Discover Financial Services Bundle

How Does Discover Financial Services Dominate the Financial Landscape?

Discover Financial Services revolutionized the credit card industry with its direct banking model and cash rewards, earning its place as a pioneer. From its inception in 1986 as part of Sears to its current status as a diversified financial powerhouse, Discover has consistently challenged traditional banking norms. This article unveils the secrets behind Discover's remarkable journey, exploring its innovative sales and marketing strategies.

This deep dive into Discover Financial Services SWOT Analysis will dissect the company's sales and marketing strategies, revealing how Discover card marketing has fueled its growth. We'll examine Discover's customer acquisition strategies, competitive analysis, and brand positioning to understand its success in the financial services marketing arena. Furthermore, we'll explore the Discover card marketing campaign examples and digital marketing plan that have solidified its market share and customer retention.

How Does Discover Financial Services Reach Its Customers?

The sales strategy of Discover Financial Services centers on a digital-first approach, leveraging its website and mobile platforms as primary sales channels. This strategy is crucial in today's financial services landscape, where consumers increasingly expect online convenience. This digital focus is essential for acquiring customers for various financial products, including credit cards and personal loans.

Discover's sales strategy also extends beyond direct channels through its payment networks: Discover Network, PULSE, and Diners Club International, collectively known as the Discover Global Network. This network significantly broadens the reach of Discover's products by enabling millions of merchants and cash access locations to accept Discover cards. In 2024, the Discover Global Network processed a total network volume of $622 billion, highlighting the scale of its indirect sales channels.

The company continuously invests in digital payment technologies, mobile apps, and online platforms to improve customer experience and management. Recent partnerships, such as the collaborations with fintech companies like Airwallex and Skipify in March 2025, are expanding payment acceptance options for merchants. These strategic moves contribute to growth by enhancing the utility and acceptance of Discover products, making them more attractive to potential customers. For more information on the company, you can check out Owners & Shareholders of Discover Financial Services.

Discover Financial Services utilizes its website and mobile platforms as primary e-commerce channels. These platforms are essential for acquiring customers for credit cards, personal loans, and deposit accounts. This digital-first strategy is critical in the evolving financial services sector, where consumers seek seamless online experiences.

The Discover Global Network, including Discover Network, PULSE, and Diners Club International, acts as an indirect sales channel. This network has approximately 70 million global acceptance points. In 2024, the network processed $622 billion in total network volume, expanding product accessibility worldwide.

Discover partners with fintech companies to expand payment acceptance. Collaborations with entities like Airwallex and Skipify in March 2025 have broadened payment options for merchants. These partnerships increase the utility and acceptance of Discover products.

Discover is evolving towards digital adoption and omnichannel integration. The company invests in digital payment technologies and mobile apps to enhance customer experience. This approach aims to provide a seamless experience across all touchpoints.

Discover Financial Services employs a multifaceted approach to reach its customer base, focusing on digital platforms and strategic partnerships to drive sales and enhance customer experience.

- Digital Platforms: Company website and mobile apps serve as primary e-commerce channels.

- Payment Networks: Discover Global Network, including Discover Network, PULSE, and Diners Club International.

- Strategic Partnerships: Collaborations with fintech companies to expand payment acceptance.

- Omnichannel Integration: Investments in digital payment technologies and mobile apps.

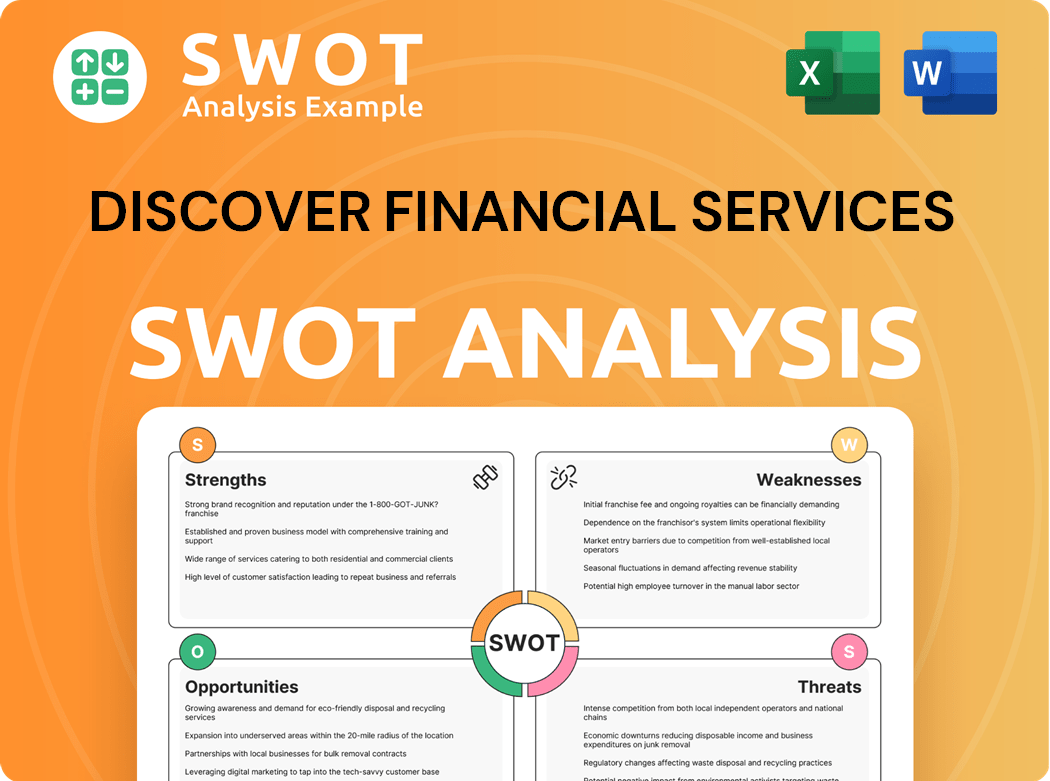

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Discover Financial Services Use?

The marketing tactics employed by Discover Financial Services are multifaceted, with a strong emphasis on digital strategies. These strategies aim to build brand awareness, generate leads, and ultimately drive sales. The company strategically uses a variety of digital channels and traditional methods to reach its target audience.

Discover's approach is heavily data-driven, using customer insights to personalize marketing efforts. This includes targeted recommendations and offers, which are crucial for customer engagement and retention. The company's investments in technology and data analytics further support these marketing initiatives.

In 2023, Discover's marketing and business development expenses were approximately $1.164 billion, reflecting a commitment to these areas. This investment supports a range of tactics designed to reach potential customers and enhance the overall customer experience. For example, Discover uses targeted social media campaigns on platforms like Facebook and Instagram to highlight card benefits and promotional offers.

Discover Financial Services leverages a comprehensive digital marketing strategy. This includes content marketing, search engine optimization (SEO), and paid advertising to reach and engage its target audience.

Social media platforms, such as Facebook and Instagram, are used to showcase card benefits and promotional offers. This helps in creating brand awareness and engaging with potential customers. Discover card marketing campaigns are a key component of this strategy.

Email marketing is a vital tool for delivering valuable content to segmented audiences. The financial services industry sees an average open rate of 26.48% and click rates of 2.70%, making it a high-performing channel.

SEO plays a critical role in driving organic traffic to the website. Discover optimizes content around relevant financial product keywords. Content marketing helps in attracting and retaining a clearly defined audience.

Data analytics are used to improve customer experience and prevent fraud. Insights are used to deliver targeted recommendations, offers, and content. This approach is crucial for effective customer acquisition.

Discover invested $300 million in technology in 2024, focusing on mobile payments, data analytics, and cybersecurity. These investments indirectly bolster marketing capabilities and support digital transformation.

Discover Financial Services employs a variety of marketing strategies to reach its target market. These initiatives are designed to increase brand awareness and drive sales. For more insights into the specific customer segments, refer to the Target Market of Discover Financial Services.

- Digital Transformation: A strong focus on digital channels, including SEO, social media, and email marketing.

- Data Analytics: Utilizing data to personalize customer experiences and prevent fraud.

- Mobile Payment Solutions: Continuous development of mobile payment solutions and online platforms.

- AI and Automation: Leveraging AI to streamline compliance and gain actionable insights.

- Customer Segmentation: Tailoring marketing efforts to specific customer segments.

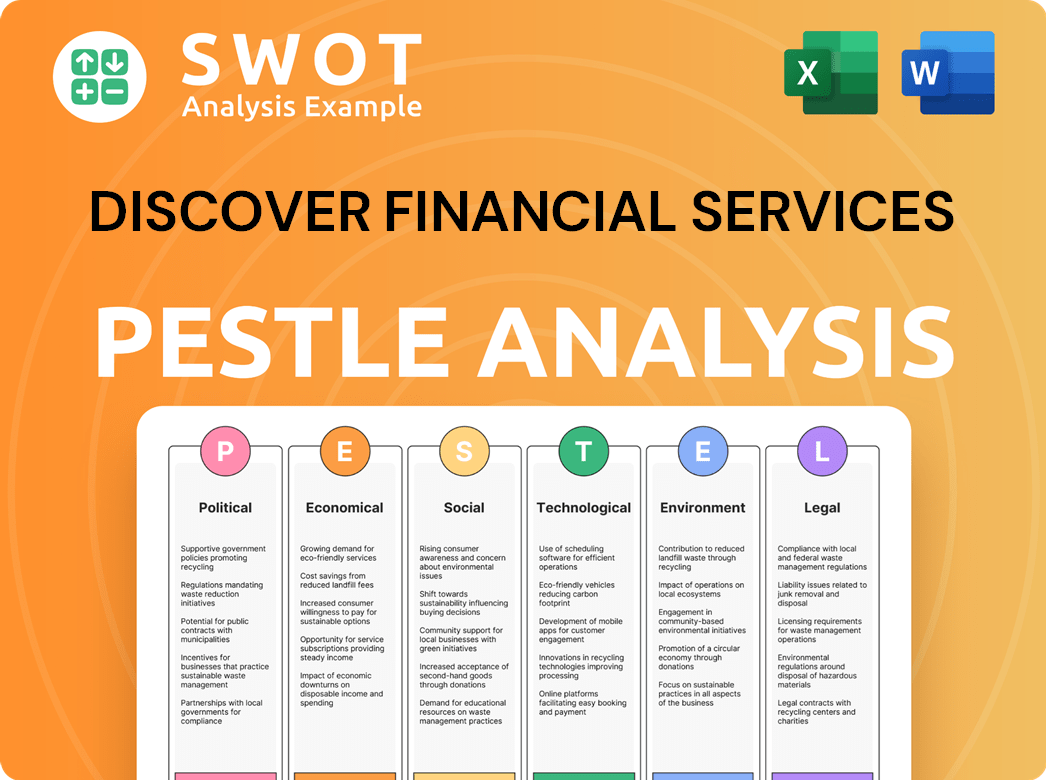

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Discover Financial Services Positioned in the Market?

The brand positioning of Discover Financial Services centers on value, customer-centricity, and innovation. Its Discover® card is historically known for straightforward rewards and no annual fees, appealing to a broad audience seeking tangible benefits. This approach aims to differentiate it within the competitive financial services sector, focusing on clear value propositions.

Discover's visual identity and communication style emphasize accessibility and reliability, aiming to empower consumers with financial tools. The company is committed to strong customer service, with an 85% customer satisfaction rating among cardholders in 2024. This commitment is reinforced by 24/7 customer service and feedback mechanisms.

Discover Financial Services employs a multifaceted approach to attract its target audience, utilizing attractive rewards programs, innovative digital solutions, and a strong emphasis on corporate responsibility. While not positioned as a luxury brand, it differentiates itself through its value and customer-focused approach, contrasting with competitors that may focus on premium services or extensive branch networks. The company's emphasis on digital banking and payment services also positions it as a modern and technologically advanced financial institution, as discussed in Growth Strategy of Discover Financial Services.

Offers straightforward rewards programs and no annual fees, making it attractive to a wide audience. This is a key component of its Discover card marketing strategy. The focus on value helps in customer acquisition.

Prioritizes strong customer service, with an 85% satisfaction rate in 2024. This customer-first approach is a key aspect of Discover company marketing. This approach helps with customer retention strategies.

Emphasizes innovative digital solutions, which is a key part of its Discover Financial Services marketing strategy. This focus helps position the company as modern and technologically advanced. The digital marketing plan is crucial.

The merger with Capital One, finalized in May 2025, is a strategic move to enhance competitiveness. This is a critical aspect of Discover Financial Services sales strategy. This merger is expected to create the largest credit card issuer by loan volume in the United States.

Discover Financial Services' brand is built on several key attributes that resonate with its target market and support its marketing strategy.

- Value: Providing clear, tangible benefits through rewards programs and no annual fees.

- Customer Service: High customer satisfaction ratings, emphasizing 24/7 support.

- Innovation: Leveraging digital solutions to enhance the customer experience.

- Accessibility: Ensuring financial products are easy to understand and use.

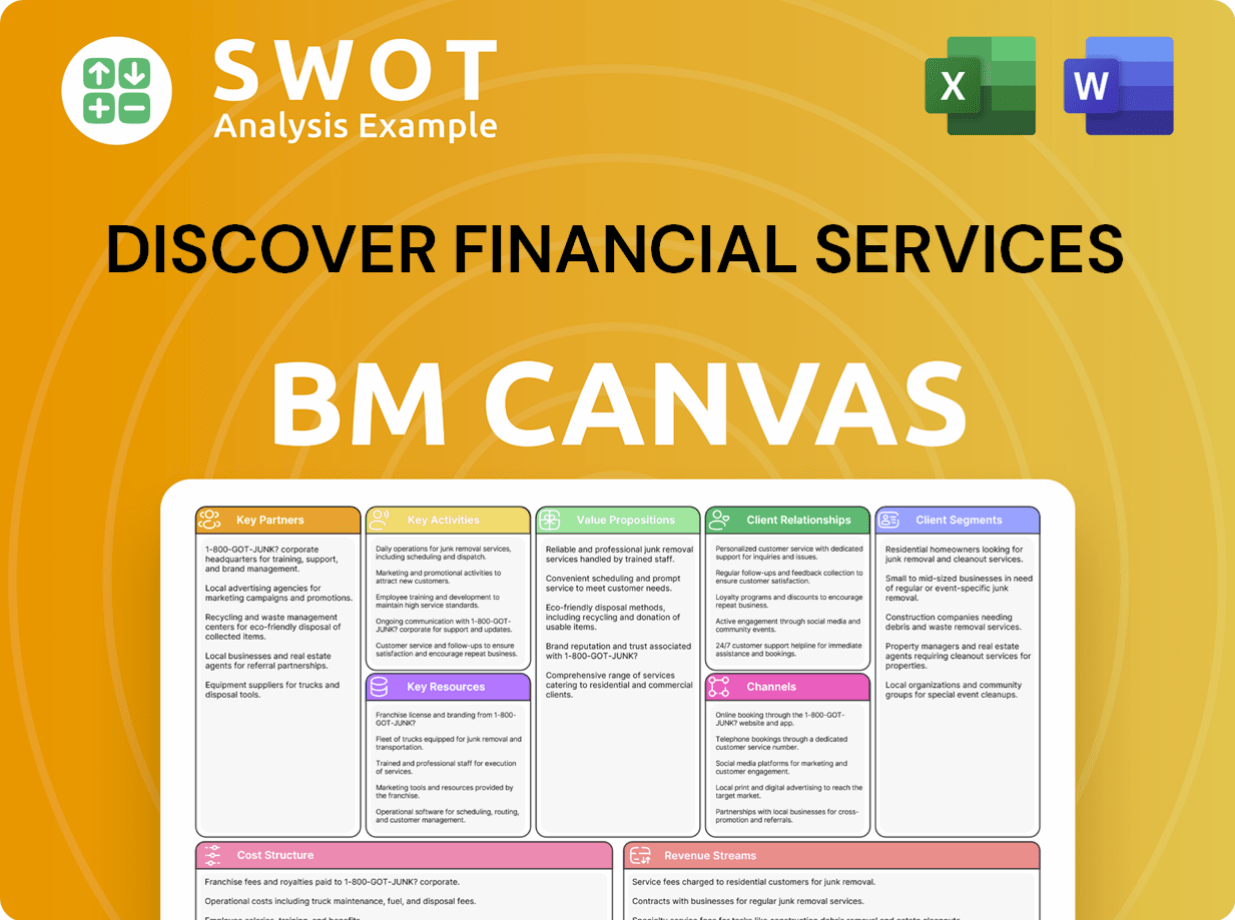

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Discover Financial Services’s Most Notable Campaigns?

The sales and marketing strategies of Discover Financial Services are centered around promoting its core value propositions, including cash rewards, customer service, and its global network. These strategies are designed to drive customer acquisition and retention within the competitive financial services market. Although specific campaign details for 2024-2025 are not widely publicized, the company consistently leverages its strengths to differentiate itself.

Historically, Discover has used the 'It Pays to Discover' messaging to emphasize its unique cashback program, aiming to attract customers seeking financial benefits. In the evolving landscape of financial services, recent marketing efforts likely promote a broader range of products, such as personal loans, home loans, and deposit accounts, in addition to its credit cards. This approach reflects a focus on offering comprehensive financial solutions to its customer base.

Discover's marketing campaigns heavily rely on digital channels to reach its target audience effectively. These channels include social media, search engine marketing, and email marketing. The goal is to drive online applications, increase engagement with its mobile app, and promote the benefits of its digital banking services. A survey in December 2024 highlighted Americans' financial resolutions for 2025, such as saving more (42%) and spending less (35%), which likely informs targeted campaigns promoting Discover's savings accounts or budgeting tools.

Discover Financial Services uses various marketing strategies to attract and retain customers. These include targeted advertising campaigns, promotional offers, and partnerships. The company leverages digital channels like social media and search engines to reach a wide audience and promote its products and services.

The digital marketing plan for Discover focuses on driving online applications and increasing engagement. This includes search engine optimization (SEO), pay-per-click (PPC) advertising, and content marketing. The goal is to provide valuable information and promote the benefits of their digital banking services.

Discover employs diverse advertising strategies to reach its target market effectively. These include television commercials, online banner ads, and social media campaigns. The company focuses on highlighting the benefits of its Discover card, such as cash rewards and customer service.

Social media marketing plays a crucial role in Discover's strategy. The company uses platforms like Facebook, Instagram, and Twitter to engage with its audience. It shares informative content, runs contests, and promotes its products and services through targeted ads.

Discover's sales are driven by its credit card offerings, personal loans, and other financial products. The company focuses on customer acquisition through various marketing campaigns and promotions. The sales strategy includes offering competitive rewards and benefits to attract new customers and retain existing ones.

The sales strategy for Discover involves a multi-channel approach, including direct mail, online applications, and partnerships. The company focuses on providing excellent customer service and building strong relationships. This approach helps drive sales growth and increase market share.

Discover's marketing efforts are designed to build brand awareness and attract new customers. The company invests in various marketing channels, including digital advertising, social media, and television commercials. It aims to highlight the benefits of its products and services.

Financial services marketing involves promoting financial products and services to target audiences. This includes credit cards, loans, and deposit accounts. The goal is to build trust, increase brand awareness, and drive sales. Discover's marketing efforts are a key part of its overall strategy.

Discover employs several strategies to acquire new customers, including promotional offers, rewards programs, and partnerships. The company targets various demographics through different marketing channels. Their focus is on attracting customers who are looking for value and benefits.

Discover positions itself as a customer-centric financial services provider. It emphasizes its rewards programs, customer service, and global network. The brand focuses on building trust and providing value to its customers. This positioning helps differentiate Discover from its competitors.

Discover's financial performance in 2024, with a net income of $4.54 billion and revenue of $17.91 billion, suggests effective marketing and sales strategies. The company's investment in marketing and business development was $1.164 billion in 2023, indicating ongoing efforts to drive growth. Collaborations with partners like Airwallex and Skipify expand payment acceptance, indirectly supporting marketing efforts.

- The merger with Capital One, approved in February 2025, will likely lead to new joint marketing initiatives.

- These initiatives aim to leverage the combined entity's scale to compete more effectively.

- The focus will be on enhancing brand visibility and driving customer acquisition.

- Discover's strategy involves a multi-channel approach to reach a broad audience.

For a deeper dive into Discover's overall strategies, consider reading about the Growth Strategy of Discover Financial Services.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.