Discover Financial Services Bundle

How Will the Capital One Merger Reshape Discover Financial Services' Competitive Landscape?

Discover Financial Services, a pioneer in the digital banking and payment services sector since 1986, is on the cusp of a major transformation. Initially known for its innovative approach to the Discover Financial Services SWOT Analysis, the company has consistently evolved, expanding beyond credit cards to offer a comprehensive suite of financial products. This evolution has positioned Discover as a key player in the Financial Services Industry, but what does the future hold?

The pending merger with Capital One, a monumental $35.3 billion deal, marks a pivotal moment for Discover. This acquisition will undoubtedly redefine the Competitive Landscape, influencing the company's Market Analysis and its standing among Credit Card Companies. Understanding Discover Financial Services' market share analysis and its competitive advantages is now more crucial than ever, as the merged entity prepares to navigate the evolving financial sector and compete with its rivals.

Where Does Discover Financial Services’ Stand in the Current Market?

Discover Financial Services, a key player in the U.S. financial services industry, primarily focuses on credit card operations and its payment network. In 2024, the company reported a total revenue net of interest expense of $17.91 billion, marking a significant increase from the previous year. This growth reflects its strong market position and strategic initiatives within the competitive landscape.

The company's value proposition centers on providing credit card services, personal loans, and deposit accounts. Discover directly issues its cards, setting it apart from major competitors that rely on networks. This approach allows for direct customer relationships and control over the customer experience. Discover's focus on digital banking further enhances its competitive edge, catering to the evolving preferences of consumers.

In the credit card market, Discover is the fourth-largest payment network in the United States by overall purchase volume. In 2024, American consumers charged $212 billion to their Discover cards. Discover credit cards accounted for 1% of global purchase volume and 2% of all credit cards in circulation worldwide as of 2023, with 71.5 million Discover credit cards in circulation. Discover's financial performance is a critical aspect of its competitive standing, with a return on equity (ROE) of 28.20% as of April 2025, indicating strong efficiency in generating profits from shareholders' equity.

Discover holds a significant position in the credit card market, ranking fourth in the U.S. by purchase volume. In 2024, consumers charged $212 billion on their cards. This highlights Discover Card's substantial presence and usage among consumers.

The company's financial health is robust, with a net income of $4.54 billion in 2024. The first quarter of 2025 saw a net income of $1.1 billion. These figures demonstrate Discover's ability to generate substantial profits, reflecting its operational efficiency and market position.

Discover is strategically focused on digital banking and its payment network. This focus allows the company to capitalize on the shift towards digital solutions. The company has demonstrated a strategic shift, such as exiting student lending in 2024, which benefited its net interest margin.

Discover offers a diverse range of financial products, including personal loans and deposit accounts. The company's core offerings include credit cards, personal loans, and deposit accounts. This diversification helps to cater to a broad customer base.

Discover's competitive advantages include its direct card issuance model and a focus on digital banking. These strategies set it apart from competitors and enhance customer engagement. However, the company faces challenges in a highly competitive market, requiring continuous innovation and customer-centric strategies. For more details on the company's growth strategy, check out the Growth Strategy of Discover Financial Services.

- Direct Card Issuance: Allows for direct customer relationships and control.

- Digital Banking Focus: Positions Discover to capitalize on the digital shift.

- Market Competition: Operates in a competitive market, requiring innovation.

- Product Diversification: Offers a range of financial products to cater to a broad customer base.

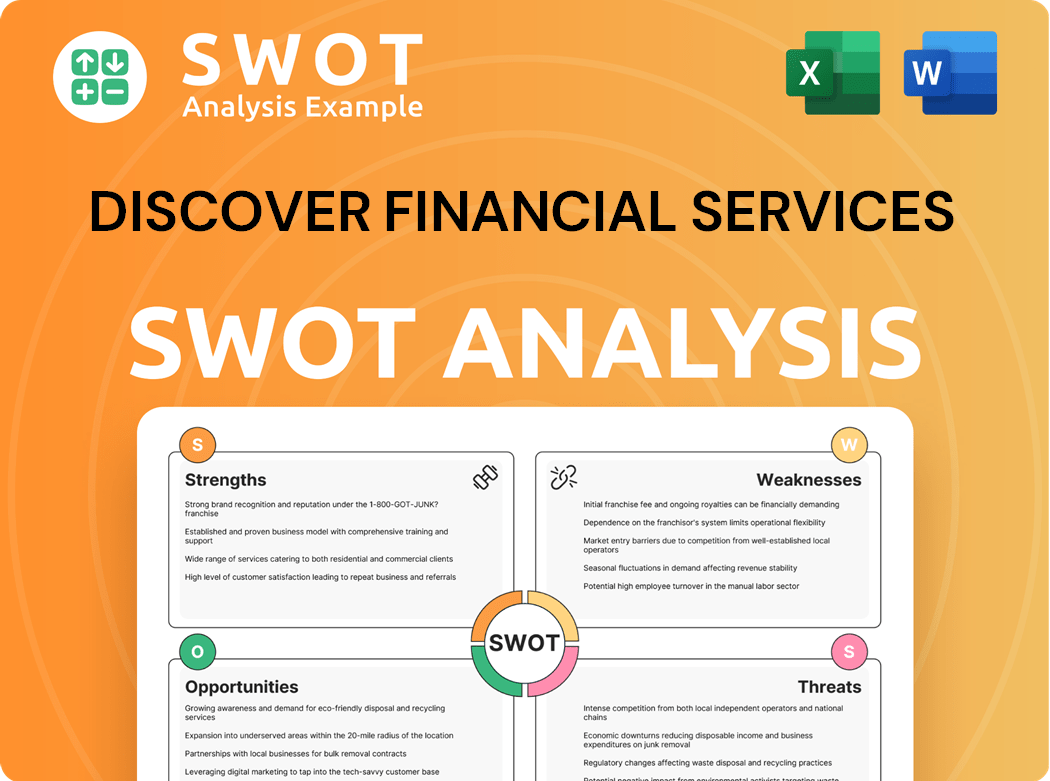

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Discover Financial Services?

The Discover Financial Services operates in a highly competitive financial services industry. It faces both direct and indirect competition across its various product lines, including its payment network and credit card offerings. Understanding the competitive landscape is crucial for assessing its market position and strategic challenges.

As a credit card network and issuer, Discover Financial Services competes with established players and emerging fintech companies. The company's performance is directly influenced by its ability to attract and retain customers, manage risk, and innovate in a rapidly evolving market. Market analysis of the competitive environment provides insights into the strategies and challenges faced by Discover Card.

Discover Financial Services must navigate the complex dynamics of the financial services sector, including regulatory changes, technological advancements, and shifting consumer preferences. Evaluating its competitive advantages and disadvantages is essential for making informed investment decisions and developing effective business strategies.

Discover Card faces direct competition from major credit card networks and issuers. These include Visa, Mastercard, and American Express, as well as large banks that issue credit cards.

Visa, Mastercard, and American Express are the primary competitors in the payment network space. These companies facilitate a vast volume of transactions globally.

Major banks such as JPMorgan Chase, Citigroup, Bank of America, and Capital One are significant competitors in the credit card issuing market. These institutions have substantial credit card portfolios.

In the personal loan segment, Discover Financial Services competes with JPMorgan Chase, Capital One, Wells Fargo, and Citi. These companies offer similar financial products to consumers.

Traditional branch lending institutions like Wells Fargo, JP Morgan Chase, US Bank, and PNC are key competitors in the home equity product market. These banks have established lending operations.

Historically, Discover Financial Services competed with entities like Sallie Mae in the student loan market. However, the student loan portfolio was sold in 2024.

The Discover Financial Services faces a dynamic competitive landscape. The pending merger with Capital One will reshape the competitive environment. The merger is expected to create the largest credit card issuer by loan volume in the United States, posing a significant challenge to Visa and Mastercard's dominance. Analyzing the Discover Financial Services market share analysis and understanding its competitive strategy are essential for assessing its future prospects. For more detailed insights, consider reading an article about Discover Financial Services and its rivals.

Several factors influence the competitive dynamics within the financial services industry. These include market share, customer acquisition strategies, and financial performance.

- Market Share: In 2023, Visa credit held a 32% market share, Mastercard 21%, American Express 9%, and Discover Card 1% of global purchase volume.

- Credit Card Issuing: JPMorgan Chase facilitated $1.344 trillion in payments in 2024, highlighting the scale of competition in this area.

- Financial Performance: Discover Card's credit card net charge-off rate was 5.03% in Q4 2024, up 35 basis points from the prior year, indicating the importance of risk management.

- Mergers and Acquisitions: The Capital One merger will significantly impact the competitive landscape, potentially altering Discover Card's market position.

- Emerging Fintech: New technologies and fintech companies are creating payment solutions and challenging traditional financial institutions.

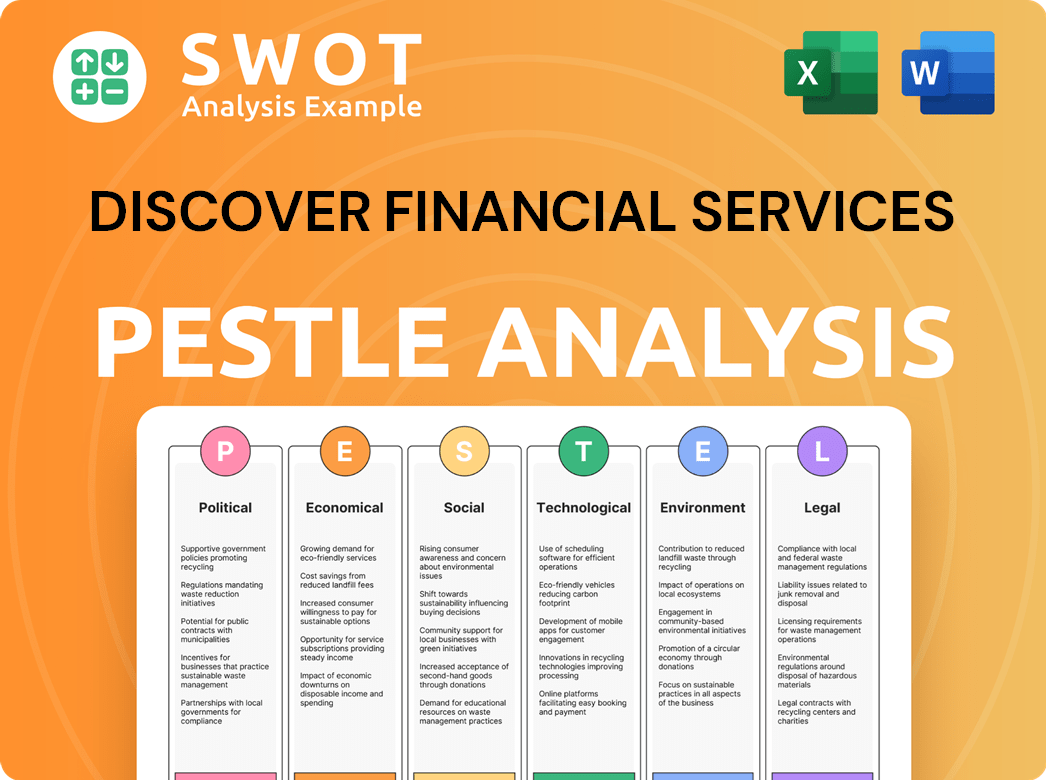

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Discover Financial Services a Competitive Edge Over Its Rivals?

The competitive landscape for Discover Financial Services, a key player in the Financial Services Industry, is shaped by its unique strengths and strategic initiatives. Understanding its competitive advantages is crucial for a thorough market analysis. The company's approach to customer engagement and technological advancements further defines its position among credit card companies.

Discover Financial Services has consistently demonstrated its ability to adapt and innovate within the credit card market. The company's strategic moves and financial performance are closely watched by investors and competitors. The company's commitment to customer service and rewards programs has helped it maintain a strong market position. For a deeper dive into its customer base, consider reading about the Target Market of Discover Financial Services.

The forthcoming merger with Capital One is expected to reshape the competitive dynamics, creating a more formidable entity in the payments and banking sector. This strategic move is expected to generate substantial synergies and enhance its competitive position. The company's focus on digital banking and continuous investment in technology provide a competitive edge.

Discover operates as both a card issuer and a payment network, allowing it to control the entire customer experience. This vertical integration enables personalized services and direct customer engagement. This model is different from competitors and allows the company to have more control over its processes.

Discover has built a reputation for strong customer service and competitive rewards programs. In 2024, the company distributed over $500 million in cashback rewards to its cardholders. Customer satisfaction rates reached approximately 85% among cardholders, reflecting its focus on customer relationships.

Discover strategically invests in technology to enhance its financial products and customer experience. In 2024, the company allocated $300 million to technology investments, focusing on mobile payments, data analytics, and cybersecurity. This commitment supports its direct-to-consumer business model.

Discover's conservative portfolio management contributes to its resilience in the competitive landscape. Recent improvements in credit quality metrics, including year-over-year decreases in delinquency rates and net charge-offs as of April 2025, highlight effective risk management. This approach helps maintain financial stability.

Discover Financial Services' competitive advantages are multifaceted, spanning its integrated business model, brand reputation, and technological investments. These advantages are critical for its success in the financial services industry. The company's strategic focus on innovation and customer satisfaction supports its market position.

- Integrated Business Model: Issuing cards and operating its own network.

- Customer-Centric Approach: Strong customer service and rewards.

- Technological Innovation: Investments in digital banking and mobile payments.

- Risk Management: Conservative portfolio management and improved credit quality.

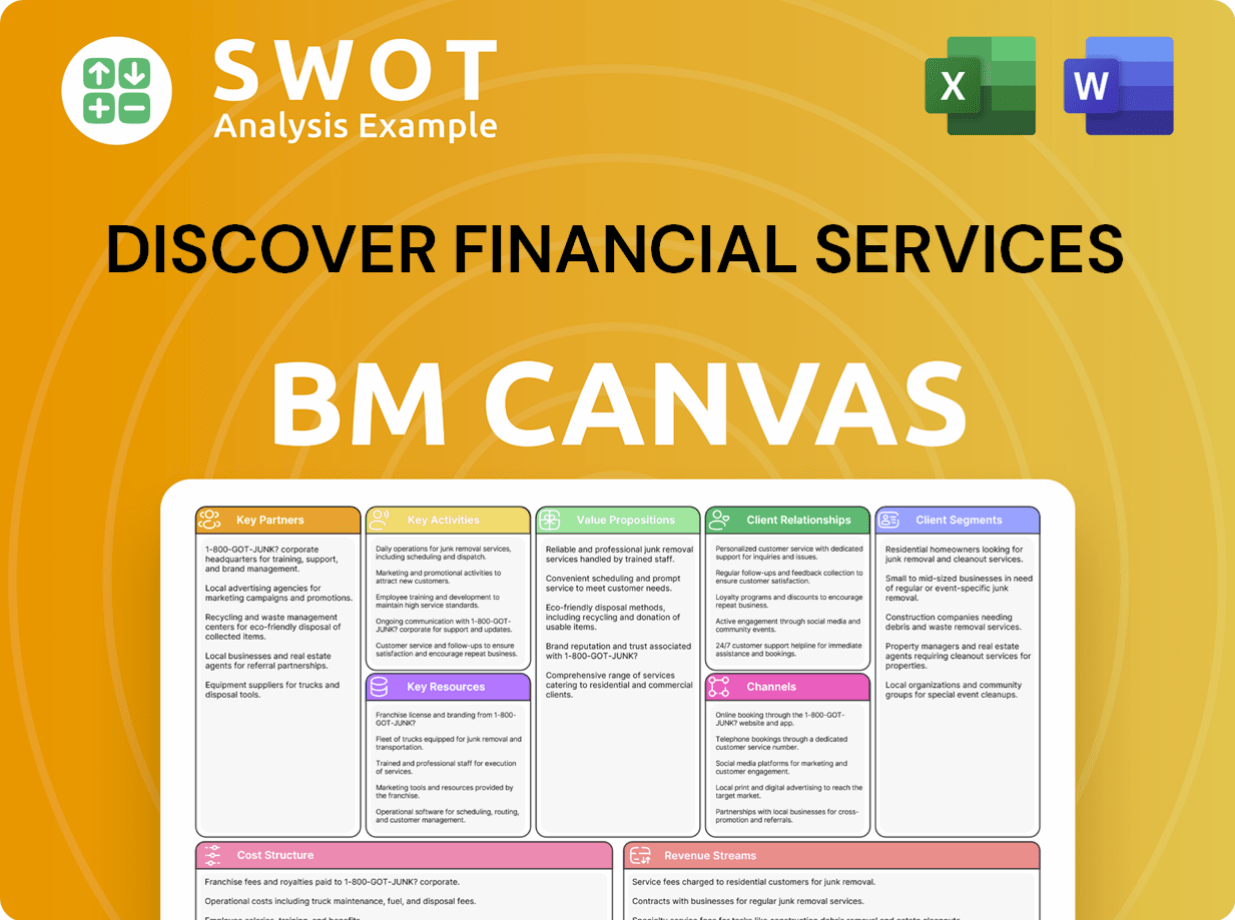

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Discover Financial Services’s Competitive Landscape?

The financial services industry is undergoing significant transformation in 2025, driven by digital innovation and evolving consumer behaviors. This creates both challenges and opportunities for companies like Discover Financial Services. Key trends include the increasing adoption of AI and the need for robust cybersecurity, while the competitive landscape is being reshaped by mergers and acquisitions.

Discover Financial Services faces risks related to market volatility, high interest rates, and the potential for increased fraud. However, the company is also positioned to capitalize on opportunities through strategic initiatives and market trends. Understanding the competitive landscape and adapting to changing market dynamics will be crucial for sustained success.

The financial services industry is seeing rapid digital transformation, with digital ad spending projected to reach nearly $37 billion in 2025. AI is being used to enhance customer service and improve operational efficiency. Open banking and personalized experiences are becoming increasingly important, and the industry is experiencing a shift towards modular control frameworks to manage regulatory complexity.

High interest rates continue to impact demand, and market volatility remains a concern. Geopolitical tensions could restrict trade and investment, affecting financial operations. Customer retention is a critical issue, with a significant percentage of consumers considering switching their primary banking relationships. The rise of deepfakes and fraud requires stronger cybersecurity measures.

The merger with Capital One, completed on May 18, 2025, creates the largest credit card issuer by loan volume in the U.S. This positions the combined entity to compete directly with Visa and Mastercard. The merger is expected to generate $2.7 billion in annual synergies by 2027. There are opportunities in open banking and personalized services to deepen customer engagement.

Discover's strategic focus will likely be on integrating with Capital One and optimizing digital offerings. Continuing to provide value-driven products and investing in 'compliance agility' will be crucial. This will help them remain resilient and capitalize on emerging market opportunities, solidifying their market position. For more insights, read about Owners & Shareholders of Discover Financial Services.

Discover Financial Services must navigate a dynamic landscape shaped by technological advancements and shifting consumer preferences. The company's competitive strategy will need to address both immediate challenges and long-term opportunities to maintain and grow market share.

- Capitalize on the merger with Capital One to enhance product offerings and expand market reach.

- Invest in AI and digital technologies to improve customer service and operational efficiency.

- Strengthen cybersecurity measures to mitigate the increasing risk of fraud.

- Adapt to evolving regulatory landscapes and focus on compliance agility.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.