Hong Kong Exchanges Bundle

Can HKEX Maintain Its Dominance in the Face of Rising Competition?

Hong Kong Exchanges and Clearing Limited (HKEX) is a powerhouse in the global financial arena, acting as a vital bridge for capital flow. Its impressive Q1 2025 results, showcasing record revenue and profit, highlight its current strength. But in a world of constant change, how does HKEX strategize to stay at the top?

This deep dive into the Hong Kong Exchanges SWOT Analysis explores the competitive landscape surrounding HKEX. We'll dissect the company's primary rivals and evaluate its unique strengths within the dynamic financial markets. This analysis provides crucial insights for anyone seeking to understand the future of the Hong Kong Stock Exchange and its position in the global market, including a detailed HKEX market share analysis.

Where Does Hong Kong Exchanges’ Stand in the Current Market?

HKEX, or Hong Kong Exchanges and Clearing, holds a significant position in the global financial landscape. It serves as a pivotal international financial center, particularly noted for its role in linking China with the worldwide markets. As of March 2024, it ranked as the eighth-largest stock exchange globally and the fifth-largest in Asia by market capitalization, underscoring its substantial influence.

The core operations of HKEX encompass a wide array of financial services. These include trading, clearing, settlement, and depository services for equities, derivatives, commodities, fixed income, and currency markets. Additionally, it provides essential listing and issuer services, supporting companies in accessing capital markets. This comprehensive suite of services positions HKEX as a central hub for financial activities in the Asia-Pacific region.

As of March 2024, HKEX was the eighth-largest stock exchange globally and the fifth-largest in Asia by market capitalization. This ranking highlights its significant size and influence in the global financial markets. HKEX's market capitalization reflects its importance as a venue for capital raising and investment.

HKEX offers a comprehensive suite of services, including trading, clearing, settlement, and depository services. These services cover equities, derivatives, commodities, fixed income, and currency markets. The exchange also provides listing and issuer services, supporting companies in accessing capital markets.

HKEX has a global reach, with a strong focus on facilitating investment and capital raising for Chinese companies. The 'Connect' schemes, such as Stock Connect and Bond Connect, are central to this strategy. These schemes enable seamless cross-border investment between Mainland China and Hong Kong.

In Q1 2025, HKEX's Average Daily Turnover (ADT) reached a record HK$242.7 billion, more than double that of Q1 2024. Southbound Stock Connect ADT soared by 255% to HK$110 billion. The derivatives markets saw a 24% year-on-year rise in Average Daily Volume (ADV) to 1.87 million contracts.

HKEX's financial health is robust, with an expanded EBITDA margin of 78% in Q1 2025. The IPO market showed significant recovery, with 17 listings raising HK$18.7 billion in Q1 2025, nearly four times the amount raised in Q1 2024. The active IPO application pipeline increased to 120 as of March 31, 2025, signaling sustained momentum.

- Record ADT: The headline Average Daily Turnover (ADT) reached a record HK$242.7 billion in Q1 2025.

- Strong IPO Market: 17 listings raised HK$18.7 billion in Q1 2025, nearly four times the amount raised in Q1 2024.

- EBITDA Margin: An expanded EBITDA margin of 78% in Q1 2025 demonstrates strong operational efficiency.

- Southbound Stock Connect: Southbound Stock Connect ADT soared by 255% to HK$110 billion in Q1 2025.

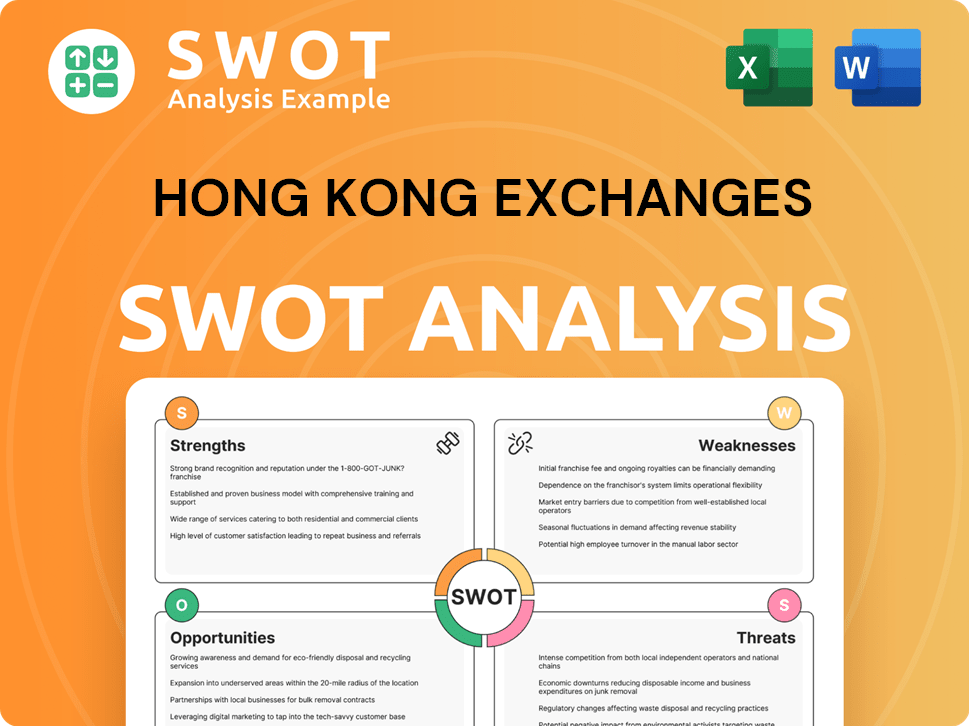

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hong Kong Exchanges?

The Competitive Landscape for Hong Kong Exchanges (HKEX) is shaped by a dynamic interplay of global and regional forces. HKEX faces competition from both direct and indirect rivals, each vying for market share and influence in the financial markets.

Understanding the competitive environment involves assessing the strengths and strategies of key players, including mainland Chinese exchanges, regional hubs, and global exchanges. The landscape is further complicated by evolving market trends and regulatory changes.

HKEX's ability to maintain its position depends on its capacity to adapt to the changing environment and capitalize on opportunities, such as attracting high-profile IPOs and maintaining liquidity.

The Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) are HKEX's primary direct competitors in the region. These exchanges are significant due to their size and influence within the Chinese market.

In January 2024, the Shanghai Stock Exchange's domestic market capitalization was approximately USD 7.27 trillion. The Shenzhen Stock Exchange reached around USD 5.21 trillion in February 2024.

The Singapore Exchange (SGX) also competes in the region, aiming to be a financial hub and attracting listings from Southeast Asia. This adds another layer of competition for HKEX.

Major global exchanges, such as the New York Stock Exchange (NYSE) and Nasdaq, compete for international listings, including those from Chinese companies. These exchanges offer access to a broader investor base.

In 2024, Hong Kong ranked fourth globally in IPO fundraising. Nasdaq and NYSE held second and third positions, respectively, highlighting the competition in attracting new listings.

Mainland Chinese exchanges benefit from their large domestic market and government support. Global exchanges offer access to a wider investor pool and potentially higher valuations.

HKEX's competitive battles involve attracting IPOs and maintaining liquidity. The relocation of Chinese firms' listings from the US to Hong Kong presents an opportunity for HKEX.

- The surge in Chinese firms relocating listings from the US to Hong Kong provides HKEX with an opportunity.

- Mergers and alliances, though not explicitly detailed in recent data, can significantly alter the competitive landscape.

- New players in virtual assets and FinTech pose indirect competition by offering alternative investment avenues.

- HKEX must adapt to regulatory changes and market trends to maintain its competitive edge.

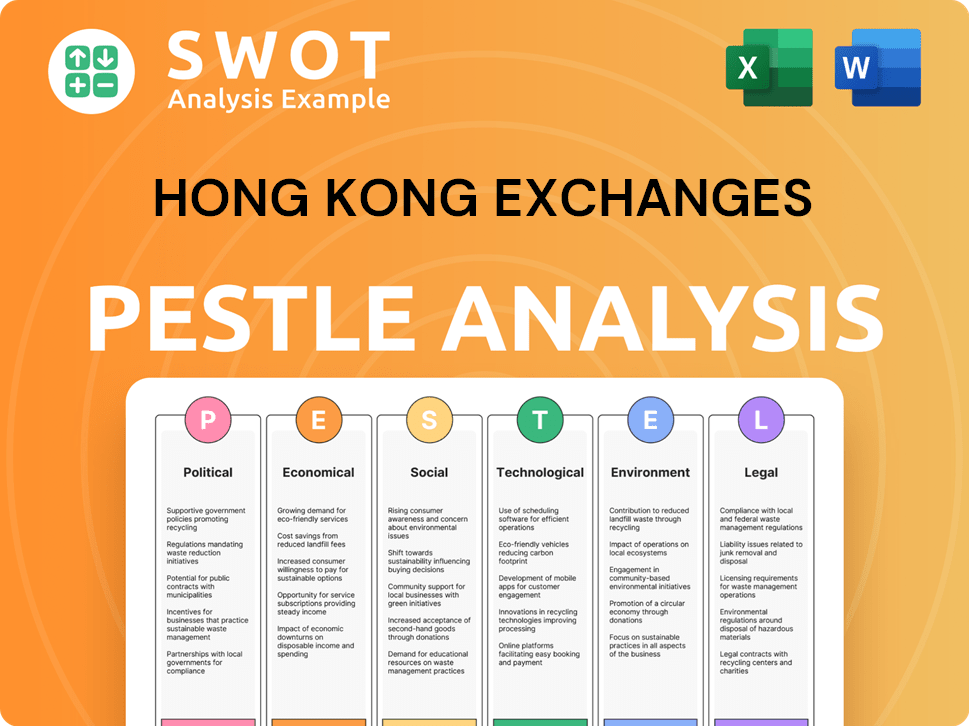

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hong Kong Exchanges a Competitive Edge Over Its Rivals?

The competitive landscape for Hong Kong Exchanges (HKEX) is shaped by its unique position and strategic advantages in the global financial market. HKEX leverages its role as a crucial gateway between Mainland China and international markets, setting it apart from competitors. This strategic positioning allows it to capitalize on capital flows and market access, making it a key player in the financial industry. For a deeper dive into the company's growth trajectory, consider exploring the Growth Strategy of Hong Kong Exchanges.

HKEX's competitive edge is further enhanced by its diverse product offerings and robust regulatory environment. The exchange continually introduces new products and services, enhancing market vibrancy and liquidity. This commitment to innovation, coupled with a strong regulatory framework, reinforces investor confidence and supports its long-term competitiveness. These factors contribute to HKEX's ability to attract both domestic and international investors, solidifying its position in the global financial market.

The "China advantage" is a pivotal element of HKEX's competitive strategy. Programs like Stock Connect and Bond Connect facilitate significant two-way capital flows, providing unparalleled access to China's markets. The Southbound Stock Connect ADT, for instance, saw a remarkable increase of 255% to HK$110 billion in Q1 2025, demonstrating the strong demand from Mainland investors. This unique connectivity is difficult for other exchanges to replicate, giving HKEX a distinct advantage.

HKEX's 'China advantage' and 'Connect' programs are key differentiators, facilitating two-way capital flows. These programs provide international investors with access to China's A-share and bond markets. This connectivity is a critical differentiator that few other exchanges can replicate.

HKEX boasts a diverse product ecosystem, including equity, commodity, fixed income, and currency products. The introduction of new products, like new stock option classes and ETFs, enhances market vibrancy. HKEX was the first exchange in Asia to offer Single Stock Leveraged and Inverse Products.

Hong Kong's reputation as an international financial center and its robust regulatory system instill investor confidence. The Securities and Futures Commission (SFC) actively works to enhance market resilience. HKEX's commitment to technological advancements strengthens its operational efficiencies.

HKEX is investing in technological advancements and infrastructure modernization. This includes a multi-year modernization program for its cash market platform. The development of the Orion Derivatives Platform further strengthens operational efficiencies.

HKEX's competitive advantages include its 'China advantage' and 'Connect' programs, which provide unparalleled access to China's markets. A diverse product ecosystem and a strong regulatory framework also contribute to its competitive standing.

- 'China Advantage' through Stock Connect and Bond Connect.

- Diverse product offerings across various asset classes.

- Strong brand equity and a robust regulatory environment.

- Commitment to technological innovation and infrastructure modernization.

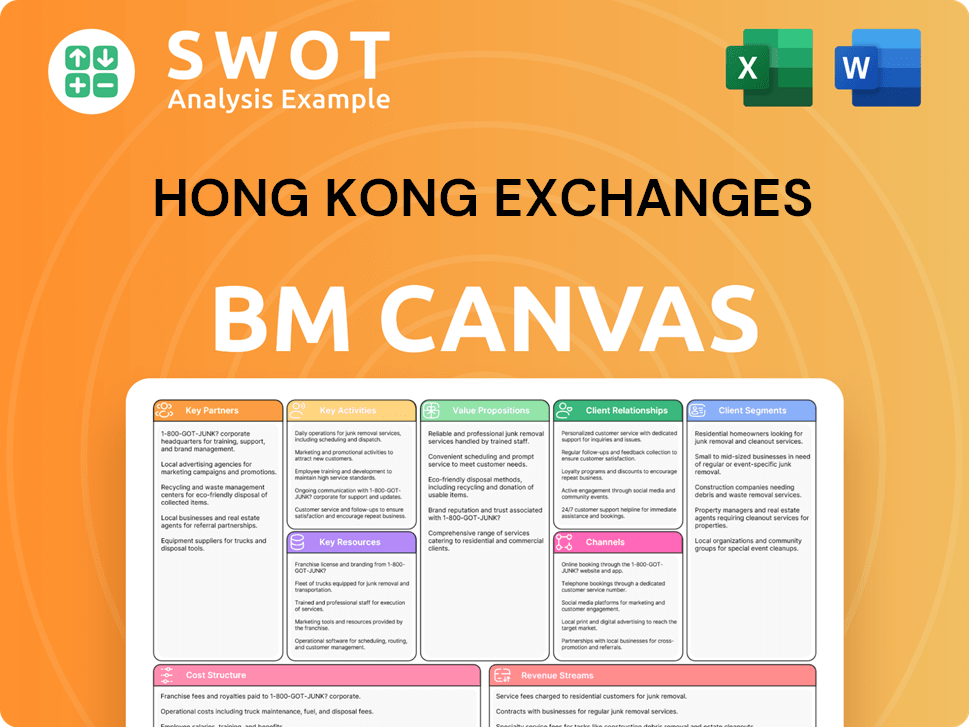

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hong Kong Exchanges’s Competitive Landscape?

The competitive landscape for Hong Kong Exchanges (HKEX) is dynamic, shaped by evolving industry trends, future challenges, and emerging opportunities. The Stock Exchange's position is influenced by technological advancements, geopolitical factors, and the increasing importance of Environmental, Social, and Governance (ESG) considerations.

Understanding the HKEX's competitive environment involves assessing its strategies, market position, and the impact of both internal and external factors. This analysis is crucial for investors, financial professionals, and business strategists making informed decisions in the Financial Markets.

Technological advancements, particularly in AI and FinTech, are driving market transformation. HKEX is investing in future-ready capabilities, including real-time trade processing. The focus on digital transformation is evident in its plans to digitize and automate the in-kind creation and redemption process for Exchange Traded Products (ETPs) by 2025.

The rapid pace of technological change necessitates continuous investment and adaptation. Geopolitical tensions and uncertainties in global monetary and trade policies pose macro volatility risks. Changes in China's A-share IPO policies and a potential decline in demand due to economic shifts could also impact HKEX's position.

Renewed global interest in China, boosted by AI and innovation, drives record volumes in HKEX's Cash and Derivatives Markets. The 'A+H' listing model is gaining momentum, with policy shifts enhancing HKEX's appeal. Analysts project a significant market upturn in 2025, with IPO fundraising potentially reaching HK$130-160 billion.

HKEX is exploring collaborations with other exchanges to attract overseas-listed companies. The long-term outlook for new energy companies listing in Hong Kong is positive. HKEX's strategy involves leveraging its China advantage, expanding global connectivity, and enhancing its platforms and products.

The Competitive Landscape of HKEX is significantly influenced by technological advancements, geopolitical uncertainties, and the increasing importance of ESG factors. The company faces challenges related to technological adaptation and macroeconomic risks, while also benefiting from opportunities presented by renewed global interest in China and the 'A+H' listing model.

- Technological Transformation: HKEX is actively investing in AI and FinTech to enhance its capabilities, including real-time trade processing and digital transformation.

- Geopolitical and Economic Risks: Geopolitical tensions and changes in China's A-share IPO policies pose significant challenges to HKEX.

- Market Growth and Opportunities: Renewed global interest in China and the 'A+H' listing model are driving market growth, with analysts projecting a significant upturn in 2025.

- Strategic Positioning: HKEX is focusing on leveraging its China advantage, expanding global connectivity, and enhancing its platforms to capture opportunities. For more information about the financial performance of Hong Kong Exchanges, you can read this article about Owners & Shareholders of Hong Kong Exchanges.

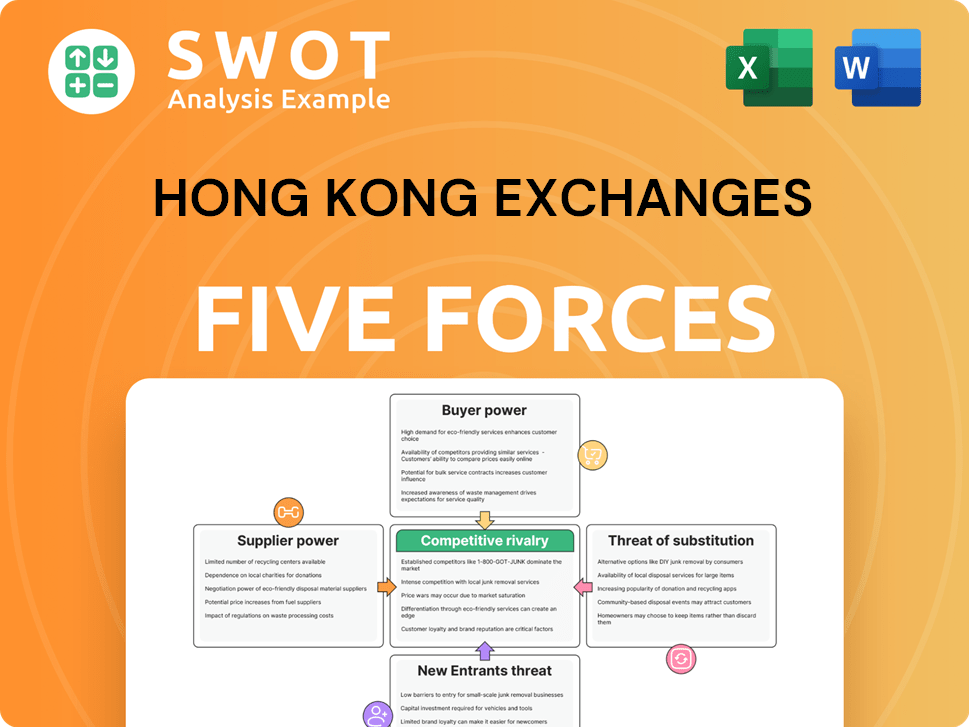

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.