Discover Financial Services Bundle

Can Discover Financial Services Navigate the Future of Finance?

In today's rapidly evolving Discover Financial Services SWOT Analysis, a well-defined growth strategy is essential for financial institutions aiming to thrive. Discover Financial Services, a pioneer in the digital banking and payments sector, faces the challenge of adapting and expanding in a competitive market. Understanding Discover's strategic initiatives and future prospects is crucial for anyone seeking to understand the dynamics of the Financial Services Industry.

This analysis dives deep into Discover Financial Services' Growth Strategy, exploring its evolution from a disruptive credit card provider to a diversified financial powerhouse. We'll examine the company's Future Prospects, considering its expansion strategies, innovation in the digital space, and its approach to risk management within the ever-changing financial landscape. This comprehensive overview will provide actionable insights for investors, analysts, and strategists interested in the long-term growth potential of Discover Financial Services.

How Is Discover Financial Services Expanding Its Reach?

Discover Financial Services is actively pursuing several growth strategies to broaden its market reach and diversify its revenue streams. The company's focus is on expanding its loan portfolio, especially in personal and student loans. By offering competitive rates and streamlined digital application processes, Discover aims to capture a larger share of these markets, catering to the increasing demand for convenient and accessible credit.

Another key area of expansion involves strengthening the Discover Global Network. This includes forming new partnerships and expanding the acceptance of its cards and payment solutions both domestically and internationally. Discover is working to increase the number of merchants and ATMs that accept its cards, enhancing the utility and reach of its network. These initiatives are driven by the need to access new customer segments, deepen existing customer relationships, and stay competitive in a rapidly evolving payments landscape.

The company's strategic planning also involves enhancing its deposit-gathering capabilities, which provides a stable funding source for its lending activities. Discover's commitment to both product expansion and network growth indicates a sustained focus on organic and inorganic growth opportunities, positioning it well within the Financial Services Industry. Understanding the Competitors Landscape of Discover Financial Services is crucial for evaluating its strategic moves.

Discover aims to increase its loan portfolio, particularly in personal and student loans. This involves offering competitive rates and simplifying digital application processes. The strategy is designed to meet the rising demand for accessible credit and attract new customers.

Discover is focused on strengthening its global network by forming new partnerships and increasing card acceptance. This includes expanding the number of merchants and ATMs that accept Discover, Diners Club International, and PULSE cards, enhancing card utility and reach. The goal is to provide more options for cardholders, especially when traveling.

Discover is also working to enhance its deposit-gathering capabilities. Deposits provide a stable funding source for its lending activities. This initiative supports the company's overall financial stability and growth strategy.

Discover continues its digital transformation, which includes improving online and mobile banking platforms. Streamlining digital processes enhances customer experience and operational efficiency, which is crucial for future growth.

Discover's expansion strategies are multifaceted, focusing on both organic and inorganic growth. These strategies include growing the loan portfolio, expanding the Discover Global Network, and enhancing deposit-gathering capabilities.

- Loan Portfolio Growth: Targeting personal and student loans with competitive rates and digital applications.

- Network Expansion: Increasing merchant and ATM acceptance globally.

- Deposit Gathering: Strengthening deposit capabilities for stable funding.

- Digital Transformation: Enhancing digital platforms for improved customer experience.

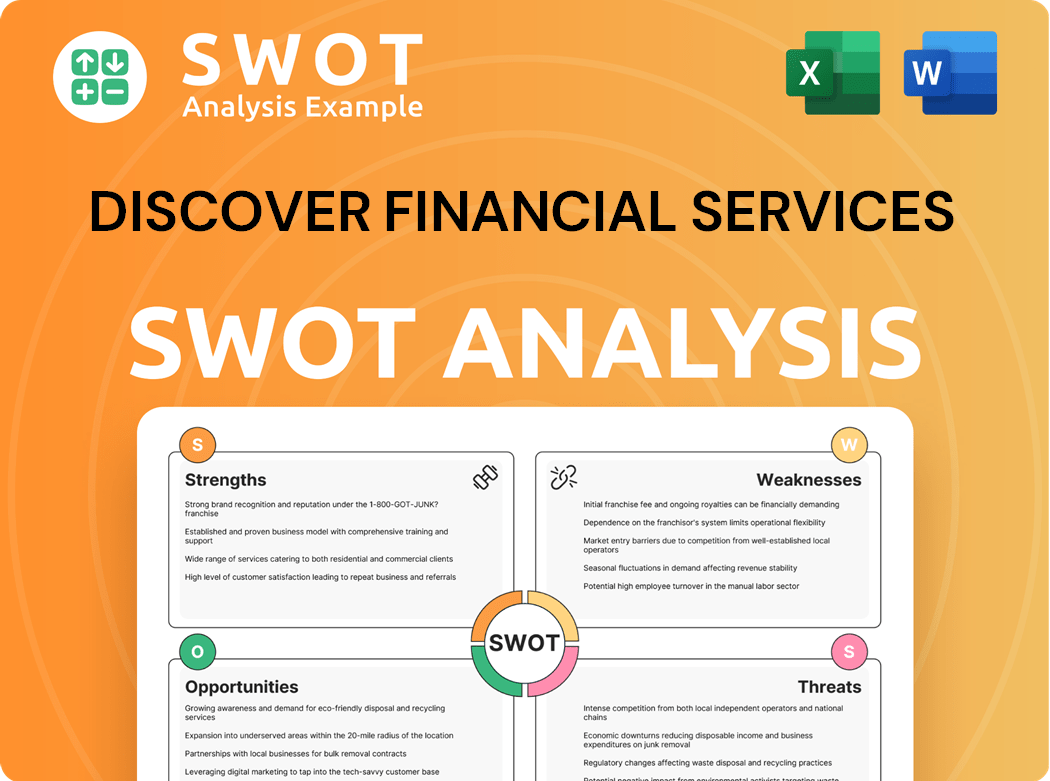

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Discover Financial Services Invest in Innovation?

Discover Financial Services recognizes that innovation and technology are vital to its Growth Strategy. The company focuses on enhancing customer experience, improving operational efficiency, and strengthening security through technology. This approach allows it to stay competitive in the dynamic Financial Services Industry.

The company's commitment to digital transformation is evident in its continuous efforts to improve its online and mobile banking platforms. These improvements are designed to provide seamless and intuitive experiences for its customers. This includes easy account management, secure payment options, and access to various financial services.

Discover Financial Services uses data analytics and artificial intelligence (AI) to personalize product offerings and improve customer service. This data-driven approach also helps in fraud detection and risk management. The company strategically uses technology to optimize its operations and enhance customer interactions.

Discover Financial Services invests heavily in digital transformation to meet evolving customer needs. This involves continuous upgrades to its mobile app and online platforms. The goal is to provide convenient and secure access to financial services.

The company leverages AI and data analytics to personalize product offerings. This includes improving fraud detection and optimizing customer service. This data-driven approach enhances both customer experience and operational efficiency.

Discover emphasizes in-house development and strategic collaborations to stay ahead in fintech. This includes exploring AI and machine learning for credit decisioning. Strategic partnerships help expand its technological capabilities.

Discover is committed to strengthening its cybersecurity measures to protect customer data. This involves implementing advanced technological solutions. Cybersecurity is a key focus to maintain customer trust in its digital platforms.

While specific R&D investment details are not always public, Discover consistently upgrades its digital infrastructure. This includes integrating emerging technologies. This commitment is crucial for sustained growth and competitive advantage.

The company's focus on technology and innovation is central to its Future Prospects. This strategic approach supports its long-term growth potential. Discover Financial Services aims to remain a leader in the financial services sector through technological advancements.

Discover's emphasis on innovation and technology is a core element of its Strategic Planning. The company’s investments in digital transformation and AI-driven solutions are designed to improve operational efficiency and customer experience. For example, in 2024, the company increased its investment in technology infrastructure by approximately 15% to enhance its digital capabilities and cybersecurity measures. This strategic focus is crucial for maintaining a competitive edge and driving sustainable growth within the Financial Services Industry. To understand more about Discover Financial Services' core values, you can read about its Mission, Vision & Core Values of Discover Financial Services.

Discover Financial Services implements various technological initiatives to support its Growth Strategy. These initiatives are aimed at improving customer service, enhancing security, and optimizing internal processes. The company's commitment to innovation is evident in its continuous efforts to integrate new technologies.

- Mobile Application Enhancements: Regular updates to the mobile app to improve user experience and add new features.

- AI-Driven Fraud Detection: Using AI and machine learning to enhance fraud detection capabilities.

- Data Analytics for Personalization: Leveraging data analytics to personalize product offerings and improve customer engagement.

- Cybersecurity Upgrades: Implementing advanced cybersecurity measures to protect customer data and ensure platform security.

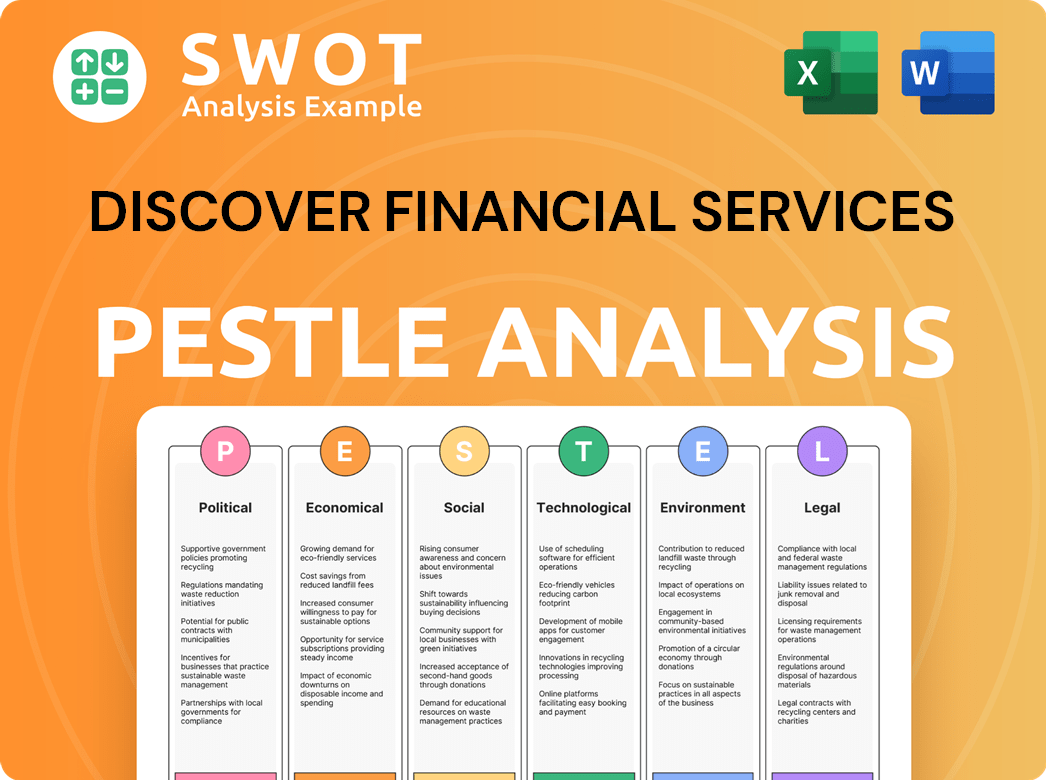

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Discover Financial Services’s Growth Forecast?

The financial outlook for Discover Financial Services reflects a strategy focused on sustainable growth and profitability. This is supported by its diverse portfolio of lending products and its payments network. The company's performance in the first quarter of 2024 demonstrated this, with a net income of $789 million, translating to $3.07 per diluted share.

A key driver of this financial health was a 9% increase in net interest income compared to the previous year, primarily due to higher average receivables. Loans also saw a substantial increase, growing by 10% year-over-year, reaching $126.5 billion. Management's confidence in navigating the economic landscape, while continuing to invest in growth, further solidifies the positive outlook.

Analyst forecasts generally anticipate continued growth in Discover Financial Services' loan portfolio and net interest income throughout 2024 and beyond, although potentially at a moderated pace. The company's robust capital position and prudent risk management are expected to support its lending activities. This allows for ongoing investments in technology and customer acquisition, which are crucial for the company's Growth Strategy.

Discover Financial Services' Financial Services Industry performance is marked by key indicators. The company's return on equity (ROE) for the first quarter of 2024 was 24%, showcasing strong profitability relative to shareholder equity. This performance underscores the effectiveness of the company's Strategic Planning and operational efficiency.

While specific long-term revenue targets are subject to market conditions and strategic adjustments, Discover's financial narrative is one of steady growth. This growth is driven by its core businesses and strategic investments in its digital capabilities and payments network. The Market Analysis indicates a positive trend in the company's revenue streams.

Discover Financial Services continues to focus on Expansion Strategies, including new product development and enhancements to its digital platforms. The company's commitment to Digital Transformation Strategy is evident in its investments in technology and customer experience. These strategies are designed to enhance its competitive position.

Risk Management and Future Outlook are critical components of Discover's strategy. The company actively manages risks to ensure long-term sustainability. This includes monitoring the Impact of Economic Trends and adapting to market changes. This proactive approach supports the Future Prospects of the company.

Discover Financial Services' financial performance is characterized by key highlights that reflect its strong market position and growth potential. The company's ability to maintain profitability and expand its loan portfolio is a testament to its effective strategies.

- Net Income: $789 million in Q1 2024.

- Diluted Earnings Per Share: $3.07.

- Loan Growth: 10% year-over-year.

- Net Interest Income Increase: 9% year-over-year.

- Return on Equity (ROE): 24% in Q1 2024.

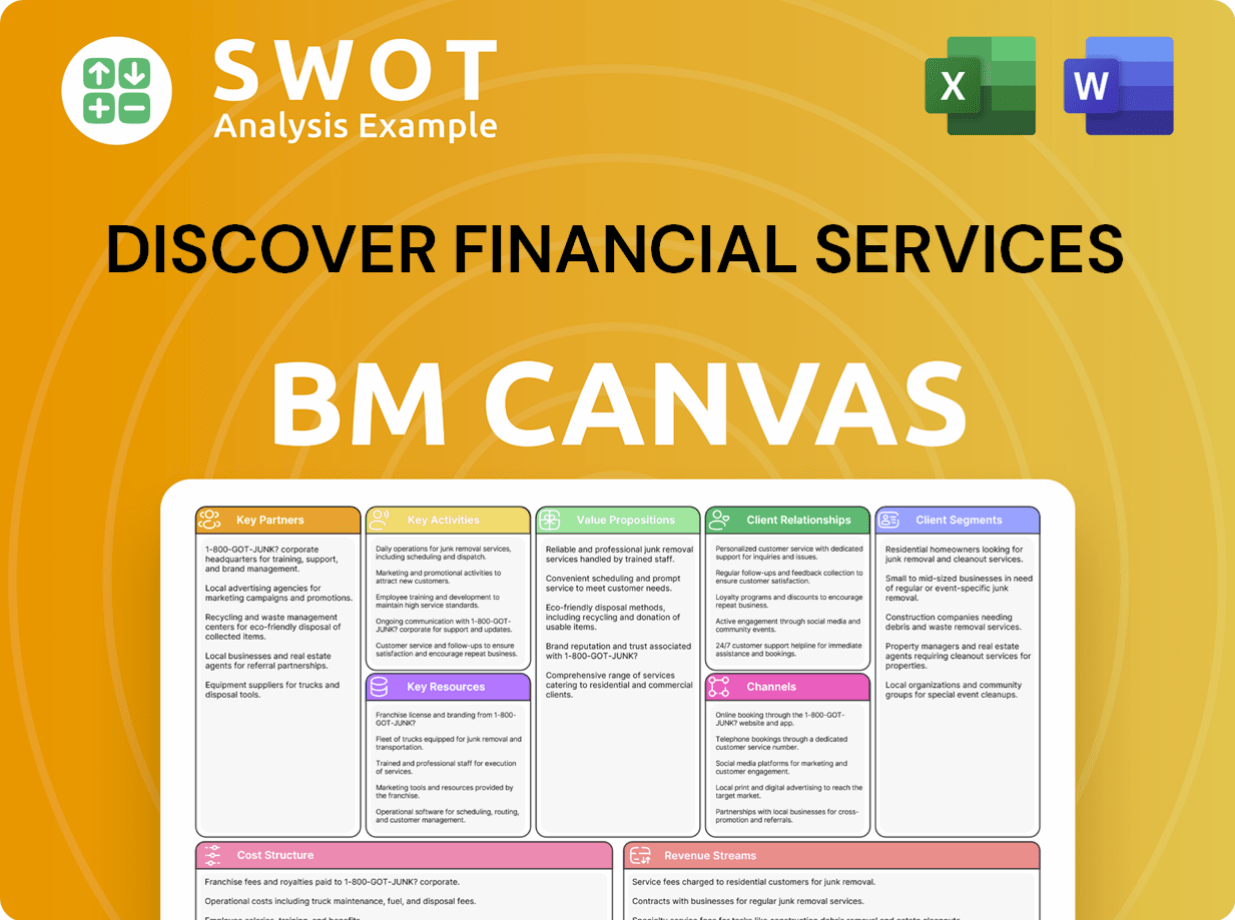

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Discover Financial Services’s Growth?

The Discover Financial Services faces several significant challenges that could affect its growth strategy and future prospects. These obstacles include intense competition within the financial services industry, regulatory changes, and rapid technological advancements. Effective risk management and strategic planning are crucial for navigating these complexities and ensuring long-term success.

Market competition remains a persistent threat, with numerous financial institutions vying for market share in credit cards, loans, and payment services. The company must continually adapt to maintain its competitive edge, which could influence its market share analysis and financial performance. Regulatory changes and economic downturns also pose risks, necessitating proactive measures to safeguard the company's financial health.

Internal resource constraints, such as attracting and retaining top talent, can also hinder innovation and operational efficiency. To mitigate these risks, the company emphasizes diversification and robust risk management frameworks. Understanding the competitive landscape and the impact of economic trends is vital for shaping Discover Financial Services' future outlook.

The financial services industry is highly competitive, with established banks and fintech companies constantly vying for market share. This competition can squeeze interest margins and increase customer acquisition costs, impacting the Discover Financial Services's growth strategy. Competitors include major credit card issuers and digital payment platforms.

The financial services industry is subject to strict regulations, and new laws or stricter enforcement can significantly affect operations and compliance costs. Increased scrutiny on consumer lending practices and data privacy can necessitate significant operational adjustments. Compliance with regulations is a continuous process.

Rapid technological advancements pose a constant challenge, as new payment methods, digital currencies, and lending platforms emerge. The company must invest in innovation to stay ahead of these disruptions and avoid obsolescence. The digital transformation strategy is crucial for long-term growth potential.

Economic downturns and rising interest rates can lead to higher loan delinquencies and charge-offs, affecting the company's financial performance. Discover Financial Services must proactively manage credit risk and strengthen its balance sheet to absorb potential losses. Economic cycles significantly impact financial outcomes.

Attracting and retaining top talent in a competitive labor market can hinder innovation and operational efficiency. The company must invest in employee development and create a positive work environment to maintain a skilled workforce. This impacts the ability to execute strategic plans effectively.

Cybersecurity threats pose a constant risk, as data breaches and cyberattacks can compromise customer data and financial assets. The company must invest heavily in cybersecurity protocols and continuously update its defenses. Protecting customer data is a top priority.

Discover Financial Services employs a robust risk management framework to mitigate these risks, including credit risk management, operational risk management, and cybersecurity protocols. The company also emphasizes diversification of its product portfolio and customer base to reduce reliance on any single market segment. For example, the company adjusts its lending criteria and strengthens its balance sheet during economic downturns. The Brief History of Discover Financial Services provides more context.

In 2024, the credit card market saw significant changes, with increased competition from fintech companies and evolving consumer spending habits. Interest rates and economic conditions continue to influence loan performance and customer behavior. The company's ability to adapt to these trends is crucial for its future prospects. Data from Q1 2024 shows that consumer spending patterns are shifting.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.