Progressive Bundle

Can Progressive Company Maintain Its Dominance?

Progressive Corporation has consistently disrupted the U.S. insurance industry, but how does it stack up against its rivals? Its strategic moves, like the continued focus on telematics, are reshaping the competitive arena, compelling competitors to innovate. Founded in 1937, Progressive has evolved from a small insurer into a major player, constantly challenging traditional models.

This article offers a deep dive into the Progressive SWOT Analysis, examining the company's competitive landscape and key strategies. We'll explore the Progressive Insurance market analysis, identifying its main Progressive's competitors and the factors driving its success in the insurance industry competition. Understanding Progressive business strategy is crucial for anyone looking to navigate the auto insurance market share dynamics.

Where Does Progressive’ Stand in the Current Market?

Progressive holds a significant market position within the U.S. insurance industry, especially in the personal auto insurance sector. As of late 2024, it's consistently one of the largest auto insurers in the United States, often competing for the top spot in market share. The company's financial health is robust, as demonstrated by a net income of $1.56 billion in the first quarter of 2024.

The company's core offerings include personal auto insurance, commercial auto insurance, and various specialty property-casualty insurance products. Progressive's geographic focus is primarily within the United States, serving a wide range of customers, from preferred drivers to those seeking non-standard coverage. This strategic positioning has been key to its success in the competitive landscape.

Progressive's business strategy includes a pioneering approach to telematics through its Snapshot program, which allows for usage-based insurance rates. This has enabled the company to attract a broader customer base by offering personalized pricing, moving beyond traditional risk assessments. The company's total revenue for the first quarter of 2024 was reported at $16.4 billion, reflecting its strong market presence. To understand more about the company's origins, you can read a Brief History of Progressive.

Progressive is a leading player in the auto insurance market. Its market share often places it among the top competitors, vying for the number one position. This strong market share reflects the company's effective strategies and customer appeal.

The company's financial performance is a key indicator of its success. Progressive reported a net income of $1.56 billion in the first quarter of 2024. Its total revenue for the same period was $16.4 billion, showcasing its financial strength.

Progressive offers a diverse range of insurance products beyond personal auto. These include commercial auto insurance and specialty lines like motorcycle, boat, and RV insurance. This diversification helps to capture a broader customer base.

Progressive's primary market is the United States. The company strategically focuses on optimizing its market penetration across various states. It adapts its offerings to local market dynamics and regulatory environments.

Progressive differentiates itself through innovation and customer-focused strategies. Its telematics program, Snapshot, provides personalized pricing. This approach allows the company to attract a wide range of customers and maintain a competitive edge in the auto insurance market.

- Telematics-based pricing

- Strong financial performance

- Diversified product offerings

- Extensive geographic presence

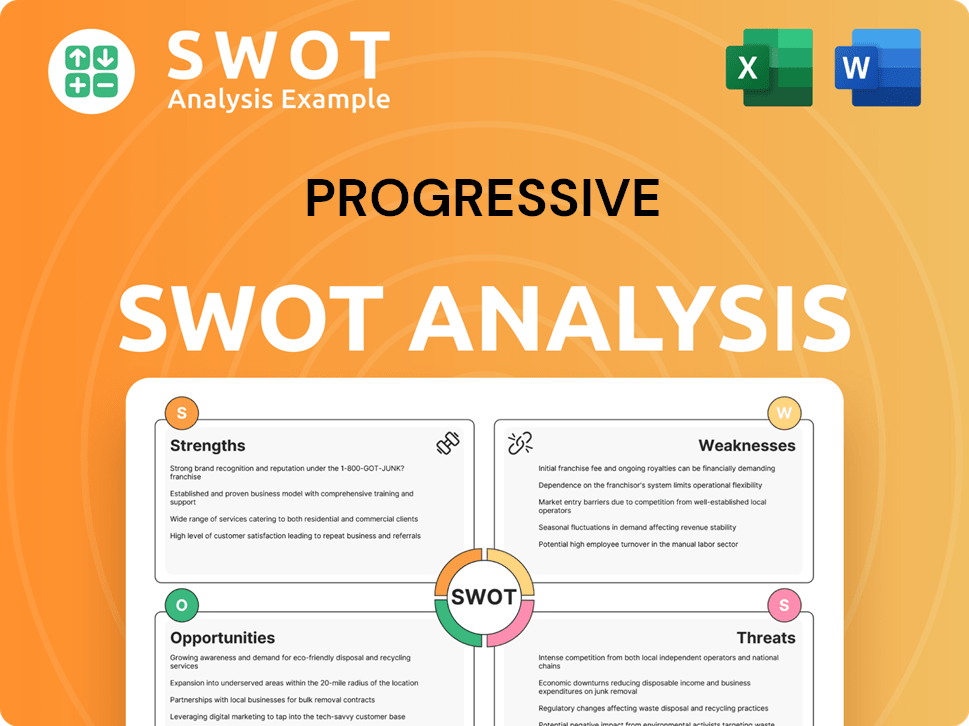

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Progressive?

The competitive landscape for the company is intense, with numerous direct and indirect rivals in the U.S. insurance market. Understanding the key players and their strategies is crucial for assessing the company's position and future prospects. This analysis examines the primary competitors, their competitive approaches, and the factors influencing market dynamics.

The company faces a multifaceted competitive environment. These competitors employ various strategies, including direct-to-consumer models, extensive agent networks, and technological advancements, to gain market share. The dynamic nature of the insurance industry, with evolving customer expectations and technological disruptions, necessitates continuous adaptation and strategic innovation.

The main direct competitors include State Farm, GEICO, Allstate, and Liberty Mutual. These companies compete with the company across various dimensions, including pricing, customer service, and technological innovation. The competitive dynamics are further shaped by new entrants and industry consolidations.

State Farm is the largest auto insurer in the U.S., offering a wide range of insurance and financial services. Their extensive agent network is a key strength, fostering strong customer relationships and loyalty.

GEICO is known for its direct-to-consumer model and aggressive advertising campaigns, primarily competing on price and convenience. They often engage in price wars to attract customers.

Allstate competes across personal lines, emphasizing brand recognition and agent relationships. They have invested heavily in technology and digital platforms to enhance customer experience.

Liberty Mutual is a diversified global insurer offering a broad range of personal and commercial insurance products. They compete on product breadth and global presence.

These competitors employ various strategies to gain market share. GEICO's direct model and marketing often lead to price wars, while State Farm's local agent presence fosters strong customer loyalty. Allstate invests in technology to enhance customer experience.

High-profile battles often revolve around market share in specific states or customer segments. Insurers frequently adjust rates and marketing campaigns to gain an edge. Telematics-based insurance highlights a key battleground for technological superiority.

The competitive landscape is also influenced by emerging players and industry consolidation. Insurtech startups leverage advanced analytics and AI, while mergers and alliances create larger entities. Understanding these dynamics is essential for assessing the company's strategic positioning and future growth potential. For more insights into the company's target customer base, consider reading about the Target Market of Progressive.

Several factors influence the competitive dynamics within the auto insurance market. These include pricing strategies, customer service, technological innovation, and marketing effectiveness. The ability to adapt to changing market conditions and customer preferences is crucial for sustained success.

- Pricing Strategies: Competitive pricing is a primary driver of market share. Companies continuously adjust rates based on risk assessment and market conditions.

- Customer Service: Excellent customer service, including efficient claims processing and responsive support, fosters customer loyalty and positive word-of-mouth.

- Technological Innovation: Leveraging technology for data analytics, telematics, and digital platforms enhances efficiency, personalization, and customer experience.

- Marketing and Advertising: Effective marketing campaigns build brand awareness and attract new customers. Advertising strategies must resonate with target demographics.

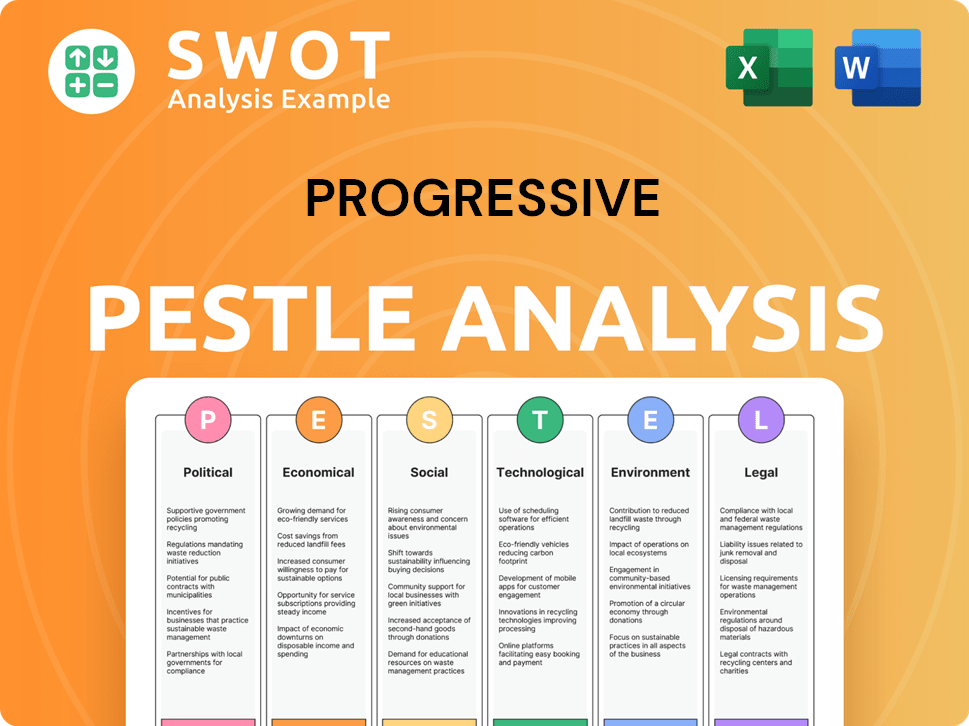

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Progressive a Competitive Edge Over Its Rivals?

The competitive advantages of the company are rooted in its technological innovation, brand strength, and data-driven approach to risk assessment. A key differentiator is its telematics program, which provides usage-based insurance. This technology allows the company to gather extensive driving data, leading to more precise risk profiling and personalized pricing. This data-driven strategy allows for competitive pricing for safer drivers, attracting a desirable customer segment.

The company's brand equity, built through distinctive advertising, has fostered significant brand recognition and customer loyalty. Its direct-to-consumer model, alongside its agency distribution channel, provides broad reach and flexibility in customer acquisition. Operational efficiencies, driven by data analytics and streamlined claims processing, contribute to a lower cost structure compared to some traditional insurers. The company initially focused on non-standard auto insurance, and its analytical capabilities allowed it to price these risks more effectively. Over time, this analytical prowess was applied to a broader customer base and integrated with technological advancements like telematics.

The company leverages these advantages in its marketing by highlighting potential savings through Snapshot, in product development by continuously refining its telematics offerings, and in strategic partnerships by collaborating with auto manufacturers for data integration. These advantages face threats from imitation as competitors invest heavily in telematics and data analytics, and from industry shifts towards even more personalized and on-demand insurance models. For a deeper dive into the company's business model, consider reading Revenue Streams & Business Model of Progressive.

The company's journey includes pioneering telematics with Snapshot, significantly impacting the auto insurance market. The company's direct-to-consumer model, alongside its agency distribution channel, provides broad reach and flexibility in customer acquisition. It has expanded its analytical capabilities to a broader customer base, integrating technological advancements.

Strategic moves include leveraging data analytics for risk assessment and pricing, enhancing customer acquisition through diverse distribution channels. The company has invested in telematics programs and refined its offerings. It has also formed strategic partnerships with auto manufacturers for data integration.

The company's competitive edge comes from its data-driven approach, brand recognition, and operational efficiency. Its telematics program provides a significant advantage in risk assessment and pricing. The company's direct-to-consumer model, alongside its agency distribution channel, provides broad reach and flexibility in customer acquisition.

The company holds a substantial market share in the auto insurance sector, competing with major players like State Farm and Geico. The company's focus on technology and data analytics has allowed it to maintain a strong position. The company's direct-to-consumer model, alongside its agency distribution channel, provides broad reach and flexibility in customer acquisition.

The company's competitive advantages include its telematics program, brand recognition, and operational efficiency. The company's direct-to-consumer model, alongside its agency distribution channel, provides broad reach and flexibility in customer acquisition. The company's data-driven approach allows for competitive pricing and attracts safer drivers.

- Telematics: Snapshot program for usage-based insurance.

- Brand Equity: Strong brand recognition and customer loyalty.

- Distribution: Direct-to-consumer and agency channels.

- Efficiency: Data analytics and streamlined claims.

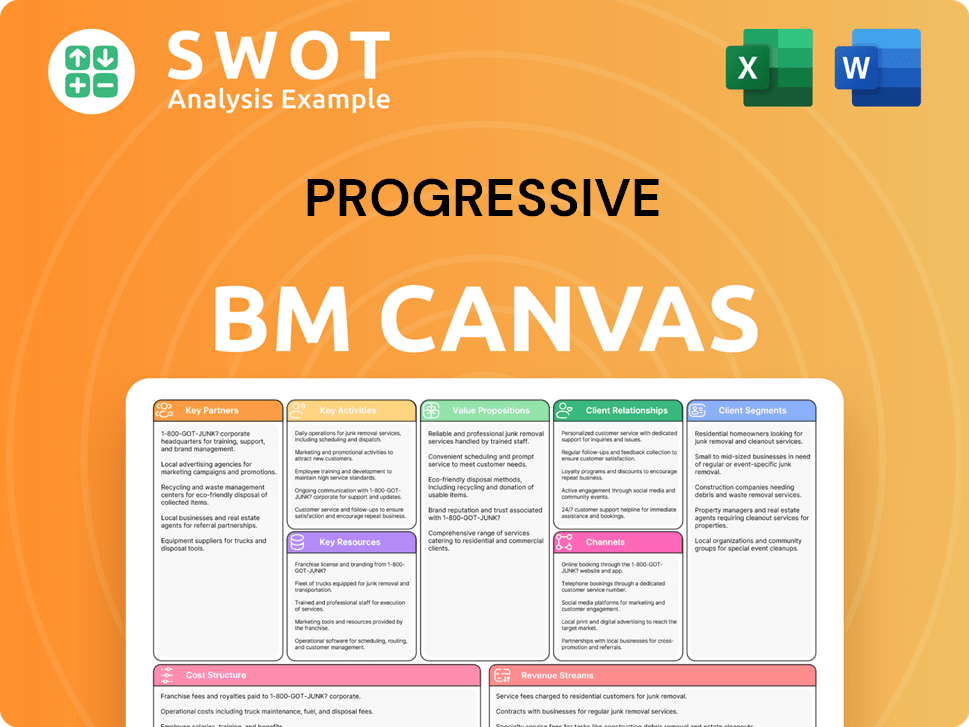

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Progressive’s Competitive Landscape?

The U.S. insurance industry is experiencing significant shifts, driven by technological advancements, regulatory changes, and evolving consumer expectations. This dynamic environment presents both challenges and opportunities for the company. The competitive landscape, analyzed through a Progressive company competitive landscape lens, reveals a complex interplay of established players and emerging disruptors.

For Progressive Insurance market analysis, the company's ability to adapt to these changes will be crucial for maintaining its market position. Key factors include its response to technological advancements, particularly in areas like AI and telematics, and its ability to navigate regulatory hurdles while meeting the demands of digitally-savvy consumers. Understanding Progressive's competitors is essential for strategic planning and sustained success.

Technological advancements are transforming the industry, with AI and machine learning improving risk assessment and claims processing. Regulatory changes, especially regarding data privacy, require constant adaptation. Consumer preferences are shifting towards digital and personalized insurance experiences. These trends are significantly impacting the competitive dynamics.

The rise of autonomous vehicles could fundamentally change the auto insurance landscape, potentially reducing accident frequency. The emergence of tech-focused insurtech companies introduces new competition. Intense price competition and increasing regulatory scrutiny also pose significant challenges. Maintaining a competitive edge requires continuous innovation.

Significant growth opportunities exist in emerging markets for telematics and personalized insurance. Expanding commercial lines and forming strategic partnerships are also key. The company can capitalize on these opportunities by leveraging its existing digital infrastructure and telematics offerings. Further information can be found in the Growth Strategy of Progressive.

The company is investing in its Snapshot program and exploring new product lines. Enhancing the digital customer experience is a key focus. The goal is to become a more data-centric and technologically advanced insurer. This approach focuses on personalized risk management and a seamless digital customer journey.

The company's competitive advantages include its data-driven approach, digital infrastructure, and telematics programs. However, it faces challenges from competitors investing heavily in similar technologies. The company's ability to innovate and adapt quickly is crucial for maintaining its market share.

- Data Analytics: Leveraging data for risk assessment and pricing.

- Technology Adoption: Implementing AI and machine learning.

- Customer Experience: Providing personalized and digital services.

- Strategic Partnerships: Collaborating with auto manufacturers and tech companies.

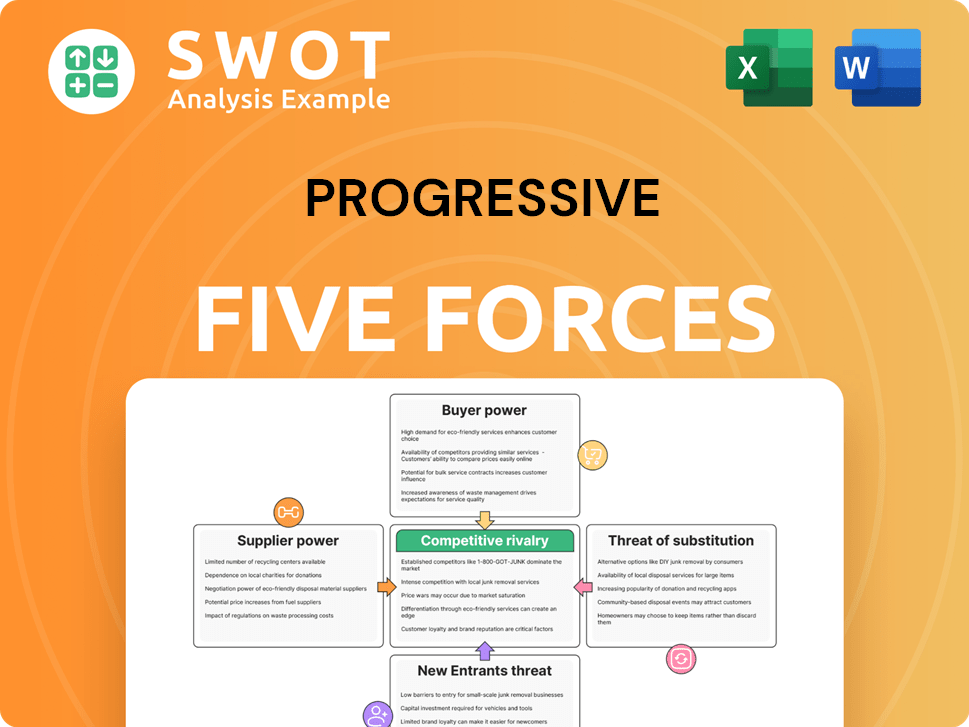

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Progressive Company?

- What is Growth Strategy and Future Prospects of Progressive Company?

- How Does Progressive Company Work?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- Who Owns Progressive Company?

- What is Customer Demographics and Target Market of Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.