Progressive Bundle

Who Really Owns Progressive Insurance?

Uncover the intricate ownership web of The Progressive Corporation, a titan in the insurance industry. From its humble beginnings in 1937 to its current status as a market leader, understanding who controls Progressive is key to grasping its future trajectory. This knowledge is essential for investors, analysts, and anyone seeking to understand the forces shaping the insurance landscape.

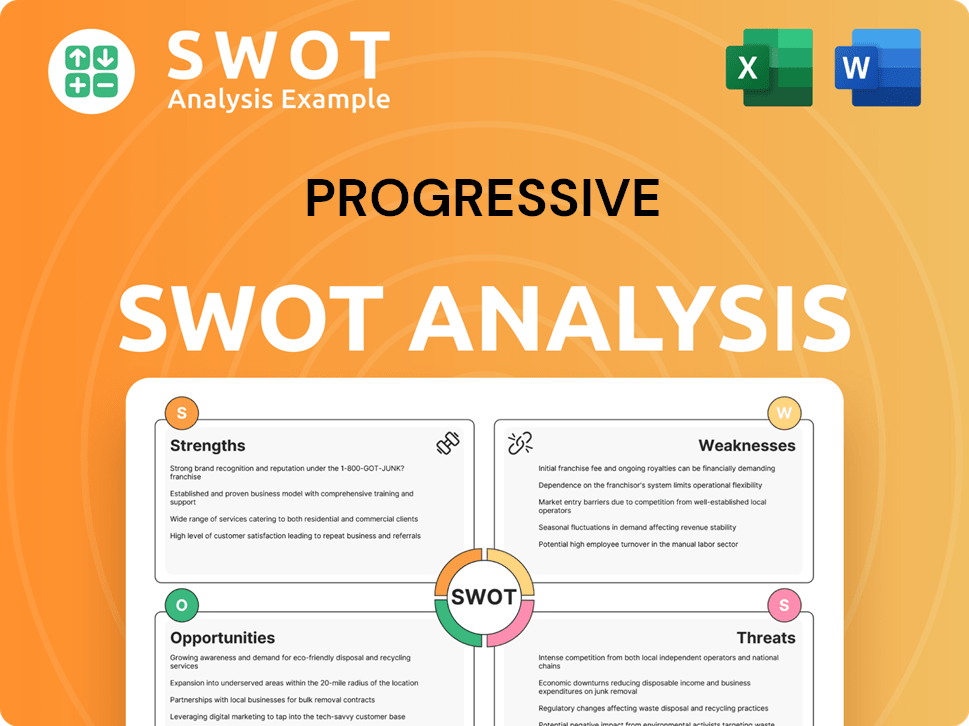

The Progressive SWOT Analysis reveals critical insights into the company's strengths, weaknesses, opportunities, and threats, all of which are influenced by its ownership structure. Knowing "Who owns Progressive Corporation?" helps to interpret the strategic decisions made by the current Progressive CEO and leadership team. This exploration of Progressive ownership will provide a comprehensive view of the company's history, from its founding to its present-day market position, offering valuable context for anyone interested in Progressive stock or the broader insurance market. Understanding the Progressive Insurance financial information and the Progressive Insurance company profile is crucial.

Who Founded Progressive?

The story of Progressive Insurance begins with its founders, Joseph Lewis and Jack Green, who established the Progressive Mutual Insurance Company on March 10, 1937. Their vision was to offer affordable auto insurance with a focus on exceptional service. This innovative approach set the stage for what would become a major player in the insurance industry.

With an initial investment of $10,000, Lewis and Green laid the groundwork for a company that would later redefine the insurance landscape. By 1940, the company was already writing approximately $100,000 worth of insurance annually, showcasing early success and potential for growth.

The early years of the company were crucial in establishing its identity and laying the foundation for future expansion. The founders' commitment to innovation and customer service set the stage for the company's long-term success in a competitive market.

Joseph Lewis and Jack Green founded Progressive Mutual Insurance Company in 1937.

Their initial capital was $10,000.

By 1940, the company was writing around $100,000 in insurance annually.

Jack Green became CEO in 1955, and Peter B. Lewis joined the company.

In 1965, Peter B. Lewis and his mother undertook a leveraged buyout.

The Progressive Corporation was formed in 1965.

Following the death of Joseph Lewis in 1955, Jack Green took over as CEO, and Peter B. Lewis, Joseph's son, began his career with the company. Peter Lewis played a pivotal role in shaping the company's direction, particularly by focusing on insuring riskier drivers, a niche that Progressive carved out for itself in 1956 with the Progressive Casualty Company. In 1965, Peter B. Lewis and his mother acquired Progressive through a leveraged buyout, borrowing $2.5 million and using their majority stake as collateral. This move solidified the Lewis family's control during a critical growth phase, leading to the formation of The Progressive Corporation in the same year. Peter B. Lewis served as CEO for 35 years, starting in 1965. For more insights into the company's history, you can read about the history of Progressive Corporation.

The early ownership of Progressive Insurance was centered on its founders and the Lewis family, who significantly shaped the company's trajectory.

- Joseph Lewis and Jack Green founded the company.

- Peter B. Lewis played a key role in the company's growth.

- The Lewis family solidified control through a leveraged buyout in 1965.

- Peter B. Lewis served as CEO for 35 years.

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Progressive’s Ownership Changed Over Time?

The evolution of Progressive Corporation's ownership is a key part of its history. Initially operating as a mutual insurance company, Progressive transitioned to a publicly traded corporation through an initial public offering (IPO) in 1971. This strategic move allowed the company to broaden its capital base, fueling significant growth over the years. This change marked a pivotal moment, shifting the company's structure and opening doors to new investment opportunities.

Today, the ownership of Progressive is largely held by institutional investors. The company's market capitalization has grown substantially since its IPO, reaching approximately $157.02 billion as of June 13, 2025, a considerable increase from its $10.90 billion market cap in December 1998. This growth reflects the company's successful navigation of the financial markets and its ability to attract significant investment.

| Ownership Aspect | Details | Date |

|---|---|---|

| Market Capitalization | Approximately $157.02 billion | June 13, 2025 |

| Institutional Owners | 3012 institutional owners | June 13, 2025 |

| Total Shares Held by Institutions | 600,066,261 shares | June 13, 2025 |

As of June 13, 2025, a significant number of institutional investors hold shares of Progressive. These include major players such as Vanguard Group Inc., BlackRock, Inc., and State Street Corp. This widespread ownership structure indicates a diversified investor base, which helps in maintaining financial stability and supporting strategic initiatives. In 2024, Progressive demonstrated strong financial performance with over 20% premium growth and redeemed preferred shares for $500 million, further solidifying its financial position. To learn more about the company's strategic direction, consider reading about the Growth Strategy of Progressive.

Progressive Insurance has evolved from a mutual company to a publicly traded corporation, significantly broadening its investor base.

- The majority of Progressive stock is held by institutional investors, including major investment firms.

- The company has demonstrated strong financial performance, with substantial premium growth and strategic financial moves.

- Understanding the ownership structure provides insights into Progressive's financial stability and strategic direction.

- The company's market capitalization reflects its growth and success in the insurance industry.

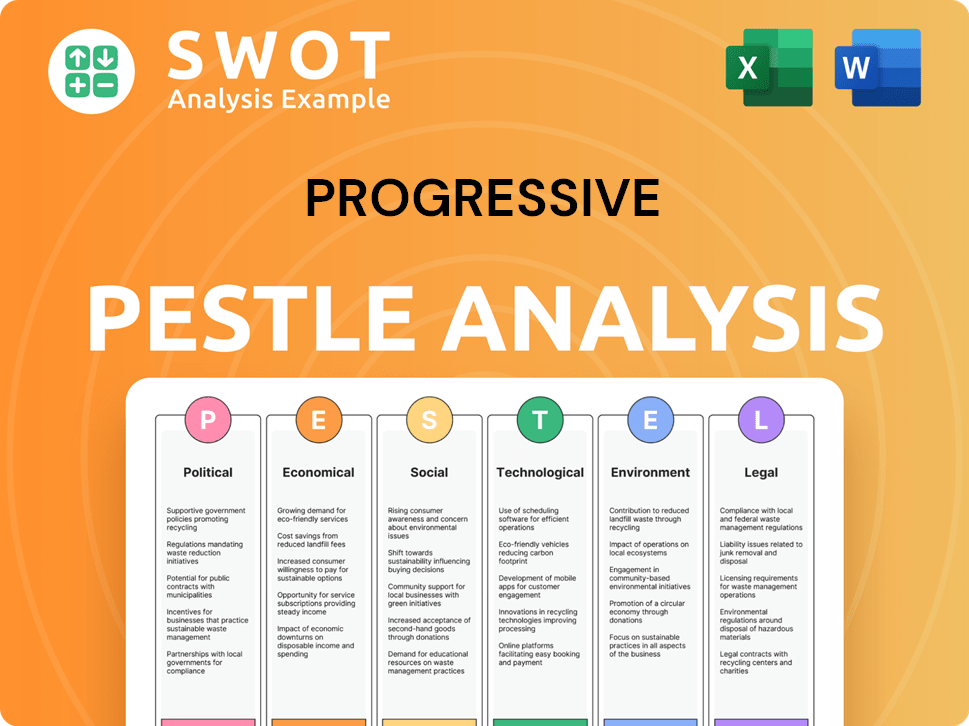

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Progressive’s Board?

The current Board of Directors for the Progressive Corporation includes a blend of company executives, former executives from other industries, and independent directors. As of the most recent data available, key figures include Tricia Griffith, serving as President and Chief Executive Officer, and Lawton W. Fitt, who holds the position of Chairperson of the Board. Additional independent directors include Philip Bleser, Stuart B. Burgdoerfer, Pamela J. Craig, Charles A. Davis, Roger N. Farah, Devin C. Johnson, Jeffrey D. Kelly, Barbara R. Snyder, and Kahina Van Dyke. Each director's term is scheduled to conclude at the 2026 Annual Meeting of Shareholders.

This composition reflects a governance structure designed to provide diverse perspectives and expertise, ensuring effective oversight of the company's operations and strategic direction. The board's role encompasses a wide range of responsibilities, from setting corporate strategy to monitoring financial performance and ensuring compliance with regulatory requirements. The presence of independent directors is particularly important for maintaining objectivity and safeguarding the interests of shareholders.

| Director | Title | Term Expires |

|---|---|---|

| Tricia Griffith | President and Chief Executive Officer | 2026 |

| Lawton W. Fitt | Chairperson of the Board | 2026 |

| Philip Bleser | Independent Director | 2026 |

The voting structure for Progressive's common shares is based on a one-share-one-vote system. As of March 14, 2025, the record date for the annual meeting, there were 586,236,114 common shares outstanding. Each share entitles the holder to one vote. While 5 million Voting Preference Shares are authorized, none have been issued. Shareholders of record as of March 14, 2025, are eligible to vote at the Annual Meeting of Shareholders, which will be held virtually on May 9, 2025. If a shareholder submits a proxy card without specific voting instructions, their shares will be voted as recommended by the Board. The Board oversees various committees, including the Nominating and Governance Committee, which manages executive and director succession planning and evaluates director qualifications and diversity.

Progressive's governance structure ensures that shareholders have a direct influence on the company's direction through their voting rights. The Board of Directors, composed of experienced individuals, oversees the company's strategic initiatives and financial performance.

- Shareholders with shares as of the record date can vote.

- The Board recommends how to vote if no specific instructions are given.

- The Nominating and Governance Committee is responsible for director succession.

- The company's structure is designed to protect shareholder interests.

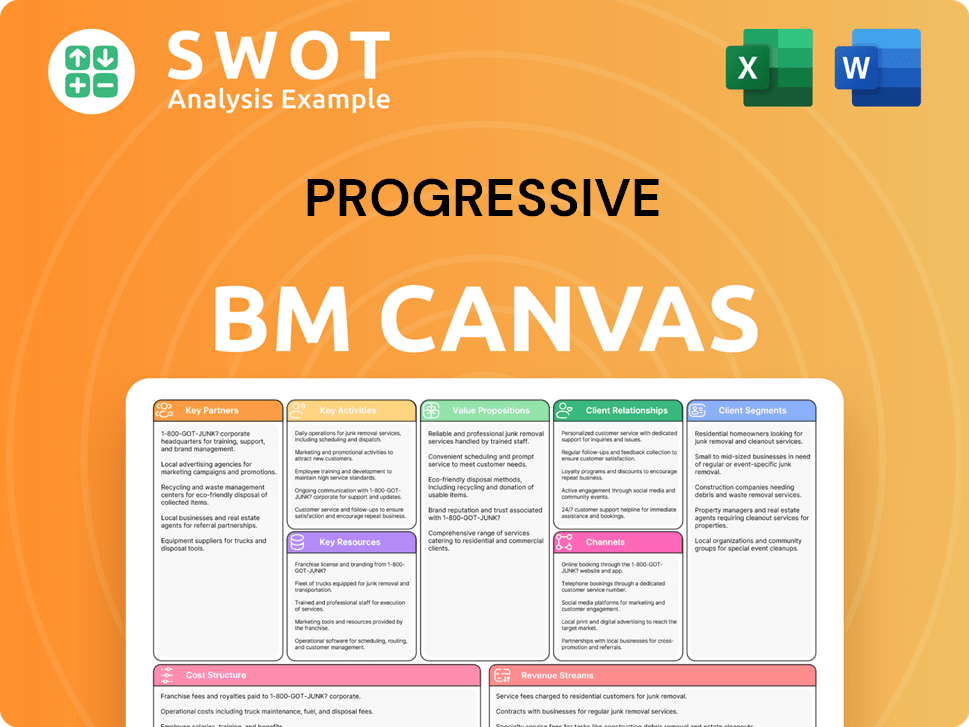

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Progressive’s Ownership Landscape?

In the past few years, Progressive Corporation has demonstrated robust financial performance. In 2024, the company achieved a record 21% premium growth and industry-leading profitability. The first quarter of 2025 continued this trend, with near-record margins and record growth. Net premiums written increased by 17% to $22.206 billion for the quarter ended March 31, 2025, compared to the same period in 2024, and net income rose by 10% to $2.567 billion. As of March 2025, the total number of policies in force across personal and commercial lines grew by 18%.

Institutional ownership remains a significant aspect of Progressive ownership. In Q1 2025, 929 institutional investors added shares, while 854 decreased their positions. Notable changes in Q4 2024 included BlackRock, Inc. adding over 4.6 million shares, and Wellington Management Group LLP removing over 3.3 million shares. JPMorgan Chase & Co. also increased its holdings by over 2.2 million shares in Q4 2024. The company has renewed its authorization to repurchase up to 25 million shares and consistently declares quarterly dividends, highlighting its commitment to shareholder returns. For more insights into their marketing approach, consider reading about the Marketing Strategy of Progressive.

Succession planning is a key focus for boards in 2025. Progressive's Board actively monitors executive and director succession. The company continues to focus on profitable growth and strategic investments, such as its corporate venturing subsidiary, Progressive Investment Company. Additionally, Progressive plans to hire over 12,000 people in 2025 to support its continued growth.

Institutional investors continue to be the primary holders of Progressive stock. There have been notable shifts in institutional holdings, with some firms increasing and others decreasing their positions. The company's commitment to shareholder returns is evident through share repurchases and dividend declarations.

The company has shown strong financial results, including premium growth and profitability. The first quarter of 2025 showed continued growth in net premiums and net income. These results reflect the company's strong position in the insurance market.

The company is focused on profitable growth and strategic investments. Progressive Investment Company, the corporate venturing subsidiary, is actively involved in funding rounds. Plans to hire over 12,000 people in 2025 indicate continued expansion.

Succession planning is a key priority for the board. The company's board actively monitors succession planning for executives and directors. This focus on leadership continuity is a reflection of industry trends.

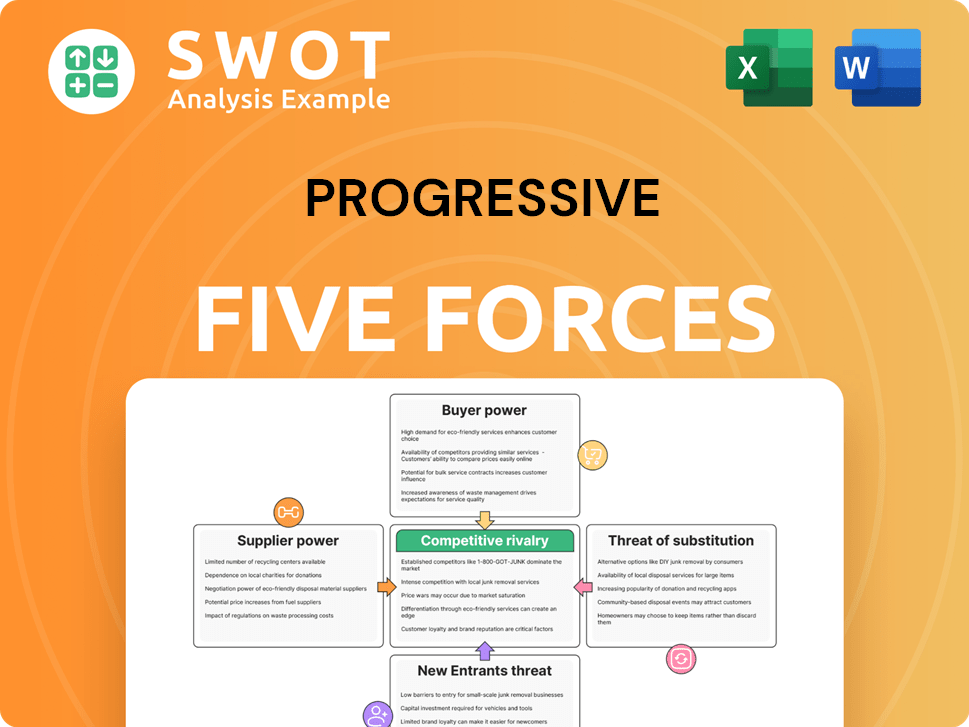

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Progressive Company?

- What is Competitive Landscape of Progressive Company?

- What is Growth Strategy and Future Prospects of Progressive Company?

- How Does Progressive Company Work?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- What is Customer Demographics and Target Market of Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.