Hong Kong Exchanges Bundle

How Does the Hong Kong Exchanges Company Drive Global Finance?

Hong Kong Exchanges and Clearing Limited (HKEX) isn't just a Hong Kong Exchanges SWOT Analysis; it's a financial powerhouse reshaping global markets. As a 'superconnector,' HKEX bridges East and West, facilitating unprecedented capital flow and investment opportunities. In 2024, HKEX's record-breaking performance highlighted its crucial role in the financial market Hong Kong.

From its pivotal Connect schemes to its ownership of the London Metal Exchange, HKEX offers a diverse ecosystem for trading in Hong Kong and beyond. This strategic positioning, coupled with its commitment to innovation and market competitiveness, makes understanding HKEX essential for anyone navigating the complexities of the Hong Kong stock market and global finance. Moreover, its impressive Q1 2025 results, with record revenue and profit, further solidify its importance in the financial landscape and offer valuable insights into how to invest in HKEX.

What Are the Key Operations Driving Hong Kong Exchanges’s Success?

The Hong Kong Exchanges Company (HKEX) operates a comprehensive financial marketplace, enabling the trading and clearing of a wide array of financial products. Its core business involves equity, derivative, commodity, fixed income, and other financial market products and services. HKEX serves a diverse clientele, including individual and institutional investors, corporations seeking capital through listings, and market intermediaries like brokers.

Its operational processes are extensive, including trading platforms for securities and derivatives, ensuring efficient price discovery and execution. HKEX's clearing houses play a critical role in mitigating counterparty risk by guaranteeing trades and facilitating settlement. Additionally, the company provides listing and issuer services, guiding companies through the process of going public and ensuring ongoing compliance. Technology development is central to HKEX's operations, with ongoing infrastructure enhancement programs designed to support real-time trade processing and derivatives trading.

HKEX's value proposition is enhanced by its 'superconnector' role, particularly through its pioneering Connect schemes with Mainland China. This unique connectivity, combined with its ownership of the London Metal Exchange (LME), differentiates HKEX from competitors by providing access to a diverse product ecosystem and deep, liquid, and international markets. Continuous efforts in product innovation further strengthen its market differentiation and cater to evolving investor needs.

HKEX provides advanced trading platforms for both securities and derivatives. These platforms are designed to ensure efficient price discovery and execution, critical for the Hong Kong stock market. The platforms support high-volume trading and real-time data dissemination, enabling investors to make informed decisions quickly.

Clearing houses are a crucial part of HKEX's operations. They mitigate counterparty risk by guaranteeing trades and facilitating settlement. This process ensures the integrity of the financial market in Hong Kong and builds investor confidence. The clearing and settlement systems are designed to be robust and efficient.

HKEX offers comprehensive listing and issuer services, guiding companies through the process of going public. These services include assisting with regulatory compliance and providing ongoing support. The company is committed to maintaining high standards for listed companies, ensuring investor protection and market integrity.

The Connect schemes, such as Stock Connect and Bond Connect, are a key part of HKEX's value proposition. These schemes facilitate cross-border capital flows, offering global investors access to China's markets. They also enable Chinese firms to raise capital internationally. This superconnector role is a significant differentiator.

HKEX distinguishes itself through its unique market position and strategic initiatives. The company's 'superconnector' role, especially through its Connect schemes, is a key differentiator. Furthermore, its ownership of the LME provides access to a diverse product ecosystem.

- Connect Schemes: Facilitate cross-border capital flows between China and the rest of the world.

- LME Ownership: Provides access to a global commodity market.

- Product Innovation: Continuous development of new products and services to meet evolving investor needs.

- Technology: Ongoing investment in technology infrastructure for efficiency and reliability.

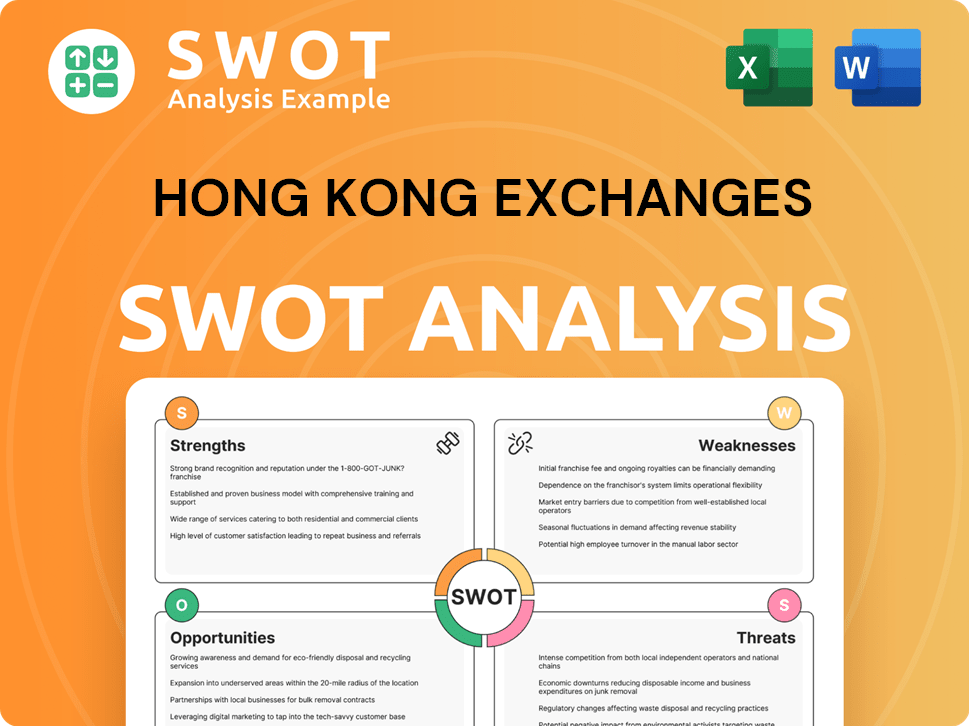

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hong Kong Exchanges Make Money?

The Hong Kong Exchanges Company (HKEX) generates revenue through diverse streams, primarily from its core business operations. These include trading, clearing, and listing services, contributing significantly to its financial performance. In 2024, HKEX's total revenue and other income reached a record high, demonstrating its robust business model.

HKEX's revenue streams are diversified, with trading and clearing fees, listing and issuer services, net investment income, and fees from the London Metal Exchange (LME) being the main contributors. The company leverages transaction-based fees, recurring listing fees, and fees for various market services as part of its monetization strategies. Strategic initiatives, such as expanding its product ecosystem and adjusting fees, further enhance its revenue generation capabilities.

HKEX's financial performance is driven by several key revenue streams. These streams are essential for the company's overall financial health and growth in the financial market Hong Kong. The company's ability to adapt and innovate ensures its continued success in the competitive landscape of the stock exchange Hong Kong.

HKEX's revenue streams are diversified, with significant contributions from trading and clearing fees, listing and issuer services, net investment income, and LME fees. These streams are crucial for understanding how the Competitors Landscape of Hong Kong Exchanges operates and generates revenue. The following details the major revenue streams:

- Trading and Clearing Fees: These fees are derived from trading volumes across the Cash, Derivatives, and Commodities Markets. In Q1 2025, a 32% year-on-year increase in revenue and other income to HK$6.86 billion was driven by higher trading and clearing fees. The average daily turnover (ADT) on the Hong Kong Stock Exchange surged 26% in 2024 to HK$131.8 billion, with Q1 2025 seeing a record headline ADT of HK$242.7 billion. Southbound Stock Connect ADT alone surged 255% to HK$110 billion in Q1 2025.

- Listing and Issuer Services: Revenue is generated from initial public offerings (IPOs) and ongoing listing fees. Hong Kong was the world's fourth-largest IPO hub in 2024, with 71 new listings raising HK$88 billion, approximately a 90% year-on-year growth. In Q1 2025, HKEX recorded 17 listings, raising HK$18.7 billion, nearly four times the amount raised in Q1 2024. The active IPO application pipeline increased to 120 as of March 31, 2025, up from 84 at year-end 2024.

- Net Investment Income from Corporate Funds: This includes income from the investment of the Group's corporate funds. In Q1 2025, net investment income from Corporate Funds was HK$516 million.

- LME Fees: As owner of the London Metal Exchange, HKEX also earns fees from commodities trading. An increment in LME fees contributed to the core business revenue growth in 2024.

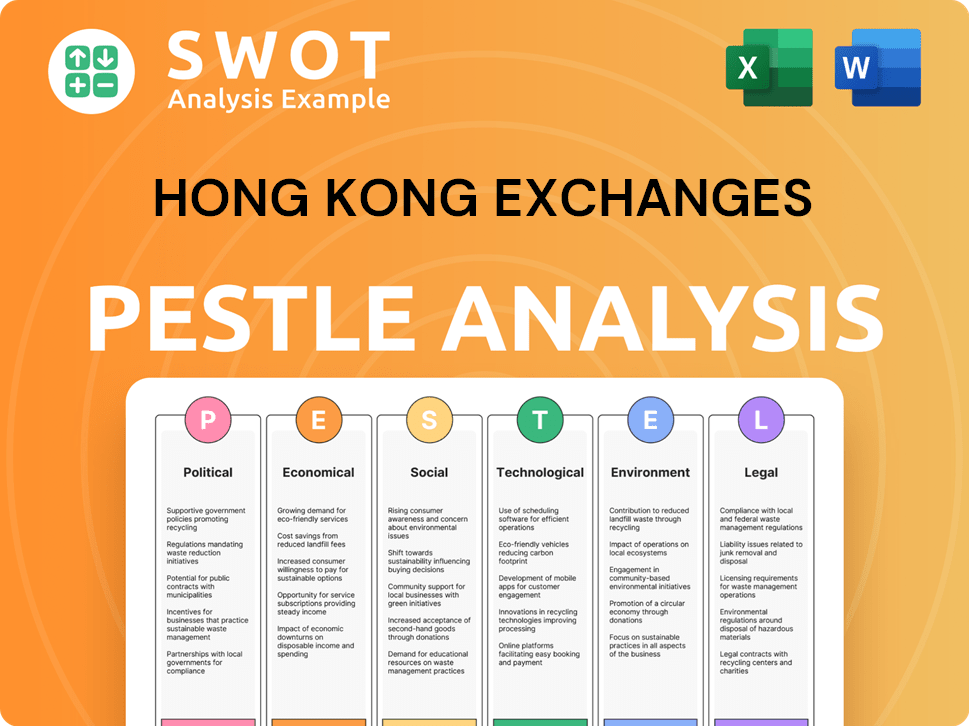

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hong Kong Exchanges’s Business Model?

The Hong Kong Exchanges Company (HKEX) has achieved significant milestones and implemented strategic moves that have reshaped its operations and financial performance. In 2024, HKEX celebrated its highest-ever annual revenue and profit, driven by increased trading activity and strategic initiatives. This success continued into Q1 2025, with the best quarterly revenue and profit recorded, reaching HK$6.86 billion in revenue and HK$4.08 billion in profit attributable to shareholders.

Strategic initiatives include continuous enhancements to market microstructure and its listing franchise. These include reforms to the Corporate Governance Code and related rules, with new climate-related disclosure rules taking effect from 2025. HKEX also plans to reduce minimum spreads of eligible securities, with the first phase set for implementation in mid-2025, to enhance market liquidity. Infrastructure enhancement programs, such as the development of the Orion Derivatives Platform (ODP) with an expected launch in 2028, and modernization of the Orion Cash Platform (OCP), are critical for future-proofing its operations and supporting next-generation investors.

HKEX has expanded its international engagement, with plans to open an office in Riyadh in 2025 and adding Abu Dhabi and Dubai to its list of recognized stock exchanges, bolstering capital market connectivity. The successful implementation of severe weather trading arrangements in 2024 also reflects its commitment to market competitiveness and resilience. For a deeper understanding of the exchange's origins, you can read more in this Brief History of Hong Kong Exchanges.

HKEX achieved record-breaking financial results in 2024 and Q1 2025, demonstrating strong growth. The company's revenue and profit reached new heights, reflecting increased trading activity and strategic initiatives. These achievements highlight HKEX's robust market position and effective operational strategies within the Hong Kong stock market.

HKEX is continuously enhancing its market infrastructure and listing franchise. This includes reforms to the Corporate Governance Code and new climate-related disclosure rules. The planned reduction in minimum spreads and the development of the Orion platforms are key strategic moves. These moves aim to improve market liquidity and future-proof operations in the financial market Hong Kong.

HKEX leverages its 'China advantage' and diversified revenue streams to stay competitive. Its brand strength, technological leadership, and the ecosystem effects of its Connect schemes provide a significant competitive edge. The introduction of new products and ESG initiatives further strengthens its position in the global market.

HKEX is expanding its international presence with an office in Riyadh and the recognition of new exchanges. The focus on technological advancements, such as the ODP, and the promotion of ESG standards are critical. These initiatives are designed to support next-generation investors and adapt to new trends in trading in Hong Kong.

HKEX's Q1 2025 revenue reached HK$6.86 billion, with profit attributable to shareholders at HK$4.08 billion. Plans to open an office in Riyadh in 2025 and the introduction of new climate-related disclosure rules are underway. The Orion Derivatives Platform (ODP) is expected to launch in 2028.

- Record financial performance in 2024 and Q1 2025.

- Strategic enhancements to market infrastructure.

- Expansion of international presence and new product launches.

- Focus on ESG standards and technological advancements.

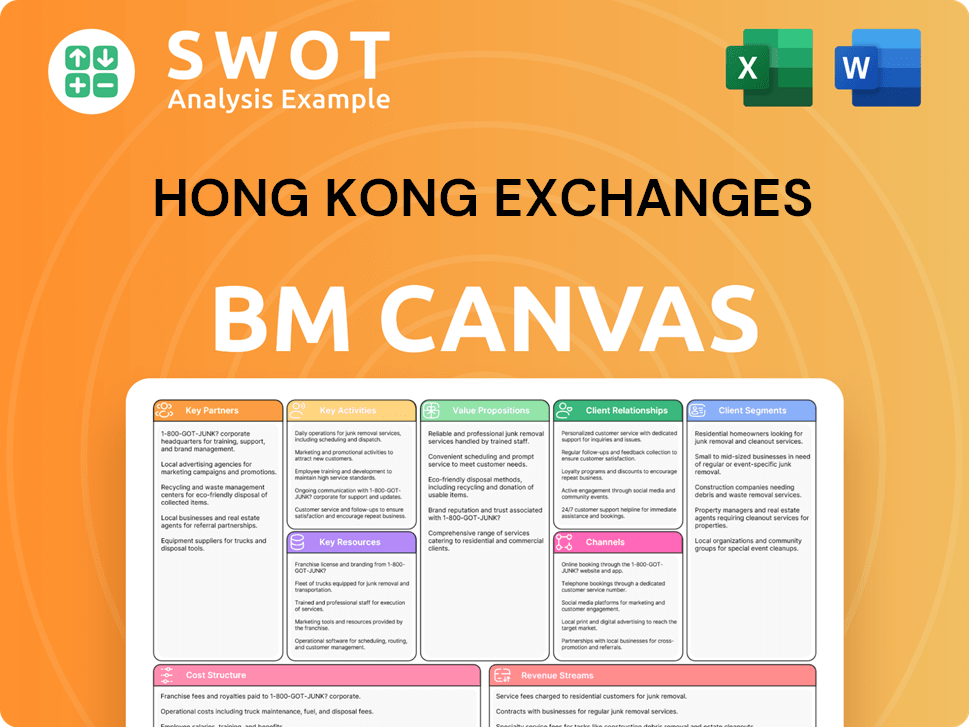

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hong Kong Exchanges Positioning Itself for Continued Success?

The Hong Kong Exchanges Company (HKEX) holds a strong position as a leading global exchange group. Hong Kong remains a prominent international financial center, consistently ranking among the top IPO venues worldwide. HKEX's strategic role as a 'superconnector' between Mainland China and global markets, particularly through its Connect schemes, solidifies its unique competitive standing.

Despite its robust position, HKEX faces several key risks, including geopolitical tensions, macroeconomic fluctuations, and regulatory changes. New competitors and technological disruptions also pose ongoing challenges, necessitating continuous innovation. Navigating these complexities requires strategic foresight and adaptability.

HKEX is a leading global exchange group, with Hong Kong ranking as a top IPO venue. The company's role as a 'superconnector' between Mainland China and global markets is crucial. HKEX's EBITDA margin expanded to 78% in Q1 2025, reflecting operational efficiency.

Geopolitical and macroeconomic developments, such as U.S.-China trade tensions and interest rate fluctuations, can impact trading volumes. Potential weakness in China's macroeconomic growth and regulatory changes are also key risk factors. New competitors and technological disruption pose ongoing challenges.

HKEX plans to ensure its systems are technically ready for a T+1 stock settlement cycle by the end of 2025. Further enhancements to its market microstructure and international engagement are ongoing priorities. The company is investing in future-ready capabilities, such as the Orion Derivatives Platform, expected to launch in 2028.

HKEX is focused on leveraging its 'China advantage' and diversified revenue streams. As of March 31, 2025, HKEX had a healthy pipeline of 120 listing applications. The company is committed to expanding its product ecosystem and capitalizing on investor demand for exposure to Asia's growth engines.

HKEX is focused on enhancing its market infrastructure and expanding its product offerings to maintain its competitive edge in the Hong Kong stock market. The company is also actively working on initiatives to attract more international investors. The company's strategic initiatives include technological advancements and regulatory compliance.

- T+1 stock settlement cycle implementation by the end of 2025.

- Launch of the Orion Derivatives Platform in 2028.

- Focus on the 'China advantage' to navigate global uncertainties.

- Continued enhancements to market microstructure and product ecosystem.

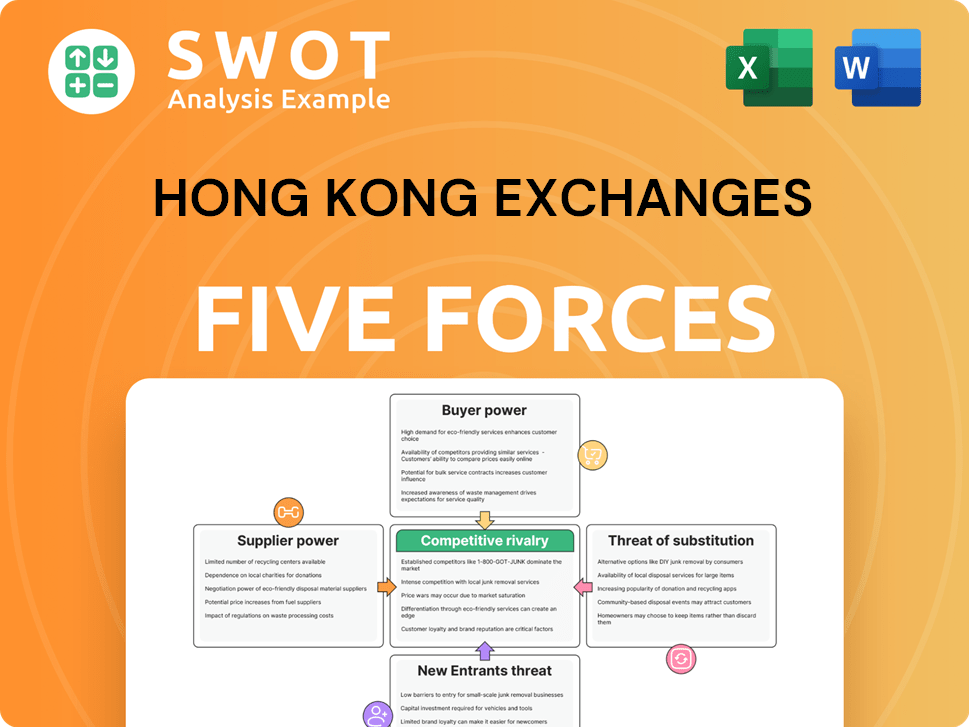

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Competitive Landscape of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.