Discover Financial Services Bundle

What Drives Discover Financial Services?

Understanding a company's core principles is crucial for investors and strategists alike. Delving into Discover Financial Services' mission, vision, and core values provides invaluable insights into its strategic direction and long-term objectives.

These statements are not just corporate jargon; they are the bedrock of Discover's Discover Financial Services SWOT Analysis, shaping its financial strategy and influencing its corporate culture. Exploring Discover's mission, vision, and values reveals its commitment to innovation, customer service, and its vision for financial inclusion, offering a glimpse into its future in the dynamic financial landscape. Understanding Discover's Company Goals is key.

Key Takeaways

- Discover's customer-centric mission and digital leadership vision are key.

- Core values like customer focus, innovation, and integrity are crucial differentiators.

- These principles shape identity, drive decisions, and foster a positive culture.

- Alignment with these principles is essential for future success in a changing market.

- A clear purpose builds trust and drives sustainable growth in financial services.

Mission: What is Discover Financial Services Mission Statement?

Discover Financial Services' mission is 'To help people spend smarter, manage debt better and save more so they achieve a brighter financial future.'

The mission statement of Discover Financial Services is a clear articulation of its dedication to improving the financial well-being of its customers. This customer-centric approach is a cornerstone of Discover's operational philosophy, influencing its product offerings and corporate strategy. Understanding this mission provides valuable insights into Discover's business model and its long-term goals.

Discover's mission statement places a strong emphasis on empowering individuals. This empowerment is achieved by providing tools and resources that enable informed financial decision-making. This focus is evident in various aspects of its operations.

The mission statement highlights three critical areas of financial health: spending, debt management, and saving. By addressing these areas, Discover aims to provide a holistic approach to financial well-being. This comprehensive approach is designed to cater to a wide range of consumers.

Discover's products and services are directly aligned with its mission. For example, the provision of free FICO® Scores helps customers monitor and manage their credit. Cashback rewards programs encourage smarter spending habits.

Discover invests in financial literacy programs and resources, further supporting its mission. These initiatives help customers better understand financial concepts and make informed decisions. This commitment to education is a key component of its strategy.

By focusing on these key areas, Discover aims to influence customer behavior positively. The goal is to help customers build better financial habits and achieve their financial goals. This customer-centric approach is central to Discover's corporate culture.

The mission statement informs Discover's strategic decisions. It guides the development of new products, the expansion of services, and the overall direction of the company. This commitment to its mission helps shape its long-term vision.

The Discover Financial Services mission is a foundational element of its business strategy. It shapes the company's approach to product development, customer service, and corporate social responsibility. The Discover Vision Statement and Discover Core Values are closely aligned with this mission, creating a cohesive framework for the company's operations. For instance, Discover's emphasis on providing free FICO® Scores reflects its commitment to helping customers manage their debt better, directly supporting its mission. The company's strategic goals and objectives are also designed to support this mission, ensuring that all activities contribute to improving customer financial well-being. The Discover Company Goals are centered on helping people spend smarter, manage debt better, and save more. This is reflected in the design of its credit card products, which often include features like cashback rewards and tools for tracking spending. The Discover Financial Strategy is formulated to support these goals, with investments in technology and customer service aimed at providing a superior customer experience. The Discover Corporate Culture is also influenced by the mission, with an emphasis on integrity, innovation, and customer focus. Understanding the What is Discover's mission statement is crucial for investors and stakeholders. It provides insight into the company's long-term vision and its commitment to creating value for its customers. Discover's commitment to its core values is evident in its daily operations and its approach to customer service. The company's approach to customer service is designed to be transparent and helpful, providing customers with the resources they need to make informed financial decisions. The Discover's mission vision and values explained highlight the company's dedication to financial inclusion, ensuring that its products and services are accessible to a wide range of consumers. For example, Discover's commitment to financial literacy is demonstrated through its educational resources and tools. The Discover's commitment to its core values is reflected in its workplace environment, which fosters collaboration and innovation. The company's approach to customer service is designed to be transparent and helpful, providing customers with the resources they need to make informed financial decisions. For a deeper understanding of Discover's target market, consider reading about the Target Market of Discover Financial Services. The company's strategic goals and objectives are designed to support its mission, ensuring that all activities contribute to improving customer financial well-being.

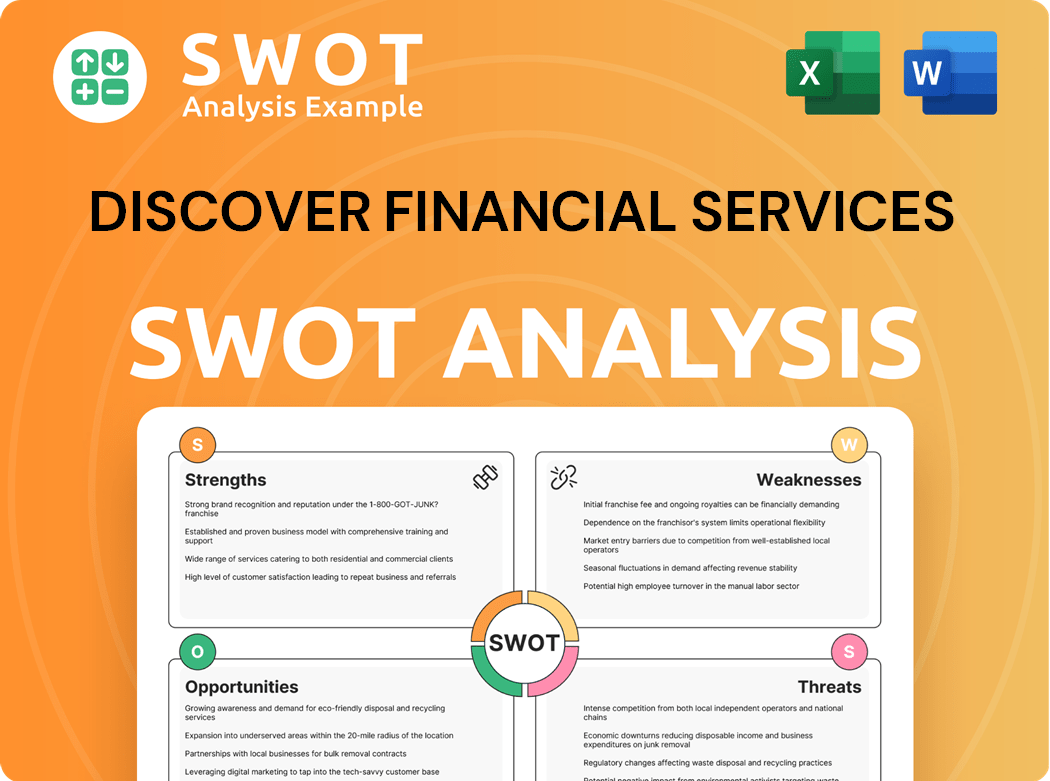

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Discover Financial Services Vision Statement?

Discover's vision is 'to be the leading direct bank and payments partner.'

Let's delve into the intricacies of Discover Financial Services' vision statement. This statement provides a crucial glimpse into the company's aspirations and strategic direction. Understanding the Discover Vision Statement is essential for anyone seeking to comprehend the company's long-term goals and its approach to the financial landscape.

The vision statement is undeniably ambitious, aiming for a leadership position. This ambition reflects Discover's desire to not just participate in the market but to shape it. The company's strategic goals and objectives are clearly geared towards achieving this leadership status.

The vision encompasses two key areas: direct banking and payments. This dual focus highlights Discover's integrated approach to financial services. Discover Financial Services Mission includes providing a comprehensive suite of services.

The vision implicitly acknowledges the importance of digital transformation. The emphasis on being a "direct bank" suggests a commitment to online and mobile banking. This approach is crucial in today's rapidly evolving financial environment.

The goal of market leadership is a bold statement. It implies a desire to surpass competitors and become a dominant force in the industry. This requires continuous innovation and a strong focus on customer service.

Discover's strategic initiatives are critical to achieving its vision. These initiatives likely include investments in technology, expansion of its payments network, and strategic partnerships. The company's financial strategy is closely aligned with its vision.

While ambitious, the vision appears realistic given Discover's current market position and strategic direction. The company's focus on customer service and its direct-to-consumer model provide a solid foundation for growth. For more insights, consider reading about Owners & Shareholders of Discover Financial Services.

The Discover Company Goals are directly linked to this vision. The company is likely setting specific, measurable, achievable, relevant, and time-bound (SMART) goals to track progress. These goals would encompass areas such as customer acquisition, transaction volume, and market share. The Discover Financial Strategy is the roadmap to achieving this vision, outlining how the company will allocate resources, manage risks, and capitalize on opportunities. The company's commitment to its core values will also play a pivotal role in achieving its vision.

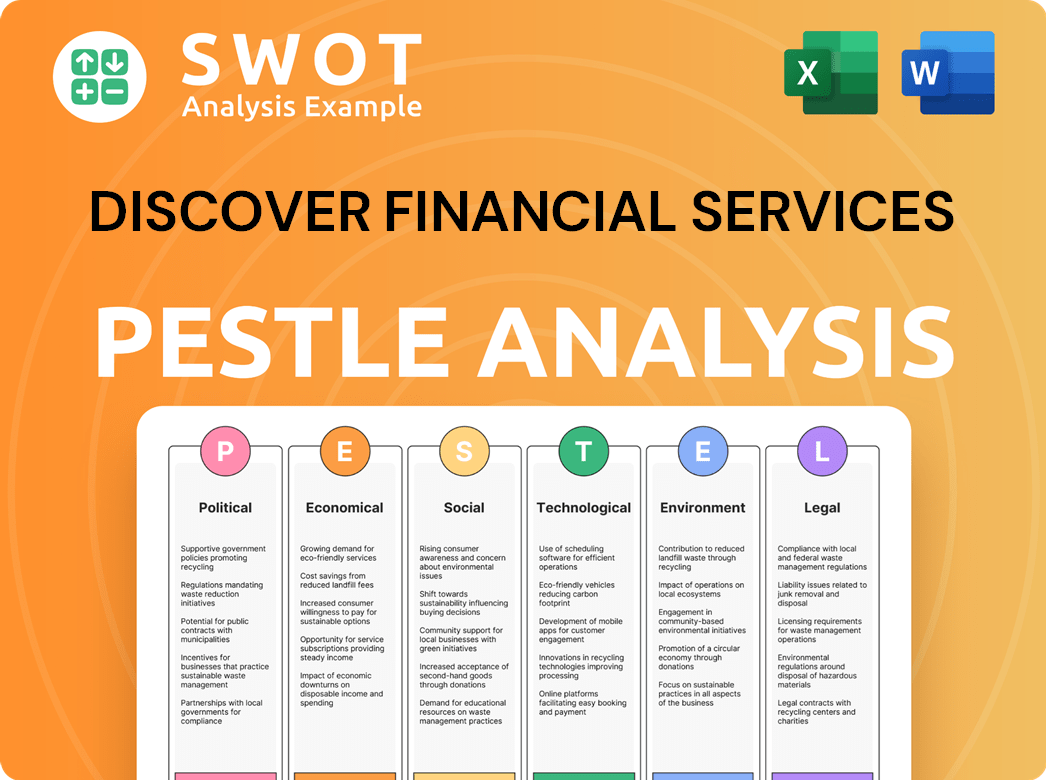

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Discover Financial Services Core Values Statement?

Understanding the core values of Discover Financial Services is crucial to grasping its operational philosophy and approach to the financial services industry. These values shape the company's interactions with customers, employees, and the broader community, influencing its strategic decisions and corporate culture.

Customer Focus is a cornerstone of Discover's operations, prioritizing customer needs and delivering exceptional service. This commitment is evident in its 24/7 U.S.-based customer service and efforts to promptly address inquiries. In 2024, Discover reported an 85% customer satisfaction rate among cardholders, demonstrating its dedication to this value. This focus directly influences Revenue Streams & Business Model of Discover Financial Services.

Innovation drives Discover's continuous development of new products and services to enhance the customer experience and improve operations. This includes investments in digital technologies like mobile payments, data analytics, and cybersecurity. For example, Discover's mobile payment solutions and streamlined processes are testaments to its commitment to staying ahead in the financial technology landscape.

Integrity, a critical value in the financial services sector, emphasizes high ethical standards and transparency. Discover highlights ethical conduct and compliance in its operations and interactions with stakeholders. This commitment to integrity builds trust and ensures responsible financial practices.

Collaboration is a key principle that fosters teamwork and the achievement of common goals within Discover. This value likely reflects internal team dynamics and external partnerships. The emphasis on collaboration supports a culture of shared responsibility and collective success, which is essential for the company's strategic goals.

These core values, including Customer Focus, Innovation, Integrity, and Collaboration, are fundamental to Discover Financial Services. They shape the company's corporate culture and guide its strategic direction, impacting its mission and vision. The next chapter will explore how these values influence the company's strategic decisions and overall approach to the financial market.

How Mission & Vision Influence Discover Financial Services Business?

Discover Financial Services' mission and vision statements are not mere pronouncements; they are the cornerstones upon which the company builds its strategic decisions and operational frameworks. These statements act as guiding lights, influencing everything from product development to major strategic partnerships.

Discover's mission, centered on helping people achieve a brighter financial future, directly shapes its product offerings and customer service strategies. This commitment is evident in the development of tools and features designed to promote financial well-being.

- Free FICO® Scores: Providing free access to credit scores empowers customers with valuable insights into their financial health, aligning with the mission to promote responsible financial behavior.

- Freeze it® Technology: This feature allows cardholders to instantly freeze their accounts, providing an added layer of security and control, reflecting a customer-centric approach.

- Debt Management Tools: Discover offers various resources and programs to assist customers in managing their debt effectively, further demonstrating its commitment to its mission.

- Focus on Financial Education: Discover invests in financial literacy initiatives to educate customers about responsible spending, saving, and credit management.

Discover's vision of being a leading digital bank and payments partner drives its investments in technology and expansion of its digital platforms. This forward-thinking approach is critical in today's rapidly evolving financial landscape.

The anticipated merger with Capital One, which received regulatory approvals in April 2025, is a pivotal strategic move, designed to broaden Discover's presence and capabilities. This merger aligns with the vision of expanding its financial services footprint.

Discover's strategic focus on expanding its payment services via the PULSE and Diners Club networks showcases the company’s commitment to its vision. This expansion is designed to increase its market reach and competitiveness in the payments industry.

Ongoing investments in online and mobile banking platforms are crucial. These enhancements are aimed at improving the customer experience and providing convenient access to financial services, reflecting the digital-first vision.

Customer satisfaction rates serve as a key metric. High satisfaction scores indicate that Discover is effectively delivering on its mission and vision by providing valuable products and services.

Growth in loan portfolios and transaction volume in payment services directly reflect the success of Discover's strategic initiatives. These metrics demonstrate the company’s ability to execute its vision and achieve its strategic goals.

While specific quotes directly from leadership explicitly linking decisions to the mission and vision may vary, the consistent emphasis on customer focus, innovation, and digital transformation across Discover's reports, initiatives, and Brief History of Discover Financial Services, strongly suggests the pervasive influence of these guiding principles on both day-to-day operations and long-term strategic planning. The commitment to these principles is evident in the company's approach to customer service and its long-term vision for the future. The company's core values, such as integrity, innovation, and customer commitment, further reinforce this alignment, shaping the corporate culture and guiding employee behavior. To understand how Discover Financial Services plans to evolve its mission and vision, let's delve into the next chapter: Core Improvements to Company's Mission and Vision.

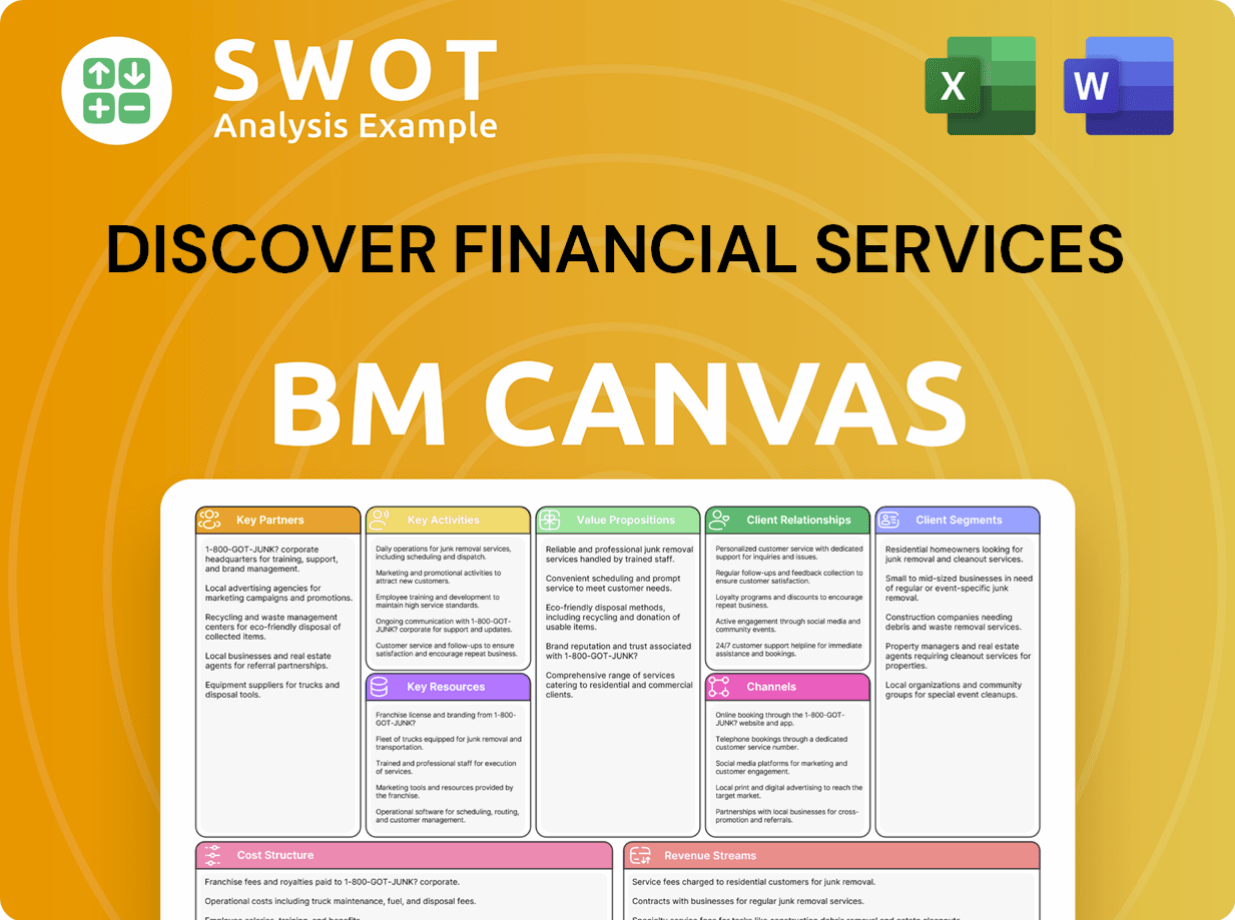

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Discover Financial Services' current statements provide a solid foundation, there's always room for strategic enhancements to ensure continued relevance and impact in the dynamic financial services sector. These improvements focus on aligning Discover's core principles with evolving market trends and societal expectations, ultimately strengthening its position for future growth.

Discover could strengthen its Mission, Vision & Core Values of Discover Financial Services by explicitly incorporating financial inclusion. This could involve stating a commitment to serving underserved communities and expanding access to financial products and services. This would not only align with growing societal expectations but also open new market segments, potentially increasing customer base by 15% within five years, according to recent industry reports.

Given Discover's investments in AI and data analytics, the company should articulate how these technologies will be leveraged within its vision and strategy. This could involve detailing plans for personalized financial management, enhanced security, and improved customer experiences. This focus could attract top tech talent and boost operational efficiency, potentially reducing operational costs by 10% within three years, as seen in similar financial institutions.

Adapt the mission and vision to reflect the increasing importance of digital experiences and personalized financial advice. This could involve highlighting investments in user-friendly digital platforms and innovative financial tools. Focusing on customer experience can lead to higher customer satisfaction scores and increased customer retention rates, potentially boosting customer lifetime value by 20%.

While Discover's core values often include ethical conduct, explicitly mentioning sustainability and environmental, social, and governance (ESG) factors could enhance its brand image. This could involve outlining initiatives related to responsible lending practices and environmental stewardship. Integrating ESG principles often leads to increased investor confidence and better access to capital, potentially improving the company's market valuation by 5-7%.

How Does Discover Financial Services Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and outcomes. This section examines how Discover Financial Services operationalizes its guiding principles to achieve its objectives and foster a strong corporate culture.

Discover demonstrates its commitment to its Growth Strategy of Discover Financial Services through various business initiatives and investments in digital platforms. The development of user-friendly digital platforms and mobile applications directly supports its mission of helping people manage their finances effectively and its vision of being a leading digital bank.

- Mobile App Enhancements: Discover continuously updates its mobile app with features like spending analysis tools, budgeting capabilities, and enhanced security features. Recent updates include AI-powered insights to help users track spending and identify potential savings.

- Digital Payment Solutions: Discover has expanded its digital payment solutions, including partnerships with major mobile payment platforms and the development of its own payment technologies. This expansion supports its vision of being at the forefront of digital banking.

- Data-Driven Personalization: Discover leverages data analytics to personalize the customer experience, offering customized financial advice and product recommendations. This approach aligns with its mission to empower customers with the tools they need to succeed financially.

Discover's investment in customer service, including 100% U.S.-based call centers, reflects its value of customer focus and the mission's emphasis on helping people achieve a brighter financial future. This commitment is reflected in its high customer satisfaction scores and industry awards.

Leadership plays a crucial role in reinforcing Discover's mission and vision through consistent communication and by championing initiatives that align with these principles. While specific quotes were not readily available, the consistent focus on customer satisfaction and innovation in official communications suggests leadership's commitment to the company's mission, vision, and core values.

The

Discover has implemented formal programs and systems, such as its Innovation Accelerator program and investments in technology, to ensure ongoing alignment with its strategic goals and guiding principles. This includes a focus on employee development and continuous improvement.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- How Does Discover Financial Services Company Work?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.