NVR Bundle

How Does NVR Dominate the Homebuilding Market?

NVR, Inc. isn't just building homes; it's constructing a legacy through a unique sales and marketing approach. Founded in 1980, this homebuilding and mortgage banking powerhouse has consistently outperformed competitors. But how does NVR navigate the complexities of the residential construction industry and maintain its strong financial footing?

This analysis dives deep into NVR's NVR SWOT Analysis, exploring its innovative sales strategies, marketing tactics, and brand positioning across its diverse portfolio, including Ryan Homes and NVHomes. We'll uncover the secrets behind NVR's market dominance, examining its effective customer acquisition strategies and how it adapts to market fluctuations. Understanding NVR's approach offers valuable insights for financial professionals and business strategists alike, offering a blueprint for success in a competitive landscape.

How Does NVR Reach Its Customers?

The sales channels employed by NVR, Inc. are primarily a blend of direct sales and integrated mortgage banking services. This approach allows the company to maintain control over the customer experience while streamlining the homebuying process. The company's strategy is designed to optimize sales and marketing efforts, ensuring a cohesive approach from initial contact to final financing.

NVR's sales strategy centers around physical sales centers, strategically located across 14 states, predominantly in the Northeastern, Mid-Atlantic, and Southeastern regions. These centers serve as the primary point of contact for potential homebuyers. The direct sales teams at these locations guide customers through the selection and customization of their new homes.

The integration of NVR Mortgage further enhances the sales process by providing mortgage-related services exclusively to NVR's homebuyers. This integration allows the company to offer competitive financing solutions, making homeownership more accessible and improving the overall customer experience. The company's integrated model supports its overall financial performance and customer satisfaction.

NVR operates through physical sales centers across 14 states, with 42 centers as of 2024. These centers are concentrated in the Northeastern, Mid-Atlantic, and Southeastern United States. The direct sales teams guide homebuyers through the selection and customization process, providing a personalized experience.

NVR Mortgage provides mortgage-related services exclusively to NVR's homebuyers, simplifying the financing process. In 2024, NVR Mortgage closed approximately 17,300 loans. The company's integrated approach enhances the overall customer experience by providing a seamless homebuying journey.

Income before tax from the mortgage banking segment increased by 17% to $154.9 million in 2024. NVR Mortgage typically sells these loans to the secondary market within 30 days of closing. This integrated service enhances the overall customer experience by providing a seamless homebuying journey.

Mortgage interest rates averaged between 6.5% and 7.2% in 2024. Typical credit score requirements ranged from 620 to 720. NVR Mortgage closed approximately 17,300 loans with an aggregate principal amount of around $6.3 billion in 2024.

NVR's sales and marketing strategy is further refined by its 'asset-light' business model, which involves pre-selling homes and purchasing finished lots. This approach minimizes capital tied up in land inventory. The company's focus on direct sales and integrated mortgage services provides a competitive edge. To understand how this strategy compares with others, you might find insights in the Competitors Landscape of NVR.

NVR's sales channels rely heavily on physical sales centers and an integrated mortgage banking segment. These channels support the company's 'asset-light' business model, enhancing customer experience and financial performance.

- Direct sales teams guide customers through the home selection process.

- NVR Mortgage provides exclusive mortgage services for homebuyers.

- The company focuses on pre-selling homes and purchasing finished lots.

- Mortgage interest rates and credit score requirements are competitive.

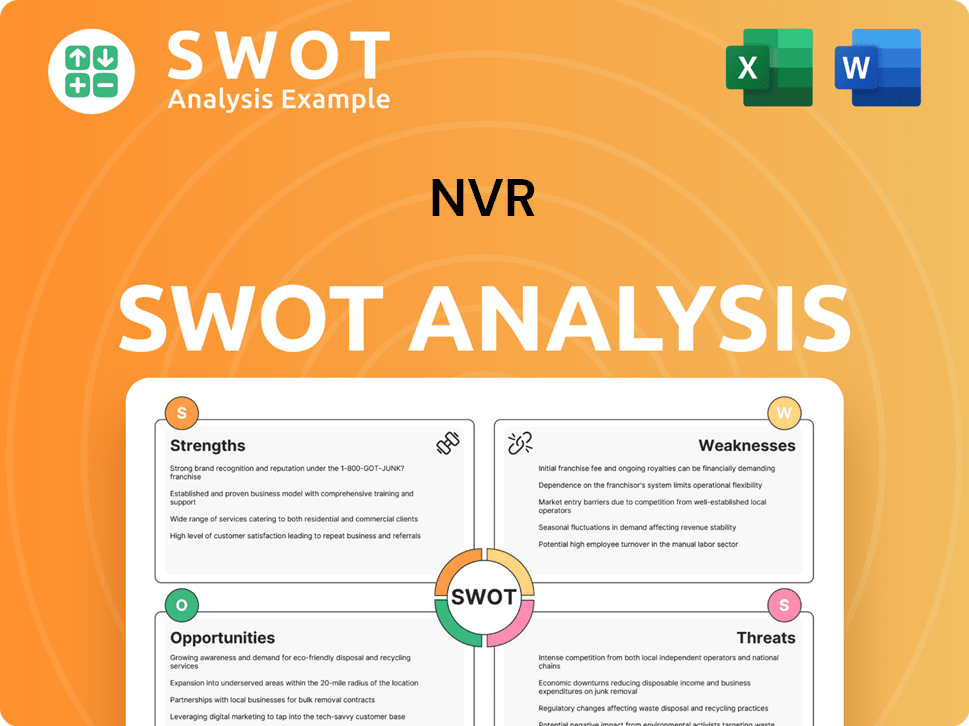

NVR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does NVR Use?

The marketing tactics employed by NVR, a major player in the homebuilding industry, are designed to build brand awareness, generate leads, and drive sales across its various brands. NVR's approach combines digital and traditional methods, with a strong emphasis on online presence and engagement. This strategy is crucial for reaching today's homebuyers, who increasingly start their search for new homes online.

NVR's digital marketing efforts include a comprehensive online presence, featuring virtual home tours and an online reservation system. These tools are essential for showcasing floor plans, design options, and community features. The company's investment in digital marketing infrastructure was significant, with $3.2 million allocated in 2023. The company's website attracts a substantial audience, with approximately 1.2 million monthly unique visitors.

NVR's marketing strategy is implicitly aligned with its brand segmentation, tailoring messages to resonate with specific target demographics. Ryan Homes typically targets first-time and first-time move-up homebuyers, while NVHomes focuses on move-up buyers, and Heartland Homes caters to luxury buyers. This segmentation allows for customized marketing campaigns. The company also uses traditional media, but its primary focus is on digital engagement, reflecting industry trends.

In 2023, NVR invested $3.2 million in digital marketing infrastructure. This investment supports the company's online presence and digital tools, such as virtual home tours.

NVR's website receives approximately 1.2 million unique visitors each month. This high traffic volume highlights the importance of the company's online presence in attracting potential homebuyers.

Virtual home tours generate 45% higher engagement rates compared to traditional listing methods. These virtual tours are a key component of NVR's digital marketing strategy.

NVR segments its brands to target specific buyer groups: Ryan Homes for first-time and first-time move-up buyers, NVHomes for move-up buyers, and Heartland Homes for luxury buyers. This segmentation allows for tailored marketing messages.

NVR uses data to track website engagement and conversion rates from virtual tours. This data-driven approach enables continuous optimization of digital strategies.

NVR's marketing mix emphasizes online accessibility and immersive virtual experiences. This reflects the increasing digital adoption among homebuyers.

NVR's marketing tactics are designed to reach potential homebuyers through a combination of digital and traditional methods. The company's approach is data-driven, allowing for continuous optimization.

- Digital Presence: A strong online presence, including a 100% digital catalog and virtual home tours.

- Brand Segmentation: Tailored messaging for Ryan Homes, NVHomes, and Heartland Homes.

- Data Analysis: Tracking website engagement and conversion rates to refine digital strategies.

- Virtual Tours: Offering immersive virtual experiences to engage potential buyers.

- Investment: Allocation of $3.2 million in 2023 for digital marketing infrastructure.

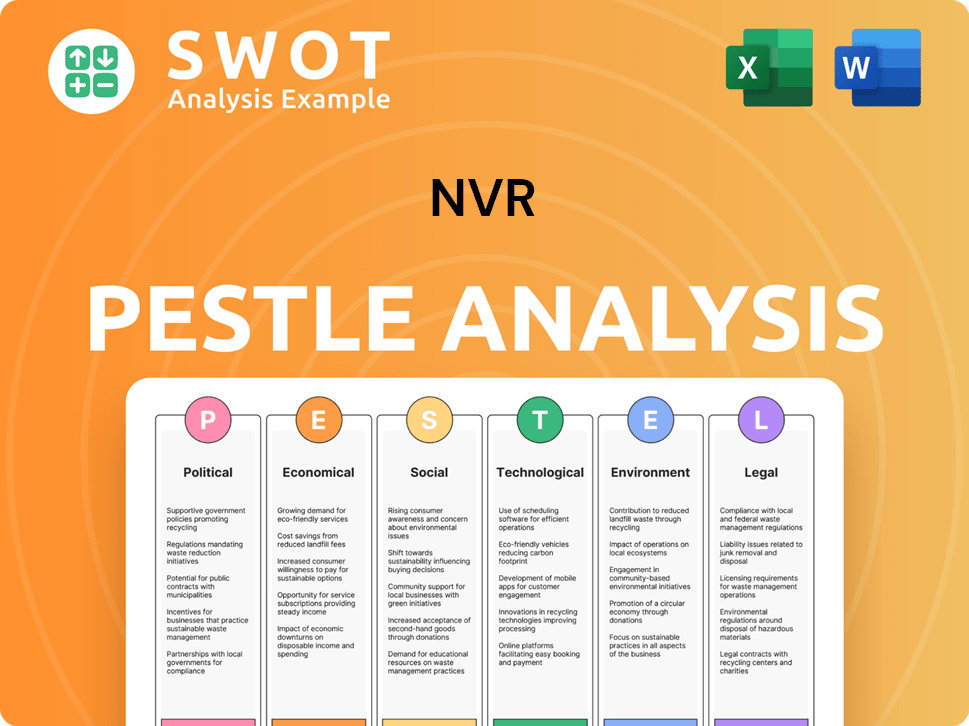

NVR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is NVR Positioned in the Market?

NVR, Inc. employs a multi-brand strategy, positioning its brands—Ryan Homes, NVHomes, and Heartland Homes—to target distinct segments within the homebuying market. This approach allows NVR to cater to a broad customer base, from first-time buyers to those seeking luxury homes. This differentiation strategy is a core element of the overall Growth Strategy of NVR, ensuring that each brand resonates with its intended audience through tailored messaging and product offerings.

Ryan Homes is typically positioned for first-time and first-time move-up homebuyers, focusing on value and accessibility. NVHomes targets move-up buyers, emphasizing upgraded features, designs, and locations. Heartland Homes, acquired in 2012, is positioned for luxury and discretionary homebuyers, leveraging its strong brand recognition in specific markets. This segmented approach is crucial for effective NVR marketing strategy, allowing for targeted campaigns and efficient resource allocation.

The core message across NVR's brands centers on quality construction, customizable options, and a streamlined homebuying process, enhanced by its integrated mortgage banking services. This integration, provided through NVR Mortgage, promises a cohesive customer experience from home selection to financing. NVR's financial performance, with consolidated revenues of $10.52 billion in 2024, demonstrates its ability to deliver on these brand promises and maintain a strong market presence.

NVR uses a multi-brand strategy to cater to different market segments. Ryan Homes targets entry-level buyers, NVHomes focuses on move-up buyers, and Heartland Homes caters to the luxury market. This approach allows NVR to capture a wider customer base.

NVR emphasizes quality construction, customization, and a simplified homebuying process. Integrated mortgage services further enhance the customer experience, providing a seamless journey from selection to financing. This streamlined approach supports NVR sales strategy.

NVR's consistent financial results, with $10.52 billion in revenue in 2024, reflect its strong market position. This financial stability supports its brand promises and allows for continued investment in customer experience and brand development. These results are key to understanding NVR company strategy.

The 'asset-light' business model contributes to predictability and efficiency. Purchasing finished lots rather than developing land helps to manage risk and maintain timelines. This efficiency is crucial for NVR's brand promise of a reliable homebuying process.

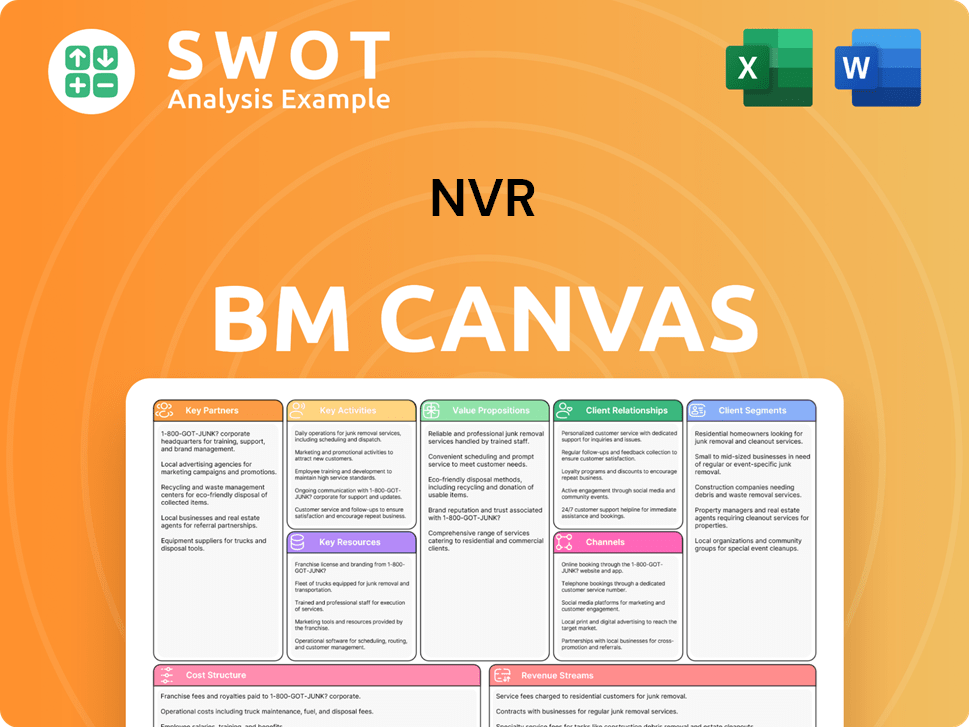

NVR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are NVR’s Most Notable Campaigns?

The sales and marketing efforts of the company, primarily center around its brand-specific strategies rather than broad, overarching campaigns. This approach emphasizes the unique selling propositions of its homebuilding brands. The company's consistent growth and market presence indicate the effectiveness of its ongoing marketing initiatives.

A significant aspect of the company's strategy involves leveraging its integrated mortgage services. This serves as a continuous 'campaign' to attract and retain homebuyers. This internal financing option simplifies the complex homebuying process for customers and likely contributes to the company's ability to maintain an average sales price of new orders.

Furthermore, the company's continuous investment in its digital presence, including virtual home tours and online reservation systems, can be viewed as an ongoing, large-scale marketing campaign. The strategic focus on these digital channels underscores a significant and successful marketing effort that has defined the brand's accessibility and customer-centric approach in the modern housing market. The consistent performance suggests these ongoing efforts effectively drive growth.

The company's integrated mortgage services serve as a continuous campaign. In 2024, the mortgage division closed approximately 17,300 loans, totaling around $6.3 billion. This internal financing simplifies the homebuying process.

The company invests continuously in its digital presence, including virtual home tours and online reservation systems. These digital tools generated 45% higher engagement rates in 2023. This approach is a significant and successful marketing effort.

The company's consistent performance, with 22,836 home settlements in 2024, up 11% from 2023, suggests these ongoing efforts effectively drive growth. The average sales price of new orders was $469,000 in Q4 2024.

The company's sales and marketing efforts are primarily driven by its brand-specific strategies. This focus is on the unique selling propositions of Ryan Homes, NVHomes, and Heartland Homes. This approach is key to the company's market presence.

The company's approach, as detailed in the Owners & Shareholders of NVR article, focuses on brand-specific strategies and integrated services, which are key components of their sales and marketing success.

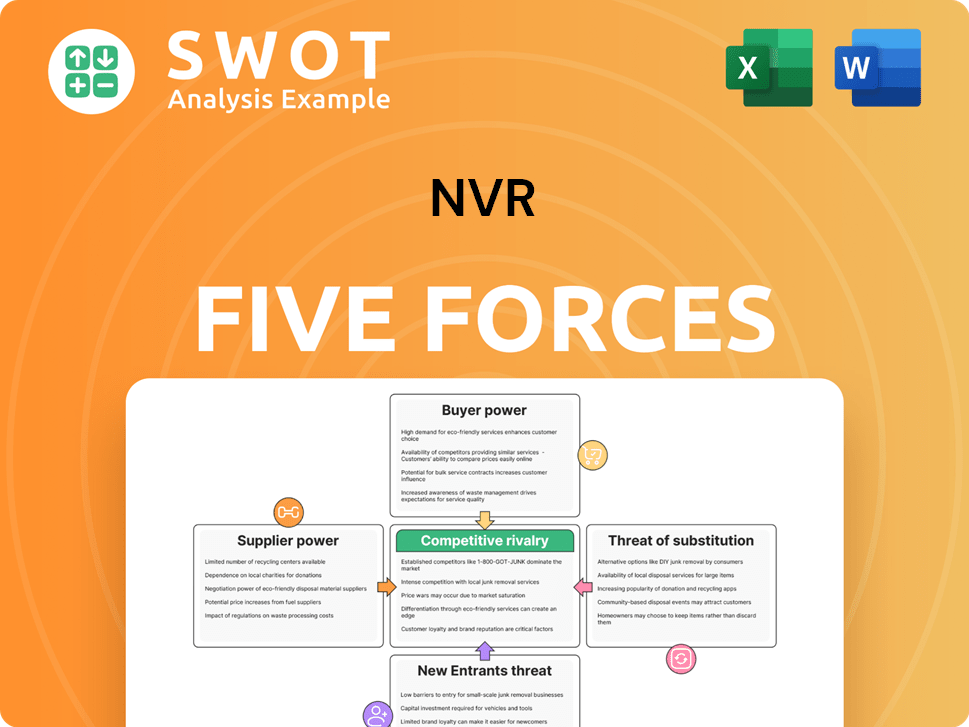

NVR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NVR Company?

- What is Competitive Landscape of NVR Company?

- What is Growth Strategy and Future Prospects of NVR Company?

- How Does NVR Company Work?

- What is Brief History of NVR Company?

- Who Owns NVR Company?

- What is Customer Demographics and Target Market of NVR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.