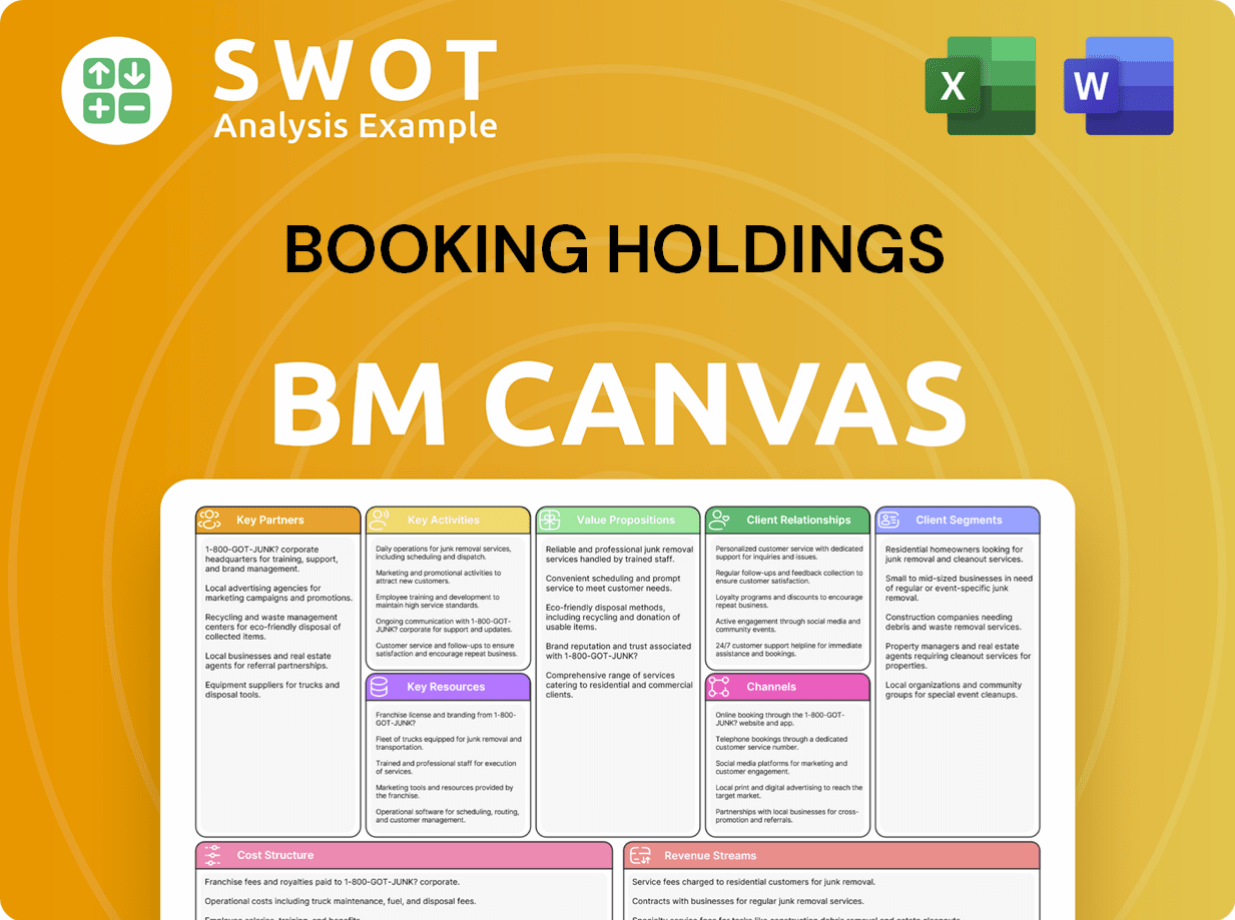

Booking Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Booking Holdings’s Growth?

The path forward for Booking Holdings, a major player in the Online Travel Agency (OTA) sector, is not without its challenges. The company faces a complex web of risks that could impact its ambitious growth plans. Understanding these potential obstacles is crucial for investors, analysts, and anyone interested in the future of the travel industry.

Competition, regulatory changes, and technological disruptions are among the key challenges. The company's ability to navigate these risks will significantly influence its long-term performance and market position. The travel industry is dynamic, so the company must remain agile and adaptable to maintain its leadership.

Booking Holdings's future is closely tied to its ability to manage these risks effectively. The following sections will delve into specific challenges and how the company is positioned to address them.

The Online Travel Agency (OTA) landscape is intensely competitive. Booking Holdings competes with established players such as Expedia Group and emerging startups. These competitors constantly innovate on pricing and features, which pressures Booking Holdings to maintain its competitive edge.

Regulatory changes present a consistent challenge. Data privacy, consumer protection, and antitrust regulations vary across jurisdictions. Evolving regulations, especially on short-term rentals, can directly affect the availability of accommodations on its platforms.

Although less direct than in other industries, supply chain disruptions can occur. Global travel disruptions, such as pandemics or geopolitical events, can severely impact booking volumes. These disruptions can lead to significant fluctuations in revenue and profitability.

Technological advancements pose an ongoing risk. While Booking Holdings invests heavily in innovation, new technologies or business models from competitors could erode its market position. The company must continually adapt to stay ahead of the curve.

Internal resource constraints, such as talent acquisition and retention in a competitive tech landscape, also present challenges. Attracting and retaining skilled employees is crucial for innovation and maintaining a competitive advantage. These constraints can affect the company's ability to execute its strategic initiatives effectively.

Emerging risks, such as increased scrutiny over dynamic pricing practices or the rise of super-apps in certain markets, could shape its future trajectory. The company must proactively address these emerging trends to maintain its market position and adapt to changing consumer behaviors.

The company's approach to mitigating these risks involves several key strategies. Booking Holdings focuses on diversifying its service offerings, implementing robust risk management frameworks, and proactively planning for various scenarios. The company's history demonstrates resilience, particularly its ability to adapt during the COVID-19 pandemic. For example, in 2020, the company's gross travel bookings decreased by approximately 63%, but it has since recovered. The company has shown resilience by adapting its strategies and focusing on domestic travel and flexible booking options. The company is also actively exploring emerging markets and customer acquisition strategies to ensure long-term growth.

Booking Holdings has a significant market share in the OTA sector. The company's revenue growth is closely tied to its ability to capture and retain customers. For 2024, analysts predict strong revenue growth, driven by increased travel demand and strategic initiatives. Understanding Booking Holdings' market share analysis is critical for assessing its competitive position and future prospects. The company's revenue growth is also influenced by its expansion strategies and technological advancements.

The COVID-19 pandemic significantly impacted the travel industry, including Booking Holdings. The company's ability to adapt to changing travel patterns and consumer behavior was crucial. Booking Holdings' strategic partnerships have also played a role in its recovery. The company is also focusing on sustainability initiatives to align with evolving consumer preferences. An example of this is the company's commitment to promoting sustainable tourism practices and reducing its carbon footprint.

Booking Holdings' financial performance is a key indicator of its success. The company's financial performance is closely watched by investors and analysts. Strategic partnerships can enhance its market position and drive growth. The company's business model and expansion strategies are also important factors. Further insights into the company's financial model can be found in the Revenue Streams & Business Model of Booking Holdings article.

Technological advancements are crucial for Booking Holdings' long-term success. The company invests heavily in technology to improve its platforms and services. Future investments will likely focus on enhancing customer experience and expanding its service offerings. The company's stock forecast and long-term growth potential depend on its ability to adapt to these technological shifts. The company's investments in technology are aimed at improving its competitive position and driving growth.

Booking Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Booking Holdings Company?

- What is Competitive Landscape of Booking Holdings Company?

- How Does Booking Holdings Company Work?

- What is Sales and Marketing Strategy of Booking Holdings Company?

- What is Brief History of Booking Holdings Company?

- Who Owns Booking Holdings Company?

- What is Customer Demographics and Target Market of Booking Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.