Discover Financial Services Bundle

How Does Discover Financial Services Thrive in the Financial World?

Discover Financial Services, a major player in the digital banking and payments sector, offers a wide array of financial products. From the popular Discover credit card to personal and student loans, Discover has established itself as a versatile financial institution. Its global reach, facilitated by the Discover Global Network, impacts transactions worldwide, making it a key entity to understand.

This analysis will explore the inner workings of Discover, including its revenue streams and strategic positioning within the competitive financial landscape. Understanding the Discover Financial Services SWOT Analysis can provide critical insights into its strengths, weaknesses, opportunities, and threats. Whether you're interested in the Discover credit card application process, the Discover rewards program details, or simply how Discover makes money, this exploration is designed to provide a comprehensive understanding of this financial powerhouse, including details about Discover banking and the Discover network.

What Are the Key Operations Driving Discover Financial Services’s Success?

Discover Financial Services operates as both a direct banking institution and a global payments network. This dual role allows it to offer a variety of financial products and services directly to consumers, as well as facilitate transactions for merchants and other financial institutions. Its core offerings include credit cards, personal loans, student loans, and deposit accounts.

The company's value proposition centers on providing accessible and competitive financial products, coupled with a robust payment network. This integrated model enables Discover to control the customer experience and offer unique benefits, such as rewards programs and tailored solutions. The company's operational model emphasizes digital platforms for efficiency and cost-effectiveness.

Discover leverages technology, risk management, and customer service to deliver its services effectively. The company's payment network, which includes Discover Network, PULSE, and Diners Club International, processes billions of transactions annually. This integrated approach allows for greater control over the customer experience, pricing, and data analytics.

Discover issues its own credit cards and manages its own payment network, giving it greater control over the customer experience. This includes credit scoring, fraud detection, and transaction processing. The Discover Card offers various benefits, including rewards programs and security features.

Discover provides a range of banking products, including deposit accounts and loans. These products are offered through digital platforms, streamlining operations. The company's digital-first approach reduces overhead compared to traditional banks.

The Discover network is a key component of Discover's operations, processing billions of transactions annually. In 2023, payment services volume reached $511.4 billion, a 6% increase from the prior year. This network includes Discover Network, PULSE, and Diners Club International.

Discover's integrated model, where it issues its own credit cards and operates its own payment network, provides a competitive edge. This allows for greater control over the customer experience. For more details, you can read about Owners & Shareholders of Discover Financial Services.

Discover's operations are characterized by digital platforms, robust risk management, and extensive customer service. The company focuses on data security, network uptime, and efficient processing. Partnerships are crucial for expanding the acceptance of Discover cards.

- Digital-first approach for banking products.

- Sophisticated algorithms for credit scoring and fraud detection.

- Secure and scalable IT infrastructure for the payment network.

- Integrated business model for competitive advantages.

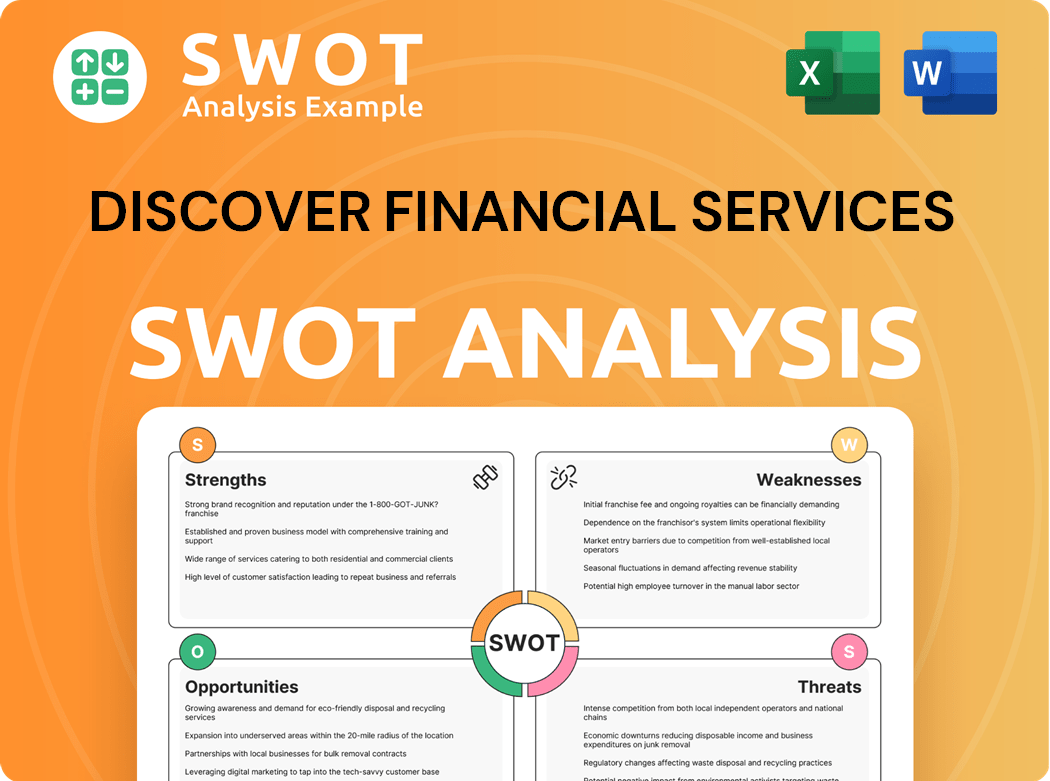

Discover Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Discover Financial Services Make Money?

Discover Financial Services generates revenue through a multifaceted approach, primarily focusing on lending activities and payment services. Its financial performance is significantly influenced by net interest income derived from its loan portfolio, which includes credit cards, personal loans, and student loans. This income stream is the difference between the interest earned on loans and the interest paid on deposits and borrowings.

In addition to net interest income, Discover earns revenue through various fees associated with its products and services. These include fees from its payment services, such as discount and interchange fees charged to merchants for processing transactions on the Discover Global Network. Other fee income sources include credit card fees, loan origination fees, and other service charges, contributing to the company's overall revenue.

The company's monetization strategies are centered on leveraging its integrated banking and payments ecosystem to maximize value. This involves offering competitive rewards programs on its credit cards to attract and retain cardholders, thereby increasing transaction volume and interchange revenue. Tiered pricing for lending products, based on creditworthiness, helps manage risk and optimize interest income.

The primary revenue stream for Discover Financial Services is net interest income, which reached $3.67 billion in the first quarter of 2024. This is complemented by fee-based income from its payment services and other financial products. Discover's strategies focus on growing its lending portfolio and expanding its global payments network.

- Net Interest Income: The largest revenue component, derived from the interest earned on loans (credit cards, personal loans, student loans) minus the interest paid on deposits and borrowings.

- Payment Services: Revenue from the Discover Network, PULSE, and Diners Club International, including interchange fees charged to merchants.

- Credit Card Fees: Includes annual fees, late payment fees, and other charges associated with credit card usage.

- Loan Origination Fees: Fees charged when loans are issued, contributing to overall fee income.

- Cross-Selling: Offering loan products to deposit customers and vice versa to leverage existing customer relationships and expand revenue streams.

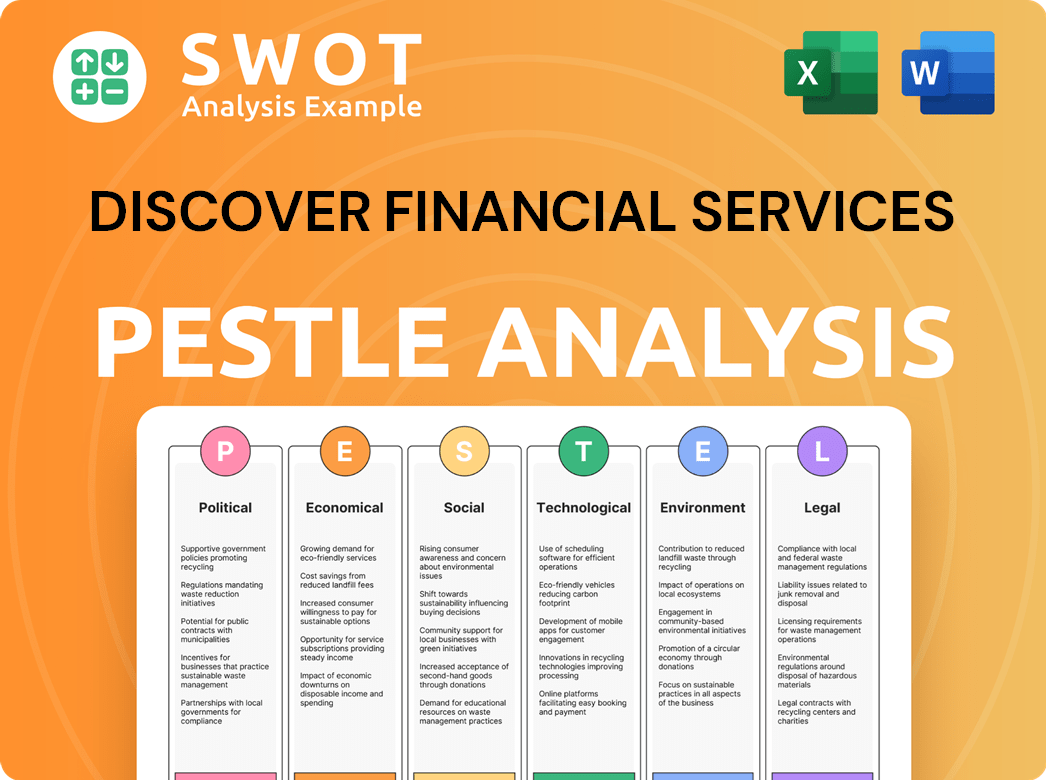

Discover Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Discover Financial Services’s Business Model?

The evolution of Discover Financial Services has been shaped by pivotal milestones, strategic initiatives, and its ability to maintain a competitive edge in the financial services industry. A significant turning point was its spin-off from Morgan Stanley in 2007, which enabled it to operate independently and focus on its core banking and payments businesses. This strategic shift allowed Discover to build its brand and expand its services, setting the stage for future growth.

Discover's strategic moves include the acquisition of The Student Loan Corporation in 2010, which strengthened its presence in the student loan market. The company has consistently expanded the Discover Global Network, including merchant acceptance and international alliances for Diners Club International and PULSE. These efforts have broadened its reach and transaction volume. Discover has also navigated operational challenges, such as economic downturns and evolving regulatory landscapes, adapting its strategies to maintain stability and compliance.

Discover's competitive advantages stem from its integrated business model, brand strength, and economies of scale. The company continues to adapt to new trends by investing in digital transformation, enhancing its mobile banking capabilities, and exploring new payment technologies. This proactive approach ensures Discover remains competitive in a rapidly evolving financial landscape. For more insights into the competitive environment, consider exploring the Competitors Landscape of Discover Financial Services.

The spin-off from Morgan Stanley in 2007 marked a pivotal moment, allowing Discover to operate independently. The acquisition of The Student Loan Corporation in 2010 expanded its market presence. Continuous expansion of the Discover Global Network, including merchant acceptance and international alliances, has been a strategic priority.

Discover has focused on expanding its global reach, with its network now reaching over 200 countries and territories. The company has invested in digital transformation to enhance its mobile banking capabilities. Adapting to regulatory changes and economic conditions has been crucial for maintaining compliance and financial health.

Discover's integrated business model, where it issues its own cards and operates its own payment network, provides a unique advantage. The brand strength, built over decades, contributes to customer loyalty. Economies of scale in digital banking and payment processing provide cost efficiencies.

Navigating economic downturns and adapting to evolving regulatory landscapes are ongoing challenges. Discover faced compliance issues, leading to a deferred prosecution agreement and a significant financial penalty in 2024. The company has responded by tightening underwriting standards during periods of economic uncertainty and investing in compliance infrastructure.

In 2024, Discover faced a deferred prosecution agreement and a financial penalty due to compliance issues. The company's net revenue for the first quarter of 2024 was approximately $3.96 billion. Discover's total loans reached approximately $105.4 billion as of the end of Q1 2024.

- Discover's credit card segment saw a total of $90.9 billion in loans outstanding as of Q1 2024.

- The Discover Global Network processed over $150 billion in transactions in 2023.

- The company's net charge-off rate for credit card loans was 3.57% in Q1 2024.

- Discover's digital banking operations continue to grow, with increased mobile banking usage.

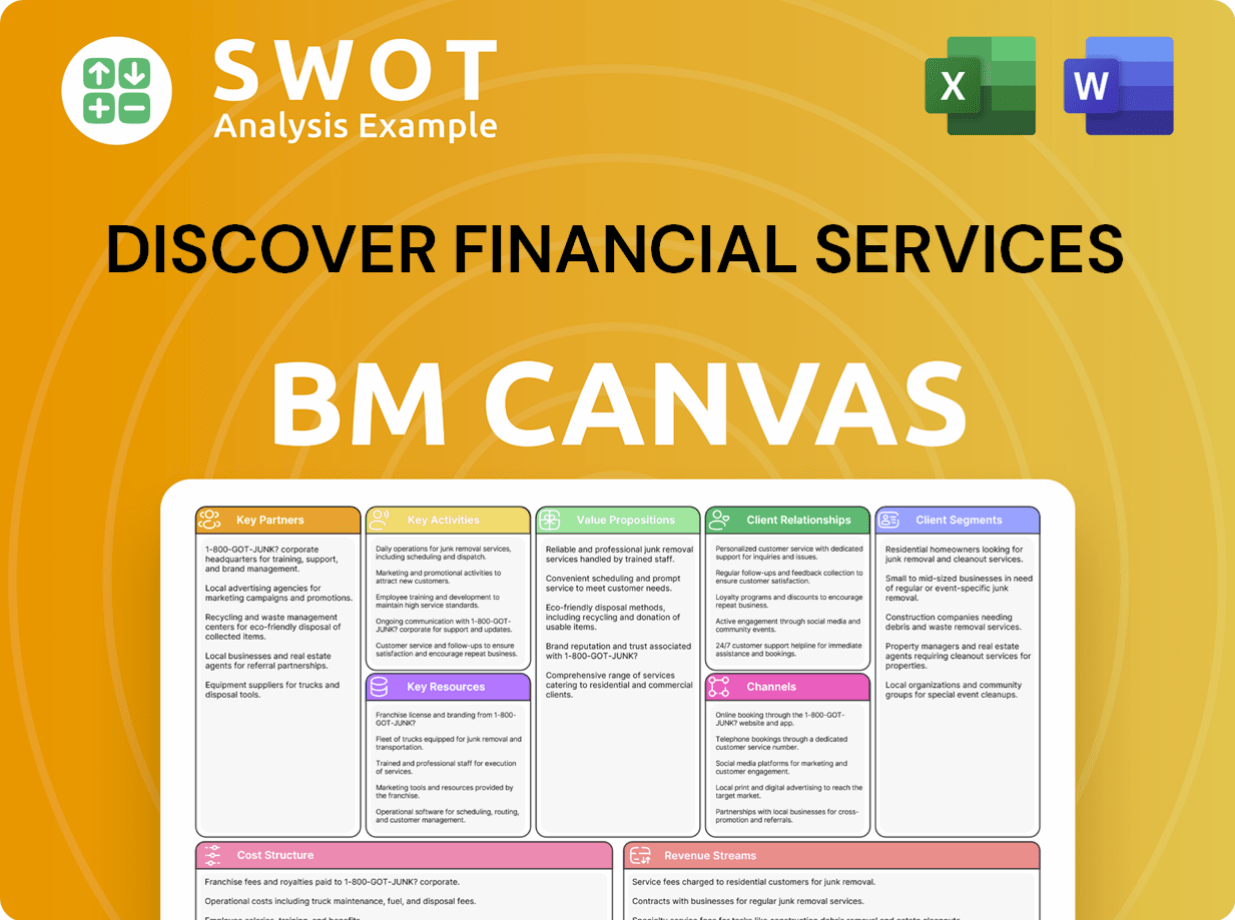

Discover Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Discover Financial Services Positioning Itself for Continued Success?

Discover Financial Services holds a prominent position in the U.S. credit card market and operates a global payments network. While not the largest issuer, it maintains a strong presence, recognized for its customer service and rewards programs. The Discover Global Network gives it a unique advantage, setting it apart from issuers relying on third-party networks. The company competes with major financial institutions and payment networks.

However, Discover faces several risks, including regulatory changes affecting consumer lending and data privacy. Scrutiny of interchange fees could impact revenue. Competition from fintech startups and economic downturns, coupled with rising interest rates, can lead to increased loan defaults and reduced consumer spending. For instance, in early 2024, Discover increased its provision for credit losses, reflecting a more cautious outlook on credit quality.

Discover is a significant player in the U.S. credit card market, known for the Growth Strategy of Discover Financial Services. It competes with major banks and payment networks. The Discover Global Network offers a competitive edge.

Regulatory changes, competition, and economic conditions pose challenges. Increased credit loss provisions in early 2024 indicate potential financial strain. Rising interest rates and economic downturns impact loan defaults.

Discover focuses on digital capabilities, expanding its network, and exploring new products. The company aims to grow its loan portfolio and network reach. Success depends on adapting to regulatory and technological changes.

Investments in digital enhancements are ongoing to improve customer experience. The company is expanding merchant acceptance for the Discover Global Network. Focus is on responsible growth and maintaining credit quality.

Discover's future depends on navigating regulatory challenges and adapting to technological advancements. The company’s ability to compete for consumer loyalty in a dynamic financial landscape is crucial. The goal is to expand its loan portfolio and grow its payment network.

- Regulatory Compliance: Navigating evolving regulations regarding consumer lending and data privacy.

- Technological Adaptation: Investing in digital capabilities to enhance customer experience and operational efficiency.

- Market Competition: Effectively competing with fintech startups and established financial institutions.

- Economic Factors: Managing risks associated with economic downturns and rising interest rates.

Discover Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Discover Financial Services Company?

- What is Competitive Landscape of Discover Financial Services Company?

- What is Growth Strategy and Future Prospects of Discover Financial Services Company?

- What is Sales and Marketing Strategy of Discover Financial Services Company?

- What is Brief History of Discover Financial Services Company?

- Who Owns Discover Financial Services Company?

- What is Customer Demographics and Target Market of Discover Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.