NVR Bundle

Who Buys Homes from NVR, and Why Does it Matter?

The housing market's ebbs and flows demand a keen understanding of its players, especially for industry leaders like NVR, Inc. With fluctuating interest rates and shifting consumer desires, knowing the NVR SWOT Analysis is crucial. This deep dive explores the customer demographics and target market of the NVR company, revealing the strategies behind its sustained success.

Understanding the customer demographics for NVR is key to effective market analysis and strategic planning. This includes identifying the ideal customer profile and conducting thorough customer segmentation. By examining factors such as NVR company customer age range, income levels, and purchasing habits, we can better understand how NVR adapts to meet its customers' needs and maintain its competitive edge. This analysis also considers the NVR customer location analysis and customer behavior patterns to provide a comprehensive view of the company's market position.

Who Are NVR’s Main Customers?

The company strategically segments its customer base across its three primary homebuilding brands: Ryan Homes, NVHomes, and Heartland Homes. This multi-brand approach enables the company to effectively target diverse buyer segments. The company's approach allows it to cater to a broad spectrum of customers, from first-time homebuyers to luxury buyers.

Ryan Homes primarily caters to first-time and first-time move-up buyers, offering accessible homeownership opportunities. NVHomes targets move-up buyers, likely those seeking larger or more premium homes with additional features. Heartland Homes focuses on the luxury buyer segment, providing higher-end properties with advanced amenities and finishes. This segmentation strategy allows the company to reduce reliance on any single market segment.

While specific demographic breakdowns by age, gender, income level, education, or occupation for each brand are not publicly detailed, the segmentation strategy implies distinct demographic profiles for each. First-time buyers (Ryan Homes) typically include younger individuals or couples, potentially with moderate income levels and seeking entry-level to mid-range housing. Move-up buyers (NVHomes) are likely older, with higher disposable incomes and established careers, looking for larger homes to accommodate growing families or lifestyle upgrades. Luxury buyers (Heartland Homes) represent the highest income brackets, often with significant wealth and a demand for bespoke features and prime locations.

The company's customer segmentation strategy involves three primary homebuilding brands: Ryan Homes, NVHomes, and Heartland Homes. This approach allows the company to target a diverse range of buyers, from first-time homebuyers to luxury buyers. This strategy is crucial for understanding the customer demographics and target market.

In 2024, homebuilding revenues increased by 11% to $10.29 billion, driven by an 11% rise in home settlements. The company's financial reports indicate that homebuilding operations are the primary revenue driver, contributing the largest portion to overall revenue. Despite a decrease in new orders in Q4 2024, the overall yearly increase in new orders (4% to 22,560 units in 2024 from 21,729 units in 2023) indicates sustained demand.

Ryan Homes focuses on first-time and first-time move-up buyers, offering accessible homeownership opportunities. NVHomes targets move-up buyers, likely those seeking larger or more premium homes. Heartland Homes caters to the luxury buyer segment, providing higher-end properties. Understanding these specific target markets is key for the company's success.

Homebuilding revenues increased by 11% to $10.29 billion in 2024. Home settlements rose by 11%, reaching 22,836 units in 2024. While new orders in Q4 2024 decreased by 8%, the overall yearly increase in new orders (4% to 22,560 units in 2024 from 21,729 units in 2023) indicates continued demand across its target segments.

The company's approach to customer segmentation is crucial for its market analysis. Each brand targets a specific demographic, from first-time buyers to luxury consumers. Understanding the ideal customer profile for each segment is essential for strategic planning.

- Ryan Homes: Targets first-time and first-time move-up buyers.

- NVHomes: Focuses on move-up buyers seeking larger homes.

- Heartland Homes: Caters to luxury buyers with high-end properties.

- The company's diversified revenue stream is a direct result of this segmentation, reducing reliance on any single market segment.

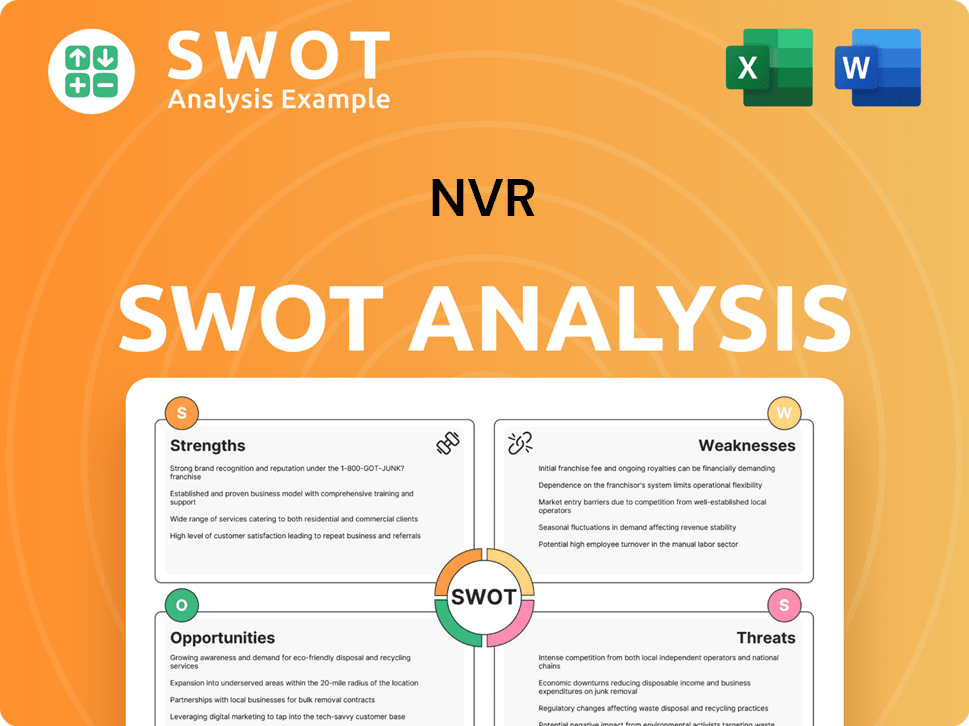

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do NVR’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Growth Strategy of NVR. Customer demographics, combined with insights into their behaviors and aspirations, shape purchasing decisions. The company's ability to cater to these diverse needs through its multi-brand strategy and integrated services is a key factor in its market performance.

The target market for the company is segmented based on different buyer profiles, each with unique needs. These segments range from first-time homebuyers to luxury buyers, each driving different needs and preferences. Meeting these diverse customer expectations requires a deep understanding of their motivations and pain points.

The company's approach addresses a range of customer needs, from affordability to premium features. The company's in-house mortgage segment, for instance, helps to streamline the homebuying process. The average sales price of new orders in Q4 2024 was $469,000, indicating a focus on attainable price points for a broad customer base.

The company caters to different customer segments, each with specific needs and preferences. First-time buyers often prioritize affordability and financing, while move-up buyers seek more space and upgraded features. Luxury buyers, on the other hand, demand high-end finishes and custom designs.

- First-Time Buyers: Primarily served by Ryan Homes, they focus on affordability and financing options.

- Move-Up Buyers: Targeted by NVHomes, seeking more space, better school districts, and upgraded features.

- Luxury Buyers: Served by Heartland Homes, prioritizing high-end finishes, custom designs, and prime locations.

- Customer Needs: The company addresses the need for accessible financing through its mortgage segment and manages costs through its 'land-light' model.

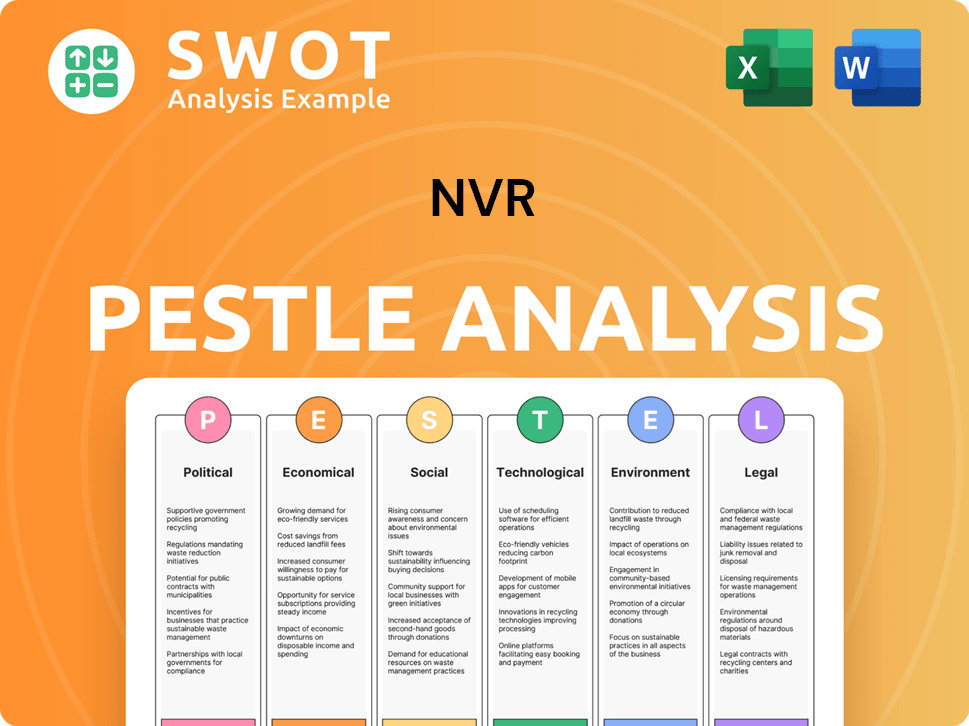

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does NVR operate?

The geographical market presence of NVR, Inc. is predominantly concentrated in the eastern United States. The company operates in thirty-six metropolitan areas across sixteen states and Washington, D.C., focusing on strategic locations to capitalize on specific demographic trends and housing demands. This regional focus allows for optimized supply chains, construction processes, and customer service, contributing to efficiency and profitability.

Key markets for NVR include Maryland, Virginia, West Virginia, Delaware, New Jersey, and Pennsylvania. These areas are central to the company's operations, where it tailors its offerings to meet local market needs. This localized approach is reflected in the performance of its various brands within these regions, demonstrating a commitment to understanding and serving its customer base effectively.

NVR's commitment to long-term growth is evident through strategic investments in land and development, totaling $1.29 billion in fiscal year 2024. This investment underscores the company's strategy to expand its geographic footprint and enhance product offerings. The company's consistent investment in these areas is a key factor in its future expansion within its targeted regions.

NVR's primary focus is on the eastern United States, with a strong presence in key states. This strategic concentration allows for efficient operations and targeted marketing efforts. The company's choice of locations is driven by favorable demographics and housing market conditions.

The Mid Atlantic segment, including Maryland, Virginia, West Virginia, Delaware, and Washington, D.C., saw an approximate 8% increase in segment profit in the first nine months of 2024 compared to the same period in 2023. This growth highlights the effectiveness of NVR's regional strategies. The average price of homes settled was $450,700 in both 2024 and 2023.

NVR is committed to expanding its geographic footprint and enhancing product offerings. This is supported by significant investments in land and development. The company's strategy involves adapting to evolving consumer demands and market dynamics.

NVR's various brands cater to different segments within its operational areas. This localized approach allows the company to meet diverse customer needs effectively. Understanding customer demographics is key for success.

To better understand the competitive landscape, it's beneficial to analyze the Competitors Landscape of NVR. This analysis provides insights into the market dynamics and the strategies of other players in the industry.

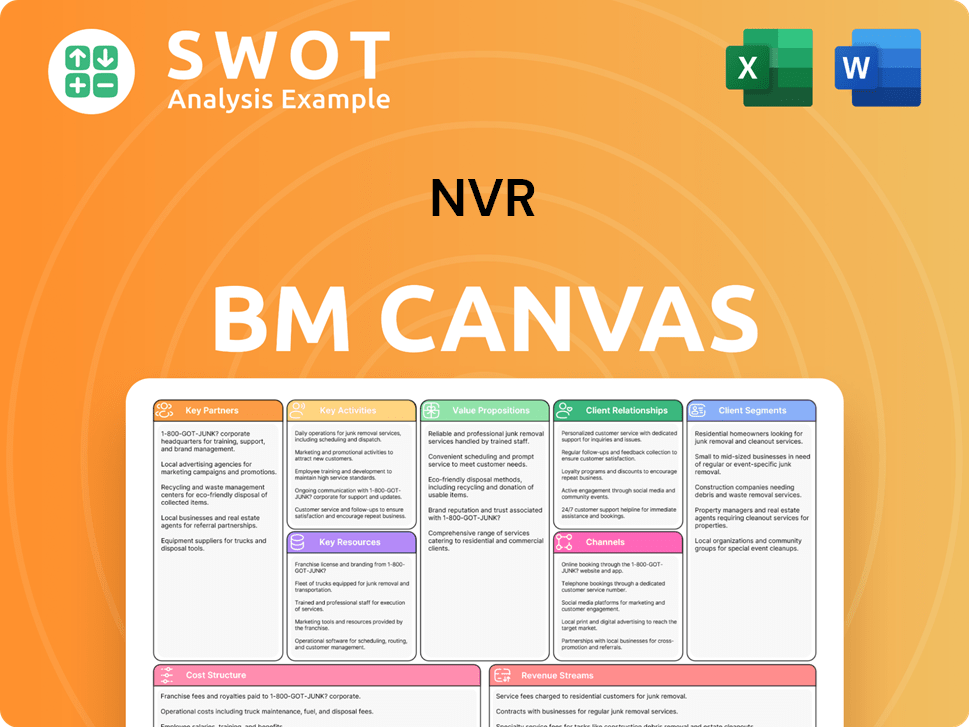

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does NVR Win & Keep Customers?

NVR, Inc. employs a multi-faceted approach to customer acquisition and retention, leveraging its diverse brand portfolio—Ryan Homes, NVHomes, and Heartland Homes—to target a broad range of homebuyers. This strategy allows for tailored marketing and product offerings, catering to specific needs and preferences across different customer segments. Understanding the Revenue Streams & Business Model of NVR is key to grasping how these strategies are implemented.

A significant component of NVR's strategy involves its mortgage banking segment, NVR Mortgage. This in-house service streamlines the home-buying process, enhancing customer satisfaction and fostering loyalty. The provision of competitive financing options and a seamless experience is a strong draw for potential buyers, contributing to both acquisition and retention within the NVR ecosystem.

The company's focus on customer satisfaction and delivering high-quality homes is central to its retention efforts. NVR emphasizes personalized design options, allowing buyers to customize their homes, and provides dedicated customer service teams. These initiatives create positive customer experiences, leading to repeat business and valuable referrals.

NVR utilizes its multiple brands to target different customer segments, from first-time buyers to luxury purchasers. This customer segmentation allows for focused marketing messages and product offerings. This approach helps in attracting a wide range of customers, which is crucial for market analysis.

NVR Mortgage provides in-house mortgage services, offering competitive financing options and streamlining the home-buying process. This vertical integration enhances customer satisfaction and loyalty. In Q4 2024, mortgage closed loan production reached $1.70 billion, a 13% increase from Q4 2023, indicating strong customer engagement.

NVR focuses on personalized design options, allowing buyers to customize their homes. Dedicated customer service teams provide support throughout the buying process. These efforts contribute to positive customer experiences, which is vital for long-term retention.

NVR's 'land-light' model and operational efficiency support financial stability, which indirectly boosts customer confidence. Despite a Q4 2024 cancellation rate increase to 17%, the overall annual increase in new orders (4% in 2024) and settlements (11% in 2024) suggests effective strategies.

NVR's strategies are designed to attract and retain customers through a combination of targeted branding, in-house services, and a customer-centric approach. Understanding the customer demographics and tailoring offerings accordingly is essential for success.

- Multi-Brand Strategy: Targeting diverse customer segments with specific brands.

- Integrated Mortgage Services: Streamlining the home-buying process for customer convenience.

- Personalized Design Options: Allowing customers to customize homes to meet their needs.

- Dedicated Customer Service: Providing support throughout the buying process.

- Financial Stability: Maintaining a 'land-light' model to navigate market fluctuations.

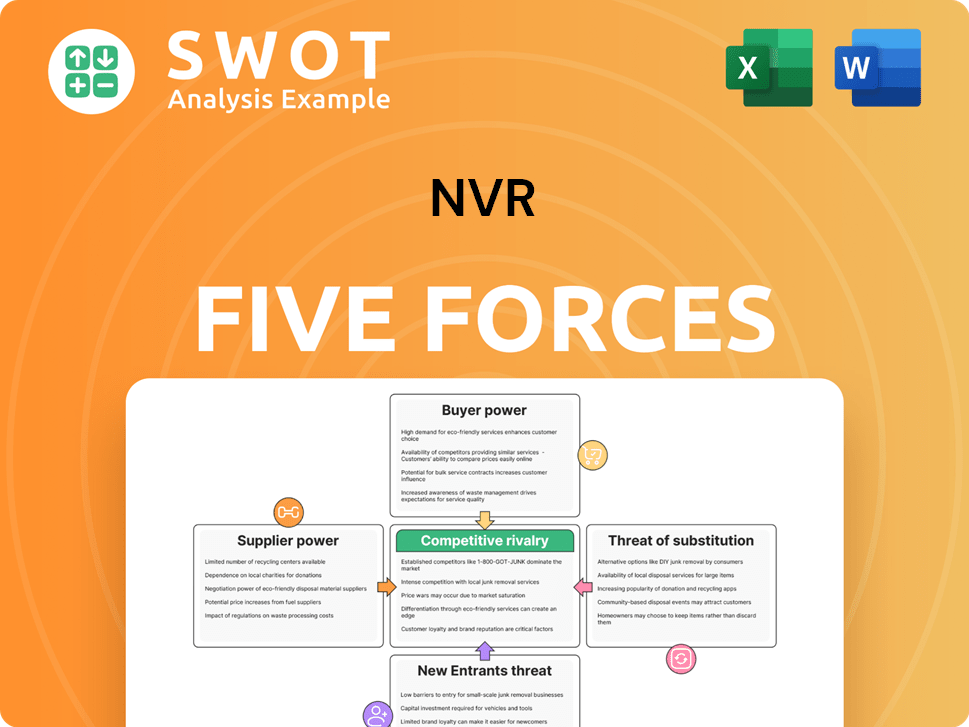

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.