Progressive Bundle

How Will Progressive Company Continue to Thrive?

Progressive Corporation, a pioneer in the insurance industry since 1937, has consistently redefined how we think about insurance. From its early focus on high-risk drivers to its current status as a leading auto insurer, Progressive's journey is a testament to its innovative spirit. Understanding the Progressive SWOT Analysis is crucial to grasp the company's trajectory and future potential.

This analysis will explore the core elements of Progressive's growth strategy, examining its expansion initiatives, and strategic financial management. We will also delve into the future prospects of the company, considering the challenges and opportunities in today's dynamic market. This investigation provides valuable insights for investors, business strategists, and anyone interested in the future of company growth and the insurance sector.

How Is Progressive Expanding Its Reach?

The company is actively pursuing several expansion initiatives to broaden its market reach and diversify its offerings. This strategic approach is designed to capitalize on emerging opportunities and reinforce its position in the insurance market. These initiatives are crucial for driving long-term growth and adapting to the evolving needs of its customer base.

The company is focused on expanding its product offerings and geographic reach. This involves the launch of new product models, such as the 9.0 model for personal auto, and the expansion of existing products like the Business Owner's Policy (BOP) to more states. These efforts are supported by investments in technology and innovation to enhance customer experience and operational efficiency.

The company's commercial division, which started in 1971 focusing on commercial auto, has expanded its business insurance offerings to include general liability, professional liability, workers' compensation, and cyber insurance. This diversification allows the company to serve a wider range of customers and mitigate risks associated with over-reliance on a single product or market segment. The multi-product quoting experience launched in 10 states allows agents to quote and bind commercial auto and BOP products in a single experience.

The company is rolling out new product models, including the 9.0 model for personal auto, expected in mid-2025. This builds on the 8.9 model introduced in January 2024, which included new coverage features. These launches are part of a broader growth strategy aimed at enhancing customer value.

The company is expanding its Business Owner's Policy (BOP) product model to more states during 2025. This initiative aims to meet the changing insurance needs of customers and improve customer retention through bundling. This expansion is key to the company's future prospects.

The commercial division has expanded its offerings to include general liability, professional liability, workers' compensation, and cyber insurance. This diversification strategy is crucial for accessing new customer segments and increasing revenue streams. The company's strategic planning includes continuous expansion.

The company launched a multi-product quoting experience in 10 states, allowing agents to quote and bind commercial auto and BOP products in a single experience. This innovation enhances efficiency and customer service, supporting the company's growth strategy. These efforts are critical for company growth.

The company's net premiums written surged by 17% to $22.21 billion in Q1 2025. This significant increase demonstrates the success of the expansion initiatives and the rising demand for both personal and commercial vehicle policies. These results highlight the company's strong financial performance and positive growth prospects.

- Expansion of product lines and geographic reach.

- Focus on customer retention through bundling and enhanced services.

- Strategic investments in technology and innovation.

- Diversification of revenue streams through commercial insurance offerings.

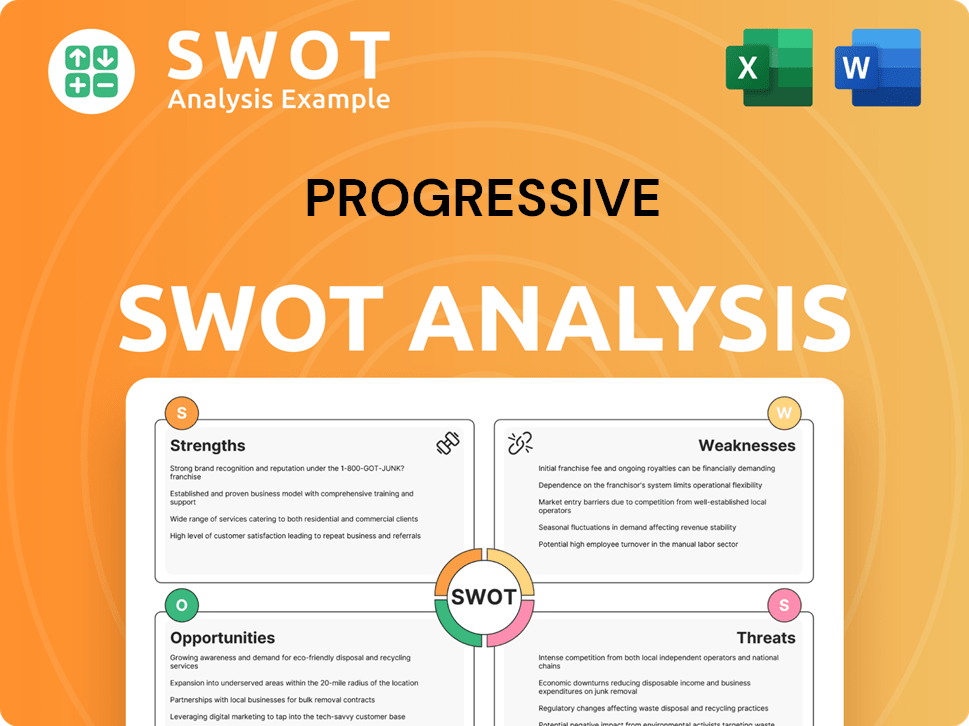

Progressive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Progressive Invest in Innovation?

The company's sustained growth is significantly driven by its commitment to innovation and technology. This approach is deeply integrated into its operational framework, providing a solid foundation for future expansion. The company's strategic focus on data analytics and telematics-based insurance positions it competitively in the market.

The company's competitive advantage is rooted in its proficiency in data analytics and usage-based insurance. CEO Tricia Griffith has emphasized the company's superior ability to gather, process, and react to data, which is crucial for personalized pricing and risk assessment. This data-driven approach allows the company to better understand customer behavior and tailor its offerings to meet specific needs.

The company's investments in technology and AI are aimed at automating the claims process and enhancing risk pricing. This strategy is designed to improve operational efficiency and customer service. The company's history of innovation demonstrates its ability to adapt and lead in the insurance industry, continuously seeking ways to improve its services and customer experience.

The company has been at the forefront of adopting telematics-based technology, such as Snapshot, which enables more precise risk assessment and personalized pricing. This technology allows the company to gather data on driving behavior, leading to improved underwriting results and customer acquisition. This data-driven approach is key to the company's growth strategy.

The company's commitment to technological advancement is reflected in its increased expenses. Other underwriting expenses, including salaries and tech spending, rose by 41% from the previous year to reach $2.7 billion in Q1 2025. This significant investment highlights the company's focus on leveraging technology to enhance its operations and achieve company growth.

The company is actively using technology and AI to automate the claims process and improve risk pricing. This approach aims to streamline operations and offer more accurate and competitive insurance rates. The company's focus on innovation is a crucial part of its business development strategy.

The company holds seven U.S. patents for usage-based insurance methods and systems, demonstrating its pioneering role in the industry. The company was the first auto insurance company to allow customers to purchase policies over the phone in 1993, launch a website in 1995, and offer online policy purchases in 1997. These milestones highlight the company's long-term commitment to innovation.

In November 2024, the company introduced an innovation within its mobile app to provide real-time assistance to customers involved in major accidents. This feature enhances customer service and supports the company's commitment to providing value to its customers. This shows how the company adapts to market changes.

The company's consistent focus on innovation and technology is a key factor driving its Progressive company growth. By leveraging data analytics, telematics, and AI, the company is able to improve its underwriting results, enhance customer service, and maintain a competitive edge in the market. This approach is essential for its future prospects.

The company's technological advancements and strategic initiatives are crucial for its sustained growth. By focusing on data analytics, telematics, and AI, the company is well-positioned to maintain its competitive advantage and adapt to market changes. As highlighted in a recent article discussing the company's strategies, the company's commitment to innovation remains a cornerstone of its success. This innovative approach is essential for the company's long-term growth and sustainability.

The company employs several key technological strategies to drive growth and maintain its competitive edge. These strategies include:

- Advanced Data Analytics: Utilizing data analytics to assess risk and personalize pricing.

- Telematics Integration: Implementing telematics-based technology like Snapshot for precise risk assessment.

- AI and Automation: Applying AI to automate claims processes and enhance risk pricing accuracy.

- Mobile App Innovation: Introducing features like real-time accident assistance to improve customer service.

- Patent Portfolio: Maintaining a portfolio of patents for usage-based insurance methods.

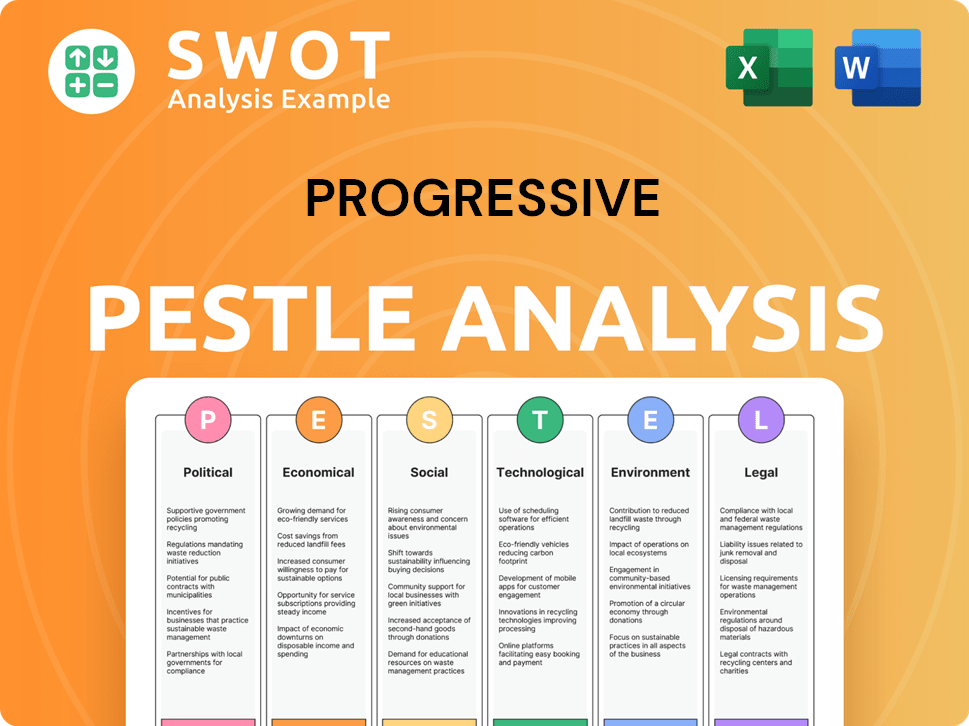

Progressive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Progressive’s Growth Forecast?

The financial outlook for the Progressive company is robust, demonstrating strong growth strategy and profitability. The company's performance in the first quarter of 2025 and throughout 2024 indicates a solid financial foundation and strategic execution. This positive trajectory is supported by increased revenues, improved underwriting results, and a commitment to shareholder value.

In the first quarter of 2025, the company reported impressive revenue figures, exceeding forecasts and achieving near-record margins. This positive trend continued into April 2025, with significant increases in net premiums written and net income. These results reflect the company's ability to effectively manage its operations and capitalize on market opportunities. The company's strategic initiatives and operational efficiencies have contributed to its financial success.

The company's commitment to business development and strategic planning is evident in its financial results. The company's management team is focused on maintaining financial flexibility and optimizing its capital structure. The consistent company growth is a result of its focus on innovation, customer satisfaction, and operational excellence. The company's financial performance is a testament to its ability to adapt to market changes and drive sustainable growth.

For Q1 2025, revenue reached $22.21 billion, surpassing the forecasted $21.6 billion. Net premiums written surged by 17% to $22.21 billion in Q1 2025. In April 2025, net premiums written increased by 11% to $6.837 billion, showing strong demand across both personal and commercial vehicle policies.

Net income surged by 134% to $986 million in April 2025 compared to April 2024. The combined ratio improved to 84.9 in April 2025 from 89.0 the previous year, with Q1 2025 showing an 86% combined ratio, indicating improved underwriting efficiency.

For the full year 2024, total revenues were $8,763 million. Net income reached $8,480 million, primarily driven by stronger underwriting and investment incomes. These figures highlight the company's strong financial performance.

Total policies in force grew by 18% to 34,952 thousand by December 2024. The company declared and accrued $2.7 billion in common share dividends at the end of 2024, demonstrating its commitment to returning value to shareholders. The company's management is committed to maintaining financial flexibility and continues its share repurchase program to optimize capital structure.

The company's financial outlook is positive, with strong revenue growth, improved profitability, and efficient capital management. These factors position the company for continued success in the future. The company's consistent performance and strategic initiatives have driven its positive financial results.

- Q1 2025 Revenue: $22.21 billion

- April 2025 Net Income: $986 million (134% increase)

- 2024 Total Revenues: $8,763 million

- 2024 Net Income: $8,480 million

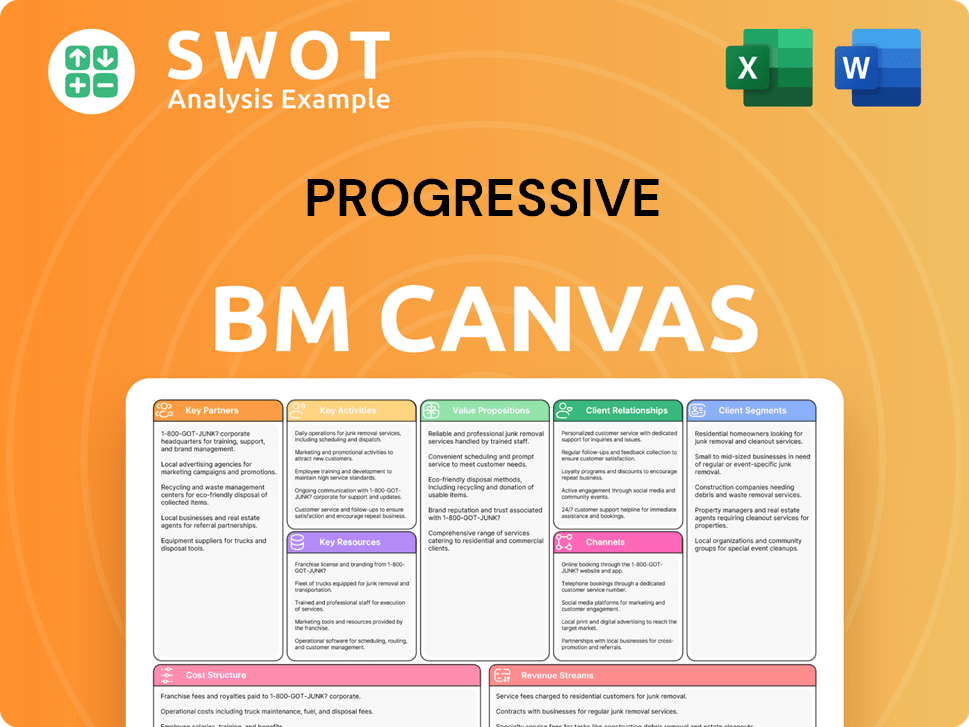

Progressive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Progressive’s Growth?

The Progressive company faces several risks that could influence its growth strategy and future prospects. These challenges include intense competition, regulatory changes, and the rapid pace of technological advancements. Understanding and managing these obstacles is crucial for the company's long-term success and continued business development.

The company must navigate a complex landscape, including potential supply chain disruptions and macroeconomic uncertainties that could impact consumer behavior. Internal resource constraints also pose a challenge, requiring careful management and strategic planning to ensure sustained company growth. Addressing these risks is essential for the company to capitalize on its opportunities.

To mitigate these risks, the company employs an enterprise risk management (ERM) program, focuses on investment portfolio diversification, and maintains a strong brand. This approach helps the company adapt to market changes and maintain its competitive edge. For more insights, you can explore the Competitors Landscape of Progressive.

The direct-to-consumer auto insurance market is highly competitive. Traditional insurers are enhancing their direct offerings, and new tech-savvy companies are entering the market, intensifying the competition. This competitive pressure can impact the company's market share and profitability. In 2024, the auto insurance industry saw significant shifts in market dynamics.

The insurance industry is heavily regulated, and changes in regulations can limit the company's ability to respond to market conditions. Inconsistencies among different jurisdictions add to compliance challenges. The regulatory environment can significantly affect operational costs and strategic flexibility. Regulatory changes can impact pricing and product offerings.

Rapid technological advancements pose a constant threat. Innovations by competitors or ineffective transitions to new technologies could negatively affect the company's competitive position. The development and use of new technologies, like generative AI, present risks such as biased outcomes or flawed datasets. The company must invest in technology to stay competitive.

Potential tariff impacts on auto parts and repair costs could affect profitability. Disruptions in the supply chain can lead to increased costs and delays. These vulnerabilities require careful management and diversification of suppliers. Supply chain issues can significantly impact claims costs.

Macroeconomic factors can influence consumer behavior and insurance shopping habits. Economic downturns or shifts in consumer spending can affect the demand for insurance products. These uncertainties require the company to adapt its strategies to changing market conditions. Economic conditions can impact the frequency and severity of claims.

The company needs sufficient internal and external talent to manage complex data sets and associated risks. The ability to attract and retain skilled employees is crucial for effective risk management and strategic planning. Skill gaps can hinder the company's ability to innovate and adapt. Data analytics and risk management require specialized expertise.

The company refines its enterprise risk management (ERM) program to address these risks. Diversifying its investment portfolio helps to mitigate financial risks. Maintaining a strong brand and reputation fosters consumer trust and loyalty. The 'Destination Era' strategy aims to provide bundled products to meet diverse customer needs, enhancing customer retention.

Bundling products can increase customer retention and profitability. Strategic planning and innovation are key to navigating market changes. The company's focus on customer needs helps to build resilience. The ERM program helps to manage and reduce potential losses. The company's ability to adapt is crucial for long-term success.

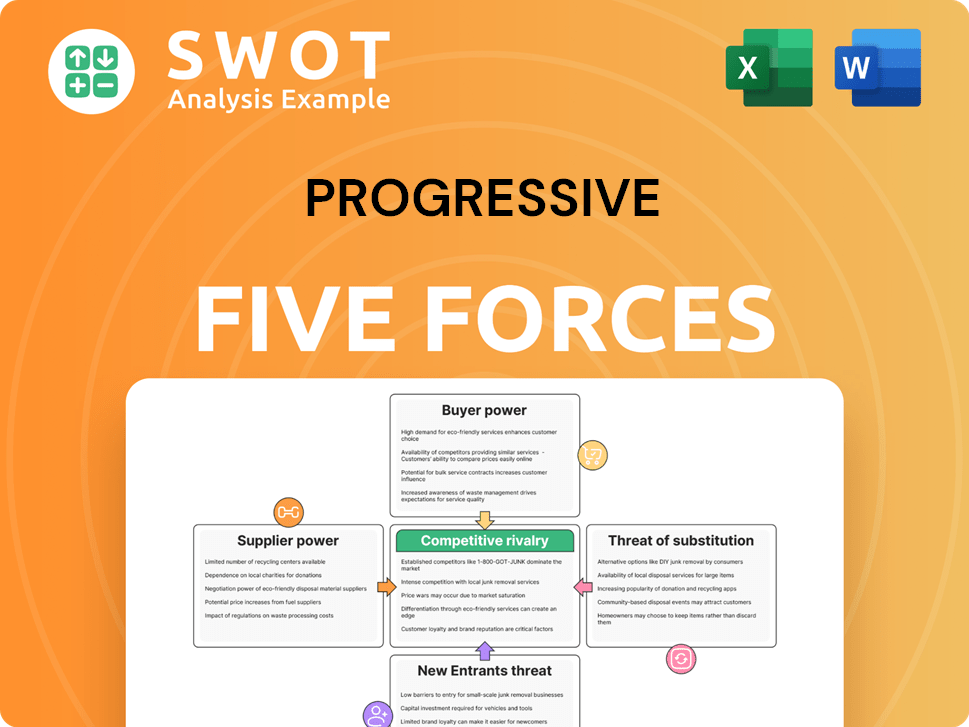

Progressive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Progressive Company?

- What is Competitive Landscape of Progressive Company?

- How Does Progressive Company Work?

- What is Sales and Marketing Strategy of Progressive Company?

- What is Brief History of Progressive Company?

- Who Owns Progressive Company?

- What is Customer Demographics and Target Market of Progressive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.