Great Panther Bundle

What Went Wrong for Great Panther Mining?

Great Panther Mining Limited, once a promising precious metals producer, ultimately succumbed to bankruptcy in 2023. This outcome raises critical questions about its Great Panther SWOT Analysis, sales and marketing approaches, and overall business strategy. Understanding the factors that led to this financial distress is crucial for investors, analysts, and anyone interested in the mining sector.

Despite its initial success and strategic shifts, including a move into gold production, Great Panther Company struggled to maintain profitability. This analysis examines the company's sales strategy and marketing strategy, exploring how it positioned itself in the market and the effectiveness of its campaigns. By dissecting the Great Panther Company's approach, we can glean valuable lessons about sales and marketing within the volatile precious metals industry, especially in light of current market dynamics.

How Does Great Panther Reach Its Customers?

The primary sales channels for Great Panther Company historically revolved around direct sales within the mining industry. This involved selling extracted precious metals, such as gold and silver, directly to refiners and metal traders. The company's operations at the Tucano Gold Mine in Brazil and its former mines in Mexico formed the core of its sales strategy, focusing on the extraction and sale of raw or semi-processed ore.

Great Panther's sales and marketing efforts were intrinsically tied to its asset portfolio and strategic shifts. The company initially concentrated on silver and gold mines in Mexico. The acquisition of Beadell Resources and the Tucano Gold Mine in Brazil in 2019 marked a significant expansion into gold production, diversifying its geographical footprint and commodity focus. This move aimed to balance market fluctuations by spreading investments across different metals and regions. However, the company underwent significant changes.

In 2022, Great Panther divested its Mexican assets for US$8 million plus shares and its Peruvian assets for US$750,000, indicating a strategic shift. The Tucano mine, which went into care and maintenance in 2022, was subsequently acquired by Tucano Gold Inc. in October 2023, with a planned production restart in Q4 2024. This transition reflects a change in the primary sales channel for the Tucano output following Great Panther's bankruptcy.

Great Panther Company's sales strategy was primarily focused on direct sales to refiners and metal traders. The company's main products were precious metals extracted from its mines. The sales process involved delivering raw or semi-processed ore to a specialized group of buyers.

The company's business strategy included a focus on silver and gold mines in Mexico, followed by expansion into gold production in Brazil. This diversification aimed to balance market risks. Strategic divestments, such as the sale of Mexican and Peruvian assets, were part of this strategy.

Great Panther Company sold its Mexican assets for US$8 million plus shares and its Peruvian assets for US$750,000 in 2022. The Tucano mine, which went into care and maintenance in 2022, was acquired by Tucano Gold Inc. in October 2023. Production is planned to restart in Q4 2024.

The future sales strategy will likely depend on the new owners of the Tucano mine. The restart of production in Q4 2024 indicates a shift in sales channels. The company's ability to adapt to market changes and manage its asset portfolio will be crucial.

Great Panther Company's sales strategy relied on direct sales to refiners and metal traders. The company's asset portfolio underwent significant changes, including acquisitions and divestitures. The future of the sales channels depends on the new owners of the Tucano mine.

- Direct sales to refiners and metal traders was the primary sales channel.

- Strategic shifts in asset portfolio, including acquisitions and divestitures.

- The future sales strategy will be influenced by the new owners of the Tucano mine.

- The company's ability to adapt to market changes and manage its asset portfolio will be crucial.

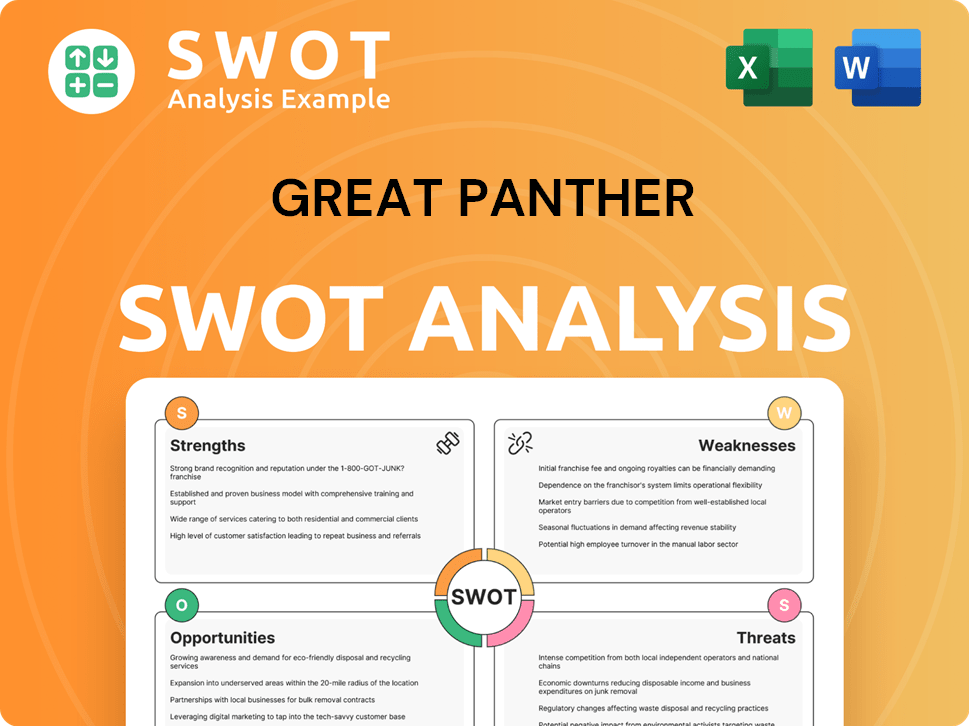

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Great Panther Use?

The marketing tactics of Great Panther Company, given its focus on the mining industry, would have primarily revolved around business-to-business (B2B) strategies. This approach would have targeted investors, financial institutions, and the broader mining community. The goal was to build trust and attract investment through transparent and informative communication.

A core element of their marketing and sales strategy would have been regular communication through official channels. This included press releases detailing production results, financial performance, and operational updates. These releases were critical for maintaining investor confidence and complying with regulatory requirements.

Participation in investor conferences and presentations would have been another crucial tactic for engaging with potential investors and analysts. These events provided opportunities to showcase the company's performance and future prospects, supporting their business strategy.

Great Panther frequently issued press releases on its quarterly production and financial results. For instance, the Q2 2022 production results were reported at 20,187 gold equivalent ounces.

Announcements regarding agreements for the sale of assets, such as the Mexican and Peruvian mines in 2022, were strategic communications to the market.

Participation in investor conferences and presentations would have been crucial for engaging with potential investors and analysts.

The mining industry is increasingly adopting digitalization for efficiency and safety, integrating sensors, data analytics, and real-time monitoring.

Technologies like AI for automation, industrial IoT, and 5G are becoming significant in the sector.

Prior to its bankruptcy, the focus would have been on financial reporting and corporate communications to maintain its listing on exchanges like the TSX and NYSE American.

While specifics on digital marketing, content marketing, or social media strategies for Great Panther Company are not readily available, the overall approach would have been geared towards maintaining transparency and providing information to the financial community. For more detailed information on how the company generated revenue, you can read about the Revenue Streams & Business Model of Great Panther.

The company's sales and marketing efforts would have focused on B2B strategies, targeting investors and financial institutions.

- Regular press releases detailing production results, financial performance, and operational updates.

- Participation in investor conferences and presentations to engage with potential investors and analysts.

- Emphasis on financial reporting and corporate communications to maintain its listing on exchanges.

- Adoption of digital technologies for efficiency and safety, aligning with industry trends.

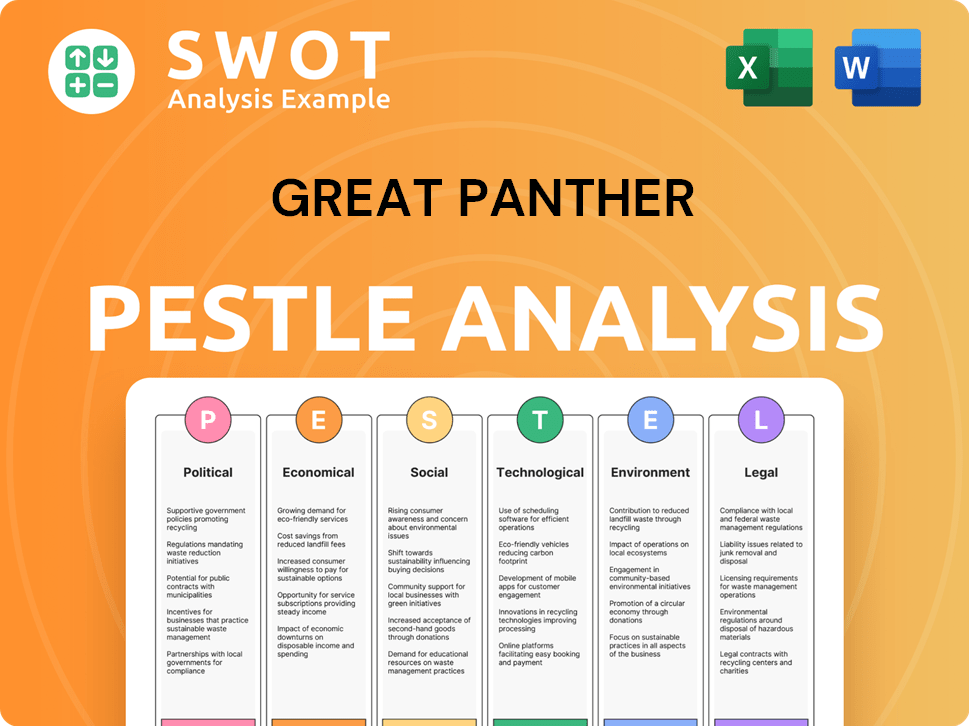

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Great Panther Positioned in the Market?

The brand positioning of the company, centered on its identity as a precious metals producer, aimed to attract investors by offering exposure to gold and silver markets. This strategy focused on operational efficiency and the acquisition of dormant mines. The goal was to create value through mining and exploration, emphasizing production stability and discovery potential, a common theme in the mining sector. The company's sales strategy was closely tied to its ability to demonstrate consistent production and financial performance to maintain investor confidence.

The company's target audience comprised investors and financial stakeholders. The visual identity and tone were professional and data-driven, highlighting geological expertise, production figures, and financial performance. This approach was designed to build trust and showcase the company's potential for growth. The company's marketing strategy focused on communicating its value proposition through formal corporate communications, including annual reports and investor presentations.

However, the company faced challenges in maintaining a positive brand perception, primarily due to consistent net losses and a reduction in reported mineral resources. The eventual bankruptcy in 2023, despite selling off assets, indicates that the company struggled to sustain its value proposition and effectively respond to market shifts and operational hurdles. The mining industry's increased scrutiny regarding ESG factors also impacted brand perception. For a deeper understanding of the company's overall approach, see the Growth Strategy of Great Panther.

The core message revolved around value creation through mining and exploration. This included emphasizing production stability and discovery potential. This was a common theme in the mining sector, aiming to attract investors.

The primary target audience was investors and financial stakeholders. The company aimed to attract these groups by offering exposure to the precious metals markets. The company's business strategy was to appeal to investors seeking safe-haven assets.

The visual identity and tone were professional and data-driven. This approach was used to emphasize geological expertise, production figures, and financial performance. The aim was to build trust and showcase the company's potential for growth.

Brand consistency was maintained through formal corporate communications. This included annual reports, press releases, and investor presentations. The company aimed to ensure a unified message across all channels.

The company faced significant challenges, including consistent net losses and a reduction in reported mineral resources. These issues negatively impacted the company's brand perception and its ability to attract and retain investors. The bankruptcy in 2023 highlighted the company's struggles.

- Consistent net losses.

- Reduction in reported mineral resources.

- Bankruptcy in 2023.

- Inability to sustain value proposition.

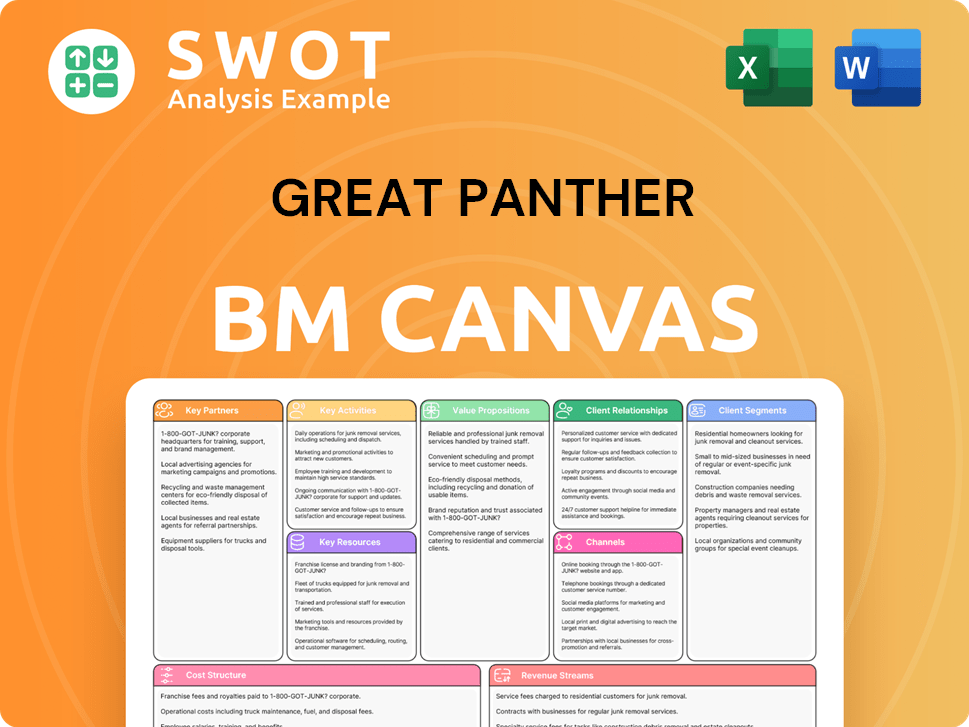

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Great Panther’s Most Notable Campaigns?

For a mining company like Great Panther, the term 'campaigns' refers to strategic initiatives focused on exploration, production, or financial restructuring, rather than traditional consumer-facing marketing. These campaigns aimed to influence investor sentiment and secure funding.

Prior to its bankruptcy, Great Panther's significant campaigns centered around operational milestones, asset acquisitions, and divestitures. These actions were crucial for its business strategy. The company's approach to sales and marketing was heavily influenced by these strategic decisions.

Understanding these campaigns provides insights into the company's sales strategy and overall business strategy. A thorough company analysis reveals how these initiatives aimed to navigate the challenges of the mining industry.

In early 2019, Great Panther acquired the Tucano Gold Mine in Brazil. This was a key move to expand its portfolio and diversify beyond its Mexican silver mines. This acquisition was a significant part of its long-term business strategy.

In 2022, the company divested its Mexican and Peruvian assets. The objective was to generate liquidity and streamline operations, focusing resources on the Tucano mine. These moves aimed to improve its sales performance.

Operational milestones were regularly communicated to the market. These updates aimed to influence investor sentiment and demonstrate progress. The company's marketing plan included sharing these achievements.

Financial restructuring was a key focus, particularly as the company faced challenges. These efforts were crucial for maintaining investor confidence. Effective marketing strategies were used to communicate these plans.

The acquisition of the Tucano Gold Mine in 2019 was a pivotal campaign for Great Panther. The goal was to transform the company into a more significant gold producer. However, in 2020, the company reported a 51% reduction of mineral resources at Tucano. Simultaneously, Great Panther pursued asset divestitures, selling its Mexican subsidiary, Minera Mexicana El Rosario S.A. de C.V., which held the Guanajuato Mine Complex and Topia Mine, in June 2022. The sales generated US$8 million for the Mexican assets and US$750,000 for the Peruvian assets. Despite these efforts, the company filed for bankruptcy in September 2022 and made a voluntary assignment into bankruptcy in December 2022. For more insights, see Competitors Landscape of Great Panther.

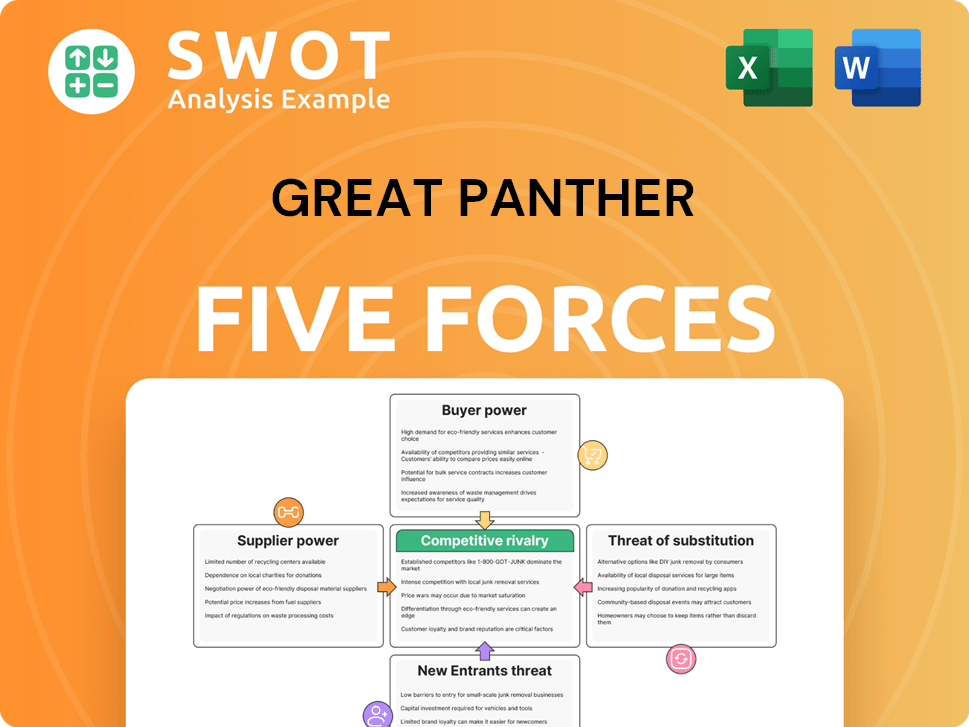

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Great Panther Company?

- What is Competitive Landscape of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- How Does Great Panther Company Work?

- What is Brief History of Great Panther Company?

- Who Owns Great Panther Company?

- What is Customer Demographics and Target Market of Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.