Discover Financial Services Bundle

How did Discover Financial Services reshape the financial landscape?

Journey back to 1986 and uncover the Discover Financial Services SWOT Analysis, a pivotal moment that revolutionized the credit card industry with the introduction of the Discover Card. This bold move, offering cash rewards, challenged industry norms and set the stage for a company that would become a major player in U.S. financial services. Explore the early years of Discover credit card and its impact on the credit card industry.

From its Discover Card origin story to its current status as a digital banking and payments powerhouse, Discover Financial Services' evolution is a compelling narrative. This brief history of Discover Financial Services company will detail key milestones, strategic decisions, and the challenges overcome, providing a comprehensive understanding of Discover Company's enduring presence. Learn about Discover Financial and its impact on the financial world.

What is the Discover Financial Services Founding Story?

The story of Discover Financial Services begins in 1986. That year, Sears, Roebuck and Co. launched what would become a major player in the credit card industry, aiming to challenge established brands like Visa and Mastercard. The creation of the Discover Card marked a significant moment in financial history, introducing innovative features to the market.

The initial concept was to offer consumers a compelling value proposition, setting the stage for future developments. This innovative approach would soon reshape the credit card landscape. The company's early strategy focused on direct banking and payment services, with the Discover Card as its flagship product.

The Owners & Shareholders of Discover Financial Services have played a crucial role in shaping the company's trajectory. The Discover Card's launch was a direct response to the existing market dynamics. It was a strategic move by Sears to enter the financial services sector.

Discover Financial Services was founded in 1986 by Sears, Roebuck and Co.

- The Discover Card was launched with a cash rewards program, a pioneering concept.

- The card distinguished itself with no annual fee, attracting consumers.

- Initially, the card's acceptance was limited, primarily at Sears stores.

- Sears' backing provided substantial resources and a broad customer base.

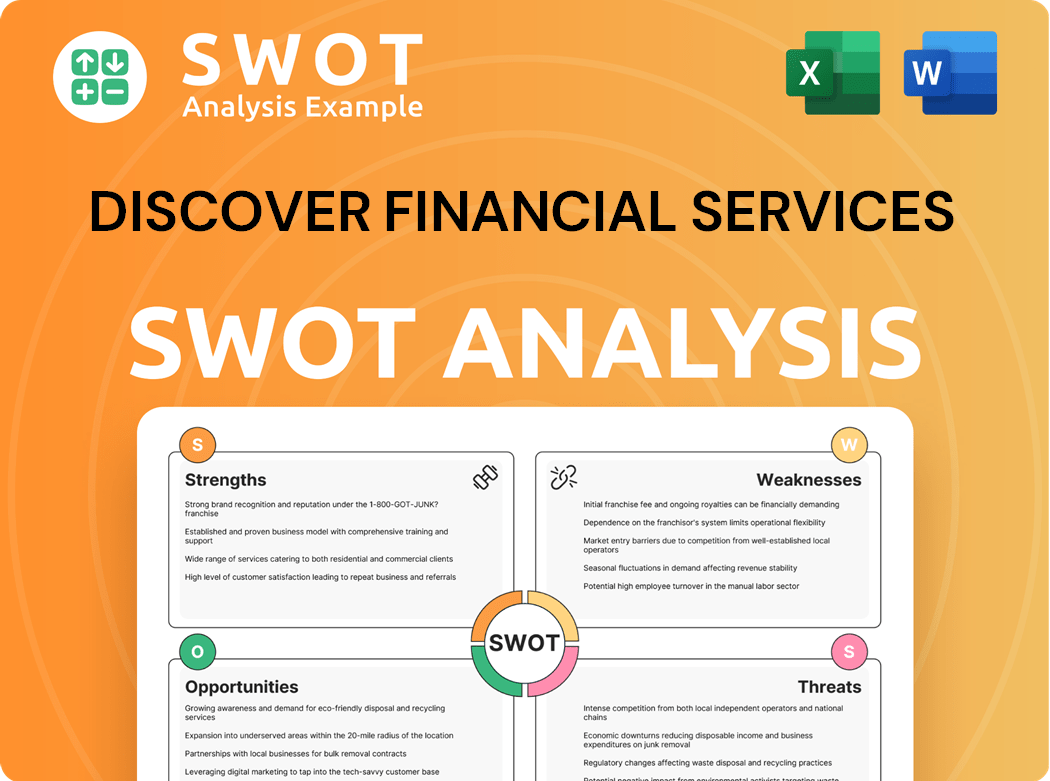

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Discover Financial Services?

The early growth of Discover Financial Services, or the brief history of Discover Financial Services company, centered on expanding the Discover Card's acceptance beyond Sears retail locations. This involved significant efforts to bring in new merchants and build the Discover Network. The company's early success was largely driven by its unique cash rewards program, which resonated with consumers and helped it stand out in a competitive market.

The company gradually expanded its product offerings beyond the Discover Card, its primary offering. A key strategic shift occurred in 1993 when Discover was spun off from Sears and became part of Dean Witter, which later merged with Morgan Stanley in 1997. This integration provided Discover with increased capital and broader market access, supporting its growth and the evolution of the Discover Credit Card.

Further expansion came with the acquisition of the PULSE debit network in 2005 and Diners Club International in 2008, which significantly broadened its payment network capabilities and global reach. These acquisitions were pivotal, transforming Discover from primarily a card issuer into a comprehensive payments services company operating a global network. Learn more about the Marketing Strategy of Discover Financial Services.

In 2007, Discover Financial Services became an independent, publicly traded company, marking a major transition in its corporate structure and allowing it to pursue its own strategic initiatives more autonomously. This period also saw the expansion into other lending products beyond credit cards, such as personal loans and student loans, further diversifying its revenue streams.

By the end of 2024, Discover's total loans reached $121.1 billion, with credit card loans at $102.8 billion, demonstrating sustained growth in its core lending segments. This financial performance reflects the company's successful expansion and diversification efforts over the years, solidifying its position in the financial services industry. Discover Financial Services' evolution continues to be marked by strategic acquisitions and product innovations.

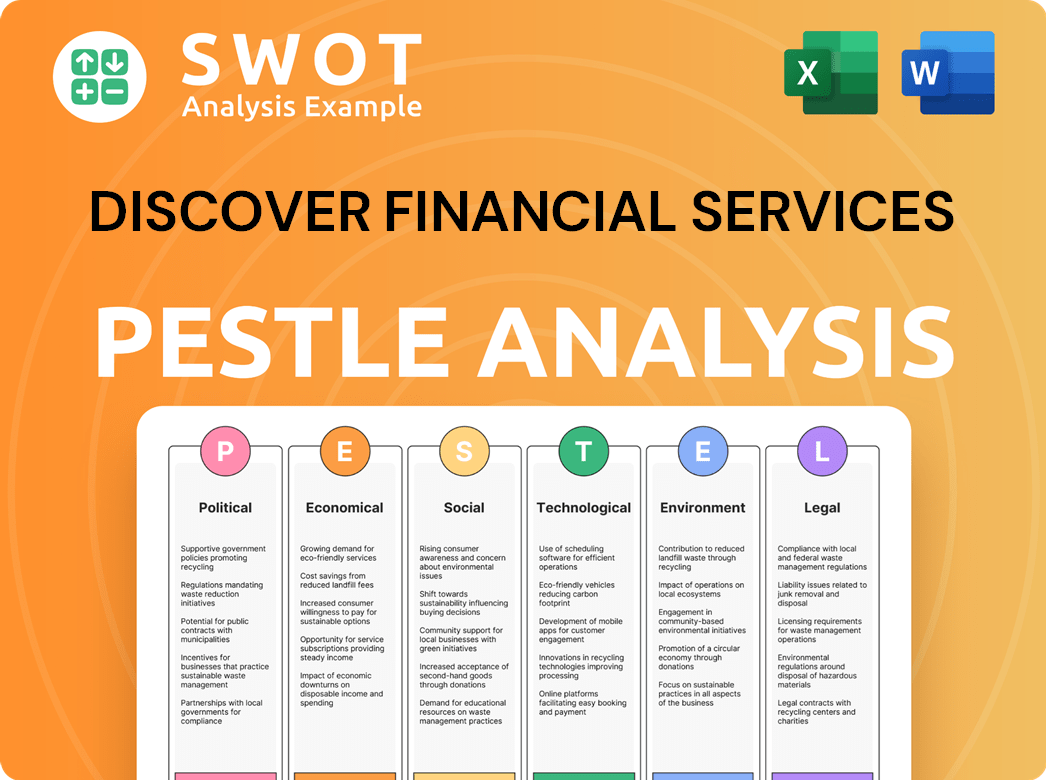

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Discover Financial Services history?

The history of Discover Financial Services is marked by significant milestones that have shaped its trajectory in the financial services sector. From its inception, the company has navigated market dynamics and competitive landscapes while introducing innovations that have influenced the credit card industry. Understanding the Competitors Landscape of Discover Financial Services provides context for its strategic moves and achievements.

| Year | Milestone |

|---|---|

| 1985 | The Discover Card was launched by Sears, Roebuck and Co., marking the company's entry into the credit card market. |

| 1986 | Discover Card introduced the cash rewards program, a pioneering feature in the credit card industry. |

| 2005 | Acquisition of PULSE, expanding Discover's payment network. |

| 2007 | Discover Financial Services became an independent, publicly traded company. |

| 2008 | Acquisition of Diners Club International, transforming Discover into a global payments player. |

| 2024 | Sale of its private student loan portfolio, streamlining its business model. |

Discover Financial Services has been at the forefront of innovation, particularly in the credit card sector. The introduction of the cash rewards program in 1986 set a new standard, influencing how credit card companies attract and retain customers.

Discover Card pioneered the cash rewards program in 1986, which became a standard feature in the credit card industry. This innovation provided cardholders with incentives for their spending, influencing consumer behavior and loyalty.

The acquisitions of PULSE and Diners Club International significantly expanded Discover's payment network. These strategic moves enabled Discover to broaden its acceptance and reach, transforming it into a global payments player.

Discover was an early adopter of online banking, providing customers with convenient access to their accounts. This focus on digital services improved customer experience and operational efficiency.

Discover has integrated mobile payment options, allowing customers to make payments using their smartphones. This innovation aligns with the growing trend of mobile commerce and enhances the user experience.

Discover has implemented advanced fraud protection measures to safeguard customer accounts. These measures include real-time monitoring, transaction alerts, and zero-liability policies, enhancing customer trust and security.

Discover has focused on providing excellent customer service, including 24/7 support and personalized assistance. This customer-centric approach has helped build brand loyalty and differentiate Discover in the competitive market.

Discover Financial Services has faced challenges, including market downturns and internal issues. In 2024, the company's total operating expenses increased, partly due to compliance investments and employee retention efforts.

The financial services sector is inherently subject to market fluctuations and economic downturns. These external factors can impact Discover's profitability and overall performance.

Discover operates in a highly competitive market, facing rivals like Visa, Mastercard, and other financial institutions. This competition necessitates constant innovation and strategic adaptation to maintain market share.

Discover has addressed internal challenges, such as card misclassification matters, which led to increased operating expenses. Addressing these issues requires significant investments in compliance and risk management.

Changes in financial regulations can create compliance challenges and increase operating costs. Discover must continually adapt to evolving regulatory landscapes to maintain compliance and avoid penalties.

Economic downturns can lead to increased credit losses and decreased consumer spending. Discover must manage its credit risk and adjust its strategies to navigate challenging economic conditions.

Discover has undertaken strategic shifts, such as selling its private student loan portfolio, to streamline its business model. These decisions require careful execution to ensure a smooth transition and positive financial outcomes.

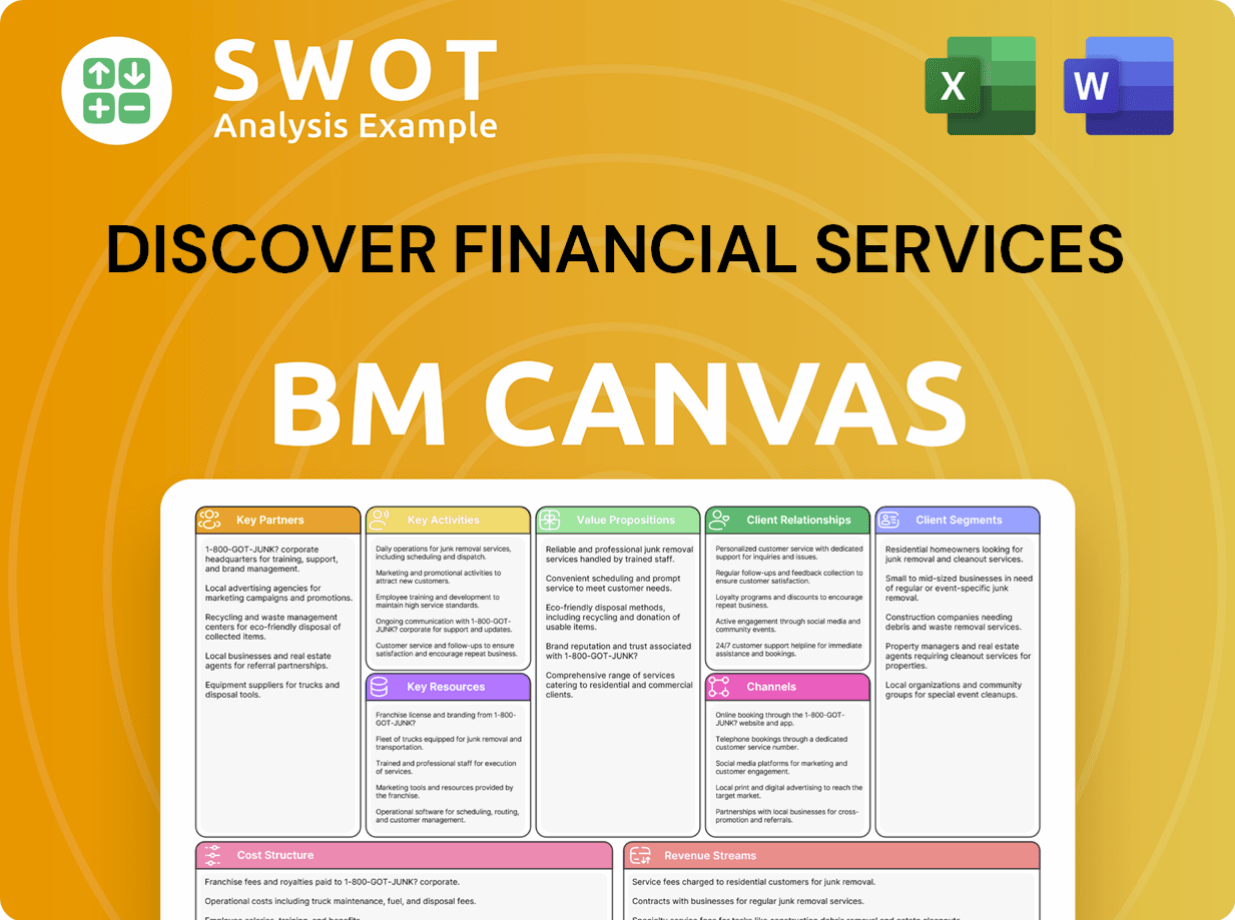

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Discover Financial Services?

The Growth Strategy of Discover Financial Services has evolved significantly since its inception. The company's journey, from its launch as the Discover Card by Sears in 1986 to its current standing, showcases a series of strategic moves and financial milestones. Discover Financial Services, with its rich history, has adapted to market changes and expanded its services, making its mark in the financial sector.

| Year | Key Event |

|---|---|

| 1986 | Launch of the Discover Card by Sears, introducing cash rewards to the market. |

| 1993 | Discover was spun off from Sears and became part of Dean Witter. |

| 1997 | Dean Witter, including Discover, merged with Morgan Stanley. |

| 2005 | Acquisition of the PULSE debit network, expanding payment capabilities. |

| 2007 | Discover Financial Services became an independent, publicly traded company. |

| 2008 | Acquisition of Diners Club International, enhancing global reach. |

| 2024 (Q2) | Reported net income of $1.5 billion and total loans of $127.6 billion, up 8% year-over-year. |

| 2024 (Q3) | Reported net income of $965 million, up 41% year-over-year; completed the first of four student loan sale closings. |

| 2024 (Q4) | Reported net income of $1.3 billion and full-year net income of $4.5 billion. Total loans ended the quarter at $121.1 billion. |

| 2025 (Q1) | Reported net income of $1.1 billion, up 30% from Q1 2024, with diluted EPS of $4.25. |

The pending merger with Capital One, announced in early 2025, is a pivotal event for Discover. This merger is expected to create a vertically integrated payments platform. Analysts predict that this strategic move will boost competition and innovation in the payments network.

For fiscal year 2025, analysts estimate an EPS of $13.98, with expectations of growth to $15.91 for fiscal year 2026. Q1 2025 showed a strong net interest margin of 12.18%. Credit quality metrics have improved, with decreases in delinquency rates and net charge-offs as of April 2025.

Discover's future success hinges on the successful integration with Capital One. It's crucial to capitalize on the synergies created by the merger. The company's ability to adapt and innovate within the competitive financial landscape will be key.

The merger is expected to transform Discover's business model and market position. The company continues its evolution from its founding vision of consumer-centric financial services. Discover's journey reflects a commitment to growth and adaptation in the financial industry.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.