Hong Kong Exchanges Bundle

What Drives the Hong Kong Exchanges Company?

Understanding the "why" behind a financial powerhouse like Hong Kong Exchanges Company (HKEX) is crucial for anyone involved in the global markets. Delving into its Mission Vision Core Values reveals the very essence of its operations and future trajectory.

HKEX's Hong Kong Exchanges SWOT Analysis provides a deeper look into the company's strategic goals and how its mission, vision, and core values shape its approach to corporate governance and market dynamics. Examining these elements offers valuable insights into HKEX's long-term goals and its commitment to ethical conduct within the financial landscape, impacting both investors and stakeholders.

Key Takeaways

- HKEX's mission, vision, and values provide a clear framework for its identity and success.

- HKEX's strategic focus connects East and West, driving market development and community engagement.

- Record Q1 2025 financial performance highlights the effectiveness of HKEX's strategic alignment.

- Adherence to core principles enables HKEX to leverage its China advantage and expand globally.

- HKEX's commitment to prosperity and market integrity shapes the future of finance.

Mission: What is Hong Kong Exchanges Mission Statement?

HKEX's mission is 'To Connect, Promote and Progress our Markets and the Communities they support for the prosperity of all.'

The mission statement of Hong Kong Exchanges Company (HKEX) encapsulates its multifaceted role within the global financial landscape. This mission statement, a cornerstone of HKEX's Mission Vision Core Values, underscores its commitment to fostering a thriving financial ecosystem. Understanding this mission is crucial for anyone seeking to engage with or invest in the markets HKEX operates. This includes individual investors, financial professionals, business strategists, and academic stakeholders alike.

The "Connect" aspect of the mission is vividly illustrated through initiatives like Stock Connect. This program facilitates cross-border investment, linking Mainland China's markets with international investors. As of early 2025, Stock Connect encompasses over 2,700 eligible stocks, representing approximately 90% of the combined market capitalization of the Shanghai, Shenzhen, and Hong Kong exchanges.

HKEX actively "Promotes" market growth through the introduction of innovative products and services. This includes the listing of new ETFs and derivatives. For example, the launch of the first Hang Seng TECH Covered Call ETF in Q1 2025 demonstrates HKEX's commitment to expanding its product offerings and enhancing market liquidity.

The "Progress" element of the mission highlights HKEX's dedication to advancing the financial ecosystem. This involves embracing technological advancements, enhancing market infrastructure, and promoting sustainable finance initiatives. HKEX's focus on environmental, social, and governance (ESG) factors is a key component of its long-term strategic objectives.

The primary target customers for HKEX are global investors and issuers. These include those seeking capital raising opportunities and investment prospects. This broad customer base is a key factor in HKEX's strategic goals.

HKEX offers a comprehensive suite of products and services. This includes trading, clearing, settlement, and depository services across various asset classes. Equities, derivatives, commodities, and fixed income are all integral to HKEX's offerings.

HKEX's market scope is global, with a distinct focus on leveraging Hong Kong's unique position as a gateway to Mainland China. The unique value proposition lies in facilitating two-way capital flows. It also aims to foster prosperity for all stakeholders, which is a key component of its Company Values.

The impact of HKEX's mission extends beyond mere financial transactions. It plays a significant role in the overall health and development of the financial ecosystem. This includes contributing to societal benefits. The HKEX mission statement analysis reveals a clear commitment to long-term value creation. The mission is not only market-centric but also community-oriented. This focus is evident in its strategic initiatives and commitment to Corporate Governance. For more insights into the strategic approach of HKEX, consider exploring the Marketing Strategy of Hong Kong Exchanges.

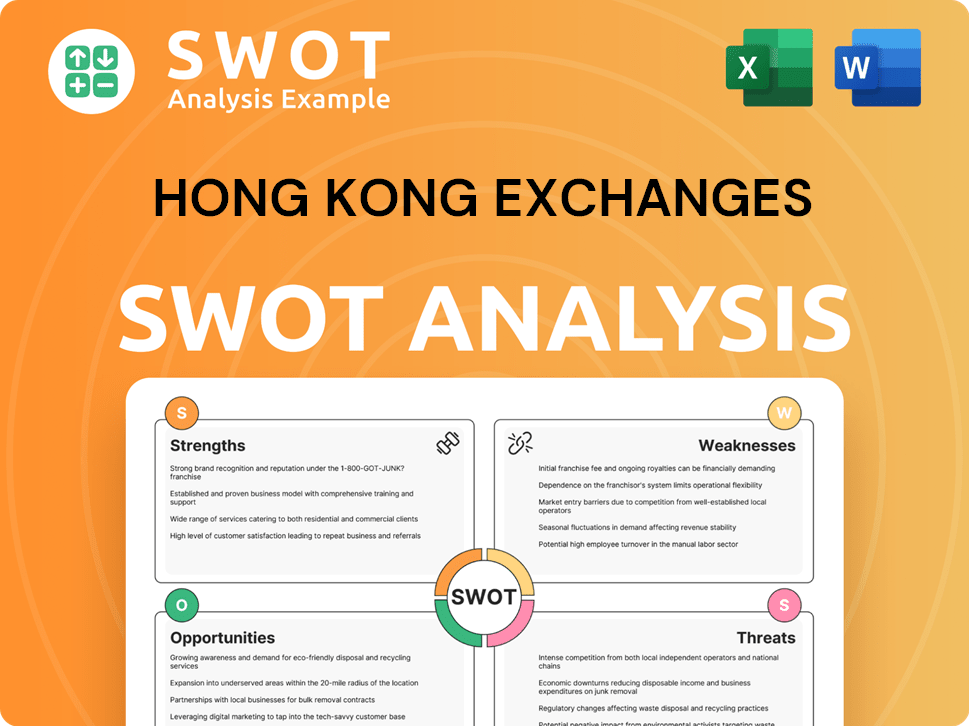

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Hong Kong Exchanges Vision Statement?

HKEX's vision is 'To build the Marketplace of the Future by facilitating the two-way capital flows between East and West, by using our scale and reputation as a platform to support our stakeholders, and by capturing the megatrend opportunities that are shaping our markets and societies.'

The vision of the Hong Kong Exchanges Company (HKEX) is a forward-looking statement that encapsulates its aspirations for the future of the financial markets. It's a clear articulation of HKEX's strategic goals, aiming for global leadership and a pivotal role in connecting Eastern and Western capital markets. This vision is not just aspirational; it's backed by concrete actions and impressive financial results, positioning HKEX for sustained growth and influence.

HKEX's ambition to build the "Marketplace of the Future" signifies a commitment to innovation and adaptability. This involves embracing technological advancements, such as digital transformation, big data analytics, and personalized finance, to enhance market efficiency and accessibility. This also includes the integration of ESG considerations into its operations and listings, reflecting a broader societal shift towards sustainable finance.

A core element of HKEX's vision is to facilitate the two-way flow of capital between East and West. This strategic goal is crucial for the company's long-term success, leveraging Hong Kong's unique position as a gateway between China and the global markets. Initiatives like Bond Connect and Swap Connect, along with RMB-denominated listings, are pivotal in achieving this.

HKEX aims to leverage its existing scale and strong reputation as a platform to support its stakeholders. This includes investors, listed companies, and other market participants. By providing a robust and reliable marketplace, HKEX fosters trust and attracts capital, further solidifying its position in the global financial landscape. This commitment to stakeholders is a key aspect of its corporate governance.

Recognizing and capturing megatrend opportunities is central to HKEX's vision. This involves proactively adapting to evolving market dynamics, including digitization, ESG, and sustainable finance. The implementation of new climate-related disclosure requirements aligned with ISSB standards, effective January 2025, is a prime example of this proactive approach, demonstrating HKEX's commitment to its core values.

HKEX's financial performance in Q1 2025, with record revenue and profit, demonstrates the company's strong momentum. The 32% increase in revenue and other income to $6.9 billion, coupled with a healthy pipeline of listing applications, underscores the effectiveness of its strategic initiatives and its ability to execute its vision. This strong financial footing is crucial for achieving its HKEX strategic objectives.

The expansion of Bond/Swap Connect and the introduction of RMB-denominated listings are key strategic initiatives that align with HKEX's vision. These efforts are designed to support RMB internationalization and further facilitate the two-way capital flows between East and West. These initiatives, combined with its focus on ESG, position HKEX for continued growth and relevance in the global market. Learn more about the historical context of HKEX in a Brief History of Hong Kong Exchanges.

In summary, the vision of Hong Kong Exchanges Company is a comprehensive roadmap for future success, emphasizing innovation, global connectivity, and stakeholder support. The company's commitment to capturing megatrends, combined with its strong financial performance and strategic initiatives, positions it well to achieve its ambitious goals and maintain its leading role in the global financial market. Understanding HKEX's mission statement analysis and HKEX's long-term goals is crucial for investors and stakeholders alike, as it provides insights into the company's direction and its potential for future growth. The importance of mission vision and values for HKEX cannot be overstated, as they guide the company's decisions and shape its interactions with the world.

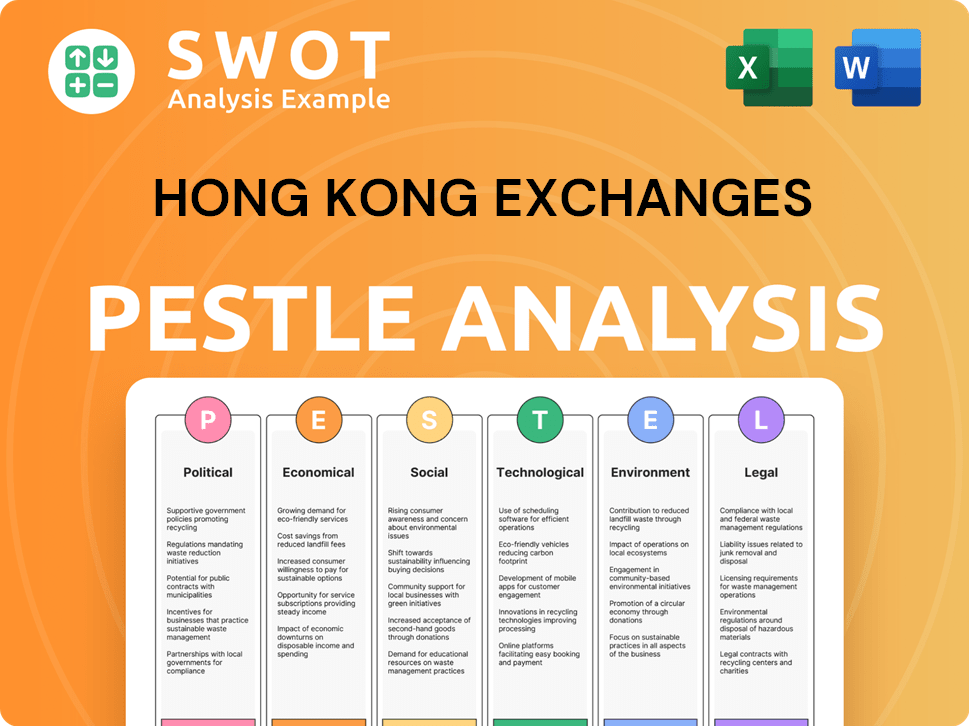

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Hong Kong Exchanges Core Values Statement?

Understanding the core values of Hong Kong Exchanges Company (HKEX) is crucial to grasping its operational philosophy and its impact on the global financial market. These values serve as the bedrock of HKEX’s strategic goals and corporate governance, shaping its interactions with stakeholders and guiding its long-term objectives.

Integrity is a cornerstone of HKEX's operations, ensuring fair and orderly markets. This commitment is evident in their continuous investment in operational resilience, providing a secure environment for market participants, and stringent policies on business ethics, data privacy, and cybersecurity. This commitment fosters trust, which is paramount in the financial sector, differentiating HKEX from its competitors.

HKEX actively promotes diversity and inclusion, recognizing that diverse perspectives lead to innovation and better decision-making. An example of this is the requirement for listed companies to have at least one female director on their board by the end of 2024. This focus enhances HKEX's ability to attract top talent and generate a broader range of solutions.

HKEX strives for excellence through continuous market enhancements and product development. This is reflected in the launch of new and sophisticated financial products, such as the Single Stock Leveraged & Inverse Products in March 2025. This pursuit of excellence positions HKEX as a leading global exchange group, attracting high-caliber listings and sophisticated investors.

Collaboration is central to HKEX's strategy, particularly in its role as a 'super connector.' This is exemplified by partnerships such as the Memorandum of Understanding with CMU OmniClear Limited in Q1 2025, aimed at enhancing Hong Kong's post-trade securities infrastructure. This collaborative approach fosters innovation and collective growth within the financial ecosystem.

These core values of HKEX—Integrity, Diversity, Excellence, Collaboration, and Engagement—are not just aspirational statements; they are the guiding principles that shape HKEX's actions and influence its strategic objectives. Understanding how these values translate into the company’s mission and vision is essential. Let's explore how mission and vision influence the company's strategic decisions in the next chapter.

How Mission & Vision Influence Hong Kong Exchanges Business?

The mission and vision of Hong Kong Exchanges Company (HKEX) serve as guiding principles, profoundly influencing its strategic decisions and operational focus. These statements shape the company's approach to market development, product innovation, and stakeholder engagement, driving its long-term growth and relevance in the global financial landscape.

HKEX's mission to 'Connect' is directly reflected in the expansion of its Connect programs. These initiatives are designed to facilitate two-way capital flows between Mainland China and global markets, aligning with the vision of bridging East and West.

- In January and March 2025, HKEX began accepting China Government and Policy Bank Bonds as collateral for Swap Connect and all Derivatives in OTC Clear, respectively.

- Southbound Stock Connect ADT soared 255% to HK$110 billion in Q1 2025, demonstrating measurable success.

- These enhancements increase market accessibility and efficiency, strengthening Hong Kong's position as a key financial hub.

The 'Promote and Progress' elements of the mission, combined with the vision of building the 'Marketplace of the Future,' drive HKEX's product development. This expansion enhances the attractiveness and competitiveness of Hong Kong's markets.

HKEX launched 17 new products in Q1 2025, including the cross-listing of the world's largest Nasdaq 100 ETF and the first Single Stock L&I Products. This contributed to a record quarterly high for ADT of HKEX's ETPs at $39.4 billion, up 197% compared to Q1 2024.

HKEX's vision influences its response to industry challenges, particularly in sustainability. The company is committed to advancing the global net-zero transition.

HKEX achieved carbon neutrality across its operations by the end of 2024. Starting in January 2025, HKEX implemented new climate-related disclosure principles aligned with the International Sustainability Standards Board's (ISSB) Climate Standard.

HKEX's commitment to 'supporting our stakeholders' and 'communities' influences strategic partnerships and corporate governance. These actions demonstrate HKEX's commitment to its strategic goals.

HKEX signed a Memorandum of Understanding with CMU OmniClear Limited in March 2025 to enhance Hong Kong's post-trade securities infrastructure. Corporate governance enhancements, effective from July 1, 2025, include board performance reviews and the appointment of a Lead INED.

HKEX's mission, vision, and core values are not just aspirational statements; they are the driving force behind its strategic decisions, influencing everything from product development and market expansion to corporate governance and sustainability initiatives. By consistently aligning its actions with these foundational principles, HKEX reinforces its role in the global financial market and ensures its continued success. Understanding the influence of these elements is crucial for investors, analysts, and anyone seeking to understand the long-term trajectory of Hong Kong Exchanges Company. Continue to the next chapter to learn more about the Core Improvements to Company's Mission and Vision.

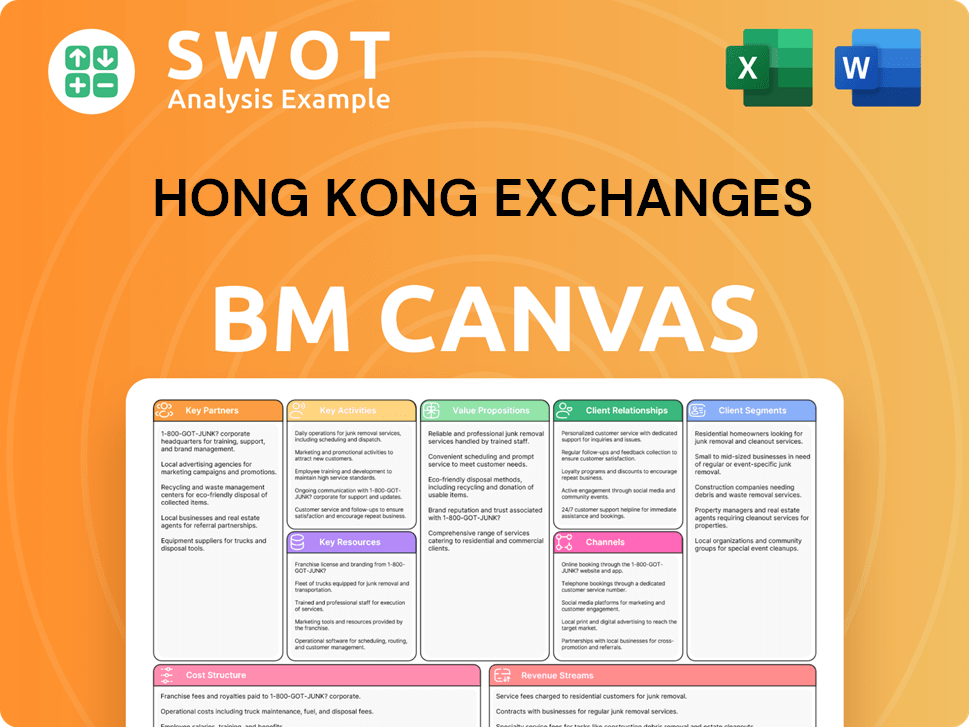

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current Mission Vision & Core Values of the Hong Kong Exchanges Company (HKEX) are fundamentally sound, strategic refinements can enhance their relevance and impact in a rapidly evolving market. These improvements aim to solidify HKEX's position as a leading global exchange and ensure its continued success in the face of technological advancements, changing investor expectations, and increasing demands for sustainability.

To better reflect its commitment to innovation, HKEX's vision should explicitly incorporate cutting-edge technologies. This could involve directly referencing blockchain, artificial intelligence, and data analytics to highlight its dedication to building the "Marketplace of the Future." This would contrast favorably with other global exchanges, many of whom are actively integrating these technologies.

Given Hong Kong's role as a gateway to a vast investor base, the mission should emphasize financial literacy and inclusion. A specific focus on empowering individual investors through education and accessible platforms would align with global best practices. For example, in 2024, HKEX saw a 15% increase in retail investor participation, which highlights the importance of educational initiatives.

A more explicit commitment to specific environmental, social, and governance (ESG) outcomes within the mission or vision would provide greater clarity and drive. This could involve expanding the mission to include a strong commitment to sustainable and responsible finance, reflecting the growing demand for transparent climate reporting. HKEX's implementation of new climate-related disclosure requirements aligned with ISSB standards, effective January 2025, demonstrates its commitment to ESG.

The Company Values should be updated to reflect adaptability and proactive stakeholder engagement. This could involve adding values like "Innovation," "Collaboration," and "Stakeholder Focus" to foster a culture that embraces change and prioritizes the needs of investors, listed companies, and the broader community. This also ties into the overall Growth Strategy of Hong Kong Exchanges.

How Does Hong Kong Exchanges Implement Corporate Strategy?

The successful implementation of a company's mission, vision, and core values is crucial for achieving its strategic goals and maintaining a strong corporate culture. This chapter explores how Hong Kong Exchanges Company (HKEX) translates its stated principles into tangible actions and measurable outcomes.

HKEX actively demonstrates its mission to 'Connect' markets and its vision of facilitating 'two-way capital flows between East and West' through the ongoing development and expansion of its 'Connect' schemes, particularly Stock Connect.

- In Q1 2025, HKEX enhanced market connectivity by accepting China Government and Policy Bank Bonds as collateral for Swap Connect and for all Derivatives in OTC Clear.

- Southbound Stock Connect ADT soared 255% in Q1 2025, highlighting the tangible impact of this strategic focus.

- The initiatives support HKEX's role in the global financial market by providing access to a wider range of investment opportunities.

Leadership plays a vital role in reinforcing HKEX's mission, vision, and core values. Bonnie Y Chan, Chief Executive Officer of HKEX, consistently articulates the company's strategic direction.

The leadership team is actively involved in strategic initiatives, such as the development of new trading platforms. The launch of LMEselect v10 in March 2025 demonstrates a commitment to 'Excellence' and building the 'Marketplace of the Future'.

Communication of the mission and vision to all stakeholders is a continuous process. HKEX utilizes various channels to provide transparent and timely public disclosures. Regular market consultations are also conducted.

HKEX demonstrates alignment between stated values and business practices through its commitment to sustainability and corporate governance. The company achieved carbon neutrality by the end of 2024.

HKEX's commitment to sustainability exemplifies its 'Integrity' and 'Engagement' values. The company's initiatives showcase its commitment to 'Excellence' in corporate governance and responsible business practices.

- HKEX achieved carbon neutrality across its operations by the end of 2024, using electricity from renewable sources for 99% of its facilities.

- Implementation of new climate-related disclosure requirements aligned with ISSB standards, effective January 2025.

- HKEX's commitment to its core values is evident in its environmental initiatives and corporate governance practices.

HKEX employs formal programs and systems to ensure alignment between its mission, vision, core values, and operational practices. The Continuous Disclosure and Communication Policy sets out guiding principles.

Regular board performance reviews, now required at least every two years from July 1, 2025, assess whether the board's performance aligns with business and strategic goals, reinforcing the value of 'Excellence' and effective governance.

By effectively implementing its mission and vision, HKEX aims to create value for all stakeholders, including investors, listed companies, and the broader financial community. The company's strategic objectives are designed to promote long-term growth and sustainability.

For a deeper understanding of how HKEX positions itself in the market, consider exploring the Target Market of Hong Kong Exchanges.

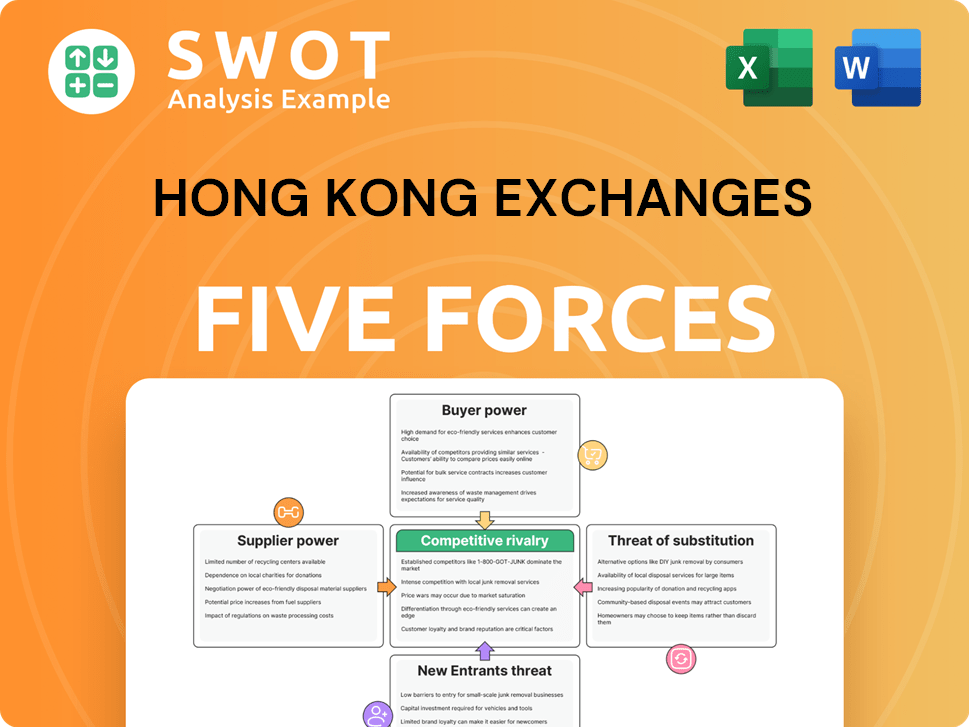

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Competitive Landscape of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.