Great Panther Bundle

What Went Wrong at Great Panther Company?

The story of Great Panther Mining Limited, a once-promising Great Panther SWOT Analysis, serves as a cautionary tale for investors and industry professionals alike. This Great Panther SWOT Analysis, a significant player in the precious metals sector, ultimately faced bankruptcy in 2023. Understanding the rise and fall of this Great Panther SWOT Analysis company is crucial for anyone seeking to navigate the volatile world of gold mining.

Delving into the operational model of Great Panther Gold, from its focus on the Tucano Gold Mine to its exploration projects, reveals the complex factors that determine success or failure in the mining industry. This analysis of the Great Panther SWOT Analysis provides valuable insights into the challenges faced by mining companies and the importance of financial stability. Examining the Great Panther SWOT Analysis will help investors and analysts understand the dynamics of Great Panther SWOT Analysis and make informed decisions about the Great Panther SWOT Analysis and the precious metals market.

What Are the Key Operations Driving Great Panther’s Success?

The core operations of Great Panther Mining Limited, often referred to as Great Panther Gold, centered around the extraction and processing of precious metals. Their primary focus was on gold and silver, with the Tucano Gold Mine in Brazil serving as a key asset. This mine was central to their value proposition, converting mineral reserves into marketable gold for the global precious metals market.

Great Panther's operational processes involved traditional hard rock mining methods. These included drilling, blasting, and hauling ore. The ore then underwent processing through crushing, grinding, and leaching to extract the gold. The company aimed to create value by efficiently managing these processes, ensuring a consistent supply of precious metals.

The company's value proposition was to provide a tangible asset for investment and industrial use. Great Panther's operational efficiency and specific geological assets were key differentiators compared to competitors. Their core capabilities were designed to translate into a consistent supply of precious metals for customers.

Great Panther's mining operations involved a series of steps from extraction to processing. The Tucano Gold Mine in Brazil was a significant part of their operations. These operations included drilling, blasting, hauling, crushing, and leaching.

The company aimed to create value by converting mineral reserves into saleable gold. This process involved efficient management of mining and processing activities. The goal was to provide a consistent supply of precious metals to the market.

Great Panther also engaged in exploration projects to expand its resource base. This strategy aimed to extend the operational lifespan of the company. The company's goal was to maintain and grow its precious metals production.

The supply chain included sourcing equipment, reagents, and labor. The distribution network focused on selling refined gold to bullion dealers and financial institutions. This ensured the precious metals reached the market.

Great Panther's core capabilities were focused on efficient mining and processing. They aimed to maintain competitive production costs. This allowed them to consistently supply precious metals to their customers.

- Efficient mining operations at the Tucano mine.

- Focus on gold and silver extraction.

- Exploration for resource expansion.

- Supply chain management for equipment and labor.

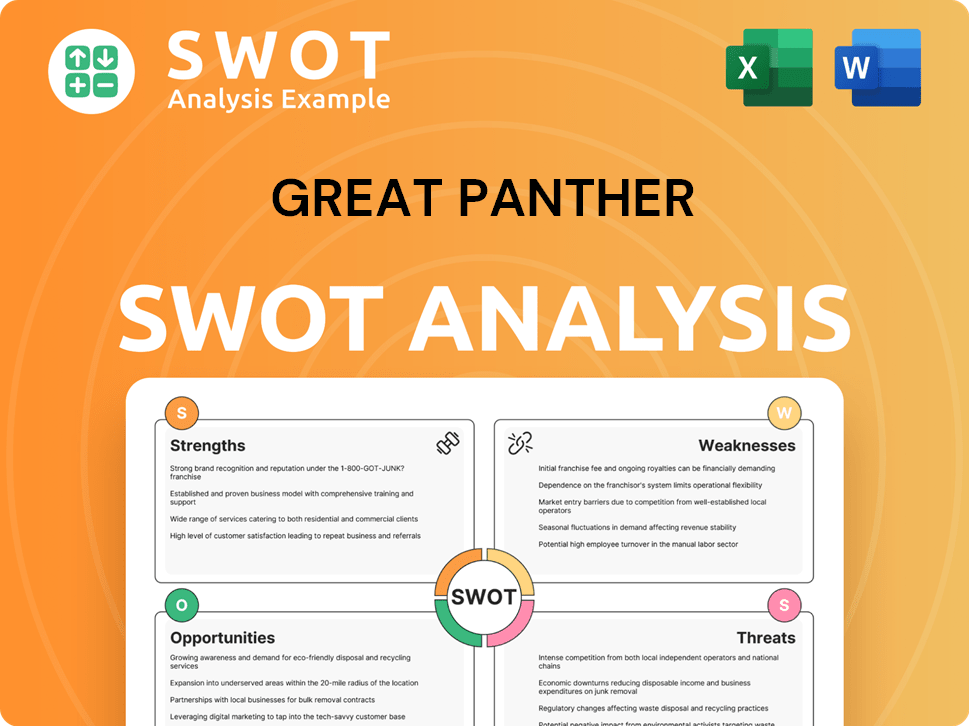

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Great Panther Make Money?

The primary revenue stream for Great Panther Company, formerly known as Great Panther Gold (GPL), was derived from the sale of gold. The company's monetization strategy was centered on extracting precious metals from its mining operations and selling them at prevailing market prices. This straightforward approach meant that financial performance was heavily reliant on gold production volume and market prices.

The shift in focus towards the Tucano Gold Mine significantly increased the contribution of gold sales to the company's total revenue. This strategic move streamlined operations and concentrated resources on its most valuable asset. Revenue fluctuations were primarily driven by the amount of gold produced and the fluctuating market price of gold.

Any innovative monetization strategies were limited within the traditional mining framework. The company's financial performance was directly tied to its production output and the global commodity markets. There would have been no significant regional differences in revenue mix, as the company's focus was largely on its Brazilian gold operations. Over time, the company's revenue sources narrowed as it divested from its silver operations to concentrate on gold, reflecting a strategic decision to streamline its portfolio and focus on its most significant asset.

Great Panther Company's revenue model was primarily based on gold sales, with monetization achieved through the extraction and sale of gold at market prices. The company's financial results were heavily influenced by gold production volume and market prices.

- Gold-Focused Strategy: The company's strategic shift to concentrate on the Tucano Gold Mine emphasized gold as its primary revenue source.

- Market Dependence: Revenue was highly sensitive to fluctuations in gold prices and the volume of gold produced.

- Streamlined Operations: Divestiture from silver operations allowed Great Panther Company to focus on its core gold assets.

- Limited Diversification: The traditional mining business model offered limited opportunities for innovative monetization strategies. For more details, you can refer to the Brief History of Great Panther.

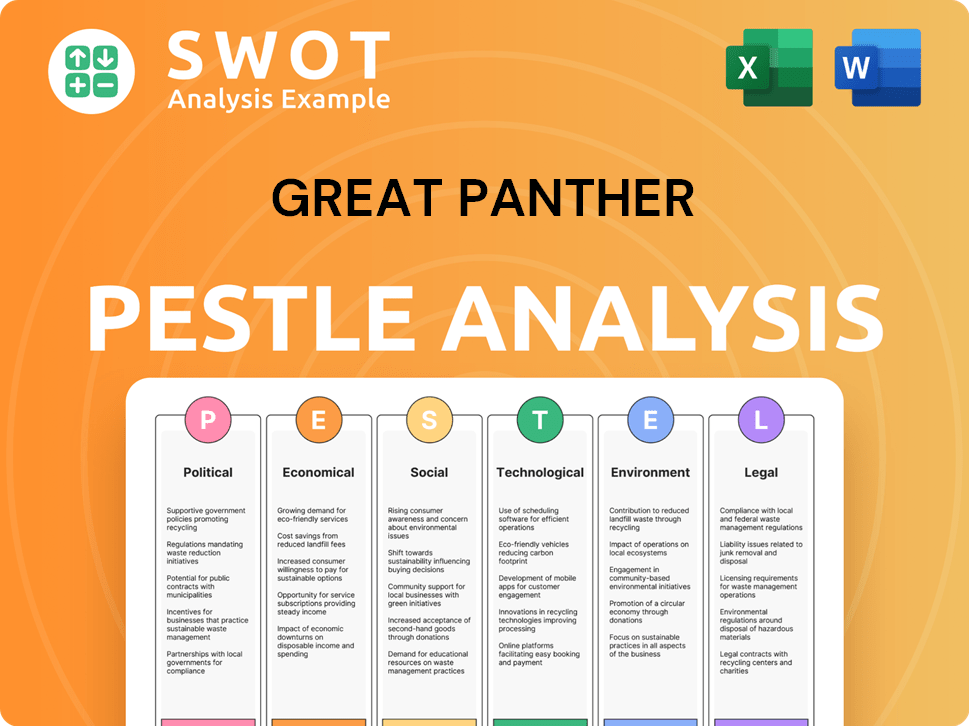

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Great Panther’s Business Model?

The story of Great Panther Company, formerly known as Great Panther Gold (GPL), showcases a journey marked by strategic pivots and operational hurdles. The company's path involved a series of key milestones, including significant acquisitions and shifts in its operational focus. Understanding these events provides insight into the challenges faced by the mining company.

A pivotal strategic move for Great Panther was the acquisition of the Tucano Gold Mine in Brazil. This marked a transition from a focus on silver and smaller gold operations to becoming a more significant gold producer. This shift aimed to boost its production profile and revenue base. However, the company encountered several obstacles that ultimately impacted its financial health and operational success.

The company’s competitive edge, if any, would have been tied to the geological characteristics and economic viability of its mineral deposits, along with its operational expertise. The ability to adapt to new trends and competitive threats would have been crucial. However, the challenges proved too significant, leading to its bankruptcy. For more details on the company's intended audience, you can read about the Target Market of Great Panther.

Great Panther Company experienced several key milestones that shaped its trajectory. The most significant was the acquisition of the Tucano Gold Mine in Brazil. This move aimed to enhance its production profile and provide a more substantial revenue base.

The acquisition of the Tucano Gold Mine was a strategic move to become a more dedicated gold producer. This included cost-cutting measures, efforts to optimize mine performance, and potentially seeking additional financing. These moves were crucial for the company's survival.

Great Panther's competitive advantages would have been primarily tied to the geological characteristics and economic viability of its mineral deposits, as well as its operational expertise in extracting those resources. Brand strength is less of a factor in the commodities market.

The company faced considerable operational and market challenges. These included fluctuations in gold prices, which directly impacted its profitability, as well as potential operational issues at the Tucano mine, such as production shortfalls, cost overruns, or environmental considerations.

Great Panther Gold struggled with fluctuating gold prices, which directly affected its profitability. The company also faced potential operational issues at the Tucano mine, including production shortfalls and cost overruns. These issues led to significant financial strain.

- Fluctuating Gold Prices: Gold price volatility impacted revenue. In 2024, gold prices have shown fluctuations, affecting mining companies.

- Production Shortfalls: Operational challenges at the Tucano mine led to production shortfalls, impacting revenue.

- Cost Overruns: Unexpected costs at the mine increased financial pressure.

- Bankruptcy: Ultimately, these challenges led to the company's bankruptcy.

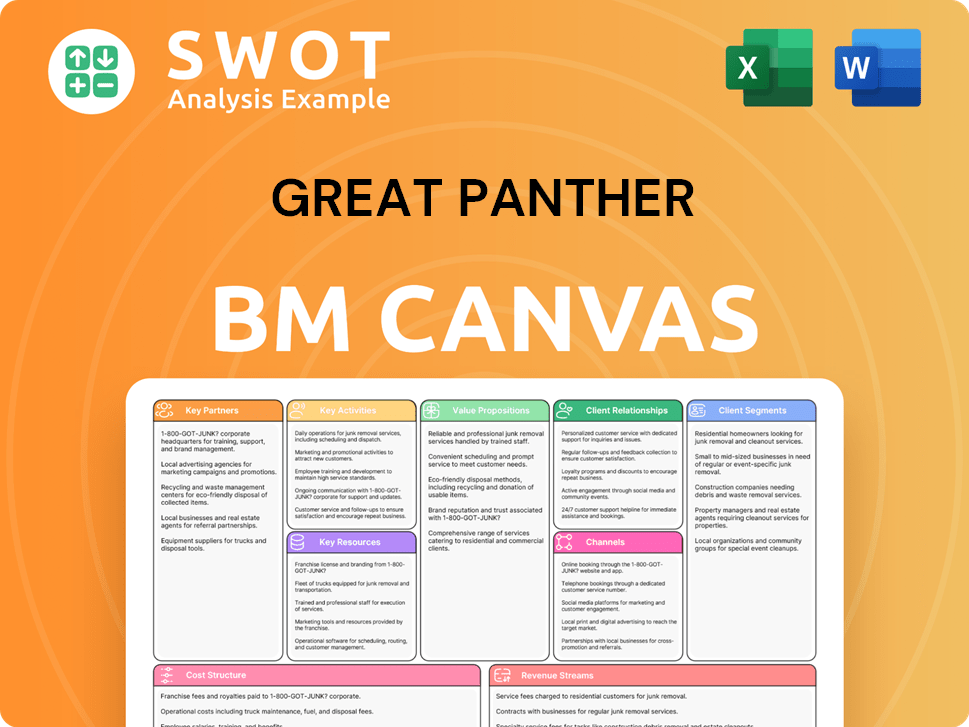

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Great Panther Positioning Itself for Continued Success?

Prior to its bankruptcy in 2023, Great Panther Mining Limited (referred to as Great Panther Company) operated within the precious metals sector. Primarily, it functioned as a mid-tier gold producer, with its main asset being the Tucano Gold Mine in Brazil. The company's market share was limited compared to larger global gold producers. Its customer base mainly consisted of bullion dealers and financial institutions. For anyone looking into 'Great Panther Gold,' it's crucial to understand its past operational scope.

The company's global presence was confined to its operations in Brazil and its exploration projects. Given its bankruptcy, the company's future outlook as an independent entity is nonexistent. Its assets would have been subject to liquidation or acquisition by other entities. This outcome reflects the failure to maintain or expand its ability to generate revenue. To learn more about its strategic approach, you can read about the Growth Strategy of Great Panther.

Great Panther Company, a 'mining company,' was positioned as a mid-tier gold producer. Its focus was on the Tucano Gold Mine in Brazil. Its market share was relatively small compared to major global gold producers.

Key risks included gold price volatility, operational issues at the Tucano mine, regulatory changes, and the capital-intensive nature of mining. The emergence of new competitors or technological disruptions could also be a threat. These factors significantly impacted Great Panther's ability to operate.

Given the bankruptcy in 2023, the future outlook for Great Panther Company as an independent entity is nonexistent. Its assets were subject to liquidation or acquisition. This outcome highlights the challenges faced by the company.

Operational risks at the Tucano mine, such as unexpected geological conditions and equipment failures, could disrupt production. Labor disputes and regulatory changes in Brazil also posed significant risks. These challenges could increase costs and affect profitability.

For anyone researching 'GPL stock' or 'Great Panther Gold,' it's vital to know the company's history and challenges. The company's financial performance was directly tied to gold prices and operational efficiency. The bankruptcy highlights the inherent risks in the gold mining industry.

- Gold price volatility directly impacted revenue.

- Operational disruptions at the Tucano mine affected production.

- Regulatory changes in Brazil posed risks.

- The capital-intensive nature of mining presented ongoing financial challenges.

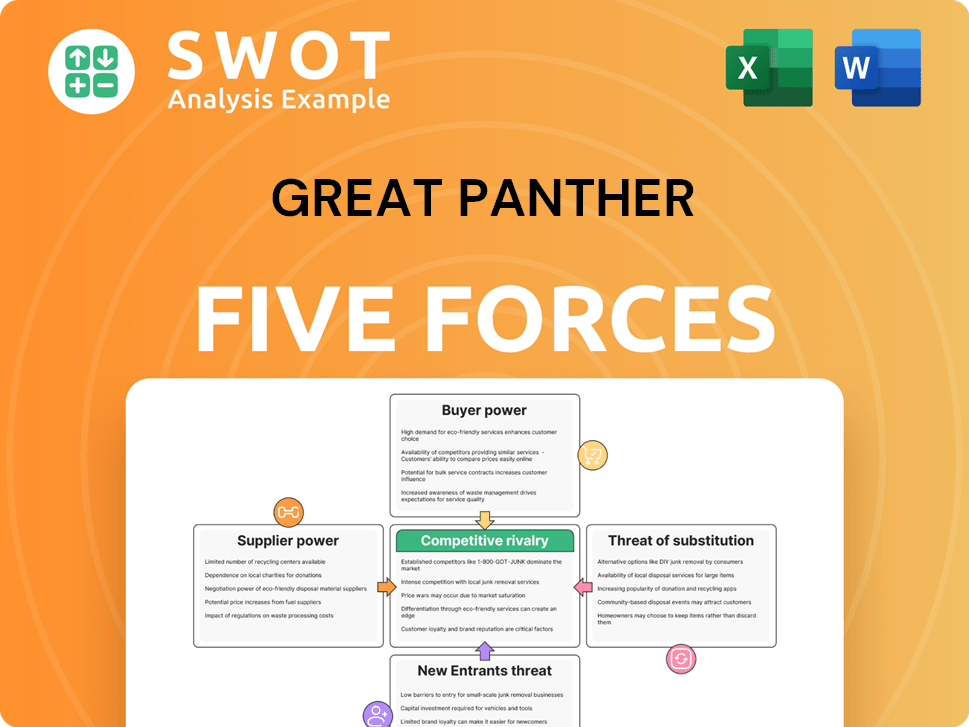

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Great Panther Company?

- What is Competitive Landscape of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- What is Sales and Marketing Strategy of Great Panther Company?

- What is Brief History of Great Panther Company?

- Who Owns Great Panther Company?

- What is Customer Demographics and Target Market of Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.