Great Panther Bundle

What Went Wrong at Great Panther Mining?

Great Panther Mining, a name synonymous with gold and silver, once glittered brightly in the mining world. Founded in 1965, this Great Panther SWOT Analysis unveils a story of ambition, strategic shifts, and ultimately, bankruptcy in 2023. From emerald prospecting to gold production, its journey is a fascinating case study.

Delving into the brief history of Great Panther Company reveals a mining company that navigated the volatile landscape of the precious metals industry. The company's transformation, from its initial exploration ventures to its eventual focus on gold mining, highlights the strategic decisions and operational challenges it faced. Understanding the Great Panther Mining Company history provides valuable insights into the factors that contributed to its rise and, ultimately, its downfall.

What is the Great Panther Founding Story?

The story of the Great Panther Company, now known as Great Panther Mining Limited, began in 1965. Initially, it was a private company called Lodestar Mines Ltd., based in Vancouver, Canada. Their early focus was on prospecting for emeralds in Zimbabwe.

The company later transitioned significantly. A key turning point came in 2005-2006 when Robert Archer became CEO. He spearheaded the acquisition and restart of dormant silver-gold mines in Mexico, marking a strategic shift towards precious metals.

The company's evolution included name changes, reflecting its growth and focus. It was formerly known as Great Panther Silver Ltd. and Great Panther Resources Ltd. before becoming Great Panther Mining Limited in March 2019.

The business model centered on quickly reviving past-producing mines.

- This approach aimed to generate cash flow for further expansion.

- The goal was to fund exploration, development, and acquisitions.

- This strategy helped navigate the volatility of metal prices.

A prime example of this strategy was the acquisition of the Guanajuato Mine Complex and the Topia Mine in Mexico in 2005. Both were brought back into production. By 2006, these mines were already producing significant quantities of zinc, lead, silver, and gold.

For more details on the company's operational history, you can consult resources that provide a comprehensive overview of Great Panther Mining Company history.

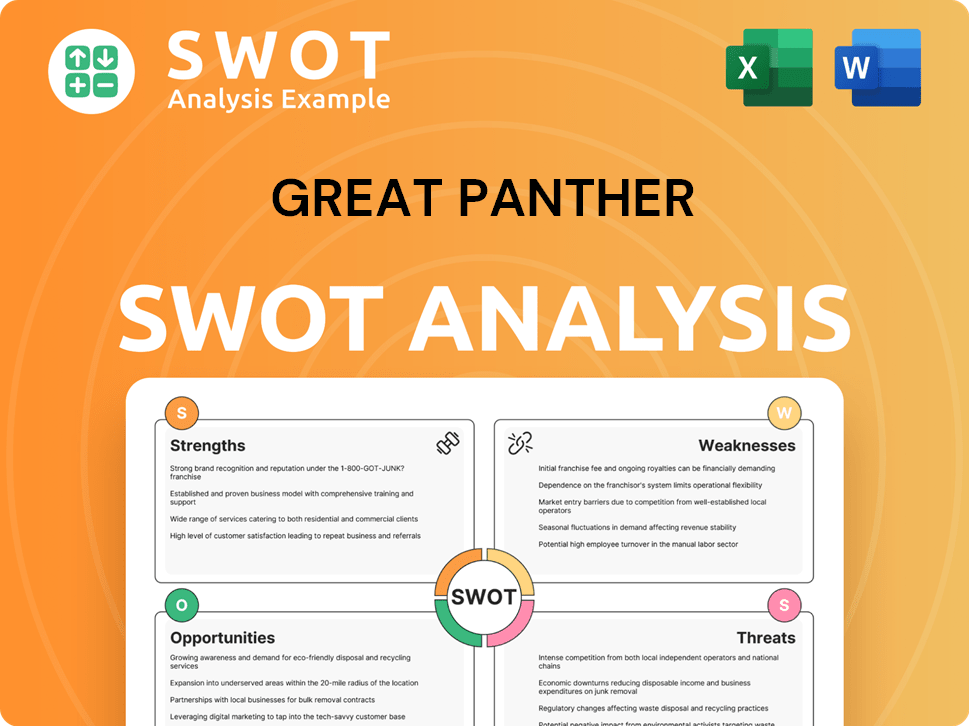

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Great Panther?

The early growth and expansion of Great Panther Mining, a mining company, were marked by a strategic focus on re-activating past-producing mines. This approach, initiated in the mid-2000s, fueled significant production increases. The company's success led to its listing on the Toronto Stock Exchange in 2006 and later on the NYSE Amex Equities Exchange.

Following the reactivation of the Guanajuato Mine Complex and Topia Mine in Mexico in 2006, Great Panther Mining experienced continuous production growth. By 2009, the company's silver equivalent ounces reached 2.2 million, demonstrating a growth rate exceeding 20% annually. This initial success was a key factor in the company's early expansion.

In 2010, the company changed its name to Great Panther Silver to reflect its primary focus. The company strategically acquired mineral interests, including the El Horcon silver-gold project and the Coricancha gold-silver project. These acquisitions were part of a broader strategy to refurbish and optimize past-producing mines.

A significant expansion occurred in early 2019 with the acquisition of Beadell Resources, which included the Tucano Gold Mine in Brazil. This move marked a shift towards gold production, aiming to establish Great Panther as a mid-sized gold producer. In 2020, the Tucano gold asset alone produced 125,000 ounces.

Despite the growth, challenges emerged, including a reported 51% reduction in mineral resources at the Tucano gold mine in 2020. The company's financial performance and operational strategies were impacted by these challenges, requiring adjustments to maintain production levels and profitability. The company's stock performance reflected these operational difficulties.

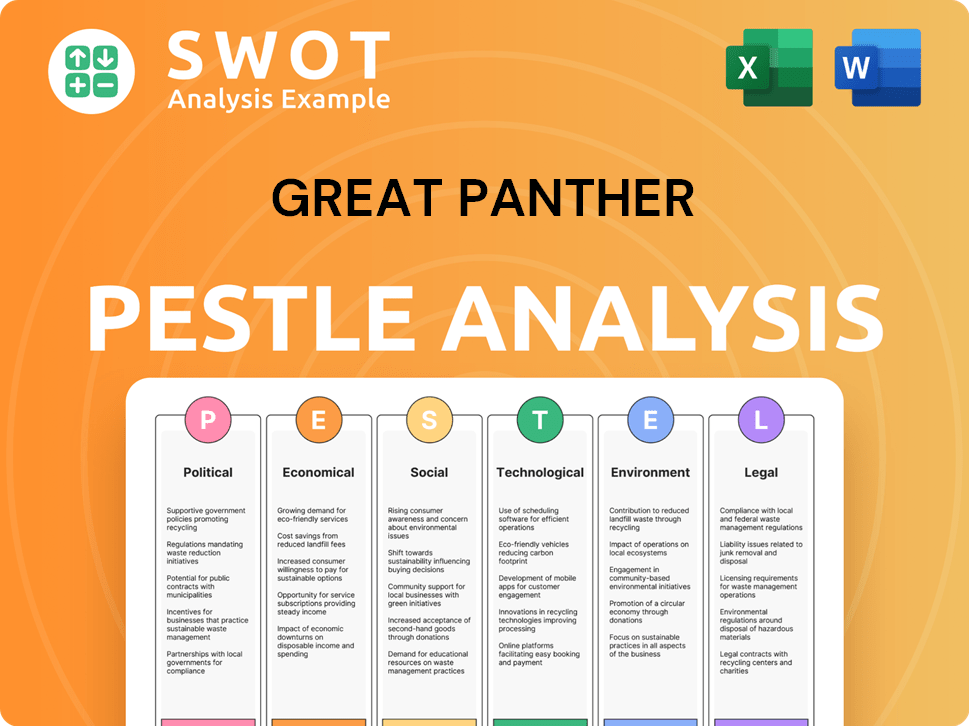

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Great Panther history?

The Great Panther Company, a prominent player in the precious metals sector, experienced a journey marked by significant milestones, strategic innovations, and considerable challenges. The

| Year | Milestone |

|---|---|

| 2006 | Listing on the Toronto Stock Exchange marked a key milestone for the company. |

| 2011 | Cross-listing on the NYSE Amex Equities Exchange expanded its investor base. |

| 2005 | Acquisition and re-commissioning of the Guanajuato Mine Complex and Topia Mine in Mexico. |

| 2009 | Achieved continuous production growth exceeding 20% annually, reaching 2.2 million silver equivalent ounces. |

| 2022 | Sold its Mexican mining assets to Guanajuato Silver Company Ltd. |

| 2022 | Filed for creditor protection in September and delisted from the Toronto Stock Exchange and NYSE American in October. |

| 2022 | Made a voluntary assignment into bankruptcy under the Bankruptcy and Insolvency Act (Canada) on December 16. |

A core innovation for

The acquisition and re-commissioning of dormant mines, such as the Guanajuato Mine Complex and Topia Mine in Mexico, formed a key part of the company's business model. This strategy allowed for rapid production growth and expansion into new markets.

By 2009, Great Panther had achieved continuous production growth exceeding 20% annually. The company reached 2.2 million silver equivalent ounces, showcasing its operational capabilities.

In its later years, the

Operational issues, including wall movements at the Urucum Central South Pit at the Tucano mine in Brazil, significantly impacted production. Delays in contractor mobilization due to equipment availability further increased costs.

In 2021, the company reported consolidated metal production of 105,006 gold equivalent ounces, but faced lower production and higher costs. Mounting difficulties and liquidity constraints led to strategic shifts.

Permitting delays for tailings storage expansion at the Guanajuato Mine Complex in Mexico presented a risk of halting milling operations. This added to the operational and financial pressures faced by the company.

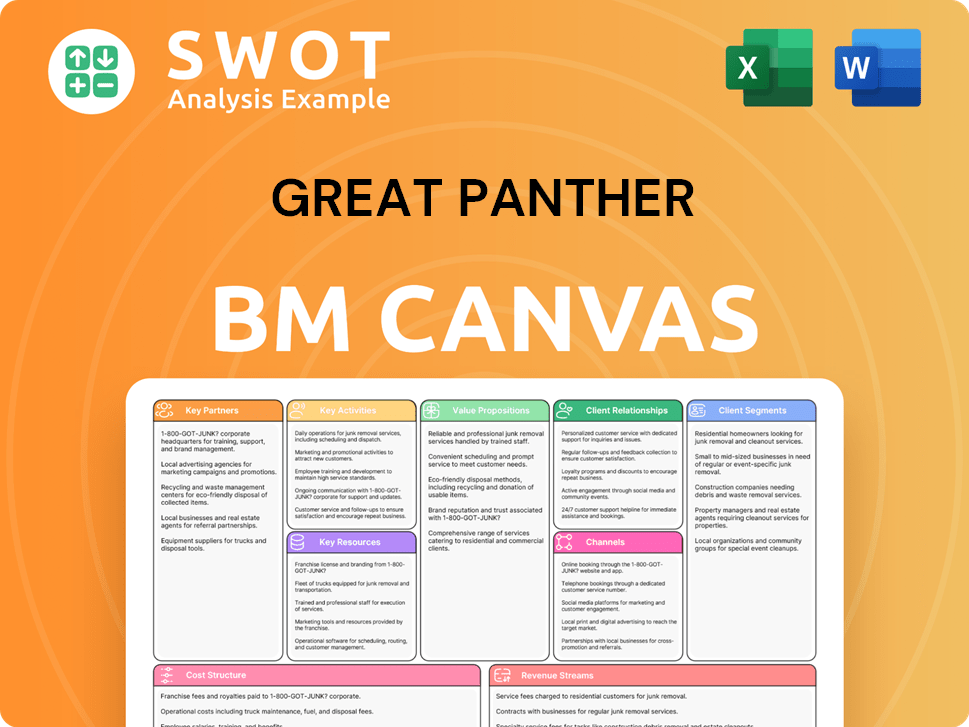

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Great Panther?

The Great Panther Mining Company history is a story of acquisitions, expansions, and ultimately, bankruptcy. The company, initially founded in 1965, navigated the mining industry for several decades, undergoing name changes and shifts in focus. Its journey included significant acquisitions of mining assets, particularly in Mexico and Brazil, before facing financial difficulties that led to its insolvency in 2023.

| Year | Key Event |

|---|---|

| 1965 | Founded as Lodestar Mines Ltd. in Vancouver, Canada. |

| 1980 | Became a public company, Lodestar Energy Inc., listed on the Vancouver Stock Exchange. |

| 2003-2004 | Reorganized as Great Panther Resources Limited, focusing on mineral rights in Mexico. |

| 2005 | Acquired the Guanajuato Mine Complex and the Topia Mine in Mexico, resuming production. |

| 2006 | Listed on the Toronto Stock Exchange as a metal producer. |

| 2010 | Company name changed to Great Panther Silver. |

| 2011 | Stock cross-listed on the NYSE Amex Equities Exchange. |

| June 2017 | Acquired the Coricancha gold-silver project in Peru. |

| March 2019 | Acquired Beadell Resources, including the Tucano Gold Mine in Brazil, and changed its name to Great Panther Mining Limited. |

| 2020 | Reported a 51% reduction of mineral resources at the Tucano gold mine. |

| May 2021 | Wall movements detected at the UCS pit at Tucano, temporarily halting mining. |

| June 2022 | Announced sale of Mexican mining assets (Guanajuato Mine Complex and Topia Mine) for US$14.7 million. |

| September 2022 | Filed for creditor protection in Canada and commenced judicial reorganization proceedings in Brazil, leading to delisting from TSX and NYSE American. |

| December 16, 2022 | Made a voluntary assignment into bankruptcy under the Bankruptcy and Insolvency Act (Canada). |

| October 2023 | Sale of Brazilian subsidiaries, Mina Tucano and Tucano Resources, to Pilar Gold's investment vehicle, Tucano Gold, completed. |

The Great Panther Mining, once a significant player in the gold mining and silver mining sectors, no longer operates as an independent entity. The company's assets have been liquidated following its bankruptcy in 2023. The sale of its assets marked the end of its operations.

Despite the demise of Great Panther Mining, the broader mineral market continues to show promise. The global mineral market was valued at US$1094.23 billion in 2024. It is expected to reach US$1161.84 billion in 2025, with a CAGR of 6.2%.

The growth in the mineral market is fueled by industrialization and infrastructure development. The increasing demand from sectors like electric vehicles, which require significant amounts of minerals such as lithium, cobalt, and nickel, also plays a crucial role. These factors contribute to the overall expansion of the market.

The Great Panther Mining Company history serves as a reminder of the risks inherent in the mining industry. The company's journey, marked by acquisitions and expansions, highlights the importance of financial stability and effective risk management. The company's bankruptcy underscores the challenges within the gold mining and silver mining sectors.

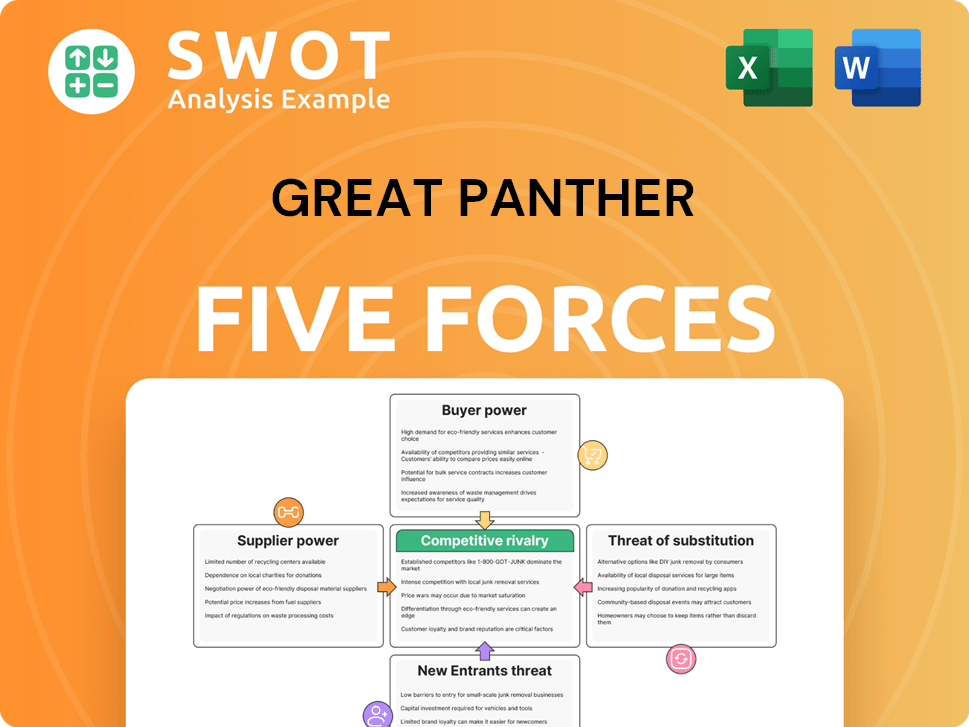

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- How Does Great Panther Company Work?

- What is Sales and Marketing Strategy of Great Panther Company?

- What is Brief History of Great Panther Company?

- Who Owns Great Panther Company?

- What is Customer Demographics and Target Market of Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.