Great Panther Bundle

What Went Wrong at Great Panther Company?

The mining industry is a battlefield, and Great Panther Company once fought for its place in the precious metals sector. This Great Panther SWOT Analysis reveals the company's struggles in a highly competitive environment. From ambitious gold mine acquisitions to ultimately declaring bankruptcy, the story of Great Panther offers a crucial lesson in market dynamics.

This deep dive into the Great Panther Company's competitive landscape provides a comprehensive market analysis, examining its industry position and financial performance. We'll explore its exploration projects, recent acquisitions, and ultimately, the factors that led to its downfall. Understanding Great Panther's challenges is vital for investors and business strategists navigating the inherent risks within the mining industry, offering insights into its growth strategy and future outlook.

Where Does Great Panther’ Stand in the Current Market?

Great Panther Mining Limited's market position was primarily shaped by its operation of the Tucano Gold Mine in Brazil. This positioned it as a significant player in the South American gold mining sector. Before its bankruptcy in 2023, the company mainly produced gold, with a historical focus on silver as well. The Revenue Streams & Business Model of Great Panther provides further insights into the company's operations.

The company's market position was that of a mid-tier producer. It competed with both larger, diversified mining giants and smaller, junior exploration companies. Its focus on gold, particularly after acquiring Tucano, aimed to boost its scale and production within the gold sector. However, operational issues and market pressures significantly impacted its financial health.

Geographically, Great Panther's presence was concentrated in Brazil, with exploration projects also contributing to its portfolio. This regional focus meant its market position was heavily influenced by the economic and regulatory environment of Brazil. The customer segments it served were primarily the global precious metals markets, selling its gold and silver to refiners and bullion dealers. The company's inability to sustain profitable operations and manage its debt ultimately led to its decline.

Great Panther's market share is no longer directly relevant due to its bankruptcy in 2023. The company operated as a mid-tier gold producer. Its competitive landscape included major mining corporations and smaller exploration companies. The mining industry is dynamic, with market positions subject to change based on production, acquisitions, and market conditions.

Great Panther's primary operations were in Brazil, which made its market position sensitive to the Brazilian economic and regulatory environment. The company sold its gold and silver to global precious metals markets. These markets include refiners and bullion dealers. This geographic concentration and customer base were key factors in its competitive landscape.

The company shifted its focus to gold, particularly after acquiring Tucano. This was intended to increase production scale. Operational issues at Tucano and broader market pressures negatively impacted its financial performance. These issues ultimately led to the company's inability to sustain profitable operations. This resulted in a weakened competitive position.

The competitive landscape for Great Panther included both large diversified mining companies and smaller exploration firms. The company faced challenges such as operational difficulties and market pressures. Risk factors included fluctuations in gold prices, operational inefficiencies, and debt management. These factors contributed to its ultimate financial difficulties.

Great Panther's market position was defined by its gold production in Brazil and its status as a mid-tier producer. Its focus on gold mining and its customer base in the precious metals markets were key aspects. The company's strategic shifts, operational challenges, and financial struggles led to its bankruptcy in 2023.

- Focused on gold production, primarily in Brazil.

- Competed with both large and small mining companies.

- Faced operational and financial challenges that led to its decline.

- Market position was significantly impacted by economic factors.

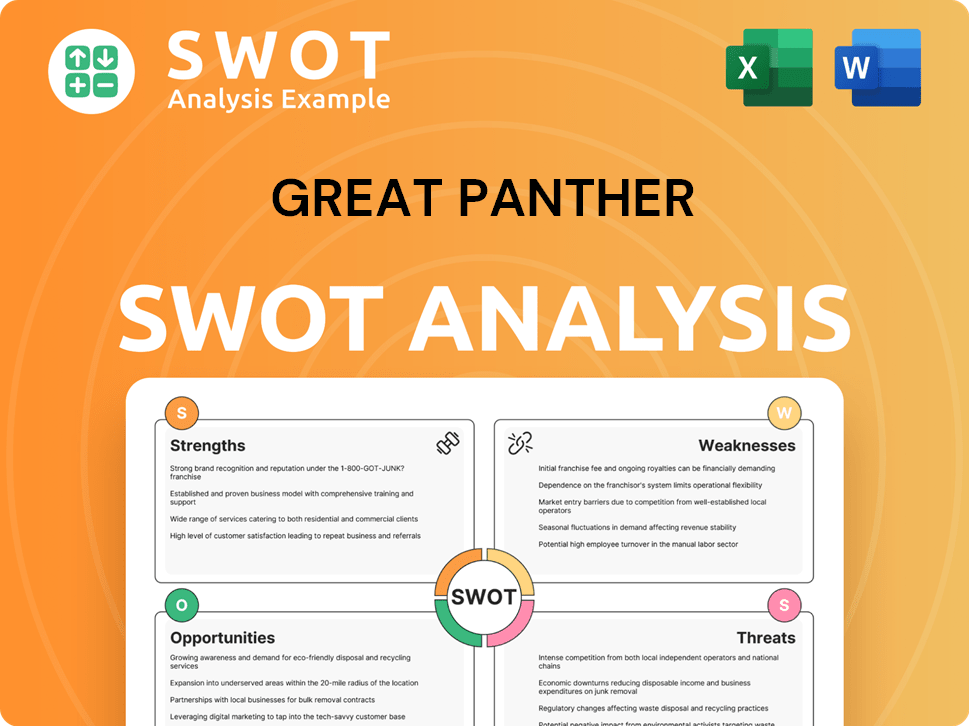

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Great Panther?

In the precious metals mining industry, understanding the Competitive landscape of companies like Great Panther was crucial for assessing their market position. The competitive environment included both direct and indirect rivals, each vying for market share and investor capital. This analysis is essential for anyone looking to perform a thorough market analysis.

Direct competitors often included other mid-tier and junior gold producers, particularly those operating in similar geographic regions, such as South America. Indirect competitors encompassed companies focused on other precious metals, like silver producers, and broader resource companies that could attract investor capital. The competitive dynamics were further shaped by new and emerging players, leveraging advanced exploration technologies.

The primary competitive challenges stemmed from price competition, especially during periods of declining gold prices, and the ability to innovate in mining techniques to reduce costs and increase efficiency. Larger competitors often had superior brand recognition and stronger distribution networks. The impact of mergers and acquisitions further consolidated power among larger players, intensifying the competitive pressure on smaller entities.

Direct competitors included mid-tier and junior gold producers. These companies often operated in the same geographic areas as Great Panther, competing for the same resources and investment dollars. Key players in this category were constantly evaluated based on their production output and financial performance.

Indirect competitors consisted of silver producers and broader resource companies. These entities could attract investor capital away from gold producers, creating a broader competitive environment. The market share analysis included these indirect competitors to provide a complete picture.

The competitive landscape was constantly evolving due to mergers, acquisitions, and the emergence of new players. These dynamics significantly impacted the industry position of companies like Great Panther. Understanding these shifts was critical for strategic planning and assessing investment potential.

Price competition and operational efficiency were major challenges. Larger competitors often had economies of scale and superior resources. The ability to innovate in mining techniques and manage costs was crucial for survival and growth. These factors directly influenced the financial reports and stock performance of companies.

Consolidation through mergers and acquisitions intensified competitive pressure. Larger entities gained market share, making it harder for smaller companies to compete. This trend highlighted the importance of strategic planning and adaptability in the mining industry. The company overview and future outlook were significantly impacted by these events.

New players leveraging advanced exploration technologies posed a competitive threat. Innovation in mining techniques was essential for reducing costs and increasing efficiency. These advancements influenced the competitive landscape and the ability of companies to secure exploration projects and maintain production output.

Analyzing the competitive landscape requires an understanding of the strategies employed by key players. Companies like Kinross Gold and Pan American Silver (following the acquisition of Yamana Gold) have significantly larger production capacities, often exceeding several million ounces of gold equivalent annually. These larger entities typically have diversified asset portfolios, allowing them to weather market downturns more effectively. Their strategies often include:

- Acquisitions: Expanding their asset base through strategic acquisitions. For example, Pan American Silver's acquisition of Yamana Gold.

- Cost Management: Implementing advanced mining techniques to reduce operational costs. This includes automation and efficiency improvements.

- Geographic Diversification: Operating mines in multiple countries to mitigate risks associated with political instability or local market fluctuations.

- Exploration: Investing in exploration projects to discover new reserves and extend mine life.

- Financial Strength: Leveraging strong balance sheets to withstand market volatility and fund expansion.

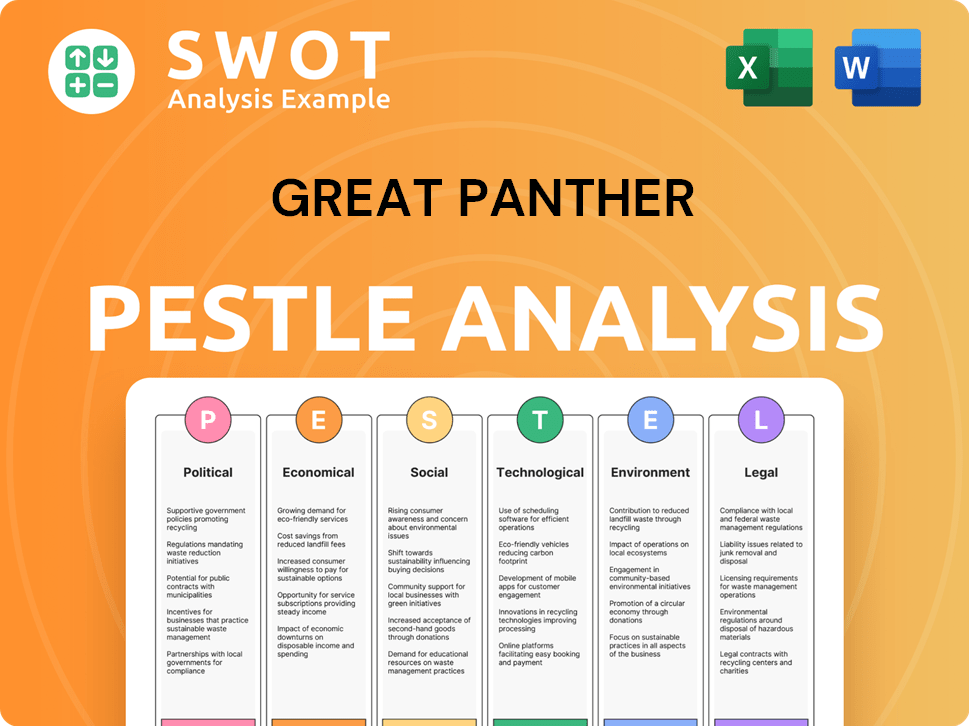

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Great Panther a Competitive Edge Over Its Rivals?

The competitive landscape for Great Panther Company, particularly within the mining industry, was shaped by its operational assets and exploration potential. The Tucano Gold Mine in Brazil served as its primary production base, offering a foundation for gold output. Exploration projects held the promise of future growth, aiming to extend the mine's lifespan and bolster its market position. This analysis is crucial for understanding the company's position within the broader market.

However, the sustainability of these advantages was challenged by operational difficulties, including permitting delays and cost overruns at Tucano. These issues hampered the company's ability to consistently meet production targets and maintain profitability. Unlike larger mining conglomerates, Great Panther lacked significant brand equity or extensive global distribution networks, which limited its competitive differentiation. A thorough market analysis reveals these challenges.

As a mid-tier producer, Great Panther struggled to achieve the same cost efficiencies as larger competitors. Its advantages were primarily tied to its mineral assets, and the ability to leverage these assets effectively in a volatile market proved difficult. The company's reliance on a single primary producing asset also meant it lacked the diversification that could buffer it against operational setbacks. For a deeper dive into the company's strategic moves, consider exploring the Growth Strategy of Great Panther.

The Tucano Gold Mine in Brazil was a key asset, providing a base for gold production. Exploration projects offered potential for future growth and extended mine life. These assets were central to Great Panther's competitive strategy within the mining industry.

Operational issues, such as permitting delays and cost overruns, hindered consistent production. The company lacked the brand equity and distribution networks of larger competitors. These factors ultimately limited its ability to compete effectively in the market.

As a mid-tier producer, Great Panther struggled to achieve the same cost efficiencies as larger companies. Reliance on a single primary asset (Tucano) increased vulnerability to operational setbacks. This lack of diversification was a significant risk factor.

The advantages were not sustainable due to operational and financial pressures. These pressures ultimately led to the company's decline. A detailed examination of these factors is essential for understanding the company's financial performance.

Great Panther's competitive position was primarily defined by its operational assets and exploration projects. However, operational challenges and a lack of diversification significantly impacted its ability to compete effectively. The company's financial reports reflect these challenges.

- Operational Assets: Tucano Gold Mine provided a production base.

- Exploration Potential: Projects aimed to extend mine life.

- Challenges: Permitting delays, cost overruns, and lack of diversification.

- Market Analysis: Mid-tier status limited economies of scale.

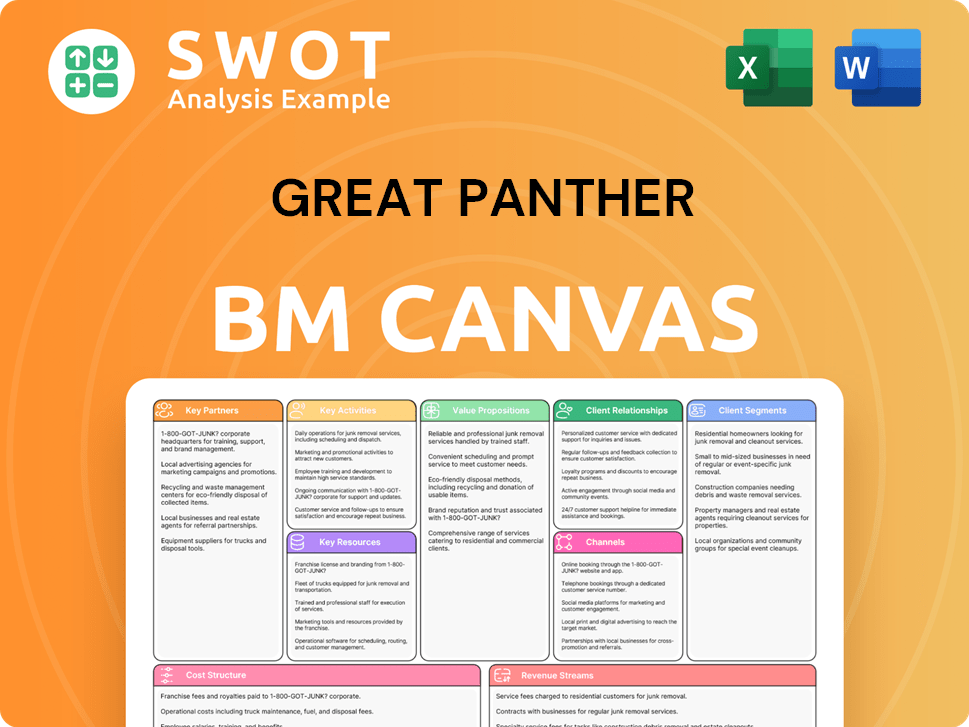

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Great Panther’s Competitive Landscape?

The precious metals mining industry, including companies like Great Panther Company, operates within a dynamic environment shaped by fluctuating commodity prices, evolving environmental and social standards, technological advancements, and global economic conditions. Understanding the competitive landscape requires careful market analysis, considering both immediate risks and long-term opportunities. The financial performance of a mining company is heavily influenced by its ability to navigate these complexities effectively.

Fluctuations in gold and silver prices directly affect revenue and profitability, making financial planning and risk management critical. For example, in 2024, gold prices have shown resilience, often acting as a safe-haven asset amidst geopolitical uncertainties and inflationary pressures. However, this volatility presents a significant challenge for maintaining consistent profitability. Regulatory changes regarding environmental protection and indigenous rights are becoming increasingly stringent, impacting permitting processes and operational costs. This necessitates greater investment in sustainable mining practices and community engagement.

The mining industry is capital-intensive and subject to commodity price volatility. Companies must manage operational costs, environmental regulations, and community relations. Market analysis reveals that companies with strong financial discipline and robust risk management are better positioned. A company's industry position is also influenced by its ability to adapt to technological advancements and embrace sustainable practices.

Key risks include commodity price fluctuations, rising operational costs, and stringent environmental regulations. Other risks are declining ore grades, labor shortages, and competition from larger rivals. Geopolitical instability and changes in government policies also pose significant threats. Effective risk management is crucial for maintaining profitability and operational continuity.

The future outlook depends on the ability to adapt to industry trends, manage risks, and pursue growth opportunities. Technological advancements, such as automation and AI, offer chances for efficiency and cost reduction. Strategic partnerships and off-take agreements can provide access to capital. Companies prioritizing ESG and innovation are more likely to thrive.

Opportunities include emerging markets with favorable geological potential and supportive regulatory frameworks. Product innovations, such as responsible sourcing, can create niche markets. Strategic partnerships and joint ventures can provide access to capital. The ability to adapt to these trends and manage risks effectively will determine the success of mining companies.

For Great Panther Company, a thorough understanding of its competitive landscape is critical. The company's financial performance depends on its ability to navigate the complexities of the mining industry. Strategic decisions, such as those related to exploration projects or recent acquisitions, must align with long-term growth objectives. The Growth Strategy of Great Panther provides more insights.

- Market Analysis: Understanding gold and silver price trends, as well as the impact of global economic conditions.

- Risk Management: Implementing strategies to mitigate the impact of commodity price volatility and rising operational costs.

- Technological Adoption: Exploring opportunities to improve efficiency and reduce costs through automation and data analytics.

- ESG Compliance: Prioritizing environmental, social, and governance factors to meet regulatory requirements and maintain community relations.

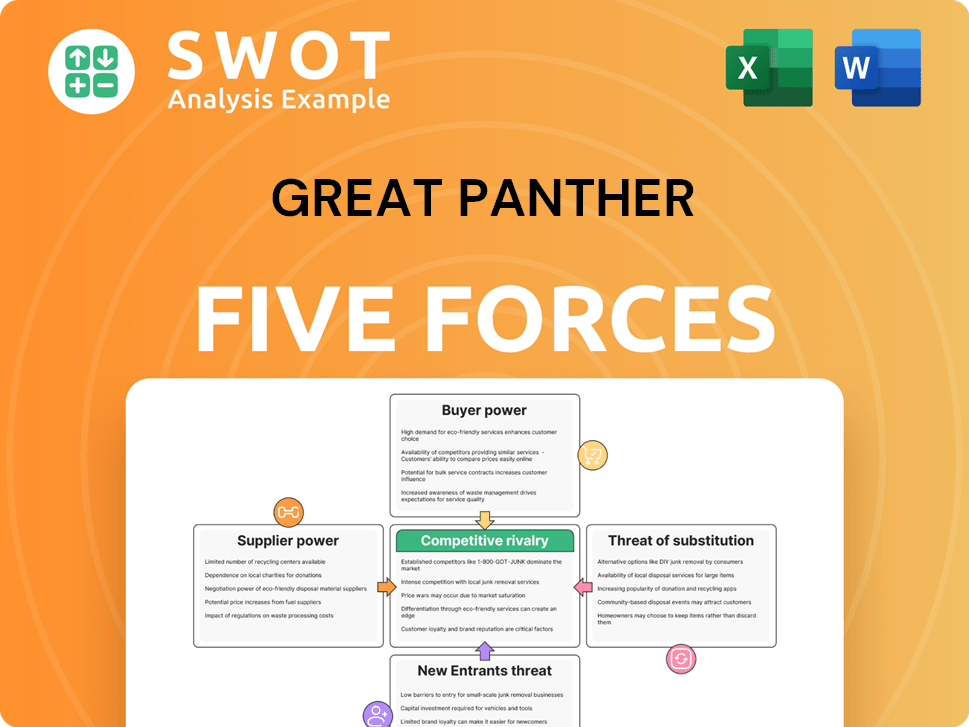

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- How Does Great Panther Company Work?

- What is Sales and Marketing Strategy of Great Panther Company?

- What is Brief History of Great Panther Company?

- Who Owns Great Panther Company?

- What is Customer Demographics and Target Market of Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.