NVR Bundle

Can NVR, Inc. Continue Its Ascent in the Homebuilding Market?

NVR, Inc. has carved a significant niche in the competitive homebuilding sector, but what's next for this industry leader? This analysis dives into NVR's strategic initiatives, examining how it plans to sustain its impressive growth trajectory. We'll explore its innovative approach to homebuilding and mortgage banking, uncovering the key drivers behind its market success and future potential.

From its inception, NVR has prioritized strategic foresight, making it a key player in the NVR SWOT Analysis. The company's integrated model, combining homebuilding with mortgage services, provides a unique advantage in the dynamic residential construction industry. This exploration will dissect NVR's growth strategy, market prospects, and how it navigates the ever-evolving video surveillance market to maintain its competitive edge and capitalize on emerging NVR technology trends.

How Is NVR Expanding Its Reach?

The expansion strategy of NVR is primarily centered around strategic geographical market entry, product diversification, and operational efficiency. These initiatives are designed to capture new customer segments and increase market share. The company's approach involves entering new housing markets where demand for new homes is strong and land is available for development.

NVR has historically focused on the Mid-Atlantic, Northeast, Southeast, and Mid-West regions of the United States. The company continuously evaluates opportunities to extend its presence in high-growth metropolitan areas. This strategic focus allows NVR to capitalize on regional economic trends and consumer preferences, driving its growth trajectory. This approach has been crucial in enabling NVR to scale its operations efficiently and enter new submarkets without significant upfront land acquisition costs.

Beyond geographical expansion, NVR pursues product diversification through its distinct brands: Ryan Homes, NVHomes, and Heartland Homes. This multi-brand strategy enables NVR to address a broader spectrum of consumer preferences and economic capacities, thereby expanding its potential customer base. This approach allows NVR to cater to various segments, from first-time buyers to luxury home seekers.

NVR focuses on entering new housing markets with robust demand and available land. The company concentrates its efforts on high-growth metropolitan areas within the Mid-Atlantic, Northeast, Southeast, and Mid-West regions. This strategic focus helps NVR capitalize on regional economic trends and consumer preferences.

NVR utilizes a multi-brand strategy, including Ryan Homes, NVHomes, and Heartland Homes. Ryan Homes targets first-time and move-up buyers with affordable to moderately priced homes. NVHomes caters to the luxury segment, while Heartland Homes expands NVR's reach in specific regional markets. This diversification allows NVR to address a broad spectrum of consumer needs.

NVR emphasizes a land-light strategy, optioning land rather than owning it outright. This approach reduces financial risk and enhances flexibility. The land-light strategy allows the company to adapt quickly to market shifts and optimize capital deployment. This strategy has been crucial in enabling NVR to scale its operations efficiently.

Future expansion will likely continue to leverage the land-light model. NVR may also explore strategic partnerships or smaller, targeted acquisitions. These initiatives align with its existing operational strengths and market focus, further enhancing its growth prospects. This helps to ensure sustainable growth and market leadership.

NVR's growth strategy focuses on geographical expansion, product diversification, and operational efficiency. The company strategically enters new housing markets and utilizes a multi-brand approach to cater to diverse customer segments. NVR's land-light strategy minimizes financial risk and enhances flexibility.

- Geographical expansion into high-growth metropolitan areas.

- Product diversification through Ryan Homes, NVHomes, and Heartland Homes.

- Land-light strategy to reduce financial risk and enhance flexibility.

- Strategic partnerships and targeted acquisitions to support growth.

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NVR Invest in Innovation?

The innovation and technology strategy of the company focuses on enhancing operational efficiency, improving the homebuyer experience, and maintaining a competitive edge through streamlined construction processes. This approach is crucial for navigating the dynamic landscape of the homebuilding industry and meeting evolving customer expectations. The company's strategic investments in technology are designed to optimize core operations and deliver value to both customers and shareholders.

The company's approach involves leveraging technology to standardize building processes and material procurement. This strategy contributes to cost efficiencies and ensures consistent product quality across its communities. Digital transformation initiatives likely include enhanced digital tools for sales and marketing, allowing potential homebuyers to explore floor plans, customize options, and conduct virtual tours.

Furthermore, focusing on pre-selling homes before construction is a key strategic approach, supported by a robust technological infrastructure, including online configuration tools and customer relationship management (CRM) systems. While specific details on AI, IoT, or sustainability initiatives are not widely publicized, the broader homebuilding industry is increasingly adopting smart home technologies and energy-efficient building practices.

The company invests in enterprise resource planning (ERP) systems. These systems help manage supply chains, inventory, and construction schedules. This investment is crucial for efficiency.

Digital tools are used for sales and marketing. Potential homebuyers can explore floor plans and customize options. Virtual tours of homes are also available.

The company focuses on pre-selling homes before construction. This strategy is supported by online configuration tools and customer relationship management (CRM) systems. This approach helps manage resources effectively.

The company likely incorporates smart home technologies and energy-efficient building practices. This is to meet evolving consumer demands and regulatory requirements. These features contribute to the long-term attractiveness and value of its homes.

Advancements in construction techniques, such as modular components or advanced framing, are part of the innovation strategy. These techniques aim to reduce build times and improve construction quality. This will help the company stay competitive.

CRM systems play a vital role in managing customer interactions and streamlining sales processes. These systems help personalize the homebuying experience and improve customer satisfaction. CRM is a key element.

The company's technology strategy focuses on enhancing operational efficiency, improving the homebuyer experience, and maintaining a competitive edge. This includes investments in ERP systems, digital tools for sales and marketing, and a focus on pre-selling homes.

- ERP Systems: These systems manage supply chains, inventory, and construction schedules. This contributes to cost efficiencies and consistent product quality.

- Digital Tools: Digital tools are used for sales and marketing, allowing potential homebuyers to explore floor plans, customize options, and conduct virtual tours. This enhances the customer journey.

- Pre-selling Strategy: The focus on pre-selling homes before construction is supported by online configuration tools and CRM systems. This helps manage resources effectively.

- Smart Home and Energy-Efficient Technologies: The company likely incorporates smart home technologies and energy-efficient building practices to meet evolving consumer demands and regulatory requirements.

- Construction Techniques: Advancements in construction techniques, such as modular components or advanced framing, are part of the innovation strategy, aimed at reducing build times and improving construction quality.

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NVR’s Growth Forecast?

The financial outlook for NVR is robust, characterized by a strong balance sheet and a focus on profitability and shareholder returns. This is underpinned by its efficient operational model. The company's financial performance is closely tied to the housing market, including interest rates and consumer confidence, which directly impact its revenue and profit margins. Analysts typically project stable revenue growth for NVR, driven by consistent demand for new homes in its operating regions.

For the first quarter of 2025, NVR reported net income of $283.4 million, or $82.72 per diluted share, on revenues of $2.4 billion. This demonstrates the company's ability to generate substantial earnings. Its gross profit margin for the homebuilding segment was 22.8% in the first quarter of 2025, indicating healthy profitability on its home sales. The company's financial strategy emphasizes effective inventory management and maintaining a strong cash position, providing flexibility for future investments and navigating potential market downturns.

NVR's investment strategy centers on land development and construction, focusing on optimizing capital deployment through its 'asset-light' land strategy. This approach minimizes the capital tied up in land inventory, allowing for greater financial agility. The company also regularly returns capital to shareholders through share repurchases, signaling confidence in its financial strength and future prospects. Long-term financial goals for NVR are likely focused on sustaining consistent profitability, expanding its market presence in key regions, and continuing to generate strong free cash flow, supported by a healthy housing market and its established operational efficiencies.

NVR's financial performance in the first quarter of 2025 showcased its strong financial position. The company's revenue reached $2.4 billion, with a net income of $283.4 million, or $82.72 per diluted share, highlighting its robust earnings capabilities. Its gross profit margin for the homebuilding segment stood at 22.8%, indicating solid profitability.

- Revenue: $2.4 billion (Q1 2025)

- Net Income: $283.4 million (Q1 2025)

- Earnings per Diluted Share: $82.72 (Q1 2025)

- Gross Profit Margin (Homebuilding): 22.8% (Q1 2025)

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NVR’s Growth?

The path of any homebuilding company, including the subject of this analysis, is fraught with potential risks and obstacles. These challenges stem from the inherent volatility of the housing market, regulatory pressures, and the competitive nature of the industry. Understanding these potential pitfalls is crucial for assessing the long-term viability and growth prospects of the company.

One of the most significant hurdles is the competitive landscape. The homebuilding sector is characterized by numerous players, from national giants to local builders, all vying for market share. This intense competition can squeeze profit margins and necessitate aggressive sales and marketing strategies. Moreover, external economic factors, such as interest rate fluctuations and changes in consumer confidence, can dramatically impact demand, creating further uncertainty.

Regulatory and supply chain issues also pose considerable challenges. Zoning laws, environmental regulations, and building codes can increase project costs and delay timelines. Fluctuations in the cost and availability of labor and materials, key components of construction, can directly affect profitability. Navigating these complex factors requires a proactive and adaptable approach.

The homebuilding industry is highly competitive, with many national, regional, and local builders vying for market share. This can lead to pricing pressures and reduced profit margins. Companies must differentiate themselves through product offerings, location, and customer service to succeed.

Economic conditions, including interest rates, inflation, and consumer confidence, have a direct impact on housing demand. Rising interest rates can make mortgages more expensive, potentially slowing sales. Inflation can increase construction costs, affecting profitability.

Changes in zoning laws, environmental regulations, and building codes can increase costs and delay project timelines. Compliance with these regulations adds complexity and expense to homebuilding operations. Staying abreast of these changes is essential.

The availability and cost of labor and materials are critical to construction projects. Fluctuations in these areas can significantly affect construction costs and project profitability. Managing supply chain risks requires careful planning and supplier relationships.

While less pronounced than in other sectors, technological advancements like innovative construction methods or materials could necessitate adaptation. This requires investment in new technologies and processes to remain competitive. The company must be prepared to adapt.

Evolving consumer preferences for sustainable and smart homes will require continuous adaptation in product offerings and building practices. Meeting these demands involves integrating new technologies and design elements. This is an ongoing process.

The company employs strategies to mitigate risks, including an 'asset-light' land strategy that reduces exposure to land value fluctuations. Diversification across multiple brands and geographic markets also helps spread risk. The integration of mortgage banking services provides control over the homebuying process.

To address these challenges, the company's strategies focus on risk mitigation. This includes careful financial planning, diversification of product offerings, and a proactive approach to managing supply chain issues. The company's ability to consistently generate profits through various economic cycles demonstrates a robust risk management framework.

Emerging risks include the impacts of climate change on construction and insurance costs. Also, evolving consumer preferences for sustainable and smart homes will necessitate continuous adaptation in product offerings and building practices. These factors require ongoing evaluation and adjustment.

The housing market is subject to cyclical fluctuations, influenced by interest rates, economic growth, and consumer confidence. Understanding these dynamics is vital for strategic planning. The company must adapt to changing market conditions to maintain its competitive position.

The company's ability to navigate these challenges and achieve sustainable growth will depend on its strategic agility and operational efficiency. The company's performance in the housing market, alongside its strategic responses to these challenges, will be key indicators of its long-term prospects. Further insights into this company can be found in the analysis of its Mission, Vision & Core Values of NVR.

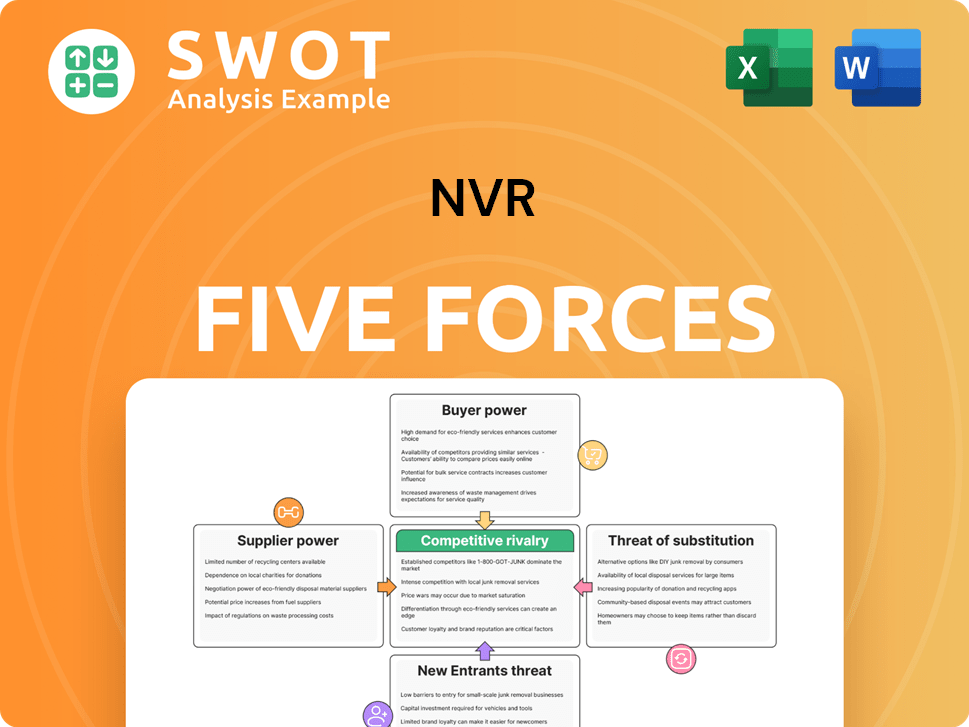

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.