Progressive Bundle

How Does Progressive Company Thrive in the Insurance Industry?

Progressive Insurance isn't just another player in the auto insurance game; it's a disruptor. From pioneering telematics to revolutionizing car insurance quotes, Progressive Company has consistently redefined industry standards. This deep dive explores how this insurance giant operates, offering insights into its strategies and sustained success in a competitive market.

Curious about the inner workings of Progressive policies? Understanding Progressive's business model is key, whether you're seeking Progressive SWOT Analysis or simply comparing car insurance quotes. This exploration will unravel how Progressive Insurance leverages innovation, customer segmentation, and strategic partnerships to maintain its leading position. Learn about Progressive insurance coverage options, the claims process, and how it stacks up against competitors.

What Are the Key Operations Driving Progressive’s Success?

The core of the company's operations revolves around providing auto insurance and other property-casualty insurance products. They cater to a wide range of customers, from individual drivers to businesses needing commercial insurance. A key aspect of their value proposition is offering competitive rates, often achieved through advanced risk assessment and direct sales methods.

The operational framework that supports these offerings is complex. The company relies heavily on technology for underwriting, claims processing, and customer service. They are a leader in using data analytics and telematics, such as the Snapshot program, to personalize rates based on driving behavior. This leads to more precise risk assessment and tailored pricing, potentially benefiting customers with lower premiums.

Their sales channels include direct-to-consumer options via online platforms and call centers, along with independent agents, providing customers with flexible choices for purchasing policies. The supply chain mainly involves managing their claims network, which includes a vast ecosystem of repair shops and adjusters to ensure timely and effective service delivery. The company's operational efficiency and data-driven approach translate into customer benefits such as customized pricing, convenient access to services, and a streamlined claims experience, ultimately differentiating the company in the crowded insurance market.

The company aims to provide competitive rates through sophisticated risk assessment. They use data analytics and telematics, like the Snapshot program, to assess driving behavior. This allows for tailored pricing and potentially lower premiums for customers.

The company leverages data analytics and telematics to personalize rates. They continuously innovate in data utilization and product development. This agility allows them to quickly respond to market changes and customer needs.

The company focuses on providing a streamlined claims experience. They offer convenient access to services and a user-friendly claims process. This customer-centric approach helps differentiate them in the market.

The company utilizes multiple sales channels, including direct-to-consumer options and independent agents. This provides customers with flexibility in how they purchase their Progressive policies. This approach enhances accessibility and customer choice.

The company's operational success hinges on several key factors. These include a robust technology infrastructure, efficient claims processing, and continuous innovation. They emphasize data-driven decision-making and an agile approach to product development to meet customer needs.

- Technology Infrastructure: Underwriting, claims processing, and customer service are all supported by a strong technological foundation.

- Data Analytics: The company uses data analytics and telematics to personalize rates and improve risk assessment.

- Claims Network: A vast network of repair shops and adjusters ensures timely and effective service delivery for insurance claims.

- Sales Channels: Offers both direct-to-consumer and independent agent options for purchasing Progressive insurance.

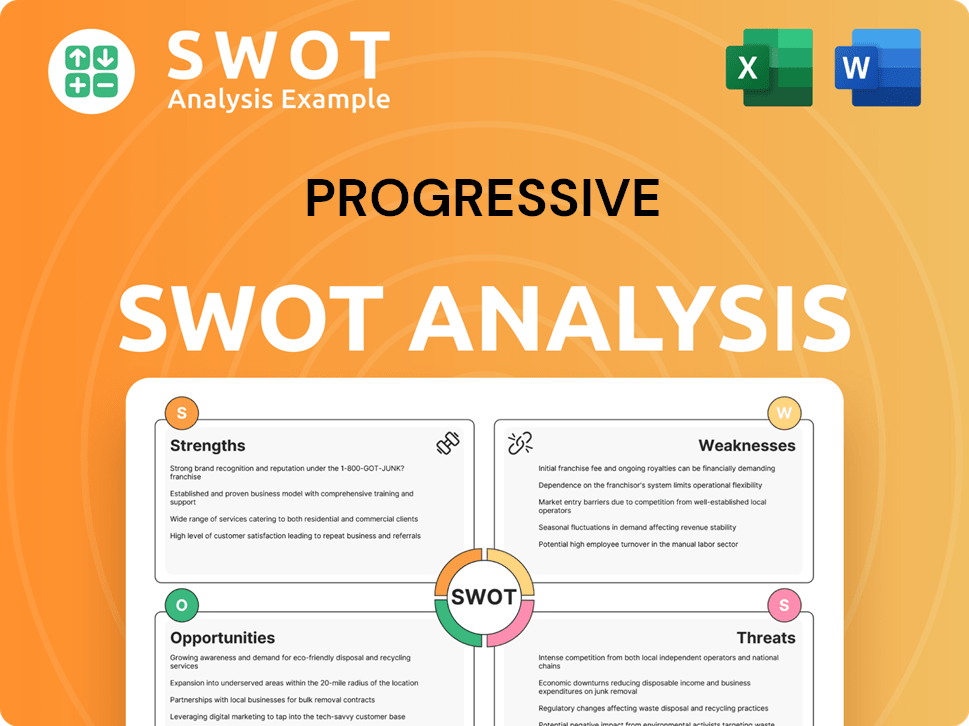

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Progressive Make Money?

The revenue streams and monetization strategies of the [Company Name] are primarily centered around the insurance business. The company generates the majority of its income through the premiums it collects from various insurance policies, with a strong emphasis on auto insurance.

As of the first quarter of 2024, the company demonstrated substantial growth in its core insurance segments. This growth is reflected in the significant net premiums written during this period.

The company employs innovative methods to generate revenue beyond traditional premiums. These methods include tools that help customers find policies within their budgets, cross-selling opportunities, and leveraging its direct-to-consumer model to reduce costs.

The company's financial performance is driven by several key strategies. These strategies include a focus on premium collection, innovative tools, and cost-effective operational models.

- Premium Collection: The company's main revenue source is the premiums earned from insurance policies. In the first quarter of 2024, net premiums written reached approximately $16.9 billion, highlighting the importance of this revenue stream.

- 'Name Your Price' Tool: This tool allows customers to specify their desired premium, which then generates coverage options. This not only helps customers but also functions as a lead generation and conversion tool, aligning customer needs with the company's underwriting criteria.

- Cross-Selling: The company increases customer lifetime value by offering bundled insurance policies. Bundling auto insurance with home, renters, or other specialty policies encourages customers to consolidate their insurance needs, increasing revenue per customer.

- Direct-to-Consumer Model: The company's strong online presence reduces operational costs. This model allows the company to retain a larger portion of premiums, enhancing profitability compared to agent-centric models.

- Investment Income: Investment income from its float—premiums collected but not yet paid out in claims—also contributes to its financial performance. This income stream fluctuates based on market conditions but consistently supports overall financial health.

- Continuous Expansion: The company continuously expands its revenue sources by entering new product lines and refining its pricing algorithms. This ensures sustained growth and profitability. To learn more about the company's structure, you can read about Owners & Shareholders of Progressive.

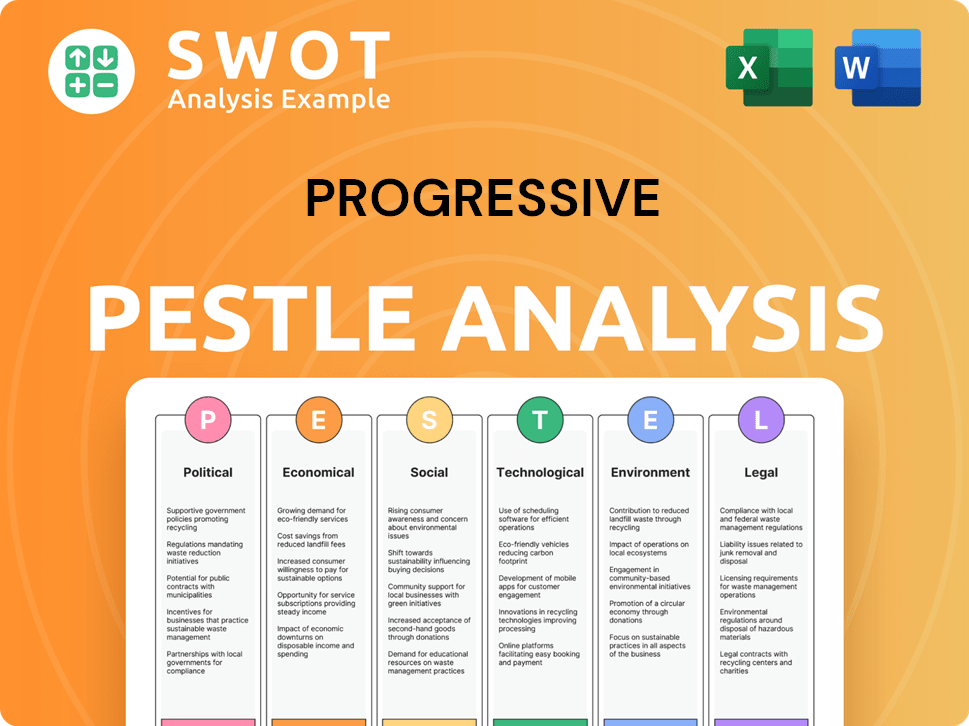

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Progressive’s Business Model?

The journey of the Progressive Company has been marked by significant milestones and strategic moves that have shaped its operations and financial success. A key early move was the embrace of direct-to-consumer sales channels, particularly through its website and call centers, starting in the late 1990s and early 2000s. This approach disrupted the traditional insurance model, allowing the company to reach a wider customer base more efficiently. Another pivotal moment was the introduction of telematics-based insurance with its Snapshot program, which launched nationwide in 2011. This innovation enabled more accurate policy pricing based on individual driving behavior, providing a competitive edge.

The company has navigated operational and market challenges, including intense competition and economic fluctuations. During periods of rising claims costs or economic downturns, Progressive has refined its underwriting models and adjusted pricing strategies to maintain profitability. Its competitive advantages are multifaceted, including brand strength cultivated through memorable advertising campaigns and a focus on customer service, fostering customer loyalty. Technological leadership, especially in data analytics and telematics, offers a significant advantage in risk assessment and personalized pricing.

Economies of scale, stemming from its large customer base and efficient operations, enable competitive pricing and investment in innovation. The company's ecosystem effect, where its diverse product offerings and multiple sales channels create a comprehensive insurance solution, further strengthens its market position. Progressive continues to adapt to new trends, such as the increasing demand for personalized insurance products and the integration of AI into claims processing, ensuring its sustained relevance and competitive edge in a dynamic industry. For example, in 2024, the company's net premiums written reached over $50 billion, demonstrating its strong market presence.

Early adoption of direct-to-consumer sales channels. Pioneering the use of telematics with the Snapshot program. Continuous innovation in data analytics and risk assessment.

Refining underwriting models during periods of economic downturn. Adjusting pricing strategies to maintain profitability. Expanding product offerings and sales channels.

Strong brand recognition and customer loyalty. Technological leadership in data analytics. Economies of scale and efficient operations. Comprehensive insurance solutions.

Integration of AI in claims processing. Focus on personalized insurance products. Continuous adaptation to changing customer needs and market trends.

Progressive Insurance has demonstrated robust financial performance, with consistent growth in premiums and market share. The company's strategic investments in technology and customer service have contributed to its strong position in the auto insurance market. For example, in 2024, the company's combined ratio remained competitive, reflecting efficient claims management and underwriting practices.

- Strong premium growth, indicating increased customer acquisition and retention.

- Effective cost management, contributing to profitability.

- Strategic investments in technology and customer service.

- Adaptation to market changes, such as the increasing demand for usage-based insurance.

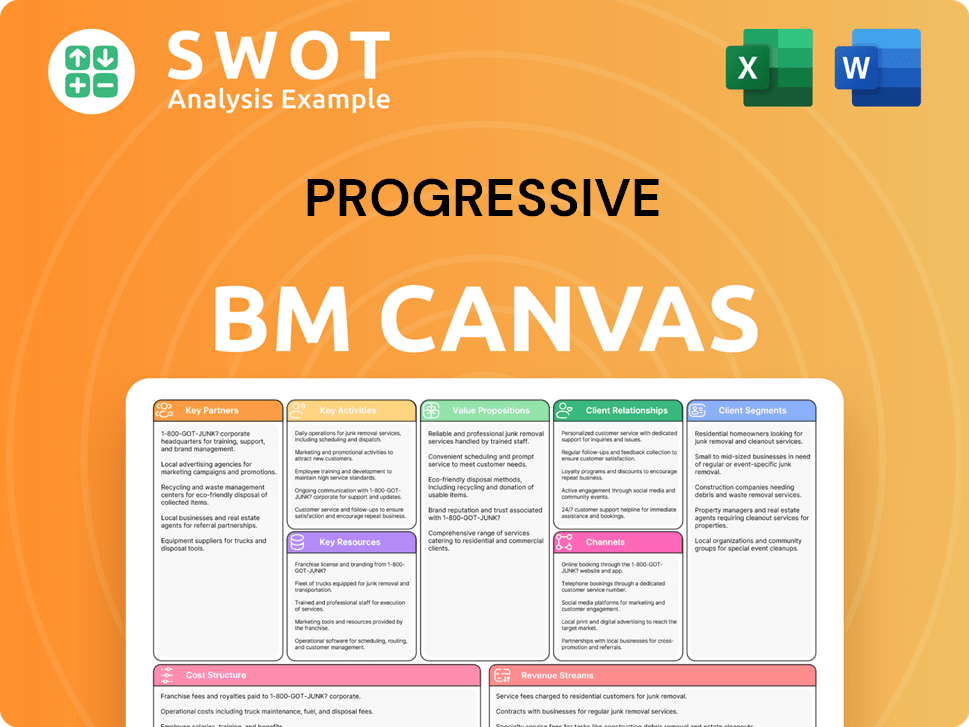

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Progressive Positioning Itself for Continued Success?

Progressive Corporation holds a prominent position in the U.S. property and casualty insurance sector, especially in auto insurance. As of early 2024, it consistently ranks among the top auto insurers by market share, often competing with GEICO and State Farm. Progressive's strong brand recognition and innovative pricing models contribute to high customer loyalty.

Despite its strong market presence, Progressive faces risks such as regulatory changes, emerging competitors, and technological disruptions. The company's strategic initiatives include investments in data analytics and artificial intelligence to improve underwriting and claims efficiency. Progressive aims to leverage technology to offer personalized insurance solutions and maintain its market leadership.

Progressive is a leading auto insurer in the U.S., competing with major players like GEICO and State Farm. They have a significant market share due to their brand recognition and innovative pricing strategies. Their operations are primarily focused within the United States, covering all 50 states and the District of Columbia.

Progressive faces risks from regulatory changes affecting pricing and data privacy. Competition from insurtech startups and technological advancements like autonomous vehicles also pose challenges. Consumer preference shifts towards usage-based insurance models require ongoing innovation and adaptation.

The company plans to invest in data analytics and AI to improve underwriting and claims processes. Progressive aims to expand into new product lines and distribution channels to diversify revenue. Their focus remains on technological innovation, customer service, and disciplined underwriting to drive future growth.

Progressive is focused on enhancing its ability to offer personalized and competitive insurance solutions. They are adapting to market changes and maintaining operational efficiency and customer satisfaction. Telematics and digital platforms are key areas of investment for future profitability.

Progressive's success is closely tied to its ability to adapt to market changes and customer needs. This includes offering competitive car insurance quotes and maintaining a strong customer service reputation. Understanding the Competitors Landscape of Progressive is crucial for investors and stakeholders.

- Progressive's Snapshot program is a key element in usage-based insurance, offering discounts based on driving behavior.

- The company is investing heavily in its mobile app to improve customer experience and streamline the insurance claims process.

- Progressive is exploring various Progressive policies and coverage options to cater to diverse customer needs.

- The company's focus on technology and data analytics is designed to provide more accurate and personalized insurance rates.

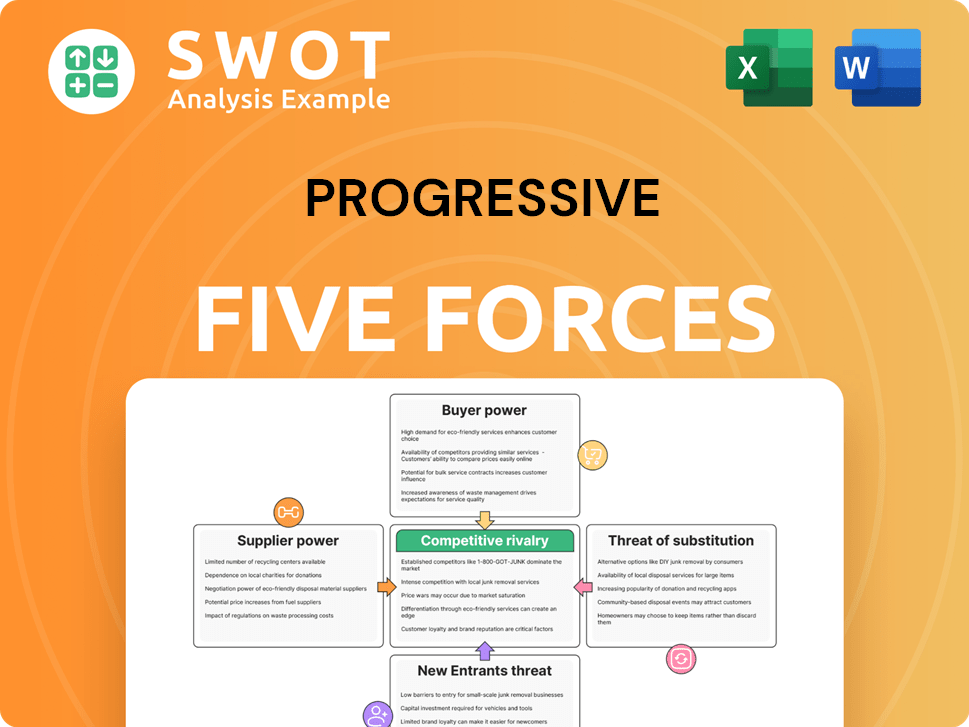

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Progressive Company?

- What is Competitive Landscape of Progressive Company?

- What is Growth Strategy and Future Prospects of Progressive Company?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- Who Owns Progressive Company?

- What is Customer Demographics and Target Market of Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.