Discover Financial Services Bundle

Who Are Discover Financial Services' Customers?

In the ever-evolving Discover Financial Services SWOT Analysis, understanding customer demographics and target market analysis is crucial for success. The pending merger with Capital One, announced in February 2024, underscores the strategic importance of expanding market reach within the financial services industry. This article dives deep into the customer profile of Discover, exploring their financial needs and how the company strategically caters to them.

Discover Financial Services, initially a credit card issuer, has broadened its scope to include various financial products and services. This shift necessitates a thorough examination of its customer base, encompassing credit card users and beyond. This analysis will provide insights into the Discover card customer profile, including demographics such as age range and income levels, geographic distribution, and spending habits, ultimately revealing the target audience for Discover credit cards and other offerings.

Who Are Discover Financial Services’s Main Customers?

Understanding the customer base is crucial for any financial institution. For Discover Financial Services, this involves a deep dive into its customer demographics and target market analysis. The company's focus is primarily on consumers, offering a range of products designed to meet their financial needs. This strategic approach helps in tailoring services and marketing efforts effectively.

Discover's primary customer segments are largely defined by its product offerings. These include credit cards, personal loans, home loans, and deposit products, all geared towards individual consumers. The company's historical emphasis on cashback rewards and student credit cards indicates a broad appeal, targeting both value-conscious consumers and those building their financial profiles. The Growth Strategy of Discover Financial Services sheds light on the company's evolution and its customer-centric approach.

While specific demographic breakdowns are not always publicly available, Discover's strategies provide insights into its target market. The company aims to attract and retain customers by offering competitive products and maintaining high levels of customer satisfaction. In 2024, Discover reported an impressive customer satisfaction rate of 85% among its cardholders, showcasing its dedication to meeting customer needs effectively.

Discover's core customer base primarily includes credit card users and individuals seeking personal loans. It also caters to students through tailored credit card products. These segments are crucial for driving revenue and maintaining a strong market presence. In 2024, credit card loans reached $102.8 billion, a 1% increase year-over-year, and personal loans saw a 5% rise, highlighting the importance of these segments.

Discover differentiates itself through cashback rewards and a strong focus on customer satisfaction. This value proposition attracts consumers seeking financial products that offer tangible benefits and excellent service. The company's emphasis on these aspects has helped it build a loyal customer base and maintain a competitive edge in the financial services industry.

Discover's strategic decisions, such as the move to stop accepting new applications for private student loans, indicate a focus on core business areas. This shift allows the company to streamline its operations and concentrate on consumer lending and payment services. The pending merger with Capital One is also expected to reshape its market presence and customer reach.

Market segmentation for Discover involves identifying distinct groups based on their financial needs and behaviors. This includes targeting value-conscious consumers, students, and those seeking various loan products. Understanding these segments allows Discover to tailor its marketing campaigns and product offerings, enhancing customer engagement and loyalty.

Discover's customer base likely includes a diverse range of individuals. While specific data on Discover card user age range, Discover card income levels, and Discover card geographic distribution are not always publicly available, the company's products and marketing strategies suggest a broad appeal across different demographics.

- Credit Card Users: Consumers seeking rewards, low fees, and convenient payment options.

- Students: Individuals looking to build credit and manage finances responsibly through student credit cards.

- Loan Applicants: Individuals needing personal or home loans to finance significant purchases or consolidate debt.

- Value-Conscious Consumers: Those who prioritize cashback rewards and other benefits.

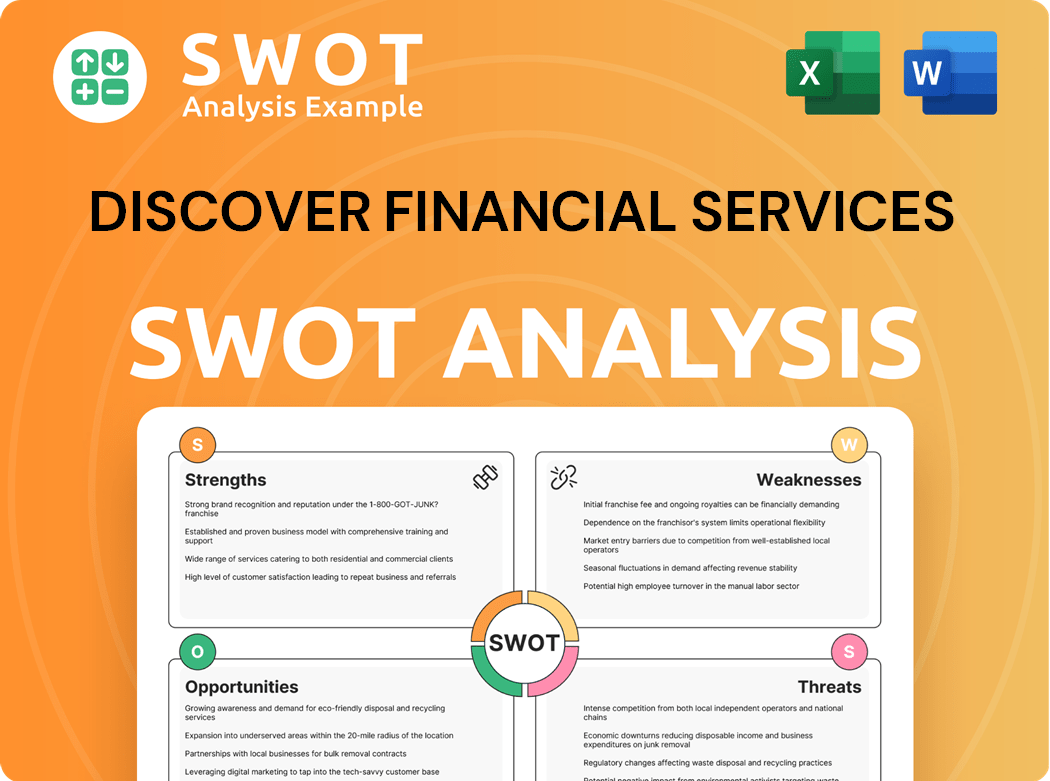

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Discover Financial Services’s Customers Want?

Understanding customer needs and preferences is crucial for Discover Financial Services to maintain its competitive edge in the financial services industry. The company focuses on delivering value, convenience, and security to its customers through its product design, marketing strategies, and customer service initiatives. This customer-centric approach helps Discover to attract and retain customers in a competitive market.

Discover Financial Services tailors its offerings to meet the evolving demands of its target market. This includes providing attractive rewards programs, investing in digital technologies, and ensuring strong customer support. By addressing these key areas, Discover aims to enhance customer satisfaction and build long-term relationships.

The primary drivers influencing customer choices include the value offered through rewards and benefits, the ease of use of digital platforms, and the security of financial transactions. Discover's strategies are designed to meet these needs effectively, leading to high customer satisfaction and loyalty.

Discover's competitive rewards programs are a significant draw for customers. In 2024, the company distributed over $500 million in cashback rewards. The 'Cashback Match' program for new cardholders doubles all cashback earned in the first year.

Discover has invested heavily in digital technologies to enhance the customer experience. The company allocated $300 million to technology investments in 2024, focusing on mobile payments, data analytics, and cybersecurity.

Discover's commitment to customer satisfaction is reflected in its high customer satisfaction rate. The company achieved an 85% customer satisfaction rate among its cardholders in 2024, indicating effective service delivery and support.

Customers increasingly prefer digital and contactless payment options. A 2024 Discover Global Network study revealed that 73% of consumers are comfortable with in-person contactless payments. This trend influences Discover's focus on promoting contactless payment options.

Discover provides 24/7 customer service and uses customer feedback to improve its offerings. In April 2024, Discover partnered with Google Cloud to integrate generative AI into its customer care centers. Early results show agents can reduce call handle time by as much as 70%.

Discover's customer-centric approach addresses common pain points through responsive customer service and continuous improvement. This focus on customer needs helps Discover to maintain a strong position in the Revenue Streams & Business Model of Discover Financial Services.

Understanding the needs and preferences of the target market is essential for Discover Financial Services. The company focuses on providing value, convenience, and security to its customers, which are key factors in their purchasing decisions. This approach supports the company's market segmentation and customer acquisition strategies.

- Value: Competitive rewards and cashback programs, such as the 'Cashback Match' program, which doubles cashback earned in the first year.

- Convenience: Seamless digital experiences, including mobile payment solutions and integrated app checkout experiences for merchants.

- Security: Cybersecurity measures and secure financial transactions, which are critical for customer trust and loyalty.

- Customer Service: 24/7 customer service and the use of AI to improve customer care, offering faster, more personalized, and efficient resolutions.

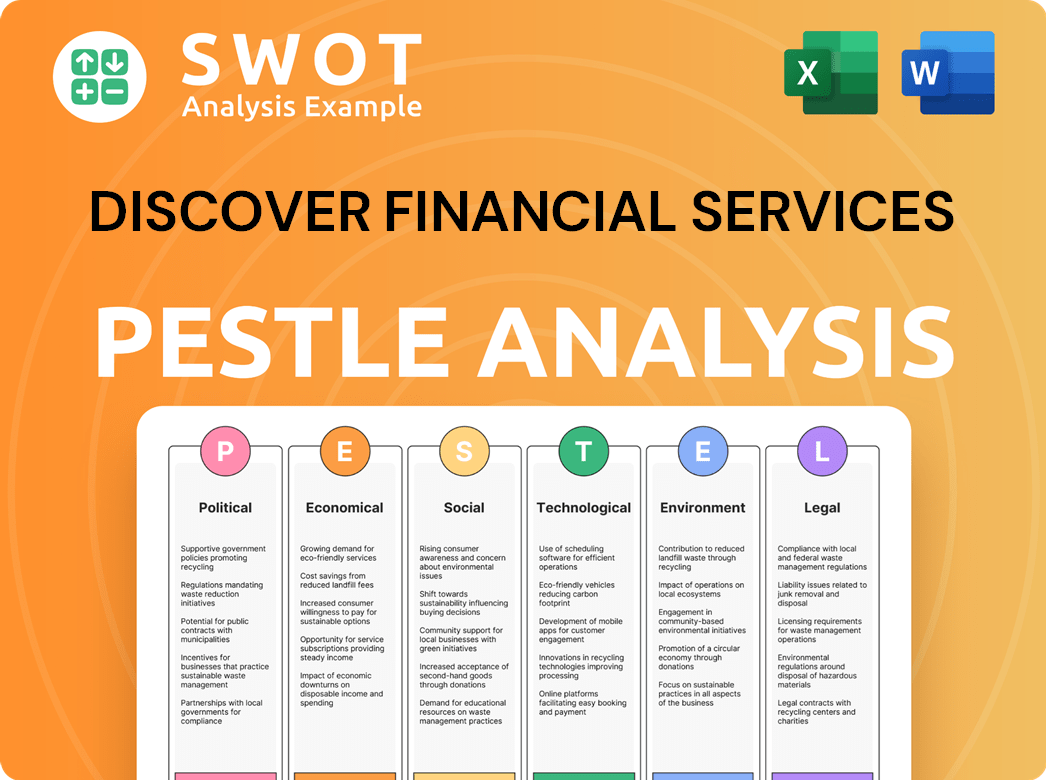

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Discover Financial Services operate?

The geographical market presence of Discover Financial Services is primarily centered in the United States, where it operates as a major credit card issuer. Its core digital banking services, including credit cards, personal loans, and deposit products, are largely focused on the U.S. consumer market. This strong domestic foundation is a critical aspect of its business strategy.

Beyond its U.S. focus, Discover has a global footprint through the Discover Global Network. This network includes Discover Network, PULSE, and Diners Club International, extending its reach internationally. While Discover Network and PULSE primarily serve the U.S., Diners Club International offers a global payments network, enabling transactions worldwide.

Strategic decisions significantly influence Discover's geographical presence. The announced merger with Capital One in February 2024 is poised to reshape its market reach and customer segments. Furthermore, the 2024 decision to cease new private student loan applications and sell its portfolio specifically affected its domestic lending operations.

Discover Financial Services holds a significant position in the U.S. market. This is reflected in its credit card market share and brand recognition. The company's primary target market is within the United States, where it has built a strong customer base. Understanding the Owners & Shareholders of Discover Financial Services can provide further insights into the company's strategic direction and market focus.

The Discover Global Network expands Discover's reach internationally. Diners Club International is a key component, offering a global payments network. In the first quarter of 2025, Diners Club volume grew by 18% year-over-year, with notable strength in India and Israel. This indicates strategic growth in specific international markets.

In 2024, Discover held a 2.0% market share of U.S. credit card purchase volume among major networks. Globally, in 2023, Discover's purchase volume share was 1%. These figures highlight Discover's competitive position in the financial services industry.

The pending merger with Capital One will likely expand Discover's market presence. This could lead to new customer segments and a broader geographical reach. Such strategic moves are crucial in the competitive landscape of the credit card market.

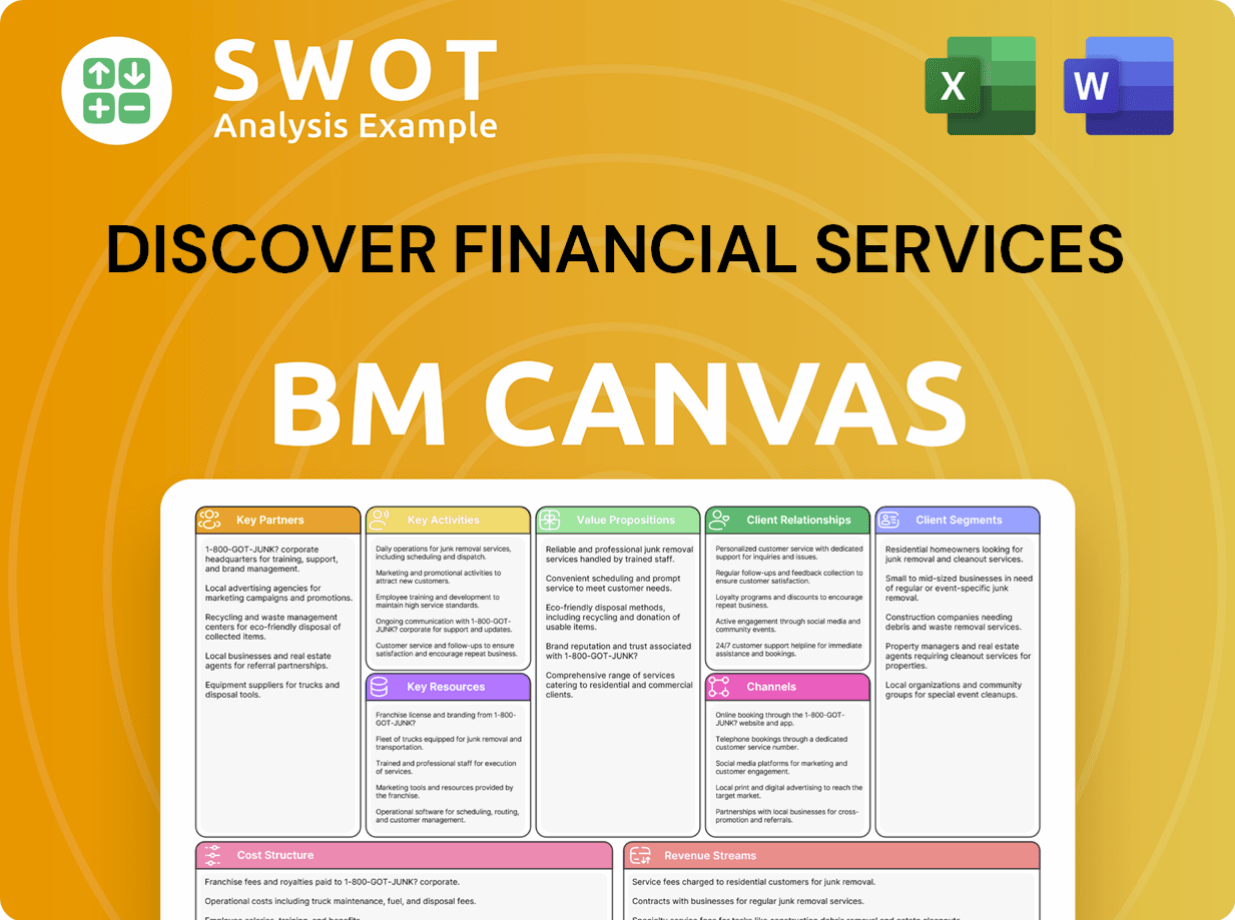

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Discover Financial Services Win & Keep Customers?

Discover Financial Services employs a comprehensive strategy for acquiring and retaining customers in the competitive financial services industry. This approach combines traditional and digital marketing techniques, emphasizing customer engagement and loyalty programs. The company's investments in marketing and business development are primarily directed towards growth in card and consumer banking products, reflecting a focus on expanding its customer base.

The company utilizes a multi-channel approach, including integrated mass and direct communications, to drive customer engagement. Strategic partnerships and sponsorships, such as those with the NHL and the Big Ten Conference, are also leveraged to boost loan growth and brand visibility. This multifaceted strategy is designed to capture the attention of potential customers and build lasting relationships.

Customer acquisition in the financial sector is particularly challenging, and Discover addresses this by streamlining and simplifying forms, using personalized exit intent overlays, and employing tailored push notifications. The company also emphasizes collecting zero-party data through interactive emails to personalize customer experiences and maximize omnichannel marketing automation.

Discover prioritizes high-quality customer service as a key element of its retention strategy. A significant initiative is the deployment of Google Cloud's generative AI in its customer care centers, which started rolling out in early 2024. This technology aims to improve customer experience and agent productivity.

Rewards programs, especially cashback offerings, are a cornerstone of Discover's retention strategy. In 2024, the company distributed over $500 million in cashback rewards to its cardholders, incentivizing usage and loyalty. This financial incentive is a direct way to reward and retain customers.

Discover focuses on providing a seamless user experience and building emotional connections through personalized interactions. Customer feedback is consistently used to improve services. For example, Discover consistently scores high in customer satisfaction surveys, reporting an 85% satisfaction rate among its cardholders in 2024.

- Internal loan modification programs are implemented to help borrowers facing financial difficulties.

- These programs include interest rate reductions and term extensions for credit card and personal loans.

- The pending merger with Capital One is expected to create opportunities for cross-selling and revenue growth.

- Combining customer bases and offering a wider range of products and services is expected.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.