UDR Bundle

How did UDR Company become a multifamily giant?

Embark on a journey through the UDR SWOT Analysis, a pivotal player in the U.S. real estate market. From its inception as United Dominion Realty Trust in 1972, UDR's story is one of strategic evolution and market adaptation. Discover how this REIT transformed its focus and built a substantial portfolio of apartment communities.

This exploration of UDR history reveals the critical decisions that shaped the company's trajectory. Learn about the UDR Company founding date and the key acquisitions that fueled its growth. Understand the factors behind UDR's success in apartment ownership and its current position as a leading multifamily REIT, offering valuable insights for investors and analysts alike.

What is the UDR Founding Story?

The story of the UDR Company, a prominent player in the real estate market, begins in 1972. It was founded in Richmond, Virginia, under the name United Dominion Realty Trust. The vision of its founder, Robert C. Larson, was to create a diversified real estate investment trust (REIT).

Initially, the company focused on acquiring existing properties across different sectors. This included apartments, office buildings, and retail spaces. The initial public offering (IPO) in 1972 marked a significant milestone, positioning the company as one of the early publicly traded REITs in the United States. This set the stage for its growth and evolution in the real estate industry.

The Revenue Streams & Business Model of UDR provides more insights into how the company operates. The company's early strategy was about generating income through property ownership and management. Over time, UDR shifted its focus, specializing in multifamily residential properties.

Here's a snapshot of UDR's foundational journey:

- 1972: United Dominion Realty Trust was established by Robert C. Larson in Richmond, Virginia.

- Initial Focus: The company started with a diversified approach, investing in apartments, office buildings, and retail properties.

- IPO: The IPO in 1972 marked its entry as a publicly traded REIT.

- Strategic Shift: Over time, the company transitioned to specializing in multifamily residential properties.

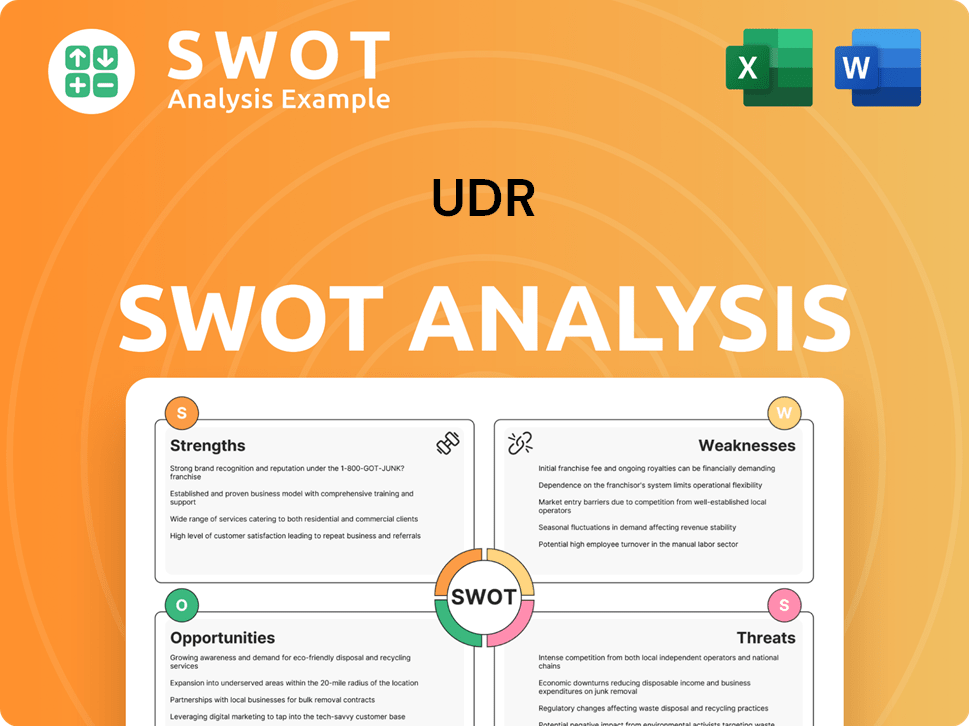

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of UDR?

The early growth of the UDR Company, formerly known as United Dominion Realty Trust, began in 1972 after its founding and initial public offering. A pivotal shift in its early years involved a strategic focus on multifamily residential properties, allowing the company to specialize in the apartment sector. This specialization helped shape the UDR real estate portfolio. The company's journey is a significant part of UDR history.

In the 1980s and 1990s, UDR transitioned from a diversified REIT to one solely focused on multifamily properties. This specialization allowed the company to refine its operational expertise. This strategic shift was crucial for its development in apartment ownership.

In 1995, UDR relocated its headquarters to Highlands Ranch, Colorado, where it continues to operate. This move was a key step in the company's expansion and operational strategy. The location has remained a central part of UDR's identity and operations.

The late 1990s and early 2000s saw significant expansion through strategic acquisitions and new development projects. These efforts solidified UDR's position in the multifamily REIT sector. This expansion is a key aspect of the UDR Company timeline.

In 2001, the company officially changed its name to UDR, Inc. As of December 31, 2024, UDR owned or had an ownership interest in 60,120 apartment homes. This significant portfolio growth highlights the company's success in the real estate market.

Recent activities include the development of a new 300-home apartment community in Riverside, CA, with a total development cost of $133.6 million expected in Q1 2025. UDR also increased its joint venture loan investment in 1300 Fairmount, a 478-home apartment community in Philadelphia, PA, by acquiring the senior loan for $114.6 million, bringing its total investment to $183.2 million.

These growth initiatives are supported by a strong balance sheet, with approximately $1.1 billion of liquidity as of March 31, 2025. This financial strength enables UDR to pursue its investment strategy. For more insights into UDR's strategy, see the Growth Strategy of UDR.

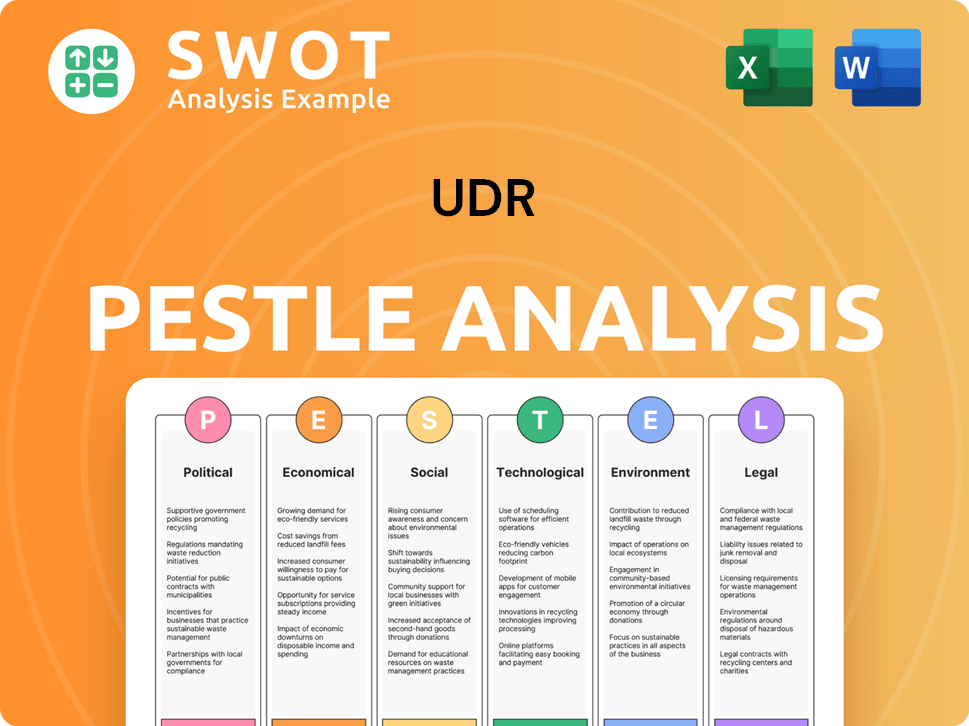

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in UDR history?

The UDR Company, a prominent player in the real estate sector, has achieved several milestones throughout its history. These achievements highlight the company's growth and influence in the apartment ownership market.

| Year | Milestone |

|---|---|

| March 2016 | The company was added to the S&P 500, a significant recognition of its market presence. |

| 2025 | The company increased its dividend for 14 consecutive years, with the annualized common dividend set at $1.72 per share. |

| 2025 | The company marked its 210th consecutive quarterly dividend. |

Innovation has been a key driver for the UDR Company, leading to significant value creation. These initiatives have allowed the company to improve operational efficiencies and enhance resident satisfaction.

The company has reduced site-level headcount by over 31% since mid-2018. This reduction allows fewer employees to manage more units, resulting in improved efficiency.

Innovation initiatives have contributed approximately $40 million of incremental run-rate Net Operating Income (NOI) since 2018. This equates to $800 million of value creation, based on a 5.0% cap rate.

The company aims to sustain high-single-digit 'other income' growth through ongoing and future initiatives. The 2025 target is $15 million.

Future initiatives (2026+) are projected to generate an additional $55 million. These initiatives are designed to increase resident retention and optimize operations.

The company focuses on enhancing resident satisfaction and improving resident retention. This is achieved through various technology-driven and operational improvements.

The company was recognized by USA Today as a 2025 Top Workplace for the second consecutive year. This recognition reflects the company's positive work environment and employee satisfaction.

Despite its successes, the UDR Company faces challenges in the dynamic real estate market. These challenges include market downturns, competitive pressures, and economic factors affecting the UDR real estate portfolio.

The multifamily sector faces a chronic undersupply of housing in the United States. However, some markets experience high supply completions, which can affect rent growth.

Sunbelt supply is anticipated to be a headwind in the first half of 2025. This may affect rent growth in some areas.

Expectations are for pricing stability in Denver, Dallas, Tampa, and Orlando by mid-2025. This indicates a potential stabilization in these key markets.

High interest expenses present a concern for the company. This impacts the financial performance and profitability of the UDR stock.

In Q1 2025, the company completed the sales of Leonard Pointe in New York for $127.5 million and One William in New Jersey for $84.0 million. These sales are part of the company's disciplined capital allocation strategy.

The company continues to focus on disciplined capital allocation, including strategic asset dispositions. This approach helps manage risk and optimize the portfolio.

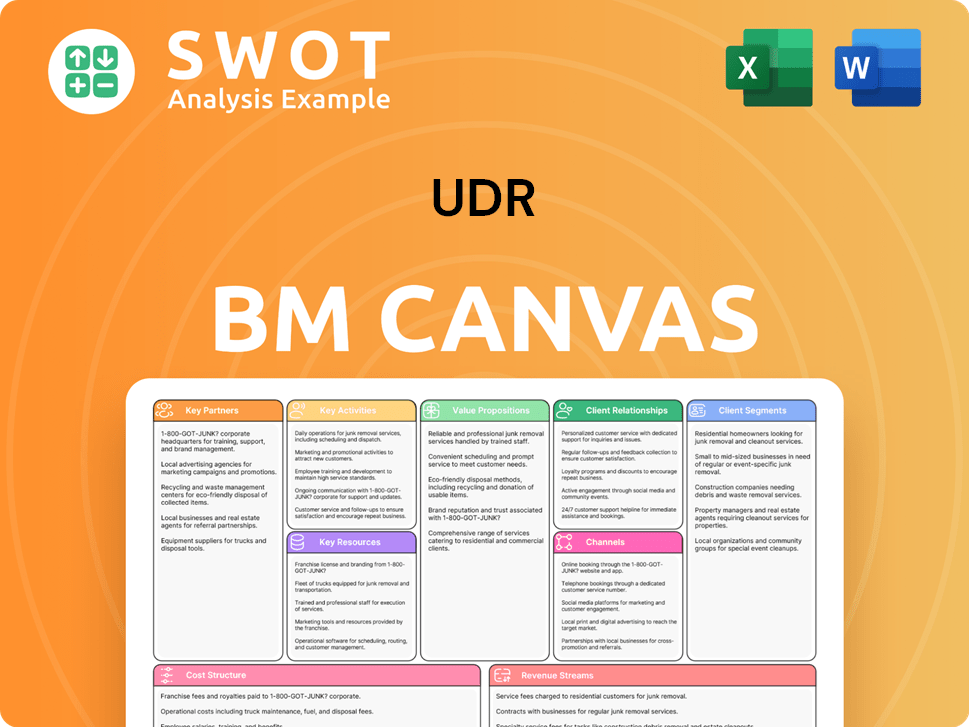

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for UDR?

The UDR Company, formerly United Dominion Realty Trust, has a rich history marked by strategic shifts and growth in the real estate sector. Founded in 1972, the company has evolved from its initial public offering to become a significant player in apartment ownership. Over the years, key milestones, including a name change and inclusion in the S&P 500, have shaped its trajectory. UDR's focus on operational efficiency and strategic investments continues to drive its performance, positioning it for future success.

| Year | Key Event |

|---|---|

| 1972 | UDR Inc. is founded as United Dominion Realty Trust in Richmond, Virginia, by Robert C. Larson, and the company completes its initial public offering. |

| 1980s-1990s | Strategic transformation shifts focus exclusively to multifamily residential properties. |

| 1995 | Headquarters relocate to Highlands Ranch, Colorado. |

| 2001 | Company officially changes its name to UDR, Inc. |

| March 2016 | UDR is added to the S&P 500. |

| Mid-2018 | Site-level headcount reduced by over 31%, improving operational efficiency. |

| 2022 | Adjusted Funds From Operations (AFFO) recovers after pandemic impact. |

| 2024 | UDR reports full-year results, with Same-Store Net Operating Income growth exceeding expectations despite high supply completions, and as of December 31, 2024, UDR owns or has an ownership interest in 60,120 apartment homes. |

| January 1, 2025 | Executive management promotions and leadership transition plans become effective, including Mike Lacy to COO and Joe Fisher to CIO in addition to his President and CFO roles. |

| February 5, 2025 | UDR announces its 2025 dividend will be $1.72 per share, marking its 14th consecutive annual dividend increase. |

| March 27, 2025 | James D. Klingbeil announces he will not seek re-election to the Board, and Jon A. Grove is elected as the new Lead Independent Director. |

| April 30, 2025 | UDR releases its first quarter 2025 financial results, reporting net income per diluted share of $0.23, a 77% increase year-over-year. Same-Store Revenue increased by 2.6% year-over-year and Same-Store Net Operating Income (NOI) rose by 2.8% year-over-year. |

| May 1, 2025 | UDR's Q1 2025 earnings call held, where CEO Tom Toomey expresses confidence in the company's solid start to 2025 and highlights strong demand for apartment homes. |

UDR anticipates improvements in new lease growth and aims to reduce resident turnover by 100 basis points compared to 2024 levels. The company reaffirmed its full-year 2025 guidance, projecting blended lease rate growth in the range of 1.4% to 1.8% for the first half of the year. The company expects multifamily supply to decline to historical averages in 2025, with completions trending even lower in 2026.

Analysts forecast UDR's rental income to increase 2% in 2025 and estimate same-property NOI to increase 2% and 4.6% in 2025 and 2026, respectively. UDR plans to fully fund its capital needs beyond 2025, supported by $1 billion in liquidity and only $535 million of debt scheduled to mature through 2026. Analyst price targets for UDR in the next twelve months range from $41.00 to $52.00, with an average of $46.44.

UDR's long-term strategic initiatives include continuing to innovate and drive durable competitive advantages across its diversified portfolio. The company is positioned to capitalize on attractive relative affordability of renting versus owning in its markets, and robust demand driven by demographic trends. CEO Tom Toomey emphasizes the company's leadership in idea generation and execution.

UDR remains optimistic, with a focus on continued growth and stability in the multifamily housing sector. The company's forward-looking approach aligns with the founding vision of providing attractive, quality apartment homes and superior customer service. The favorable demand versus supply dynamic should benefit future rental rate growth.

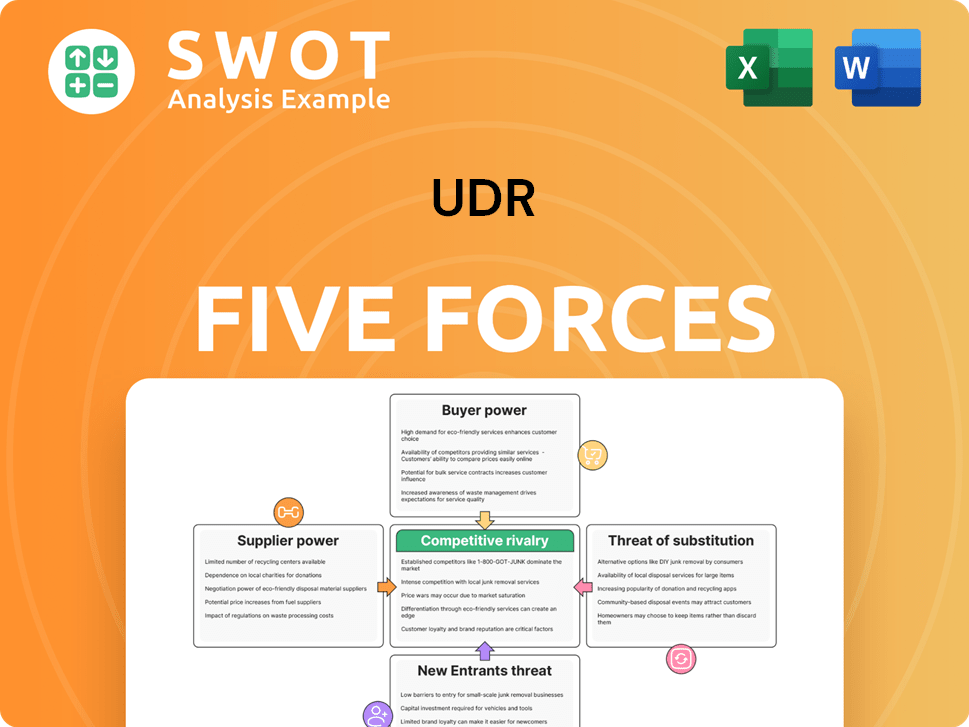

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of UDR Company?

- What is Growth Strategy and Future Prospects of UDR Company?

- How Does UDR Company Work?

- What is Sales and Marketing Strategy of UDR Company?

- What is Brief History of UDR Company?

- Who Owns UDR Company?

- What is Customer Demographics and Target Market of UDR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.