Progressive Bundle

How Did Progressive Insurance Revolutionize the Insurance Industry?

From its humble beginnings, Progressive Insurance has reshaped the insurance landscape. This journey, marked by innovation and strategic foresight, showcases a remarkable transformation. Discover how Progressive SWOT Analysis reveals the key drivers behind its success.

Founded in 1937, Progressive's story is a compelling narrative of growth and adaptation. The company's early adoption of groundbreaking technologies and customer-centric approaches, such as the Snapshot program, propelled its rise. Understanding the brief history of Progressive Insurance company offers valuable insights into its enduring success and its impact on the financial services industry. The company's current market share and financial health are a direct result of its commitment to innovation, as reflected in its current market capitalization of $162.56 billion in May 2025.

What is the Progressive Founding Story?

The Progressive Company History begins in 1937. It was a time when the insurance industry was ripe for innovation. Two lawyers, Joseph Lewis and Jack Green, saw an opportunity to revolutionize how people secured their vehicles.

Their vision was to offer accessible and affordable insurance. This was a stark contrast to the practices of the time. They aimed to provide essential protection to vehicle owners. This approach laid the groundwork for what would become a major player in the insurance market.

Progressive Insurance, as it became known, was officially founded on March 10, 1937, in Cleveland, Ohio. This marked the beginning of a journey. It would transform the insurance landscape through innovative strategies and a customer-focused approach.

From its inception, Progressive Corporation focused on innovation. The company introduced groundbreaking initiatives to streamline the insurance process and make it more customer-friendly.

- One of the earliest innovations was the introduction of the industry's first drive-in claims location. This simplified the claims process.

- Another key innovation was offering customers the option to pay premiums in installments. This made insurance more accessible.

- In 1956, Progressive Casualty Insurance Company was established. It catered specifically to 'nonstandard insurance'.

- This focused on higher-risk drivers, a niche that many other insurers avoided.

Peter B. Lewis, Joseph Lewis's son, joined the company in 1955. He later became the Progressive CEO in 1965. He held this role for 35 years. His leadership profoundly shaped the company's trajectory. The company's early growth indicates a successful foundational strategy and a clear understanding of market needs. The company's early strategies and innovations set the stage for its future success.

The company's early focus on customer service and innovation set it apart. These early moves positioned Progressive Auto Insurance for long-term growth. For more insights into the company's expansion, you can explore the Growth Strategy of Progressive.

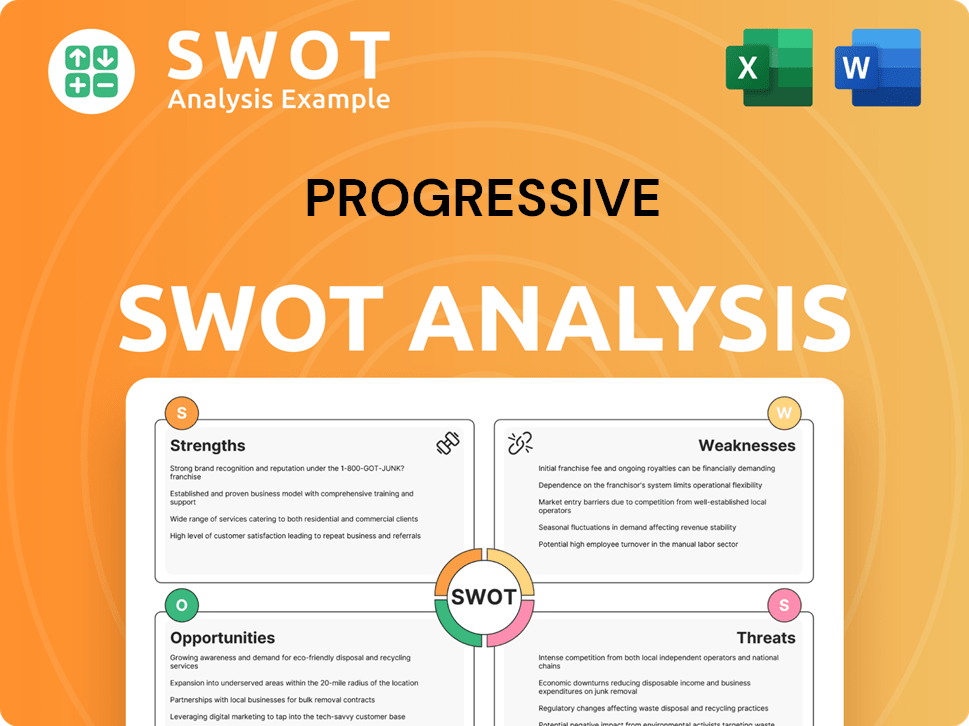

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Progressive?

The early years of the Progressive Company History saw consistent growth and strategic expansion. This period laid the foundation for its future success in the insurance industry. Key decisions and innovations during this time helped shape the company's approach to customer service and market strategies.

By 1951, the company's growth required a move to new offices in downtown Cleveland. In 1956, the company formed the Progressive Casualty Insurance Company, designed for nonstandard insurance. This was coupled with the launch of the Safe Driver Plan in Ohio.

The 1960s saw further expansion, leading to the formation of The Progressive Corporation in 1965. Peter B. Lewis became CEO the same year. Progressive began insuring motorcycles and motor scooters during this decade.

In 1971, Progressive held its first public offering of stock. The company aimed for a combined ratio objective of 96. That year, it also expanded into motor home and commercial lines policies.

By 1974, the company moved its headquarters to Mayfield Village, Ohio. By 1987, written premiums surpassed $1 billion, and the stock was listed on the New York Stock Exchange under the symbol PGR. By 1994, written premiums exceeded $2 billion.

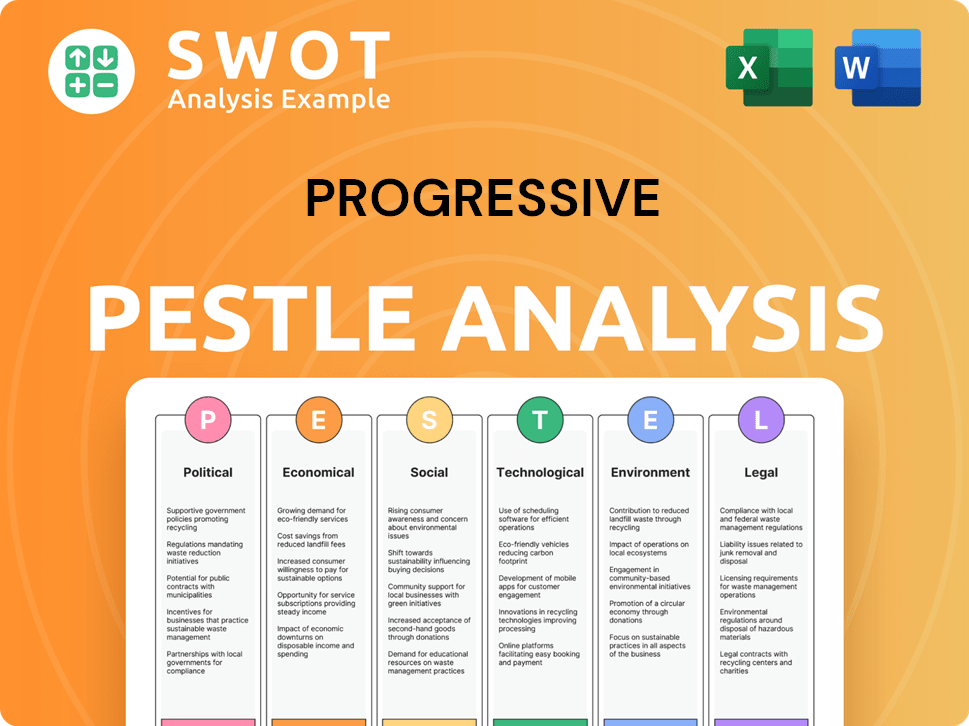

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Progressive history?

The history of the Progressive Corporation is marked by significant milestones that have shaped its trajectory in the insurance industry. These achievements reflect its commitment to innovation and customer service, which have been critical to its growth and market position. The company's evolution showcases its adaptability and strategic foresight in a competitive market.

| Year | Milestone |

|---|---|

| 1990 | Introduced Immediate Response claims service, providing 24/7 support to auto customers, setting a new industry standard. |

| 1993 | Became the first auto insurance company to offer comparison rates and the option to purchase policies over the phone, alongside 24/7 customer service. |

| 1995 | Launched its website, auto-insurance.com, becoming the first major auto insurer globally to have an online presence, with online policy purchasing available by 1997. |

| 2008 | Introduced the Snapshot program, a usage-based insurance (UBI) initiative using telematics for personalized pricing based on driving behavior. |

| 2020 | Introduced Snapshot ProView for commercial vehicles, expanding telematics offerings. |

Progressive Insurance has consistently embraced innovation to enhance its services and maintain a competitive edge. The company's early adoption of technology, from online platforms to telematics, has significantly impacted the insurance landscape. These innovations have allowed for more accurate risk assessment and personalized customer experiences.

This service, launched in 1990, provided 24/7 support to auto customers, setting a new standard for customer service in the insurance industry. This initiative was a key differentiator, offering immediate assistance during critical times.

Progressive Insurance was the first major auto insurer to establish an online presence with the launch of auto-insurance.com in 1995. This early adoption of the internet allowed customers to purchase policies online by 1997.

Introduced in 2008, Snapshot uses telematics to gather driving data. This program allows Progressive to offer personalized pricing based on actual driving behavior, rewarding safe drivers.

Launched in 2020, Snapshot ProView extends the telematics offering to commercial vehicles. This innovation provides data-driven insights for commercial fleets, enhancing risk management.

Progressive pioneered the use of UBI with the Snapshot program. This approach allows for more accurate risk assessment and personalized pricing, a significant advantage in the market.

Progressive leverages data analytics to inform decisions across all aspects of its business. This includes risk assessment, pricing, and customer service, contributing to its competitive advantage. The company's ability to adapt quickly to changing market conditions and claims trends is a key strength.

Progressive has faced various challenges, including rising claims costs and intense market competition. The company's strategic responses, such as adjusting rates and increasing advertising, have been crucial for maintaining its market position. The company's data-centric approach and continuous investment in technology have helped it navigate these challenges effectively.

During periods of increased claims costs, Progressive has strategically adjusted its rates to maintain profitability. This proactive approach is essential for managing financial performance in a dynamic market.

The direct-to-consumer auto insurance segment is highly competitive, requiring continuous innovation and strategic investments. Progressive has responded by investing in technology and AI to automate claims processes and improve risk pricing.

In 2024, Progressive's advertising spending reached nearly $3.5 billion. This substantial investment demonstrates the company's aggressive strategy to capitalize on market opportunities and maintain brand visibility.

Continuous investment in technology and AI is a key strategy for Progressive. These advancements aim to automate claims processes and improve risk pricing, contributing to the company's financial performance. For more details, you can explore the Competitors Landscape of Progressive.

Progressive's data-driven approach is a cornerstone of its competitive strategy. This allows the company to react quickly to changing market conditions and claims trends, enhancing its ability to adapt and thrive.

During periods of loss-cost inflation, Progressive strategically adjusts its rates to maintain profitability and market share. This proactive approach is critical for financial stability.

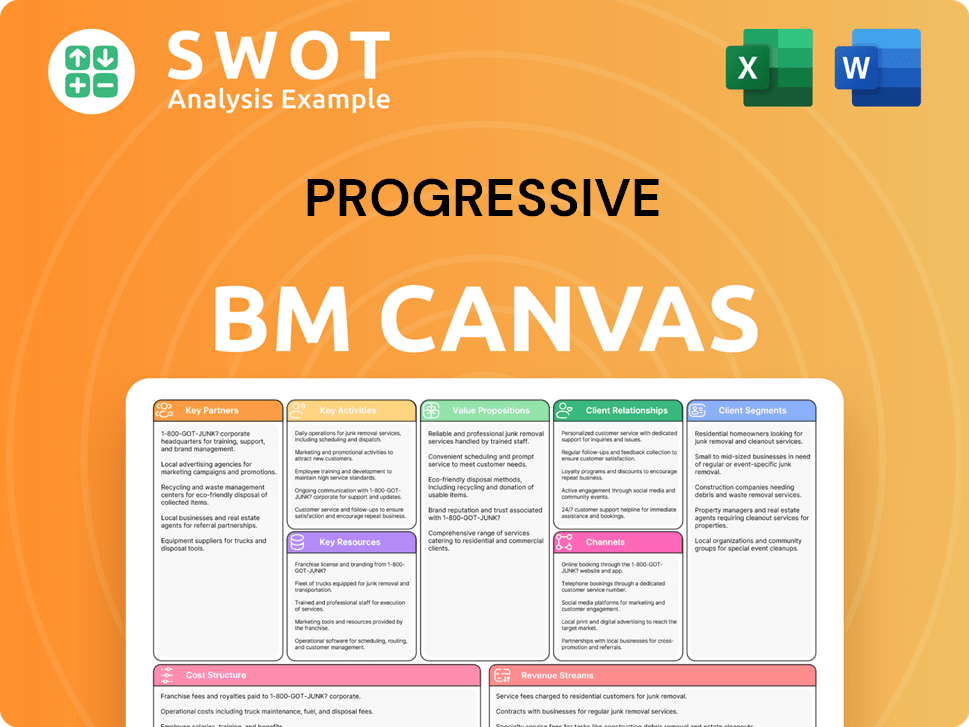

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Progressive?

The Progressive Company History is marked by significant milestones, from its humble beginnings to its current position as a major player in the insurance industry. Founded in 1937, the company has consistently adapted and innovated, driving its growth and market share. Key strategic moves, such as the introduction of usage-based insurance and online services, have shaped its trajectory. The evolution of the company also reflects the leadership transitions and strategic shifts that have been crucial to its success.

| Year | Key Event |

|---|---|

| March 10, 1937 | Joseph Lewis and Jack Green founded Progressive Mutual Insurance Company in Cleveland, Ohio. |

| 1956 | Progressive Casualty Insurance Company was formed to underwrite nonstandard insurance, and the Safe Driver Plan was launched. |

| 1965 | The Progressive Corporation was founded, and Peter B. Lewis became CEO. |

| 1971 | Progressive conducted its first public offering of stock and began offering commercial lines policies. |

| 1974 | The company moved its headquarters to Mayfield Village, Ohio. |

| 1987 | Written premiums surpassed $1 billion, and Progressive stock was listed on the NYSE. |

| 1990 | Immediate Response claims service was introduced, offering 24/7 support. |

| 1993 | Progressive offered comparison rates and direct policy purchase by phone, and 24/7 customer service. |

| 1995 | Progressive launched its website, becoming the first major auto insurer with an online presence. |

| 1997 | Policies became available for purchase online. |

| 2000 | Glenn Renwick took over as CEO. |

| 2008 | The Snapshot usage-based insurance program was introduced. |

| 2011 | Snapshot was rebranded. |

| 2016 | Tricia Griffith became CEO. |

| 2020 | Progressive Commercial introduced Snapshot ProView for commercial vehicles. |

| 2024 | Annual revenue reached $75.34 billion, with net income surging to $8.48 billion, a 117.44% increase from 2023. Advertising expenditure hit a record high of nearly $3.5 billion. The company added over 5 million policies in force. |

| March 2025 | Net premiums written increased by 17% to $9.04 billion, and net premiums earned by 20% to $6.79 billion compared to March 2024. |

| April 2025 | Net income surges by 134% to $986 million compared to April 2024. |

Progressive is focused on continued growth, leveraging its leadership in telematics and data analytics. The company plans to maintain its advertising spending into 2025 to further increase market share. Analysts project revenue for the year ending December 31, 2025, to be around $86.06 billion.

The company is also exploring expansion into other insurance segments like home and commercial insurance, aiming to diversify its product portfolio and reduce dependence on auto insurance. Estimated EPS is approximately $16.09. This expansion will help the company to reach new customers.

Progressive expects to hire over 12,000 new employees in 2025, supported by its remote and hybrid-friendly policies. Ongoing investment in AI and technology is anticipated to enhance underwriting precision, automate claims, and improve customer service.

The focus on innovation and technology reinforces its competitive advantage. This approach aligns with its founding vision of making insurance accessible and efficient. The company's strategic initiatives are designed to meet the evolving needs of its customers.

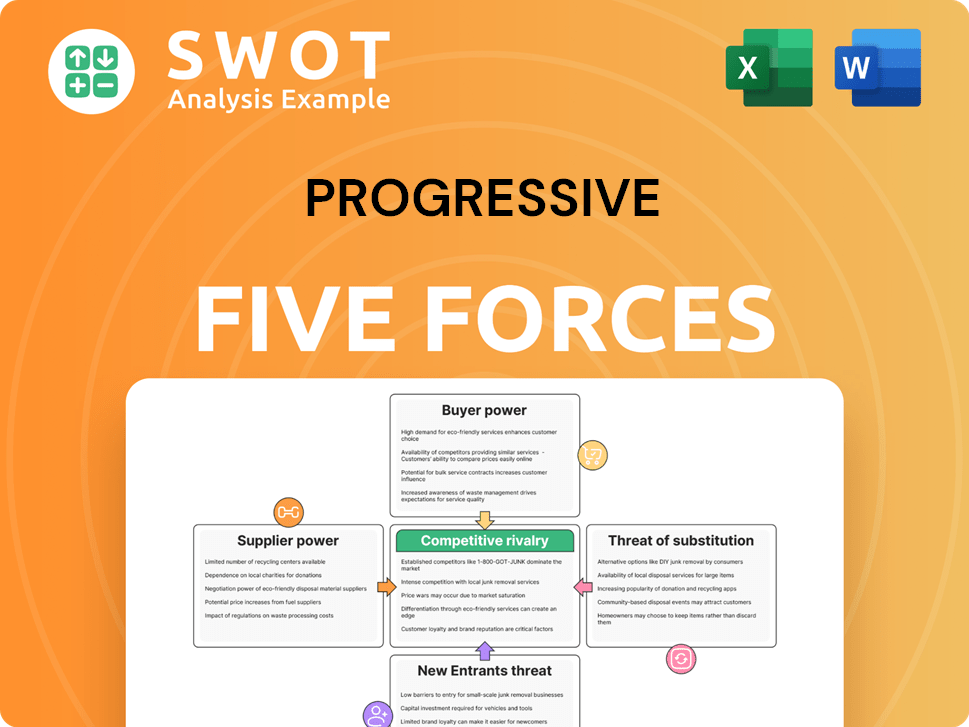

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Progressive Company?

- What is Growth Strategy and Future Prospects of Progressive Company?

- How Does Progressive Company Work?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- Who Owns Progressive Company?

- What is Customer Demographics and Target Market of Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.