NVR Bundle

How did NVR Company rise to become a housing market giant?

NVR, Inc. is a major player in the American housing market, known for its unique approach to homebuilding and mortgage banking. Its story began in 1980 with Dwight Schar's NVHomes, Inc., focusing on single-family homes. This journey reveals how strategic acquisitions and an innovative business model shaped NVR's remarkable success.

From its inception as NVHomes to its current status, the NVR SWOT Analysis reveals the company's trajectory, marked by pivotal moments like the 1986 acquisition of Ryan Homes. The NVR history showcases a strategic evolution, adapting to market dynamics and solidifying its position as a leading home construction company. Understanding the NVR timeline provides valuable insights into its growth and resilience within the competitive housing market.

What is the NVR Founding Story?

The story of the NVR Company begins in 1980 with the establishment of NVHomes, Inc. by Dwight Schar. This marked the initial step in what would become a significant player in the homebuilding industry. Schar's experience in the field, including his time at Ryan Homes, provided a solid foundation for his new venture, setting the stage for NVR's future growth and influence.

The early focus of NVHomes was on constructing single-family homes, particularly in the Washington, D.C., metropolitan area. This strategic choice allowed the company to concentrate its efforts and resources, laying the groundwork for its expansion and the development of its unique business model. This focus on a specific market segment was crucial in the early years.

A key aspect of NVR's early success was its asset-light business model. This approach, which continues to set the company apart, involves acquiring finished building lots from third-party developers under fixed-price agreements. This strategy minimizes the financial risks associated with land ownership and development, allowing for greater capital efficiency and contributing to its rapid growth. For more details on the company's business model, check out Revenue Streams & Business Model of NVR.

The company's evolution is marked by strategic decisions and acquisitions that have shaped its current structure.

- 1980: Founding of NVHomes, Inc. by Dwight Schar.

- 1983: NVHomes achieves over $1 million in earnings.

- 1986: Reorganization as NVH L.P. and initial public offering.

- 1989: Name changed to NVR L.P.

- 1999: Reorganization as NVR Inc., a holding company.

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of NVR?

The early growth of the NVR Company, initially known as NVHomes, was marked by rapid expansion and strategic acquisitions. This growth was fueled by its unique asset-light model, focusing on acquiring finished lots. By 1983, the company had already achieved earnings exceeding $1 million, demonstrating its early financial success and laying the foundation for future growth. The company's history is a testament to its strategic vision and adaptability.

A pivotal moment in the NVR history was the acquisition of Ryan Homes in 1986, significantly broadening its geographic reach. This strategic move expanded its market presence, particularly on the East Coast of the United States. The company's earnings reached $33.5 million by 1988, reflecting its continued growth. In 1989, the company was renamed NVR L.P., and later reorganized as NVR Inc. in 1999.

Despite facing challenges, including a bankruptcy filing in 1992, NVR emerged stronger. The company's focus on its capital-light strategy proved to be a competitive advantage. Financial performance improved, with earnings recovering from a loss to a positive $29 million between 1993 and 1997. NVR also pursued geographical diversification, acquiring Fox Ridge Homes in 1997.

The establishment of NVR Mortgage Finance, Inc. further integrated its services, providing a complementary revenue stream. As of the first quarter of 2025, the mortgage banking segment continued to show growth, with closed loan production totaling $1.43 billion, an increase of 4% compared to the first quarter of 2024. For more insights into the competitive landscape, explore the Competitors Landscape of NVR.

The company's ability to adapt and strategically expand, especially in the face of market fluctuations, has been a key factor in its long-term success. The NVR timeline demonstrates a history of strategic acquisitions and financial restructuring. The company's early focus on an asset-light model and its ability to integrate services have been crucial to its growth.

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in NVR history?

The NVR Company has a history marked by significant milestones, strategic innovations, and considerable challenges. From its early days to its current position in the market, the company has demonstrated resilience and adaptability. This NVR history showcases its journey through various economic cycles and technological advancements.

| Year | Milestone |

|---|---|

| 1992 | The company filed for bankruptcy in April due to financial difficulties during the early 1990s recession. |

| 1993 | Successfully emerged from bankruptcy in September, showcasing its restructuring efforts and the resilience of its business model. |

| 2006-2023 | Achieved consistent net income growth, with a median annual growth rate of over 11%. |

| 2014-2023 | Aggressively bought back stock, reducing outstanding shares from 4.4 million to 3.4 million. |

| 2025 | Reported a decrease in net income in the first quarter, despite a modest increase in revenues. |

One of the key innovations that has defined the NVR Company is its 'asset-light' approach to land acquisition. This strategy has allowed the company to maintain higher returns on equity and greater financial stability. This approach is a core element of its business model, setting it apart from many competitors.

The company's focus on securing finished lots through options or purchase agreements with third-party developers minimizes financial exposure. This approach allows for greater flexibility and capital efficiency, especially during economic fluctuations.

The asset-light model has allowed the company to remain profitable throughout economic downturns, unlike many of its competitors. This financial stability is a cornerstone of its long-term success and resilience.

The company has consistently used cash to aggressively buy back stock, reducing outstanding shares. This capital allocation strategy aims to drive future growth and shareholder value.

The company's strategic initiatives include a continued focus on operational efficiency. This focus helps to improve profitability and maintain a competitive edge in the market.

The company has demonstrated adaptability by navigating through various economic cycles and technological advancements. This adaptability has been crucial for its long-term success.

The company’s strategic initiatives aim to drive future growth and shareholder value. These initiatives include a focus on operational efficiency and a robust share repurchase program.

The NVR Company faces several challenges, including economic downturns and rising interest rates. In the first quarter of 2025, the company reported a decrease in net income and a decline in gross profit margin. The company's performance is also affected by fluctuations in material and labor costs.

The company operates in a cyclical industry, making it vulnerable to economic downturns. These downturns can significantly impact sales and profitability.

Rising interest rates can affect affordability and demand in the housing market. This can lead to decreased sales and increased cancellation rates.

Fluctuations in material and labor costs can impact the company's gross profit margins. These costs can erode profitability if not managed effectively.

Affordability challenges can lead to pricing pressure, which can reduce profit margins. The company must balance pricing with maintaining profitability.

The company operates in a highly competitive market, which requires continuous innovation and strategic adaptation. Competition can impact market share and profitability.

Increased cancellation rates can negatively impact the company's financial performance. Managing cancellation rates is crucial for maintaining revenue and profitability.

For more insights into the company's core values, you can read about the Mission, Vision & Core Values of NVR.

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for NVR?

The NVR Company has a rich history marked by strategic expansions and financial milestones. The NVR timeline begins in 1948 with the founding of Ryan Homes, a precursor to the company. Over the years, it has evolved through various phases, including a bankruptcy filing and subsequent restructuring, eventually emerging as a publicly traded entity. The company has grown through acquisitions and strategic realignments, culminating in its inclusion in the S&P 500 in 2019. The company has consistently demonstrated financial strength, achieving record revenues and net income in recent years, and has shown continued revenue growth in Q1 2025.

| Year | Key Event |

|---|---|

| 1948 | Edward Ryan founded Ryan Homes, which would later become part of the company's history. |

| 1961 | Ryan Homes was incorporated as Edward M. Ryan, Inc. Builders. |

| 1980 | Dwight Schar founded NVHomes, Inc. |

| 1986 | NVHomes, Inc. was reorganized as NVH L.P. and went public, acquiring Ryan Homes. |

| 1989 | The company was renamed NVR L.P. |

| 1992 | NVR filed for bankruptcy due to an economic recession. |

| 1993 | NVR emerged from bankruptcy protection and became a public company again. |

| 1997 | Acquired Fox Ridge Homes, expanding into new markets. |

| 1999 | Reorganized as NVR Inc., a holding company for NVR Homes and NVR Financial Services; acquired First Republic Mortgage. |

| 2012 | Acquired Heartland Homes. |

| 2019 | NVR was added to the S&P 500 stock market index. |

| 2024 | Consolidated revenues reached $10.52 billion, with net income of $1.68 billion. |

| Q1 2025 | Reported total revenue of $2.4 billion and net income of $299.6 million. |

The NVR Company maintains a strong position in the homebuilding market, focusing on operational efficiency and market responsiveness. Its asset-light business model provides a competitive advantage, enabling quick adaptation to market changes. Analysts generally have a positive outlook, citing its financial strength and unique business model as drivers for future growth.

The company has demonstrated robust financial performance, with consolidated revenues reaching $10.52 billion and a net income of $1.68 billion in 2024. In Q1 2025, the company reported total revenue of $2.4 billion and a net income of $299.6 million. This strong financial standing supports its strategic initiatives and future growth prospects.

The homebuilding industry faces challenges such as interest rate fluctuations, material costs, and labor expenses. While potential Federal Reserve rate cuts offer optimism, higher mortgage rates and increasing costs remain a concern. The company aims to address these challenges by maintaining a disciplined approach to lot acquisition and focusing on shareholder value.

The company’s long-term strategic initiatives include a disciplined lot acquisition strategy and a continued focus on shareholder value through share repurchases. The company aims to remain a leading homebuilder in the eastern United States, known for financial efficiency, quality construction, and customer satisfaction. For more insights, you can explore the history of the company and its impact on the industry by reading an article about the NVR history.

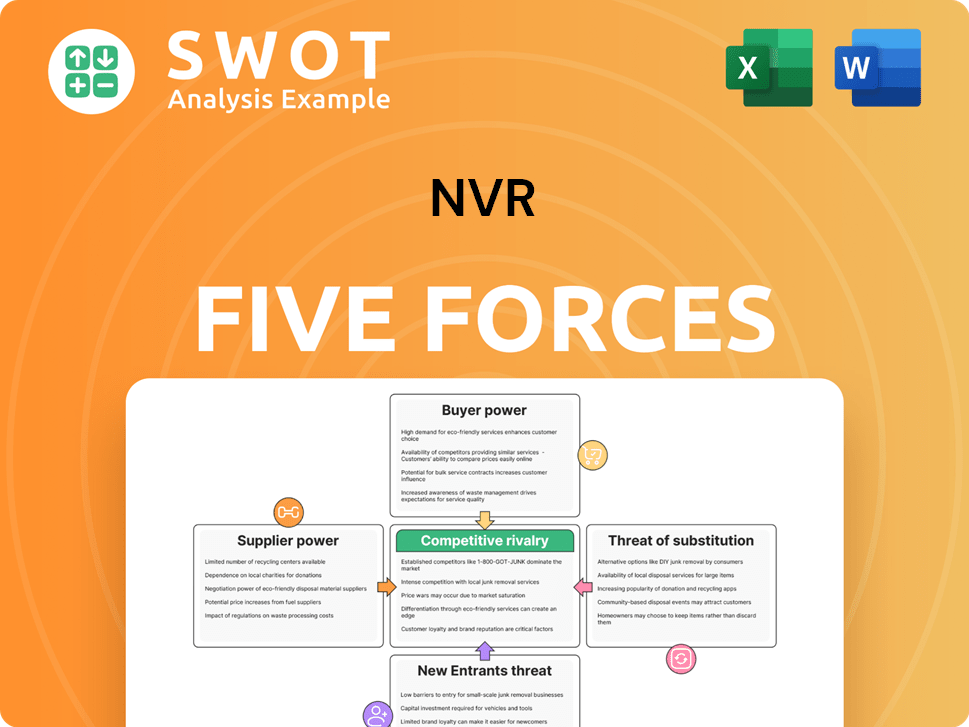

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of NVR Company?

- What is Growth Strategy and Future Prospects of NVR Company?

- How Does NVR Company Work?

- What is Sales and Marketing Strategy of NVR Company?

- What is Brief History of NVR Company?

- Who Owns NVR Company?

- What is Customer Demographics and Target Market of NVR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.