Hong Kong Exchanges Bundle

How did a small trading association become a global financial powerhouse?

Journey back in time to uncover the fascinating Hong Kong Exchanges SWOT Analysis and the pivotal role it plays in today's global financial system. From its humble beginnings in the late 19th century, the Hong Kong Exchanges Company has transformed into a leading platform for capital raising and international investment. Discover the key milestones and innovations that have shaped the evolution of this financial giant.

The HKEX history is a testament to the resilience and adaptability of the Hong Kong Stock Exchange. Understanding the brief history of HKEX provides crucial context for grasping its current significance within the financial market Hong Kong and its impact on Hong Kong's economy. This exploration will delve into the stock market development, highlighting the key events that have shaped its journey from a local trading hub to a global financial center, and its role in Asia.

What is the Hong Kong Exchanges Founding Story?

The story of the Hong Kong Exchanges Company, or HKEX, begins with the establishment of the Association of Stockbrokers in Hong Kong. This marked the formal beginning of a regulated financial market, evolving into what we know today as the Hong Kong Stock Exchange. This early foundation set the stage for the significant role HKEX plays in the global financial landscape.

The formation of the Hong Kong Stock Exchange was a response to the need for regulation in the financial market. The initial trading activities, which occurred in informal settings like streets and tea houses, eventually transitioned into a more structured environment. This early evolution is a key part of the HKEX history and its growth into a leading exchange.

The Hong Kong Exchanges and Clearing Limited (HKEX) has a rich history. Here's a look at its founding story:

The origins of HKEX trace back to February 18, 1891, with the establishment of the Association of Stockbrokers in Hong Kong. This was in response to a 'Share Bill' aimed at regulating market speculation. Key figures included Mr. Vernon (Chairman), and founding members such as Mr. E. Jones Hughes, William Legge, and others. Trading initially took place in informal locations like streets and tea houses.

- In 1914, the Association of Stockbrokers was renamed The Hong Kong Stock Exchange.

- By 1972, there were four stock exchanges in Hong Kong, leading to calls for unification.

- The Stock Exchange of Hong Kong Limited was incorporated in 1980, with trading starting on April 2, 1986.

- The Hong Kong Futures Exchange was established in December 1976 as the Hong Kong Commodities Exchange, later renamed in 1985.

- The Hong Kong Securities Clearing Company Limited was incorporated in 1989 and began operations in 1992, introducing the Central Clearing and Settlement System (CCASS).

- These entities merged into Hong Kong Exchanges and Clearing Limited (HKEX) on March 6, 2000, and listed on the stock exchange on June 27, 2000. This consolidation was a strategic move to enhance global competitiveness.

The evolution of the Hong Kong Stock Exchange reflects the broader stock market development in the region. The consolidation of various exchanges into HKEX was a strategic move. This was aimed at strengthening Hong Kong's financial market and its position in the global economy. The Target Market of Hong Kong Exchanges includes a diverse range of participants, from individual investors to major financial institutions.

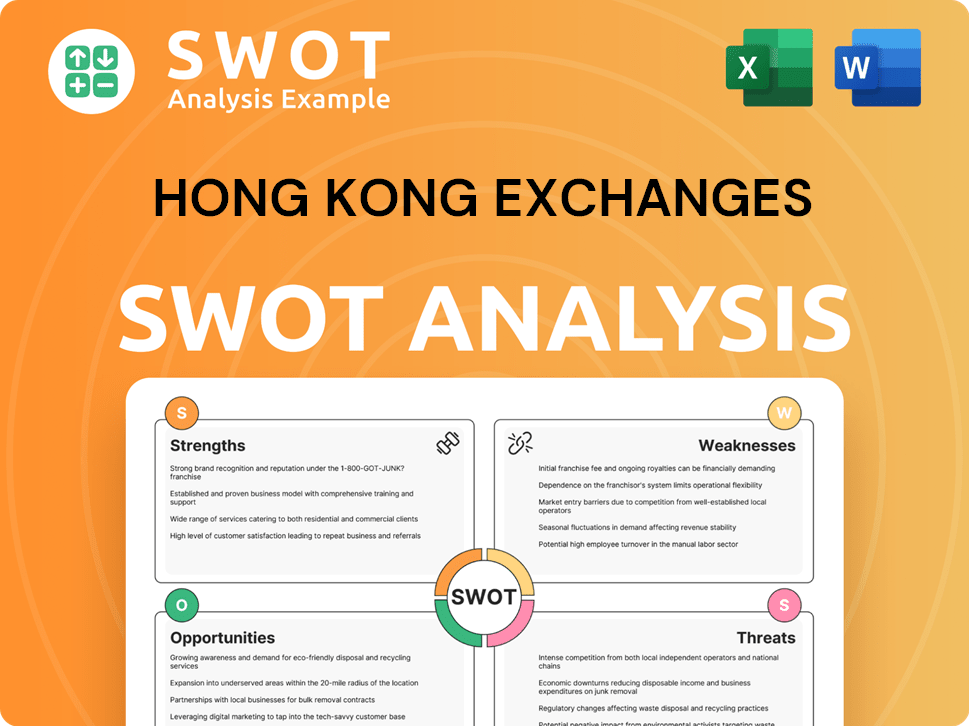

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hong Kong Exchanges?

The early years of the Hong Kong Exchanges Company, following the formal establishment of the Stock Exchange of Hong Kong Limited in 1986, were marked by significant growth and infrastructural advancements. This period saw the introduction of new technologies and financial products, shaping the trajectory of the financial market in Hong Kong. A pivotal moment arrived with the merger of key exchanges in 1999, which enhanced Hong Kong's global competitiveness. This strategic consolidation helped pave the way for HKEX's role as a major player in the global financial landscape.

The Stock Exchange of Hong Kong Limited opened a new trading hall on April 2, 1986, with 249 listed companies and a total market capitalization of HK$245 billion. The introduction of a computer-assisted trading system also occurred on April 2, 1986. The 'Automatic Order Matching and Execution System' (AMS) was launched in 1993. These advancements were crucial for the stock market development.

New financial products were introduced, including the first derivative warrant in February 1988. The first China-incorporated enterprise (H-share), Tsingtao Brewery, was listed in June 1993. Regulated short selling was introduced in January 1994, and stock options in September 1995. The Growth Enterprise Market (GEM) was introduced in November 1999 to support growth companies. These changes significantly impacted the evolution of Hong Kong's stock market.

In March 1999, the Stock Exchange, the Hong Kong Futures Exchange, and their clearinghouses merged to form Hong Kong Exchanges and Clearing Limited (HKEX), officially formed on March 6, 2000. This strategic move aimed to enhance Hong Kong's global competitiveness. HKEX launched the third-generation trading system, AMS/3, in October 2000. The acquisition of the London Metal Exchange (LME) in 2012 further solidified HKEX's position.

The focused development during this period laid the groundwork for HKEX's role as a 'super-connector' between China and global markets. The early days of the Hong Kong Exchanges were crucial in establishing its prominence. Understanding the Revenue Streams & Business Model of Hong Kong Exchanges can provide further insights into its operations and impact on Hong Kong's economy.

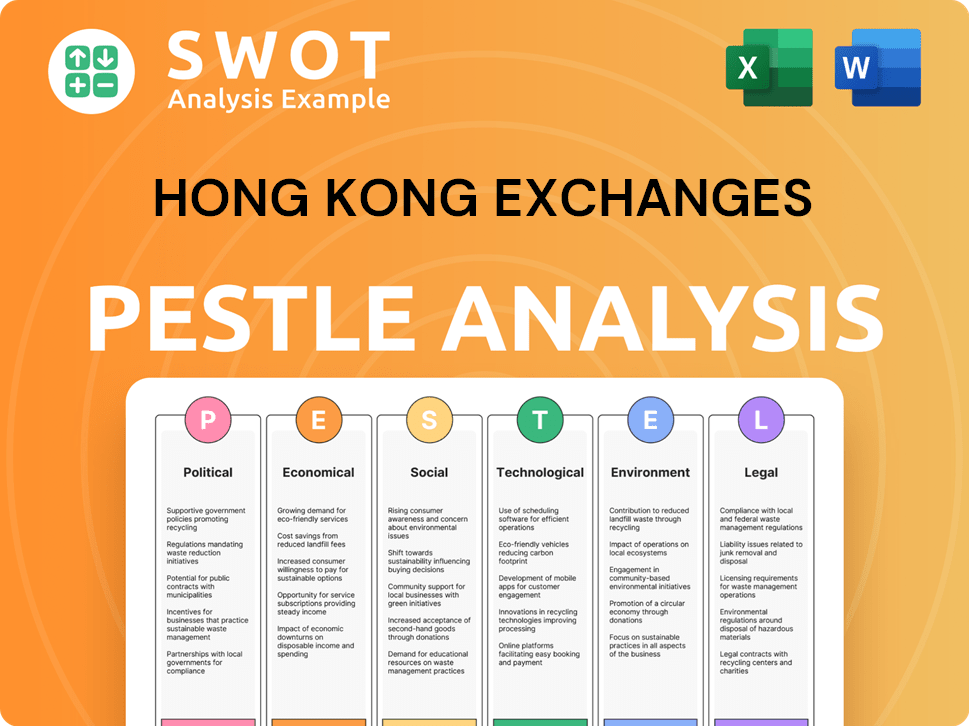

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hong Kong Exchanges history?

The Hong Kong Exchanges Company (HKEX) has a rich history marked by significant milestones that have shaped the Hong Kong Stock Exchange and its role in Hong Kong's economy. These achievements reflect its growth and adaptation to the evolving global financial landscape. The HKEX history is a testament to its resilience and strategic vision.

| Year | Milestone |

|---|---|

| June 1992 | Introduction of the Central Clearing and Settlement System (CCASS), streamlining clearing, settlement, and depository activities. |

| 2000 | Launch of AMS/3, a robust trading system that modernized market operations. |

| 2012 | Acquisition of the London Metal Exchange (LME), expanding global reach and diversifying product offerings. |

| Q1 2025 | Launched six new stock option classes, the cross-listing of the world's largest Nasdaq 100 ETF, and the first Hang Seng TECH Covered Call ETF and Single Stock L&I Products. |

| 2024 | Achieved carbon neutrality in its operations through the use of renewable electricity and offsetting emissions via its Core Climate marketplace. |

Hong Kong Exchanges Company has consistently embraced innovation to enhance its market infrastructure. The introduction of advanced trading systems and the expansion of its product offerings, such as the recent launch of new stock options and ETFs, demonstrate its commitment to staying at the forefront of financial market technology and services.

CCASS streamlined clearing, settlement, and depository activities, enhancing efficiency and security. This innovation was crucial for the stock market development in Hong Kong.

AMS/3 provided a robust platform for modern market operations, supporting higher trading volumes and complex financial instruments. This system was a key factor in the evolution of the Hong Kong Stock Exchange.

The acquisition of the London Metal Exchange expanded HKEX's global reach and diversified its product offerings into commodities. This strategic move enhanced its position in the financial market Hong Kong.

The launch of new stock option classes, the cross-listing of the world's largest Nasdaq 100 ETF, and the first Hang Seng TECH Covered Call ETF and Single Stock L&I Products expanded investment choices. These innovations reflect the dynamic nature of the Hong Kong Exchanges Company.

Achieving carbon neutrality through renewable energy and offsetting emissions demonstrates a commitment to sustainability. This initiative aligns with global environmental goals and enhances the company's reputation.

Partnership with CMU OmniClear Limited aims to modernize Hong Kong's securities settlement system. This initiative is designed to improve efficiency and reduce risks in the market.

Despite its successes, Hong Kong Exchanges Company faces ongoing challenges. Macroeconomic factors, such as US-China trade tensions and rising interest rates, continue to influence global markets and impact HKEX's performance. Maintaining its competitiveness as a listing venue is another key challenge, especially with the rise of other markets.

The 1987 market crash and current macroeconomic challenges, including US-China trade tensions and rising interest rates, have tested the resilience of HKEX. These events highlight the need for adaptability and robust risk management.

The Indian market surpassing Hong Kong to become the world's fourth-largest stock market by value of shares poses a competitive threat. This necessitates strategic initiatives to attract and retain listings.

Streamlining the listing application process and modifying minimum listing requirements for specialist technology companies are ongoing efforts. These changes aim to enhance the attractiveness of the Hong Kong Stock Exchange.

New corporate governance rules, including changes to independent non-executive director (INED) tenure and mandatory director training, aim to enhance market quality. These measures are intended to boost investor confidence.

US-China trade tensions and other geopolitical factors can significantly impact market sentiment and trading volumes. HKEX must navigate these challenges to maintain stability and attract international investors.

Rising interest rates can affect market liquidity and investment decisions, impacting trading activity. HKEX must adapt to these changes to ensure market stability and attract investment.

To learn more about the strategic direction of Hong Kong Exchanges Company, you can read this article about Growth Strategy of Hong Kong Exchanges.

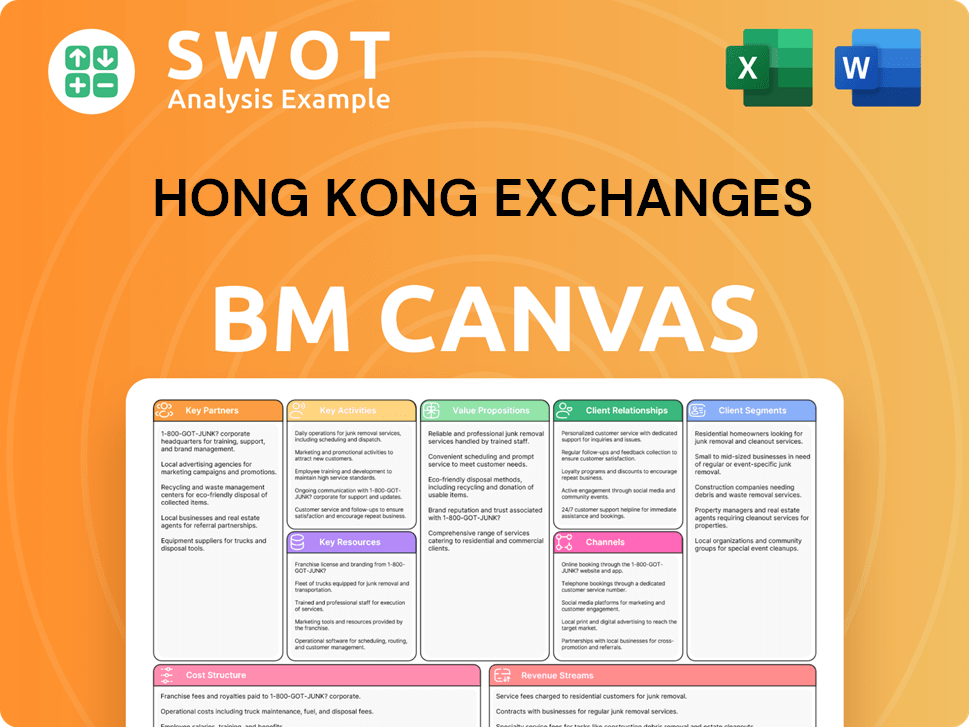

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hong Kong Exchanges?

The Hong Kong Stock Exchange (HKEX) has a rich history, evolving from its early beginnings to become a leading global financial hub. The evolution of the Hong Kong Stock Exchange reflects the growth of Hong Kong's economy and its role in facilitating international trade. Understanding the HKEX history provides insights into the development of the financial market in Hong Kong and its significance in Asia. This timeline highlights key milestones and the future outlook of the exchange. Read more about the company's core values in this article: Mission, Vision & Core Values of Hong Kong Exchanges.

| Year | Key Event |

|---|---|

| 1891 | The Association of Stockbrokers in Hong Kong is established, marking the formal beginning of the stock market. |

| 1914 | The Association is renamed The Hong Kong Stock Exchange. |

| 1976 | The Hong Kong Commodity Exchange (predecessor of HKFE) is established. |

| 1986 | Trading commences on the unified Stock Exchange of Hong Kong Limited, with a computer-assisted trading system introduced. |

| 1992 | The Central Clearing and Settlement System (CCASS) is introduced. |

| 1993 | The first China-incorporated enterprise (H-share) is listed (Tsingtao Brewery). |

| 1999 | The Growth Enterprise Market (GEM) is introduced. |

| 2000 | Hong Kong Exchanges and Clearing Limited (HKEX) is formed through the merger of the Stock Exchange of Hong Kong, the Hong Kong Futures Exchange, and their clearinghouses; HKEX is listed on its own exchange. |

| 2012 | HKEX acquires the London Metal Exchange (LME). |

| 2024 | HKEX achieves carbon neutrality in its operations. |

| 2025 (Q1) | HKEX reports record quarterly revenue and profit, with profit attributable to shareholders jumping 37% year-on-year to HK$4.08 billion and revenue up 32% to HK$6.86 billion; headline average daily turnover (ADT) reaches a record HK$242.7 billion. |

| 2025 (January) | New corporate governance rules, including enhanced climate-related disclosures, take effect. |

| 2025 (March) | HKEX plans to launch six new single stock options. |

| 2025 (Mid-year) | First phase of minimum spread reduction for eligible securities is planned for implementation. |

| 2025 (Second half) | Applicants seeking to list on HKEX are likely to be subject to and benefit from new IPO rules. |

| 2025 (End) | HKEX aims for technical readiness for a T+1 stock settlement cycle. |

| 2026 (Early) | The Uncertificated Securities Market (USM) regime is expected to become effective for new issuers. |

HKEX is committed to leveraging its 'China advantage' and expanding its connectivity with global markets. This strategy is crucial for enhancing its role in facilitating international trade and investment. The focus is on strengthening links with both mainland China and international financial centers.

Analysts project HK$130–150 billion in IPO funds for 2025, driven by dual listings from A-share companies and firms from the Middle East and ASEAN. HKEX plans to open an office in Riyadh in 2025 to strengthen its Middle East presence. This expansion highlights HKEX's role in Asia and its commitment to global reach.

The exchange is enhancing its channels, platforms, and products. Ongoing strategic initiatives invest in future-ready capabilities, ensuring long-term vibrancy and sustainability. This includes multi-year platform development programs to support the next generation of investors.

Efforts to enhance market microstructure and the listing franchise are underway. These initiatives aim to improve the efficiency and attractiveness of the market. This is essential for maintaining the significance of the Hong Kong stock market.

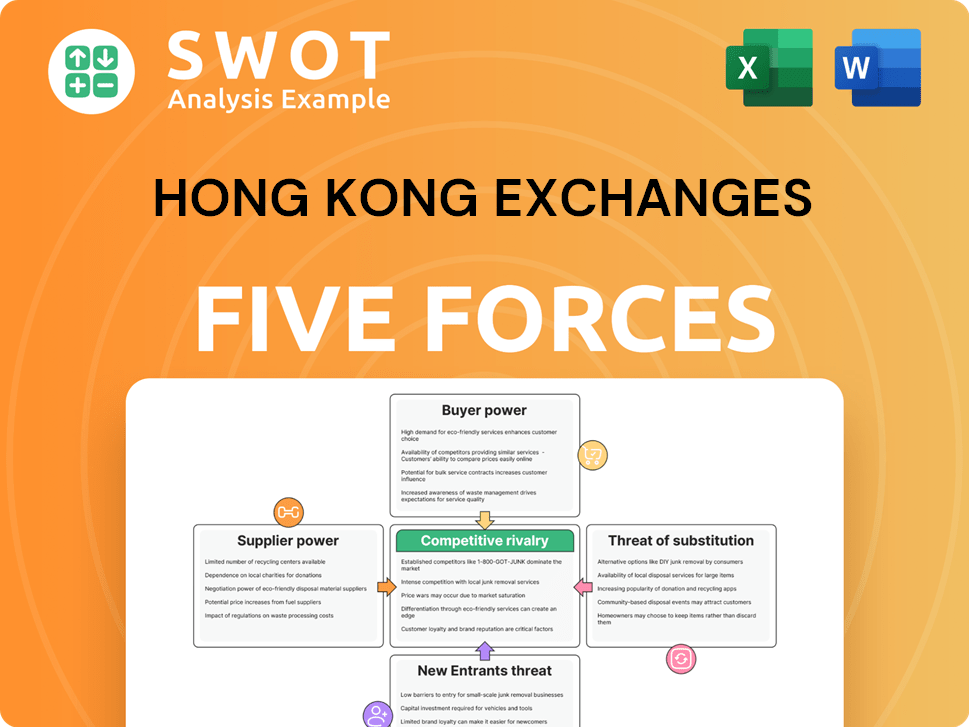

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.