Progressive Bundle

Who Buys Progressive Insurance?

Understanding the Progressive SWOT Analysis is crucial for grasping the company's strategic positioning. Identifying the Progressive target market and analyzing customer demographics is key to success in the competitive insurance industry. Progressive's evolution from a niche provider to a major player reveals a dynamic approach to understanding its target audience. This exploration will uncover the intricacies of who chooses Progressive.

From its inception, Progressive has focused on providing accessible auto insurance, a strategy that continues to shape its customer base. Examining the Progressive company profile reveals a commitment to innovation and customer-centric solutions. This deep dive into Progressive insurance will explore the characteristics of its insurance customer, including Progressive insurance customer age range, Progressive insurance customer income levels, and Progressive insurance customer location, providing a comprehensive Progressive target market analysis.

Who Are Progressive’s Main Customers?

Understanding the customer demographics and target market is crucial for any insurance company. For the company, this means focusing on both individual consumers (B2C) and businesses (B2B) within the United States. The company's approach to its target audience has evolved, reflecting changes in consumer behavior and market opportunities. A deep dive into the primary customer segments reveals key insights into its strategic focus.

The primary customer segments for the company are diverse, encompassing both personal and commercial auto insurance. These segments are defined by specific needs, preferences, and behaviors. By tailoring its products and services to these distinct groups, the company aims to maintain a competitive edge and drive growth. The company's ability to understand and adapt to the needs of its customers is a key factor in its success.

The company's core customer base for personal auto insurance historically includes drivers seeking affordable rates and flexible coverage. These customers often use online platforms for quotes and policy management. They may also be open to telematics programs like Snapshot. This segment frequently falls within the middle-income bracket, typically between 25 and 55 years old, and is comfortable with digital interactions. The company's ability to attract and retain these customers is critical to its overall performance. As shown in a Marketing Strategy of Progressive, understanding these demographics helps tailor marketing efforts.

The primary focus is on drivers looking for competitive rates and flexible coverage options. This includes individuals who prefer online channels for managing their policies. Many are open to usage-based insurance programs like Snapshot.

Targets small businesses and commercial vehicle owners. These customers require specialized coverage tailored to their business needs. They prioritize efficient claims processing and cost management.

The company's customer base is diverse, with a significant portion of personal auto customers in the middle-income bracket. The company's commercial lines net premiums earned increased by 19% in 2023 to $7.7 billion, demonstrating strong growth in this segment. The introduction of Snapshot has attracted drivers willing to share their driving data for potential discounts, appealing to more careful drivers.

- Age: Personal auto customers often range from 25 to 55 years old.

- Income: A significant portion falls within the middle-income bracket.

- Digital Preference: Strong preference for online channels for quotes and policy management.

- Commercial Focus: Targets small businesses and commercial vehicle owners across various industries.

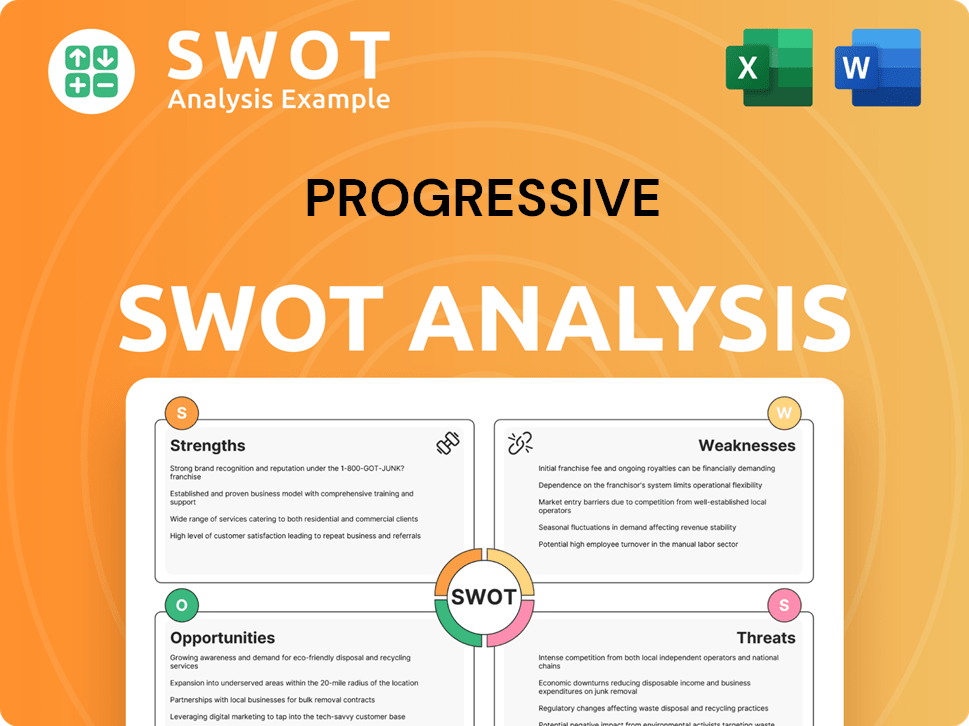

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Progressive’s Customers Want?

Understanding the needs and preferences of customers is crucial for any insurance provider. For the company, this involves recognizing what drives their customers' choices and how to best meet those needs. This approach allows the company to tailor its products and services to resonate with its target market, ensuring customer satisfaction and loyalty.

The company's customers are motivated by a mix of practical and financial considerations, emphasizing value, convenience, and reliable protection. This focus helps the company to maintain a competitive edge in the insurance market. By addressing these key drivers, the company aims to attract and retain a diverse customer base.

The company's focus on digital tools and mobile apps caters to customers who prefer self-service and quick access to policy information. This emphasis on digital solutions reflects a broader trend in the insurance industry, where customers increasingly expect online and mobile options for managing their policies and claims.

Competitive pricing is a significant factor for customers, particularly in the personal auto insurance segment. Customers are always looking for the best value when it comes to their insurance premiums. The company's ability to offer competitive rates is a key driver in attracting and retaining customers.

The ease with which customers can obtain quotes is another critical factor. Customers value a streamlined and user-friendly process when seeking insurance. The company's investment in online tools and digital platforms makes it easier for potential customers to get quotes quickly and efficiently.

Efficient claims service is paramount for customer satisfaction. When customers experience a loss, they need a claims process that is quick, fair, and easy to navigate. The company's commitment to efficient claims handling is a key factor in building customer trust and loyalty.

Flexible payment options are essential for many customers, reflecting a need for financial manageability. Offering various payment plans allows customers to choose the option that best fits their budget. The company understands the importance of providing financial flexibility to its customers.

The breadth of coverage offered is a critical factor in customer decision-making. Customers need insurance policies that provide comprehensive protection against various risks. The company's ability to offer a wide range of coverage options is a key selling point.

Customers increasingly prefer interacting with insurers through digital channels. The company's investment in online tools and mobile apps caters to this preference, providing customers with convenient access to policy information and services. This focus on digital solutions enhances the overall customer experience.

The company addresses customer needs by offering clear policy explanations and user-friendly interfaces. This approach simplifies the insurance process and improves customer satisfaction. The company's commitment to customer-centric solutions is a key differentiator in the insurance market. Understanding the Progressive target market and their needs is crucial for the company's success. The company's focus on innovation and customer feedback helps it to stay ahead of market trends and meet the evolving needs of its customers.

- Customer Demographics: The company serves a broad range of customers, including individuals and businesses, with a focus on value-conscious consumers.

- Target Audience: The company targets drivers seeking affordable insurance, as well as commercial clients needing tailored coverage.

- Marketing Strategies: The company employs diverse marketing campaigns, including advertising and digital platforms, to reach its target audience. For example, the company's advertising often features relatable characters and scenarios that resonate with everyday drivers.

- Product Development: The ongoing evolution of Snapshot reflects the company's response to customer preferences for personalized pricing based on actual driving behavior.

- Customer Segmentation: The company tailors its marketing to specific segments, ensuring that its messaging and offerings are relevant to each group.

- Customer Buying Behavior: Customers are influenced by factors such as premium cost, coverage breadth, and ease of interaction with the insurer.

- Digital Solutions: The company's emphasis on online tools and mobile apps caters to customers who prefer self-service and quick access to policy information.

- Customer Location: The company operates nationally, serving customers across various locations.

- Customer Interests: The company's marketing campaigns often align with customer interests, such as safe driving and financial security.

For commercial clients, the company focuses on providing tailored coverage, responsive service, and competitive rates. This approach helps businesses manage their risks effectively. The company's ability to understand and address the unique challenges of different industries sets it apart. To learn more about the financial aspects, consider reading about the Revenue Streams & Business Model of Progressive.

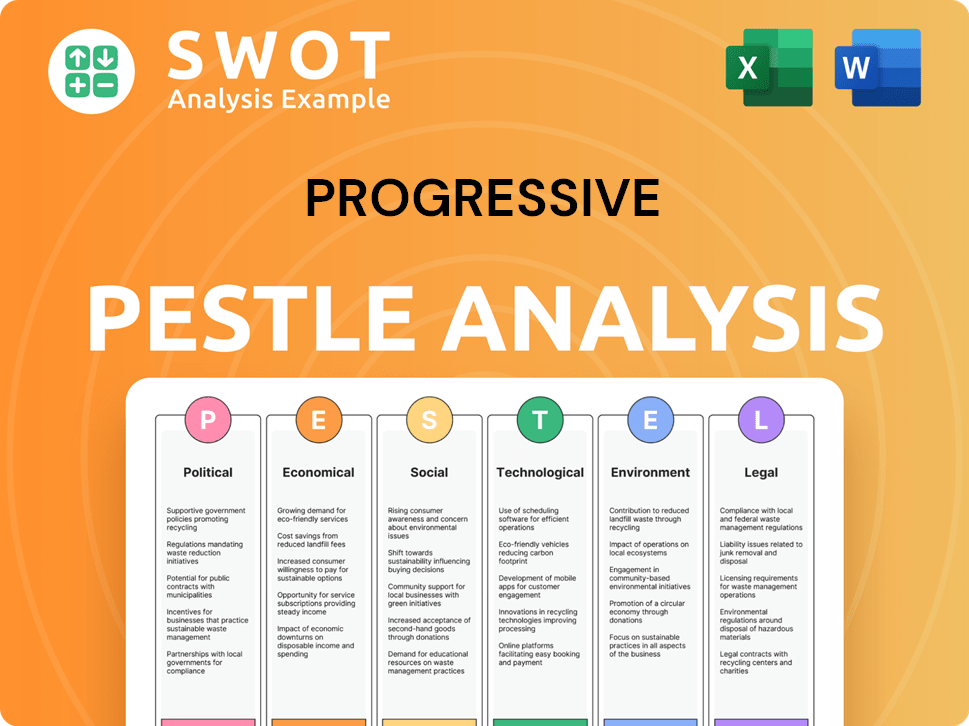

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Progressive operate?

The company's geographical market presence is predominantly within the United States. It holds a substantial market share across all 50 states and the District of Columbia. This widespread coverage is a key aspect of its business strategy, allowing it to reach a broad spectrum of potential insurance customer.

The company maintains a strong presence in major markets, particularly those with high population densities and significant vehicle ownership rates. While specific market share data by city or region can fluctuate, the company consistently ranks among the top auto insurers nationally. This consistent performance underscores its ability to compete effectively across diverse geographic landscapes.

The company strategically adapts its offerings to meet the varying needs of different regions. This approach includes tailoring pricing models to state-specific regulations and risk profiles, ensuring it remains competitive and relevant. For a deeper understanding of how the company achieves growth through strategic initiatives, consider exploring the Growth Strategy of Progressive.

Differences in customer demographics are evident across regions. For instance, urban areas may have a higher concentration of younger drivers and demand for ride-sharing insurance. This requires the company to adapt its product offerings to suit those needs.

Rural areas might see a greater need for commercial vehicle coverage for agricultural or transportation businesses, which influences the company's target audience. The company customizes its approach to address these varied demands and preferences.

The company tailors marketing messages and partnerships to resonate with regional nuances. For example, the company might emphasize different aspects of coverage in areas prone to specific weather events. The company uses localized strategies.

The company's strategic approach involves continuous analysis of regional market dynamics to optimize its product distribution and marketing efforts. This ensures that the company remains competitive and relevant across diverse geographic landscapes. This is part of its Progressive company profile.

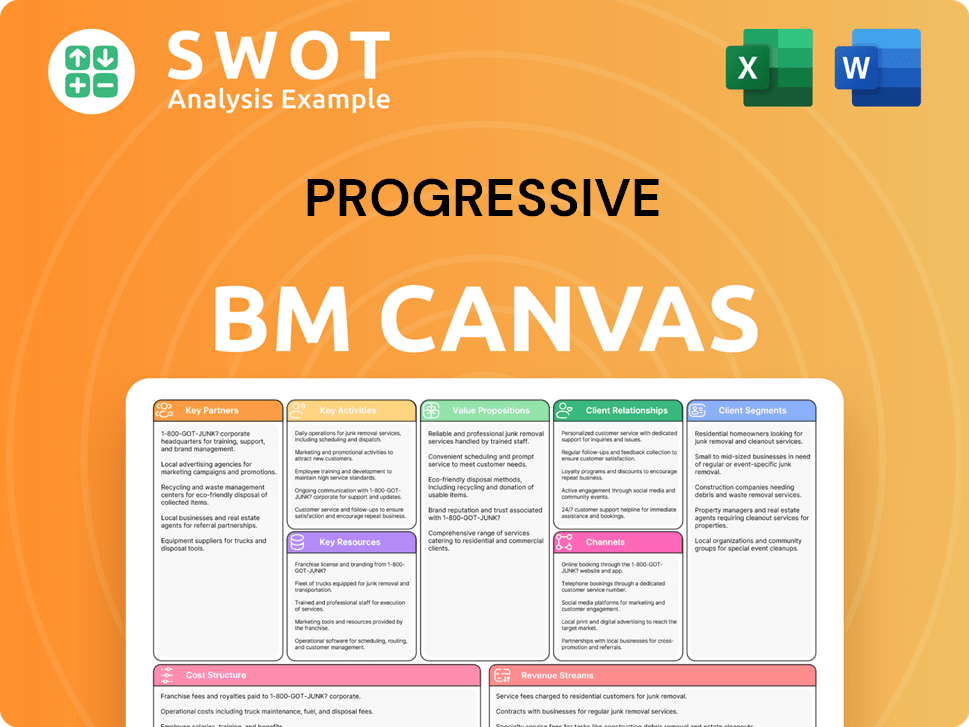

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Progressive Win & Keep Customers?

The company uses a multi-channel strategy to acquire and retain customers, blending digital and traditional marketing approaches. Digital channels, including search engine marketing and social media, are crucial for reaching new customers, who often conduct online research. The company's website and mobile app facilitate instant quotes and policy enrollment, while traditional advertising, such as television commercials, builds brand awareness.

Sales strategies involve direct-to-consumer sales through its website and call centers, alongside independent agents. This hybrid approach caters to diverse customer preferences. Data and CRM systems are used to segment customers, enabling targeted marketing and personalized recommendations. For instance, data analytics help identify customers who would benefit from usage-based insurance programs or bundling options.

In terms of retention, the company focuses on competitive pricing, efficient claims processing, and customer service. Loyalty programs are embedded in its pricing structure, rewarding safe driving behaviors and multi-policy discounts. They have also invested in personalized customer experiences, using data to provide tailored communications and proactive support. Recent changes include a greater emphasis on bundling home and auto policies to increase customer lifetime value and reduce churn. These strategies have contributed to consistent growth in policyholders and premiums. To learn more about the company's overall strategy, you can check out the Growth Strategy of Progressive.

The company leverages digital marketing channels like search engine marketing (SEM), display advertising, and social media to reach its target audience. These channels are effective for attracting price-sensitive customers who research insurance options online. The company's website and mobile app are key for providing instant quotes and facilitating policy enrollment, streamlining the customer journey.

Traditional advertising, such as television commercials featuring iconic characters, helps build brand awareness. This approach is crucial for reinforcing brand recall and reaching a broader target market. These commercials are designed to resonate with a wide audience, enhancing the company's visibility and recognition.

The company employs a hybrid sales approach, offering direct-to-consumer sales through its website and call centers, alongside independent agents. This strategy allows the company to cater to different customer preferences and buying behaviors. This multi-channel approach ensures accessibility and convenience for potential insurance customers.

Customer data and CRM systems are used to segment customers, enabling targeted marketing campaigns and personalized product recommendations. Data analytics are used to identify customers who would most benefit from programs like Snapshot or bundling options. This data-driven approach helps in understanding Progressive insurance customer needs and preferences.

The company focuses on offering competitive pricing to attract and retain customers. This strategy is critical in the insurance industry, where price sensitivity is high. Competitive pricing helps the company remain attractive to a broad spectrum of potential customers.

Efficient claims processing is a key factor in customer retention. Quick and hassle-free claims resolution builds customer trust and loyalty. This focus on efficiency enhances customer satisfaction and reduces churn.

Providing excellent customer service is a cornerstone of the company's retention strategy. Responsive and helpful customer service teams address customer inquiries and resolve issues effectively. This commitment to service fosters customer loyalty.

The company incorporates loyalty programs into its pricing structure, incentivizing customer loyalty. Safe driving behaviors, tracked through programs like Snapshot, and multi-policy discounts are examples of these incentives. These programs encourage long-term customer relationships.

The company leverages data to provide personalized customer experiences, including tailored communications and proactive support. This approach enhances customer engagement and satisfaction. Personalization helps in creating stronger customer connections.

The company emphasizes bundling home and auto policies to increase customer lifetime value and reduce churn. Bundling encourages customers to consolidate their insurance needs, leading to greater loyalty. This strategy is designed to increase customer retention rates.

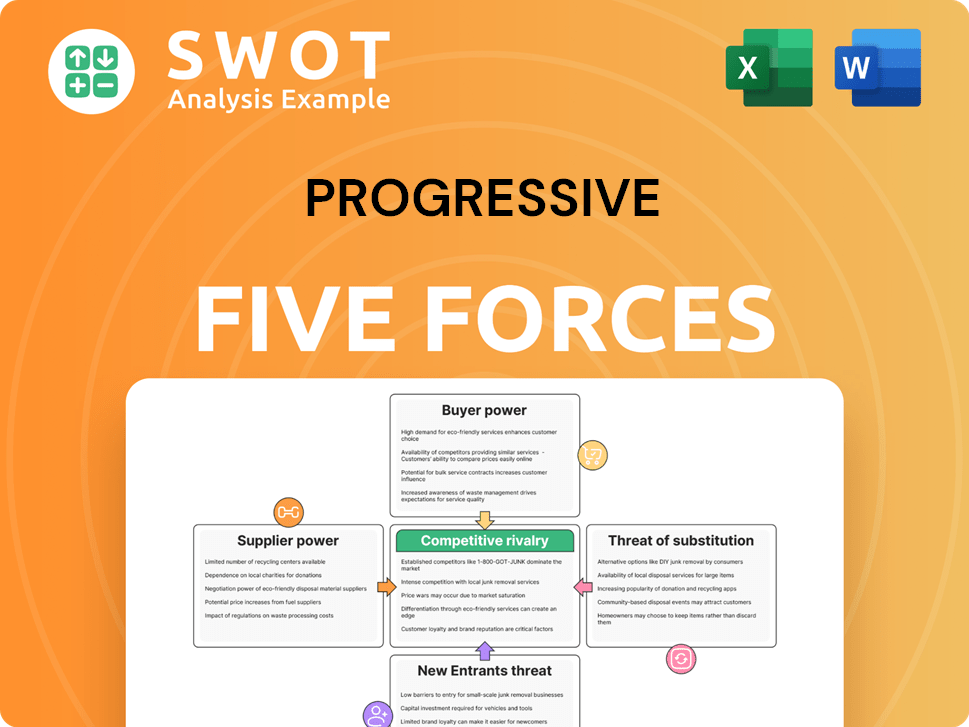

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Progressive Company?

- What is Competitive Landscape of Progressive Company?

- What is Growth Strategy and Future Prospects of Progressive Company?

- How Does Progressive Company Work?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- Who Owns Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.