Great Panther Bundle

Who Really Controls Great Panther Mining After Bankruptcy?

Ever wondered about the hidden hands shaping the future of a mining giant? The story of Great Panther Mining, once a prominent player in the gold and silver sector, offers a compelling case study in corporate ownership. From its inception to its eventual bankruptcy in 2023, the company's ownership structure underwent a dramatic transformation, impacting everything from its strategic direction to its very survival.

The journey of Great Panther SWOT Analysis, a mining company, from its formation in 2004 to its eventual restructuring, reveals critical insights into the dynamics of mining company ownership. Understanding "Who owns mining companies" like Great Panther, and the impact of events like bankruptcy, is crucial for investors and analysts. This exploration will dissect the evolution of Great Panther Mining's ownership, examining the roles of key stakeholders and the implications of its financial distress, providing a comprehensive view of the company's lifecycle and the ultimate fate of its assets.

Who Founded Great Panther?

The detailed founding ownership structure of Great Panther Mining Limited, now known as Great Panther Company, isn't readily available in public records. Information primarily focuses on its public trading history rather than the private formative years. As a company founded in 2004, it initially operated privately.

Ownership in the early stages of a mining company like Great Panther Company typically involves founders with geological, engineering, or financial backgrounds. They contribute capital and expertise in exchange for equity. Early backers might have included angel investors, venture capitalists, or even friends and family who saw potential in the founders' vision for precious metals exploration and production.

These early agreements would have likely included vesting schedules, tying founders' equity to continued service, and potentially buy-sell clauses to manage ownership transitions. Any initial ownership disputes or buyouts would have occurred prior to the company's public listing, shaping the initial distribution of control and reflecting the founding team's vision for the company's strategic direction in the precious metals sector.

Founders often have backgrounds in geology, engineering, or finance.

Early investors may include angel investors or venture capitalists.

Agreements often include vesting schedules and buy-sell clauses.

Initially, the company operated privately before going public.

The founding team's vision influenced the company's strategic direction.

The company's focus was on precious metals exploration and production.

Understanding the early ownership of Great Panther Company, or Great Panther Mining, is crucial for grasping its evolution. While specific details on the initial equity split are not easily accessible, the general pattern for mining companies involves founders, early investors, and agreements that shape the company's direction. For more insights into the company's growth, you can explore the Growth Strategy of Great Panther.

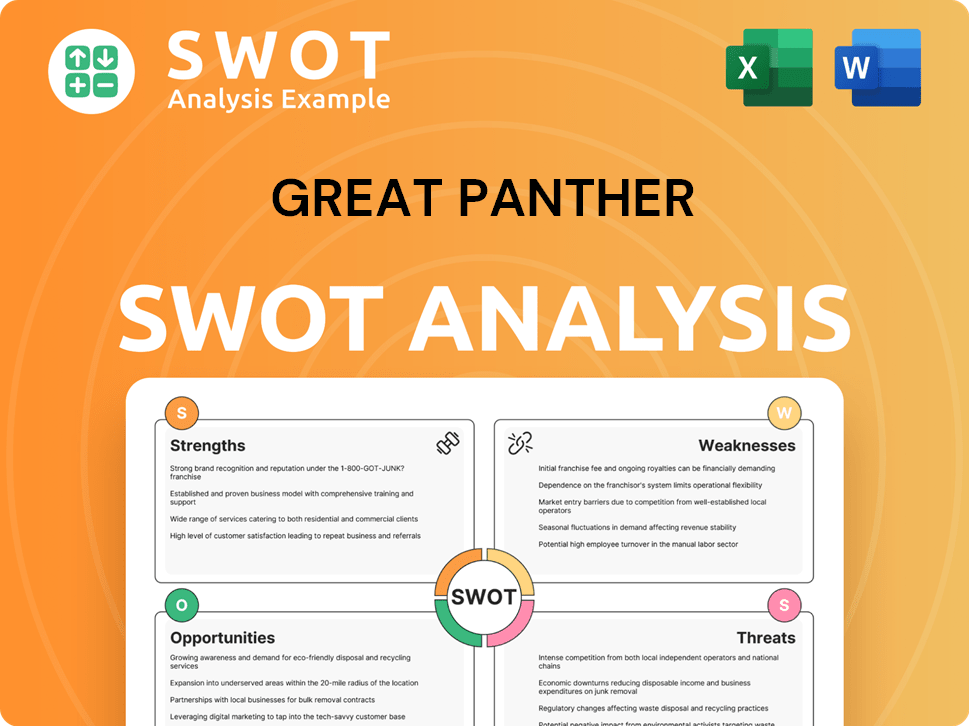

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Great Panther’s Ownership Changed Over Time?

The ownership structure of Great Panther Mining (GPR) underwent significant changes after its initial public offering (IPO), as it became a publicly traded entity. The company's shares were traded on stock exchanges, leading to a fluctuating shareholder base. Institutional investors, including mutual funds, hedge funds, and pension funds, along with individual insiders, bought and sold shares, influencing the company's ownership dynamics. The exact IPO date and initial market capitalization are not immediately available, but its status as a publicly traded entity meant its shares were bought and sold on stock exchanges, leading to a dynamic shareholder base.

Before its bankruptcy in 2023, Great Panther's major stakeholders included a mix of institutional and individual investors. Institutional investors often held a considerable portion of shares in publicly traded mining companies. Individual shareholders, such as company executives or long-term private investors, also held notable stakes. SEC filings and annual reports provided detailed breakdowns of these holdings, showing the largest positions. For example, institutional investors like Van Eck Associates Corporation, known for precious metals investments, were significant shareholders in various mining companies, potentially including Great Panther at some point. These ownership changes directly affected company strategy and governance, as major shareholders influenced decisions through voting rights and engagement with management.

| Ownership Event | Impact | Stakeholders Affected |

|---|---|---|

| IPO | Transition to public ownership; increased shareholder base. | Company, new and existing investors |

| Institutional Investment | Increased influence from large investors; potential for strategic shifts. | Institutional investors, company management |

| Shareholder Activism | Influence on company strategy, governance, and financial decisions. | Major shareholders, board of directors, company management |

Understanding the evolution of Great Panther Mining's ownership structure is crucial for grasping its strategic direction and financial health. The shift from private to public ownership, the influence of institutional investors, and any potential acquisitions or mergers all played a role in shaping the company's trajectory. To learn more about the company's target market, consider reading this article: Target Market of Great Panther.

Great Panther Mining's ownership structure was dynamic due to its status as a publicly traded company.

- Institutional investors and individual shareholders significantly influenced the company.

- Changes in ownership impacted company strategy and governance.

- Understanding the ownership evolution is key to assessing the company's strategic direction.

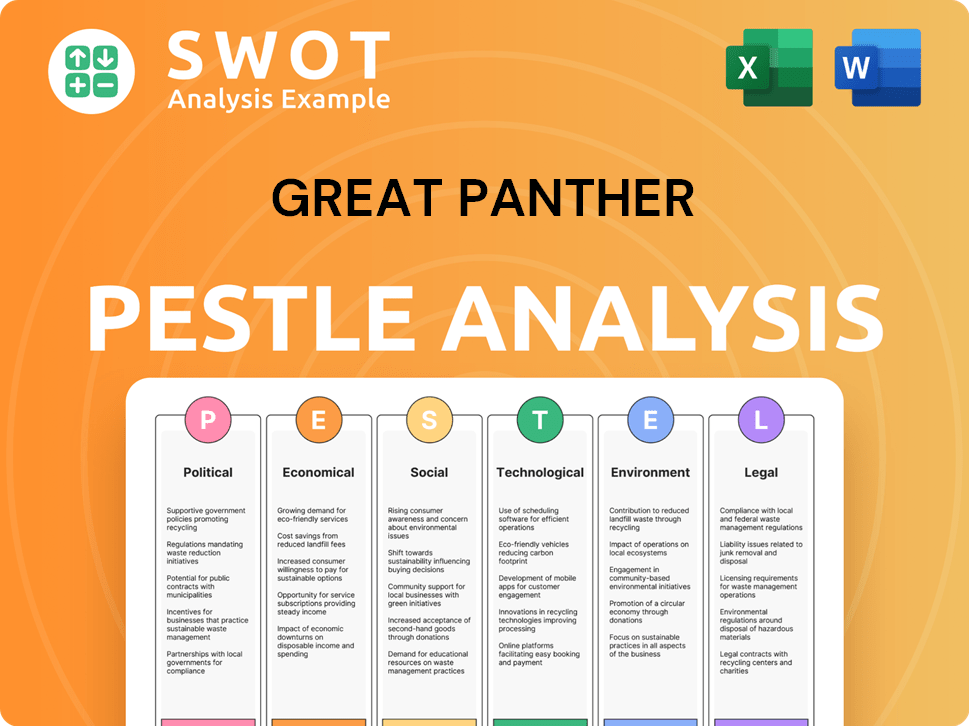

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Great Panther’s Board?

Prior to the bankruptcy, the board of directors of Great Panther Company, or Great Panther Mining (GPR), comprised a mix of individuals. These individuals represented major shareholders, founders (if still involved), and independent directors. The board's primary responsibilities included overseeing the company's strategic direction, appointing and supervising management, and ensuring good governance. The specific composition of the board at the time of bankruptcy is not readily available. However, typical board structures for publicly traded mining companies include individuals with expertise in geology, finance, law, and corporate management.

The voting structure for Great Panther, as a publicly traded company on exchanges like the Toronto Stock Exchange (TSX) and NYSE American, generally followed a one-share-one-vote principle. This meant that each common share entitled the holder to one vote on matters presented at shareholder meetings, such as the election of directors or approval of major corporate actions. Special voting rights or dual-class shares are less common for standard publicly traded mining companies. Any individuals or entities with outsized control would have stemmed from holding a significant percentage of the outstanding shares. The board's decision to declare bankruptcy reflected the dire financial circumstances and the board's assessment of the company's viability.

| Board Member | Title | Notes |

|---|---|---|

| (Information not available post-bankruptcy) | (Information not available post-bankruptcy) | (Information not available post-bankruptcy) |

| (Information not available post-bankruptcy) | (Information not available post-bankruptcy) | (Information not available post-bankruptcy) |

| (Information not available post-bankruptcy) | (Information not available post-bankruptcy) | (Information not available post-bankruptcy) |

Given the bankruptcy of Great Panther Mining, information on the current board of directors is not readily available. Details regarding current board members, their affiliations, and voting power would be pertinent to understanding the company's restructuring or any potential acquisition scenarios. Information on the current status of the company can be obtained through official filings and announcements.

Before its bankruptcy, the board oversaw strategic decisions. Voting followed a one-share-one-vote principle. Key players would have been those with significant shareholdings.

- Board members included experts in various fields.

- Shareholders voted on key decisions.

- Bankruptcy was a board-approved action.

- Outsized control came from large shareholdings.

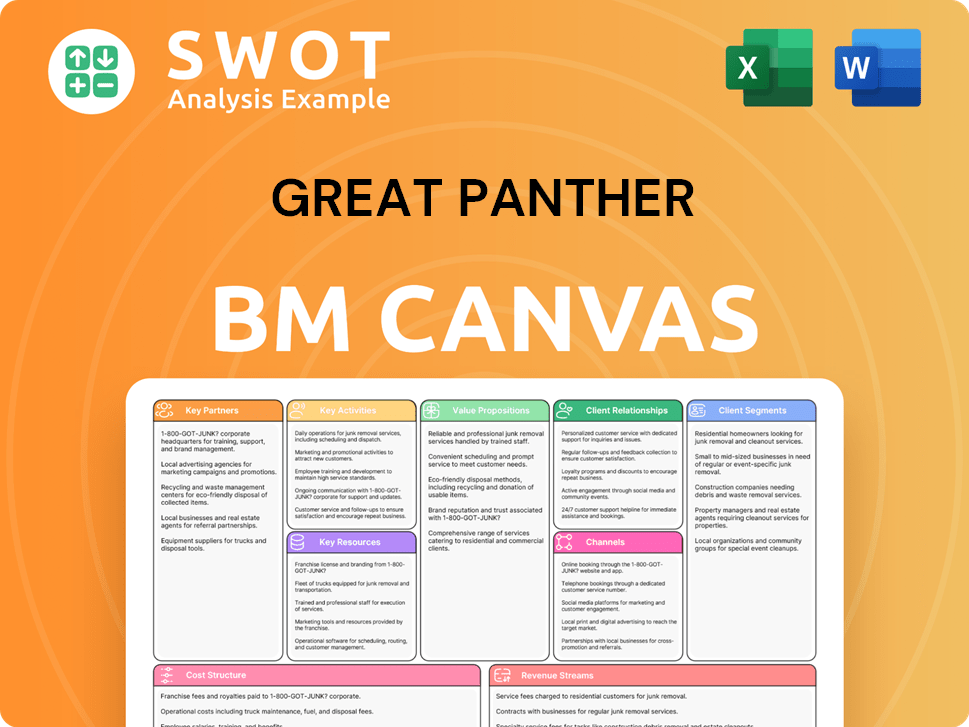

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Great Panther’s Ownership Landscape?

The most impactful recent development concerning Great Panther Mining's ownership was its bankruptcy declaration in 2023. This event dramatically reshaped the ownership structure. The restructuring or liquidation process that followed led to significant dilution or complete loss for existing shareholders. Before the bankruptcy, trends in mining company ownership often included increased institutional investment. Large funds sought exposure to commodity cycles, which would have changed the shareholding. The company's financial health was deteriorating. This is evident from the bankruptcy filing, which superseded any planned ownership changes.

Preceding its financial difficulties, the company might have explored options like secondary offerings. These offerings aimed to raise capital or consider mergers and acquisitions. These actions would have affected its shareholding. However, these efforts proved inadequate. The bankruptcy shifted the focus to insolvency proceedings, asset sales, and potential recoveries for creditors. This change replaced the focus on equity ownership. The mining industry often sees consolidation of distressed assets. Stronger companies may acquire assets from bankrupt entities, further shifting ownership within the sector. For more details on the company's past, you can read the Brief History of Great Panther.

| Metric | Details | Impact |

|---|---|---|

| Bankruptcy Filing | Declared in 2023 | Shareholder value dilution or loss |

| Institutional Ownership | Increased before bankruptcy | Exposure to commodity cycles |

| Asset Sales | During insolvency proceedings | Recovery for creditors |

The bankruptcy of Great Panther Mining significantly altered its ownership structure. Existing shareholders faced dilution or complete loss. The focus shifted from equity ownership to creditor claims and asset sales.

Before bankruptcy, mining companies often saw increased institutional ownership. This was driven by the desire to capitalize on commodity cycles. Distressed assets frequently lead to consolidation in the mining sector.

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Great Panther Company?

- What is Competitive Landscape of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- How Does Great Panther Company Work?

- What is Sales and Marketing Strategy of Great Panther Company?

- What is Brief History of Great Panther Company?

- What is Customer Demographics and Target Market of Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.