Hong Kong Exchanges Bundle

How Does Hong Kong Exchanges Company Dominate the Global Financial Stage?

Hong Kong Exchanges and Clearing Limited (HKEX) has masterfully transformed itself into a crucial link between China and the global financial markets, a strategic pivot that has redefined its sales and marketing approach. This evolution is particularly evident in its innovative 'Connect' schemes, such as the Shanghai-Hong Kong Stock Connect, which have revolutionized access to Mainland Chinese markets for international investors. As a publicly-traded entity, HKEX's performance directly reflects the effectiveness of its strategies.

To understand HKEX's success, we'll delve into its intricate Hong Kong Exchanges SWOT Analysis, exploring how it delivers its financial services, builds brand awareness, and strategically positions itself in a competitive landscape. This analysis will examine the company's sales strategy and marketing strategy, including its digital marketing strategy and international marketing campaigns, providing actionable insights for investors and business strategists. We'll also explore how HKEX attracts investors and the impact of regulations on its sales, offering a comprehensive market analysis of this financial powerhouse.

How Does Hong Kong Exchanges Reach Its Customers?

The Hong Kong Exchanges Company (HKEX) employs a multi-faceted sales strategy, focusing on institutional clients, exchange participants, buy-side investors, and custody banks. Direct engagement is key to promoting its core services in trading, clearing, and settlement. The company's marketing strategy is designed to support its sales efforts, ensuring that its products and services reach the target audience effectively.

HKEX's sales channels are strategically designed to facilitate both domestic and international market participation. The 'Connect' schemes, including Stock Connect, Bond Connect, and Swap Connect, are pivotal, bridging Hong Kong's markets with Mainland China. These schemes provide access for offshore investors to Chinese assets, and outbound investment channels for Chinese institutions, enhancing the overall market connectivity and providing financial services.

The evolution of HKEX's sales and marketing strategy is driven by initiatives to broaden product offerings and improve market access. HKEX's commitment to enhancing its market data suite and expanding its global presence underlines its dedication to providing comprehensive financial services.

The 'Connect' schemes are crucial sales channels. Northbound Stock Connect's average daily turnover reached 136.3 billion yuan ($18.59 billion) in the first 10 months of 2024. These schemes are designed to facilitate cross-border investments, linking Hong Kong's markets with those in Mainland China.

HKEX continuously enhances its product offerings. The Derivatives Holiday Trading service, extended to currency futures and options in March 2024, helps manage risk during Hong Kong public holidays. This demonstrates HKEX's commitment to meeting the evolving needs of its clients.

HKEX actively engages with information vendors and independent software vendors. In December 2023, HKEX introduced an enterprise data package for Level 1 real-time streaming Hong Kong securities data at a fixed monthly fee of $400,000 for unlimited clients. The company also reduced the retail mobile market data service fee by 74%.

HKEX is expanding its global footprint to bolster capital market connectivity. Plans include opening an office in Riyadh and adding Abu Dhabi and Dubai to its list of recognized stock exchanges. These initiatives are part of a broader strategy to enhance its international presence.

HKEX's sales strategy focuses on direct engagement with market participants and leveraging 'Connect' schemes. The marketing strategy is aligned to support these sales efforts, with a focus on product enhancements and market data distribution. The company's approach is designed to attract investors and facilitate cross-border investments.

- Direct engagement with institutional clients and exchange participants.

- Strategic partnerships with information vendors and software providers.

- Expansion of global presence through new offices and recognized stock exchanges.

- Continuous enhancement of product offerings to meet market demands.

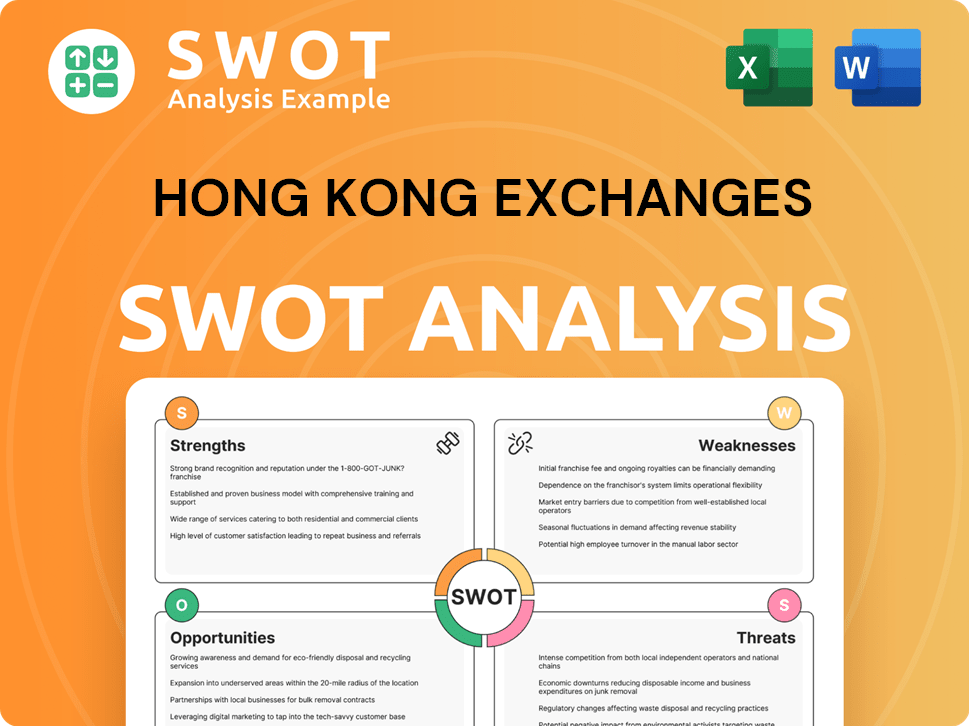

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Hong Kong Exchanges Use?

The Growth Strategy of Hong Kong Exchanges includes a multifaceted approach to marketing and sales, designed to boost awareness, generate leads, and increase sales. This strategy heavily relies on digital engagement and investor relations to connect with a global audience. These tactics are crucial for promoting financial services and maintaining a strong market position.

HKEX employs a range of marketing tactics to build awareness, generate leads, and drive sales, with a strong emphasis on digital engagement and investor relations. The company focuses on enhancing its online platforms and using data-driven marketing to tailor strategies. Traditional media and events also play a role in their marketing mix.

The company's approach to data-driven marketing and customer segmentation is evident in its efforts to tailor strategies to local market dynamics and optimize its product portfolio in overseas markets. This includes plans to utilize modeling and algorithm analysis of sales data by 2026 to refine marketing strategies and enhance the effectiveness of online promotions. HKEX also plans to upgrade its membership management platform by 2027 to enhance customer interaction and provide personalized services.

Continuous improvement of website and online platforms is a key digital tactic. The HKEX Data Marketplace, a new web-based data platform, supports global investors.

Active engagement with market participants through presentations and conference calls. These activities enhance corporate transparency and understanding of business operations.

Plans to use modeling and algorithm analysis of sales data by 2026. This will refine marketing strategies and enhance online promotions.

Upgrading the membership management platform by 2027. This will enhance customer interaction and provide personalized services.

Participation in international exhibitions and social media events. These activities support brand promotion.

Development of the ODP, an in-house technology platform expected to launch in 2028. It aims to offer near 24-hour derivatives trading and introduce new products.

HKEX’s marketing strategy focuses on digital engagement and investor relations to drive sales. The company uses data analysis to refine its approach and enhance customer interaction. The launch of the Orion Derivatives Platform in 2028 is a significant innovation to boost efficiency and competitiveness.

- Digital Engagement: Continuous improvement of website and online platforms.

- Investor Relations: Regular presentations and conference calls to enhance transparency.

- Data-Driven Marketing: Utilizing sales data analysis by 2026 to refine strategies.

- Membership Platform Upgrade: Enhancing customer interaction by 2027.

- Product Innovation: Launching the Orion Derivatives Platform (ODP) in 2028.

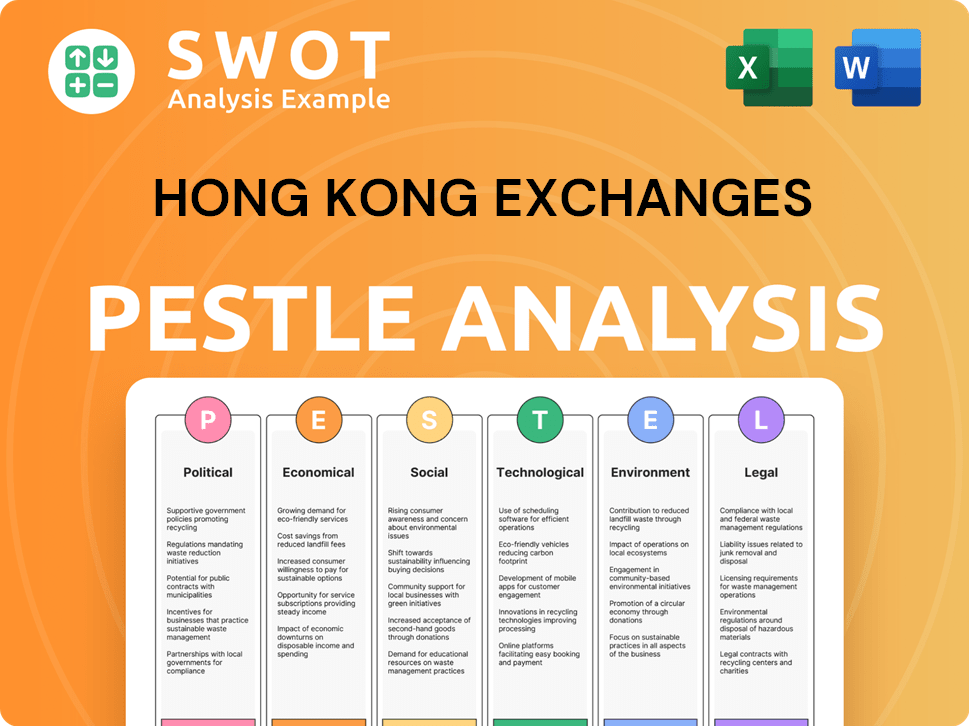

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Hong Kong Exchanges Positioned in the Market?

The Hong Kong Exchanges Company (HKEX) strategically positions itself as a 'superconnector' and a leading international financial center. This positioning is crucial for its Owners & Shareholders of Hong Kong Exchanges, emphasizing its role as a gateway between China and global markets. The core message centers on facilitating the two-way flow of capital, ideas, and dialogue, highlighting its innovative Connect schemes and diverse product ecosystem.

HKEX's brand identity and communication style reflect its commitment to being a robust and reliable market infrastructure, dedicated to long-term sustainable growth. This approach is designed to attract a broad target audience, including individual investors, financial professionals, business strategists, and academic stakeholders. The focus is on providing access, choice, and opportunities within deep, liquid, and international markets.

The company's dedication to sustainability and corporate governance is a key element of its brand positioning. HKEX has become a Partner Exchange of the United Nations Sustainable Stock Exchanges initiative, aiming to promote sustainable and transparent capital markets. It requires listed companies to report environmental, social, and governance (ESG) information and has enhanced ESG disclosure requirements. The Sustainable & Green Exchange (STAGE) platform, launched by HKEX, further promotes green finance and sustainability integration across asset classes, providing information and access to sustainable investment products.

HKEX's strong brand positioning supports its sales and marketing strategies. Its focus on being a 'superconnector' and a leading international financial center helps attract both issuers and investors. This positions the company as a key player in global financial services.

HKEX emphasizes access, choice, and opportunities in deep, liquid, and international markets. This appeals to a wide audience, including individual investors and financial professionals. This focus is central to its marketing strategy.

HKEX's commitment to sustainability and ESG factors enhances its brand. The Sustainable & Green Exchange (STAGE) platform and carbon neutrality efforts are key components of its marketing. This resonates with investors and stakeholders.

HKEX's digital marketing strategy focuses on enhancing its online presence and investor engagement. This includes social media campaigns and digital content to reach a global audience. These efforts support its sales performance.

HKEX employs several key strategies to maintain its brand positioning and drive sales and marketing success:

- Connect Schemes: Leveraging the Stock Connect, Bond Connect, and other schemes to facilitate cross-border investment.

- Product Diversification: Expanding its product offerings to include derivatives, ETFs, and other financial instruments.

- Digital Engagement: Utilizing digital marketing and social media to engage with investors and stakeholders globally.

- Sustainability Initiatives: Promoting ESG factors and sustainable finance through platforms like STAGE.

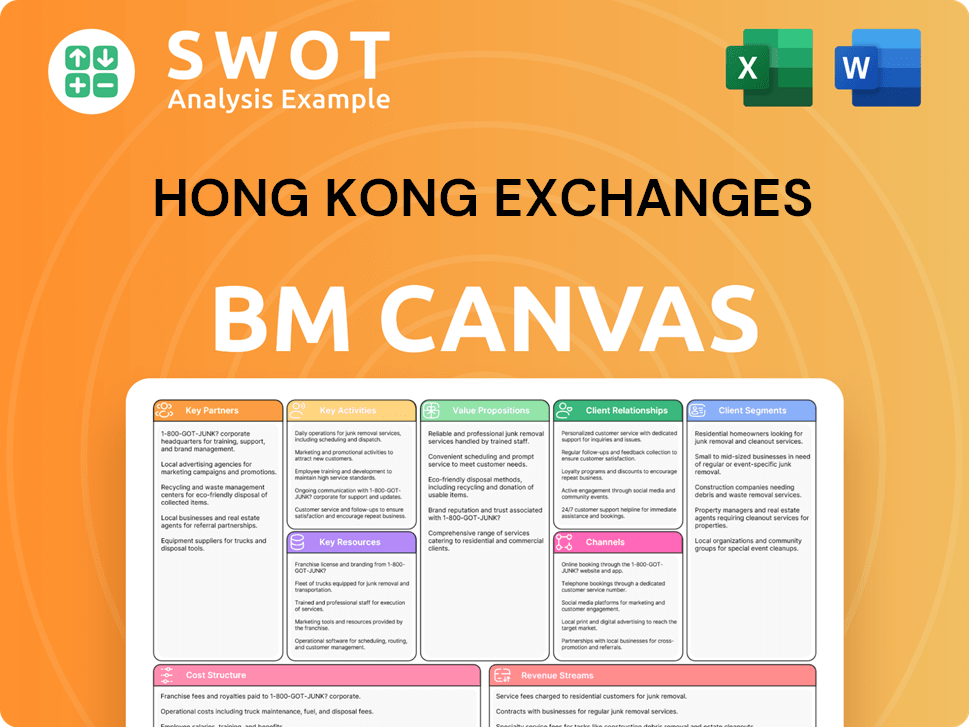

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Hong Kong Exchanges’s Most Notable Campaigns?

The Hong Kong Exchanges Company (HKEX) employs a multifaceted sales and marketing strategy, focusing on product launches, market enhancements, and strategic partnerships. These efforts aim to solidify its position as a leading international financial center and a crucial link to mainland China. The company's campaigns are designed to attract investors, boost market liquidity, and provide efficient cross-border investment channels.

A core element of HKEX's sales and marketing strategy involves promoting its 'Connect' schemes. These schemes, including Stock Connect, Bond Connect, and Swap Connect, facilitate cross-border investment. These initiatives are critical for driving capital flows and enhancing market accessibility. These campaigns are essential for maintaining and growing its market share in the competitive financial services sector.

Recent campaigns highlight HKEX's focus on technological advancements and expanding its derivatives market. The company aims to differentiate its derivatives offerings, enhance trading and clearing capabilities, and boost its global competitiveness. By supporting its customers and advancing market vibrancy and liquidity, HKEX continues to adapt to the evolving needs of the financial industry.

The promotion of 'Connect' schemes is a historically significant and ongoing campaign. These include Stock Connect, Bond Connect, and Swap Connect. These schemes have been instrumental in driving cross-border investment and capital flows.

The announcement and ongoing development of the Orion Derivatives Platform (ODP) is a significant initiative. This platform is expected to launch in 2028. This campaign aims to enhance trading and clearing capabilities and boost global competitiveness.

HKEX has focused on enhancing market data accessibility. This includes the introduction of an enterprise data package. A 74% reduction in mobile market data service fees was implemented in December 2023.

HKEX is actively pursuing technological advancements to improve its services. This includes the development of new platforms and the enhancement of existing ones. These efforts are designed to attract greater retail participation and provide more flexible, cost-effective data choices.

HKEX's campaigns are supported by robust performance indicators, reflecting the success of its sales and marketing strategies. These metrics are crucial for assessing the effectiveness of the initiatives and guiding future strategies.

- Northbound Stock Connect: Average daily turnover reached 136.3 billion yuan ($18.59 billion) in the first 10 months of 2024.

- Market Data Revenue: HKEX's market data revenue is a key indicator of its success in attracting and retaining customers.

- Derivatives Trading Volume: The volume of derivatives trading reflects the success of campaigns related to the derivatives market.

- Investor Participation: Measuring the level of retail and institutional investor participation is essential.

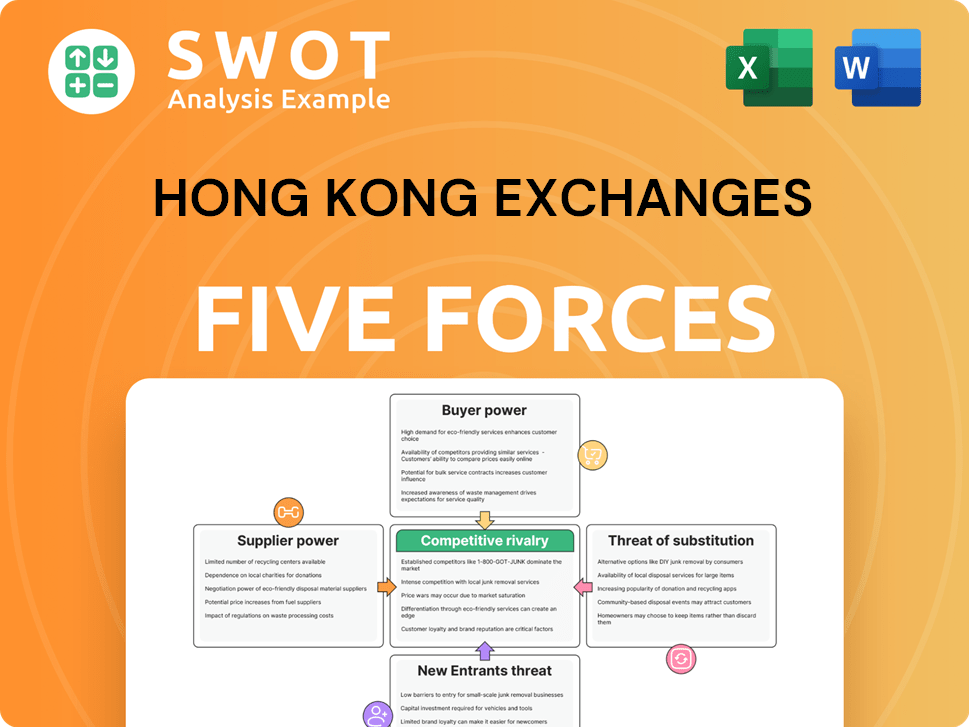

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Competitive Landscape of Hong Kong Exchanges Company?

- What is Growth Strategy and Future Prospects of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.