NVR Bundle

How Does NVR Inc. Stack Up Against the Competition?

The homebuilding industry is a battlefield, constantly reshaped by economic forces and consumer preferences. Amidst this volatility, understanding the NVR SWOT Analysis is crucial. This analysis dives deep into the NVR competitive landscape, examining its position within the dynamic housing market. We'll explore the key players, strategic advantages, and emerging trends that define NVR's success.

This exploration of the NVR market analysis will illuminate how NVR, Inc. navigates the challenges and opportunities inherent in the homebuilding sector. Analyzing the Network Video Recorder competition is essential for investors and strategists alike. By examining NVR's strategies, we gain insights into the broader trends affecting the industry, providing a foundation for informed decision-making.

Where Does NVR’ Stand in the Current Market?

NVR, Inc. holds a prominent position within the U.S. homebuilding sector. It consistently ranks among the top national builders. As of early 2024, NVR was the fourth-largest homebuilder in the United States based on closings, demonstrating its substantial market presence.

The company focuses on single-family detached homes, townhomes, and condominium buildings. These are offered through its brands: Ryan Homes, NVHomes, and Heartland Homes. Ryan Homes caters to first-time and move-up buyers. NVHomes serves the luxury segment, and Heartland Homes focuses on specific Midwestern markets.

NVR's geographic footprint spans across 15 states and 35 metropolitan areas, primarily in the Eastern and Midwestern United States. This strategic focus allows the company to leverage regional market strengths and optimize its supply chain. For a deeper understanding of the company's origins, you can read a Brief History of NVR.

NVR's market position is solidified by its consistent ranking among the top homebuilders nationally. In early 2024, the company held the fourth-largest position in the U.S. based on the number of home closings. This ranking highlights NVR's significant influence within the competitive landscape of the homebuilding industry.

The company's product lines include single-family detached homes, townhomes, and condominiums. These are offered through brands like Ryan Homes, NVHomes, and Heartland Homes. Ryan Homes targets first-time and move-up buyers with more affordable options. NVHomes focuses on the luxury segment, while Heartland Homes serves Midwestern markets.

NVR's operations are concentrated in 15 states and 35 metropolitan areas. This strategic focus allows for optimized supply chains and leveraging regional market strengths. The primary geographic focus is in the Eastern and Midwestern United States, which influences its competitive positioning.

NVR's financial health is robust, as reflected in its consistent profitability and strong balance sheet. For the first quarter of 2024, NVR reported net income of $244.6 million. Diluted earnings per share were $7.02, indicating solid financial performance compared to industry averages. This financial strength supports its market position.

While NVR maintains a strong position in its core markets, its presence in rapidly growing Sun Belt states is less pronounced. This presents a potential area for future expansion. The company's focus on the Eastern and Midwestern United States could be seen as a strength due to established market presence.

- Strong Financials: Demonstrated by a net income of $244.6 million in Q1 2024.

- Geographic Focus: Concentrated in the Eastern and Midwestern United States.

- Brand Segmentation: Offers products through Ryan Homes, NVHomes, and Heartland Homes.

- Potential for Expansion: Opportunities in the Sun Belt states.

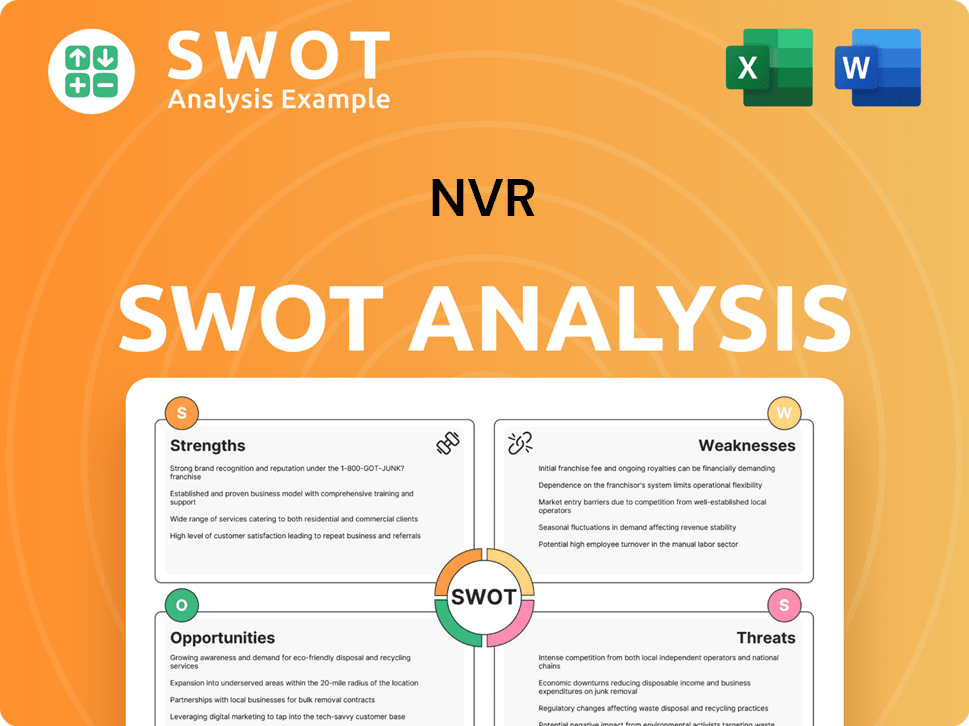

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NVR?

The competitive landscape for NVR is multifaceted, encompassing a range of homebuilding companies that vie for market share. This analysis delves into the key players and market dynamics shaping the industry. Understanding the competitive environment is crucial for assessing NVR's position and strategic options.

NVR faces competition from both direct and indirect sources. Direct competitors include large national homebuilders, regional builders, and smaller local firms. Indirect competition comes from the resale housing market and rental properties. This comprehensive view helps to understand the complexities of the NVR market.

The homebuilding industry is dynamic, with mergers, acquisitions, and technological advancements constantly reshaping the competitive dynamics. This chapter will explore the key competitors and their strategies, providing a clear picture of the challenges and opportunities.

The primary direct competitors for NVR include major publicly traded national homebuilders. These companies often have extensive geographic footprints and a wide range of offerings.

D.R. Horton is the largest homebuilder in the U.S. by volume. It competes directly with NVR, particularly through its diverse product offerings across various price points. In 2023, D.R. Horton reported revenues of approximately $33.8 billion.

Lennar Corporation is another significant competitor, also with a national presence. It focuses on efficiency and digital integration in its homebuilding processes. Lennar's revenue in 2023 was around $34.2 billion.

PulteGroup competes with NVR through its diversified brand portfolio, targeting various buyer segments. PulteGroup's revenue in 2023 was roughly $16.9 billion.

Toll Brothers specializes in luxury homes, competing with NVR's NVHomes brand in the upscale market. Toll Brothers reported revenues of approximately $9.7 billion in 2023.

NVR also faces competition from numerous regional builders. These builders often have strong local market knowledge and established relationships, providing a competitive edge. These builders often focus on specific geographic areas, allowing them to tailor their offerings to local preferences.

Indirect competition for NVR comes from several sources. The resale housing market offers existing homes as an alternative to new construction, influencing demand. Apartment rentals, especially in urban areas, also compete for potential homebuyers. Additionally, emerging players in modular construction and sustainable building practices are gaining traction, although their market share is currently smaller. The homebuilding industry is subject to cyclical fluctuations, influenced by economic conditions, interest rates, and consumer confidence. Understanding the dynamics of the Revenue Streams & Business Model of NVR is crucial for assessing its competitive position.

The competitive landscape is constantly evolving due to mergers and acquisitions, technological advancements, and changes in consumer preferences. These factors impact the strategies and market positions of all players.

- Mergers and Acquisitions: Consolidation within the homebuilding industry continues, with larger builders acquiring smaller regional firms. This trend can lead to increased competition for land and skilled labor.

- Technological Advancements: The adoption of digital tools, sustainable building practices, and modular construction methods is reshaping the industry.

- Economic Factors: Interest rates, inflation, and overall economic conditions significantly influence the housing market. In 2024, the industry is navigating challenges related to rising interest rates and supply chain issues.

- Consumer Preferences: Changing consumer preferences, such as demand for energy-efficient homes and smart home technologies, impact home design and construction.

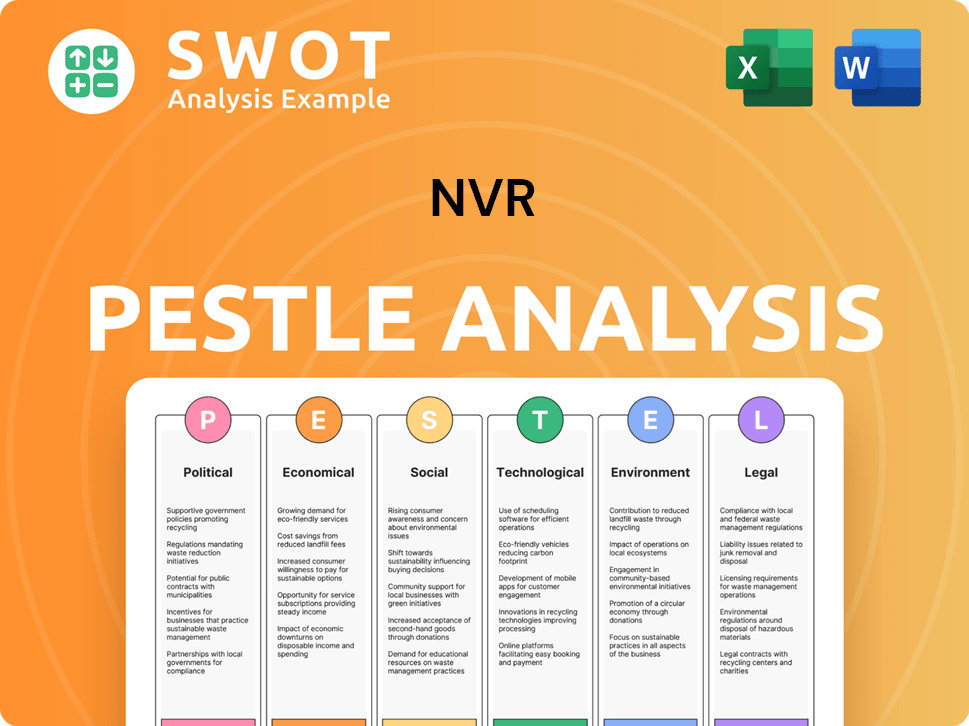

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NVR a Competitive Edge Over Its Rivals?

The competitive advantages of the homebuilding company are rooted in its unique business model, operational efficiency, and strong financial management. This approach sets it apart from traditional homebuilders, fostering resilience and adaptability in the dynamic housing market. Understanding these strengths is crucial for anyone analyzing the Growth Strategy of NVR and its position within the broader industry.

The company's success stems from its 'land-light' strategy, which significantly reduces capital intensity and exposure to land value fluctuations. Additionally, its robust mortgage banking segment streamlines the homebuying process, enhancing profitability. These strategies, combined with efficient construction processes and strong brand equity, create a powerful and sustainable competitive edge.

The company's ability to maintain and enhance these advantages is a key factor in its long-term success. While some aspects can be imitated, the company's established experience and integrated operations create a significant barrier to entry for competitors. This positions the company well in the evolving homebuilding market.

The company's 'land-light' approach, which involves optioning land rather than outright ownership, offers significant financial flexibility. This strategy reduces capital requirements and minimizes the risk associated with land value fluctuations. This approach allows the company to adapt more quickly to changing market conditions.

The company's in-house mortgage services, known as Mortgage, streamline the homebuying experience. This integration provides greater control over the sales process, potentially leading to higher capture rates and improved profitability. This integrated approach is a key differentiator in the competitive landscape.

The company focuses on standardized designs and efficient construction processes across its brands. This approach contributes to economies of scale and cost efficiencies. This operational excellence allows the company to maintain competitive pricing and strong margins.

The company's strong brand equity, particularly with its Ryan Homes brand, has cultivated significant customer loyalty. This reputation for quality and value helps drive sales and supports a premium brand image. This brand strength is a key advantage in the NVR competitive landscape.

The company's competitive advantages are multifaceted, encompassing a land-light model, integrated mortgage services, operational efficiency, and strong brand equity. These strengths contribute to financial resilience and market adaptability. The company's ability to consistently refine its strategies and maintain its competitive edge is a key factor in its long-term success.

- Land-Light Strategy: Reduces capital intensity and land risk.

- Integrated Mortgage: Streamlines homebuying and boosts profitability.

- Operational Efficiency: Standardized designs and efficient construction.

- Strong Brand: Drives customer loyalty and supports premium pricing.

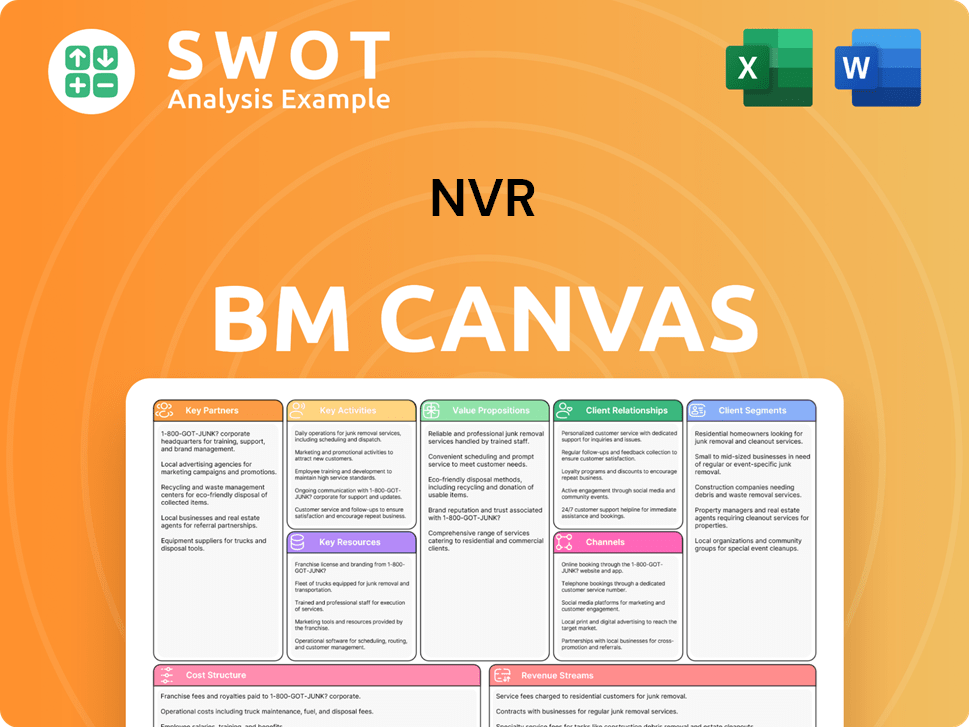

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NVR’s Competitive Landscape?

The homebuilding industry is currently navigating a complex landscape shaped by rising interest rates, inflation, and evolving consumer demands. These factors, combined with technological advancements and regulatory changes, create both challenges and opportunities for companies like NVR. Understanding the NVR competitive landscape and the broader security camera market is crucial for strategic planning and sustained growth.

For NVR, these industry dynamics necessitate careful consideration of market trends, potential risks, and future opportunities. This involves adapting to changing consumer preferences, managing supply chain disruptions, and leveraging technological advancements to maintain a competitive edge. The ability to anticipate and respond to these shifts will be critical for NVR's long-term success.

The housing market faces headwinds from rising interest rates, which can decrease affordability and potentially impact sales volumes. Consumers are increasingly seeking energy-efficient and smart home features, creating demand for innovative products. Supply chain disruptions, though easing, still pose a challenge to construction timelines and costs.

Rising interest rates can dampen housing demand, potentially affecting NVR's sales. Supply chain issues can lead to construction delays and increased costs. Competition from other video surveillance companies intensifies as the market evolves. Economic downturns could reduce consumer spending on new homes.

The increasing demand for smart and energy-efficient homes allows NVR to innovate its product offerings. Demographic shifts, such as the millennial cohort entering homebuying years, present a growth opportunity. Geographic expansion into new markets can drive revenue growth. Technological advancements offer potential for improved construction efficiency.

NVR can leverage its land-light model to mitigate market risks. Optimizing construction processes will enhance efficiency. Investing in technologies that improve home features or construction speed is crucial. Adapting to changing consumer preferences will be key to success.

NVR's ability to adapt to changing market dynamics and consumer demands will be crucial for sustained growth. The company's financial prudence and integrated business model are expected to maintain a strong competitive position. Strategic initiatives, such as exploring expansion into new geographic markets and investing in technological advancements, will be vital.

- NVR market analysis indicates a need for continuous innovation in home designs and features to meet evolving consumer preferences.

- Adapting to the increasing demand for smart and energy-efficient homes is a key priority.

- Maintaining financial discipline and operational efficiency is essential to navigate potential economic downturns.

- Exploring new markets and leveraging technological advancements will support long-term growth. For more insights, consider reading about the Marketing Strategy of NVR.

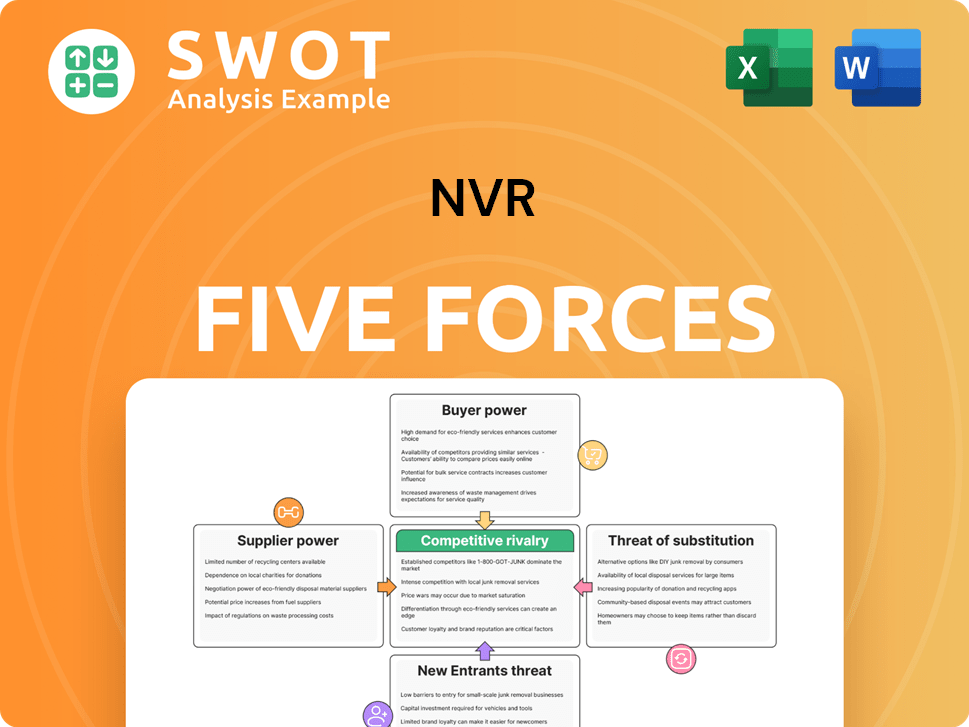

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NVR Company?

- What is Growth Strategy and Future Prospects of NVR Company?

- How Does NVR Company Work?

- What is Sales and Marketing Strategy of NVR Company?

- What is Brief History of NVR Company?

- Who Owns NVR Company?

- What is Customer Demographics and Target Market of NVR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.