NVR Bundle

How Does NVR, Inc. Build Its Empire?

NVR, Inc. isn't just another homebuilder; it's a powerhouse reshaping the U.S. housing landscape. Operating under well-known brands, NVR constructs and sells a wide array of residential properties across 16 states and Washington, D.C. Its impressive 2024 revenue of $10.52 billion underscores its robust market presence and operational prowess.

Delving into NVR's unique operational model, especially its 'land-light' strategy and integrated mortgage banking, offers invaluable insights. This approach, alongside its financial performance and strategic advantages, is key to understanding its success. For a deeper dive into NVR's strengths and weaknesses, consider exploring the NVR SWOT Analysis.

What Are the Key Operations Driving NVR’s Success?

The core operations of the company revolve around its dual business model, encompassing both homebuilding and mortgage banking. This integrated approach is designed to streamline processes and mitigate risks, particularly those associated with land acquisition. The company's strategy focuses on delivering value through operational efficiency and a customer-centric approach.

The company offers homes under three distinct brands: Ryan Homes, NVHomes, and Heartland Homes. This segmentation allows the company to cater to a diverse range of customers, from first-time buyers to those seeking luxury homes. This multi-brand strategy enables the company to adapt to varying market conditions and customer preferences effectively.

A key differentiator for the company is its 'land-light' strategy. This approach minimizes the financial exposure and capital expenditure typically associated with large land holdings. As of December 31, 2024, the company controlled approximately 162,400 lots.

The company's mortgage banking segment, provides mortgage-related services exclusively to its homebuyers. This vertical integration enhances customer satisfaction and streamlines the home-buying process. In 2024, the company closed approximately 17,300 loans.

The company's operational efficiency is significantly enhanced by its land-light strategy and integrated mortgage banking services. The company's approach to land acquisition, using fixed-price lot purchase agreements, reduces financial risk. The mortgage banking segment provides a seamless experience for homebuyers.

- The company primarily purchases finished lots from third-party developers.

- Mortgage banking services are offered exclusively to the company's homebuyers.

- The company's strategy insulates it from market downturns and interest rate fluctuations.

- The company's approach contributes to its operational efficiency and market differentiation.

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NVR Make Money?

The revenue streams and monetization strategies of the company are primarily driven by its homebuilding and mortgage banking segments. The company leverages an asset-light model and a pre-sold construction approach to efficiently generate revenue and adapt to market dynamics. This strategy, combined with integrated mortgage banking services and a diversified brand portfolio, enables the company to capture various market segments and maintain a stable revenue mix.

In 2024, the company's consolidated revenues reached $10.52 billion, an increase of 11% from $9.52 billion in 2023. Homebuilding revenues were the main contributor, totaling $10.29 billion, also an 11% increase. The mortgage banking segment also significantly contributes to overall revenue, with income before tax increasing in both 2024 and the first quarter of 2025.

For the first quarter of 2025, consolidated revenues totaled $2.40 billion, a 3% increase from $2.33 billion in Q1 2024. Homebuilding revenues in Q1 2025 were $2.35 billion, up 3% from $2.29 billion in Q1 2024. Despite revenue growth, the gross profit margin in homebuilding decreased to 21.9% in Q1 2025 from 24.5% in Q1 2024.

The company's financial performance is a result of its strategic focus on homebuilding and mortgage banking. Here's a closer look at the financial data:

- 2024 Consolidated Revenues: $10.52 billion, an 11% increase from 2023.

- 2024 Homebuilding Revenues: $10.29 billion, an 11% increase.

- Q1 2025 Consolidated Revenues: $2.40 billion, a 3% increase from Q1 2024.

- Q1 2025 Homebuilding Revenues: $2.35 billion, up 3% from Q1 2024.

- Q1 2025 Homebuilding Gross Profit Margin: 21.9% compared to 24.5% in Q1 2024.

- 2024 Mortgage Banking Income Before Tax: Increased 17% to $154.9 million.

- Q1 2025 Mortgage Banking Income Before Tax: Increased 12% to $32.5 million.

- 2024 Mortgage Closed Loan Production: Increased 9% to $6.26 billion.

- Q1 2025 Mortgage Closed Loan Production: $1.43 billion, a 4% increase.

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NVR’s Business Model?

The journey of NVR has been marked by strategic pivots and a steadfast commitment to financial discipline. A significant turning point was its emergence from Chapter 11 bankruptcy in 1993, which set the stage for its distinctive 'land-light' business model. This model, a core element of its competitive strategy, has enabled NVR to navigate the cyclical nature of the housing market with greater resilience.

NVR's financial strategy centers on minimizing risk and maximizing shareholder value. The company's approach to land acquisition, where it only purchases land when a buyer is secured and financing is in place, is a crucial element of this strategy. This method reduces the financial burden of holding large land inventories and helps maintain a low-debt balance sheet. This focus on financial health has been a key factor in its long-term success.

The company's strategic moves and financial decisions have consistently aimed at creating value for its shareholders. NVR's commitment to operational efficiency and its unique business model have allowed it to maintain strong financial performance.

NVR's restructuring after Chapter 11 bankruptcy in 1993 was a pivotal moment. The adoption of the 'land-light' model significantly reduced financial risk. This strategy has been crucial for maintaining financial stability and a competitive edge in the housing market.

The company's diversified brand portfolio, including Ryan Homes, NVHomes, and Heartland Homes, allows it to target various customer segments. The 'cost-plus contract' model provides predictable revenue and stable profit margins. NVR consistently repurchases shares, demonstrating a commitment to shareholder value.

The 'land-light' model minimizes financial risk and reduces debt. The diversified brand portfolio caters to various customer preferences. The cost-plus contract model helps stabilize profit margins. NVR's strategic capital allocation, including share repurchases, underscores its strong financial position.

On December 11, 2024, the Board of Directors authorized the repurchase of up to $750 million of its outstanding common stock. The share repurchase program, which began in 1996, has resulted in the retirement of 76% of shares. In 2024, NVR repurchased $2.1 billion of outstanding stock.

NVR has faced market challenges, including rising mortgage rates and economic uncertainty. In Q4 2024, new orders decreased by 8% to 4,794 units, and the cancellation rate increased to 17%. In Q1 2025, new orders decreased by 12% to 5,345 units, and the cancellation rate rose to 16%. Despite these headwinds, NVR's strategic focus has allowed it to maintain strong financial performance.

- The company's strategic focus on operational efficiency and its unique business model have allowed it to maintain strong financial performance.

- NVR's financial strategy centers on minimizing risk and maximizing shareholder value.

- The company's approach to land acquisition, where it only purchases land when a buyer is secured and financing is in place, is a crucial element of this strategy.

- This method reduces the financial burden of holding large land inventories and helps maintain a low-debt balance sheet.

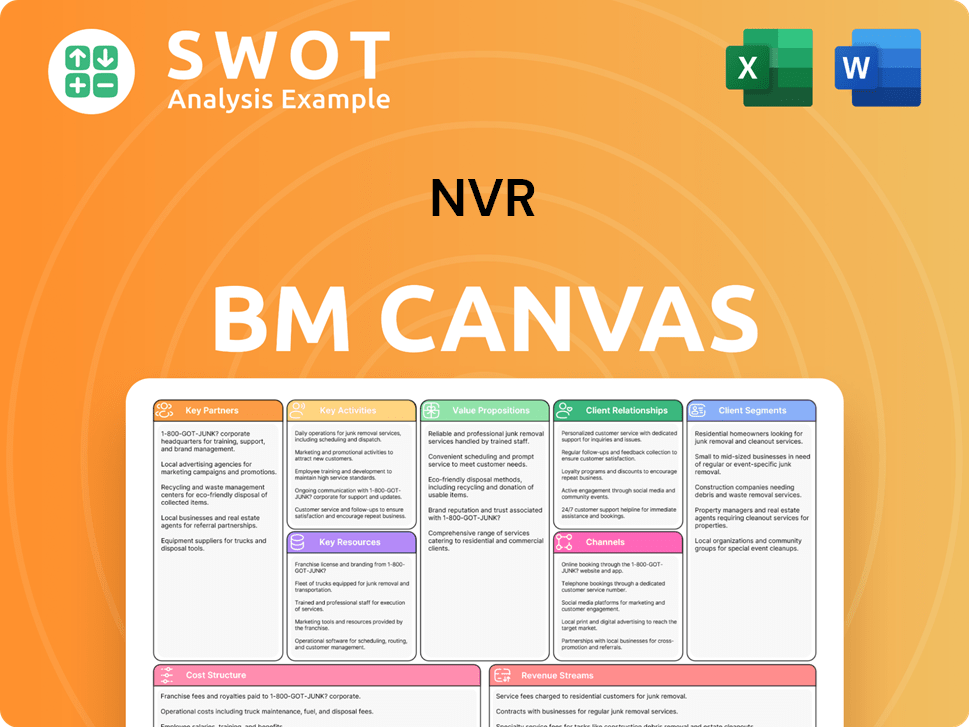

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NVR Positioning Itself for Continued Success?

In the U.S. homebuilding market, NVR holds a significant position, ranking as the 4th largest home construction company based on the number of homes closed as of 2023. Its strategy of focusing on leading market positions in each area provides efficiency and competitive advantages. This approach helps mitigate the impact of regional economic cycles.

However, NVR faces several risks. Economic downturns, rising interest rates, and fluctuations in material and labor costs are ongoing concerns. High mortgage rates, especially if they stay above 6%, could limit affordability and lower demand. Increased construction activity might also lead to supply chain disruptions. The homebuilding industry is cyclical and sensitive to consumer confidence and preferences.

NVR is a major player in the U.S. homebuilding sector. Its market concentration strategy enables it to achieve leading positions in its operating areas. This approach helps the company to mitigate the effects of regional economic downturns.

The company faces risks related to economic conditions, interest rates, and costs. High mortgage rates and supply chain issues can also affect operations. Consumer confidence and preferences also play a role in the homebuilding industry.

Analysts generally have a positive outlook for NVR, citing its strong financial performance. The company's strategic initiatives and commitment to operational efficiency are expected to drive future growth in the housing market.

NVR's strong balance sheet, with a net cash balance exceeding $1.6 billion as of December 31, 2024, supports its ability to handle disruptions. While a slight decline in EPS is projected for 2025, a rebound is anticipated in 2026.

NVR's future growth is expected to be driven by its 'land-light' approach, cost-plus contracts, and share repurchase program. The company's focus on operational efficiency and responsiveness to market changes is important for navigating the housing market. For understanding the competitive landscape, consider this analysis: Competitors Landscape of NVR.

- The company supports affordable housing initiatives.

- NVR is among the top builders whose mortgages are included in Fannie Mae's 'green bond' program.

- In Q1 2025, gross profit margin was impacted by higher lot costs and pricing pressure.

- Analysts project a slight decline in annual EPS for 2025 to $504.28.

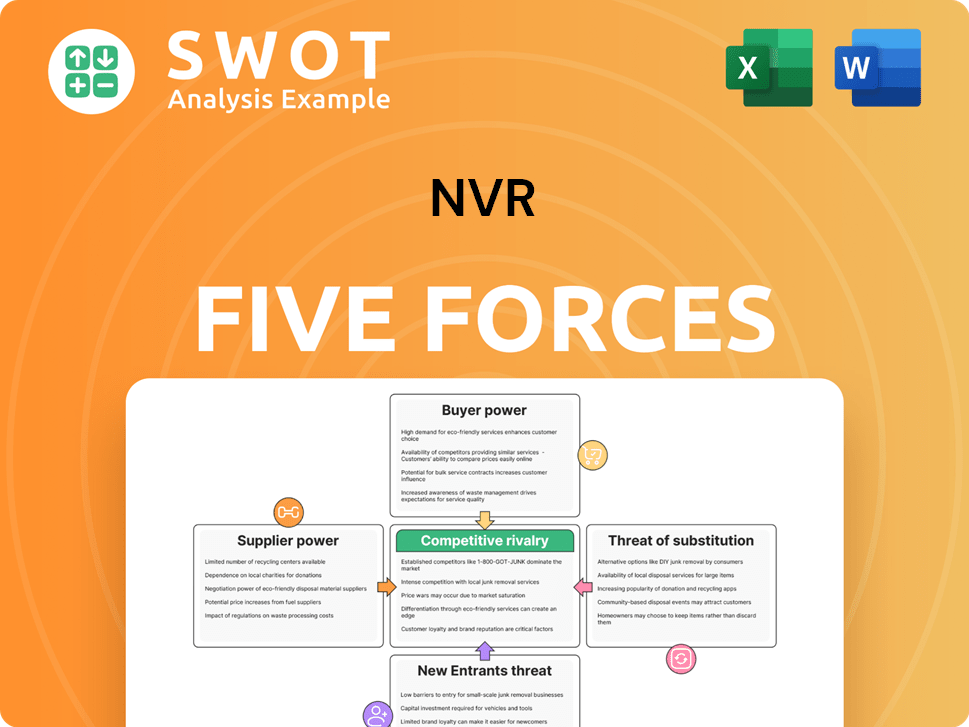

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NVR Company?

- What is Competitive Landscape of NVR Company?

- What is Growth Strategy and Future Prospects of NVR Company?

- What is Sales and Marketing Strategy of NVR Company?

- What is Brief History of NVR Company?

- Who Owns NVR Company?

- What is Customer Demographics and Target Market of NVR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.