Hong Kong Exchanges Bundle

Who are the Key Players Driving Hong Kong Exchanges Company's Success?

Understanding the Hong Kong Exchanges SWOT Analysis is key to grasping its strategic position. The Hong Kong Exchanges Company (HKEX) thrives on a diverse customer base, making the analysis of its customer demographics and target market essential for sustained growth. The shift in global financial dynamics, particularly the rise of Asian markets, has reshaped HKEX's landscape, demanding a keen understanding of its clientele.

This exploration delves into the intricacies of HKEX's Customer Demographics and Target Market, providing a detailed Market Analysis. We'll examine the Investor Profile, including HKEX shareholders' geographic location and income levels, as well as strategies for reaching and retaining them. Analyzing the HKEX target market segmentation and investor behavior offers crucial insights for investors and business strategists alike, aiming to answer the question of Who invests in HKEX and how to effectively engage them.

Who Are Hong Kong Exchanges’s Main Customers?

Understanding the Customer Demographics and Target Market of Hong Kong Exchanges Company (HKEX) is crucial for grasping its business model. HKEX operates primarily in a business-to-business (B2B) environment, serving financial institutions and companies. The ultimate beneficiaries of HKEX's services, however, include individual investors, making its Target Market multifaceted.

HKEX's core strategy involves connecting global capital with opportunities in Asia, especially mainland China. This focus has led to a diverse customer base, each with unique needs and investment behaviors. A detailed Market Analysis reveals several key segments that drive HKEX's revenue and growth.

The Investor Profile of HKEX's customers is dynamic, evolving with market trends and regulatory changes. HKEX's success hinges on its ability to attract and retain diverse participants, from institutional giants to individual retail investors, all seeking to leverage the exchange's robust infrastructure and market access.

This segment includes asset managers, hedge funds, sovereign wealth funds, and pension funds. They contribute significantly to HKEX's revenue through high trading volumes and demand for complex financial products. These investors require advanced services for market access, liquidity, risk management, and regulatory compliance.

Companies use HKEX for capital raising through initial public offerings (IPOs) and secondary listings. In 2023, HKEX saw 73 new listings, raising HK$46.3 billion, highlighting the continued importance of this segment. This segment ranges from multinational corporations to small and medium-sized enterprises (SMEs).

Brokerage firms, banks, and custodians facilitate trading and clearing for their clients. They act as a bridge between HKEX and end-users, supporting market activity. These intermediaries are crucial partners in the trading ecosystem.

HKEX has increased its focus on connecting with mainland Chinese investors and companies. Initiatives like Stock Connect and Bond Connect have broadened HKEX's reach. In 2023, Northbound trading under Stock Connect reached a record high, with an average daily turnover (ADT) of RMB107.5 billion. This segment has distinct preferences and needs.

The increasing emphasis on mainland China reflects the ongoing financial liberalization and growing demand for international investment avenues. These Customer Demographics often have specific preferences regarding asset classes, regulatory considerations, and a need for Renminbi-denominated products. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Hong Kong Exchanges.

While specific demographic breakdowns are less applicable to HKEX's B2B model, understanding the institutional capacity, investment mandates, and geographical location of its clients is vital. HKEX's success depends on its ability to adapt to the evolving needs of these diverse segments.

- Focus on institutional capacity and investment mandates of clients.

- Adapt to the unique needs of mainland Chinese investors.

- Provide services that meet regulatory requirements.

- Offer a range of products and services to attract and retain diverse participants.

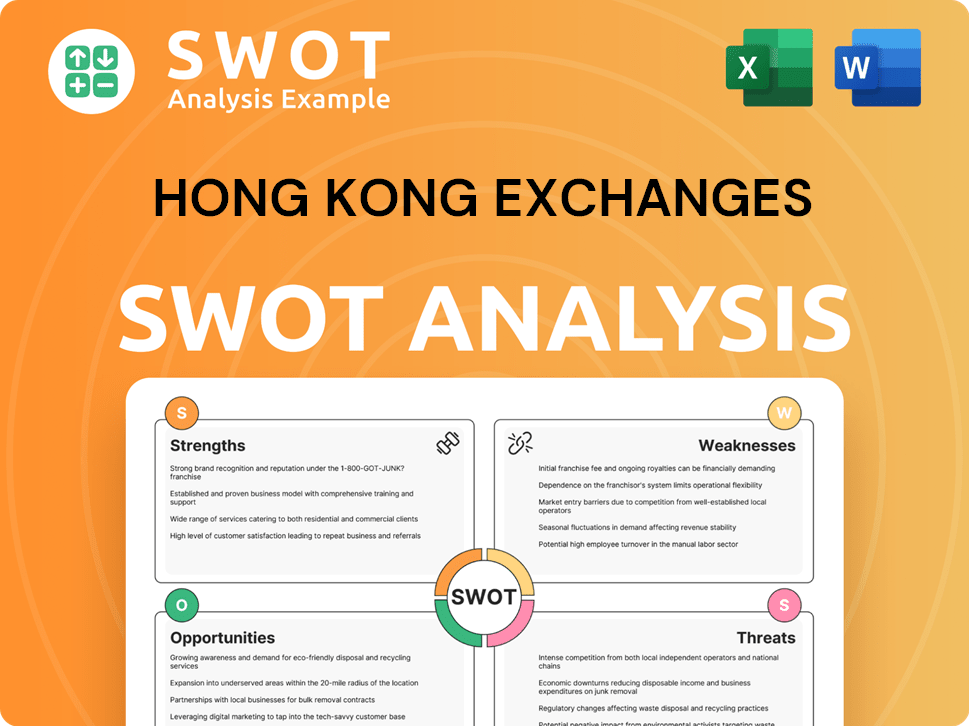

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Hong Kong Exchanges’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Hong Kong Exchanges Company (HKEX). The company's diverse customer base, including institutional investors, listed companies, and intermediaries, has specific requirements that drive their engagement with the exchange. These needs are primarily centered around efficiency, liquidity, risk management, and access to capital and investment opportunities.

The motivations and preferences of these customers are deeply rooted in the financial landscape. For example, institutional investors seek deep liquidity and competitive pricing, while listed companies prioritize efficient capital-raising mechanisms. Intermediaries, on the other hand, require reliable trading systems and comprehensive market data to serve their clients effectively. All these factors shape the strategic direction of HKEX and its ability to meet the evolving demands of the market.

HKEX's commitment to adapting to market dynamics is evident in its product development and customer engagement strategies. The company actively promotes ESG-related products and services, reflecting the growing investor preference for sustainable investments. Through targeted engagement, HKEX aims to meet the unique requirements of each market segment, ensuring its continued relevance and competitiveness.

HKEX's target market is driven by the need for efficient and reliable financial services. The exchange's success hinges on its ability to meet the varied needs of its customers, including institutional investors, listed companies, and intermediaries. The company's approach involves providing robust infrastructure, innovative products, and tailored services to foster customer loyalty and attract new participants. For more insights, you can explore the Marketing Strategy of Hong Kong Exchanges.

- Institutional Investors: They prioritize deep liquidity, competitive pricing, and robust infrastructure for high-volume trading. The average daily turnover (ADT) of HKEX's cash market was approximately HK$105 billion in 2023.

- Listed Companies: They seek efficient capital-raising mechanisms, strong investor interest, and a reputable platform.

- Intermediaries: They require reliable trading and clearing systems, comprehensive market data, and effective connectivity solutions.

- Technological Solutions: There is an increasing demand for advanced technological solutions, including low-latency trading systems and enhanced cybersecurity measures.

- Risk Management Tools: Customers need robust risk management tools, clear regulatory guidelines, and a transparent market environment.

- ESG-related Offerings: There's a growing preference among investors for sustainable investments, leading to the promotion of ESG-related products.

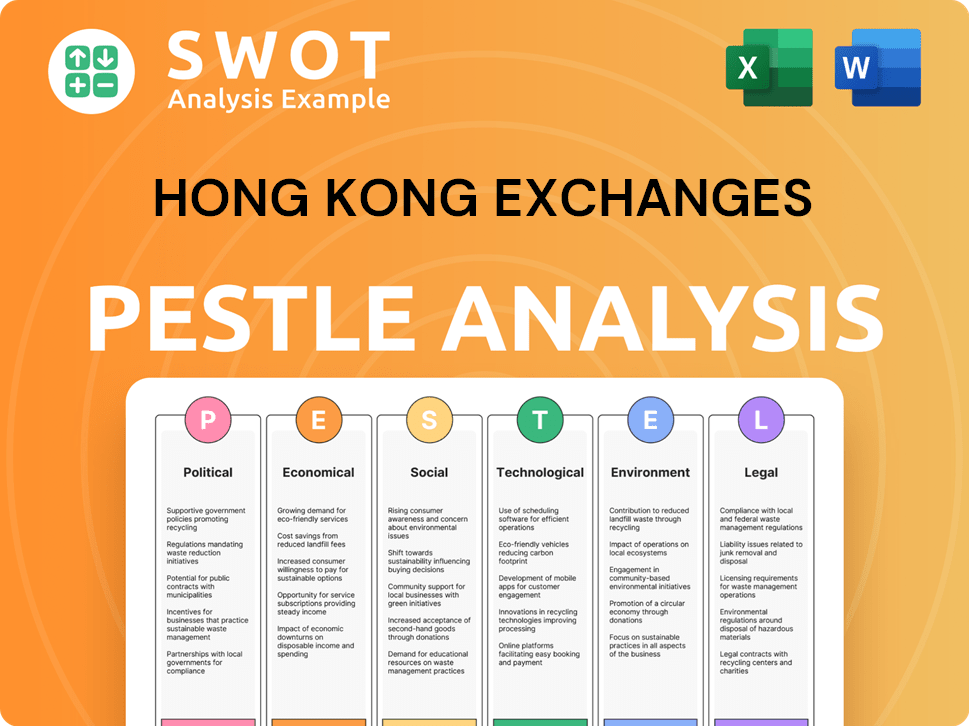

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Hong Kong Exchanges operate?

The primary geographical market for the Hong Kong Exchanges Company (HKEX) is Hong Kong, serving as its operational base and the core of its trading and clearing activities. However, its strategic vision and operational reach extend far beyond its physical location, aiming to connect China with global markets. A brief history of Hong Kong Exchanges reveals its evolution from a local exchange to a key player in international finance.

HKEX's influence extends significantly across mainland China, particularly through initiatives like Stock Connect and Bond Connect, which facilitate cross-border capital flows. These programs have effectively expanded HKEX's market to include a vast pool of mainland Chinese investors and companies seeking international investment and fundraising opportunities. The Northbound trading under Stock Connect, for example, saw a record high average daily turnover of RMB107.5 billion in 2023, highlighting the deep integration with mainland China.

Beyond Greater China, HKEX targets international institutional investors, asset managers, and financial institutions based in major global financial centers such as London, New York, and Singapore. These regions represent significant sources of capital and demand for diverse investment products. Differences in customer demographics and preferences across these regions are evident; mainland Chinese investors may have a higher propensity for growth stocks and specific sectors, while international investors often prioritize liquidity, corporate governance, and a broader range of derivatives.

The main customer segments for HKEX include institutional investors, retail investors, and corporate issuers. Institutional investors are a significant part, particularly those based in global financial hubs. Retail investors in Hong Kong and mainland China also make up a substantial portion of the market.

The investor profile varies across regions. Mainland Chinese investors often focus on growth stocks and specific sectors. International investors generally prioritize liquidity and corporate governance. Understanding the investor profile is key for effective market analysis and customer acquisition strategies.

The geographic distribution of HKEX customers is heavily weighted towards Hong Kong and mainland China. There is a growing contribution from international participants, especially those leveraging HKEX as a gateway to Asian opportunities. This includes investors from London, New York, and Singapore.

HKEX employs several customer acquisition strategies. These include providing Renminbi-denominated products, ensuring regulatory alignment with mainland Chinese authorities for Connect schemes, and engaging in targeted outreach and investor education in different regions. Recent expansions focus on enhancing connectivity with mainland China and diversifying product offerings.

Market research reports on HKEX often analyze investor behavior and demographics. These reports provide insights into the age distribution, gender breakdown, income levels, and education levels of HKEX investors. Such data helps in tailoring offerings to meet specific market needs.

Institutional investors in HKEX are characterized by their significant trading volumes and long-term investment horizons. They often prioritize liquidity, corporate governance, and a broad range of derivatives. These investors play a crucial role in the stability and growth of the exchange.

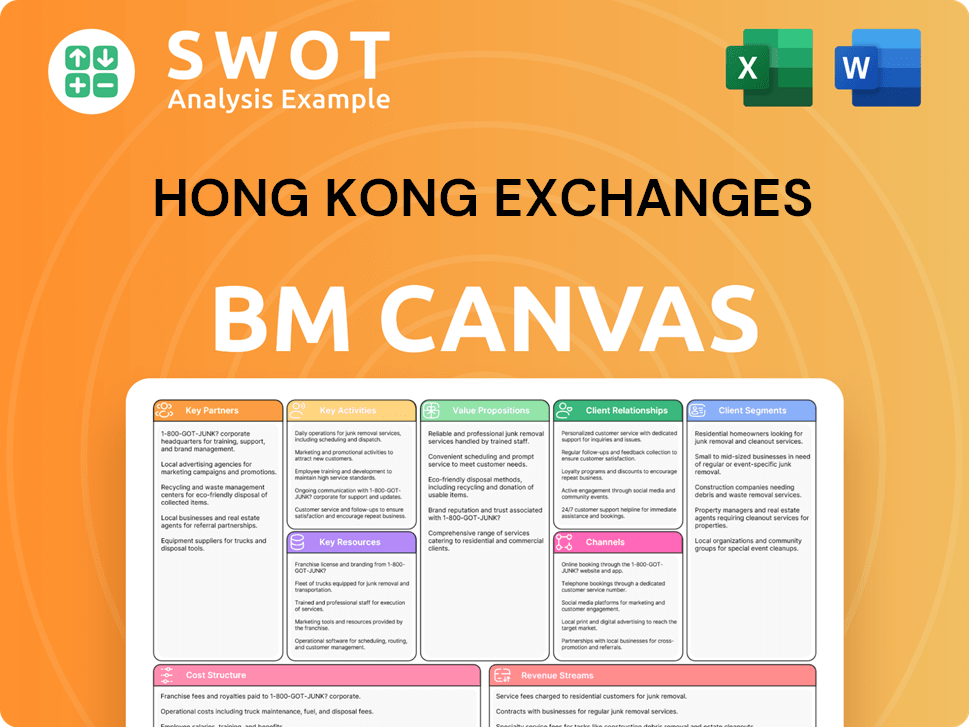

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Hong Kong Exchanges Win & Keep Customers?

The Hong Kong Exchanges Company (HKEX) uses a multifaceted approach for acquiring and retaining customers, focusing on strengthening its market infrastructure, broadening product offerings, and building strategic partnerships. These strategies are critical for maintaining its position as a leading global exchange. Understanding the Customer Demographics and the Target Market is essential for tailoring these strategies effectively.

A key part of HKEX's acquisition strategy involves enhancing its listing platform. This includes streamlining the listing process and attracting diverse industries, with a specific focus on new economy companies and those with sustainability goals. For institutional investors and intermediaries, acquisition is driven by providing highly liquid markets and a wide range of products. The continued success of Stock Connect and Bond Connect also plays a crucial role, attracting mainland Chinese and international investors.

Retention strategies center on delivering high-quality services, continuously innovating its product suite, and building strong relationships with market participants. HKEX invests in advanced technology to ensure reliable trading, clearing, and settlement services. Customer data and analytics are increasingly important for identifying market trends and refining product development. The company's focus on ESG products and services is a recent strategic shift, reflecting global trends and attracting sustainability-focused investors.

HKEX focuses on making its listing platform more appealing to attract new companies. Streamlining the listing process is a key strategy. In 2023, HKEX saw 73 new listings, highlighting its continued attractiveness as a listing venue.

HKEX continually expands its range of financial products to meet the evolving needs of its clients. This includes equities, derivatives, and fixed income instruments. The goal is to cater to a diverse range of investors and trading strategies.

Stock Connect and Bond Connect are crucial channels for attracting investors. These schemes provide unparalleled market access for mainland Chinese and international investors. They facilitate cross-border trading and investment.

HKEX prioritizes high-quality services to retain its institutional clients. This includes reliable trading, clearing, and settlement services. Advanced technology ensures efficient and dependable market operations.

Analyzing the Investor Profile helps HKEX tailor its offerings to different segments. This includes understanding the trading patterns and demographics of participants in the Connect schemes. Such data helps in refining product development.

HKEX is increasing its focus on ESG products and services. This reflects a global trend towards sustainable investing. This focus attracts investors with sustainability mandates.

Investing in advanced technology is crucial for maintaining a competitive edge. This ensures efficient trading, clearing, and settlement services. Innovation is key to meeting evolving market needs.

Building strong relationships with market participants is essential for customer retention. This includes ongoing engagement through forums and consultations. Personalized experiences are delivered through dedicated account management.

Customer data and analytics play a crucial role in understanding market trends. This data helps in refining product development and identifying opportunities. Data from the Connect schemes helps in tailoring offerings.

Regular Market Analysis allows HKEX to adapt to changing market dynamics. This includes understanding investor behavior and preferences. Responsiveness to market changes is key to long-term success.

HKEX's strategy involves a combination of attracting new listings and retaining existing customers through various initiatives. These strategies are designed to strengthen its position in the global market. For more details, you can read about the Growth Strategy of Hong Kong Exchanges.

- Enhancing Listing Platform: Streamlining processes and attracting diverse industries.

- Expanding Product Offerings: Providing a wide range of financial instruments.

- Leveraging Connect Schemes: Facilitating cross-border trading.

- Focusing on Service Quality: Ensuring reliable trading and settlement services.

- Data-Driven Decision Making: Using analytics to understand market trends.

- Emphasis on ESG: Attracting investors with sustainability mandates.

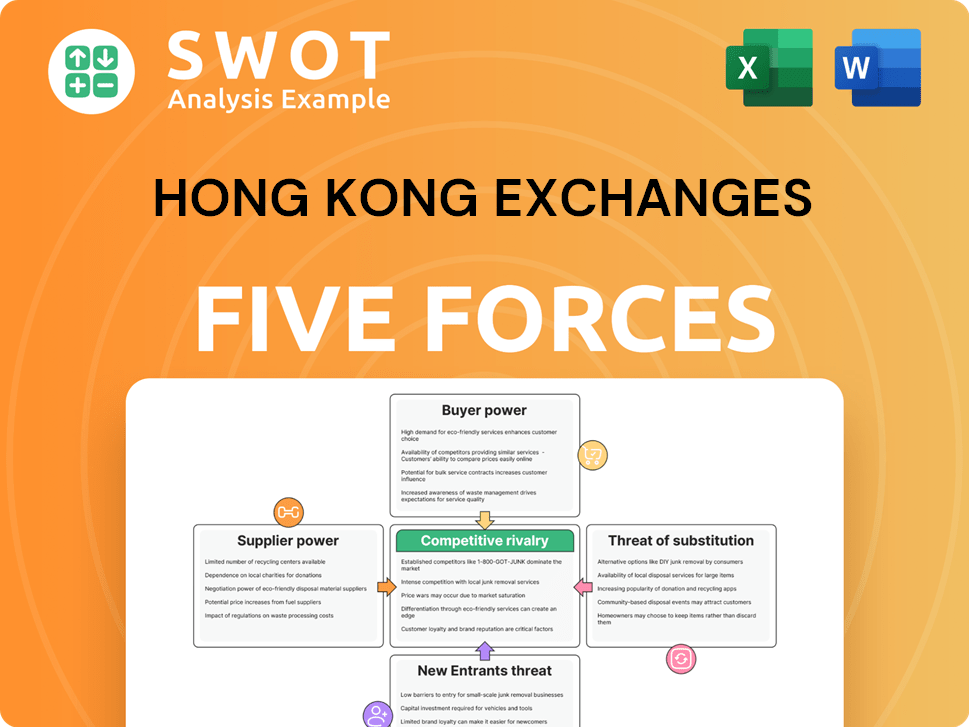

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Competitive Landscape of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.