Great Panther Bundle

Who Were Great Panther's Customers?

Understanding the customer base is critical for any company, especially in the volatile mining sector. For Great Panther Company, formerly a precious metals producer, identifying its Great Panther SWOT Analysis customer demographics and target market was essential for survival and success. This exploration delves into the evolution of Great Panther's customer profile, from its early days to its operations across the Americas.

This analysis of Great Panther Company's customer demographics and target market reveals how the company adapted to the complexities of the precious metals market. We'll examine the company's customer segmentation, geographic reach, and the specific needs of its ideal customer. Understanding these factors provides valuable insights into the strategic challenges and opportunities faced by Great Panther, particularly in a market projected to experience significant growth. This research will cover the demographic breakdown of Great Panther Company customers, and the interests of Great Panther Company's customers.

Who Are Great Panther’s Main Customers?

Understanding the customer demographics and target market of the Great Panther Company is crucial for grasping its business operations. As a business-to-business (B2B) entity, Great Panther's focus was on the precious metals market, targeting entities involved in the refining, industrial use, and investment of gold and silver. The company's strategic direction and asset portfolio significantly influenced its customer segmentation over time.

The primary customer segments for Great Panther Mining Limited revolved around entities within the precious metals market. These included refiners, industrial users, and potentially financial institutions and investors. The company's success hinged on its ability to provide consistent supply, high-quality concentrates, and competitive pricing to these key customer groups.

While a detailed demographic breakdown isn't applicable to a B2B mining company, analyzing customer segments by industry, company size, and purchasing behavior offers valuable insights. The target market for Great Panther evolved with its assets, starting with a focus on silver and gold from Mexican mines and later shifting towards gold production with the acquisition of the Tucano Gold Mine in Brazil.

These companies purchased raw gold and silver doré or concentrates from Great Panther's mines for further processing. They were driven by a consistent supply, the quality of the concentrate, and competitive pricing. Great Panther's operations, such as the Tucano Gold Mine in Brazil, were key to serving this segment.

Businesses that used precious metals as raw materials in their manufacturing processes, such as electronics, automotive, or jewelry. Their needs included specific metal purities, delivery schedules, and bulk quantities. The jewelry segment is expected to generate approximately USD 117.56 billion in market revenue in 2025.

Large-scale investors, hedge funds, and financial institutions were a critical target market for Great Panther as a publicly traded company. Their interest was in the company's stock and its ability to generate revenue and profit. Gold prices surged to an all-time high in October 2024, supported by geopolitical tensions and central bank purchases.

Over time, Great Panther's target segments shifted as its asset portfolio changed. The company had a strong focus on silver and gold from its Mexican mines. With the acquisition of the Tucano Gold Mine in Brazil in 2019, its focus increasingly shifted towards gold production. For more details, please see the Brief History of Great Panther.

The ideal customer profile for Great Panther Company included refiners, industrial consumers, and investors seeking reliable supply and consistent financial performance. Understanding the customer demographics and their needs was crucial for the company's success. The company's focus on gold production, especially after acquiring the Tucano Gold Mine, significantly shaped its target market.

- Refiners looking for consistent supply and quality concentrates.

- Industrial consumers requiring specific metal purities and delivery schedules.

- Investors seeking reliable financial reporting and a clear growth strategy.

- Focus on gold production, especially after acquiring the Tucano Gold Mine.

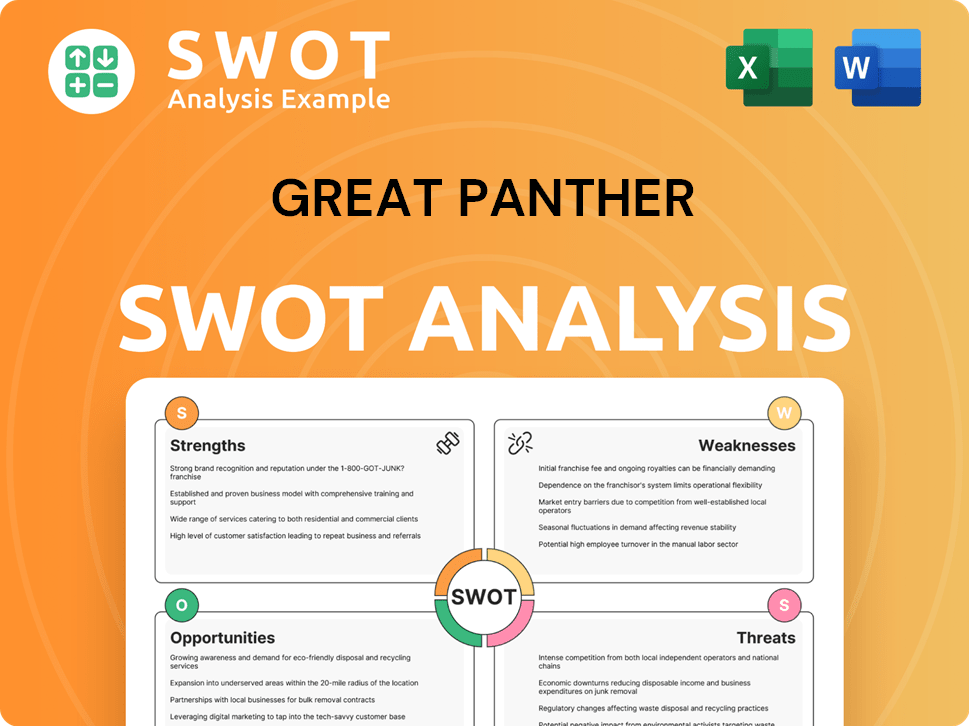

Great Panther SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Great Panther’s Customers Want?

Understanding the customer needs and preferences for Great Panther Company, a precious metals producer, is crucial for strategic planning. The company operated within a B2B model, selling gold doré and silver concentrates. Therefore, the focus was on meeting the demands of refiners and smelters, the primary customers.

The target market for Great Panther Company was primarily composed of businesses involved in the refining and processing of precious metals. These customers sought consistent supply, high-quality products, and competitive pricing. This B2B approach required a deep understanding of their technical specifications and logistical requirements.

The Competitors Landscape of Great Panther reveals the importance of customer relationships in the mining sector. The company's success depended on its ability to meet the stringent demands of its business clients, which included reliable delivery and adherence to contractual agreements.

Customers prioritized consistent supply, quality, and competitive pricing. These factors were critical in a market where differentiation is essential.

Purchasing involved long-term contracts and off-take agreements. Decision-making was based on technical specifications, logistical capabilities, and financial stability.

Great Panther's output was integrated into downstream processing and manufacturing supply chains. This required consistent performance and adherence to agreements.

Loyalty was built on consistent performance, adherence to agreements, and transparent communication. These factors were crucial for maintaining long-term relationships.

Customers sought a stable and cost-effective supply of raw materials. This was especially important given commodity price fluctuations.

Great Panther aimed to provide reliable sources of precious metals. This helped mitigate supply chain disruptions and price volatility.

Market trends and feedback significantly influenced Great Panther's strategic decisions, particularly concerning its portfolio of mines. The company's focus on gold production, especially in response to market opportunities, was a key strategy.

- The acquisition of the Tucano Gold Mine in Brazil in 2019 was a strategic move to capitalize on gold production.

- Ongoing geopolitical tensions and central bank purchases have supported high gold prices in 2024 and are expected to continue into 2025.

- Despite these efforts, the company faced challenges, including a substantial reduction in reported mineral resources at Tucano in 2020 and ultimately filed for bankruptcy in 2023.

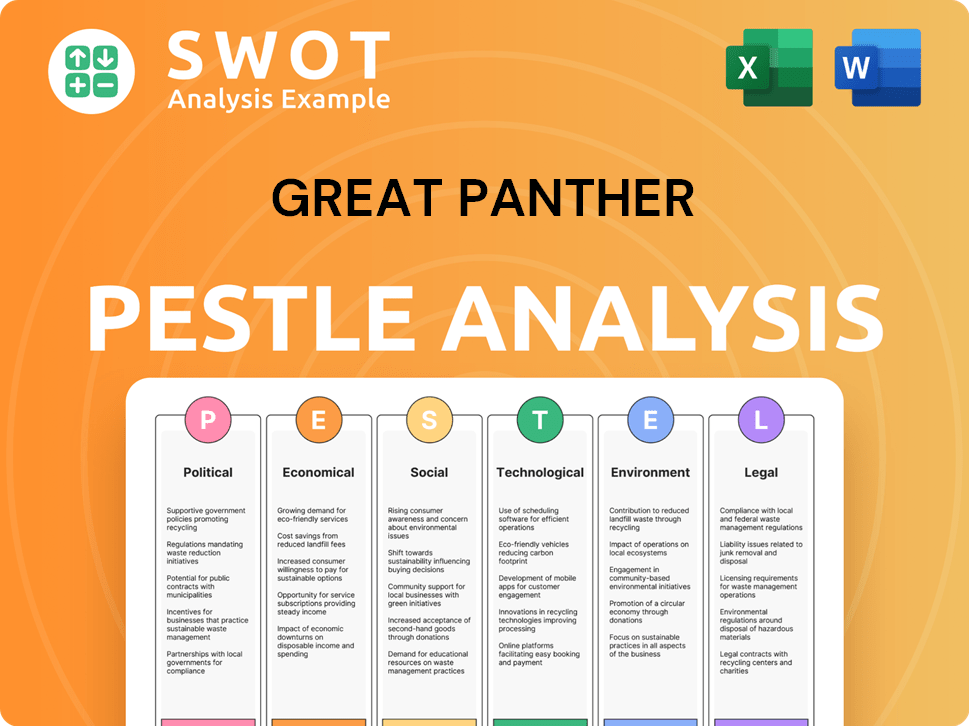

Great Panther PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Great Panther operate?

The primary geographical market presence of Great Panther Mining Limited, before its bankruptcy, was concentrated in the Americas. Its operations were primarily located in Brazil, Mexico, and Peru. The company's strategic focus was on precious metals production, particularly gold and silver. The Growth Strategy of Great Panther involved acquiring and developing mining assets within these key regions to capitalize on the demand for these commodities.

The company's most significant asset was the Tucano Gold Mine in Brazil, which became its main revenue generator. This mine, acquired in 2019, was the cornerstone of its gold production. In Mexico, it operated the Topia mine and the Guanajuato Mine Complex (GMC), focusing on silver and gold concentrate production. Additionally, in Peru, the Coricancha Mine Complex was part of its portfolio.

The customer demographics and target market, in the context of Great Panther, were largely defined by the nature of the commodities extracted and the refining processes involved. The gold doré from Tucano was directed to gold refiners, while concentrates from Mexico were sold to smelters capable of processing polymetallic ores. Localization efforts included adhering to local mining regulations, community engagement, and establishing relationships with local suppliers.

The Tucano Gold Mine in Brazil was the company's primary revenue source. In 2020, it produced approximately 136,681 ounces of gold. The mine's location in the prospective Vila Nova Greenstone Belt, covering nearly 200,000 hectares, highlights a strong regional focus within Brazil.

Operations in Mexico focused on silver and gold concentrate production, along with lead and zinc. These assets were later sold to Guanajuato Silver Company Ltd. The Topia mine and the Guanajuato Mine Complex (GMC) were key in the production of silver and gold concentrates.

The Coricancha Mine Complex in Peru was a gold-silver-copper-lead-zinc mine. In 2022, the company sold its Peruvian assets to Newrange Gold. The mine's operations were focused on the extraction of multiple metals, reflecting a diverse customer base.

Great Panther aimed to be a significant precious metals producer in the Americas. The production from Tucano, which produced approximately 136,681 ounces of gold in 2020, indicated its standing in the Brazilian gold market. The company's focus was on increasing its market share through strategic acquisitions and efficient operations.

The company's trajectory was marked by expansions and strategic withdrawals. The acquisition of Beadell Resources and its Tucano Gold Mine in early 2019 was a major expansion. However, in 2022, the company sold its Mexican and Peruvian assets. These divestitures preceded Great Panther's bankruptcy filing in 2023. The geographic distribution of sales shifted, with Brazil becoming the dominant revenue source before the company's insolvency.

- Acquisition of Tucano Gold Mine in 2019.

- Sale of Mexican assets in 2022.

- Sale of Peruvian assets in 2022.

- Bankruptcy filing in 2023.

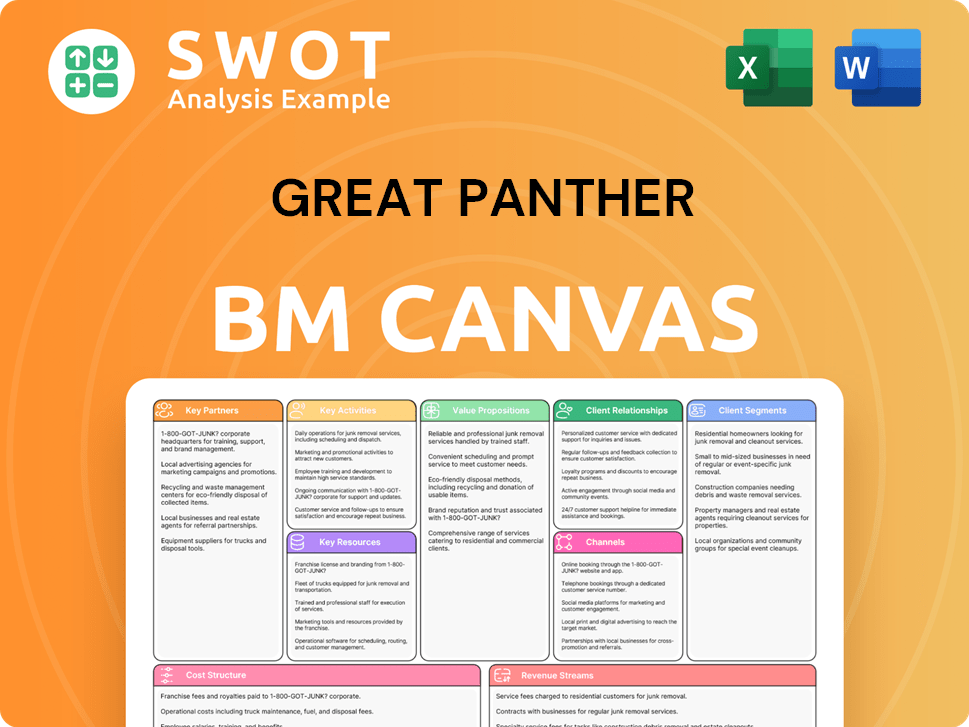

Great Panther Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Great Panther Win & Keep Customers?

For a B2B mining company like Great Panther Mining Limited, understanding customer demographics and defining the target market were crucial for success. Unlike consumer-facing businesses, Great Panther's 'customers' were primarily institutional entities. This included metal refiners, smelters, and, from an investment perspective, institutional and individual investors. The company's approach to customer acquisition and retention reflected this unique business-to-business model.

The primary focus for customer acquisition involved securing off-take agreements and sales contracts for mined products like gold doré, silver, and base metal concentrates. This required a strategic approach to identify and engage with key players in the industry. Simultaneously, attracting and retaining investors was critical for maintaining a strong financial position and supporting operational activities. The company's strategy was designed to create long-term stakeholder value through safe and sustainable production and reinvestment into exploration.

Customer retention centered on maintaining strong relationships with off-take partners and fostering investor confidence. Ensuring a reliable supply chain and adhering to contractual obligations were paramount. The quality of the products and proactive communication with investors about operational challenges and financial performance were also key elements in maintaining trust and loyalty. The company's ability to adapt and respond to market dynamics played a significant role in its ability to retain customers and investors.

Great Panther engaged directly with large-scale refiners, industrial users, and commodity traders. The goal was to negotiate long-term supply agreements. This involved demonstrating the quality and consistency of their mineral output, a key factor in securing contracts. The company focused on building lasting relationships with key stakeholders in the industry.

Participation in global mining and metals conferences was essential. These events provided opportunities to connect with potential buyers, partners, and investors. Networking at these events was a crucial part of the acquisition strategy. This helped in expanding the company's reach and building valuable relationships.

Great Panther maintained investor relations efforts to attract and retain investors. Publishing financial reports, production results, and technical studies was a priority. This demonstrated operational efficiency and resource potential. The company aimed to build long-term stakeholder value.

Ensuring consistent and timely delivery of precious metals according to contractual obligations was crucial. This was a key factor in retaining refining and industrial customers. The reliability of supply was a major factor in maintaining strong relationships with buyers.

Maintaining high standards for the purity and composition of products was crucial. This was essential for customer satisfaction and repeat business. Quality control was a key part of the company's operations.

Demonstrating a commitment to responsible mining practices enhanced the company's reputation. This appealed to environmentally and socially conscious investors and partners. This was a key consideration in building a positive image.

Open communication with investors about operational challenges and financial performance was vital. This helped in managing expectations and maintaining trust. This was a key aspect of investor relations.

Customer data and CRM systems were critical for managing relationships with B2B partners. They were also used for tracking sales agreements. Data on market demand, commodity prices, and competitor performance informed strategic decisions. For example, gold prices surged by 20% in 2024, impacting strategic decisions.

Successful acquisition campaigns for Great Panther involved mergers and acquisitions. The acquisition of Beadell Resources in 2019, which included the Tucano Gold Mine in Brazil, significantly boosted gold production capacity. This move was designed to enhance its portfolio and increase its appeal to investors. The company aimed to capitalize on opportunities to expand its operations.

Changes in strategy over time, such as the divestment of Mexican and Peruvian assets in 2022, impacted customer loyalty. Challenges at the Tucano mine, including a reported 51% reduction in mineral resources in 2020, also affected investor confidence. These events highlighted the importance of adapting to market changes and maintaining investor trust.

Ultimately, these factors led to Great Panther's bankruptcy in 2023. The company's focus shifted from operational growth to managing its estate and asset liquidation. This was done to cover debts. The company's strategic shifts and operational challenges ultimately led to its downfall.

Investor relations played a crucial role in Great Panther's strategy. The company focused on providing transparent information to investors. This included financial reports, production results, and technical studies. This helped in building and maintaining investor confidence.

Market conditions significantly influenced Great Panther's operations and customer relationships. Fluctuations in commodity prices, such as the 20% surge in gold prices in 2024, directly affected the company's financial performance. These changes highlighted the importance of adapting to market dynamics.

Securing off-take agreements was a cornerstone of Great Panther's customer acquisition strategy. These agreements with refiners and industrial users provided a stable revenue stream. The terms of these agreements, including pricing and delivery schedules, were crucial for maintaining customer relationships. Understanding the Marketing Strategy of Great Panther can help in evaluating the company's approach.

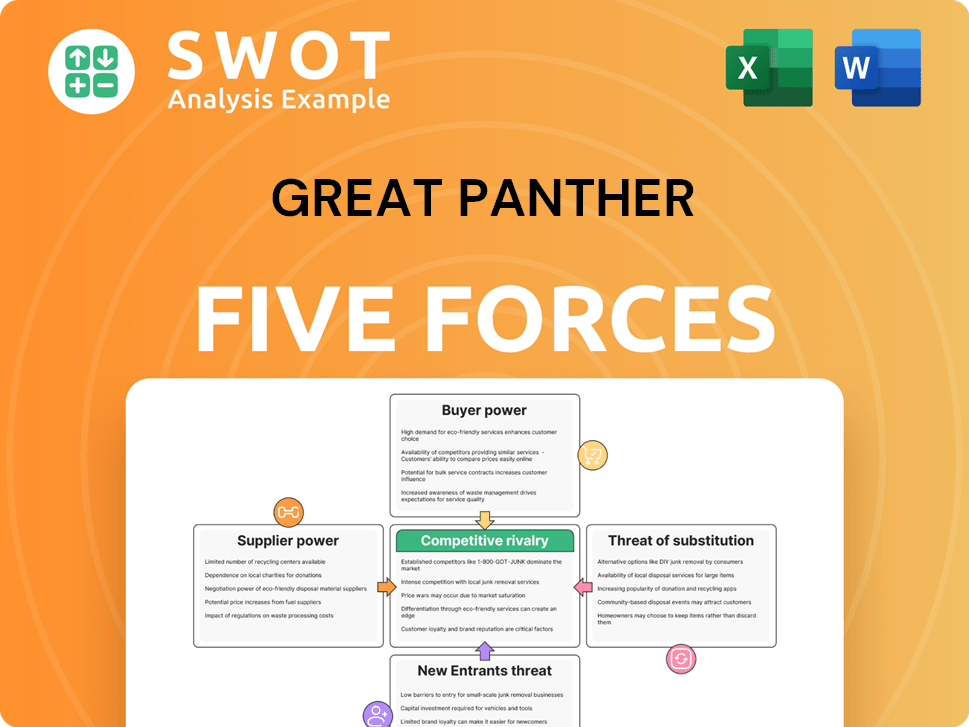

Great Panther Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Great Panther Company?

- What is Competitive Landscape of Great Panther Company?

- What is Growth Strategy and Future Prospects of Great Panther Company?

- How Does Great Panther Company Work?

- What is Sales and Marketing Strategy of Great Panther Company?

- What is Brief History of Great Panther Company?

- Who Owns Great Panther Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.