Hong Kong Exchanges Bundle

Can Hong Kong Exchanges Company Maintain Its Global Financial Dominance?

The Hong Kong Exchanges and Clearing Limited (HKEX) stands at the crossroads of global finance, acting as a vital link between East and West. Established in 2000, HKEX has evolved into a major exchange group, facilitating trading in equities, commodities, and derivatives. Its strategic consolidation aimed to enhance the competitiveness of Hong Kong's financial markets on a global scale.

With a focus on Hong Kong Exchanges SWOT Analysis, this analysis dives into the HKEX growth strategy, examining its recent performance and future prospects. The company's robust performance in Q1 2025, with a significant surge in IPO listings, highlights its continued importance in the Hong Kong stock market. Exploring HKEX's strategic initiatives, technological advancements, and financial planning is crucial for understanding the future of HKEX and its role in the global financial market.

How Is Hong Kong Exchanges Expanding Its Reach?

The Hong Kong Exchanges Company (HKEX) is actively pursuing a multifaceted expansion strategy to broaden its market reach and diversify its offerings. This strategy focuses on international engagement, product innovation, and enhancements in its fixed income and currency (FIC) business. These initiatives are designed to access new customers, diversify revenue streams, and maintain HKEX's competitive edge in the evolving financial landscape. The HKEX growth strategy is closely tied to its unique position as a gateway between China and the rest of the world, offering a 'China advantage' to global investors.

A key aspect of HKEX's expansion involves strengthening capital market connectivity between Asia and the Middle East. This includes plans to open an office in Riyadh and recognize stock exchanges in Abu Dhabi and Dubai. These moves are part of a broader effort to leverage HKEX's position to connect the world's second-largest economy with new and emerging sources of global capital. The Hong Kong stock market is a crucial component of the global financial system, and HKEX's growth is vital to its continued success.

HKEX's focus on innovation and strategic initiatives is crucial for its long-term growth. By expanding its product offerings and improving its infrastructure, HKEX aims to attract more investors and maintain its position as a leading global exchange. Understanding the Competitors Landscape of Hong Kong Exchanges is essential in assessing HKEX's strategic positioning and future prospects.

HKEX is expanding its global footprint by opening an office in Riyadh. It also plans to recognize stock exchanges in Abu Dhabi and Dubai. These initiatives aim to strengthen capital market links between Asia and the Middle East, increasing its international presence.

In 2024, HKEX introduced weekly Hang Seng TECH Index Options and weekly options for 10 single stocks. This caters to the growing demand for shorter-dated options. The Exchange Traded Products (ETPs) market is also growing significantly.

The average daily turnover in the ETP market reached HK$18.7 billion as of November 2024, an increase of approximately 34% from the previous year. HKEX has welcomed listings of Covered Call ETFs and Asia's first Spot Virtual Asset ETFs, enhancing product diversity and liquidity.

In 2024, Swap Connect significantly contributed to HKEX OTC Clear's clearing volume, which reached a record high of US$1.19 trillion, a 142% increase compared to 2023. Exploring the launch of China Treasury Bond Futures in Hong Kong is also underway.

HKEX plans to digitize and automate the in-kind creation and redemption process for ETPs in 2025, aiming to increase market efficiency. Collaboration with CMU OmniClear Limited to enhance Hong Kong's post-trade securities infrastructure is also underway.

- International Expansion: Opening offices and recognizing exchanges in key Middle Eastern markets.

- Product Innovation: Introducing new derivatives and expanding the ETP market.

- FIC Business: Strengthening OTC clearing and exploring new products like China Treasury Bond Futures.

- Technology and Efficiency: Digitizing ETP processes to enhance market activity.

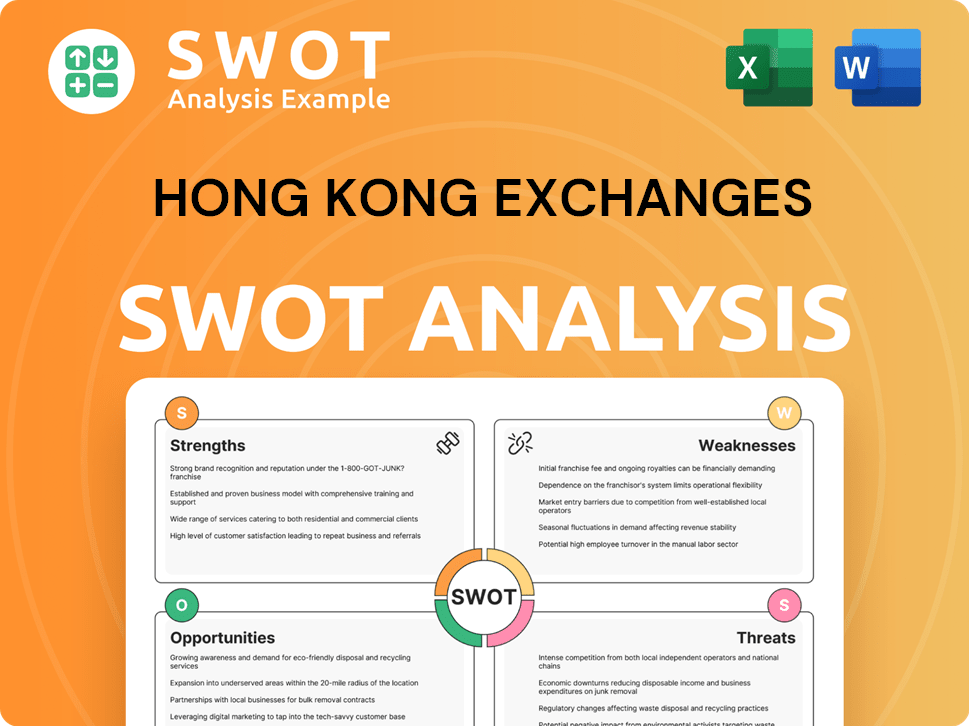

Hong Kong Exchanges SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hong Kong Exchanges Invest in Innovation?

The Hong Kong Exchanges Company (HKEX) is heavily investing in technology and innovation to ensure its markets remain competitive and future-ready. This strategic focus is critical for driving sustained growth within the financial market of Hong Kong and beyond. These initiatives are designed to meet the evolving needs of investors and maintain the stock exchange's performance.

A key aspect of HKEX's strategy involves developing in-house platforms to differentiate its offerings. These platforms will enable real-time trade processing and round-the-clock derivatives trading, catering to the demands of the next generation of investors. Digital transformation is a central theme, with a focus on digitizing and automating processes to enhance market efficiency.

HKEX is also exploring new adjacencies by leveraging technology. This includes venturing into indexes and enhancing Hong Kong's fund industry value chain. Furthermore, the launch of a new data marketplace and the promotion of robust ESG standards demonstrate HKEX's commitment to sustainability and supporting global investors.

HKEX is developing in-house platforms, including the Orion Cash Platform (OCP) and the Orion Derivatives Platform (ODP). These multi-year programs aim to enable real-time trade processing.

HKEX plans to ensure its systems are ready for a T+1 stock settlement cycle by the end of 2025. A white paper will be published in the first half of 2025 to discuss settlement cycles.

Digitization and automation of processes, such as in-kind creation and redemption for ETPs, are being implemented using Distributed Ledger Technology (DLT) and smart contracts.

HKEX introduced the HKEX Virtual Asset Index Series and the Hang Seng HKEX Stock Connect China Enterprises Index in 2024. A Fund Repository on the Integrated Fund Platform has also been launched.

A new web-based HKEX Data Marketplace has been launched to distribute historical data products, supporting global investors. This initiative helps in understanding Revenue Streams & Business Model of Hong Kong Exchanges.

New climate-related disclosure rules are set to come into effect from 2025, aligning with international standards like IFRS S2. This demonstrates a commitment to sustainability.

HKEX's technology investments are focused on enhancing market efficiency, expanding product offerings, and promoting sustainability. These initiatives are crucial for the future of HKEX and its role in global finance.

- Development of in-house platforms for real-time trade processing and round-the-clock derivatives trading.

- Implementation of a T+1 stock settlement cycle by the end of 2025.

- Digitization and automation of processes using DLT and smart contracts.

- Introduction of new indexes and a Fund Repository to enhance market offerings.

- Launch of a data marketplace to support global investors.

- Adoption of new climate-related disclosure rules aligned with international standards.

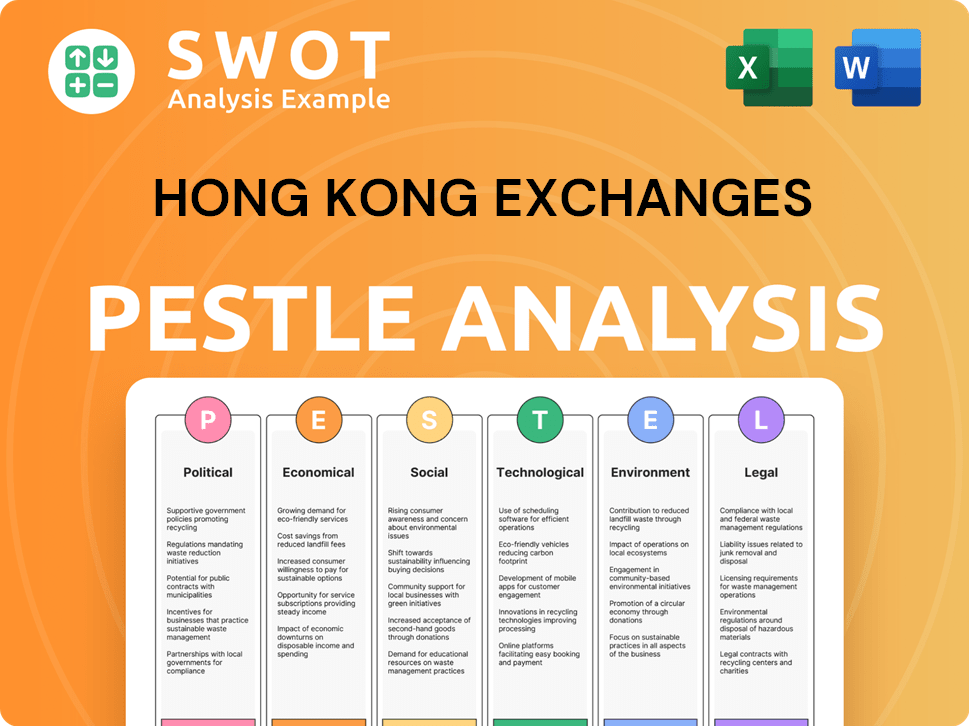

Hong Kong Exchanges PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hong Kong Exchanges’s Growth Forecast?

The financial outlook for the Hong Kong Exchanges Company (HKEX) is positive, supported by strong financial results and strategic initiatives. The company's performance in Q1 2025 reflects robust growth across key business segments. This positive trajectory is expected to continue, driven by a recovering IPO market and investments in market infrastructure.

HKEX's commitment to enhancing its market infrastructure and expanding its global reach positions it well for future growth. Despite facing geopolitical and macroeconomic challenges, the company is focused on maintaining its competitiveness and capitalizing on opportunities in the financial market. The diversified revenue streams and a China-centric strategy are key factors in its growth prospects.

The company's Q1 2025 results showed significant improvements. Revenue and other income reached HK$6.86 billion, a 32% increase compared to Q1 2024. Profit attributable to shareholders also saw a substantial rise of 37% year-on-year. This growth was fueled by increased trading and clearing fees across the Cash, Derivatives, and Commodities Markets, demonstrating a strong performance in the Hong Kong stock market.

The core business revenue of HKEX increased by 36% against Q1 2024. The London Metal Exchange (LME) trading volumes in Q1 2025 were the second-highest quarterly levels in the last 11 years. The IPO market in Hong Kong is also showing strong signs of recovery, contributing to the overall positive financial results.

IPO equity funds raised in Q1 2025 were nearly four times that of Q1 2024. Analysts predict that IPO funds raised in Hong Kong could exceed HKD 100 billion in 2025, with projections ranging from HKD 130 billion to HKD 150 billion. This indicates a strong recovery and increased investor confidence in the future of HKEX.

Capital expenditures surged by 73% to HK$481 million in Q1 2025, with funds allocated to upgrades for its cash clearing system and the LME's new trading platform, LMEselect v10. These investments highlight HKEX's commitment to enhancing its infrastructure and competitiveness.

HKEX remains committed to investing in its market infrastructure and enhancing competitiveness despite ongoing geopolitical and macroeconomic developments. The company’s diversified revenue streams and China-centric strategy are expected to position it for continued growth. As of March 31, 2025, there was a healthy pipeline of 120 listing applications.

HKEX's financial performance in Q1 2025 was marked by significant revenue growth and increased profitability. The company's strategic investments and focus on market infrastructure are expected to support its continued growth. For more insights, consider reading about the Mission, Vision & Core Values of Hong Kong Exchanges.

- Revenue and other income reached HK$6.86 billion, a 32% increase year-on-year.

- Profit attributable to shareholders increased by 37% year-on-year.

- Core business revenue was up 36% against Q1 2024.

- Capital expenditures surged by 73% to HK$481 million.

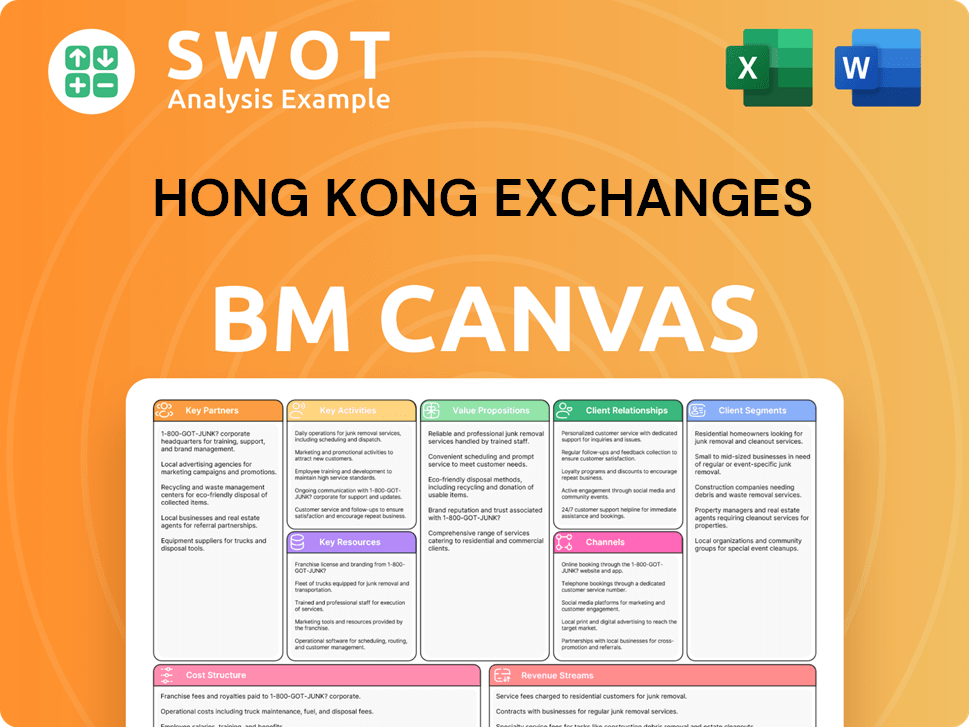

Hong Kong Exchanges Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hong Kong Exchanges’s Growth?

The Hong Kong Exchanges Company (HKEX) faces several potential risks and obstacles that could influence its future. These challenges range from market competition to geopolitical tensions and regulatory changes. Addressing these risks is crucial for maintaining its position in the financial market Hong Kong and ensuring sustainable HKEX growth strategy.

Competition from other global exchanges is a constant threat, requiring HKEX to continually innovate and enhance its offerings. Furthermore, the macroeconomic environment, including factors like U.S.-China relations, significantly impacts investor sentiment and trading activity. These factors can directly affect the Hong Kong stock market and, consequently, stock exchange performance.

Regulatory changes represent another significant risk. HKEX operates within a heavily regulated environment, and alterations to listing rules or financial regulations can affect its operations and competitiveness. For instance, new climate-related disclosure rules are coming into effect from January 1, 2025, requiring listed companies to disclose greenhouse gas emissions.

HKEX competes with other global exchanges for listings and trading volumes. This requires continuous efforts to enhance services and attract investors. The future of HKEX depends on its ability to stay competitive.

Geopolitical events, such as U.S.-China trade tensions, can significantly impact global markets. These factors can affect investor confidence and trading volumes, impacting the Hong Kong stock market outlook 2024.

Changes in listing rules and financial regulations pose a significant risk. New climate-related disclosure rules will require listed companies to disclose emissions from January 1, 2025. These regulations may impact HKEX revenue growth drivers.

Technological disruptions and internal resource constraints can affect trading and operations. The increasing number of trading suspensions in 2024 raises concerns about market stability. The impact of regulations on HKEX is significant.

The rapid pace of technological change presents both opportunities and risks. HKEX must invest in technology to remain competitive and resilient. These investments are crucial for HKEX's technology investments.

Internal resource limitations can hinder HKEX's ability to adapt to changes. Proper allocation of resources is essential for successful implementation of HKEX strategic initiatives.

HKEX addresses market volatility through ongoing investments in operational resilience. This includes measures to ensure fair and orderly trading during periods of volatility and severe weather events. This is a key factor in stock exchange performance.

The rise in trading suspensions, with 74 companies suspended for three months or more as of August 30, 2024, highlights compliance challenges. These suspensions are often related to delayed financial disclosures or fraud. The challenges facing Hong Kong stock exchange are evident.

HKEX is providing implementation guidance for climate disclosures and has developed tools to assist listed companies. A workshop revealed that 49% of attendees felt unprepared for upcoming climate disclosure requirements. This impacts sustainability initiatives by HKEX.

HKEX emphasizes a culture of responsibility, transparency, and accountability. This includes policies and training in areas such as business ethics, data privacy, and cybersecurity. This contributes to the HKEX's role in global finance.

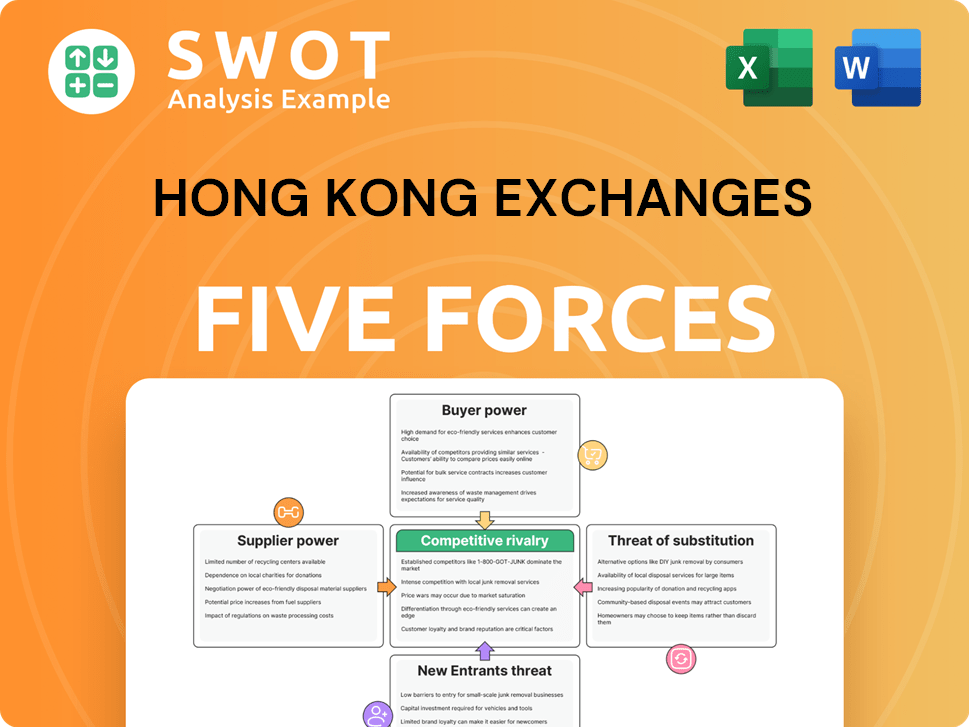

Hong Kong Exchanges Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Kong Exchanges Company?

- What is Competitive Landscape of Hong Kong Exchanges Company?

- How Does Hong Kong Exchanges Company Work?

- What is Sales and Marketing Strategy of Hong Kong Exchanges Company?

- What is Brief History of Hong Kong Exchanges Company?

- Who Owns Hong Kong Exchanges Company?

- What is Customer Demographics and Target Market of Hong Kong Exchanges Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.