Discover Financial Services Bundle

Who Owns Discover Financial Services Now?

With Capital One's planned acquisition of Discover Financial Services for $35.3 billion, the landscape of the credit card industry is about to transform. This deal, slated to finalize in late 2024 or early 2025, makes understanding Discover's ownership structure more critical than ever. Before the acquisition, Discover operated as a publicly traded company, but its roots trace back to its origins within Sears, Roebuck and Co.

This article will explore the evolution of Discover Financial Services SWOT Analysis and its ownership, from its inception as a Discover Card issuer to its current status. We'll examine the historical context, the Discover parent company dynamics, and the impact of major stakeholders, including the upcoming Capital One acquisition. Understanding the Discover ownership will provide valuable insights for investors and anyone interested in the Discover Company's future.

Who Founded Discover Financial Services?

The genesis of Discover Financial Services, or Discover Company, traces back to 1985, when it was launched by Sears, Roebuck and Co. as a new credit card product. This marked the beginning of Discover Card, which would later evolve into a major player in the financial services industry. Initially, the ownership structure was entirely within Sears, a prominent retail corporation in the United States.

There were no individual founders in the traditional sense with specific equity splits at the outset, as Discover was an internal initiative of Sears. The vision for Discover was to create a credit card that offered no annual fee and a cash-back reward program, a novel concept at the time, aimed at enhancing customer loyalty to Sears and attracting new consumers. Early backing came directly from Sears' corporate resources and strategic directives.

As an internal division, there were no angel investors or friends and family acquiring stakes during this initial phase; all capital and strategic direction originated from the parent company. Early agreements related to Discover's operations would have been internal corporate mandates rather than external vesting schedules or buy-sell clauses. The founding team, in this context, refers to the executives and product development teams within Sears who spearheaded the creation and launch of the Discover Card.

Discover Card's initial structure was as a division within Sears, Roebuck and Co. This meant that all financial backing, strategic decisions, and operational oversight were managed internally by Sears. The parent company's resources were fully utilized for the card's development and launch.

The main objectives for Discover Card were to boost customer loyalty to Sears and draw in new consumers. The card's design, which included no annual fees and a cash-back rewards program, was intended to give it a competitive advantage.

Early operational agreements were internal corporate mandates rather than external vesting schedules. The focus was on integrating the card into Sears' existing retail network and leveraging the company's infrastructure for distribution and customer service.

The founding team consisted of executives and product development teams within Sears who were responsible for the creation and launch of the Discover Card. Their vision was customer-centric, focusing on value-driven features.

The initial distribution strategy involved leveraging Sears' extensive retail network. This allowed the Discover Card to reach a large customer base quickly and efficiently. The card was directly tied to the parent company's retail presence.

The initial funding for the Discover Card came entirely from Sears' corporate resources. There were no external investors or venture capital involved in the early stages of the company's development.

The executives and product development teams within Sears who spearheaded the creation and launch of the Discover Card formed the founding team. Their vision, focused on a customer-centric and value-driven credit card, was directly reflected in the product's features and its initial distribution strategy through Sears' extensive retail network. As of Q1 2024, Discover Financial Services reported a net income of $1.4 billion, indicating strong financial performance since its inception. For more insights, check out the Marketing Strategy of Discover Financial Services.

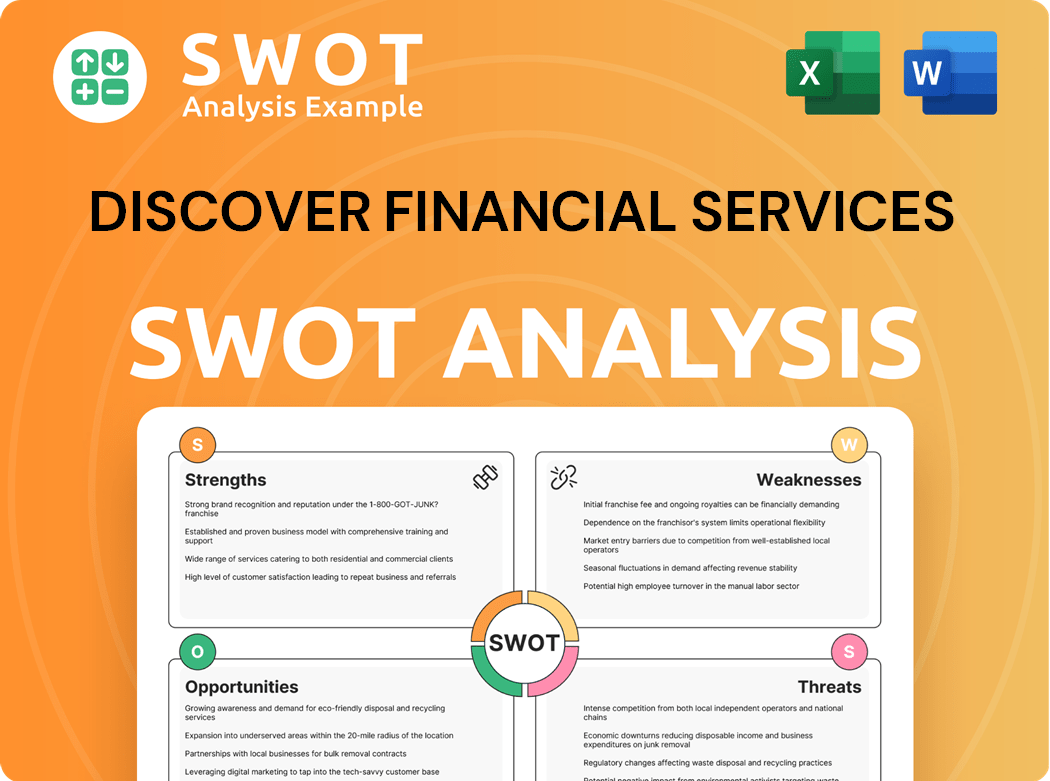

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Discover Financial Services’s Ownership Changed Over Time?

The journey of Discover Financial Services, from its inception to its current status, showcases a dynamic evolution in ownership. Initially conceived in 1985 as a subsidiary of Sears, Roebuck and Co., the Discover Card began its journey under the umbrella of the retail giant. The first major shift occurred in 1993 when Sears spun off its financial services arm, including the Discover Card, into a new publicly traded entity called Dean Witter, Discover & Co., marking the initial step towards its independent public ownership. This transition set the stage for future developments, altering the company's strategic direction and shareholder base.

Further changes in ownership occurred when Dean Witter, Discover & Co. merged with Morgan Stanley Group Inc. in 1997, leading to the formation of Morgan Stanley Dean Witter & Co. This merger integrated Discover into a larger financial organization. The most significant transformation came on June 30, 2007, when Morgan Stanley spun off Discover Financial Services as a standalone public company. This move, which established Discover as an independent entity listed on the New York Stock Exchange under the ticker DFS, was a pivotal moment in the company's history. This Brief History of Discover Financial Services provides a deeper dive into these pivotal events.

| Timeline | Event | Impact on Ownership |

|---|---|---|

| 1985 | Launch of Discover Card | Owned by Sears, Roebuck and Co. |

| 1993 | Spin-off of Dean Witter, Discover & Co. | Publicly traded, independent of Sears |

| 1997 | Merger with Morgan Stanley | Part of Morgan Stanley Dean Witter & Co. |

| 2007 | Spin-off of Discover Financial Services | Independent, publicly traded company |

As of early 2024, before the announcement of the Capital One acquisition, Discover Financial Services had a diverse ownership structure, with significant stakes held by institutional investors. For example, The Vanguard Group, Inc. held 46,303,812 shares as of March 31, 2024. BlackRock Inc. held 40,022,963 shares, State Street Corp. held 20,404,496 shares, and Capital Research Global Investors held 19,002,118 shares. These institutional investors collectively wielded considerable influence over the company's strategic direction and governance. Individual insiders also held stakes, aligning their interests with the company's performance. This ownership structure has played a crucial role in shaping Discover's strategic decisions and its overall market position.

Discover Financial Services has evolved from being a part of Sears to becoming an independent, publicly traded company.

- Initially owned by Sears, then spun off.

- Merged with Morgan Stanley, then spun off again.

- Institutional investors hold significant stakes.

- Ownership structure influences corporate governance.

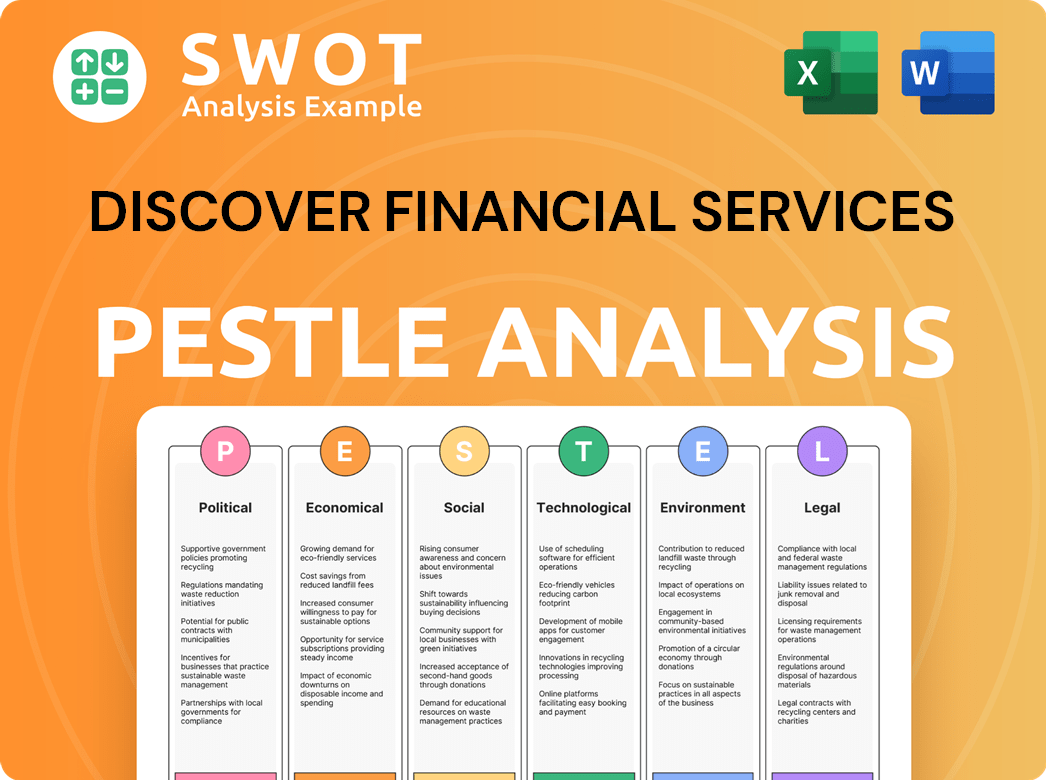

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Discover Financial Services’s Board?

As of early 2024, before the anticipated Capital One acquisition, the Board of Directors of Discover Financial Services included both independent directors and executives. For instance, Roger Hochschild, who was the CEO and President, was on the Board. Other board members usually had experience in finance, technology, and consumer services, offering oversight and strategic direction. The majority of board seats were typically held by independent directors, a common practice to ensure objective decision-making and protect shareholder interests.

The Board of Directors plays a crucial role in overseeing the strategy and operations of Discover Financial Services. They are responsible for making important decisions, such as appointing top executives and ensuring the company follows regulations. The board's composition, including independent directors, is designed to provide a balance of perspectives and expertise, which is vital for effective governance and shareholder value.

| Board Member | Title | Notes |

|---|---|---|

| Michael G. Rhodes | President and CEO | Appointed December 2023 |

| Vasant M. Nagvenkar | Lead Independent Director | Oversees independent directors |

| Diane M. Brickner | Director | Independent Director |

Discover Financial Services operates with a one-share-one-vote structure. This means each share of common stock generally gives its holder one vote on matters like electing directors or approving major corporate actions. There are no known dual-class shares or special voting rights that would give outsized control to any single entity. This structure ensures that voting power is directly proportional to equity ownership. The company has faced scrutiny over its compliance and risk management practices, leading to leadership changes and shifts in strategic focus.

The Board of Directors at Discover Financial Services oversees the company's operations and ensures regulatory compliance. The board's structure, with independent directors, aims to protect shareholder interests. Discover Card's governance is currently under review due to past compliance issues.

- One-share-one-vote structure.

- Independent directors provide oversight.

- Leadership changes reflect operational challenges.

- Board ensures regulatory compliance.

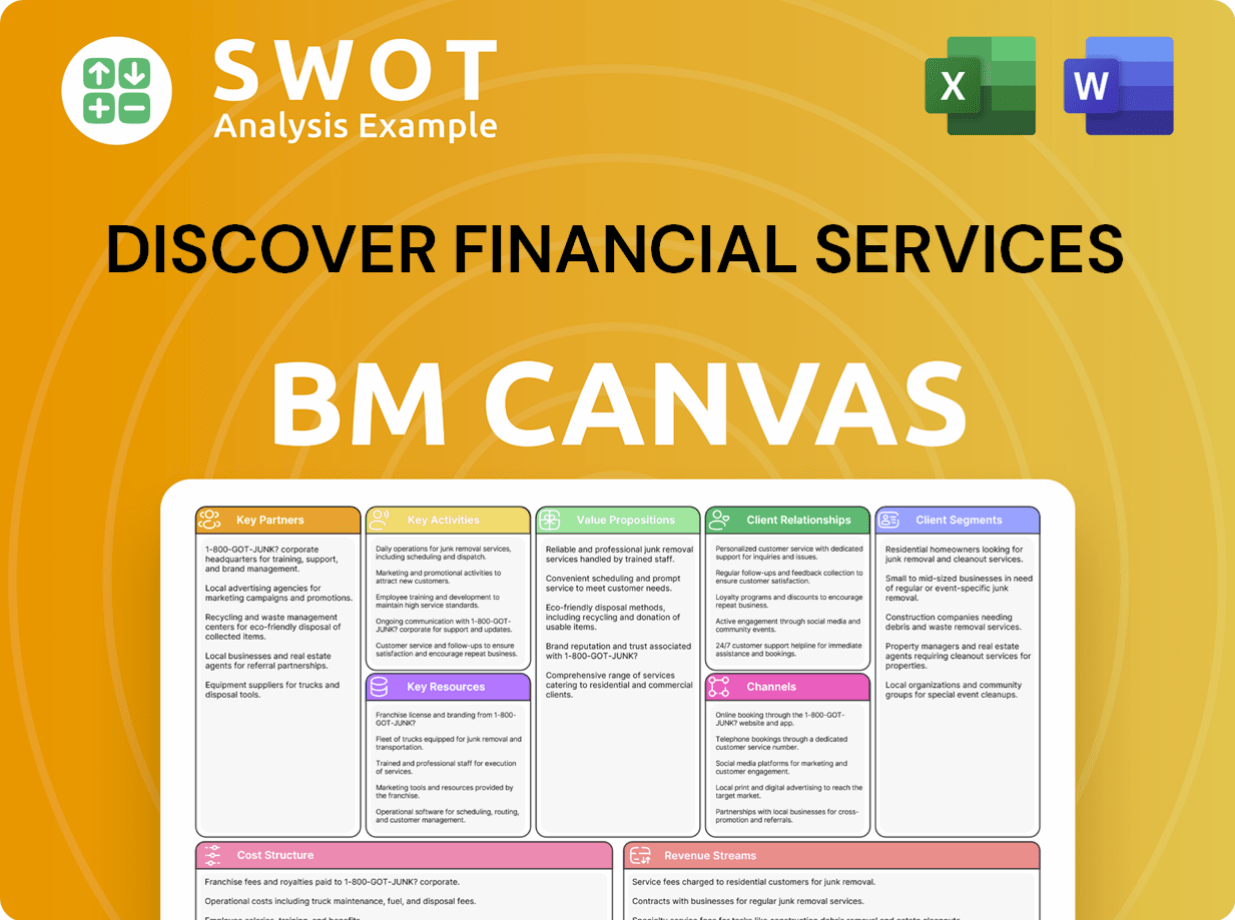

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Discover Financial Services’s Ownership Landscape?

In the past few years, the ownership profile of Discover Financial Services has seen significant changes, mainly due to the proposed acquisition by Capital One. On February 19, 2024, Capital One announced it would acquire Discover Financial Services in an all-stock deal valued at $35.3 billion. This translates to a per-share value of $139.86 for Discover Company common stock. The deal is expected to close in late 2024 or early 2025, pending regulatory and shareholder approvals. This merger marks a major shift in the U.S. payments and banking sector, altering Discover's independent public ownership.

Before the acquisition announcement, Discover was involved in share buyback programs, a common practice to return value to shareholders. However, these buybacks were temporarily halted in mid-2023 due to compliance issues, which also led to leadership changes. The departure of CEO Roger Hochschild in August 2023 and the appointment of Michael Rhodes in December 2023 were important internal developments that preceded the acquisition. These changes reflected a focus on strengthening compliance and operational efficiency. For more information about the company's growth, you can read about the Growth Strategy of Discover Financial Services.

| Key Development | Details | Timeline |

|---|---|---|

| Acquisition Announcement | Capital One to acquire Discover Financial Services in an all-stock transaction. | February 19, 2024 |

| Deal Value | $35.3 billion | February 19, 2024 |

| Share Buyback Pause | Temporary halt due to compliance issues. | Mid-2023 |

| CEO Transition | Roger Hochschild's departure and Michael Rhodes' appointment. | August 2023/December 2023 |

Industry trends, such as increased institutional ownership, continue to be relevant for Discover. Major investors like Vanguard and BlackRock hold substantial stakes, influencing governance. The acquisition by Capital One reflects a broader trend of consolidation in financial services, driven by the pursuit of scale and efficiency. Discover's shareholders will receive 1.0192 Capital One shares for each Discover share, transitioning Discover from an independently traded entity to a subsidiary of Capital One. This will dilute the ownership stakes of current Discover shareholders, who will become shareholders of the combined entity, Capital One.

Discover Financial Services is set to become a subsidiary of Capital One. This shift will change the ownership structure, with current shareholders becoming shareholders of the combined company.

Vanguard and BlackRock are among the major institutional investors holding significant stakes in Discover, influencing governance.

The merger aims to enhance competitiveness and create value for shareholders of the combined company, according to public statements.

The acquisition is subject to regulatory approvals and shareholder approval, with an expected closing in late 2024 or early 2025.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.