Booking Holdings Bundle

Who Really Owns Booking Holdings?

Unraveling the ownership structure of Booking Holdings is key to understanding its strategic moves and future potential. From its roots as Priceline.com to its current status as a global travel powerhouse, the company's evolution is a fascinating case study in corporate governance. Knowing the Booking Holdings SWOT Analysis is essential for any investor.

The identity of the Booking.com owner and the broader Booking Holdings ownership landscape is a crucial aspect for investors and analysts alike. Understanding the influence of major shareholders, the role of institutional investors, and the impact of the company's stock performance provides a comprehensive view of its trajectory. This analysis will explore the company's structure, including its subsidiaries list and key executives, offering insights into its financial performance and market capitalization.

Who Founded Booking Holdings?

The origins of Booking Holdings, formerly known as Priceline.com, can be traced back to 1996. It was founded by Jay S. Walker in Stamford, Connecticut, with the launch of Priceline.com. This marked the beginning of a travel service that would later revolutionize the industry.

Priceline.com quickly gained recognition for its innovative 'Name Your Own Price' bidding model, which allowed consumers to propose prices for travel services. This unique approach set the stage for its future success and growth. In 1999, the company went public through an initial public offering (IPO) on the NASDAQ National Market.

The IPO was a significant event, trading under the ticker symbol 'PCLN'. At the time of the IPO, Jay S. Walker held a substantial 35% stake in the company. This ownership propelled him to multi-billionaire status, highlighting the early success and potential of the company.

The IPO of Priceline.com broadened its ownership beyond the founding team, introducing the company to public investors. Early agreements like vesting schedules were standard for a company of this nature. The initial vision of the founding team was tied to the early distribution of control.

- The IPO allowed for a wider distribution of shares, attracting various institutional and individual investors.

- Early investors and venture capitalists likely played a role in the pre-IPO funding rounds, although specific details are not widely available.

- Vesting schedules and buy-sell clauses were crucial for managing founder interests.

- Walker's significant ownership reflected his leadership and the company's unique market position.

For further insights into the competitive environment, consider exploring the Competitors Landscape of Booking Holdings. The company's early structure and ownership played a crucial role in its ability to compete and grow in the travel industry.

Booking Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Booking Holdings’s Ownership Changed Over Time?

The journey of Booking Holdings, the Booking.com owner, as a publicly traded entity began on March 30, 1999, with its initial public offering (IPO). The company has since seen significant shifts in its ownership structure. As of June 30, 2024, the market value of common stock held by non-affiliates was approximately $133.1 billion, indicating the substantial scale of the company and its investor base.

The ownership structure of Booking Holdings is primarily dominated by institutional investors. This evolution reflects broader trends in the financial markets, where institutional investors play a crucial role in shaping corporate strategy and governance. The shift underscores the importance of understanding the influence of these major shareholders on the company's direction and decision-making processes.

| Ownership Category | December 2024 | May 2025 |

|---|---|---|

| Institutional Ownership | 92.08% | 91.65% |

| Insider Ownership | 0.16% | 0.16% |

| Mutual Funds | 109.09% | 109.12% |

As of March 2025, the major institutional shareholders of Booking Holdings included Vanguard Group Inc. holding 3.0 million shares valued at $14 billion, BlackRock, Inc. with 2.7 million shares valued at $12 billion, and State Street Corporation with 1.4 million shares valued at $6.5 billion. Other significant holders include JPMorgan Investment Management, Inc., Capital World Investors, T. Rowe Price Associates Inc./MD/, Geode Capital Management, LLC, and Dodge & Cox. These major shareholders have a significant impact on the company's strategic decisions.

The ownership of Booking Holdings is largely controlled by institutional investors, reflecting a trend in the market. The influence of these major shareholders is significant in shaping the company's strategy and governance.

- Institutional investors hold approximately 91.65% of the shares as of May 2025.

- Vanguard, BlackRock, and State Street are among the largest institutional shareholders.

- Insider holdings remain relatively small.

Booking Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Booking Holdings’s Board?

The current Board of Directors of Booking Holdings Inc. oversees the company's strategic direction and governance. Glenn D. Fogel is the Chief Executive Officer and a Director since January 2017. Robert J. Mylod Jr. serves as the Chairman of the Board. Other board members include Thomas Rothman, Charles Noski, Lynn Radakovich, Mirian Graddick-Weir, Nick Read, Vanessa Wittman, Sumit Singh, and Joseph Quinlan. These individuals represent a blend of major shareholders and independent directors. Understanding the Booking Holdings company profile is crucial for investors and stakeholders.

This board includes representatives from major institutional investors. The board also focuses on succession planning for senior executives. Furthermore, the company maintains a continuous refreshment process for the board to ensure a beneficial mix of directors. Knowing the Booking.com owner and the board's composition provides insights into the company's strategic decisions and operational oversight. For more information, check out the Target Market of Booking Holdings.

| Director | Title | Since |

|---|---|---|

| Glenn D. Fogel | CEO and Director | 2017 |

| Robert J. Mylod Jr. | Chairman of the Board | N/A |

| Thomas Rothman | Director | N/A |

Regarding voting, each stockholder gets one vote per share of common stock. The company's restated certificate of incorporation does not provide for cumulative voting. This means that the holders of a majority of the shares voted can elect all directors. There are no special voting rights or founder shares that would grant outsized control to specific entities beyond their proportional shareholding. Understanding Booking Holdings ownership structure is essential for assessing shareholder influence.

The Board of Directors includes the CEO, Chairman, and several other members. The voting structure is straightforward, with one vote per share. The board actively manages succession planning and refreshment.

- Glenn Fogel is the CEO and a Director.

- Robert J. Mylod Jr. is the Chairman.

- Each share gets one vote.

- No special voting rights exist.

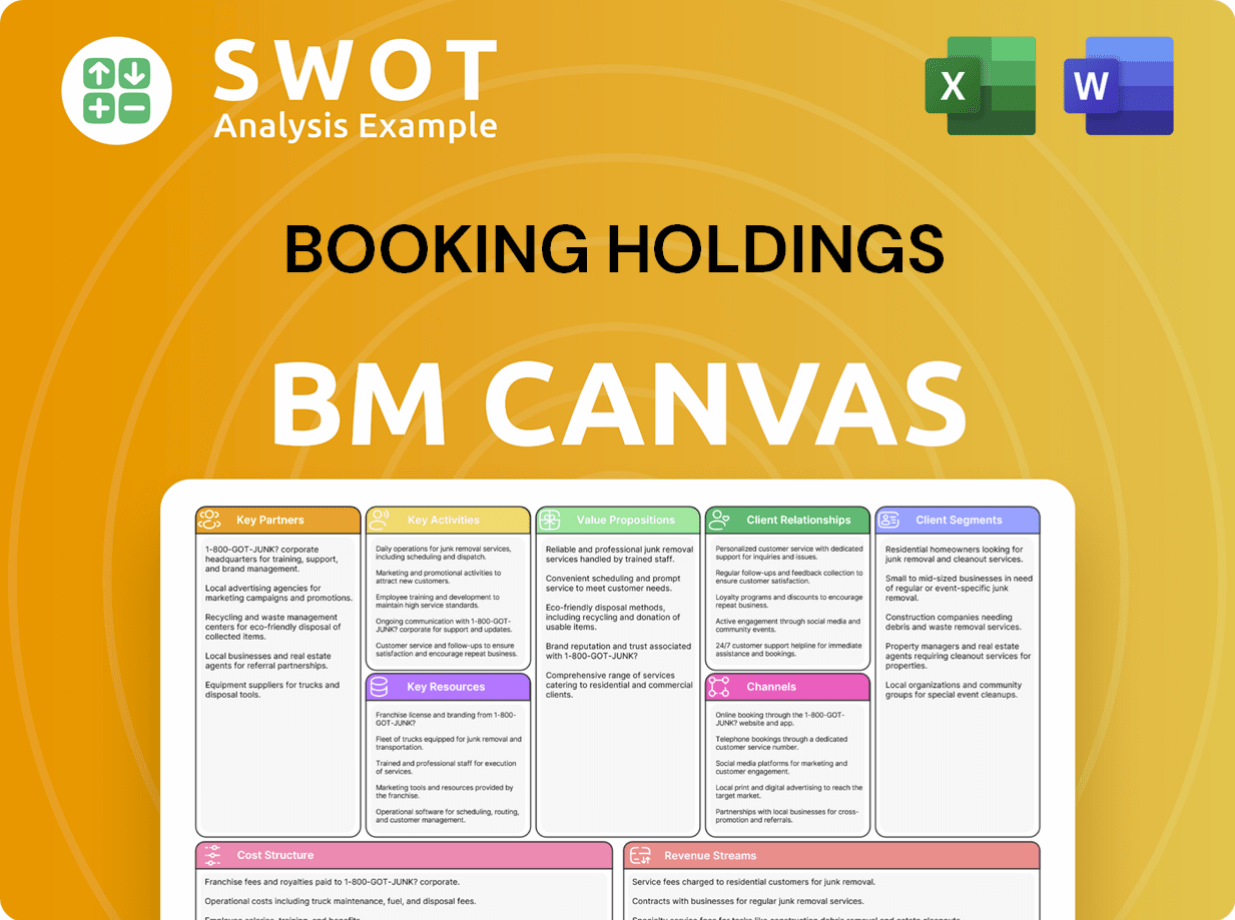

Booking Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Booking Holdings’s Ownership Landscape?

In recent years, Booking Holdings, the parent company of Booking.com, has consistently prioritized shareholder value through significant share buyback programs. The company's commitment to returning capital to shareholders is evident in its substantial repurchase activities. In early 2025, a new $20 billion stock buyback program was authorized, supplementing the remaining $7.7 billion from a $24 billion program authorized in Q1 2023. As of March 31, 2025, Booking Holdings completed a $1.8 billion stock buyback, with a considerable $25.9 billion still authorized for future repurchases.

The annual share buybacks for 2024 reached $6.509 billion, reflecting the company's ongoing strategy to reduce the number of outstanding shares. This strategy aims to increase earnings per share, benefiting the remaining shareholders. The focus on share repurchases underscores the company's confidence in its financial health and its commitment to enhancing shareholder returns. These buybacks demonstrate the company's proactive approach to managing its capital structure and creating value for investors.

| Metric | Details | Date |

|---|---|---|

| Institutional Ownership | Approximately 91.65% | May 2025 |

| Authorized Stock Buyback (New) | $20 billion | Early 2025 |

| Stock Buyback Completed | $1.8 billion | Q1 2025 |

| Remaining Authorized for Repurchases | $25.9 billion | March 31, 2025 |

| 2024 Annual Share Buybacks | $6.509 billion | 2024 |

Institutional investors continue to hold a dominant position in Booking Holdings ownership. As of May 2025, institutional investors held approximately 91.65% of the company's stock. While some institutional investors have adjusted their holdings, the overall trend indicates strong confidence in the company. JPMorgan Chase & Co. increased its stake in Q1 2025, while Capital World Investors reduced its position. The CEO, Glenn Fogel, has been in his role since January 2017, and the company has formal executive succession planning in place.

Institutional investors hold a significant portion of Booking Holdings stock, around 91.65% as of May 2025. This high level of institutional ownership indicates strong confidence in the company's long-term prospects and financial stability.

Booking Holdings has a history of share buybacks. The company has a new $20 billion stock buyback program authorized in early 2025. The company repurchased $1.8 billion in Q1 2025.

Glenn Fogel has served as CEO since January 2017, indicating strong leadership continuity. The company also has formal executive succession planning in place to ensure stability and strategic direction.

While institutional ownership is dominant, there are shifts among institutional investors. Some, like JPMorgan Chase & Co., have increased their positions, while others, like Capital World Investors, have decreased theirs.

Booking Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Booking Holdings Company?

- What is Competitive Landscape of Booking Holdings Company?

- What is Growth Strategy and Future Prospects of Booking Holdings Company?

- How Does Booking Holdings Company Work?

- What is Sales and Marketing Strategy of Booking Holdings Company?

- What is Brief History of Booking Holdings Company?

- What is Customer Demographics and Target Market of Booking Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.